We all know BlackBerry fell to Apple. But that’s not the full story.

Behind their rapid rise, there was a fatal flaw. A single decision that sparked the collapse.

And here’s the shocking truth—BlackBerry could have saved themselves. But didn’t.

Here's why:

Behind their rapid rise, there was a fatal flaw. A single decision that sparked the collapse.

And here’s the shocking truth—BlackBerry could have saved themselves. But didn’t.

Here's why:

In January 19, 1999, the first BlackBerry pager, BlackBerry 850, was released. It was a game-changer.

Portable, wireless internet, and a unique keyboard that made emailing a breeze.

Business professionals swore by it. Everyone loved it.

Portable, wireless internet, and a unique keyboard that made emailing a breeze.

Business professionals swore by it. Everyone loved it.

By 2002, BlackBerry’s 5810 model added calls, color screens, and insane battery life.

They had gone from making phones to creating a lifestyle.

This is the point where the smartphone king emerged.

The difference was clear now. BlackBerry was on top.

They had gone from making phones to creating a lifestyle.

This is the point where the smartphone king emerged.

The difference was clear now. BlackBerry was on top.

Celebrities, CEOs, and even President Obama were proud to carry their BlackBerrys.

By 2009, the company behind it, Research in Motion (RIM), was Fortune's #1 fastest-growing company.

Apple? Ranked 39th. Google? 68th.

BlackBerry was untouchable. Or so they thought.

By 2009, the company behind it, Research in Motion (RIM), was Fortune's #1 fastest-growing company.

Apple? Ranked 39th. Google? 68th.

BlackBerry was untouchable. Or so they thought.

Then came 2007, and Steve Jobs changed everything.

The iPhone was introduced.

It was sleek, had a touchscreen, and was user-friendly— a complete revolution.

The iPhone had features that redefined what a phone could do.

The iPhone was introduced.

It was sleek, had a touchscreen, and was user-friendly— a complete revolution.

The iPhone had features that redefined what a phone could do.

When iPhone launched, Lazaridis (co-CEO of BlackBerry), grabbed his co-CEO Jim Balsillie at the office and pulled him in front of a computer.

“Jim, I want you to watch this,” he said, pointing to a webcast of the iPhone unveiling.

“Jim, I want you to watch this,” he said, pointing to a webcast of the iPhone unveiling.

“They put a full Web browser on that thing.” “These guys are really, really good. This is different.”

“It’s OK—we’ll be fine,” Balsillie responded.

Spoiler alert: They weren’t fine. Apple had something far more powerful than BlackBerry ever anticipated.

“It’s OK—we’ll be fine,” Balsillie responded.

Spoiler alert: They weren’t fine. Apple had something far more powerful than BlackBerry ever anticipated.

But BlackBerry didn’t see the iPhone as a threat to its core business.

They dismissed it as a “lousy” product with poor security and battery life.

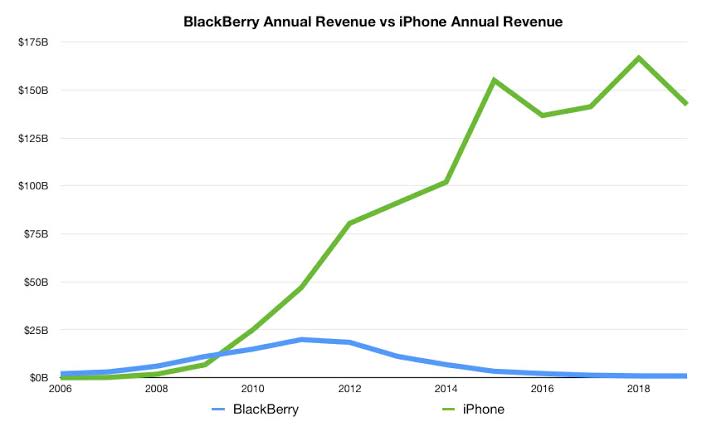

In 2008, Apple sold 11.6M iPhones.

By 2010, that number jumped to 20.73M.

They dismissed it as a “lousy” product with poor security and battery life.

In 2008, Apple sold 11.6M iPhones.

By 2010, that number jumped to 20.73M.

By 2011, Apple had already started chipping away at BlackBerry's market share, and the gap only grew.

The solution was clear: BlackBerry needed to pivot and embrace the new technology.

The solution was clear: BlackBerry needed to pivot and embrace the new technology.

But BlackBerry stuck to its guns, betting its loyal customers would choose the physical keyboard over the iPhone’s touchscreen.

They were wrong.

