Engineer. Researcher. Stonk Enjoyer. Don't ask me if the drapes match the carpet.

5 subscribers

How to get URL link on X (Twitter) App

https://x.com/Dr_Gingerballs/status/2008696836962595286The blackwell racks used about 120 kW of power. I remember when he announced those he said that the inlet water temp was 20 C and the outlet was 40 C, with a 2 L/s flow rate. This was notable to me because it was about 170 kW of cooling, which is a lot for a rack.

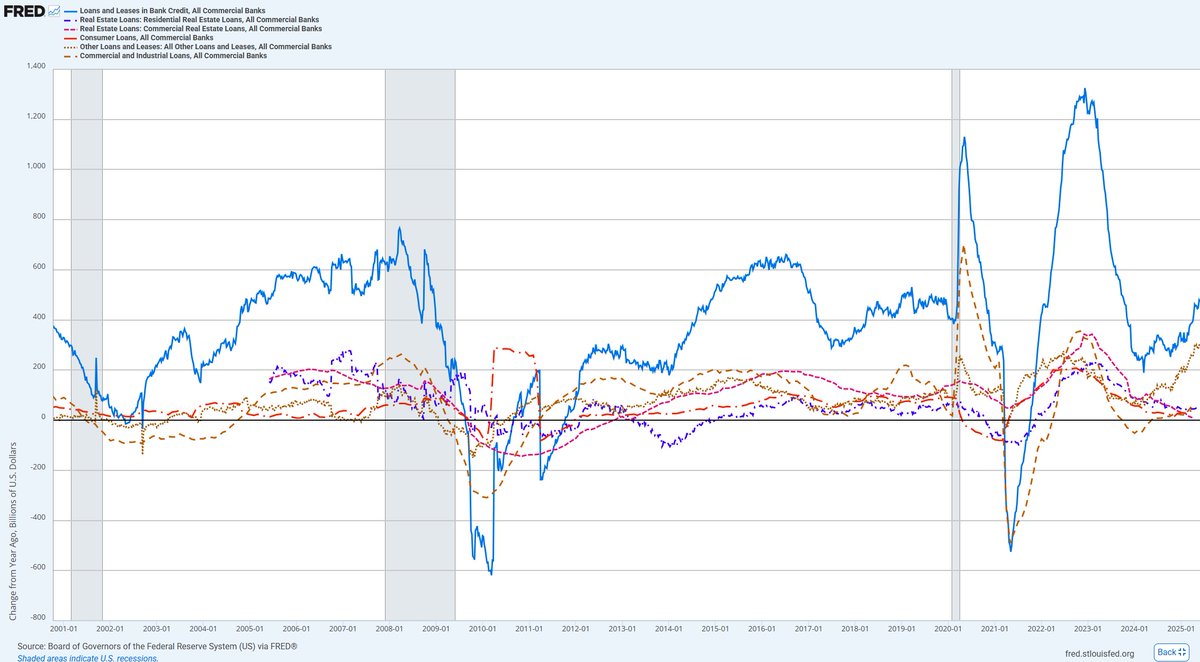

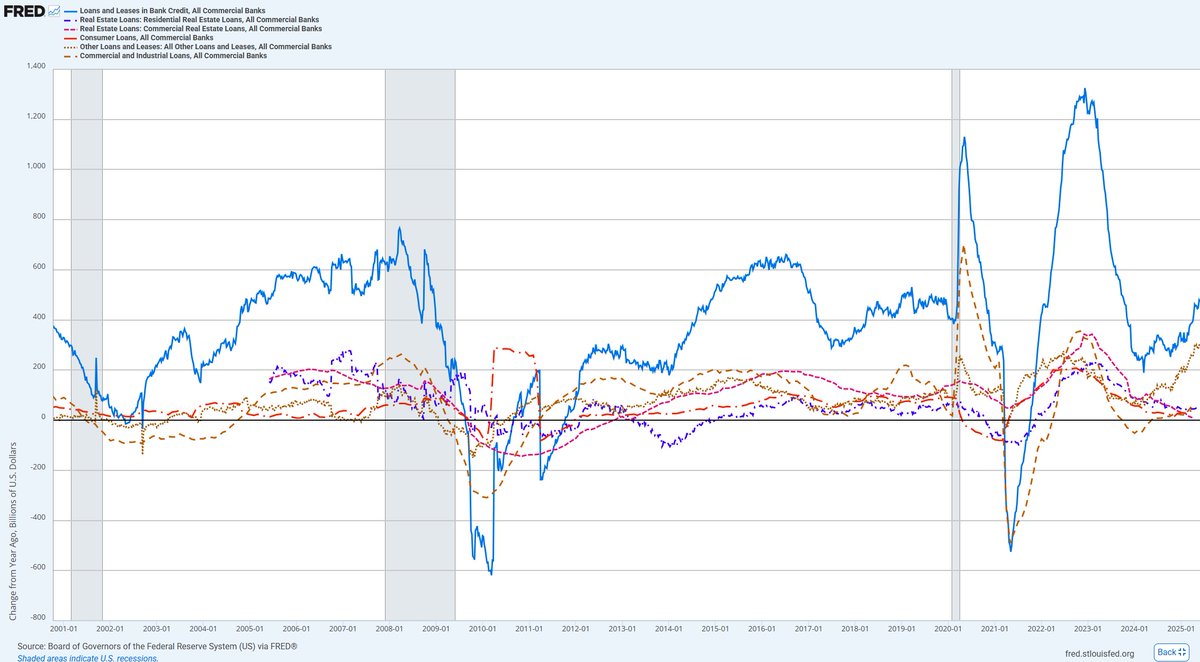

In the chart above is the change in loans over a year in billions of dollars. Over the last 25 years, it more or less seems reasonable. It's broken into residential real estate, commercial real estate, consumer loans, C&I loans, and "other loans and leases."

In the chart above is the change in loans over a year in billions of dollars. Over the last 25 years, it more or less seems reasonable. It's broken into residential real estate, commercial real estate, consumer loans, C&I loans, and "other loans and leases."

