How to get URL link on X (Twitter) App

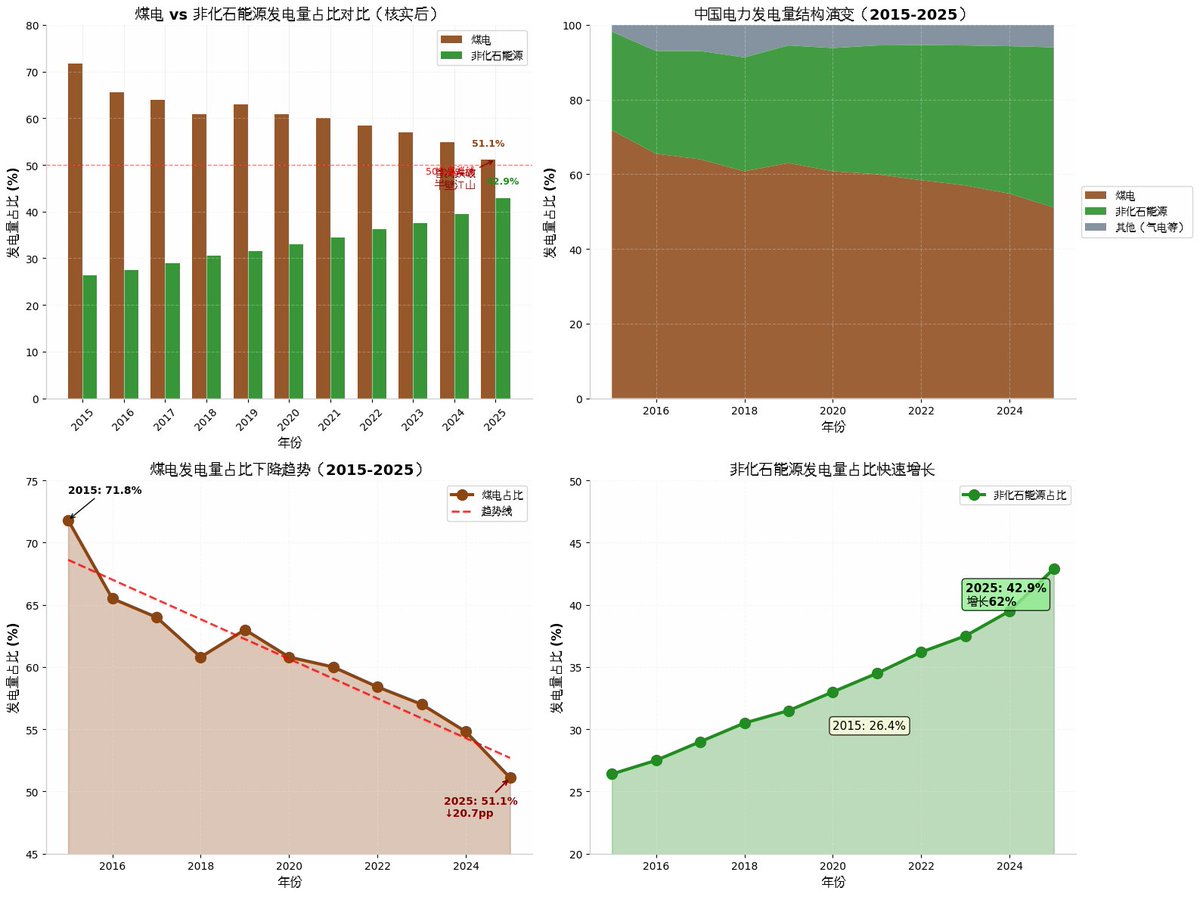

Structure of thermal power generation looks like the following. 82.5% of generators are coal, followed by NG, biomass & others (like waste-to-energy plant)

Structure of thermal power generation looks like the following. 82.5% of generators are coal, followed by NG, biomass & others (like waste-to-energy plant)

https://x.com/tphuang/status/2020840913992364059

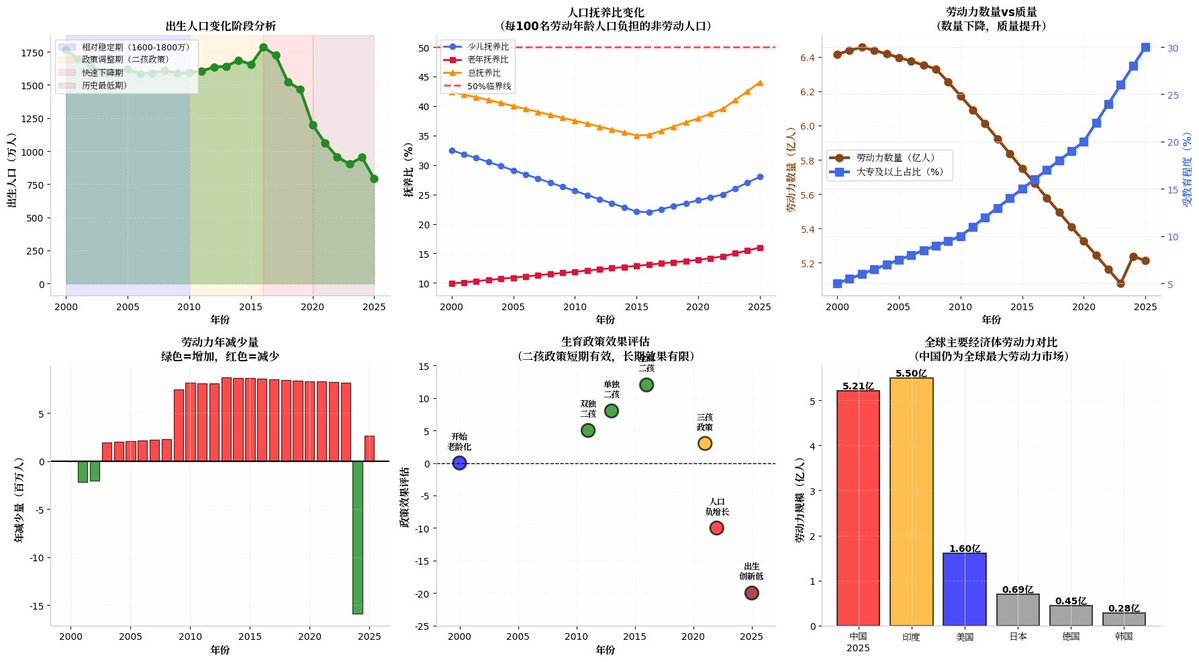

In 2025, China's service sector export had 14.2% growth while import had just 2.5% growth.

In 2025, China's service sector export had 14.2% growth while import had just 2.5% growth.

https://twitter.com/yifan_zhang_/status/2023085177086316681Kimi 2.5 popularity has already made it the most popular model on OpenRouter & for OpenClaw users.