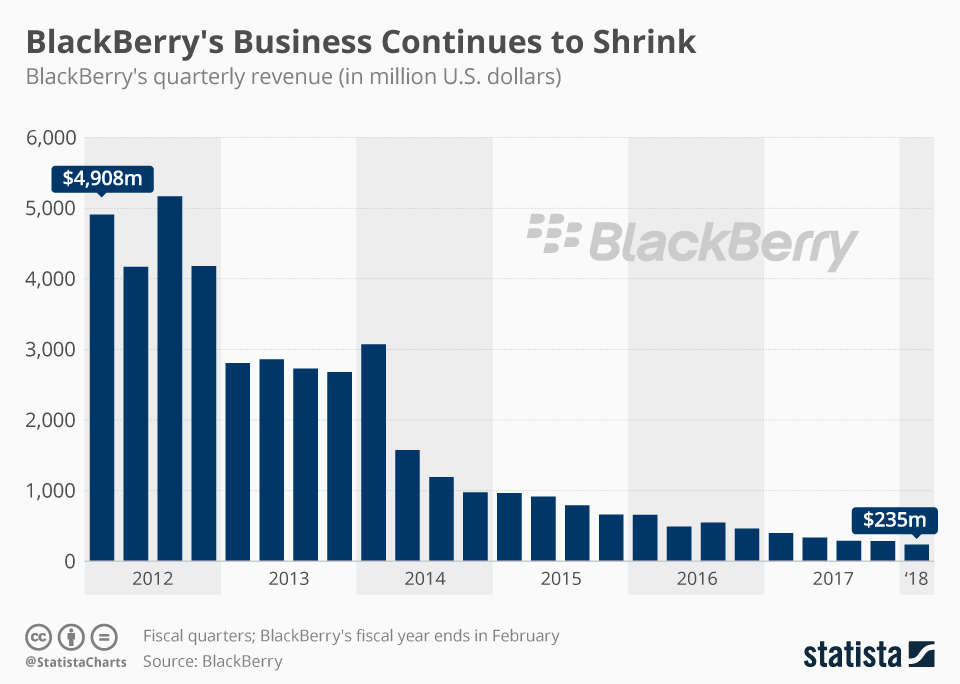

Their market share shrank from 33% in 2011 to just 2.31% in 2016.

By 2021, BlackBerry’s market share had hit 0%.

They were wrong.

Their market share shrank from 33% in 2011 to just 2.31% in 2016.

By 2021, BlackBerry’s market share had hit 0%.

The company, once untouchable, was irrelevant.

The iPhone may have taken most of BlackBerry’s market share, but BlackBerry also made moves that made it worse.

They ignored the power of touchscreens and, in doing so, ignored the future.

But that’s not all.

The iPhone may have taken most of BlackBerry’s market share, but BlackBerry also made moves that made it worse.

They ignored the power of touchscreens and, in doing so, ignored the future.

But that’s not all.

The launch of iPhone shook BlackBerry so much that they started making mistakes:

– A global outage in 2011 left BlackBerry users in the dark for 3+ days.

– Their PlayBook tablet launched with no email, calendar, or notes apps—basic functions that BlackBerry users expected.

– A global outage in 2011 left BlackBerry users in the dark for 3+ days.

– Their PlayBook tablet launched with no email, calendar, or notes apps—basic functions that BlackBerry users expected.

And they kept rushing products without understanding market needs.

By 2012, co-chairs Lazaridis and Balsillie stepped down, and Apple dominated.

In 2017, BlackBerry stopped manufacturing phones altogether.

By 2012, co-chairs Lazaridis and Balsillie stepped down, and Apple dominated.

In 2017, BlackBerry stopped manufacturing phones altogether.

To put this in perspective,

In 2009, BlackBerry controlled 50% of the smartphone market.

Five years later, in 2014, that number was less than 1%.

In 2009, BlackBerry controlled 50% of the smartphone market.

Five years later, in 2014, that number was less than 1%.

The BlackBerry story is a cautionary tale.

1. Innovation waits for no one—touchscreen tech already existed, but BlackBerry ignored it.

2. Never underestimate your competition. The iPhone turned out to be a revolution.

3. Loyalty fades fast if you don't evolve.

1. Innovation waits for no one—touchscreen tech already existed, but BlackBerry ignored it.

2. Never underestimate your competition. The iPhone turned out to be a revolution.

3. Loyalty fades fast if you don't evolve.

If you liked this thread, follow @RogerWang11 for more business insights.

Comment what other content you're interested in - and I'll write about it.

DM me for tips to go viral :)

Comment what other content you're interested in - and I'll write about it.

DM me for tips to go viral :)

• • •

Missing some Tweet in this thread? You can try to

force a refresh