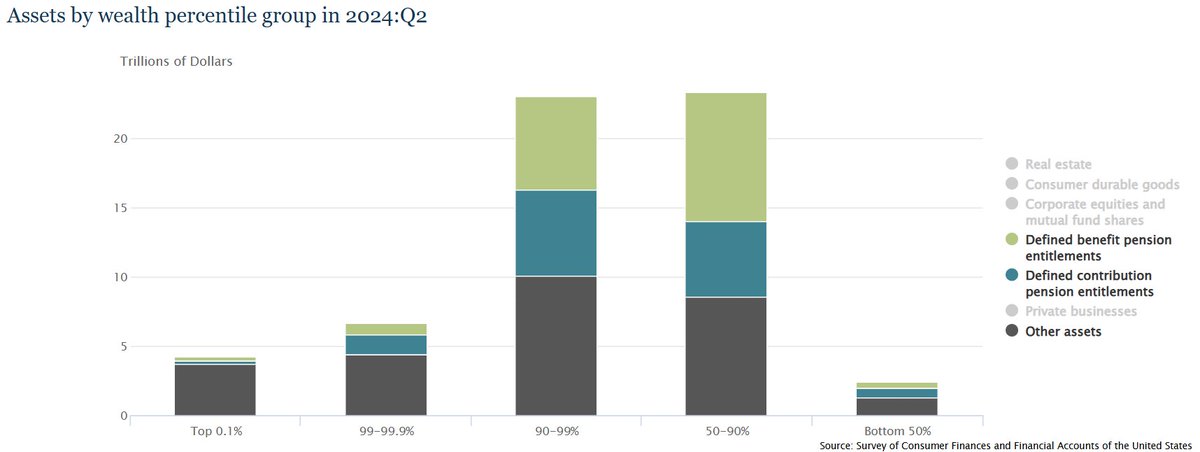

It's pretty simple, just pulled the data from the Fed Z tables on household wealth.

It's pretty simple, just pulled the data from the Fed Z tables on household wealth.

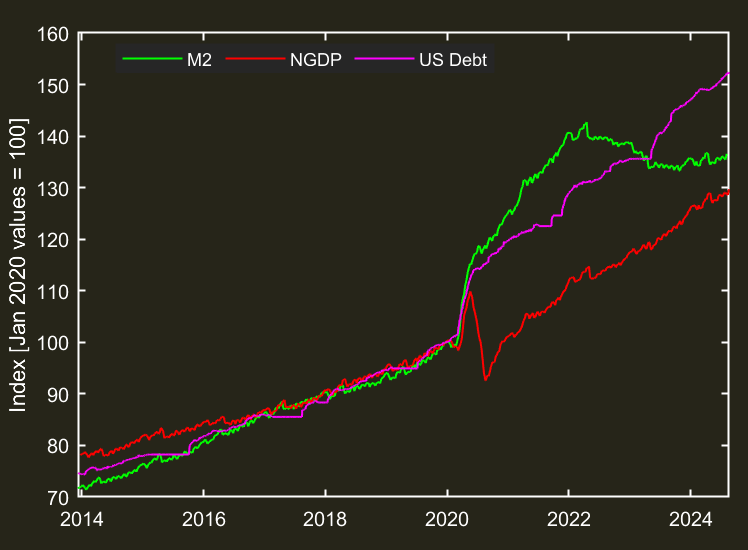

Before we talk about market dynamics, let's quickly discuss what $BTC is. People argue over whether it is a store of value, or a currency, or a commodity, which I am not going to try and decide here. Instead I will simply present the information and let you decide yourself.

Before we talk about market dynamics, let's quickly discuss what $BTC is. People argue over whether it is a store of value, or a currency, or a commodity, which I am not going to try and decide here. Instead I will simply present the information and let you decide yourself.