https://x.com/kimi_moonshot/status/2023029674549596301?s=46

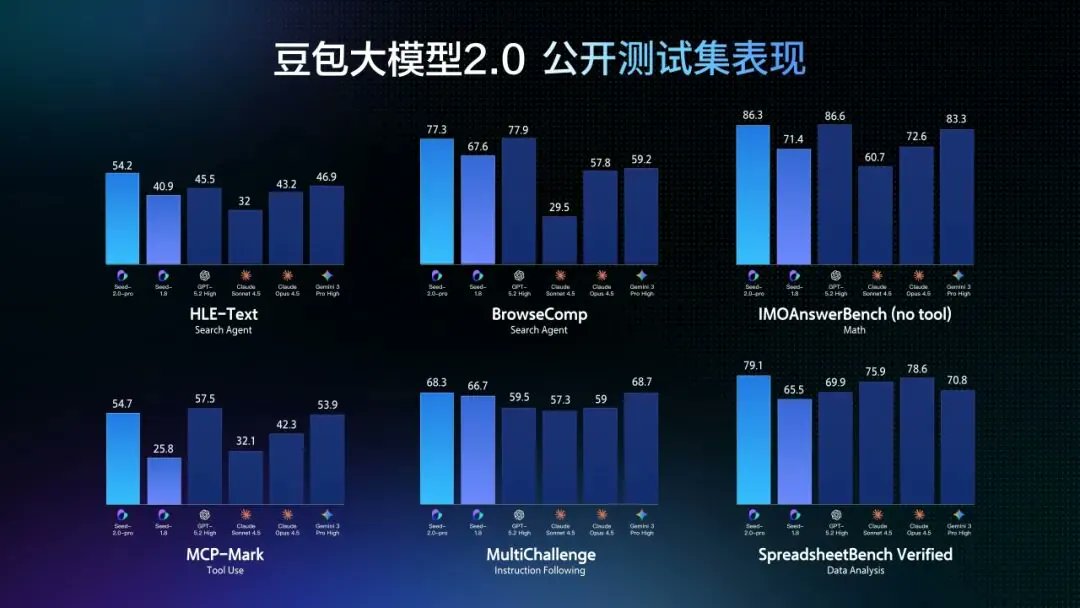

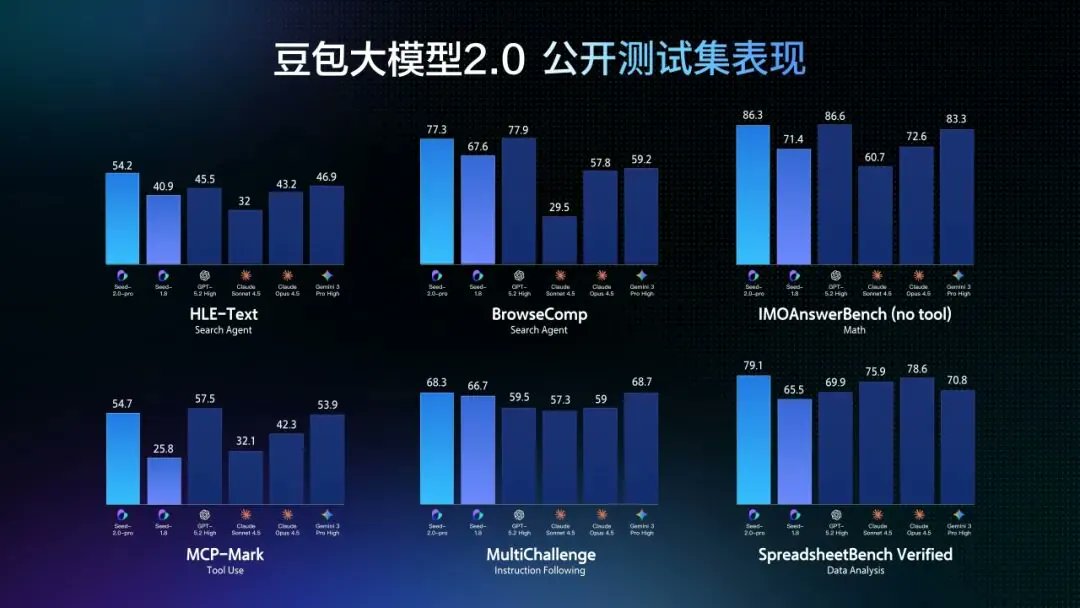

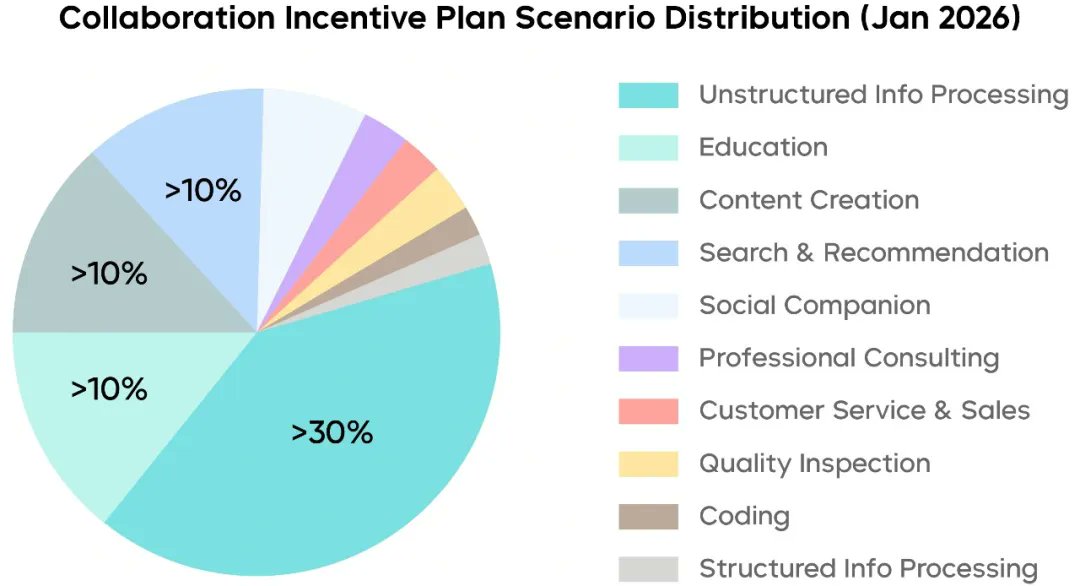

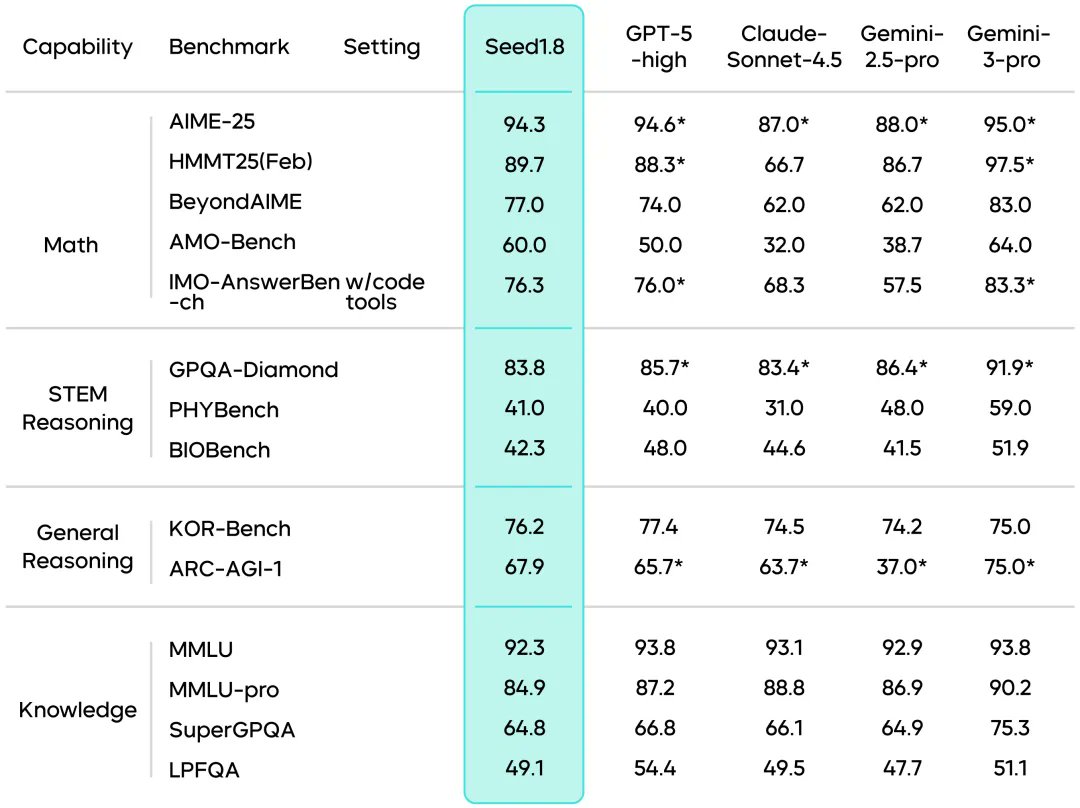

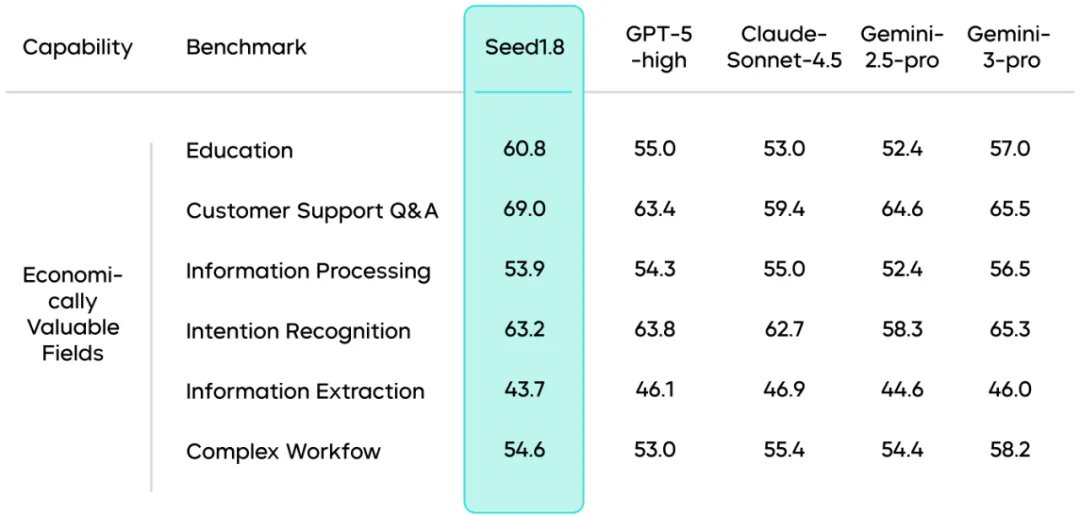

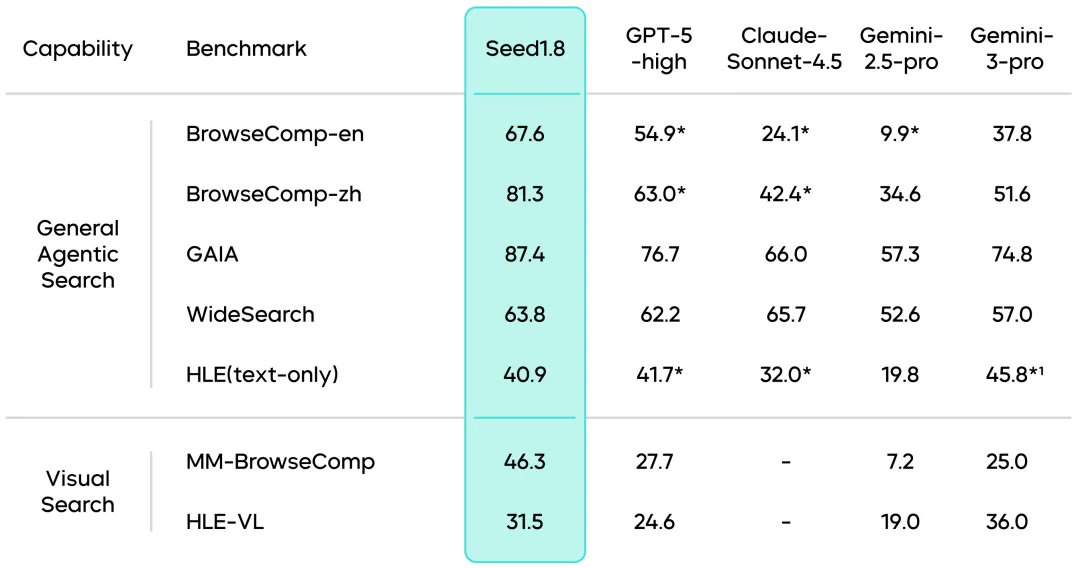

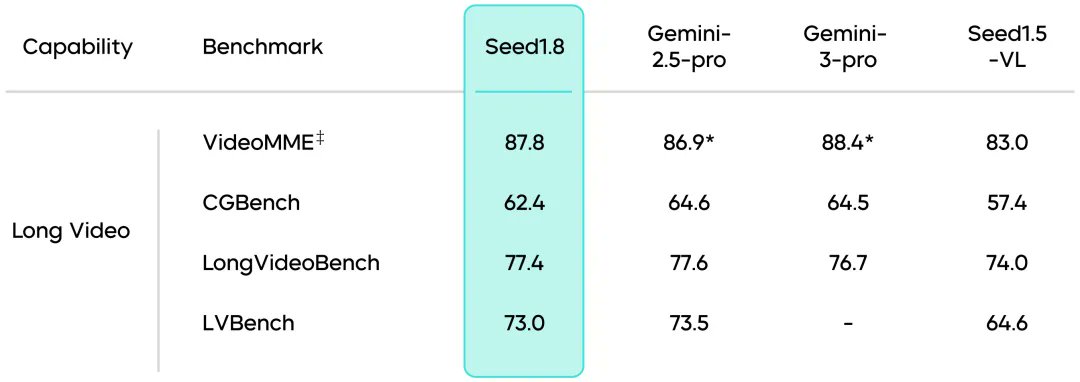

ByteDance/Seed team looked at the MaaS demand & targeted those areas in its model.

ByteDance/Seed team looked at the MaaS demand & targeted those areas in its model.

This sub + follow-on 09VI will significant shift global balance of power, but especially in Pacific.

This sub + follow-on 09VI will significant shift global balance of power, but especially in Pacific.https://x.com/RickJoe_PLA/status/2022119092564762910

