🚨🚨 $ASTS WEEK IN REVIEW🚨🚨

$ASTS gets industry recognition as well as a lot of attention at AT&T's analyst day, as much more...

$ASTS gets industry recognition as well as a lot of attention at AT&T's analyst day, as much more...

🍰Summary

Achievements and Industry Position:

Recognition: $ASTS was named the "2024 Emerging Space Company of the Year."

Industry Alignment: Positioned at a critical intersection of technology and connectivity trends, such as satellite communication.

Trading Sentiment:

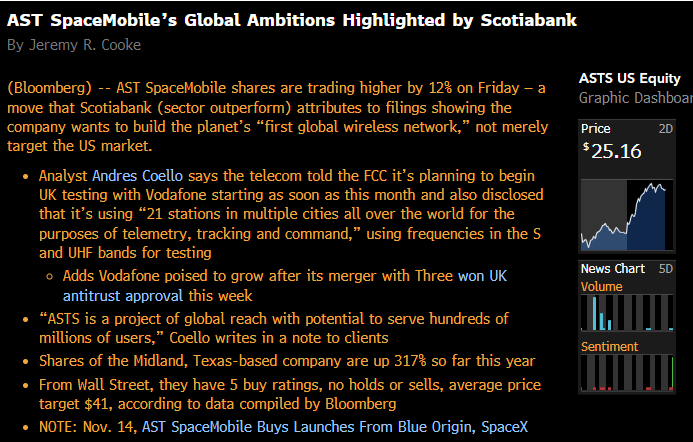

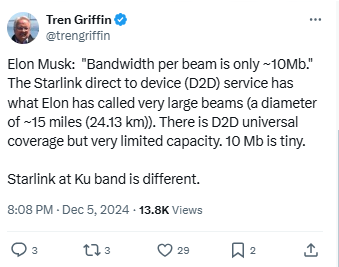

Market Dynamics: Noted trading patterns where $ASTS is seen as a pair trade against Starlink news, with investors reacting to perceived competition.

Zoomed-Out Perspective: Investors are encouraged to focus on the long-term structural advantages and milestones of $ASTS.

Competitive Insights:

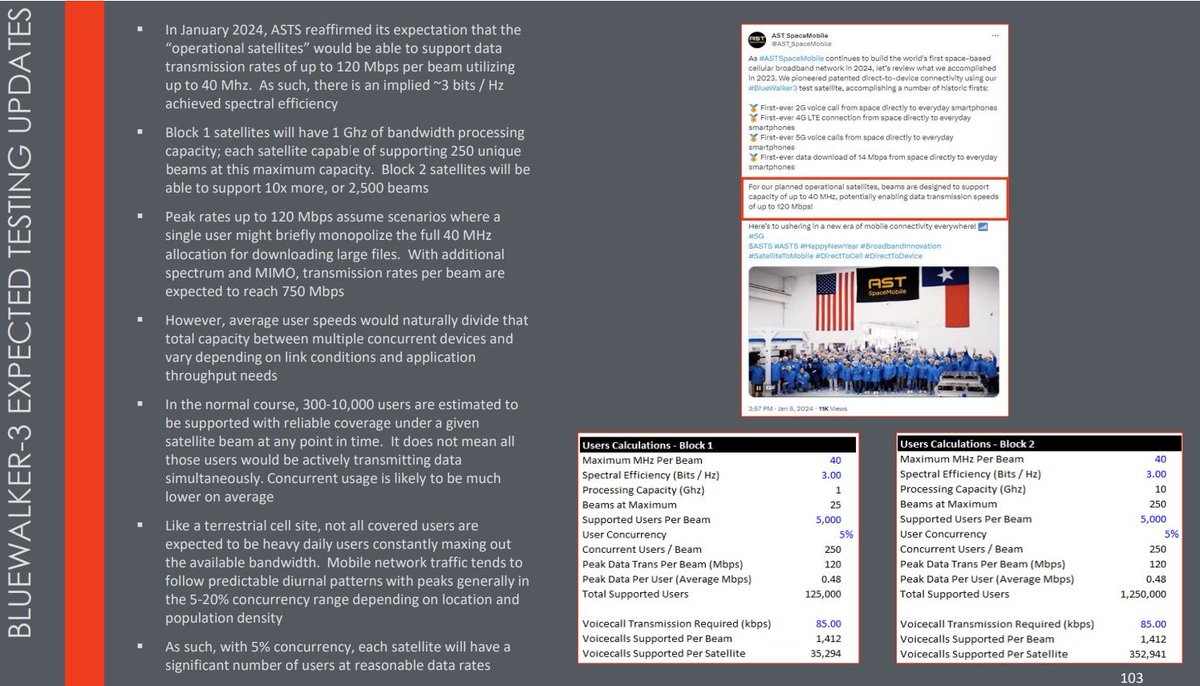

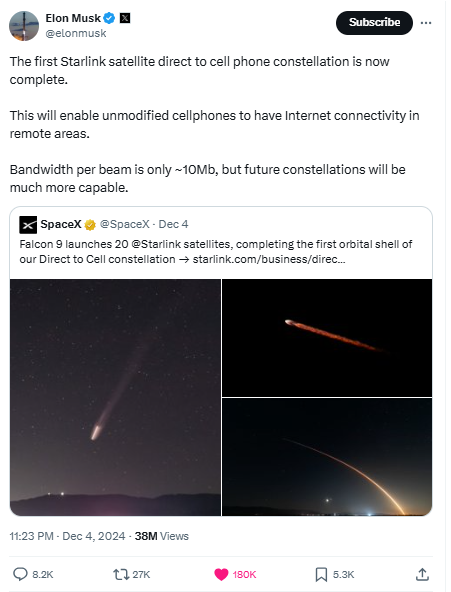

Starlink Comparisons: Differences highlighted between $ASTS's higher speeds and capacity versus Starlink's shared-beam model.

Investor Challenges: Difficulty for institutions to invest in $ASTS due to pre-revenue status and competition with Elon Musk's ventures.

Satellite Operations: Updates on AST5000 ASIC development for enhanced performance in space environments.

Regulatory Milestones: Progress in FCC approvals, including spectrum leasing arrangements and compliance.

Partnerships:

AT&T Collaboration: AT&T's strategy emphasizes $ASTS's role in augmenting terrestrial services. AT&T and Verizon's spectrum contributions bolster $ASTS's offering.