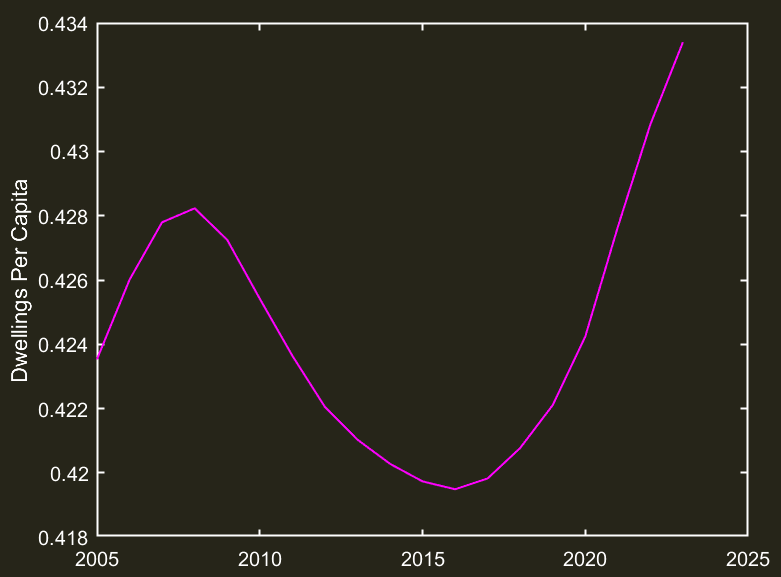

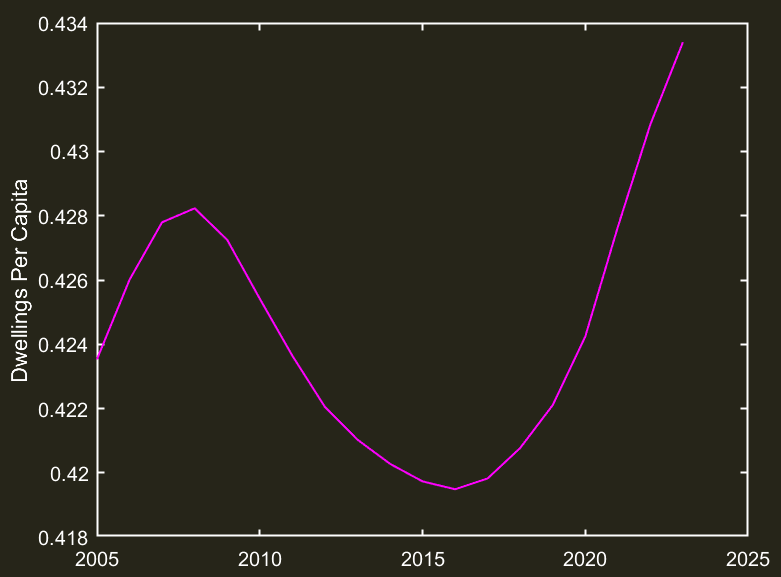

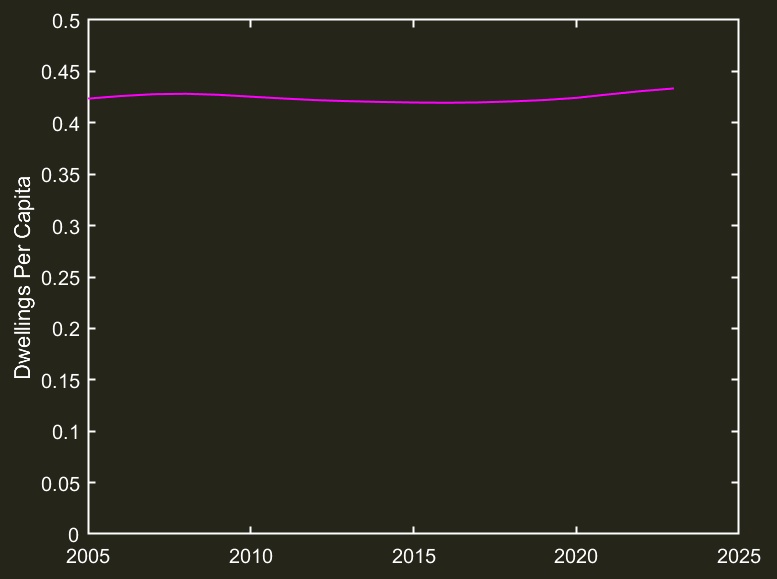

Let's be real, the plot above is really just a flat line. So if housing supply more or less always tracks total population, what's really happening to housing prices? Let's peel it back and see if we can find anything.

Let's be real, the plot above is really just a flat line. So if housing supply more or less always tracks total population, what's really happening to housing prices? Let's peel it back and see if we can find anything.

