Finding winning stocks feels like searching for a needle in a haystack... until you have a system.

Here’s an 8-step framework to consistently spot breakout stocks that can lead to big profits: 🚀👇

Here’s an 8-step framework to consistently spot breakout stocks that can lead to big profits: 🚀👇

Step 1: Start with Market Context

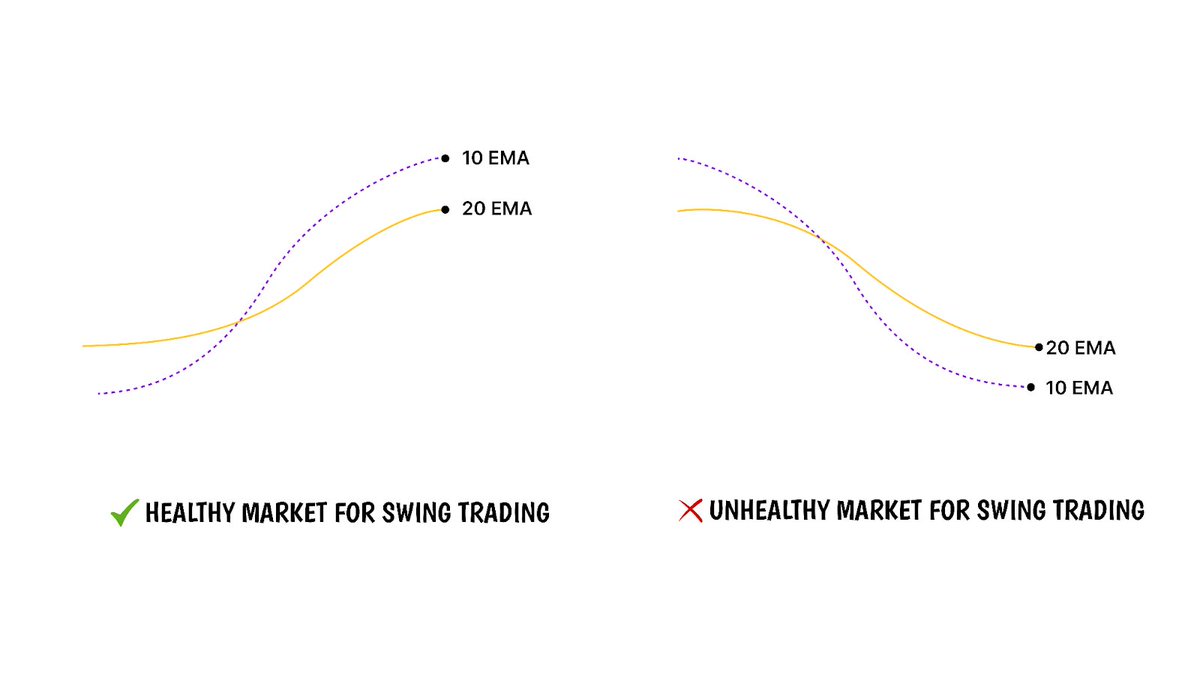

Before picking a stock, understand the broader market trend.

Is the market in an uptrend, downtrend, or sideways?

Use tools like moving averages and indices (e.g., Nifty/S&P 500).

A rising tide lifts all boats; trade with the trend.

Before picking a stock, understand the broader market trend.

Is the market in an uptrend, downtrend, or sideways?

Use tools like moving averages and indices (e.g., Nifty/S&P 500).

A rising tide lifts all boats; trade with the trend.

Step 2: Scan for Strong Sectors

Top-performing stocks often belong to top-performing sectors.

Look at sector indices (e.g., IT, Pharma).

Check relative strength to identify which sectors outperform the market.

Focus your attention here.

Top-performing stocks often belong to top-performing sectors.

Look at sector indices (e.g., IT, Pharma).

Check relative strength to identify which sectors outperform the market.

Focus your attention here.

Step 3: Filter for Momentum Stocks

Now, zoom into individual stocks showing strength:

Price near 52-week highs or all-time highs.

Relative Strength Index (RSI) > 60 (optional).

Increasing trading volume.

These stocks are likely under accumulation by institutions.

Now, zoom into individual stocks showing strength:

Price near 52-week highs or all-time highs.

Relative Strength Index (RSI) > 60 (optional).

Increasing trading volume.

These stocks are likely under accumulation by institutions.

Step 4: Look for a Base or Consolidation

Momentum alone isn’t enough. Identify stocks that have paused to consolidate.

Common patterns:

Cup and Handle

Ascending Triangle

Flat Base

These setups signal that big players are preparing for the next move.

Momentum alone isn’t enough. Identify stocks that have paused to consolidate.

Common patterns:

Cup and Handle

Ascending Triangle

Flat Base

These setups signal that big players are preparing for the next move.

Step 5: Evaluate Fundamentals (Optional)

Though swing trading focuses on technicals, a quick fundamental check adds confidence.

Is the company profitable?

Revenue and earnings trends—up or down?

Avoid stocks with poor fundamentals unless you're playing a short-term technical setup.

Though swing trading focuses on technicals, a quick fundamental check adds confidence.

Is the company profitable?

Revenue and earnings trends—up or down?

Avoid stocks with poor fundamentals unless you're playing a short-term technical setup.

Step 6: Confirm Breakout with Volume

A breakout is only valid if it happens with strong volume.

Wait for the stock to break above resistance.

Volume should be higher than the 50-day average.

This shows genuine buying interest.

A breakout is only valid if it happens with strong volume.

Wait for the stock to break above resistance.

Volume should be higher than the 50-day average.

This shows genuine buying interest.

Step 7: Manage Risk with Stop-Loss

Every trade needs a plan to manage losses.

Place a stop-loss below the base or consolidation area.

Risk only 1-2% of your total capital on a single trade.

Risk management is your survival tool in trading.

Every trade needs a plan to manage losses.

Place a stop-loss below the base or consolidation area.

Risk only 1-2% of your total capital on a single trade.

Risk management is your survival tool in trading.

Step 8: Track and Adjust the Trade

Once in the trade:

Set a trailing stop to lock in profits.

Exit when the stock hits your price target or shows signs of reversal.

Always review trades to refine your process.

Once in the trade:

Set a trailing stop to lock in profits.

Exit when the stock hits your price target or shows signs of reversal.

Always review trades to refine your process.

Conclusion

This 8-step process simplifies finding and managing winning stocks:

1️⃣ Market Context

2️⃣ Strong Sectors

3️⃣ Momentum Stocks

4️⃣ Bases/Consolidations

5️⃣ Fundamentals (Optional)

6️⃣ Volume Breakout

7️⃣ Stop-Loss

8️⃣ Trade Management

Trading is about discipline, not prediction.

This 8-step process simplifies finding and managing winning stocks:

1️⃣ Market Context

2️⃣ Strong Sectors

3️⃣ Momentum Stocks

4️⃣ Bases/Consolidations

5️⃣ Fundamentals (Optional)

6️⃣ Volume Breakout

7️⃣ Stop-Loss

8️⃣ Trade Management

Trading is about discipline, not prediction.

If you like Such Learning Posts

( 1 ) Please Follow me on X

@ankurpatel59

Bookmark and Retweet this Post

( 1 ) Please Follow me on X

@ankurpatel59

Bookmark and Retweet this Post

• • •

Missing some Tweet in this thread? You can try to

force a refresh