🚨🚨 $ASTS WEEK IN REVIEW🚨🚨

$ASTS is set to receive FCC approval, Starlink gets to pursue its defective system, FUD Busting, and much more on this week's Weekly

$ASTS is set to receive FCC approval, Starlink gets to pursue its defective system, FUD Busting, and much more on this week's Weekly

Week in Review Highlights:

Global Expansion and Partnerships: Permits filed in Turkey with Vodafone. Notable collaborations with AT&T, including mentions of their strategic investments and upcoming Analyst Day.

Competitive Landscape: Critical analysis of Starlink's limitations, regulatory challenges, and service model, highlighting $ASTS's edge in technology and market positioning.

Market Opportunities: Emphasis on the scalability and economic potential of commercial space applications, with $ASTS poised to revolutionize telecommunications, especially in underserved areas.

Investment Case for $ASTS: Focus on its superwholesale model, strategic partnerships, and visionary leadership driving innovation.

Financial health underlined by significant cash reserves and successful satellite launches.

Key Takeaways from DB Conference: Observations on industry lethargy versus $ASTS's dynamic approach, with leadership seen as focused and mission-driven.

Analysis of historical failures in satellite

communications and how $ASTS is breaking that mold.

Regulatory and Competitive Insights: Updates on FCC approvals, spectrum battles, and the impact of lower orbital altitudes on satellite longevity and efficiency.

Starlink's challenges with interference and its perceived struggles to compete with $ASTS.

Technological Innovation: Discussion on space-based power generation and other potential non-communication applications for $ASTS's technology.

Market Trends and Sentiment: Shift in generalist investor sentiment towards space stocks, with $ASTS emerging as a long-term growth story.

Analysis of adjacent industries and their role in $ASTS's success, including military and government programs.

Broader Space Economy: Highlights on the growing valuation of space companies like SpaceX and the potential for market disruption in the telecommunications sector.

Global Expansion and Partnerships: Permits filed in Turkey with Vodafone. Notable collaborations with AT&T, including mentions of their strategic investments and upcoming Analyst Day.

Competitive Landscape: Critical analysis of Starlink's limitations, regulatory challenges, and service model, highlighting $ASTS's edge in technology and market positioning.

Market Opportunities: Emphasis on the scalability and economic potential of commercial space applications, with $ASTS poised to revolutionize telecommunications, especially in underserved areas.

Investment Case for $ASTS: Focus on its superwholesale model, strategic partnerships, and visionary leadership driving innovation.

Financial health underlined by significant cash reserves and successful satellite launches.

Key Takeaways from DB Conference: Observations on industry lethargy versus $ASTS's dynamic approach, with leadership seen as focused and mission-driven.

Analysis of historical failures in satellite

communications and how $ASTS is breaking that mold.

Regulatory and Competitive Insights: Updates on FCC approvals, spectrum battles, and the impact of lower orbital altitudes on satellite longevity and efficiency.

Starlink's challenges with interference and its perceived struggles to compete with $ASTS.

Technological Innovation: Discussion on space-based power generation and other potential non-communication applications for $ASTS's technology.

Market Trends and Sentiment: Shift in generalist investor sentiment towards space stocks, with $ASTS emerging as a long-term growth story.

Analysis of adjacent industries and their role in $ASTS's success, including military and government programs.

Broader Space Economy: Highlights on the growing valuation of space companies like SpaceX and the potential for market disruption in the telecommunications sector.

🇹🇷Testing Permits Continue

$ASTS permits with Vodafone are filed in Turkey. We're going global.

$ASTS permits with Vodafone are filed in Turkey. We're going global.

https://x.com/catse___apex___/status/1861064004715663681?s=61&t=A0iuFRBcW53DZvUrwsGTMg

🤩AT&T Is Calling The #SpaceMob

It's cool that AT&T is helping us with our DD. Tune in on December 3 for AT&T's Analyst Day. $ASTS should be an important part of their capital allocation and maybe we'll get an announcement about additional strategic investment or at least how they are going to commercialize the service

The event will include presentations from AT&T’s senior leadership team outlining the Company’s investment-led growth strategy and capital allocation plans as well as a live Q&A session

x.com/ATT/status/186…

It's cool that AT&T is helping us with our DD. Tune in on December 3 for AT&T's Analyst Day. $ASTS should be an important part of their capital allocation and maybe we'll get an announcement about additional strategic investment or at least how they are going to commercialize the service

The event will include presentations from AT&T’s senior leadership team outlining the Company’s investment-led growth strategy and capital allocation plans as well as a live Q&A session

x.com/ATT/status/186…

💰AT&T Capital Allocation Call

Remember earlier we had Sambar say they’re invest in $ASTS again and FirstNet had sale this:

“We are also planning on additional investments that will—over time—enable satellite-direct-to-device capability for FirstNet subscribers. We will work with public-safety stakeholders nationwide to ensure that our investment dollars achieve the maximum benefit for public safety. Our goal is to enhance the experience of public safety, wherever and whenever they access the nation’s only dedicated public-safety network.”

x.com/defiantclient/…

Remember earlier we had Sambar say they’re invest in $ASTS again and FirstNet had sale this:

“We are also planning on additional investments that will—over time—enable satellite-direct-to-device capability for FirstNet subscribers. We will work with public-safety stakeholders nationwide to ensure that our investment dollars achieve the maximum benefit for public safety. Our goal is to enhance the experience of public safety, wherever and whenever they access the nation’s only dedicated public-safety network.”

x.com/defiantclient/…

🚑FirstNet & AT&T

While AT&T could easily be talking about new telephone poles, there might also be hints out there on other areas of investment AT&T is set to pursue

While AT&T could easily be talking about new telephone poles, there might also be hints out there on other areas of investment AT&T is set to pursue

https://x.com/ASTSVisionary/status/1861905224190890366

🦘Australia Does The Meme

Slapping Starlink's on cars? Christ. Imagine what $ASTS' opportunity will look like?

