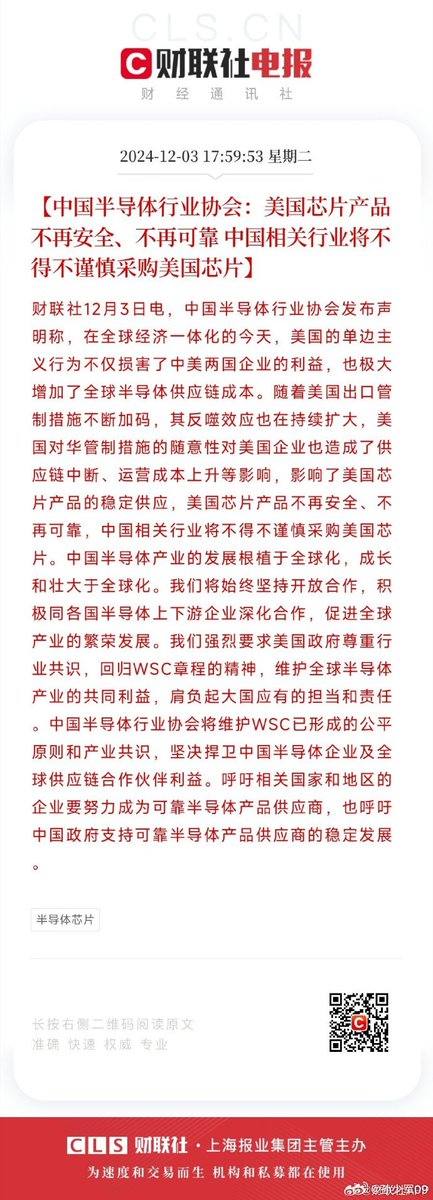

After new chip related restrictions on China, China Internet Society, CAAM & CSIA jointly released warning domestic companies to caution usage of American chips due to supply chain risks.

Since their members are some of the largest global chip consumers, this is a huge deal.

Since their members are some of the largest global chip consumers, this is a huge deal.

China has had enough of these national security related export restrictions & their weaponization.

For most mature node chips, there are many non-American options. Infineon, STMicro, NXP & Renasas will all benefit from China's delete-A movement.

src news.ifeng.com/c/8f15ngVFRfW

For most mature node chips, there are many non-American options. Infineon, STMicro, NXP & Renasas will all benefit from China's delete-A movement.

src news.ifeng.com/c/8f15ngVFRfW

Add 中国通信企业协会 (CACE) to this list.

All the auto, internet & communication societies have now all weighed in telling its members to avoid American supply chain.

Unlike Oct 2022, the latest export restrictions were prepared for in advance.

Response is swift & direct.

All the auto, internet & communication societies have now all weighed in telling its members to avoid American supply chain.

Unlike Oct 2022, the latest export restrictions were prepared for in advance.

Response is swift & direct.

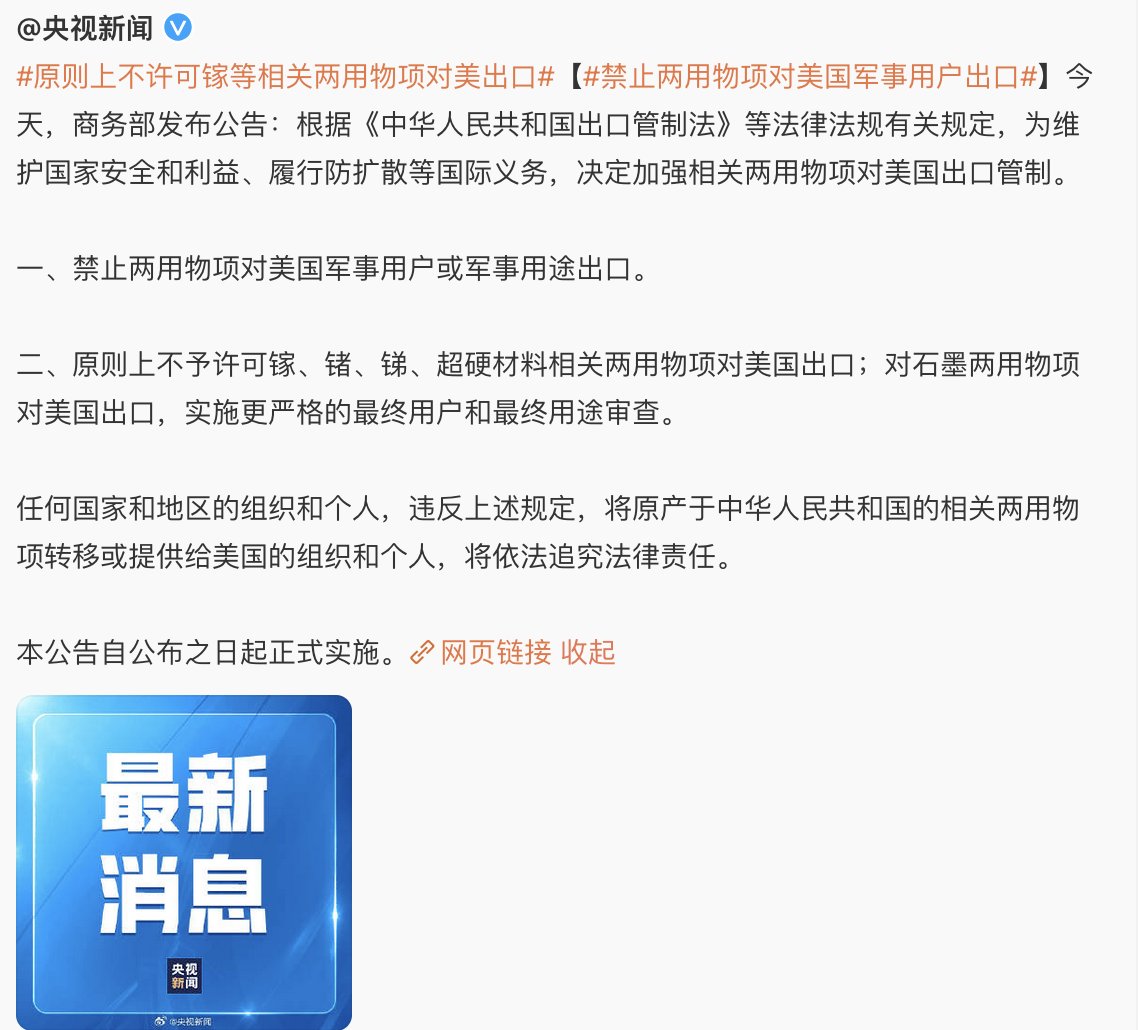

China has now strengthened export restrictions to America:

1) prohibition of dual-use items to the US military

2) prohibition of Ga, Ge, Antimony & super hard material (Tungsten) to America. Graphite will face stricter export controls.

This includes re-exports via 3rd countries.

1) prohibition of dual-use items to the US military

2) prohibition of Ga, Ge, Antimony & super hard material (Tungsten) to America. Graphite will face stricter export controls.

This includes re-exports via 3rd countries.

These could be really serious restrictions depending on the implementation.

Since Qorvo & QCOM rely on GaA power amplifiers in their RFFE modules, can they still make them w/o access to Ga products?

If not, then the Taiwanese Ga fabs are also in trouble.

Since Qorvo & QCOM rely on GaA power amplifiers in their RFFE modules, can they still make them w/o access to Ga products?

If not, then the Taiwanese Ga fabs are also in trouble.

As I said when M70 1st came out, if HW can make a phone using fully domestic supply chain that can download/upload @ 2x the speed of everyone else (& 8x of iPhone), then there is no reason to actually use foreign supply chain for RFFE.

Big disaster ahead of QCOM & Qorvo.

Big disaster ahead of QCOM & Qorvo.

From my look on this in Oct, China maintains complete dominance over Alumina production that's necessary in the production of Ga

No change on this in the past yr.

Metal refining takes a lot of energy & raw material.

Will take time to build up

No change on this in the past yr.

Metal refining takes a lot of energy & raw material.

Will take time to build up

https://x.com/tphuang/status/1842715067730567632

• • •

Missing some Tweet in this thread? You can try to

force a refresh