Catalysts and Future Outlook:

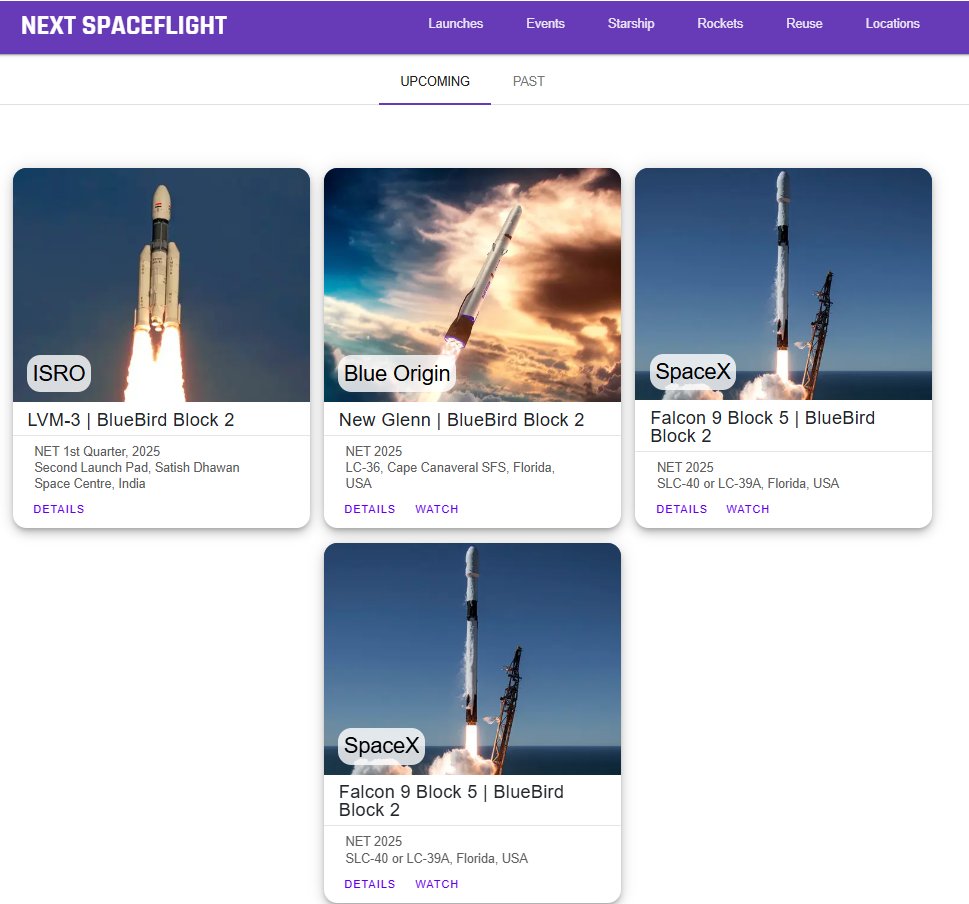

Upcoming Catalysts: Regulatory approvals, new launches (e.g., Bluebird 2), government contracts, and initial operations/revenue.

Long-Term Vision: Potential for significant revenue growth and impact on mobile network operators' subscriber value.

Geopolitical and Global Context:

International Developments: Regulatory challenges in Namibia for Starlink, opportunities in Europe, and competitive positioning in the Indian market.

MNO Partnerships: The strategic choice to collaborate with mobile network operators ensures smoother market entry and broader adoption.

Investment Insights:

Valuation Potential: The potential for exponential growth if milestones are achieved, highlighting parallels with historical tech successes.

Market Awareness: Awareness and investment traction are still in the early stages, with significant room for growth.

Achievements and Industry Position:

Recognition: $ASTS was named the "2024 Emerging Space Company of the Year."

Industry Alignment: Positioned at a critical intersection of technology and connectivity trends, such as satellite communication.

Trading Sentiment:

Market Dynamics: Noted trading patterns where $ASTS is seen as a pair trade against Starlink news, with investors reacting to perceived competition.

Zoomed-Out Perspective: Investors are encouraged to focus on the long-term structural advantages and milestones of $ASTS.

Competitive Insights:

Starlink Comparisons: Differences highlighted between $ASTS's higher speeds and capacity versus Starlink's shared-beam model.

Investor Challenges: Difficulty for institutions to invest in $ASTS due to pre-revenue status and competition with Elon Musk's ventures.

Satellite Operations: Updates on AST5000 ASIC development for enhanced performance in space environments.

Regulatory Milestones: Progress in FCC approvals, including spectrum leasing arrangements and compliance.

Partnerships:

AT&T Collaboration: AT&T's strategy emphasizes $ASTS's role in augmenting terrestrial services. AT&T and Verizon's spectrum contributions bolster $ASTS's offering.

Catalysts and Future Outlook:

Upcoming Catalysts: Regulatory approvals, new launches (e.g., Bluebird 2), government contracts, and initial operations/revenue.

Long-Term Vision: Potential for significant revenue growth and impact on mobile network operators' subscriber value.

Geopolitical and Global Context:

International Developments: Regulatory challenges in Namibia for Starlink, opportunities in Europe, and competitive positioning in the Indian market.

MNO Partnerships: The strategic choice to collaborate with mobile network operators ensures smoother market entry and broader adoption.

Investment Insights:

Valuation Potential: The potential for exponential growth if milestones are achieved, highlighting parallels with historical tech successes.

Market Awareness: Awareness and investment traction are still in the early stages, with significant room for growth.

🏆2024 Emerging Space Company of the Year

Well-earned recognition for $ASTS after a pivotal year of execution

Well-earned recognition for $ASTS after a pivotal year of execution

https://x.com/AST_SpaceMobile/status/1865153932961403155

✅Right Industry

We are at the right intersection of change. It comes down to security selection

We are at the right intersection of change. It comes down to security selection

https://x.com/CNBC/status/1864455825638449421

🙄Predictable Trading

I haven't gone back to test this, but it feels that whenever Starlink is in the news, $ASTS is just the easy "pair trade" where simple investors just assume the competitive hammer is dropping. Elon confirms the capacity per beam. Remember, the Starlink beam is shared among many more users than the comparable $ASTS beam

x.com/elonmusk/statu…

I haven't gone back to test this, but it feels that whenever Starlink is in the news, $ASTS is just the easy "pair trade" where simple investors just assume the competitive hammer is dropping. Elon confirms the capacity per beam. Remember, the Starlink beam is shared among many more users than the comparable $ASTS beam

x.com/elonmusk/statu…

😢Mood Through Thursday

Because I've been doing this a long time, the sentiment is as fascinating as anything else.