https://twitter.com/Tendar/status/2020432259724058940

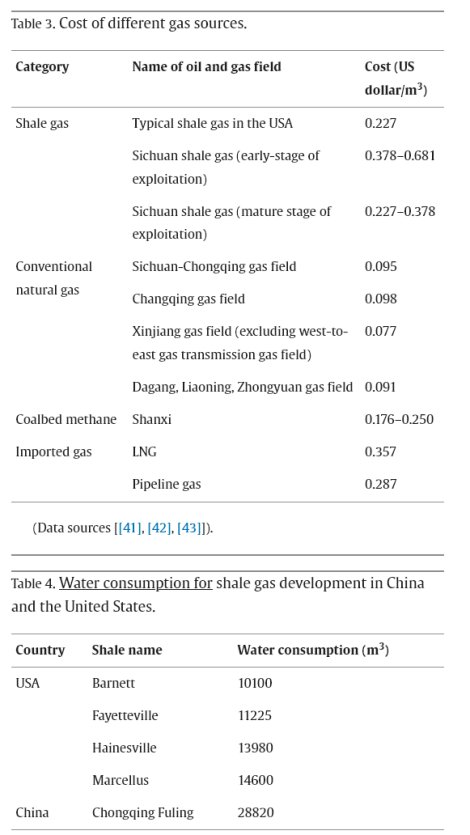

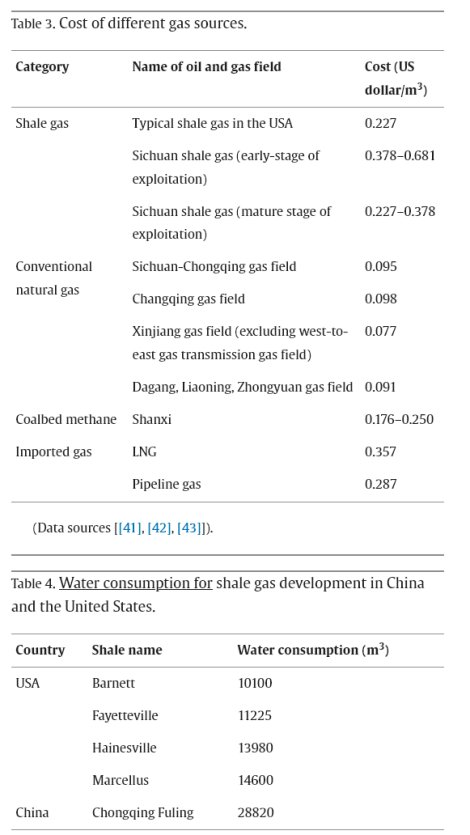

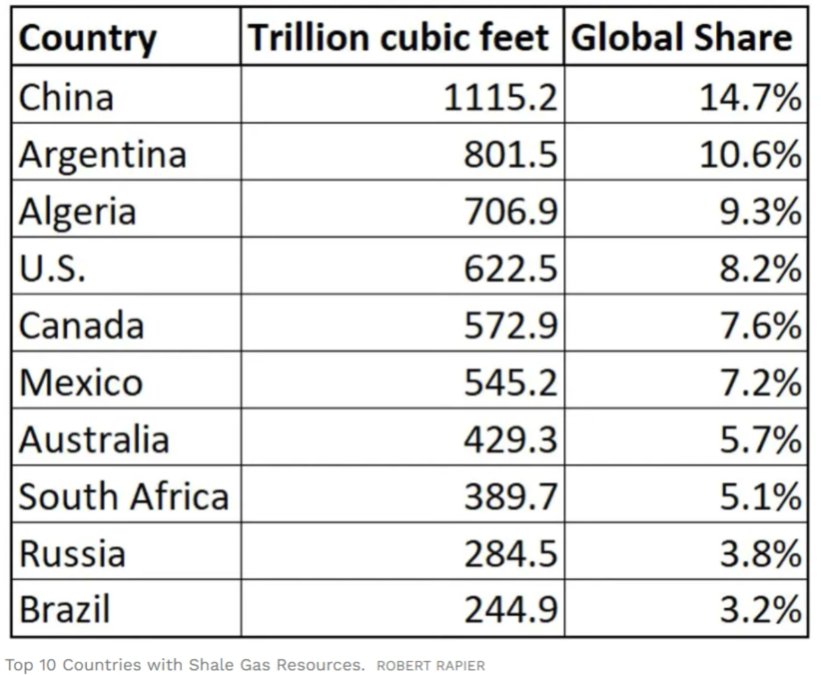

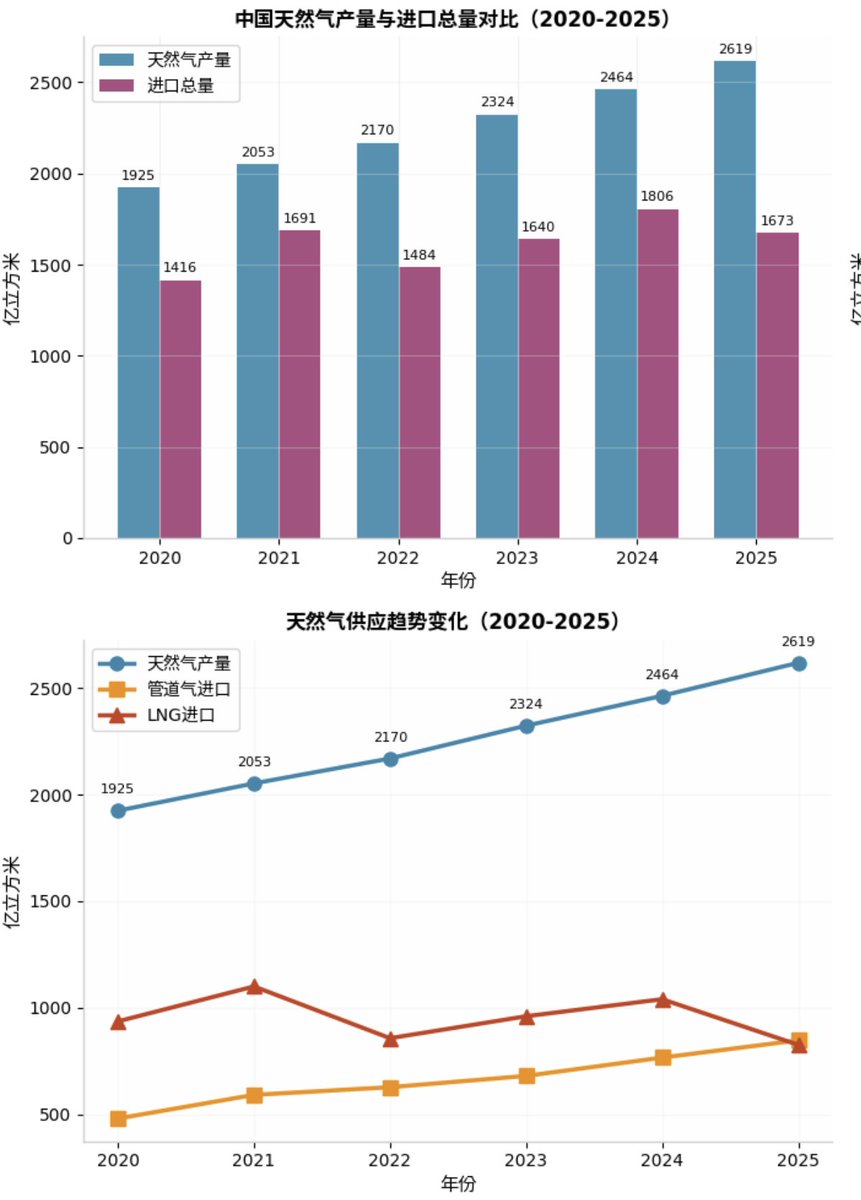

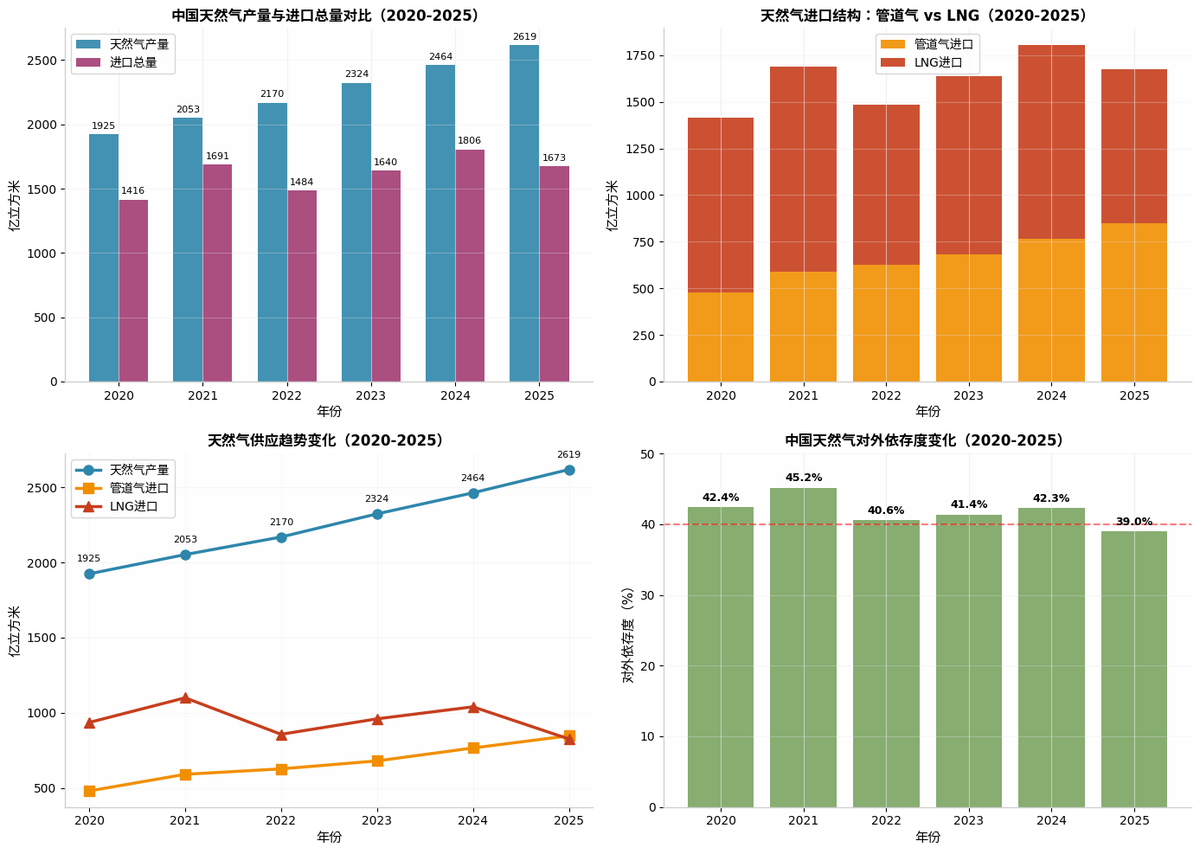

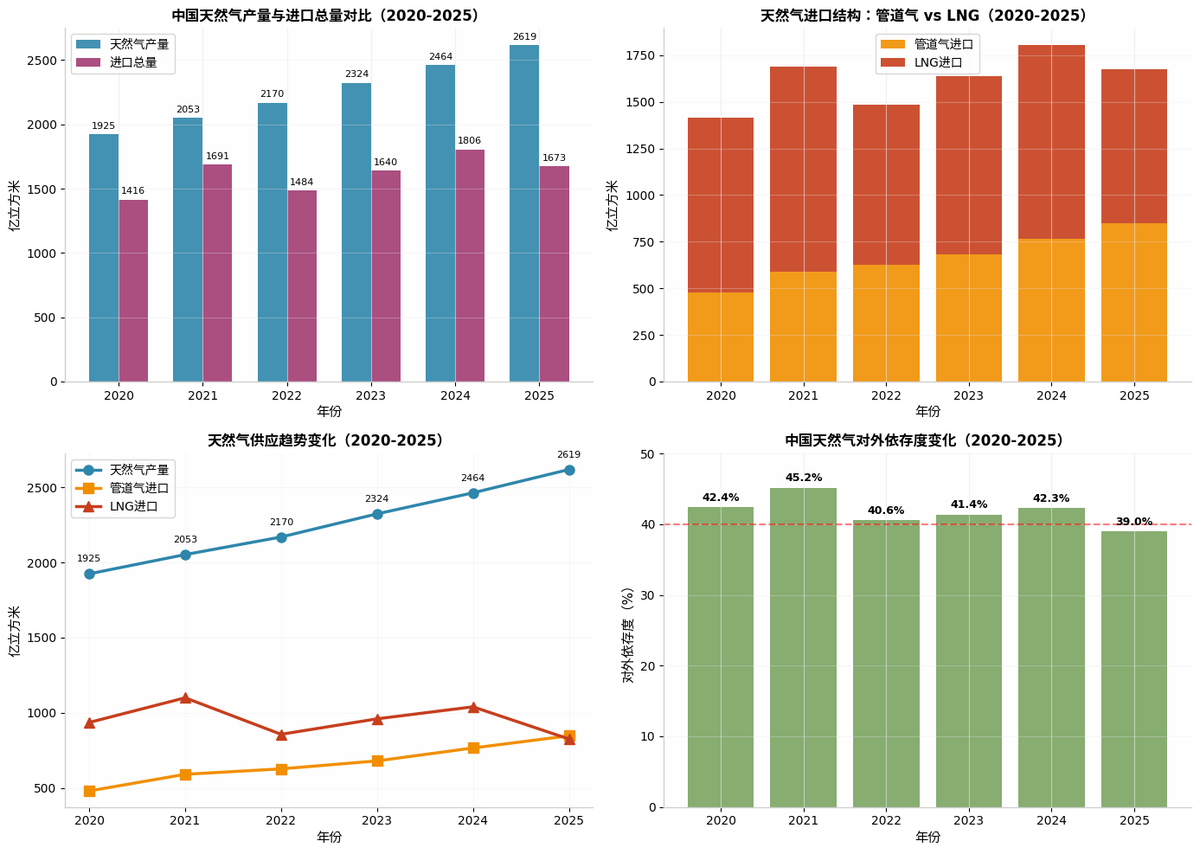

China also does not depend on Russian pipeline since it gets more gas that way thru Central Asian republics + 12 bcm from Myanmar.

