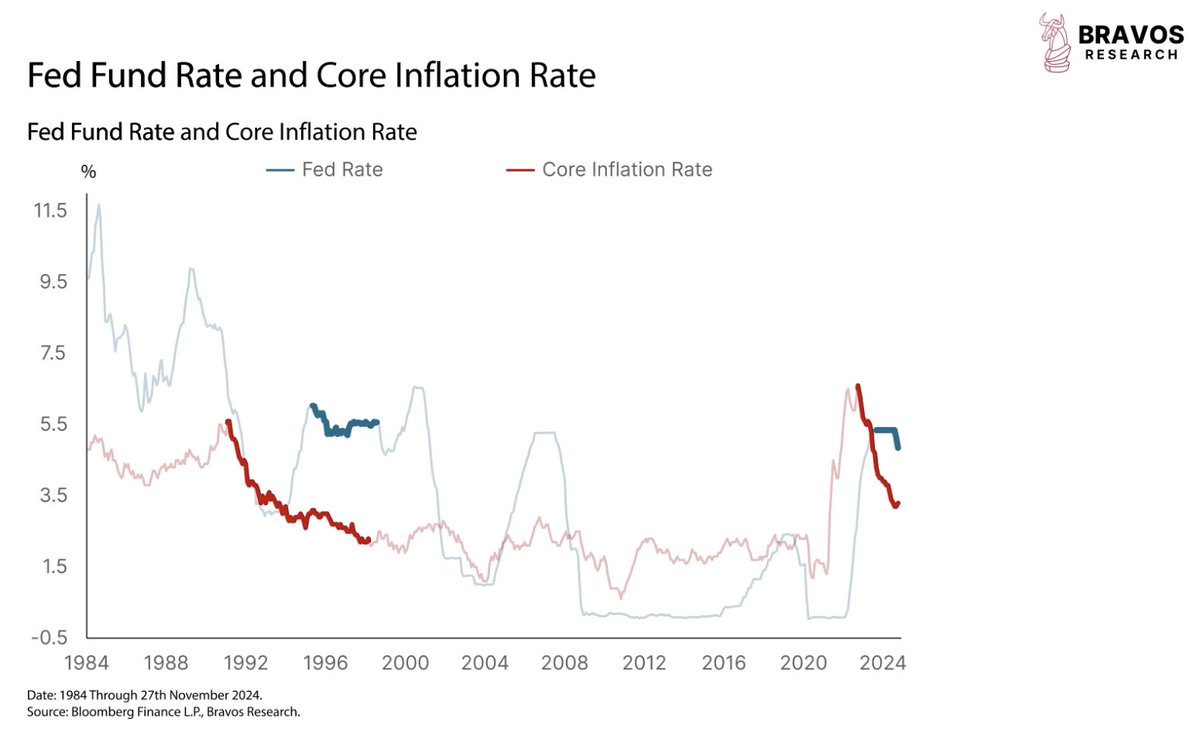

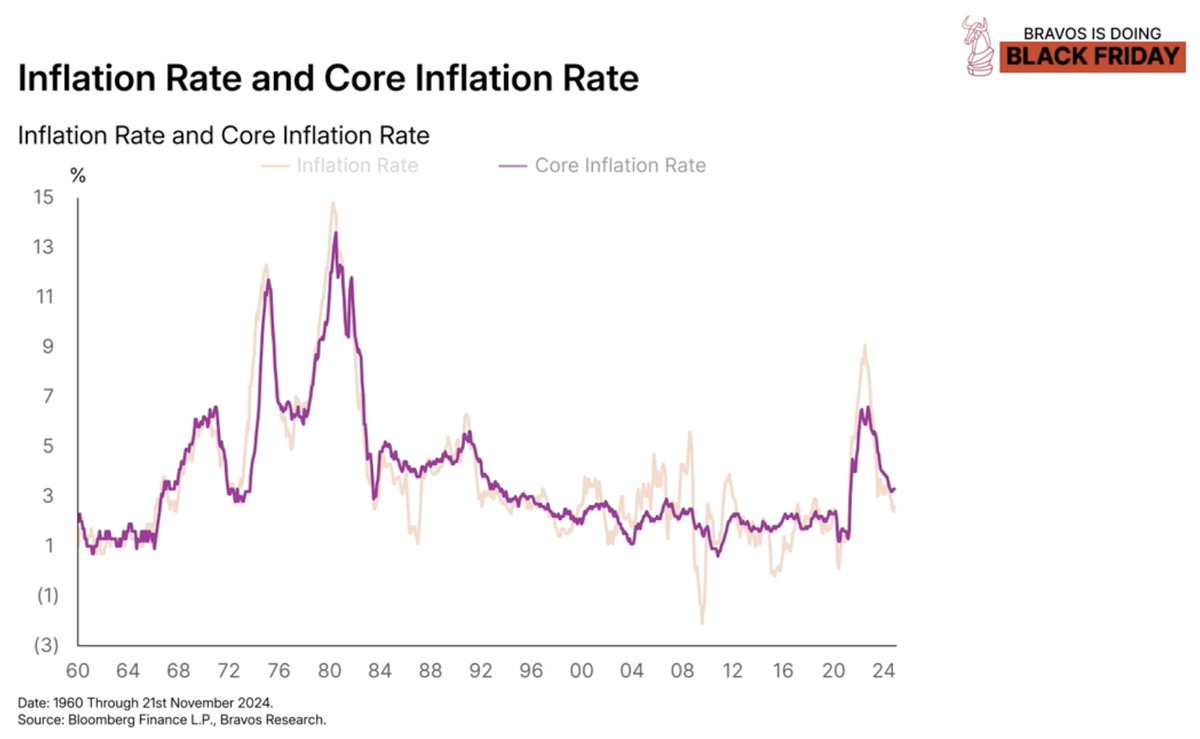

Inflation is still very sticky

With Core CPI above the Fed’s 2% target

This could be a MAJOR problem

A thread 🧵