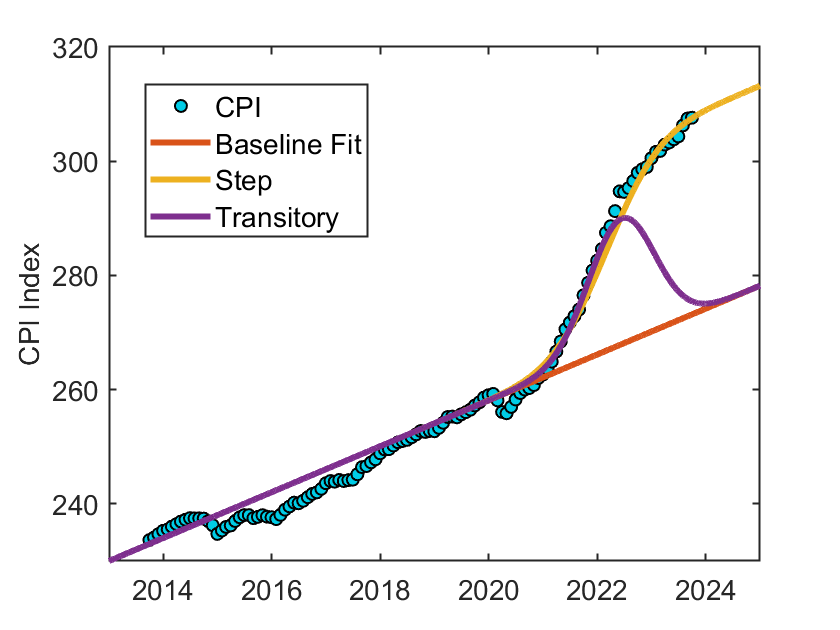

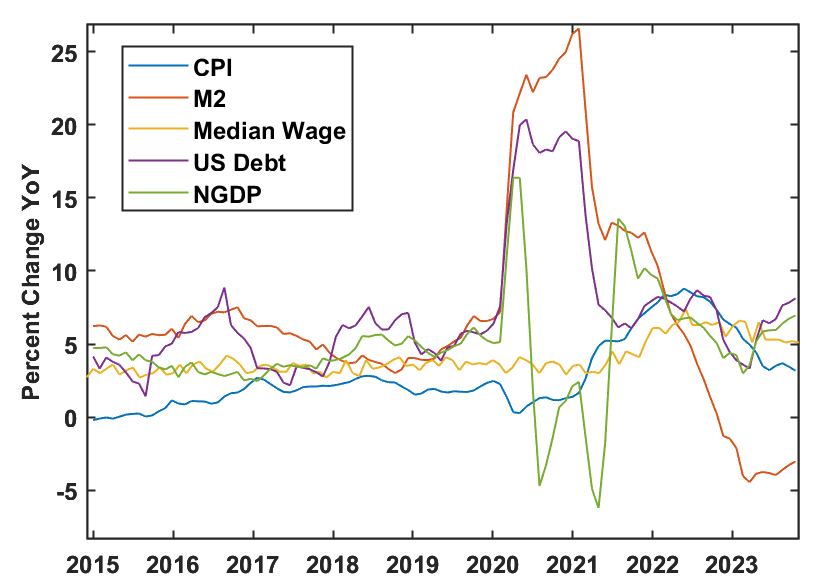

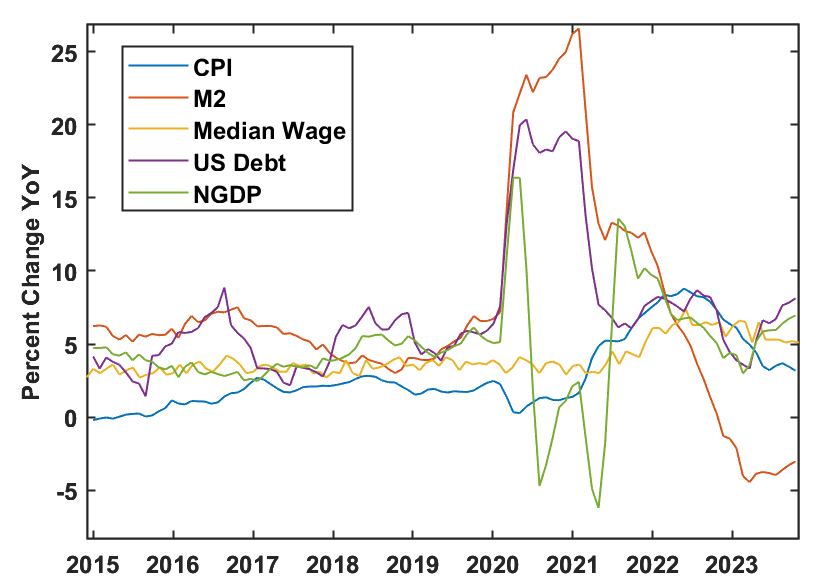

Just to quickly recap, during and following Covid, the Fed printed and distributed nearly 40% of all money at the time. This influx of money was an attempt to offset the drop in money velocity (how many times money changes hands) from the pandemic.

Just to quickly recap, during and following Covid, the Fed printed and distributed nearly 40% of all money at the time. This influx of money was an attempt to offset the drop in money velocity (how many times money changes hands) from the pandemic.