Slapping Starlink's on cars? Christ. Imagine what $ASTS' opportunity will look like?

https://x.com/SawyerMerritt/status/1860813969964888088

👑Scott at DB

Here is the full replay of what institutional investors saw at the DB conference. Bobby Axelrod was there.

Here is the full replay of what institutional investors saw at the DB conference. Bobby Axelrod was there.

https://x.com/Michael97670912/status/1861586184507371748

🥹The Key Is The "Go To Market" Model

Listening to Iridium and Globalstar talk about the consumer market reveals the institutional scar tissue those companies have from their attempts in the 1990s / 2000s to sell customer terminal. $ASTS is doing it differently (which is not the same as saying "this time it's different).

x.com/cytoplasmicana…

Listening to Iridium and Globalstar talk about the consumer market reveals the institutional scar tissue those companies have from their attempts in the 1990s / 2000s to sell customer terminal. $ASTS is doing it differently (which is not the same as saying "this time it's different).

x.com/cytoplasmicana…

🎶DB Conference Takeaways

Here is a nice summary of the key takeaways

Here is a nice summary of the key takeaways

https://x.com/spacanpanman/status/1862533943678968011

👾Space Is The Place

Never underestimate how long it takes institutional investors to re-gear to a new paradigm. I was shocked at how long SaaS was hanging around before investors really understood it.

📷

cnbc.com/2024/11/15/spa…

Never underestimate how long it takes institutional investors to re-gear to a new paradigm. I was shocked at how long SaaS was hanging around before investors really understood it.

📷

cnbc.com/2024/11/15/spa…

🛸The Space Economy

Blasting large phallic symbols is fun, but let’s not forget about where the economic value is

Blasting large phallic symbols is fun, but let’s not forget about where the economic value is

https://x.com/michael97670912/status/1860741199222481214?s=61&t=A0iuFRBcW53DZvUrwsGTMg

📑The Simple Pitch Gets Easier To Understand

As Space is in the news, as people hear more about D2D, etc, the simple elevator pitch will resonate with generalists.

As Space is in the news, as people hear more about D2D, etc, the simple elevator pitch will resonate with generalists.

https://x.com/stocksavvyshay/status/1861031025356513581?s=61&t=A0iuFRBcW53DZvUrwsGTMg

🔖Another Nice Simple Summary

Why I Think AST SpaceMobile $ASTS Could Be a Stellar Long-Term Investment👇

1️⃣ Revolutionizing Connectivity:

AST SpaceMobile is developing the first space-based cellular broadband network, a revolutionary technology that enables mobile phones to connect directly to broadband from space. This innovation targets underserved areas worldwide, potentially transforming the global telecommunications landscape.

2️⃣ Strong Execution and Technology:

The successful launch and unfolding of the first five commercial BlueBird satellites mark a significant achievement for AST SpaceMobile. These satellites set the stage for beta services with major partners like AT&T and Verizon, while future Block 2 BlueBird satellites aim to deliver continuous global coverage.

3️⃣ Expanding Government and Commercial Partnerships:

AST SpaceMobile’s technology has attracted major contracts, including a selection by the U.S. Space Development Agency (SDA) for the HALO program. These government collaborations complement its commercial efforts, which span partnerships with 45+ mobile network operators serving over 2.8 billion subscribers.

4️⃣ Strong Financial Position:

With $518.9M in cash and strong backing from its warrant redemption and ATM program, AST SpaceMobile is well-equipped to continue investing in its groundbreaking technology and infrastructure.

5️⃣ Massive Market Opportunity:

The company's dual-use technology addresses critical gaps in connectivity, particularly in rural and underserved markets. This positions AST SpaceMobile to capitalize on a telecommunications market projected to grow to $1 trillion, with unique capabilities that bridge space and terrestrial networks.

6️⃣ Visionary Leadership:

Abel Avellan, the CEO of AST SpaceMobile, brings deep expertise and vision to the company. Backed by a team of skilled professionals, the leadership is driving a mission to revolutionize global connectivity and unlock significant long-term value.

While the industry presents challenges such as high capital costs and execution risks, AST SpaceMobile’s unique technology, strong partnerships, and growing momentum make it a compelling choice for long-term investors. 🌍📶

x.com/mind1nvestor/s…

Why I Think AST SpaceMobile $ASTS Could Be a Stellar Long-Term Investment👇

1️⃣ Revolutionizing Connectivity:

AST SpaceMobile is developing the first space-based cellular broadband network, a revolutionary technology that enables mobile phones to connect directly to broadband from space. This innovation targets underserved areas worldwide, potentially transforming the global telecommunications landscape.