With Core CPI above the Fed’s 2% target

This could be a MAJOR problem

A thread 🧵

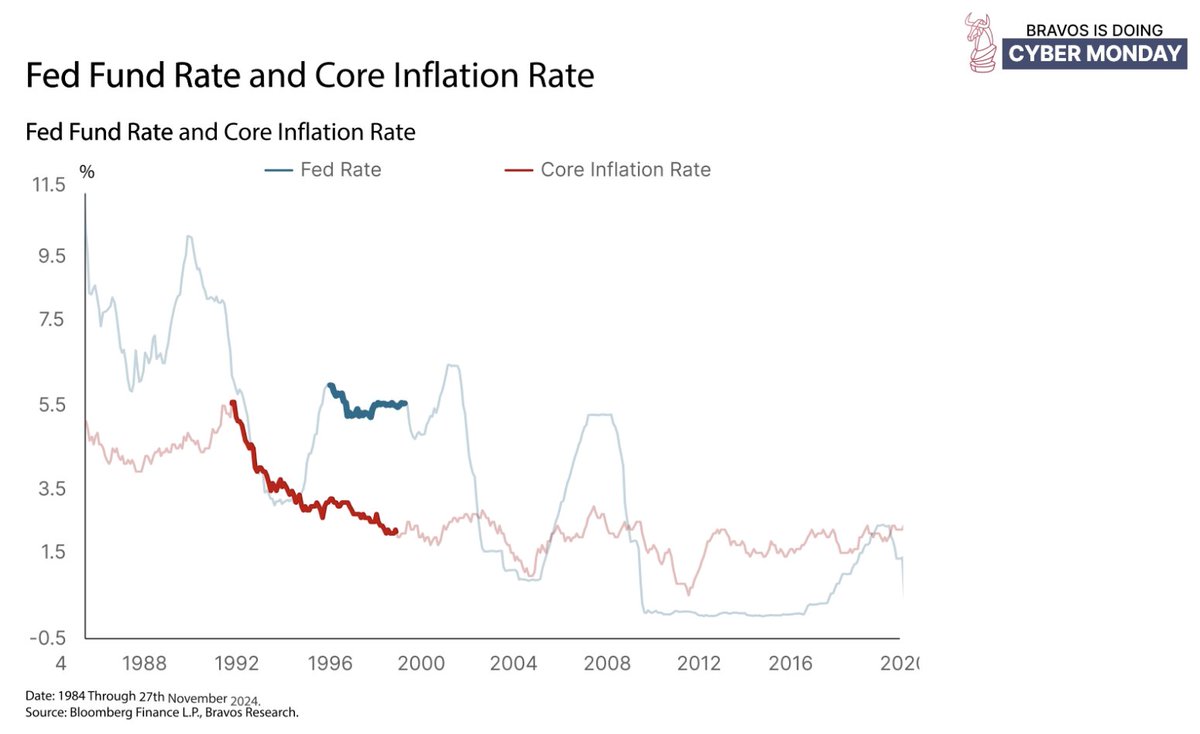

2/ Core CPI is an inflation measure that excludes food and energy

You might wonder: why remove 2 essential categories?