Because I've been doing this a long time, the sentiment is as fascinating as anything else.

https://x.com/alien_fgal/status/1864324848417231192

🔥I Didn't Light the Fire

Sometimes random things just seem to correlate when the stock might have wanted to pop anyway

Sometimes random things just seem to correlate when the stock might have wanted to pop anyway

https://x.com/itsrosehan1/status/1865029230024679884

⏳Juxtaposition of Short-term vs. Long-term

In contrast to how most retail (and institutions think), Tut does a great recap of what's happened over the past year

In contrast to how most retail (and institutions think), Tut does a great recap of what's happened over the past year

https://x.com/kingtutcap/status/1864120220954013844

🍼Simple Summaries

This simple summary outlines the key differences as to why Starlink and $ASTS are not in the same ball park

This simple summary outlines the key differences as to why Starlink and $ASTS are not in the same ball park

https://x.com/Marketsleaked/status/1864709818684239974

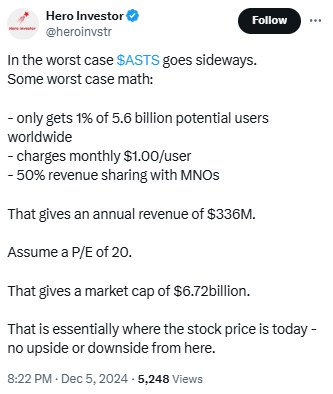

➕Simple Math

I find it very useless to map out the white space, but also understand the hurdle of what you need to believe

I find it very useless to map out the white space, but also understand the hurdle of what you need to believe

https://x.com/heroinvstr/status/1864888069347856390

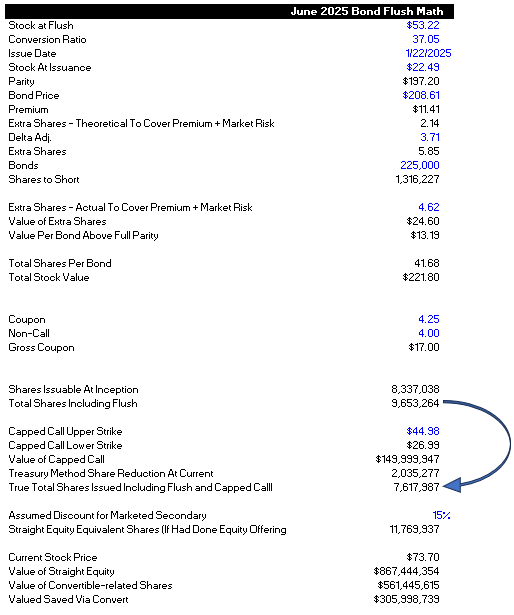

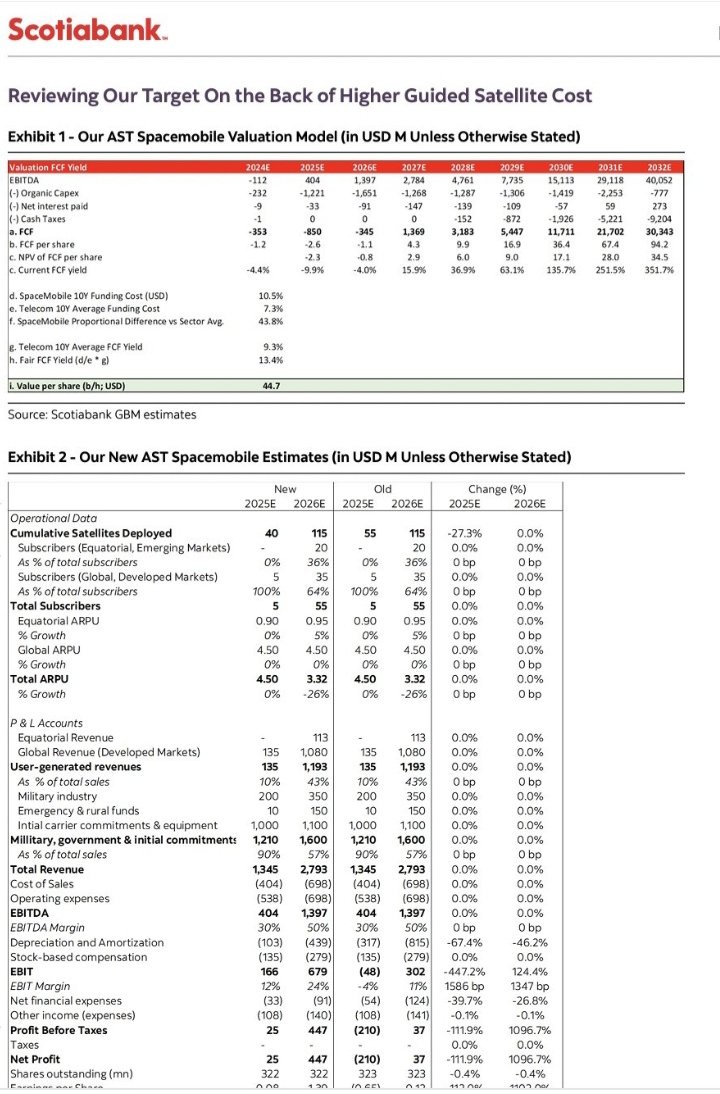

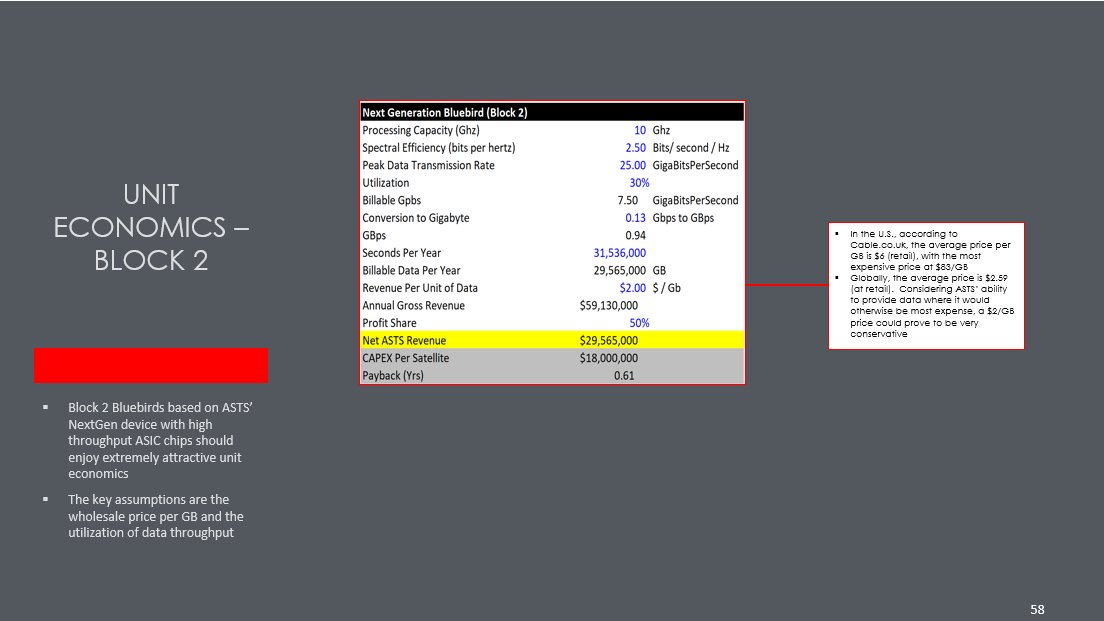

🧮Complex Math

Just theory at this point, but the key to make big money is understanding where opportunity lurks

