How to get URL link on X (Twitter) App

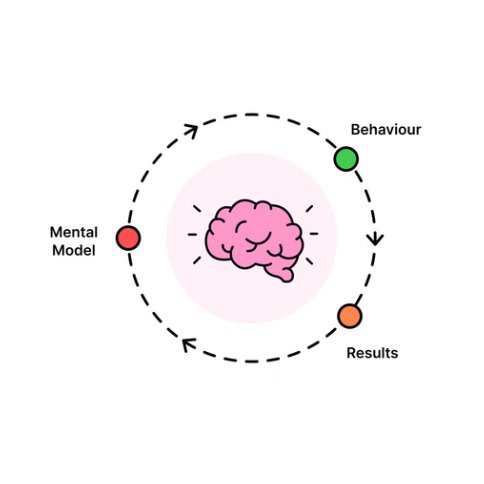

1. Circle of Competence (Warren Buffett)

1. Circle of Competence (Warren Buffett)

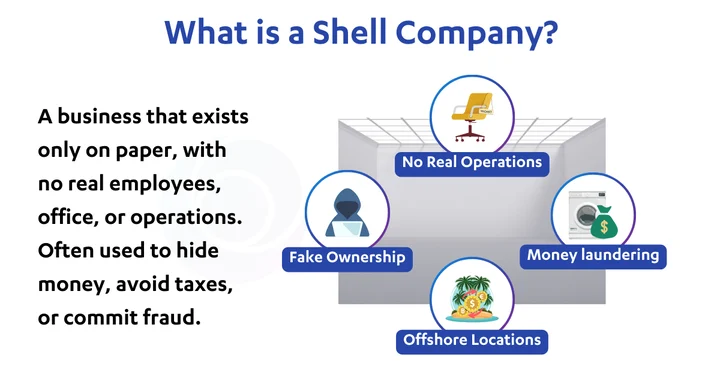

First, what is a shell company?

First, what is a shell company?

Britain's formula was a 4-step colonial playbook:

Britain's formula was a 4-step colonial playbook:

In the early 1900s, U.S. banking was chaotic.

In the early 1900s, U.S. banking was chaotic.

1. Think Big

1. Think Big

In the early 1990s, many Asian countries were experiencing unprecedented economic growth.

In the early 1990s, many Asian countries were experiencing unprecedented economic growth.

In 1911, Frank C. Mars began making chocolate in his kitchen in Tacoma, Washington.

In 1911, Frank C. Mars began making chocolate in his kitchen in Tacoma, Washington.