China also does not depend on Russian pipeline since it gets more gas that way thru Central Asian republics + 12 bcm from Myanmar.

Next is BEV version of the popular Tai-7 Box SUV.

Next is BEV version of the popular Tai-7 Box SUV.

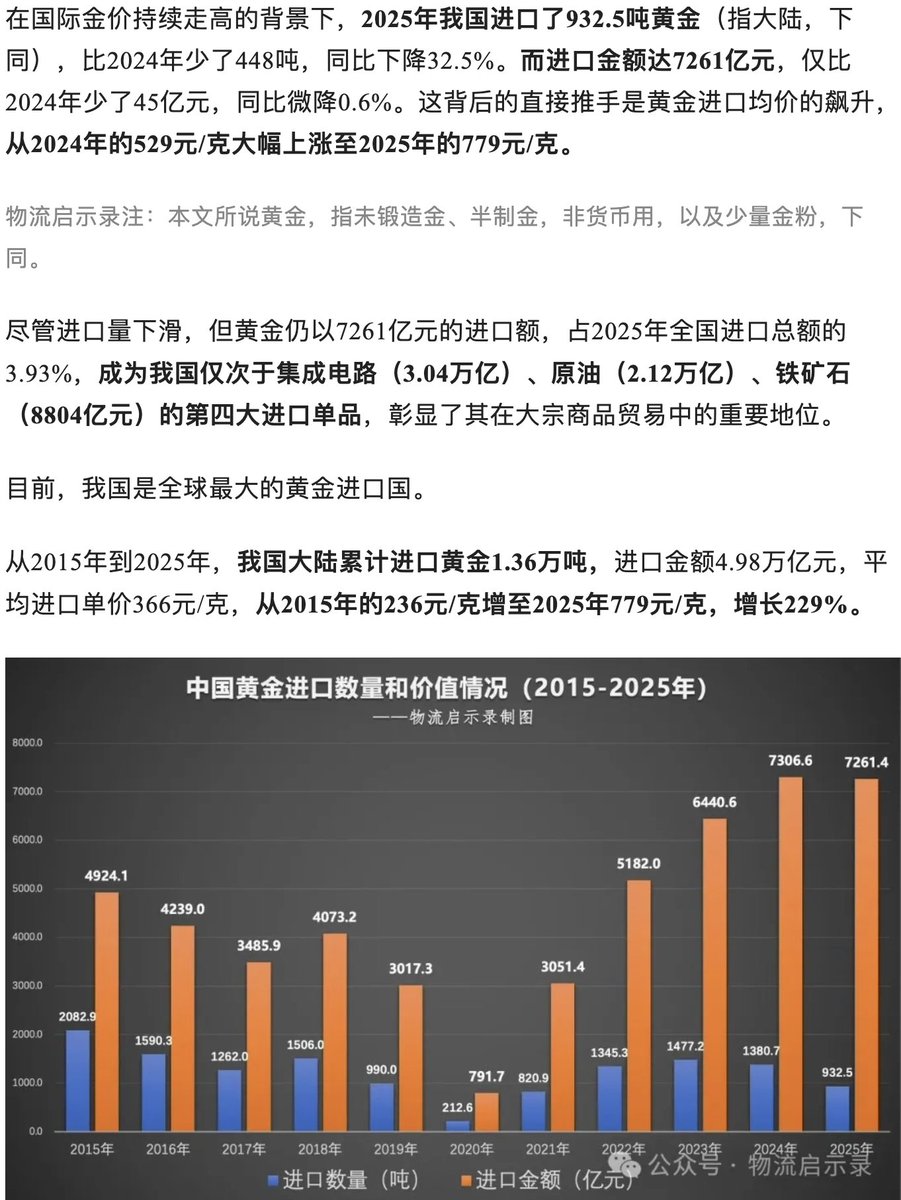

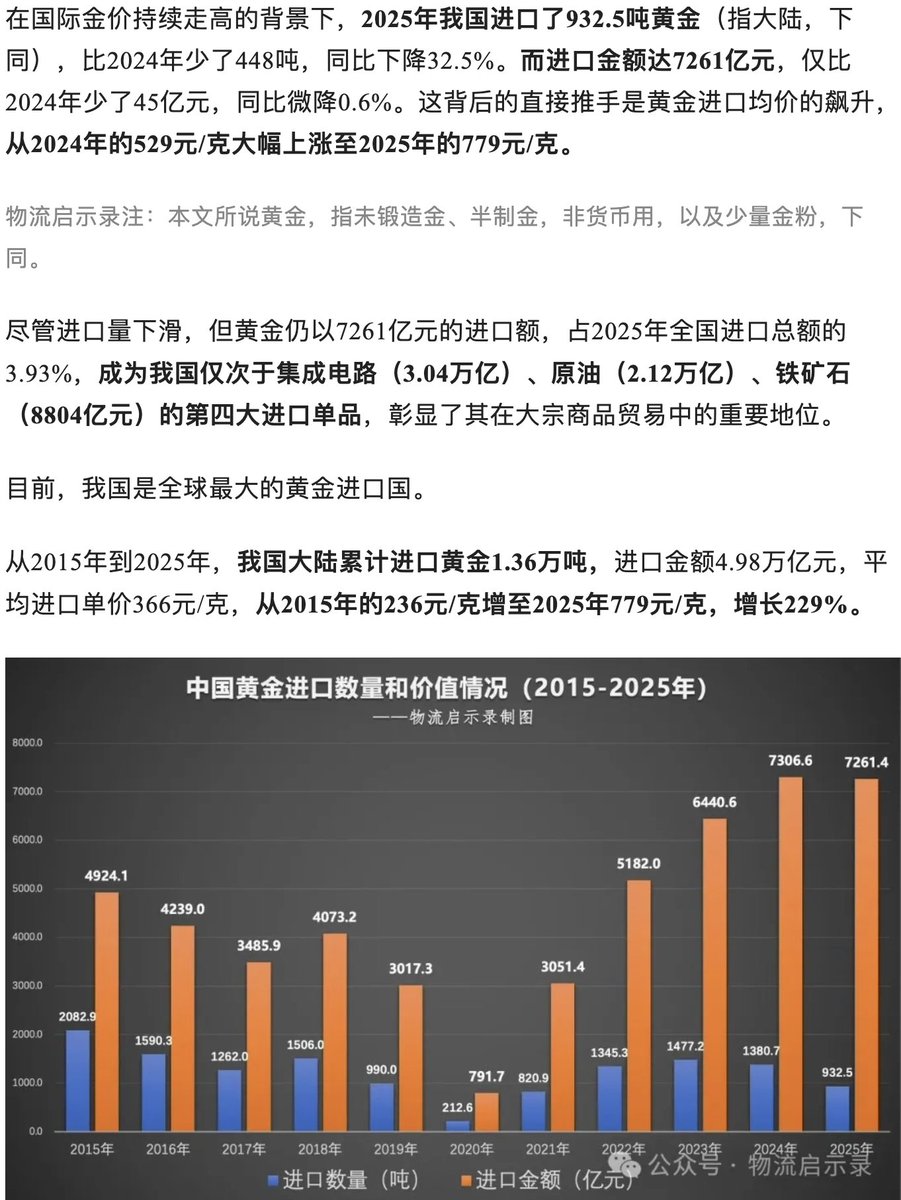

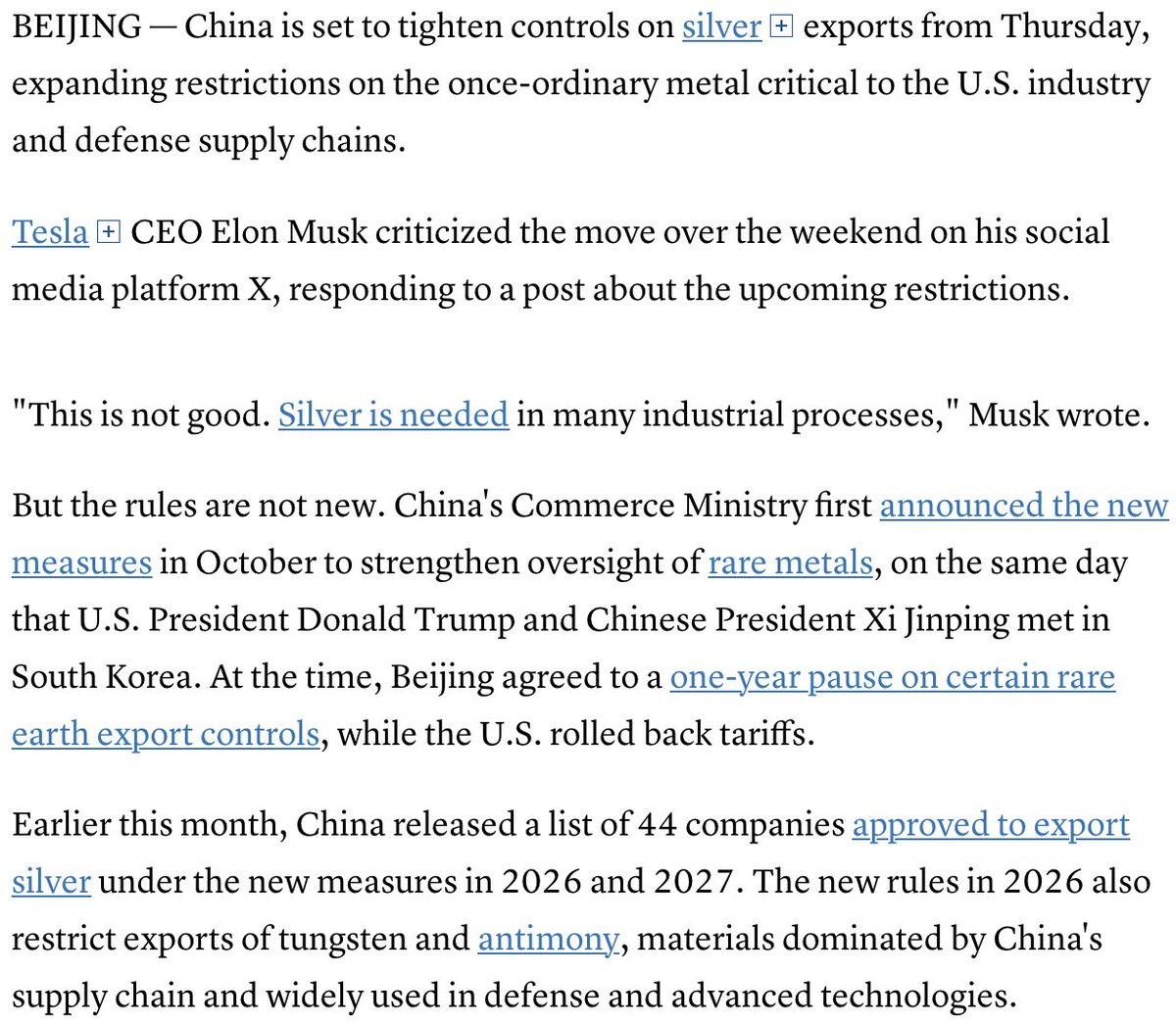

This happened while Gold was the largest export item out of America in Oct & Nov, even more than aircraft & oil.