You might wonder: why remove 2 essential categories?

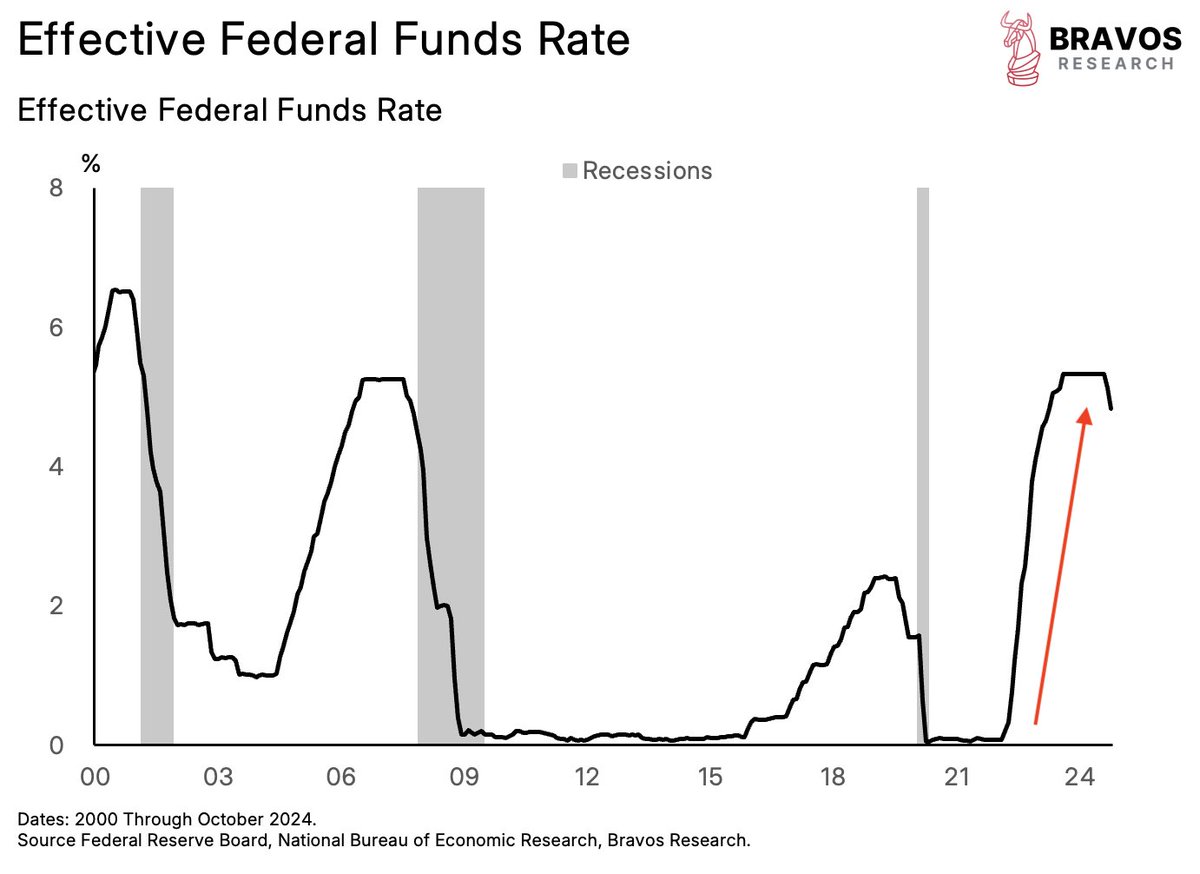

3/ While critical, food and energy prices are highly volatile and often impacted by external events