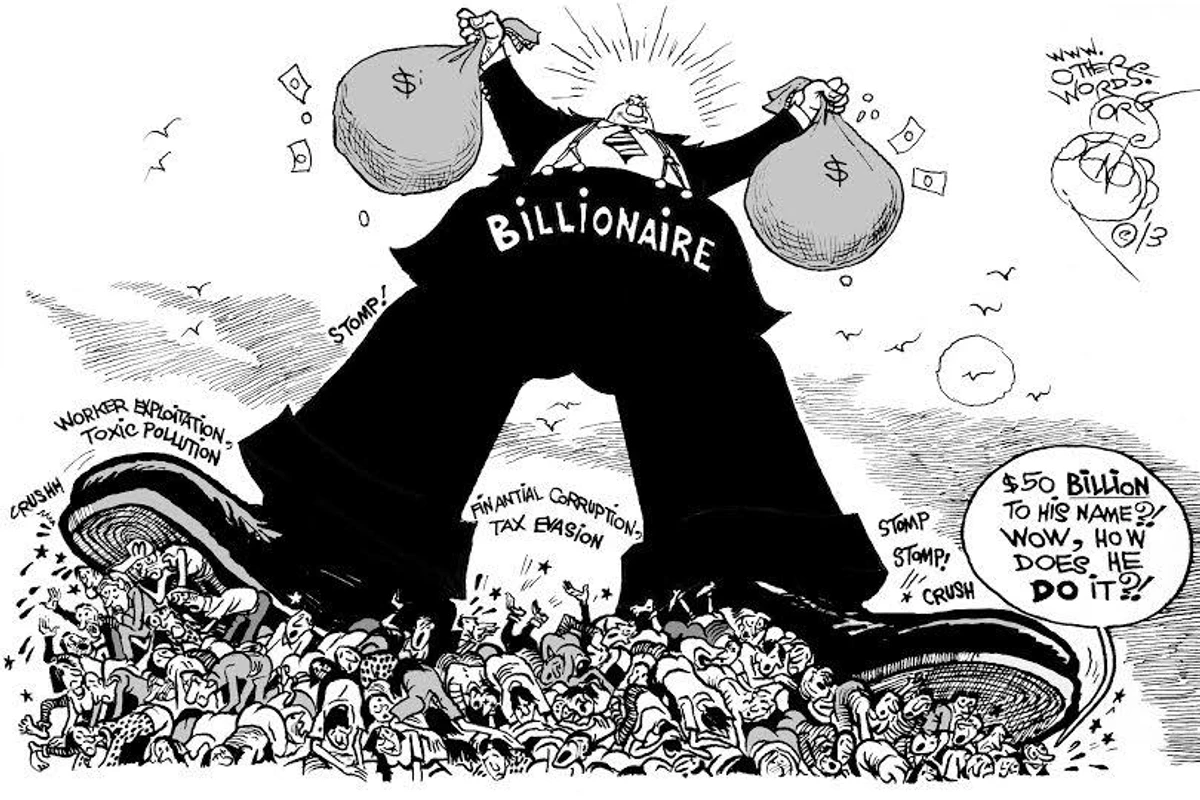

🇲🇨 Monaco: The Billionaire’s Playground

🇲🇨 Monaco: The Billionaire’s Playground

First, what is a shell company?

First, what is a shell company?

This setup isn’t just tax-advantaged.

This setup isn’t just tax-advantaged.

1. Discipline beats brilliance

1. Discipline beats brilliance

History is full of scams, but few can match the audacity of Gregor MacGregor, a Scottish conman who sold an entire fake country to unsuspecting investors in the 1820s.

History is full of scams, but few can match the audacity of Gregor MacGregor, a Scottish conman who sold an entire fake country to unsuspecting investors in the 1820s.