Just theory at this point, but the key to make big money is understanding where opportunity lurks

https://x.com/forsuremaya/status/1865374374989017465

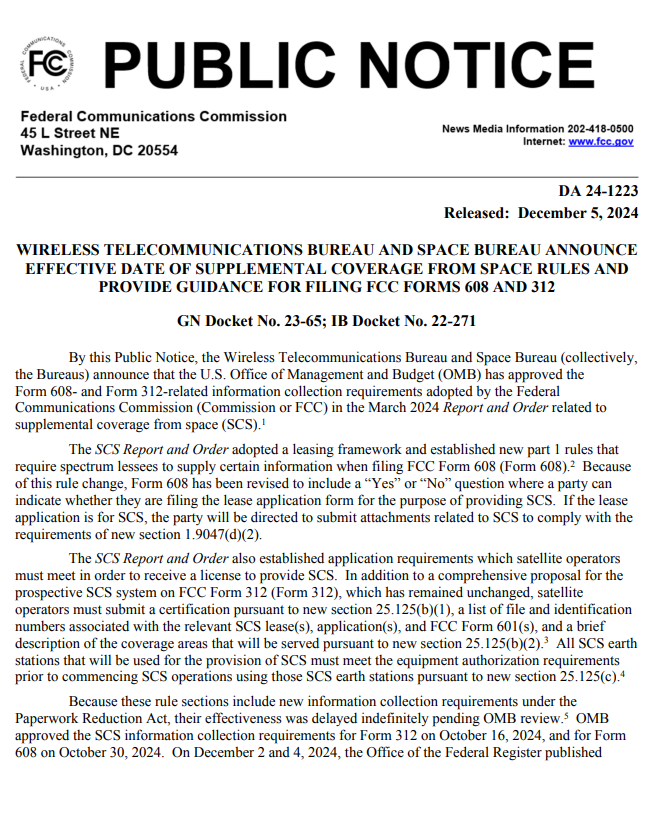

🧪Catalysts

I see the following as catalyst over the next 3 months:

FCC STAs

FCC SCS

MNO Contracts

Initial Operations

Initial Revenue

Government Contracts (SDA)

EXIM Progress

Strategic Payments

New Glenn Launch Success

Bluebird 2 Launch

Launch schedule

Manufacturing updates

International STAs

FirstNet Updates

I see the following as catalyst over the next 3 months:

FCC STAs

FCC SCS

MNO Contracts

Initial Operations

Initial Revenue

Government Contracts (SDA)

EXIM Progress

Strategic Payments

New Glenn Launch Success

Bluebird 2 Launch

Launch schedule

Manufacturing updates

International STAs

FirstNet Updates

https://x.com/forsuremaya/status/1864924507045056551

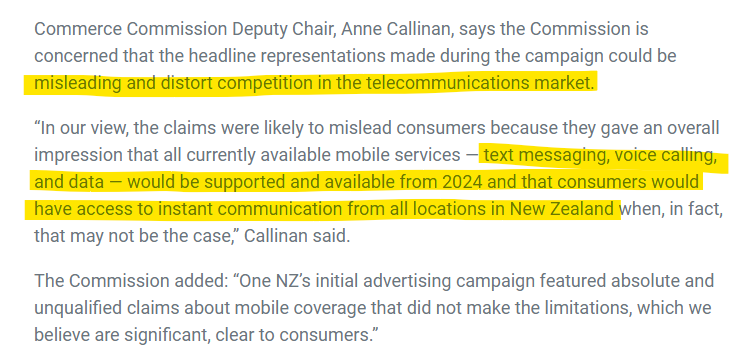

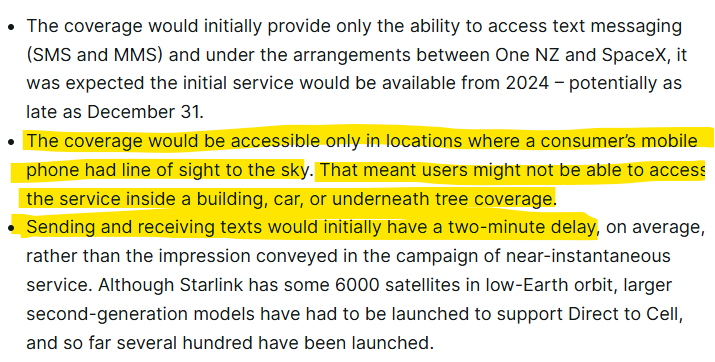

🤥True Starlink Service

Look to the courts where the truth comes out

Look to the courts where the truth comes out

https://x.com/Eminetwork101/status/1864706239302599065

🫢Starlink Changes Its Message

Funny how the physics catch up. Tut caught a nice one here. At first it was "text and data," then it was changed to "text then data"

Funny how the physics catch up. Tut caught a nice one here. At first it was "text and data," then it was changed to "text then data"

https://x.com/kingtutcap/status/1864661737863102948

📲AT&T Analyst Day Overview

AT&T lays outs its broad network convergence strategy. They highlighted the role of satellite in this strategy.

AT&T lays outs its broad network convergence strategy. They highlighted the role of satellite in this strategy.

https://x.com/spacanpanman/status/1864521910949687415

🔨Stankey Lays It Down

We have one partner. "We have a full year ahead of us to get more birds up in the sky." 1 year. Talks about how consumers do not want degradation of service.

We have one partner. "We have a full year ahead of us to get more birds up in the sky." 1 year. Talks about how consumers do not want degradation of service.

https://x.com/CatSE___ApeX___/status/1864068287027368169

💰Multi-Client Model

Stankey talks about the point I spoke about two weeks ago about the power of the multi-client model. It makes no sense for a single MNO to build this because it will never be economic to them to do so.