2️⃣ Strong Execution and Technology:

The successful launch and unfolding of the first five commercial BlueBird satellites mark a significant achievement for AST SpaceMobile. These satellites set the stage for beta services with major partners like AT&T and Verizon, while future Block 2 BlueBird satellites aim to deliver continuous global coverage.

3️⃣ Expanding Government and Commercial Partnerships:

AST SpaceMobile’s technology has attracted major contracts, including a selection by the U.S. Space Development Agency (SDA) for the HALO program. These government collaborations complement its commercial efforts, which span partnerships with 45+ mobile network operators serving over 2.8 billion subscribers.

4️⃣ Strong Financial Position:

With $518.9M in cash and strong backing from its warrant redemption and ATM program, AST SpaceMobile is well-equipped to continue investing in its groundbreaking technology and infrastructure.

5️⃣ Massive Market Opportunity:

The company's dual-use technology addresses critical gaps in connectivity, particularly in rural and underserved markets. This positions AST SpaceMobile to capitalize on a telecommunications market projected to grow to $1 trillion, with unique capabilities that bridge space and terrestrial networks.

6️⃣ Visionary Leadership:

Abel Avellan, the CEO of AST SpaceMobile, brings deep expertise and vision to the company. Backed by a team of skilled professionals, the leadership is driving a mission to revolutionize global connectivity and unlock significant long-term value.

While the industry presents challenges such as high capital costs and execution risks, AST SpaceMobile’s unique technology, strong partnerships, and growing momentum make it a compelling choice for long-term investors. 🌍📶

x.com/mind1nvestor/s…

🇨🇦Scotia Bank Report

Honestly, a weak take. Like ceding the mobile phone market to Blackberry not realizing the better thing was about to hit. Scotia seems to get a bit weak in the knees on what we all expected was a Starlink approval. Even if they had received the OOBE waiver, it would not have changed my calculus on $ASTS. But they didn't. Scotia misses so many points I don't know where to begin.

x.com/spacanpanman/s…

Honestly, a weak take. Like ceding the mobile phone market to Blackberry not realizing the better thing was about to hit. Scotia seems to get a bit weak in the knees on what we all expected was a Starlink approval. Even if they had received the OOBE waiver, it would not have changed my calculus on $ASTS. But they didn't. Scotia misses so many points I don't know where to begin.

x.com/spacanpanman/s…

🦎Analysis of People Who Sell The Stock

Here is your 5 seconds of DD.

Here is your 5 seconds of DD.

https://x.com/vincent13031925/status/1861596396715188345

🥜Tim Farrar Peanut Gallery

Yes Tim spent years crapping on SpaceX until its sheer enormity ran him over. Yes, the exact same thing appears to be happening to him on $ASTS. That said, let’s suffer the indignity of acknowledging his existence

Yes Tim spent years crapping on SpaceX until its sheer enormity ran him over. Yes, the exact same thing appears to be happening to him on $ASTS. That said, let’s suffer the indignity of acknowledging his existence