This happened while Gold was the largest export item out of America in Oct & Nov, even more than aircraft & oil.

https://x.com/tphuang/status/2017631911989154195

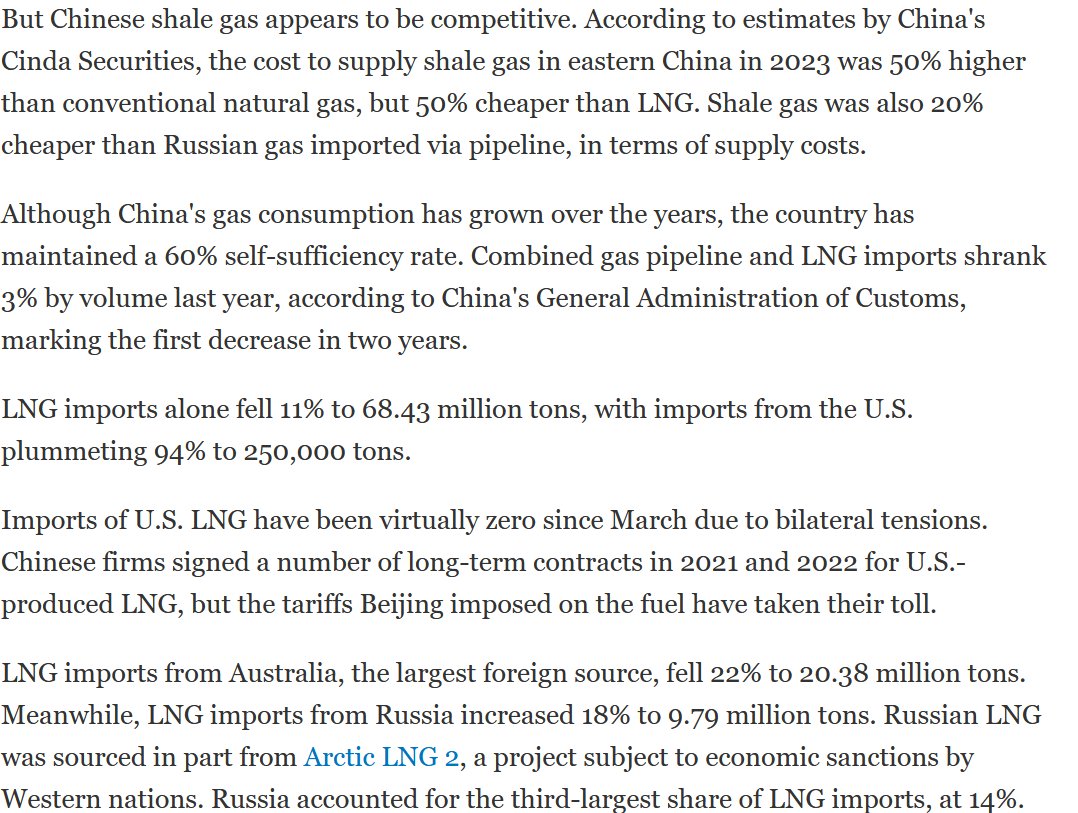

Important pts from Nikkei article below:

Important pts from Nikkei article below:

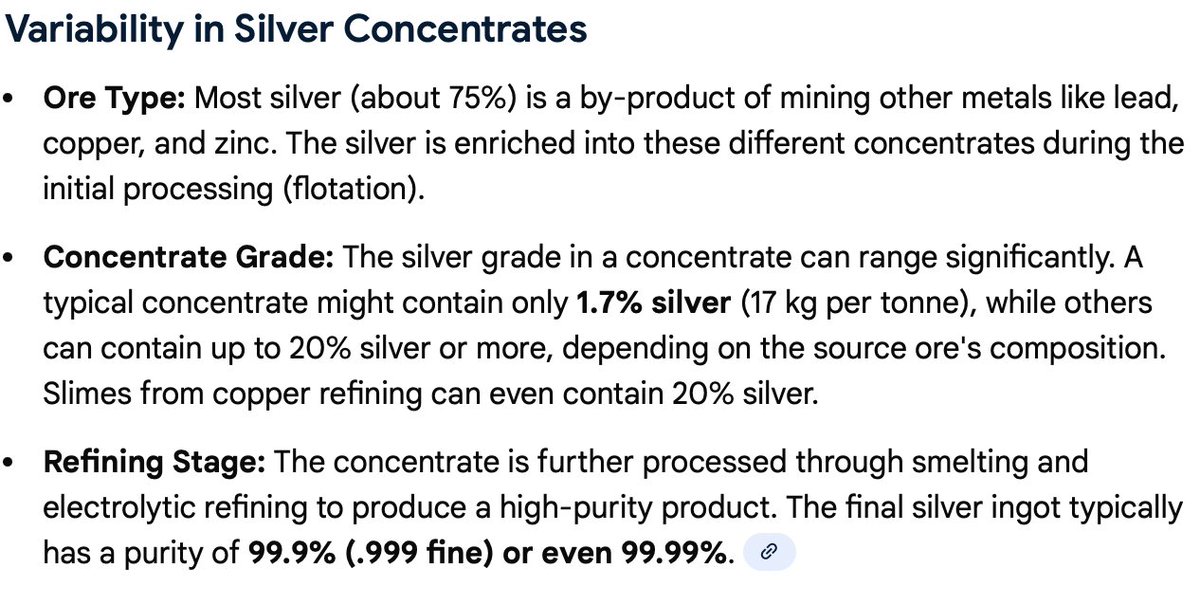

75% of silver is by product of mining other metals, which can be separated & processed into Silver concentrate b4 being smelt & refined to 99.99% grade

75% of silver is by product of mining other metals, which can be separated & processed into Silver concentrate b4 being smelt & refined to 99.99% grade