Stankey talks about the point I spoke about two weeks ago about the power of the multi-client model. It makes no sense for a single MNO to build this because it will never be economic to them to do so.

https://x.com/CatSE___ApeX___/status/1864076346458010015

🧭The True North

Will identifies the most important thing to the MNOs: lifetime value.

"One statistic stood out for me. Converged services are lifting the operator's lifetime subscriber value by 15%."

Will identifies the most important thing to the MNOs: lifetime value.

"One statistic stood out for me. Converged services are lifting the operator's lifetime subscriber value by 15%."

https://x.com/WillTownTech/status/1864757773629821125

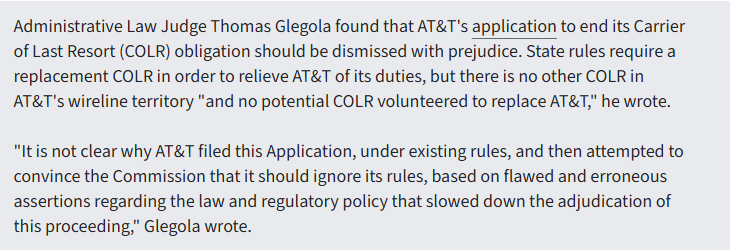

🪙Copper Trade

MNOs are required to maintain certain connectivity levels. Maintaining the old copper networks are a $6BN a year proposition.

MNOs are required to maintain certain connectivity levels. Maintaining the old copper networks are a $6BN a year proposition.

https://x.com/SPACtacular_/status/1864492551136321621

🛟Carrier of Last Resort

Being a monopoly carries costs, and in this instance, it's the Faustian bargain with the government.

Being a monopoly carries costs, and in this instance, it's the Faustian bargain with the government.

https://x.com/TrailerParkMGMT/status/1864502704179171501

💕Convergence

Satellite will augment terrestrial service. Good simple overview of $ASTS

x.com/i/status/18640…

x.com/CatSE___ApeX__…

Satellite will augment terrestrial service. Good simple overview of $ASTS

x.com/i/status/18640…

x.com/CatSE___ApeX__…

🏃Reminder of the MNOs Selling Towers

Who has advantaged information here? The buyer or the seller?

Who has advantaged information here? The buyer or the seller?

https://x.com/SimonDesrocher1/status/1840736398288060482

🎁AT&T & ASTS Presenting

More investors will be hearing about the exciting AT&T / $ASTS partnership on 12/10 at the UBS conference

More investors will be hearing about the exciting AT&T / $ASTS partnership on 12/10 at the UBS conference

🚑How FirstNet Does It Today

How do you do emergency response today? Inefficiently, expensively, and slowly

How do you do emergency response today? Inefficiently, expensively, and slowly

https://x.com/xASSMAN420x/status/1863768637355512206

👮♂️FirstNet Board Meeting

Latest FirstNet Updates will be on December 11th at 1130 AM EST.

Latest FirstNet Updates will be on December 11th at 1130 AM EST.

https://x.com/forsuremaya/status/1864414554760896569

🐦⬛Reminder about the Government

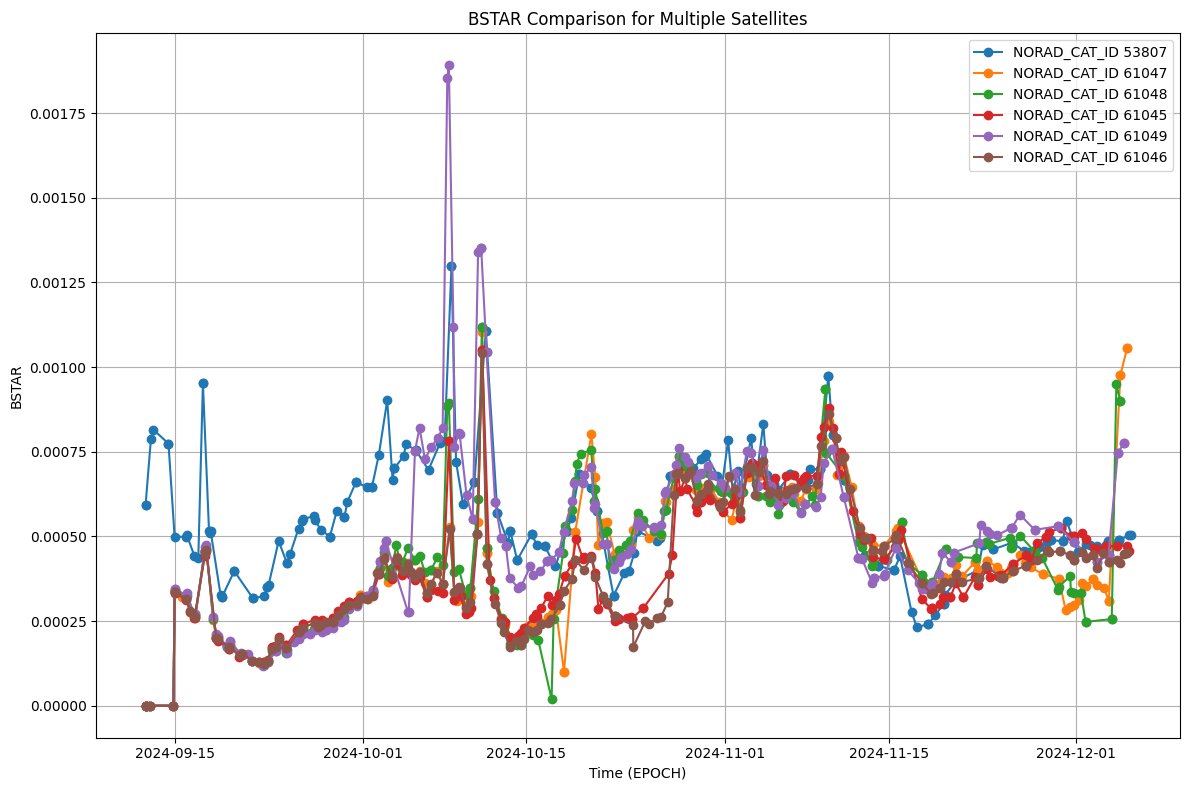

I've been reading a book about Keyhole. These projects were so classified that people who worked on them, to this day, cannot talk about them. I speak because I know. Meanwhile, did $ASTS deploy something else off two birds? Lots of redacted filings