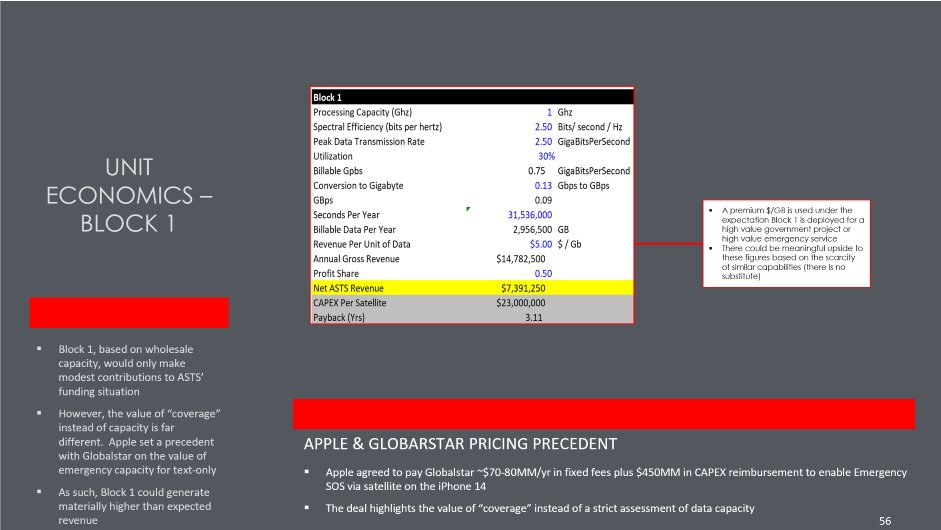

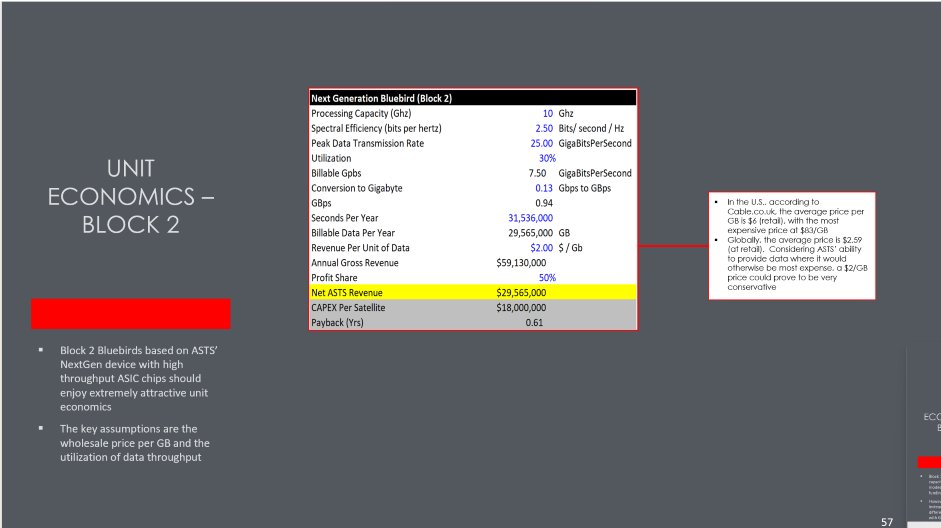

🧮TheKOOKReport Thought About Math Before

It might not come as a surprise, but I thought about the financial model of $ASTS prior to making my investment.

It might not come as a surprise, but I thought about the financial model of $ASTS prior to making my investment.

https://x.com/CatSE___ApeX___/status/1862390107048648990

🔙Back Up Math

I think Scott is sandbagging here. But 1MM GB/Month is a nice round number. Say he's right…at $2/GB gross, that's $12MM per satellite per year net to $ASTS. That's $1.2BN on a fleet of 100 satellites. Now, I firmly believe this is not a linear service b/c you'll oversell your capacity and sell a service, not direct data. I also think we are going to blow away their more conservative 15% utilization rate because of non-communication use cases and the reselling of capacity for FirstNet and back-up. The $2/GB number is my made up number and a small fraction of the current market rate for satellite data.

x.com/CatSE___ApeX__…

I think Scott is sandbagging here. But 1MM GB/Month is a nice round number. Say he's right…at $2/GB gross, that's $12MM per satellite per year net to $ASTS. That's $1.2BN on a fleet of 100 satellites. Now, I firmly believe this is not a linear service b/c you'll oversell your capacity and sell a service, not direct data. I also think we are going to blow away their more conservative 15% utilization rate because of non-communication use cases and the reselling of capacity for FirstNet and back-up. The $2/GB number is my made up number and a small fraction of the current market rate for satellite data.

x.com/CatSE___ApeX__…

💹Pricing

I think there will be a diverse set of payers in the market who will pay a mix of capacity and usage charges, each with their own value-based pricing

I think there will be a diverse set of payers in the market who will pay a mix of capacity and usage charges, each with their own value-based pricing

🌐Terrestrial Pricing

I took a stab at just understanding "what if" the pricing were in-line with terrestrial pricing, which would be a terrible outcome. Sure looks healthy to me.

I took a stab at just understanding "what if" the pricing were in-line with terrestrial pricing, which would be a terrible outcome. Sure looks healthy to me.

🪐Non-Terrestrial Pricing

Non-terrestrial pricing is off the charts compared to your normal data plans, as you might have already known

Non-terrestrial pricing is off the charts compared to your normal data plans, as you might have already known

⭐️Starlink Pricing

For fun, what's Starlink cost? Oh yeah, a lot. Yes, it's a different service at very high bandwidth - but it's serving a purpose in a unique, low-friction way. You are telling me that $2/GB is a crazy assumption? What if $ASTS put an "all you can eat" plan out at $100. I bet there is a reasonable segment of the market that would love that.

For fun, what's Starlink cost? Oh yeah, a lot. Yes, it's a different service at very high bandwidth - but it's serving a purpose in a unique, low-friction way. You are telling me that $2/GB is a crazy assumption? What if $ASTS put an "all you can eat" plan out at $100. I bet there is a reasonable segment of the market that would love that.

🚦Zoom Out on Market Disruption

Now why do I think $ASTS is going to get a ton of market share? Let's just ask Iridium why they got share. $ASTS is going to blow them away. It's going to massively expand the market in ways people truly cannot think about.

Now why do I think $ASTS is going to get a ton of market share? Let's just ask Iridium why they got share. $ASTS is going to blow them away. It's going to massively expand the market in ways people truly cannot think about.

⁉️Maybe We Should Ask AT&T

This interview was incredible. They expect $ASTS to be a "mass market" product. "A secondary network that blankets the primary network."

This interview was incredible. They expect $ASTS to be a "mass market" product. "A secondary network that blankets the primary network."

https://x.com/kingtutcap/status/1838734226016829839

🚀Mass Monetization

Now what is $ASTS doing with NASA?