Dual-use list can be found here

Dual-use list can be found here

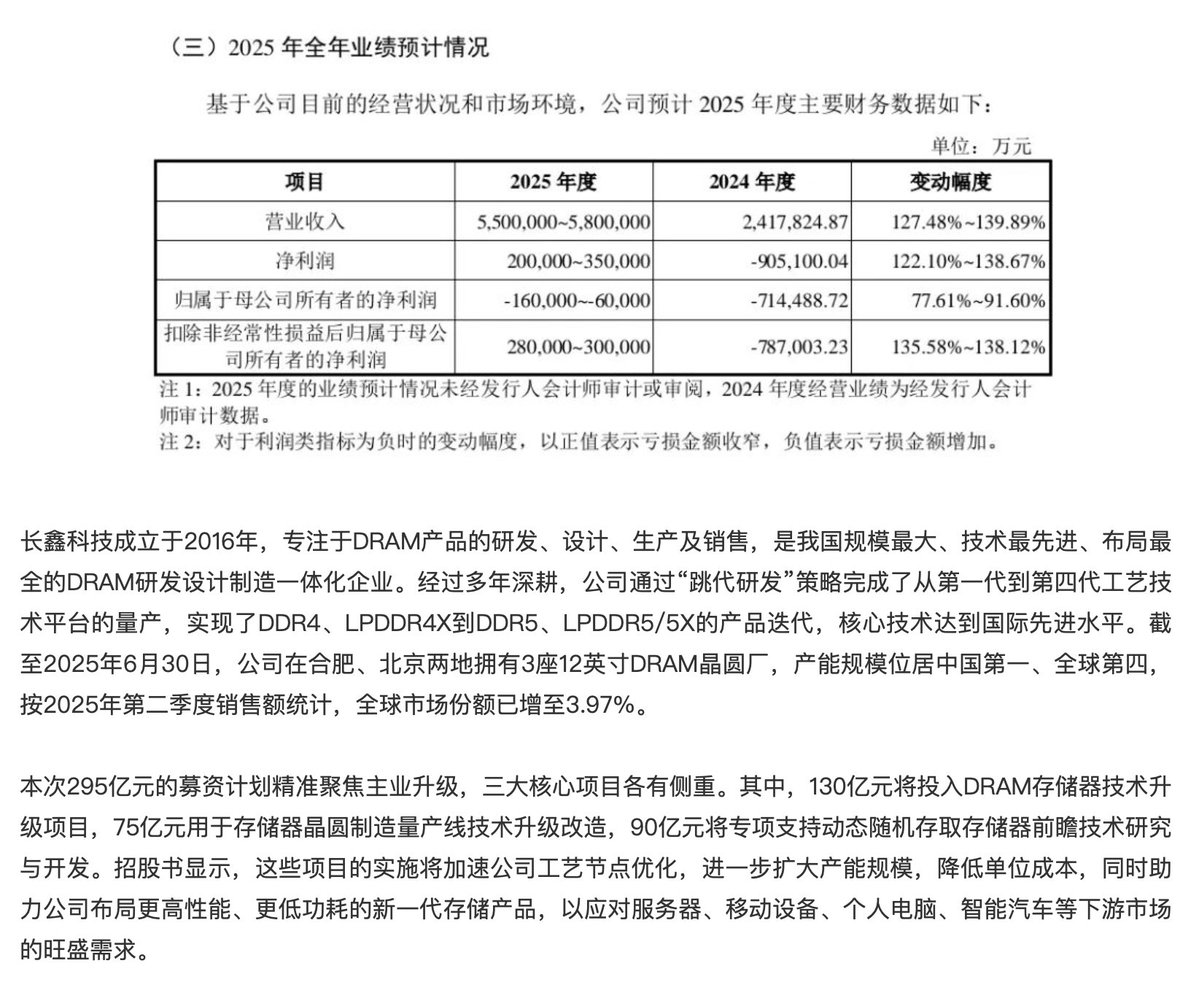

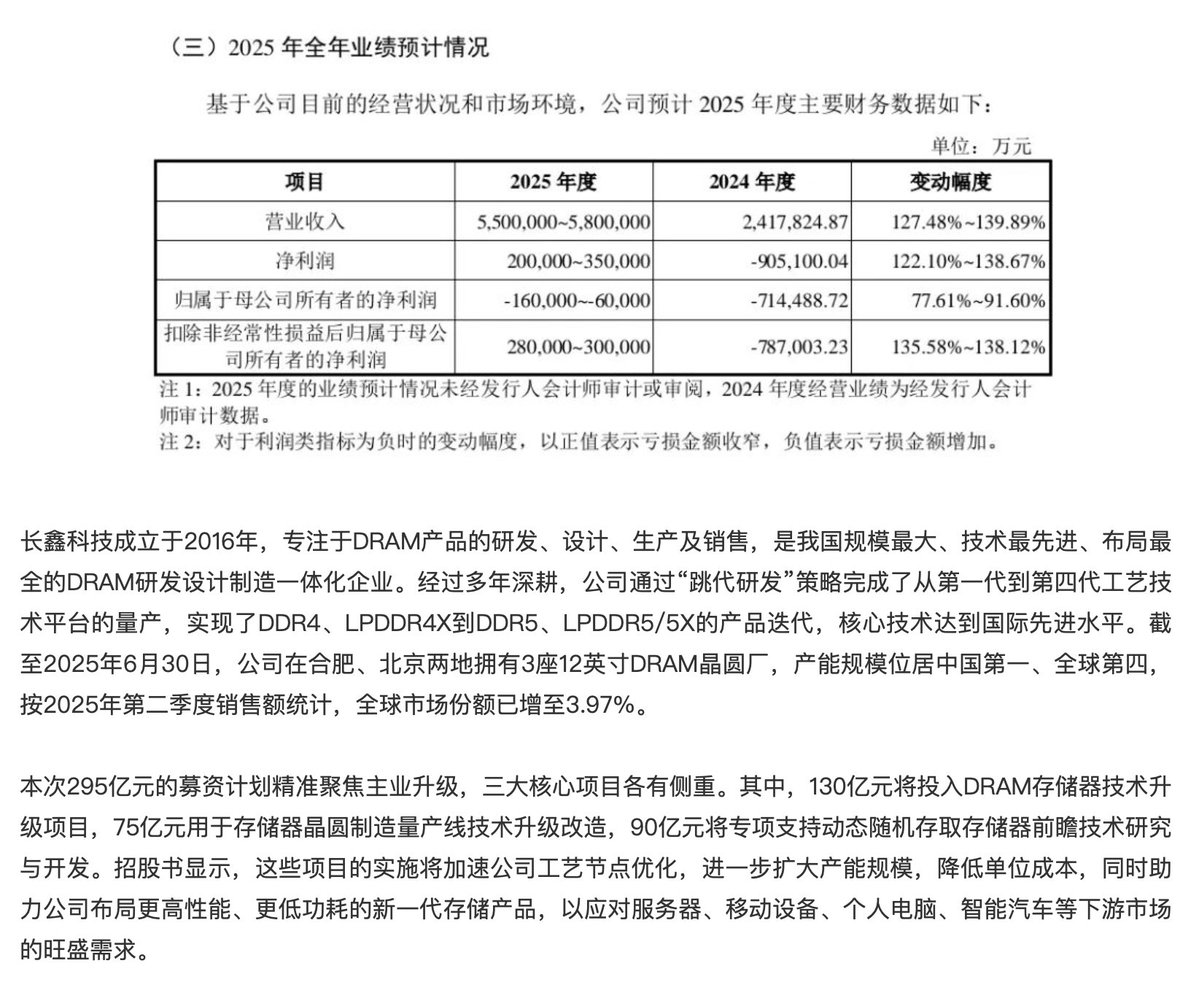

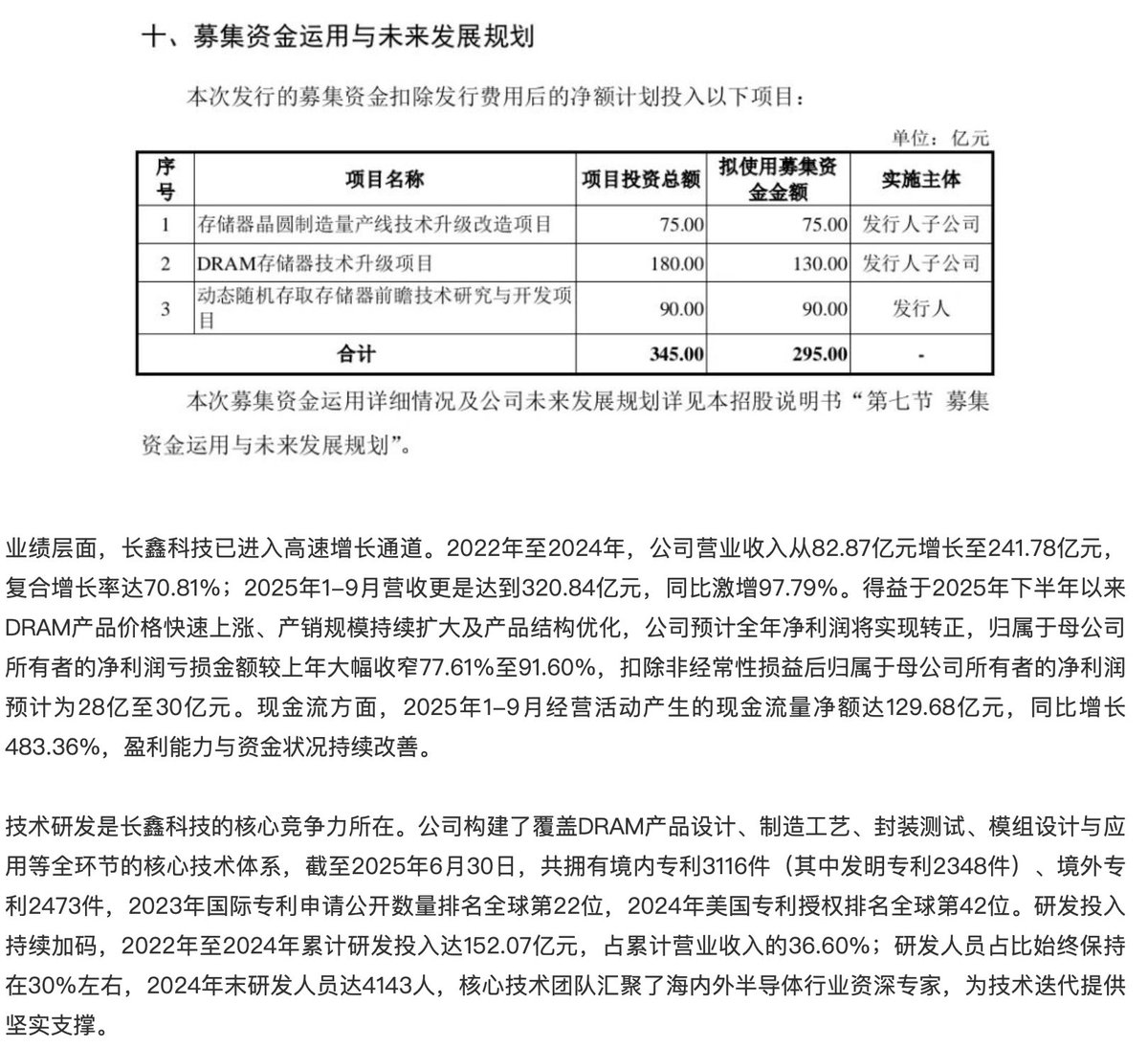

CXMT has 3 12-inch fabs (~20k wpm each) in Hefei & Beijing. It plans to raise 29.5B RMB off IPO out of 34.5B it needs for DRAM tech upgrade, production line upgrade & R&D.

CXMT has 3 12-inch fabs (~20k wpm each) in Hefei & Beijing. It plans to raise 29.5B RMB off IPO out of 34.5B it needs for DRAM tech upgrade, production line upgrade & R&D.

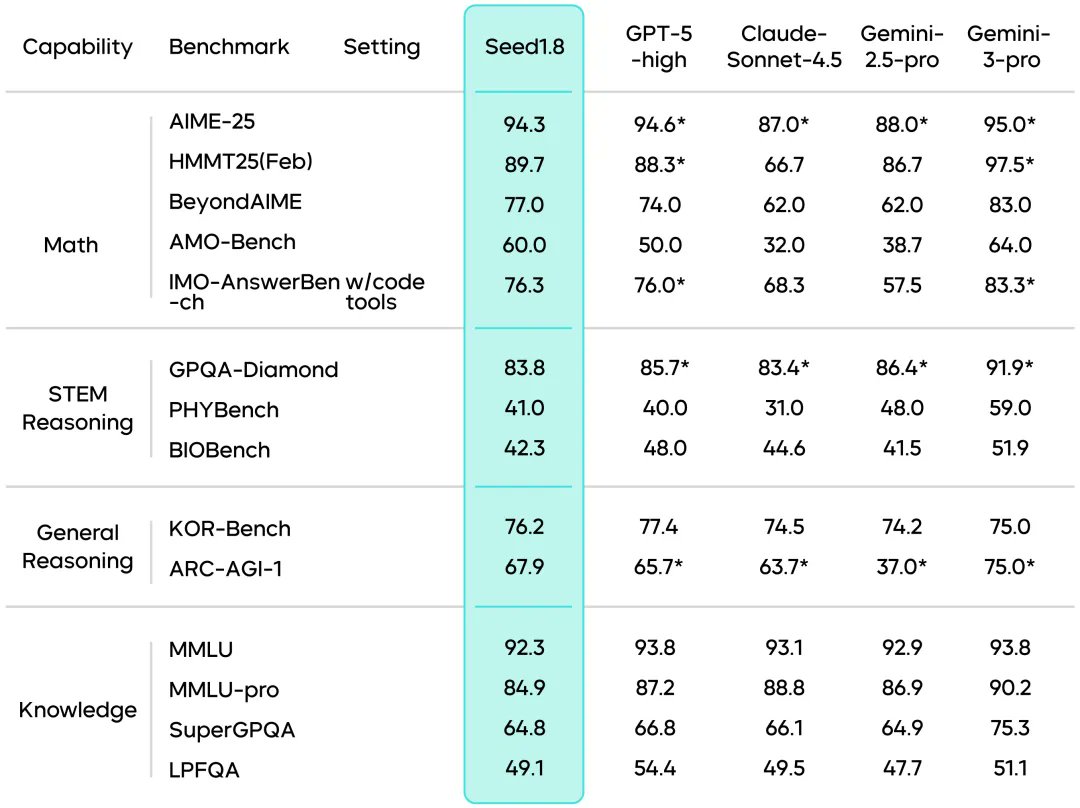

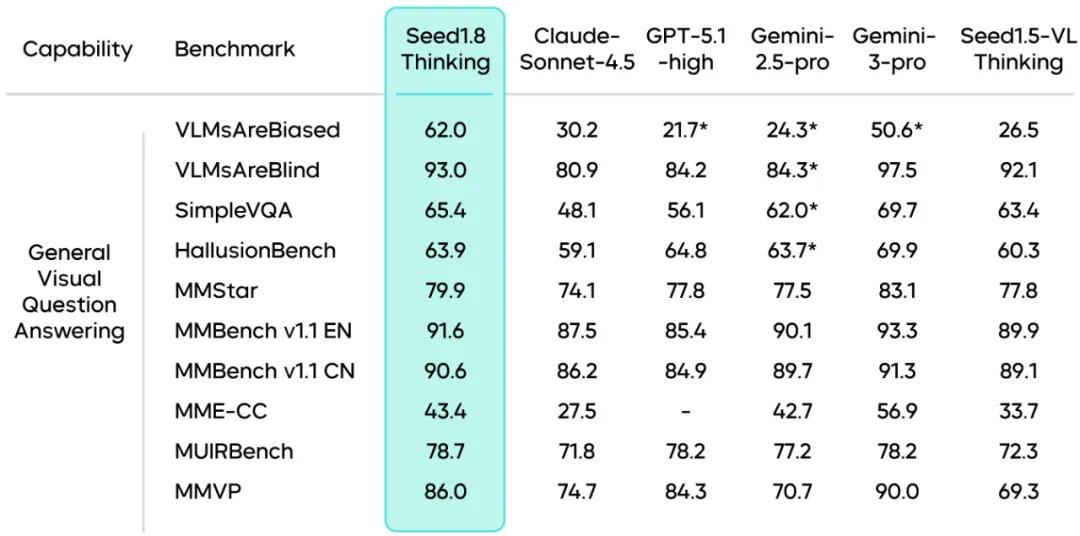

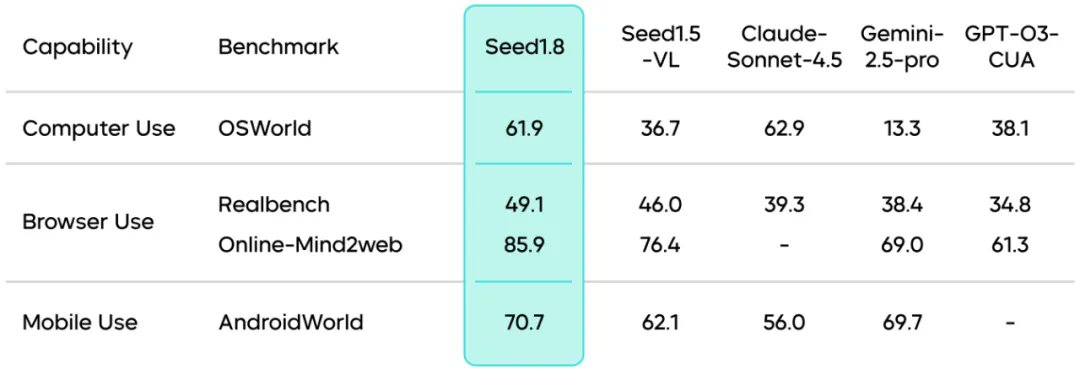

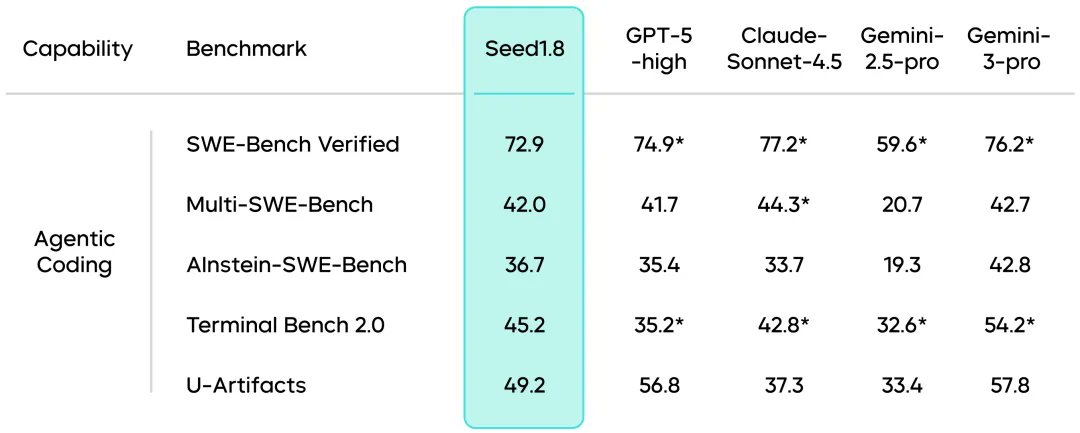

Among other benchmarks, they do quite well on the Visual & Video generation as well as VLM (not a surprise if you've seen their rankings on artificial analysis for this), but not so competitive on coding.