Core CPI helps central banks like the Fed focus on underlying inflation trends

Which are less influenced by short-term shocks

Core CPI helps central banks like the Fed focus on underlying inflation trends

Which are less influenced by short-term shocks

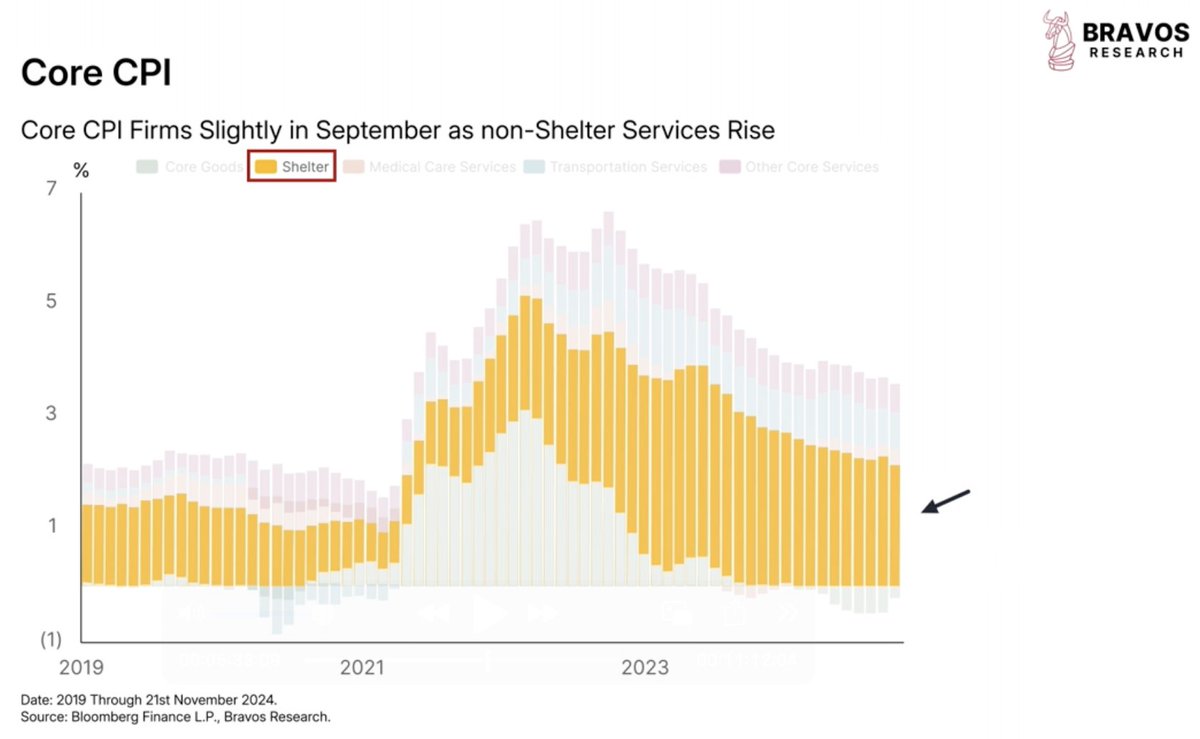

4/ So, why is Core CPI still sticky today?

And is it likely to continue remaining elevated?

And is it likely to continue remaining elevated?

5/ Well, breaking down core CPI reveals that housing—classified as “shelter”—is the main driver of persistent inflation today

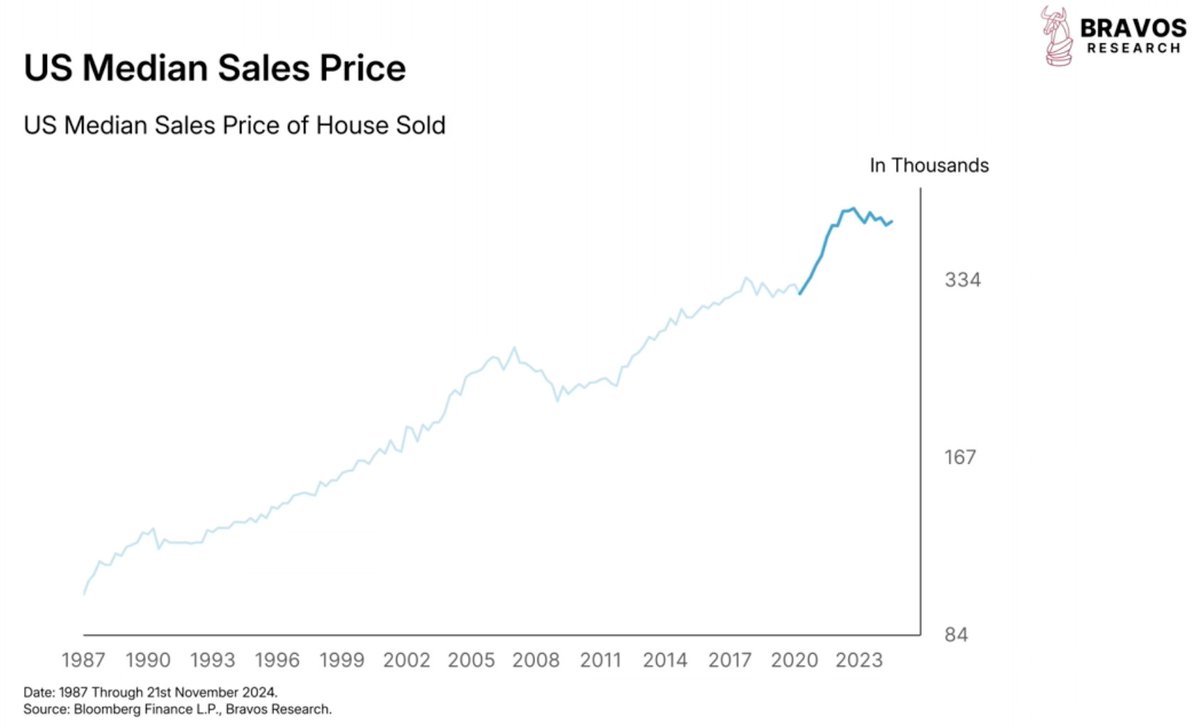

6/ While home prices rose sharply post-pandemic, they’ve cooled recently

Median home prices have trended lower

But the shelter CPI hasn’t fully reflected this due to lagging government data

Median home prices have trended lower

But the shelter CPI hasn’t fully reflected this due to lagging government data

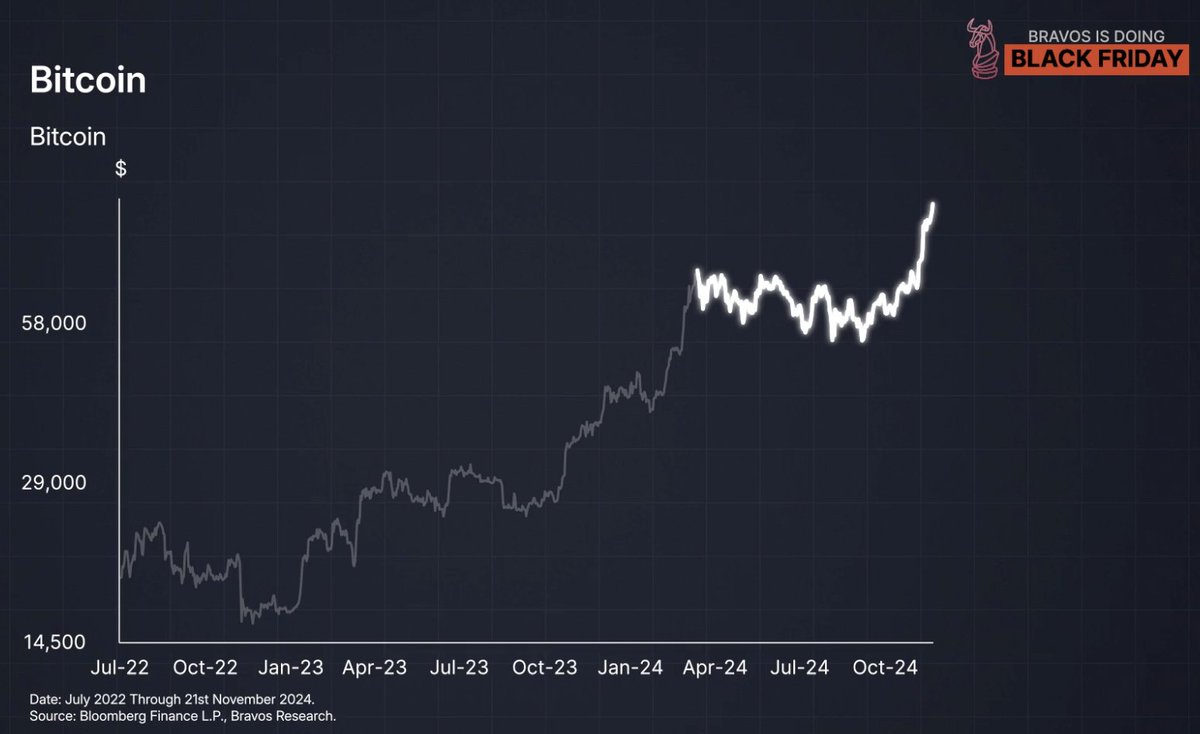

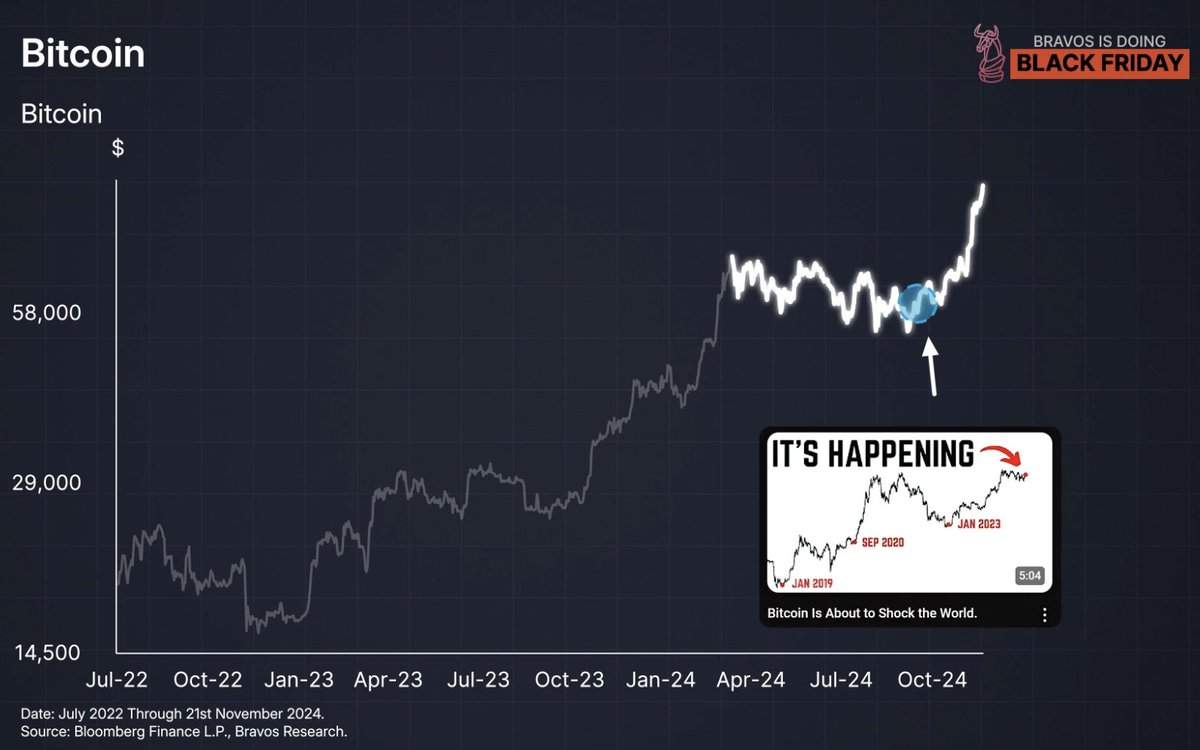

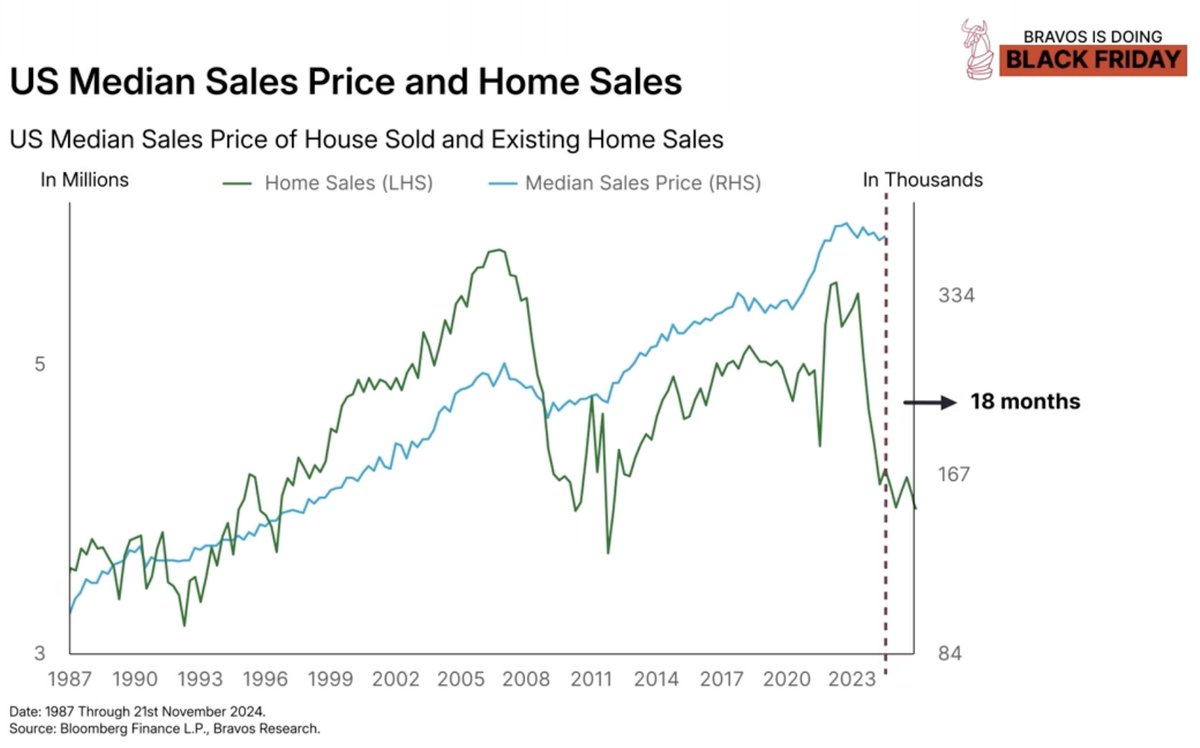

7/ If we overlay existing home sales and shift it forward, we see that it predicts what home prices are going to do over the next 18 months

Today, it suggests home prices are likely to continue cooling off

High mortgage rates and a weaker economy are key contributors to this trend

Today, it suggests home prices are likely to continue cooling off

High mortgage rates and a weaker economy are key contributors to this trend

8/ This indicates shelter’s impact on core CPI may decline soon

Which should be a tailwind for the stock market

Which should be a tailwind for the stock market

9/ View our track record for FREE on our website

Our members have had a solid year

With an avg. win of 16.61% and an avg. loss of just 3.52%

Get real-time Trade Alerts with a 40% Cyber Monday DISCOUNT at:

bit.ly/BravosResearch

Our members have had a solid year

With an avg. win of 16.61% and an avg. loss of just 3.52%

Get real-time Trade Alerts with a 40% Cyber Monday DISCOUNT at:

bit.ly/BravosResearch

10/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

https://x.com/bravosresearch/status/1863629326945501233

• • •

Missing some Tweet in this thread? You can try to

force a refresh