Look at these two brothers.

They once controlled 1/3rd of the world’s silver and tried to corner the market.

Then it all collapsed and their family fortune was wiped out.

Here’s the wild story of how the Hunt Brothers lost everything:

They once controlled 1/3rd of the world’s silver and tried to corner the market.

Then it all collapsed and their family fortune was wiped out.

Here’s the wild story of how the Hunt Brothers lost everything:

The Hunt family, led by H.L. Hunt, was already one of the richest families in the United States due to their oil fortune.

However, Nelson and William Hunt sought to increase their wealth further by turning to commodities, particularly silver.

However, Nelson and William Hunt sought to increase their wealth further by turning to commodities, particularly silver.

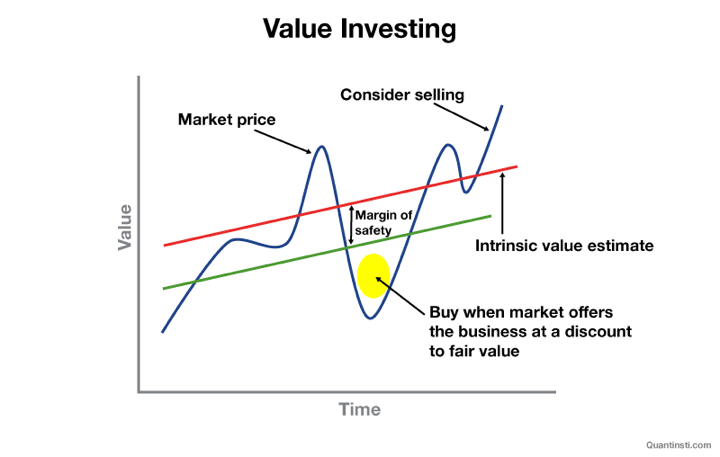

Their interest in silver stemmed from concerns about inflation and the weakening U.S. dollar.

The brothers believed silver would be a more stable store of value than paper currency.

From 1973 to 1979, the Hunt brothers began purchasing large amounts of physical silver.

The brothers believed silver would be a more stable store of value than paper currency.

From 1973 to 1979, the Hunt brothers began purchasing large amounts of physical silver.

They also used futures contracts to control an even larger share of the market.

By 1979, the brothers had accumulated over 100 million ounces of silver, which accounted for nearly half of the world's privately owned silver supply.

By 1979, the brothers had accumulated over 100 million ounces of silver, which accounted for nearly half of the world's privately owned silver supply.

As their buying spree continued, the price of silver skyrocketed from around $6 per ounce to $50 per ounce in January 1980.

This massive buying frenzy created a silver bubble, and many other investors jumped in, hoping to ride the wave.

This massive buying frenzy created a silver bubble, and many other investors jumped in, hoping to ride the wave.

As the price soared, the Hunt brothers saw their wealth multiply.

At one point, their silver holdings were estimated to be worth billions.

However, the U.S. government and commodities exchanges soon took notice of the Hunt brothers' influence on the market.

At one point, their silver holdings were estimated to be worth billions.

However, the U.S. government and commodities exchanges soon took notice of the Hunt brothers' influence on the market.

Concerned about the destabilization of the silver market, the CFTC and the NYMEX implemented rules designed to limit the Hunts' control.

One such rule was raising margin requirements, which increased the amount of capital needed to hold futures positions.

One such rule was raising margin requirements, which increased the amount of capital needed to hold futures positions.

These new rules forced the Hunts to liquidate some of their silver holdings to cover their positions, leading to a dramatic drop in silver prices.

On March 27, 1980, known as "Silver Thursday," the price of silver plummeted by more than 50% in a single day.

On March 27, 1980, known as "Silver Thursday," the price of silver plummeted by more than 50% in a single day.

The Hunts were eventually charged with market manipulation and faced multiple lawsuits.

In the end, they filed for bankruptcy, and the government stepped in to help manage the fallout from their failed attempt to corner the silver market.

In the end, they filed for bankruptcy, and the government stepped in to help manage the fallout from their failed attempt to corner the silver market.

• • •

Missing some Tweet in this thread? You can try to

force a refresh