Now what is $ASTS doing with NASA?

https://x.com/CatSE___ApeX___/status/1861827399689666629

🇺🇳Reminder of Changing Needs

This just speaks to the many non-communication use cases that are arising that $ASTS is well-positioned to address

spacenews.com/the-urgent-nee…

This just speaks to the many non-communication use cases that are arising that $ASTS is well-positioned to address

spacenews.com/the-urgent-nee…

💩More Farrar FUD

Farrar says no European SCS. While our friend who cannot see past the front windshield is right that there is not a current SCS rule-making process...we saw it spring up in Canada quickly (and it looks like it does in the US). And curiously, we have all the European telecoms posting in the FCC docket about their preferences for rules that would apply in Europe.

x.com/MWM76/status/1…

Farrar says no European SCS. While our friend who cannot see past the front windshield is right that there is not a current SCS rule-making process...we saw it spring up in Canada quickly (and it looks like it does in the US). And curiously, we have all the European telecoms posting in the FCC docket about their preferences for rules that would apply in Europe.

x.com/MWM76/status/1…

🇯🇵Meanwhile, Rakuten Confirms Service

Rakuten is admittedly not in Europe, but nonetheless confirming 2026 service

Rakuten is admittedly not in Europe, but nonetheless confirming 2026 service

https://x.com/yYuTVDKL24A2WqI/status/1862340698416324945

🪟Japanese Translation

A loyal Mobber tried to translate the above video. My kids made me turn it off as I tried to watch it with Google lens in a hotel room, but the Japanese was driving them insane as they were supposed to go to sleep

reddit.com/r/ASTSpaceMobi…

A loyal Mobber tried to translate the above video. My kids made me turn it off as I tried to watch it with Google lens in a hotel room, but the Japanese was driving them insane as they were supposed to go to sleep

reddit.com/r/ASTSpaceMobi…

🇬🇧The UK Is Getting Up To Speed

Oh yeah, and its Vodafone educating them. But again, Farrar says no.

Oh yeah, and its Vodafone educating them. But again, Farrar says no.

https://x.com/defiantclient/status/1862302242545533401

➗Reminder: Digital Divide

While we are focused on high ARPU developing countries, do not forget the sheer numbers of people who will benefit from these services. I wouldn't be surprised if a lot of grant money comes in.

While we are focused on high ARPU developing countries, do not forget the sheer numbers of people who will benefit from these services. I wouldn't be surprised if a lot of grant money comes in.

https://x.com/CytoplasmicANA/status/1862270349771002264

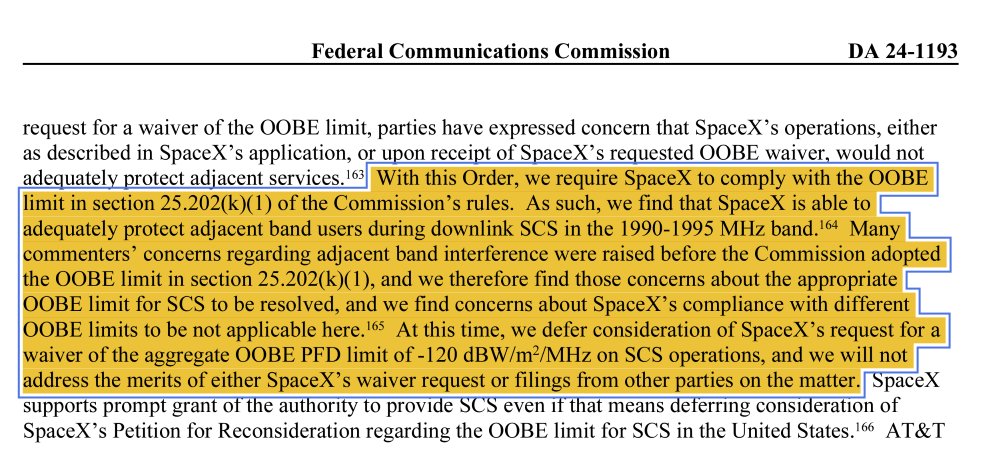

👋ASTS Is About To Get Approval

This is really why Scotiabanks's note was so dumb.

spacenews.com/spacex-gets-co…

This is really why Scotiabanks's note was so dumb.

spacenews.com/spacex-gets-co…

🪪Starlink Gets US Commercial License

7,500 Gen2 satellites approved

VLEO orbit of 340-360km approved

No OOBE waiver

7,500 Gen2 satellites approved

VLEO orbit of 340-360km approved

No OOBE waiver

https://x.com/longmier/status/1861492913462747450

🧐Do Starlink's Engineers Have A Wholistic View?

I don't get it. Sometimes orgs are silo'd and engineers do not really understand the business or regulatory aspects of things. I really cannot make heads or tails of this but it's bizarre.

x.com/vikramskr/stat…

x.com/defiantclient/…

I don't get it. Sometimes orgs are silo'd and engineers do not really understand the business or regulatory aspects of things. I really cannot make heads or tails of this but it's bizarre.

x.com/vikramskr/stat…

x.com/defiantclient/…

📨What Service Will Starlink Provide?

Starlink already told us in its FCC filings, which its own head of engineer did not seem to read based on his X posts. T-Mobile read it though.

Starlink already told us in its FCC filings, which its own head of engineer did not seem to read based on his X posts. T-Mobile read it though.

https://x.com/Stockflyer15/status/1861602341322936791

🏆KOOK Review

I had anticipated this. I think AT&T was playing chess here knowing that if Starlink got its approval without a waiver, it was trapped.