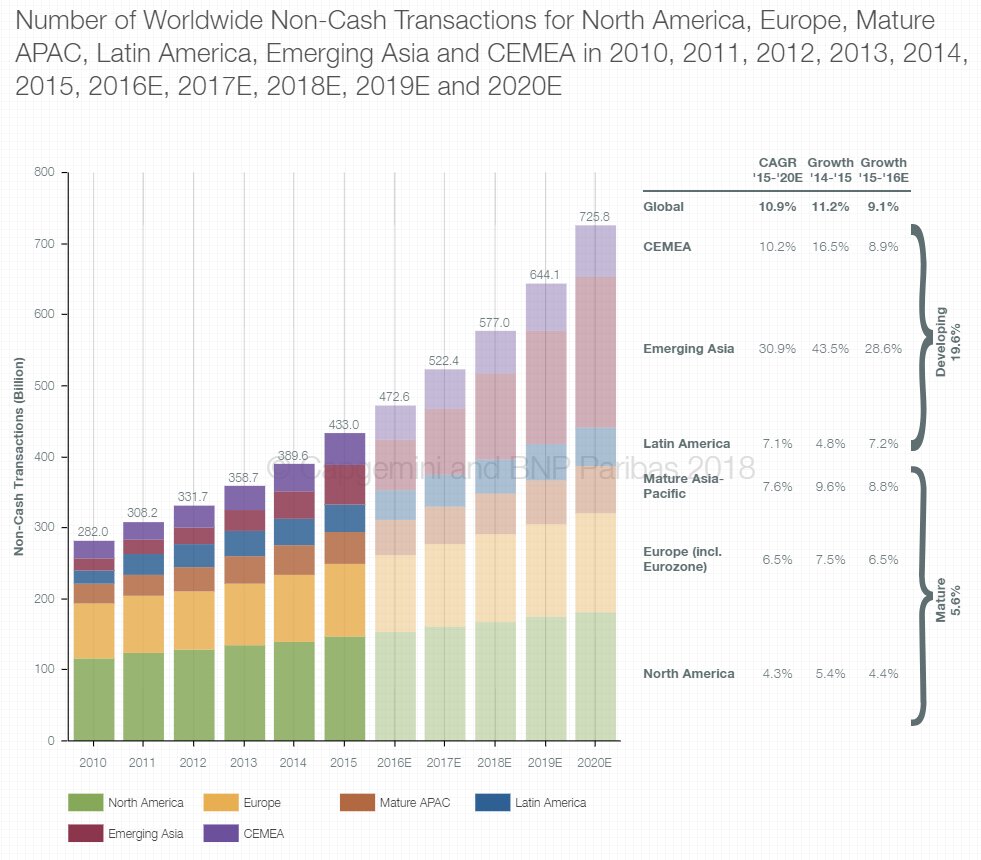

In the UK, only 3% of money exists as cash.

In the UK, only 3% of money exists as cash.

In 2008, the world was gripped by a financial meltdown.

In 2008, the world was gripped by a financial meltdown.

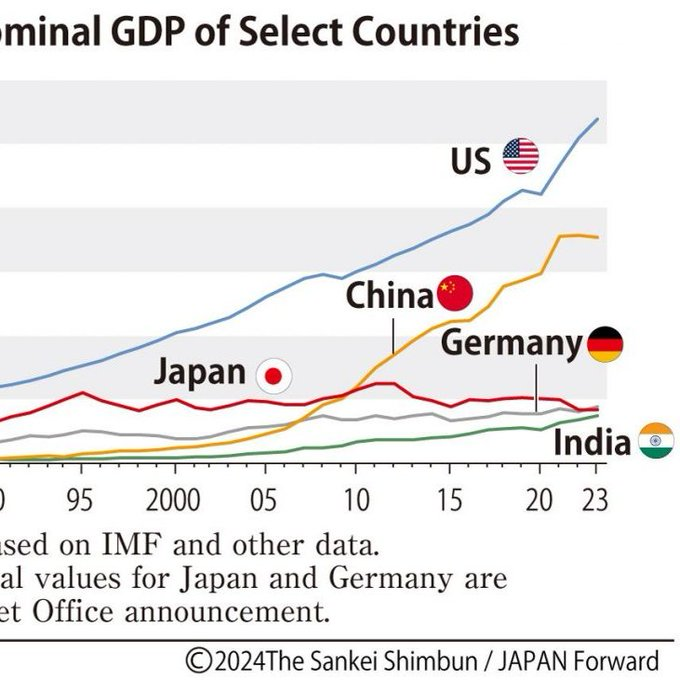

In the 1980s, Japan was an unstoppable force.

In the 1980s, Japan was an unstoppable force.

Before building one of the most successful hedge funds in history, Jim Simons was a mathematician and a former codebreaker for the U.S. government.

Before building one of the most successful hedge funds in history, Jim Simons was a mathematician and a former codebreaker for the U.S. government.

1. Inversion (Charlie Munger)

1. Inversion (Charlie Munger)

1. Think Big

1. Think Big

1. The Billion-Dollar Shell Game

1. The Billion-Dollar Shell Game

1. Circle of Competence (Warren Buffett)

1. Circle of Competence (Warren Buffett)

In the late 1980s, Japan was a financial superpower.

In the late 1980s, Japan was a financial superpower.