I've been reading a book about Keyhole. These projects were so classified that people who worked on them, to this day, cannot talk about them. I speak because I know. Meanwhile, did $ASTS deploy something else off two birds? Lots of redacted filings

https://x.com/Truthful_ast/status/1863961136577515796

🐿️ASICS Are Cool

Cadence highlighting a partnership like this with AST SpaceMobile is relatively typical in the technology and semiconductor industries, especially for major projects involving innovative applications. Cadence uses this announcement to underscore its leadership in Electronic Design Automation (EDA) and IP solutions. By linking its tools and expertise to a groundbreaking project like AST SpaceMobile’s BlueBird satellites, Cadence positions itself as a critical enabler of cutting-edge technology

cadence.com/en_US/home/com…

Cadence highlighting a partnership like this with AST SpaceMobile is relatively typical in the technology and semiconductor industries, especially for major projects involving innovative applications. Cadence uses this announcement to underscore its leadership in Electronic Design Automation (EDA) and IP solutions. By linking its tools and expertise to a groundbreaking project like AST SpaceMobile’s BlueBird satellites, Cadence positions itself as a critical enabler of cutting-edge technology

cadence.com/en_US/home/com…

✝️ASTS, AI, Amazon, and the Confluence

No pun intended, but ASTS is hitting a cadence on the relevant key themes in the world. What good is AI if you are not connected?

No pun intended, but ASTS is hitting a cadence on the relevant key themes in the world. What good is AI if you are not connected?

https://x.com/pharmdaz/status/1864498428476313738

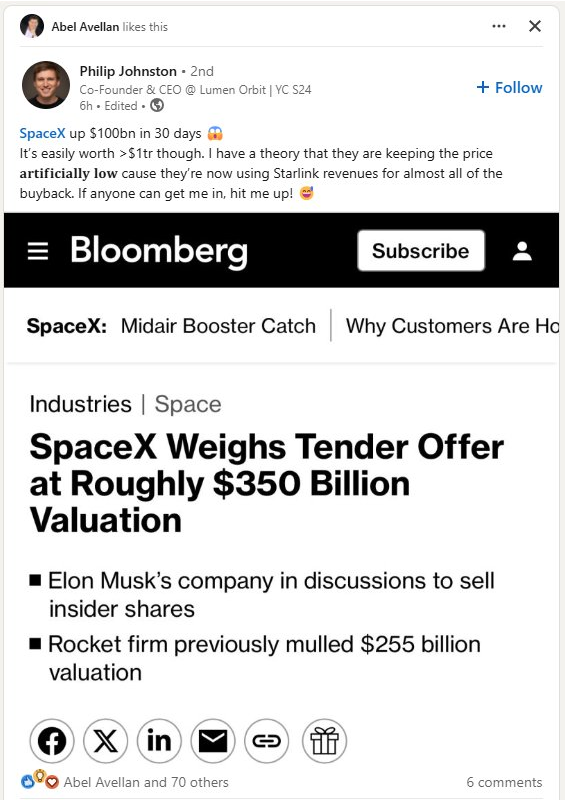

🧑⚖️FCC Streamlines the Process

Everything is getting wired for SCS, We see from these filings that the SCS rules are now in effect. I hadn't realized they weren't in effect, which just underscores how we are all learning here.

docs.fcc.gov/public/attachm…

Everything is getting wired for SCS, We see from these filings that the SCS rules are now in effect. I hadn't realized they weren't in effect, which just underscores how we are all learning here.

docs.fcc.gov/public/attachm…

🐎ASTS Gearing Up For Operations

They are finalizing how to get the constellation rolling. Just another little telltale that we're almost to prime time.

They are finalizing how to get the constellation rolling. Just another little telltale that we're almost to prime time.

https://x.com/CatSE___ApeX___/status/1864773703453581561

⚡️AT&T Spectrum

AT&T paid $1bn for 700MHz from US Cellular

AT&T paid $1bn for 700MHz from US Cellular

https://x.com/CatSE___ApeX___/status/1864767779863208017

🌎Meanwhile, The World

The emissary of God on earth reminds us that there is more than America. The India docket is heating up. $ASTS is getting referenced.

x.com/kingtutcap/sta…

x.com/kingtutcap/sta…

The emissary of God on earth reminds us that there is more than America. The India docket is heating up. $ASTS is getting referenced.

x.com/kingtutcap/sta…

x.com/kingtutcap/sta…

🇳🇦Namibia Strikes Back

"The Communications Regulatory Authority of Namibia (CRAN) has formally ordered Starlink to halt its satellite internet operations within the country, citing a lack of the required telecommunications license. "

spaceinafrica.com/2024/12/02/nam…

"The Communications Regulatory Authority of Namibia (CRAN) has formally ordered Starlink to halt its satellite internet operations within the country, citing a lack of the required telecommunications license. "

spaceinafrica.com/2024/12/02/nam…

🇫🇷Remember Europe?

Well, France is mentioning $ASTS? But I thought Europe was not going to have SCS, according to one expert? This is from the website of the French regulator

"AST SpaceMobile aims for a global expansion of high-speed connectivity. With a substantial increase in its cash reserves and strategic partnerships, AST SpaceMobile is ready to enhance global cellular coverage, targeting over 5 billion mobile users. (Investing.com)"

x.com/DaInverseCrame…

Well, France is mentioning $ASTS? But I thought Europe was not going to have SCS, according to one expert? This is from the website of the French regulator

"AST SpaceMobile aims for a global expansion of high-speed connectivity. With a substantial increase in its cash reserves and strategic partnerships, AST SpaceMobile is ready to enhance global cellular coverage, targeting over 5 billion mobile users. (Investing.com)"

x.com/DaInverseCrame…

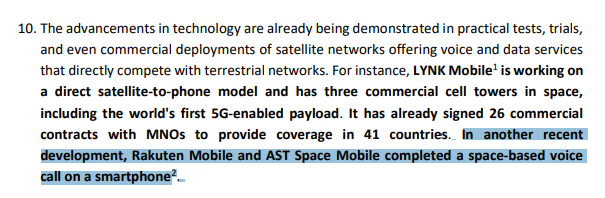

🏴UK Testing

UK testing STA filed for Llanidloes, Wales. Testing with Vodafone

x.com/defiantclient/…

ukfcf.org.uk/ofcom-prep-pro…

UK testing STA filed for Llanidloes, Wales. Testing with Vodafone

x.com/defiantclient/…

ukfcf.org.uk/ofcom-prep-pro…

Owner Operators

The full interview with Bezos was great, but the characteristics of a true Owner-Operator are evident in $ASTS, as they were with Bezos