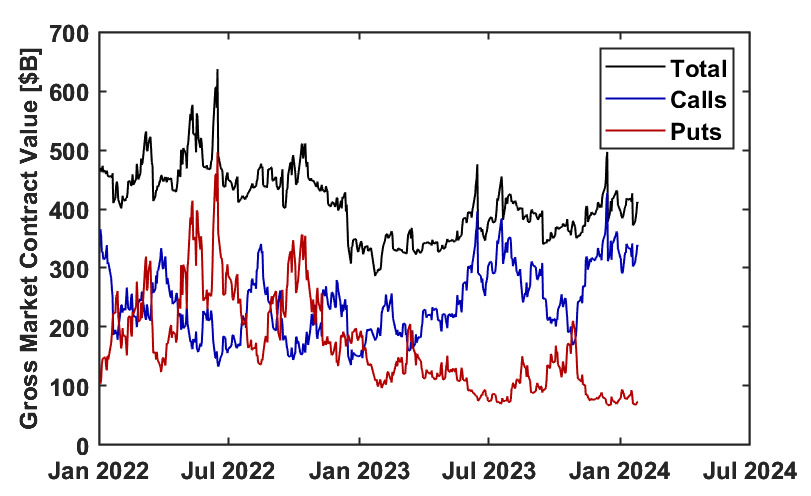

https://twitter.com/Dr_Gingerballs/status/1726000196524417464This week was Feb OPEX. Last week I said it looked a lot like Dec OPEX, which would likely provide immense upward pressure if it played out similarly. Although we ended the week negative, I think most people would agree buying pressure was immense.

I did a reverse image search in Google (take that $MSFT and Sony!), and quickly returned many likenesses of what is obviously a Sony Dualshock 4 wireless controller.

I did a reverse image search in Google (take that $MSFT and Sony!), and quickly returned many likenesses of what is obviously a Sony Dualshock 4 wireless controller.

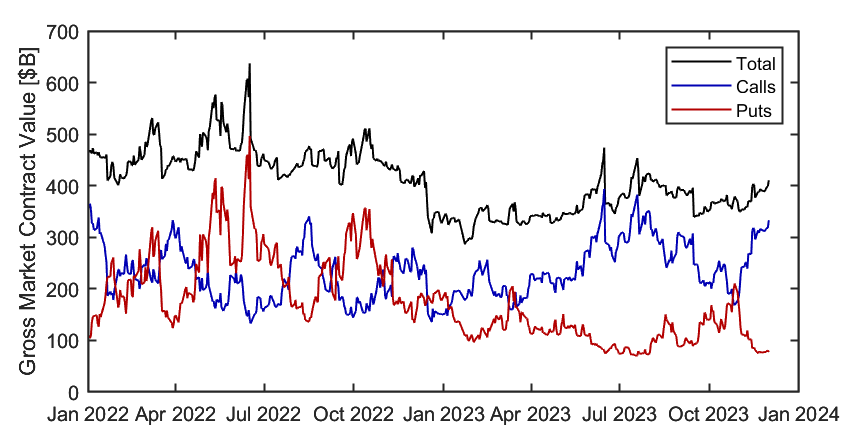

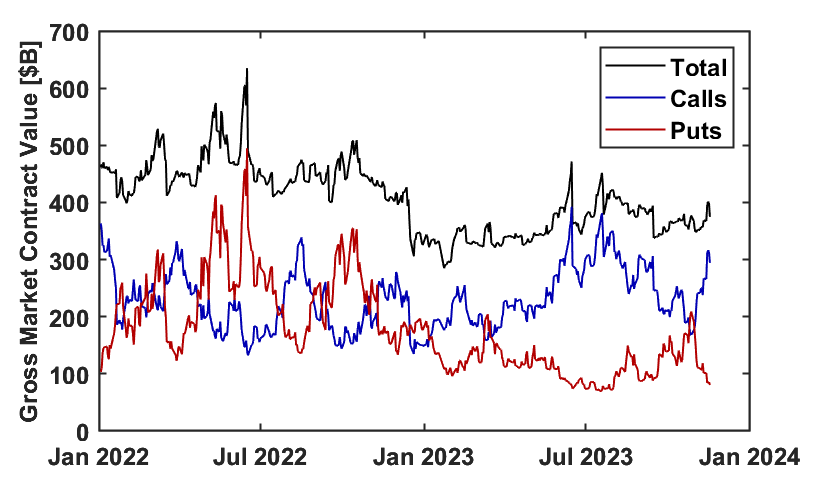

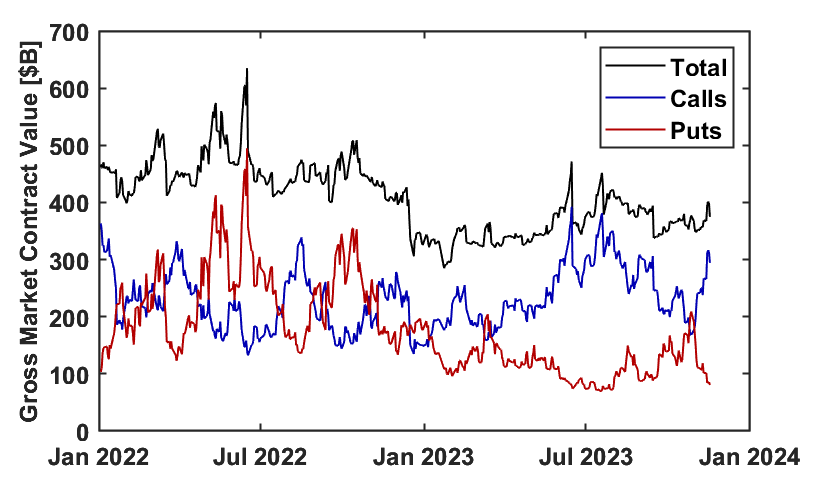

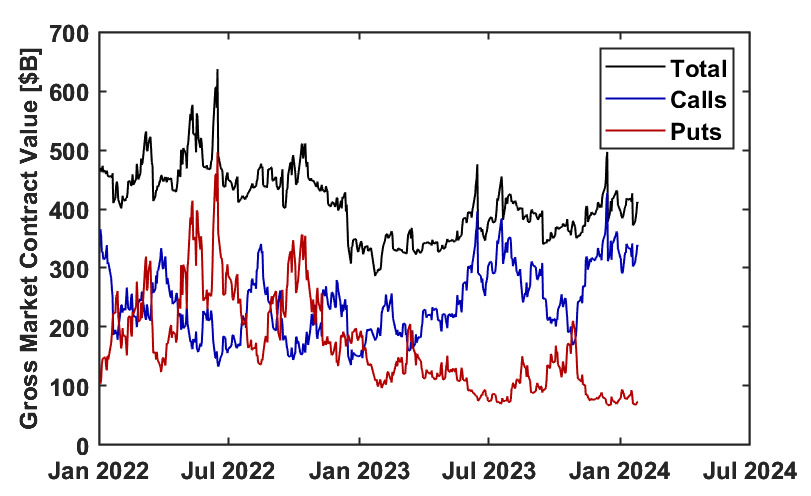

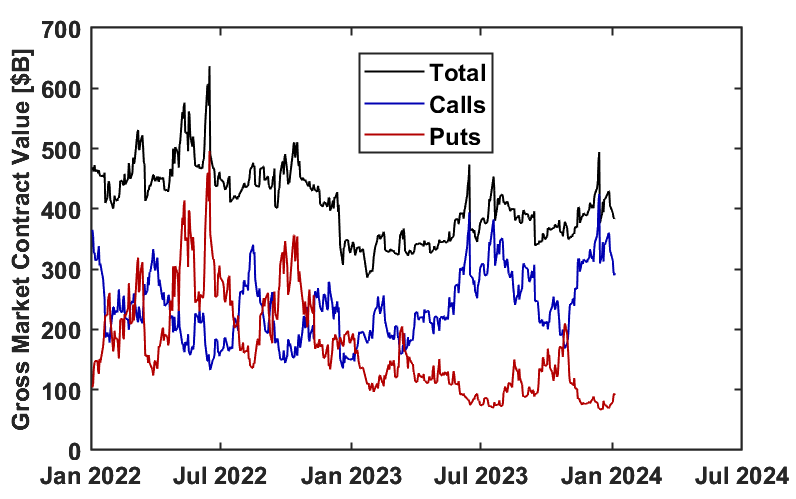

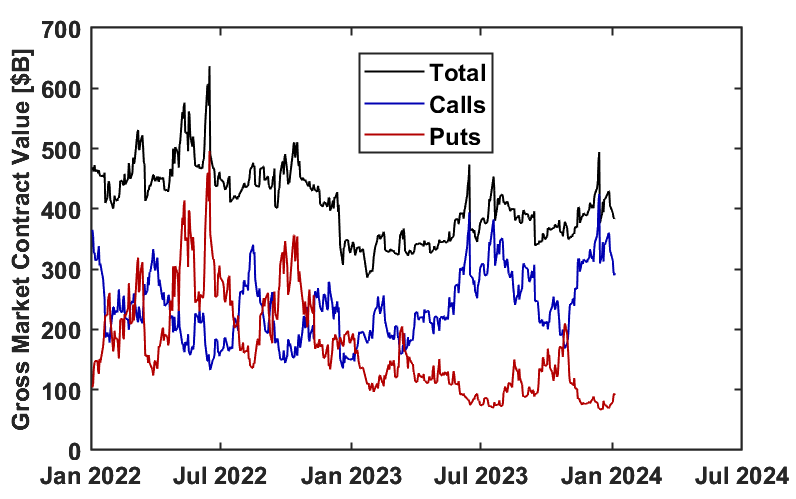

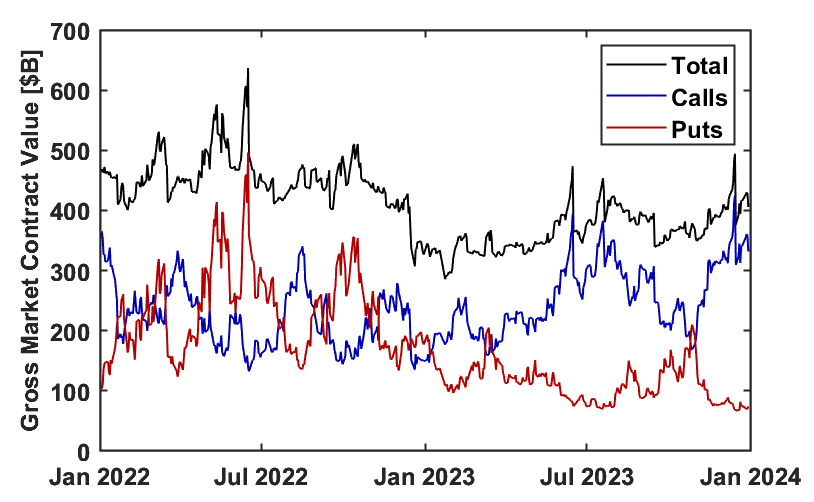

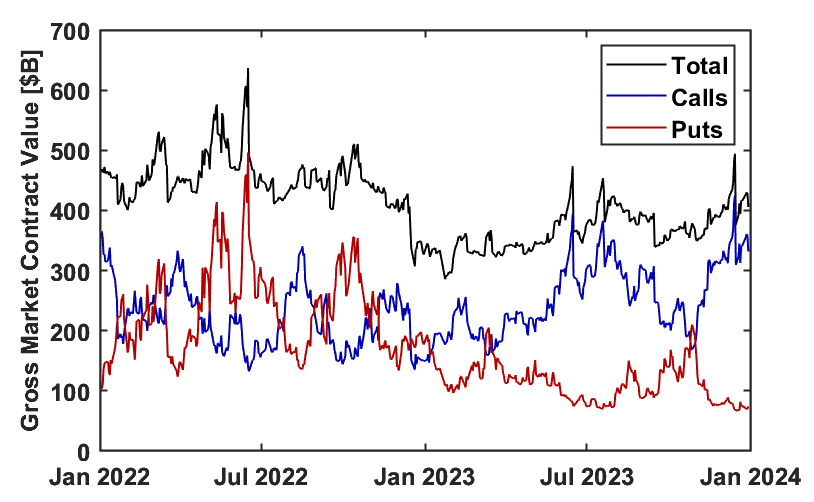

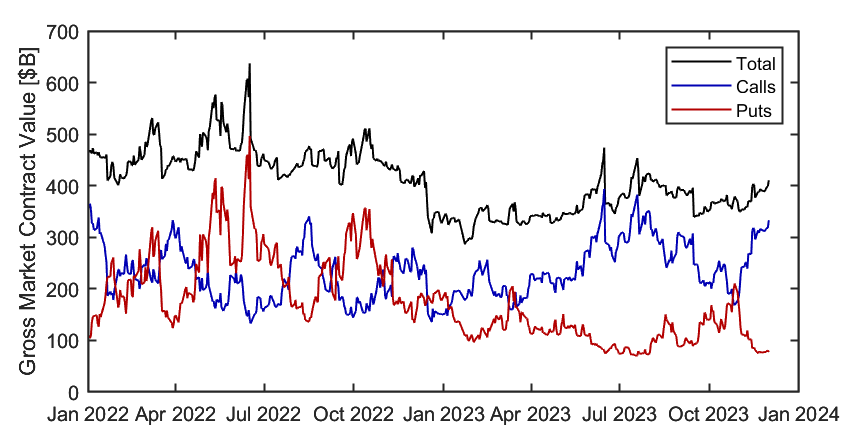

https://twitter.com/Dr_Gingerballs/status/1726000196524417464The total dollar value of open contracts has been pretty stable and boring since nov 23. Calls continue to make up most of the value. This week, over 1M puts were open on $SPX and only about 400k calls. Put selling continues en masse.

https://twitter.com/Dr_Gingerballs/status/1726000196524417464Total contract values on the market remain fairly stable just under $400B. Since The end of 2023, Calls have lost about $60B in value and puts have gained about $25B.

https://twitter.com/jam_croissant/status/1741298265352794248This morning I received this. The reply below. He never responded to my reply. He clearly thinks I’m just stealing his ideas. There’s a bunch of problems with this.