"SPACEX FCC FILING OF INTEREST: This filing is interesting. AT&T is playing a smart game here. Fully banning SpaceX is pretty silly. It accomplishes nothing. By purusing this path, AT&T kills a few birds. For one, it ties T-Mobile to Starlink and presumably prevents a release from their contract. Secondly, it prevents SpaceX from having to be embarrassed. Why does that matter? A pissed off SpaceX is a motivated SpaceX. Now they are committed, in a way, to doing their defected D2D program instead of a more expedited re-engineering of their system. Their defective system is wildly inferior to what $ASTS will provide. T-Mobile customers will be harmed, helping AT&T and Verizon win subscribers. Starlink will chew up a lot of launch capacity for sub economic spend on its D2D system. I strongly suspect this is also part of a compromise between Starlink/SpaceX/ASTS/AT&T/VZ to then also get launch capacity. We saw the other day SpaceX leveraged its launch capacity to get spectrum. This cuts both ways. Maybe I'll be wildly wrong - but I'm putting my best thinking out there for public scrutiny. This is Art of War stuff. Sometimes it can be strategic to let the enemy into the city. It just has to be on your terms. The retained power limits ensure that SpaceX and other satellite operators continue to operate under established U.S. regulatory conditions while the FCC takes time to review the potential alignment with international standards. Thus, the core of the compromise is maintaining the status quo regarding power limits while allowing SpaceX to deploy services and deferring any decision on adopting new interference standards. In summary, the MNOs beat the hell out of Starlink and now Starlink has a defective service, but is yet committed to having to commit capital against launching that defective service. Starlink will build awareness for SCS, and then AT&T and Verizon will come in and trump T-Mobile. Can you hear me now?

x.com/thekookreport/…

I had anticipated this. I think AT&T was playing chess here knowing that if Starlink got its approval without a waiver, it was trapped.

"SPACEX FCC FILING OF INTEREST: This filing is interesting. AT&T is playing a smart game here. Fully banning SpaceX is pretty silly. It accomplishes nothing. By purusing this path, AT&T kills a few birds. For one, it ties T-Mobile to Starlink and presumably prevents a release from their contract. Secondly, it prevents SpaceX from having to be embarrassed. Why does that matter? A pissed off SpaceX is a motivated SpaceX. Now they are committed, in a way, to doing their defected D2D program instead of a more expedited re-engineering of their system. Their defective system is wildly inferior to what $ASTS will provide. T-Mobile customers will be harmed, helping AT&T and Verizon win subscribers. Starlink will chew up a lot of launch capacity for sub economic spend on its D2D system. I strongly suspect this is also part of a compromise between Starlink/SpaceX/ASTS/AT&T/VZ to then also get launch capacity. We saw the other day SpaceX leveraged its launch capacity to get spectrum. This cuts both ways. Maybe I'll be wildly wrong - but I'm putting my best thinking out there for public scrutiny. This is Art of War stuff. Sometimes it can be strategic to let the enemy into the city. It just has to be on your terms. The retained power limits ensure that SpaceX and other satellite operators continue to operate under established U.S. regulatory conditions while the FCC takes time to review the potential alignment with international standards. Thus, the core of the compromise is maintaining the status quo regarding power limits while allowing SpaceX to deploy services and deferring any decision on adopting new interference standards. In summary, the MNOs beat the hell out of Starlink and now Starlink has a defective service, but is yet committed to having to commit capital against launching that defective service. Starlink will build awareness for SCS, and then AT&T and Verizon will come in and trump T-Mobile. Can you hear me now?

x.com/thekookreport/…

🎊Starlink Service Demonstration

Look a garbled text message is still better than morse code, which itself revolutionized the world. But it’s not the same as what $ASTS is offering

Look a garbled text message is still better than morse code, which itself revolutionized the world. But it’s not the same as what $ASTS is offering

https://x.com/an_astman/status/1860738763132911723?s=61&t=A0iuFRBcW53DZvUrwsGTMg

🛑Omnispace Issue - In-band Interference

Omnispace had lodged a complain about Starlink using the same spectrum downlink that is commonly used as uplink. While the FCC ruled that Starlink can proceed on this issue, it is worth highlighting that secondary nature of SCS. If Starlink interferes, they must cease

Omnispace had lodged a complain about Starlink using the same spectrum downlink that is commonly used as uplink. While the FCC ruled that Starlink can proceed on this issue, it is worth highlighting that secondary nature of SCS. If Starlink interferes, they must cease

🧑🤝🧑Adjacent Band Interference

The big issue that industry railed against Starlink on was adjacent band interference, or OOBE. The FCC did not approve Starlink's higher power levels, which has significant implications for the quality of its service

The big issue that industry railed against Starlink on was adjacent band interference, or OOBE. The FCC did not approve Starlink's higher power levels, which has significant implications for the quality of its service

🪂Lower Altitudes

Now, why does Starlink want to fly at lower altitudes? It's to improve their link budget for given power levels and reduce latency. Why don't all companies fly at lower altitudes? Simple - it's more expensive. You need more satellites, more often, at lower altitude. Altitudes de-orbit more quickly and you need more satellites because of the look angle. Double trouble.

x.com/CatSE___ApeX__…

Now, why does Starlink want to fly at lower altitudes? It's to improve their link budget for given power levels and reduce latency. Why don't all companies fly at lower altitudes? Simple - it's more expensive. You need more satellites, more often, at lower altitude. Altitudes de-orbit more quickly and you need more satellites because of the look angle. Double trouble.

x.com/CatSE___ApeX__…

🚔No Interference, Got it?