The full interview with Bezos was great, but the characteristics of a true Owner-Operator are evident in $ASTS, as they were with Bezos

https://x.com/compound248/status/1864649603036876805

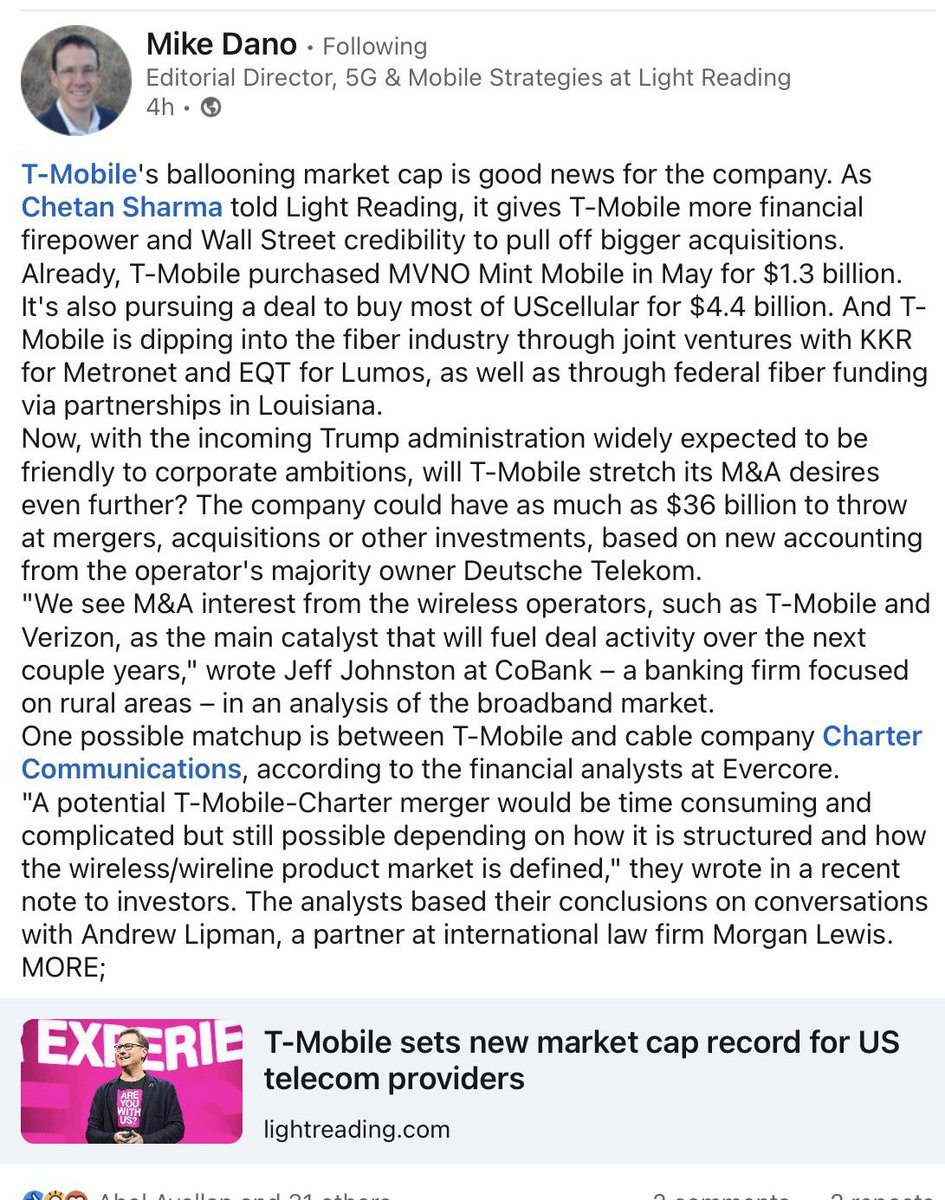

T-Mobile Valuation

AT&T and Verizon know they need to tackle the guys who came and challenged their position. That's why they are trying to have an iPhone moment with $ASTS

AT&T and Verizon know they need to tackle the guys who came and challenged their position. That's why they are trying to have an iPhone moment with $ASTS

https://x.com/mikeddano/status/1864691449842847904

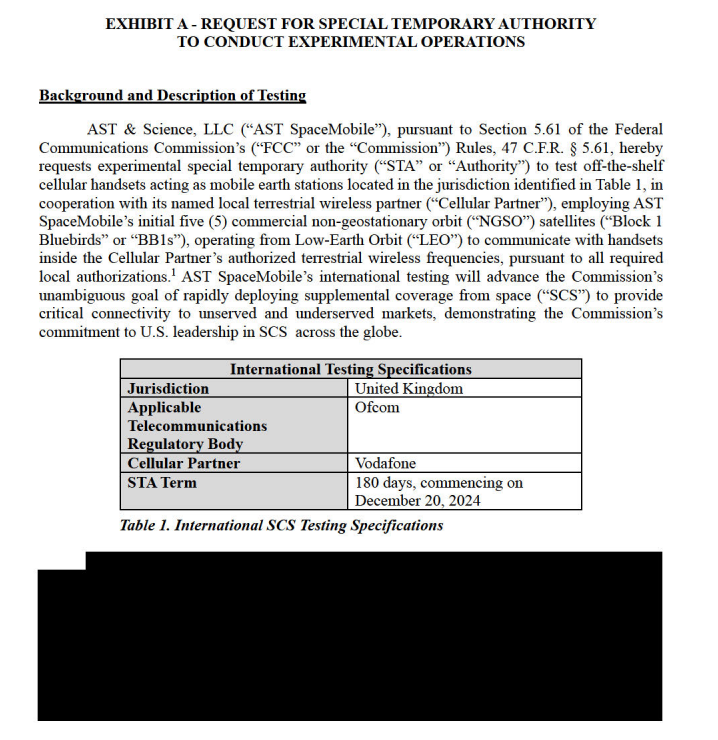

SpaceX Goes To Infinity

$250BN is for chumps. SpaceX goes higher

$250BN is for chumps. SpaceX goes higher

https://x.com/ASTS_Investors/status/1863926166354059544

But Also Comes Closer To Earth

Elon talks about the lower latency that is coming, but again, closer to early has a cost.