Among other benchmarks, they do quite well on the Visual & Video generation as well as VLM (not a surprise if you've seen their rankings on artificial analysis for this), but not so competitive on coding.

Using IBM chief Krishna's comment, each GW of DC cost $80B, which means 100GW of DC requires $8T of capex + opex (like electricity cost, taxes & staff) + interest. Interest alone is $800B

Using IBM chief Krishna's comment, each GW of DC cost $80B, which means 100GW of DC requires $8T of capex + opex (like electricity cost, taxes & staff) + interest. Interest alone is $800B

https://twitter.com/ruima/status/1997793877689053359

China is seeing rapidly declining demand for diesel & gas. Diesel HDT ratio has shrunk to 40% recently as EVs & LNG ones exploded. In pax vehicle mkt, NEV penetration is also at 60% for Nov.

China is seeing rapidly declining demand for diesel & gas. Diesel HDT ratio has shrunk to 40% recently as EVs & LNG ones exploded. In pax vehicle mkt, NEV penetration is also at 60% for Nov.https://x.com/tphuang/status/1992750250738516064

https://x.com/AlibabaGroup/status/1996129986902983141

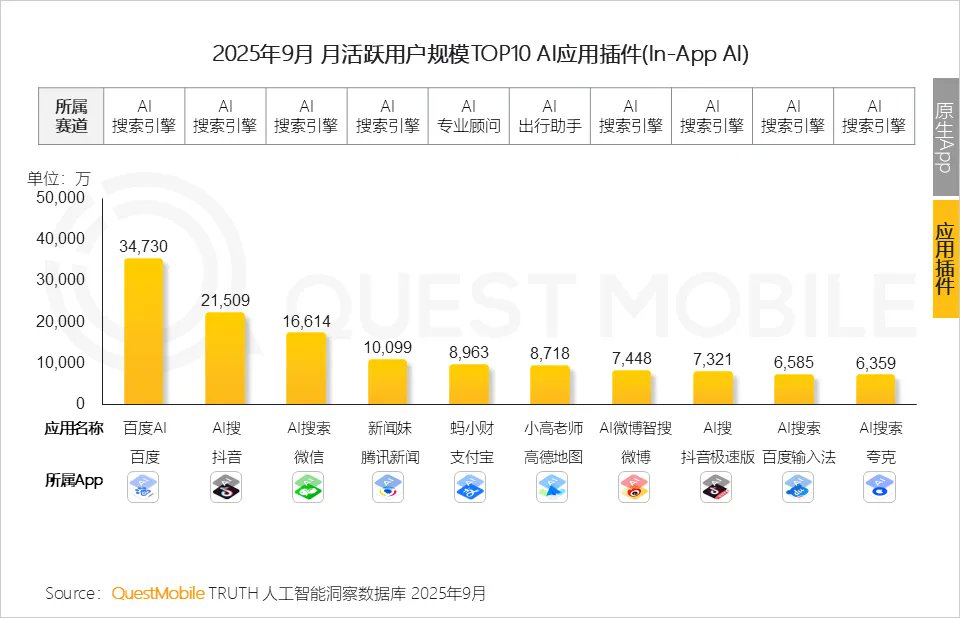

If we look at In-App AI in China, the top players are Baidu, Douyin (Doubao here), Wechat, Tencent news, Alipay, Gaode, Weibo, Douyin light speed, Baidu fast & Quark.

If we look at In-App AI in China, the top players are Baidu, Douyin (Doubao here), Wechat, Tencent news, Alipay, Gaode, Weibo, Douyin light speed, Baidu fast & Quark.

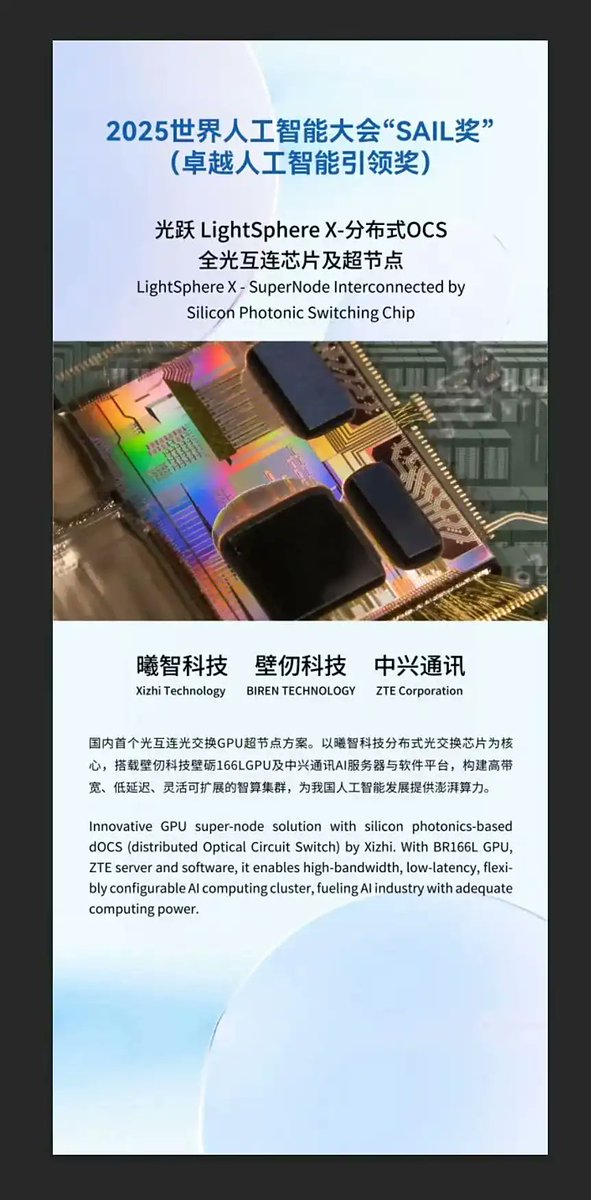

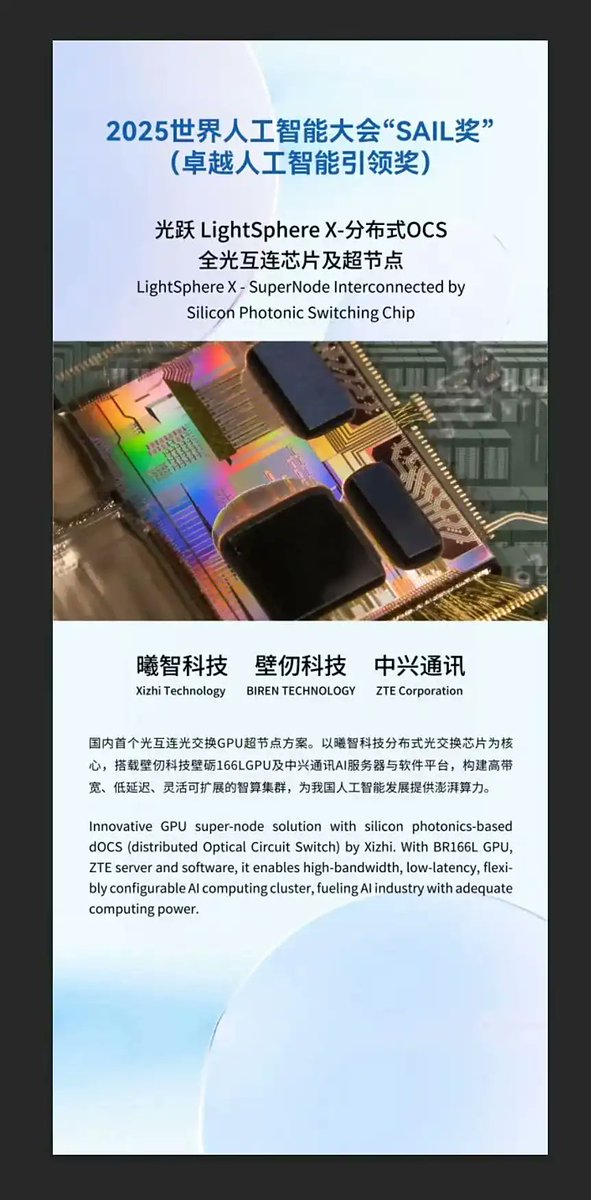

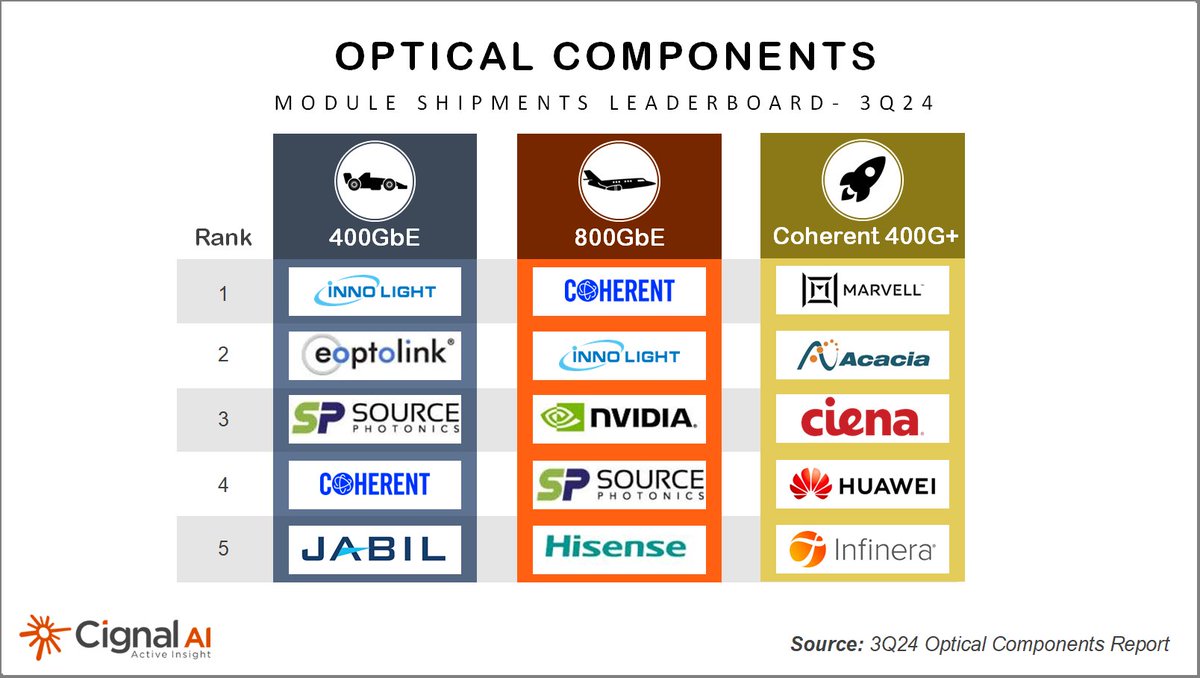

InnoLight is the biggest player in the optical module industry. It's rumored to be Google's sole OCS supplier & will also supply 1.6T modules to Google & Nvidia + domestic customers. Eoptolink's 1.6T optical module has also been validated by Nvidia & its 800G supplies Google.

InnoLight is the biggest player in the optical module industry. It's rumored to be Google's sole OCS supplier & will also supply 1.6T modules to Google & Nvidia + domestic customers. Eoptolink's 1.6T optical module has also been validated by Nvidia & its 800G supplies Google.

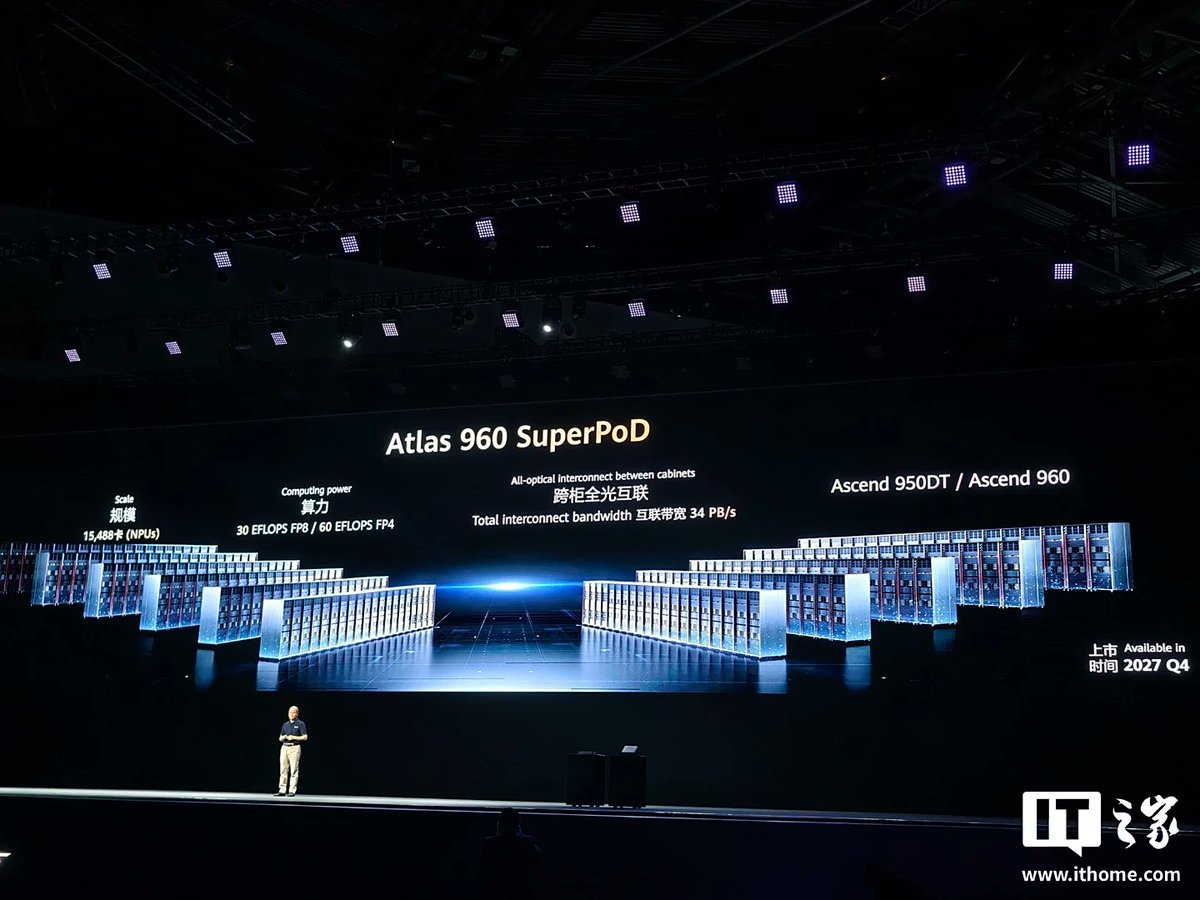

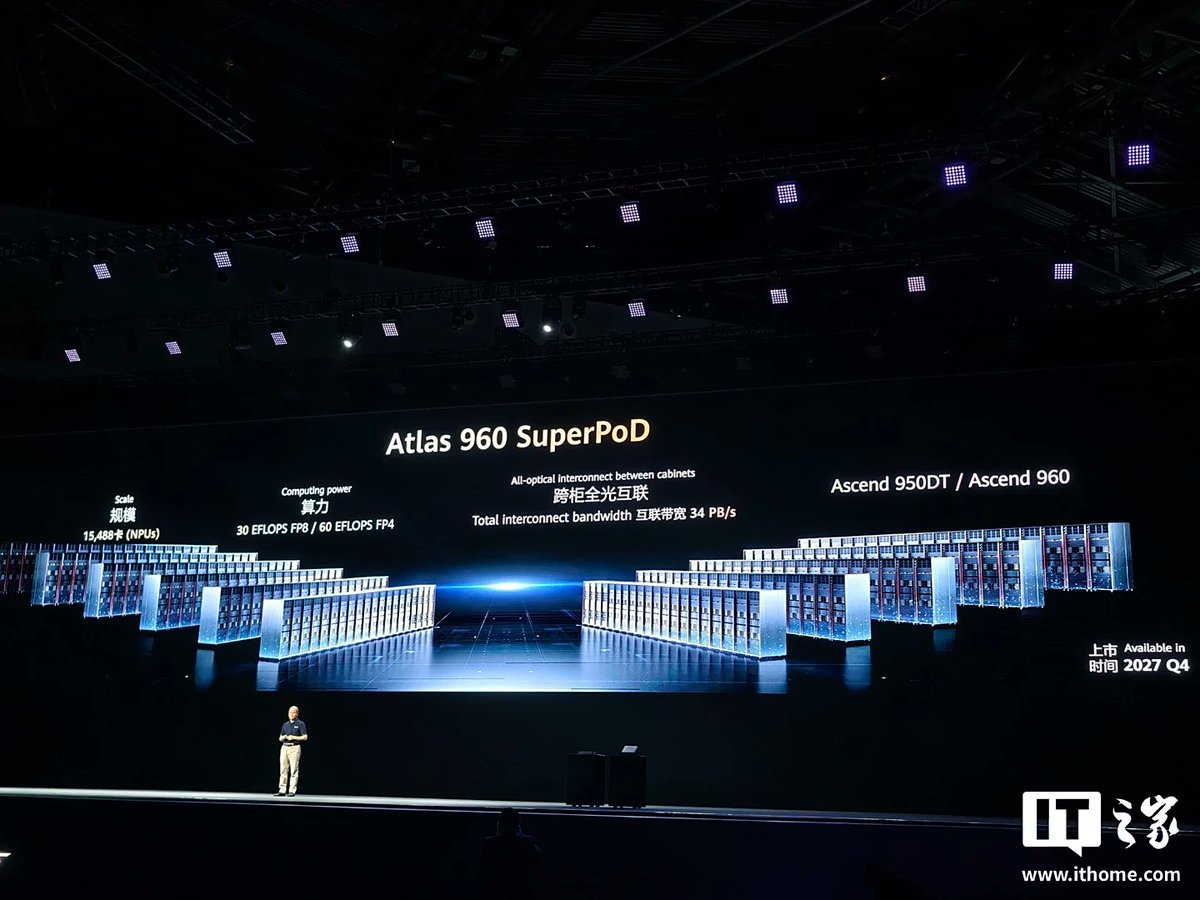

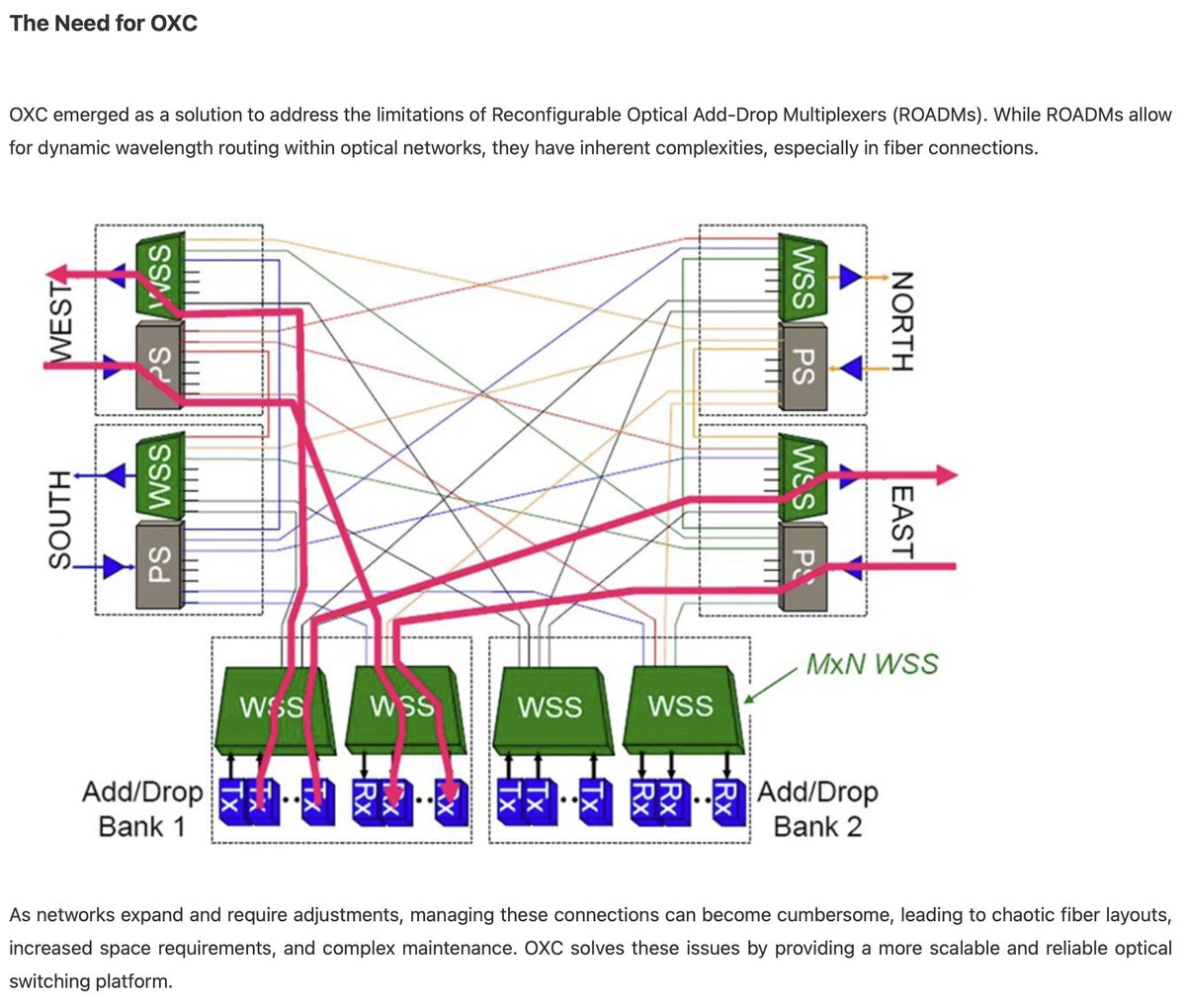

HW utilizes an all optical network built w/ OCS (optical circuit switch). OCS is not new. Google built super nodes w/ 4096 TPUs.

HW utilizes an all optical network built w/ OCS (optical circuit switch). OCS is not new. Google built super nodes w/ 4096 TPUs.

See below for domestic ratio of 1-3kw to 10kw+ from 2019 to 2023:

See below for domestic ratio of 1-3kw to 10kw+ from 2019 to 2023: