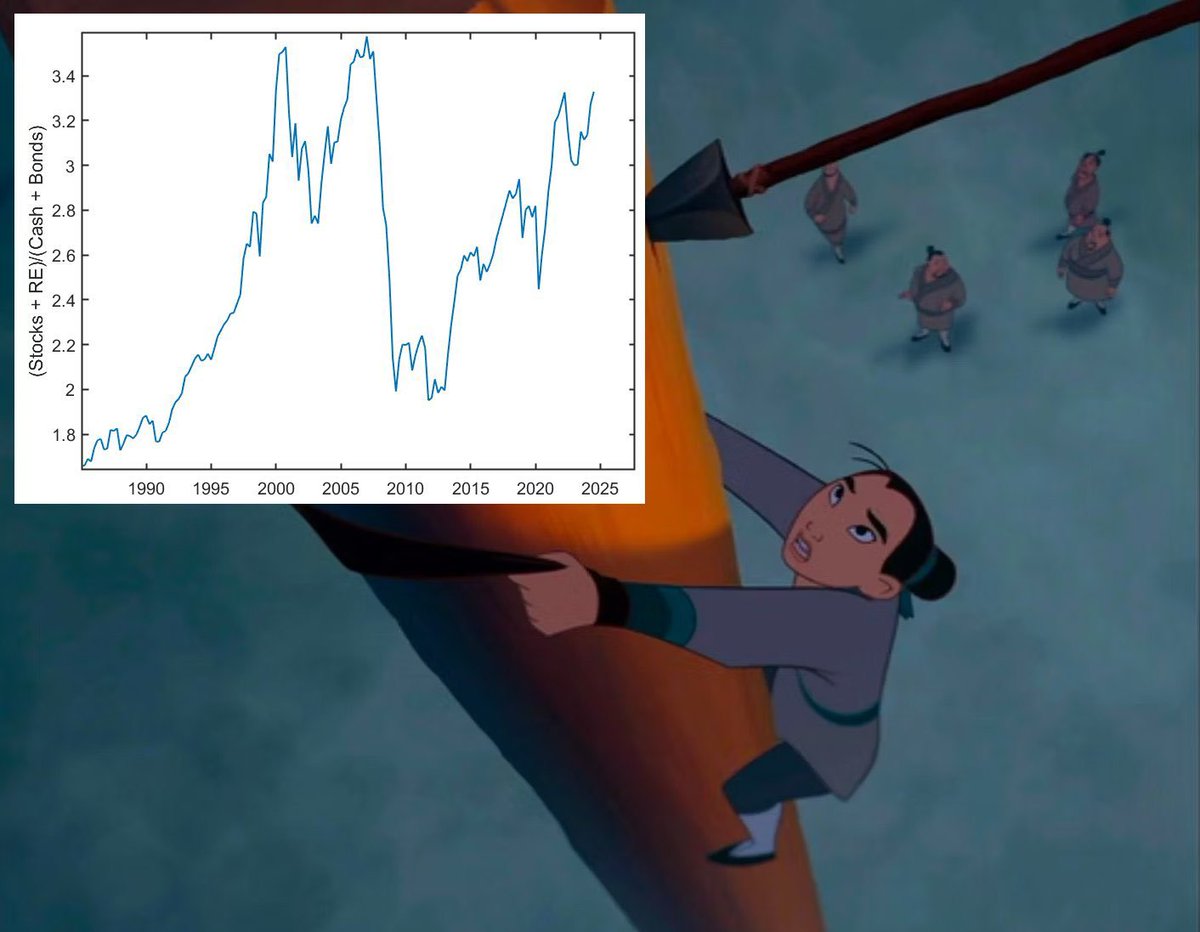

Some people have asked me to explain my Disney meme more clearly. This is, in my opinion, the most important macro chart of all. 🧵

It's pretty simple, just pulled the data from the Fed Z tables on household wealth.

federalreserve.gov/releases/z1/

federalreserve.gov/releases/z1/

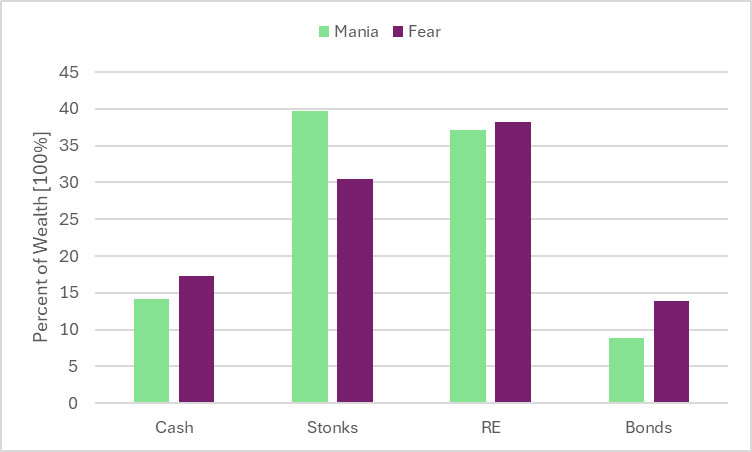

It shows what components make up the wealth of US households over time. The ratio of stocks + real estate over cash + US treasuries shows a measure of the relative portfolio risk of all US households.