Elon talks about the lower latency that is coming, but again, closer to early has a cost.

https://x.com/elonmusk/status/1864484938206335078

And Cuts Price

A mobile Starlink is $450 and $30/month, or $0.60/GB. Amortize that $450 over 3 years, you have $150 / 12 = $12.5 / 50 = $0.25 in addition, or $0.85/GB. However, it's bundled so it's not a clean price b/c you have to also pay the $165. Remember, fixed broadband is a different animal than data delivered over terrestrial.

x.com/MarioNawfal/st…

A mobile Starlink is $450 and $30/month, or $0.60/GB. Amortize that $450 over 3 years, you have $150 / 12 = $12.5 / 50 = $0.25 in addition, or $0.85/GB. However, it's bundled so it's not a clean price b/c you have to also pay the $165. Remember, fixed broadband is a different animal than data delivered over terrestrial.

x.com/MarioNawfal/st…

Tail Risk

Playing Emperor is a dangerous game. While Musk looks to be the most powerful man in the world, never underestimate the power of hubris.

cnbc.com/2024/12/05/spa…

Playing Emperor is a dangerous game. While Musk looks to be the most powerful man in the world, never underestimate the power of hubris.

cnbc.com/2024/12/05/spa…

Brendan Carr Interview

Here are Carr's priorities:

CARR: Yeah, there’s four main ideas that I’ve been talking a lot about in terms of the agenda that I want to run. I mean, obviously, first and foremost, I want to make sure I continue to work with the Trump transition team and make sure I understand 100% what their agenda is. But for my part, number one is looking at tech censorship. Number two, there’s a whole set of media issues that I think deserve the FCC taking a fresh look at. There’s -- third, a whole set of economic issues from permitting reform to spectrum to the space economy, where, frankly, we’ve got to add some rocket fuel to that process. And then finally, national security. I think particularly with Salt Typhoon top of mind for a lot of people, it’s important that we continue to make progress there.

x.com/Akashi1459455/…

Here are Carr's priorities:

CARR: Yeah, there’s four main ideas that I’ve been talking a lot about in terms of the agenda that I want to run. I mean, obviously, first and foremost, I want to make sure I continue to work with the Trump transition team and make sure I understand 100% what their agenda is. But for my part, number one is looking at tech censorship. Number two, there’s a whole set of media issues that I think deserve the FCC taking a fresh look at. There’s -- third, a whole set of economic issues from permitting reform to spectrum to the space economy, where, frankly, we’ve got to add some rocket fuel to that process. And then finally, national security. I think particularly with Salt Typhoon top of mind for a lot of people, it’s important that we continue to make progress there.

x.com/Akashi1459455/…

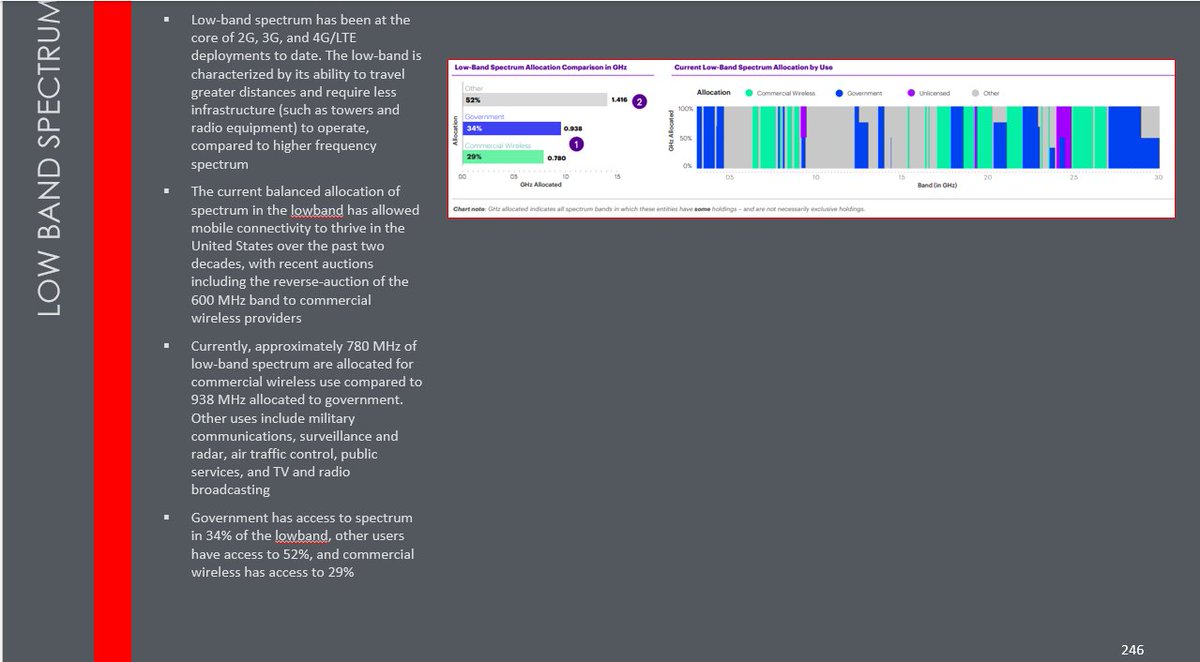

More Spectrum

Carr talks about Spectrum. Below is my work just showing how much spectrum is stuck with the government

"CARR: Yeah, I think he’s right. And Senator Ted Cruz, who I think is positioned to come in and lead the Commerce Committee, has said that freeing up more Spectrum is going to be his number one priority. And I agree wholeheartedly with that. When you free up Spectrum, it drives down prices for consumers. You can see traditional mobile wireless, for instance, competing in the in-home broadband market with cable. I think that’s a great thing for consumers. It’s also part of our national security interest. When we free up Spectrum, the world takes notice. Capital comes here. We get to set the rules of the road on the standard setting process. So there’s no question we’ve fallen into sort of a deep malaise on Spectrum under Biden administration. I hope we get a chance to turn that around while also protecting DOD. I mean, look, they’ve got national security missions that we can’t impinge on either. But we need a better balance than we’ve had the last couple of years."

Carr talks about Spectrum. Below is my work just showing how much spectrum is stuck with the government

"CARR: Yeah, I think he’s right. And Senator Ted Cruz, who I think is positioned to come in and lead the Commerce Committee, has said that freeing up more Spectrum is going to be his number one priority. And I agree wholeheartedly with that. When you free up Spectrum, it drives down prices for consumers. You can see traditional mobile wireless, for instance, competing in the in-home broadband market with cable. I think that’s a great thing for consumers. It’s also part of our national security interest. When we free up Spectrum, the world takes notice. Capital comes here. We get to set the rules of the road on the standard setting process. So there’s no question we’ve fallen into sort of a deep malaise on Spectrum under Biden administration. I hope we get a chance to turn that around while also protecting DOD. I mean, look, they’ve got national security missions that we can’t impinge on either. But we need a better balance than we’ve had the last couple of years."

• • •

Missing some Tweet in this thread? You can try to

force a refresh