How many times does the FCC say that SCS is a secondary user of spectrum and that it cannot cause interference? A lot. Why? That is one of the primary functional roles of the FCC. They are the noise police.

How many times does the FCC say that SCS is a secondary user of spectrum and that it cannot cause interference? A lot. Why? That is one of the primary functional roles of the FCC. They are the noise police.

💱Meanwhile, SpaceX Is Trying To Change The Rules

This study DOES NOT RELATE TO SCS but instead Starlnk’s core fixed satellite business.

FSS Focus: The test is explicitly centered on Starlink’s Ku-band operations for broadband services, which fall under the category of fixed satellite services (FSS). Epfd Compliance: Starlink must comply with existing epfd limits in these bands to ensure it doesn’t cause harmful interference to GSO systems, which also operate in these shared frequencies. The test evaluates whether relaxing these epfd limitscould allow Starlink to improve service capacity and efficiency while still protecting critical GSO operations.

x.com/elenaneira/sta…

This study DOES NOT RELATE TO SCS but instead Starlnk’s core fixed satellite business.

FSS Focus: The test is explicitly centered on Starlink’s Ku-band operations for broadband services, which fall under the category of fixed satellite services (FSS). Epfd Compliance: Starlink must comply with existing epfd limits in these bands to ensure it doesn’t cause harmful interference to GSO systems, which also operate in these shared frequencies. The test evaluates whether relaxing these epfd limitscould allow Starlink to improve service capacity and efficiency while still protecting critical GSO operations.

x.com/elenaneira/sta…

🇩🇪Deutsche Telekom Goes With…

Wait, what? This isn't the narrative. Deutsche Telekom, which owns T-Mobile, is not going with Starlink for narrowband texting services. Now that's interesting.

Wait, what? This isn't the narrative. Deutsche Telekom, which owns T-Mobile, is not going with Starlink for narrowband texting services. Now that's interesting.

https://x.com/SkyloTech/status/1861339678378504614

🏀Be Like Mike

It does appear to be a remarkable card to flip that Deutsche Telekom left Starlink at the alter. Is there trouble brewing with the t-Mobile contract after the material deficiency?

It does appear to be a remarkable card to flip that Deutsche Telekom left Starlink at the alter. Is there trouble brewing with the t-Mobile contract after the material deficiency?

https://x.com/mwm76/status/1862534338383954282?s=61&t=A0iuFRBcW53DZvUrwsGTMg

🪇One of Many Reasons Why Starlink Cannot Compete

Starlink is believed to require a 100km buffer zone between countries. In Europe, this requirement renders the country effectively unserviceable.

Starlink is believed to require a 100km buffer zone between countries. In Europe, this requirement renders the country effectively unserviceable.

😱Orbital scarcity

We spoke last week about the situation where LEO has scarcity, which it inherently has. The FCC put the lid on Starlink’s request for the number of satellites.

We spoke last week about the situation where LEO has scarcity, which it inherently has. The FCC put the lid on Starlink’s request for the number of satellites.

https://x.com/marionawfal/status/1861272801971228969?s=61&t=A0iuFRBcW53DZvUrwsGTMg

🦯Less Is More

The issue of blasting the orbit with 1,000s of satellites is just one thing after another

science.org/content/articl…

The issue of blasting the orbit with 1,000s of satellites is just one thing after another

science.org/content/articl…

🚗Brendan Carr

Carr’s chapter sees the development of low-earth-orbit (LEO) satellites such as Starlink and Amazon’s Project Kuiper as “the most significant technological development of the last few years.” He argues that the FCC should review and approve applications to launch new satellites more quickly.

truthonthemarket.com/2024/11/21/wha…

Carr’s chapter sees the development of low-earth-orbit (LEO) satellites such as Starlink and Amazon’s Project Kuiper as “the most significant technological development of the last few years.” He argues that the FCC should review and approve applications to launch new satellites more quickly.