In times when exuberance is low, People want to hold more cash relative to stocks + RE. When mania is raging, people don't want to hold cash and bonds.

The difference is subtle, but very impactful. It is this small difference that drives all of the price improvement you see in equities. Flows are simply the path to arrive at this portfolio allocation.

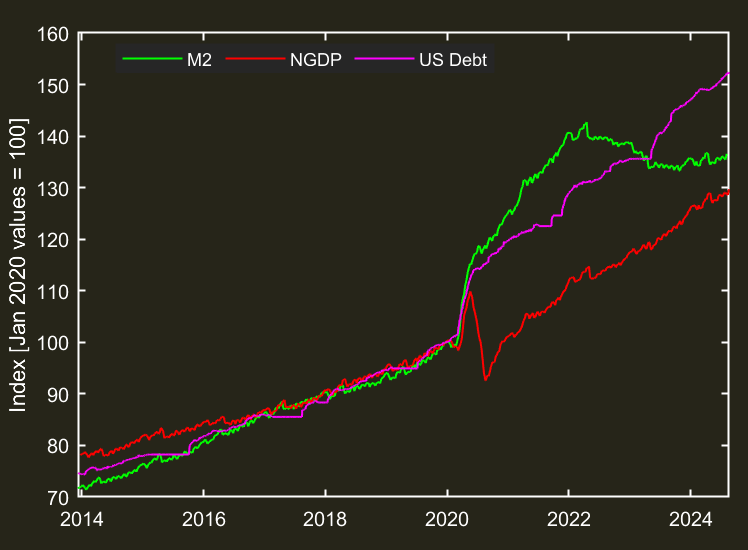

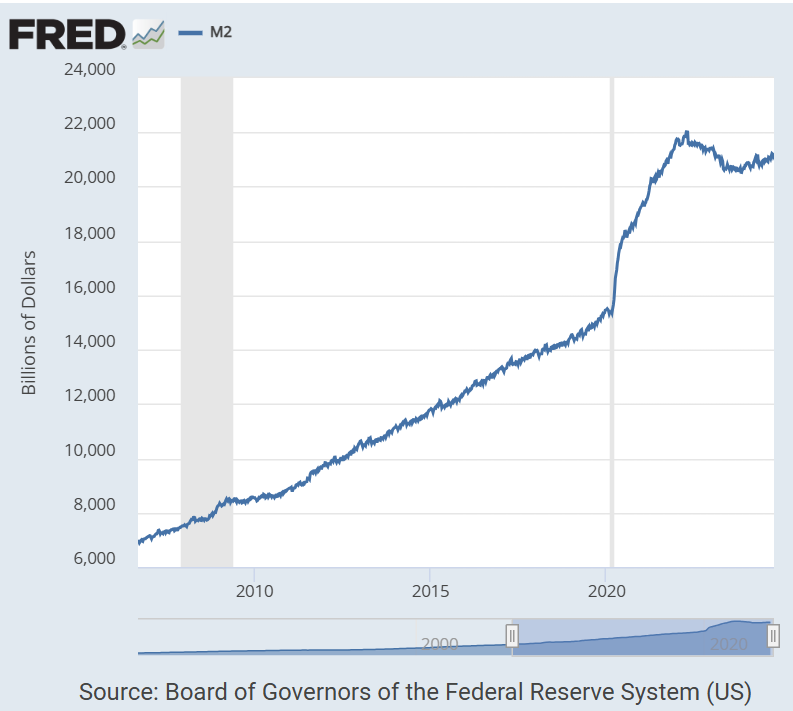

Underpinning this portfolio allocation is the ever present foundation that is the money supply. This ever-present rise lifts all boats, making everything seem less risky over time. Or another way to think about it, holding cash is seen as riskier because other things will rise.

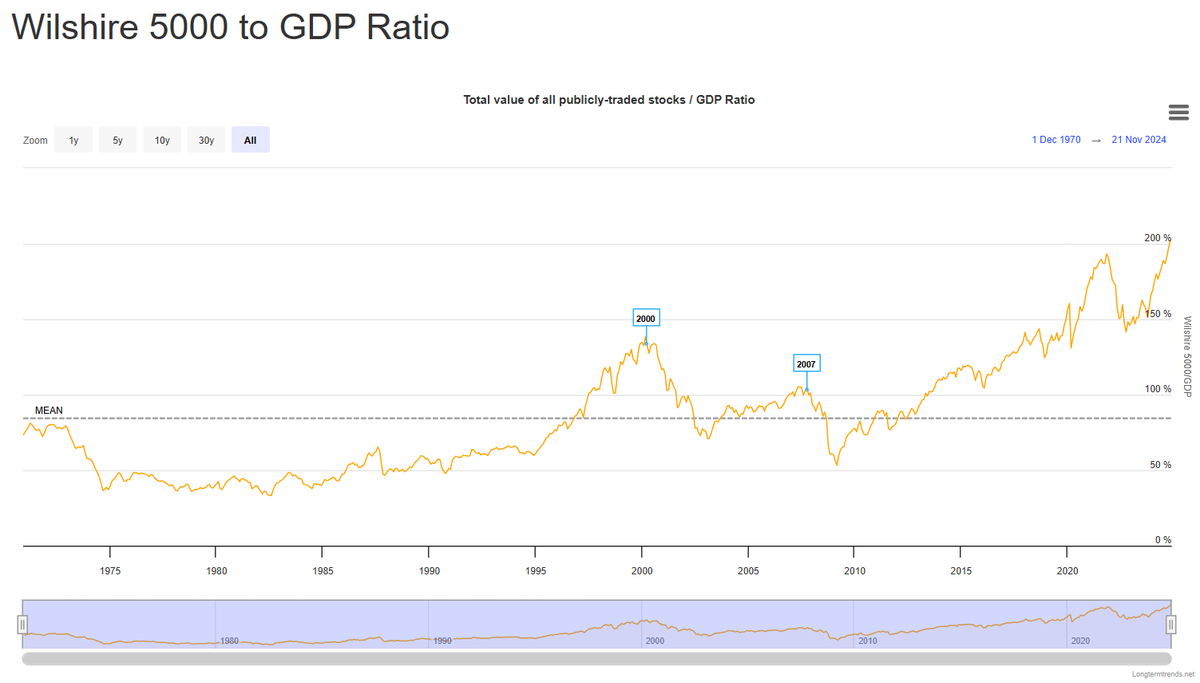

During the height of the dot com bubble, the market cap of the stock market hit 300% of the money supply. Today we are very close to the same level. But money today is much less productive than in the past, so looking at market cap to GDP, the "Buffett Indicator," shows an ATH.

So why are multiples rising to astronomical values? The portfolio allocation. There are simply too many dollars lying around and their productivity is at an all time low. Then for the same percent portfolio allocations, stocks must be ever higher valued.

This has important implications for markets. For those looking to understand why value investing is dead, it is the modern portfolio balance. People will simply invest based on risk tolerance, with no attention paid to fundamentals. What percent of X and y do you want to own?

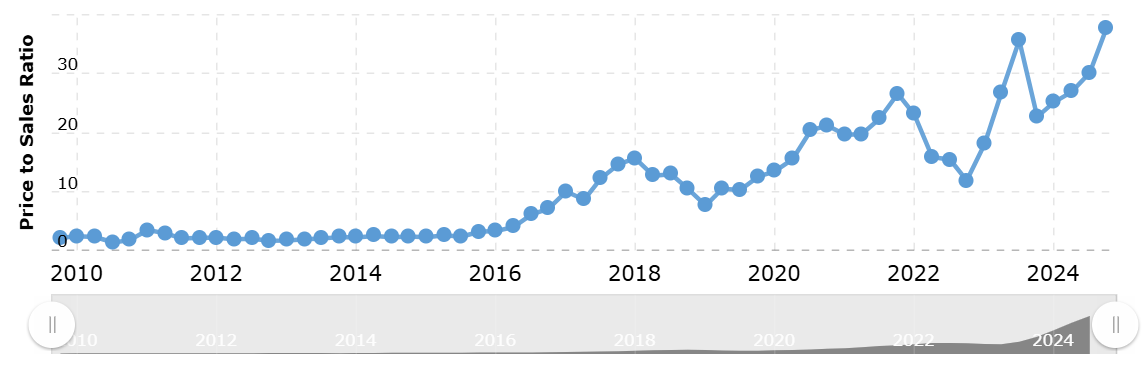

This results in things like $NVDA having a price to sales ratio of over 30x. During the dot com bubble, where the CEO of Sun Microsystems famously wrote a letter to investors asking "what were you thinking?!?" when their P/S hit 10x before the bust.

So what's the problem? Money is debt. The growth in our money supply comes from the extension of debt and credit, both public and private. What happens eventually when leverage goes up and productivity goes down? Eventually something has to pop.

This pop leads to a massive deleveraging like the ones we saw in 2000, 2008, and 2020. The key is that the government responds to every crisis with more money, continuing the progression of more money with lower productivity.

So back to my Disney meme. Typically these bubbles tend to pop once they reach a certain point of leverage. This data is from Q2, so is one quarter old. My estimate is that we are close to the top of previous bubbles. As long as the Fed is not printing...

It's likely we will see a pop. But watch out for the printer, because when they turn it on again, valuations are going to get even crazier. If you think markets are broken now, wait until the next cycle. I think we have at least one more in us, so I'm not bullish right now.

Disclosure: I have a 2.85% 30 yr mortgage and would love for JPOW to inflate my asset backed debt to zero. Print baby, print.

• • •

Missing some Tweet in this thread? You can try to

force a refresh