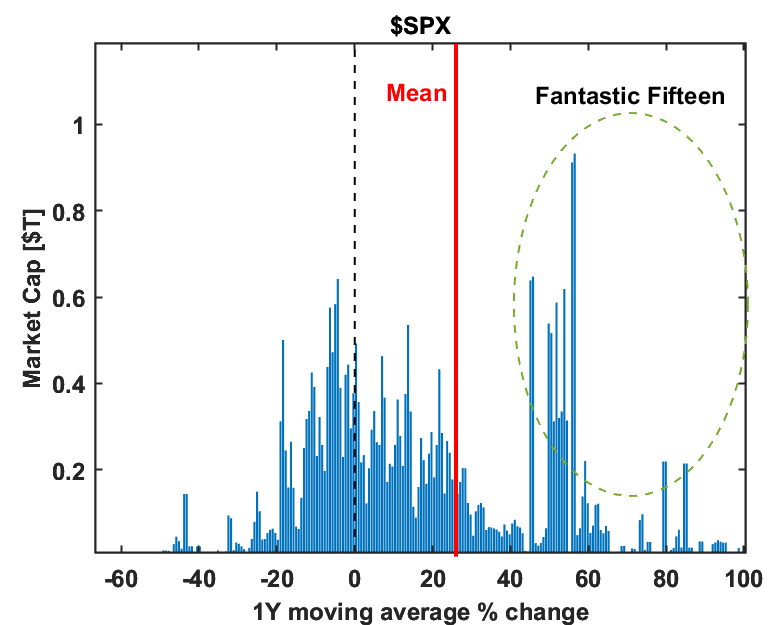

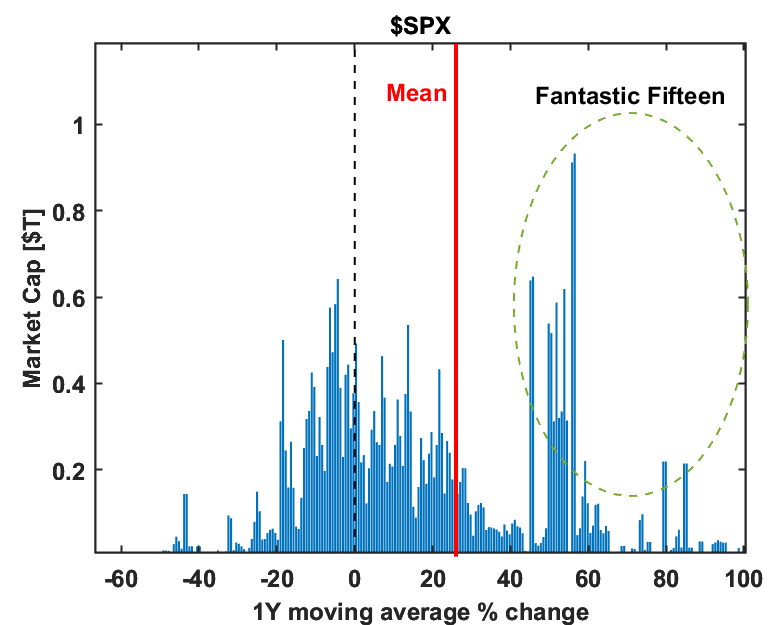

Above is a market cap weighted histogram of the 1Y % change over time for the $SPX. So for example, the large $1T bar near 55% means that $1T worth of companies in the $SPX increased by 55% this year.

Above is a market cap weighted histogram of the 1Y % change over time for the $SPX. So for example, the large $1T bar near 55% means that $1T worth of companies in the $SPX increased by 55% this year.

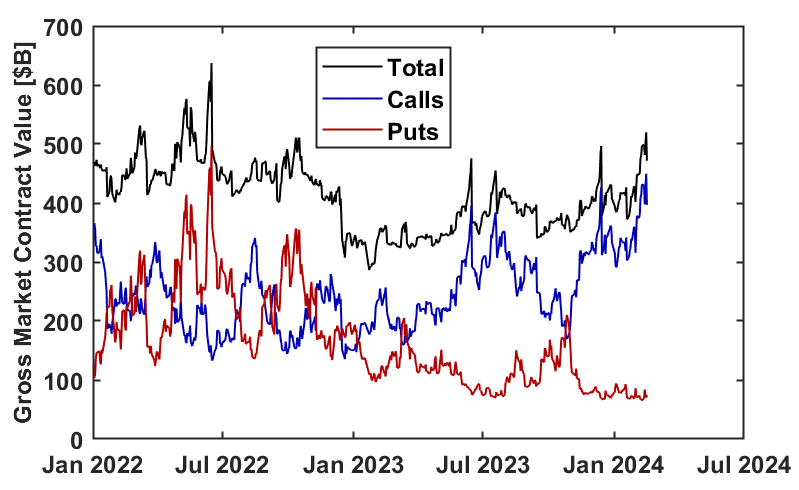

https://twitter.com/Dr_Gingerballs/status/1726000196524417464First, total contract value on the market. With the EOY roll off, we sit around $400B, in line with longer term historical averages. The value is still mostly in calls, as we are concluding one of the fastest runs in recent market history.

The next common one I see is actually a lot of different yes/no criteria. For example, percent of companies above their 20 day moving average. I saw percent of companies below 200 day moving average for awhile back in October. These are...okay...but they throw out a lot of info.

The next common one I see is actually a lot of different yes/no criteria. For example, percent of companies above their 20 day moving average. I saw percent of companies below 200 day moving average for awhile back in October. These are...okay...but they throw out a lot of info.

https://x.com/Dr_Gingerballs/status/1726000196524417464?s=20First up we have the total contract value of all contracts in the market. As can be seen, this jumped considerably this week to $420B, up from $400B. This was primarily driven by sold puts driving more calls ITM at $SPX $4600.

https://x.com/Dr_Gingerballs/status/1726000196524417464?s=20Gross market contract value increased noticeably by $20B this week, led by calls. Total value $410B.