truthonthemarket.com/2024/11/21/wha…

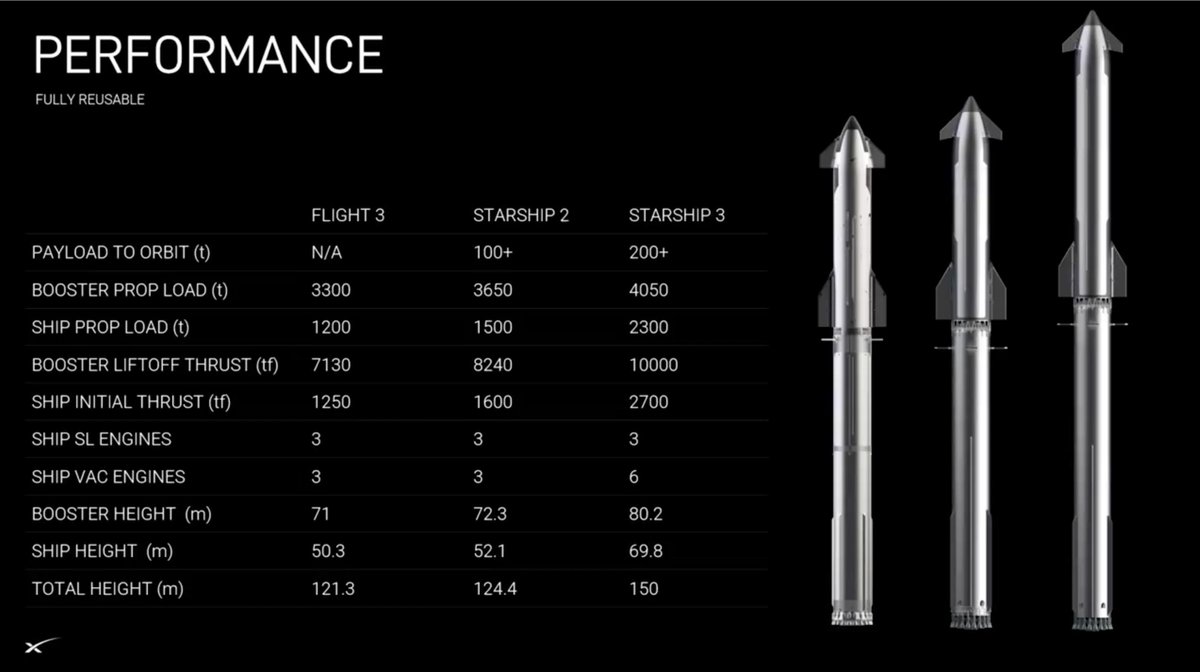

⛴️A Reminder On Launch

When this much capacity is coming online, call me skeptical, but run.

When this much capacity is coming online, call me skeptical, but run.

https://x.com/Sir_Benedict_S/status/1862339912709660784

⚠️Space Valuations

I don’t focus too much on random transaction comparables, except as a proxy to spot special businesses and generally provide a sanity check on whether I’m overlooking cyclical it’s of an industry or secular headwinds. This is a defense deal, but still a healthy multiple. $ASTS is a defense stock right now.

x.com/spacecasetayl0…

I don’t focus too much on random transaction comparables, except as a proxy to spot special businesses and generally provide a sanity check on whether I’m overlooking cyclical it’s of an industry or secular headwinds. This is a defense deal, but still a healthy multiple. $ASTS is a defense stock right now.

x.com/spacecasetayl0…

🌲Rockets & Valuations Grow to the Sky

Morgan Stanley out with some SpaceX figures. They are shocking.

SpaceX reportedly valued at more than $250bn in latest tender offer. According toFinancial Times and Reuters, SpaceX is preparing to launch a December tender offer to sell existing shares at about $135, valuing the company at more than $250bn. We note SpaceX was previously valued at $210bn during a similar tender offer in June. Based on our proprietary forecasts, this would value the company at ~17x Price/Sales (FY24e) or ~4x FY30e sales.

Morgan Stanley out with some SpaceX figures. They are shocking.

SpaceX reportedly valued at more than $250bn in latest tender offer. According toFinancial Times and Reuters, SpaceX is preparing to launch a December tender offer to sell existing shares at about $135, valuing the company at more than $250bn. We note SpaceX was previously valued at $210bn during a similar tender offer in June. Based on our proprietary forecasts, this would value the company at ~17x Price/Sales (FY24e) or ~4x FY30e sales.

⚡️Non-Communication Use Cases

Something we have not talked about is space-based power generation. It's a thing.

caltech.edu/about/news/in-…

Something we have not talked about is space-based power generation. It's a thing.

caltech.edu/about/news/in-…

🪻The Why Now

Electricity from space, phone's that work anywhere, new radar systems…why now? This thread does a great job outlining the big change

Electricity from space, phone's that work anywhere, new radar systems…why now? This thread does a great job outlining the big change

https://x.com/thegrahamcooke/status/1862542111012528257

🤣I love Elon’s Humor

@scottwisniews , you have to put the flight patches up on the store, especially for Bluebird Block 1 India since I don’t think I can go to that one. A lot of us want to collect the patches so let’s get on top of it!!!

@scottwisniews , you have to put the flight patches up on the store, especially for Bluebird Block 1 India since I don’t think I can go to that one. A lot of us want to collect the patches so let’s get on top of it!!!

https://x.com/mcrs987/status/1860813488156705230?s=61&t=A0iuFRBcW53DZvUrwsGTMg

💪New Glenn Does Pull-Ups

Taking after its owner, New Glenn is getting jacked and doing pull-ups over there at LC-36.

x.com/i/status/18611…

x.com/Harry__Strange…

Taking after its owner, New Glenn is getting jacked and doing pull-ups over there at LC-36.

x.com/i/status/18611…

x.com/Harry__Strange…

😎Cool #Spacemob Content

This video is emotional for me. What a journey it has been. When the rockets are firing, something overtakes me.

This video is emotional for me. What a journey it has been. When the rockets are firing, something overtakes me.

https://x.com/therealcphphd/status/1860553867504525330?s=61&t=A0iuFRBcW53DZvUrwsGTMg

I'd like to thank this week's sponsor of The Weekly. They didn't actually sponsor me but I love their boards.

Please support your local surf shop.

@WaldenSurf

waldensurfboards.com

Please support your local surf shop.

@WaldenSurf

waldensurfboards.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh