Altseason

1) Only memes, or also utility tokens?

2) Spotting other hot sections.

3) Altcoin sections I'm watching.

Sector positioning is key—not everything pumps anymore.

Read with me 👇🫡

1) Only memes, or also utility tokens?

2) Spotting other hot sections.

3) Altcoin sections I'm watching.

Sector positioning is key—not everything pumps anymore.

Read with me 👇🫡

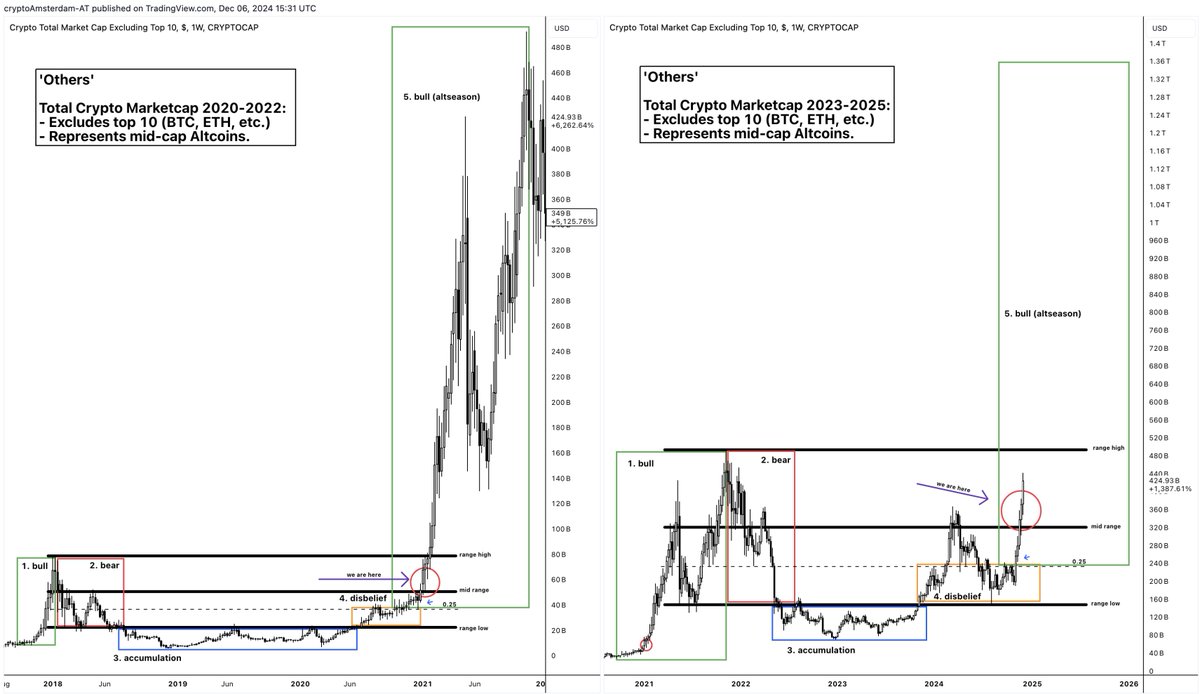

Starting with a short, simple intro so everyone can follow:

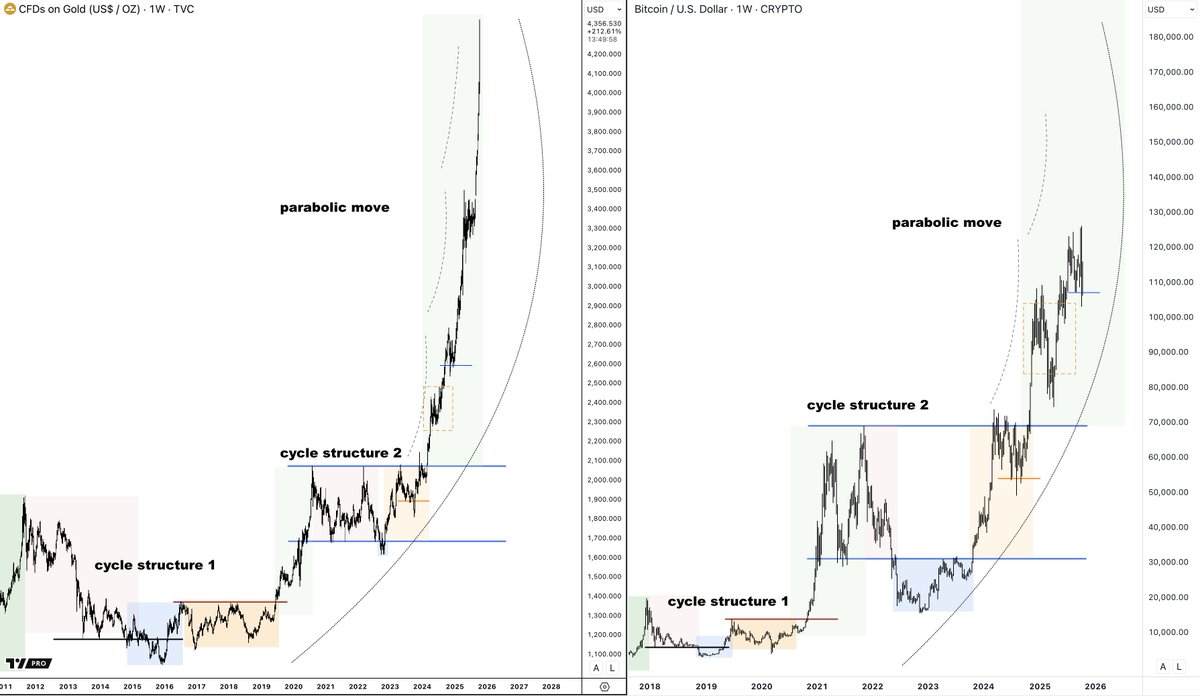

Cycle concept

Every asset follows a cycle—Crypto is no different:

Bear (stage 2): lower lows/highs

Accumulation (stage 3): equal lows/highs

Disbelief (stage 4): first higher high

Bull (stage 5): higher highs/lows

Look for a bottom in stage 3, or enter assets in stages 4 and 5—when prices go up.

Cycle concept

Every asset follows a cycle—Crypto is no different:

Bear (stage 2): lower lows/highs

Accumulation (stage 3): equal lows/highs

Disbelief (stage 4): first higher high

Bull (stage 5): higher highs/lows

Look for a bottom in stage 3, or enter assets in stages 4 and 5—when prices go up.

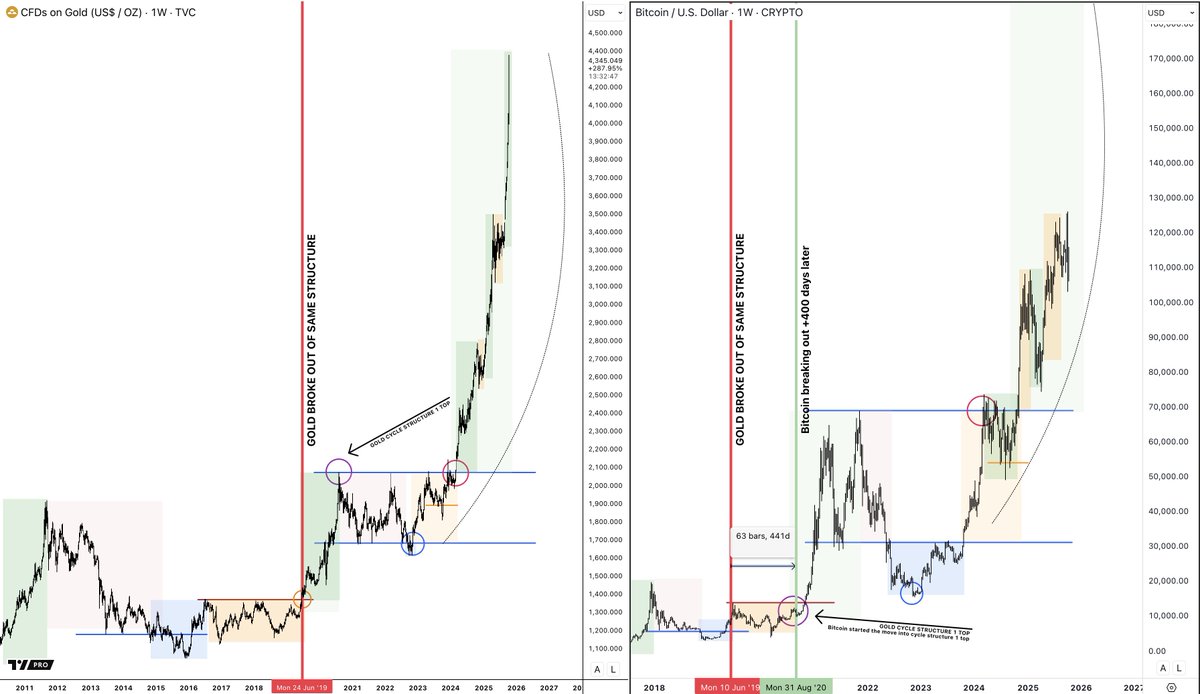

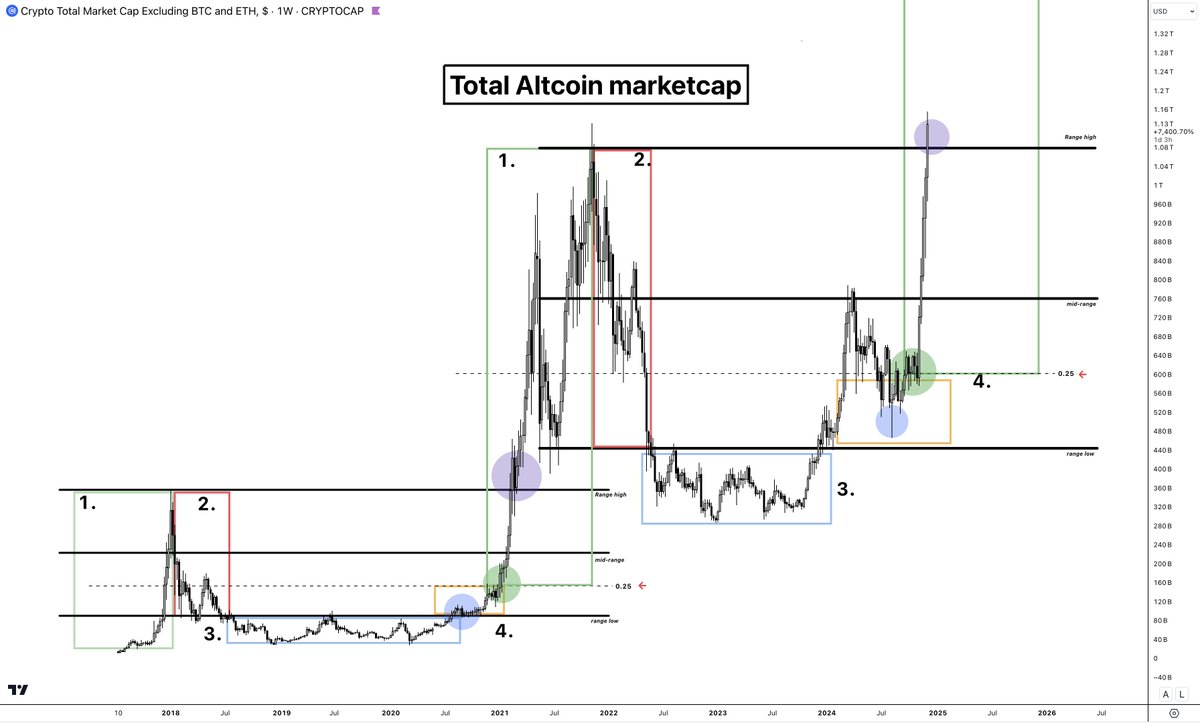

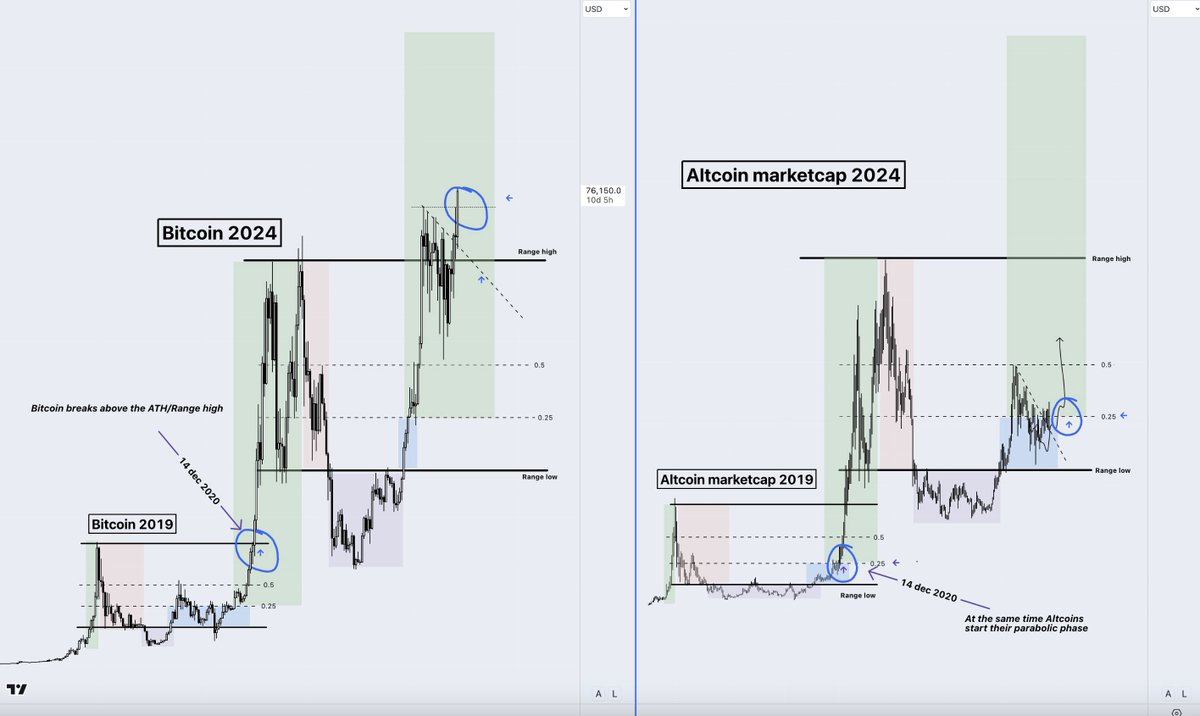

Range concept and the range low reclaim

When prices break below the range but re-enter, they often move quickly to the opposite side.

After reclaiming the range low, you can target the highs.

Combine cycle structure with range reclaim to know:

> Where we are

> What to expect

> Targets

> Invalidation

> Use range bias and cycle structure to understand the context

> Use range key levels as entry

When prices break below the range but re-enter, they often move quickly to the opposite side.

After reclaiming the range low, you can target the highs.

Combine cycle structure with range reclaim to know:

> Where we are

> What to expect

> Targets

> Invalidation

> Use range bias and cycle structure to understand the context

> Use range key levels as entry

You can use the cycle and range strategy on Bitcoin and altcoins and the Total Altcoin Market Cap.

> This helped me get into Bitcoin at 17k and 30k.

> But also positioning into Altcoins over the last 6 months as the Total Altcoin Marketcap was at the range low in stage 4.

> This helped me get into Bitcoin at 17k and 30k.

> But also positioning into Altcoins over the last 6 months as the Total Altcoin Marketcap was at the range low in stage 4.

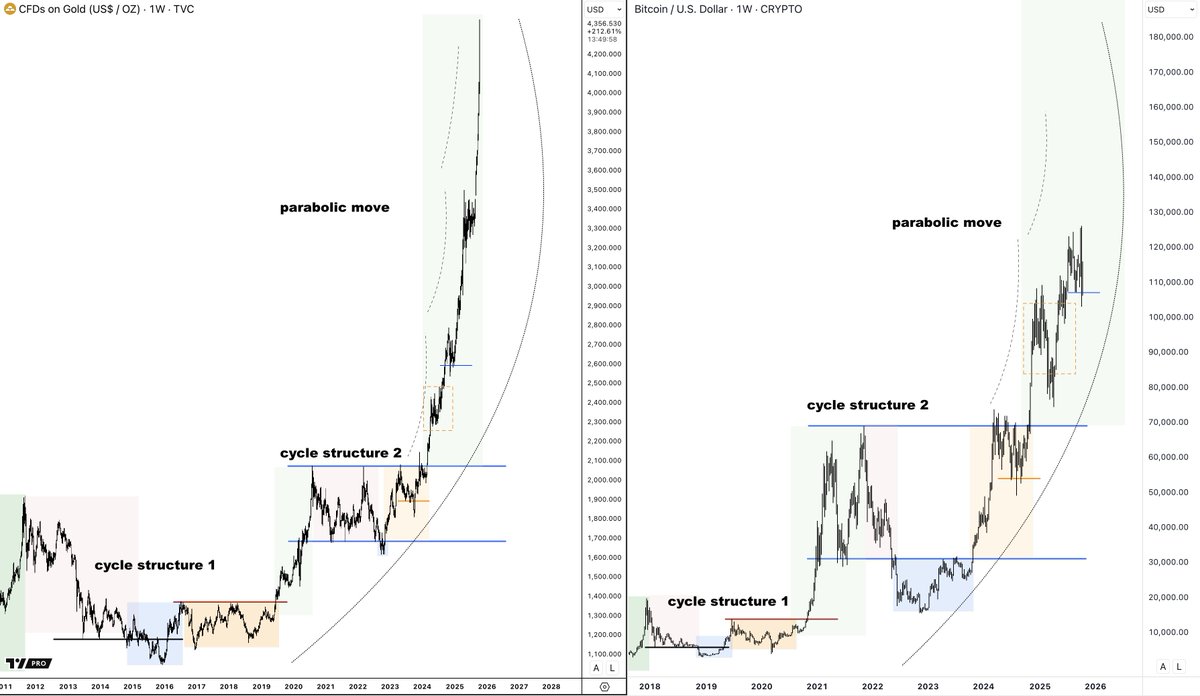

Studying past cycles and range structures helps you see how Altcoins and Bitcoin interact.

And here's where it's getting interesting.

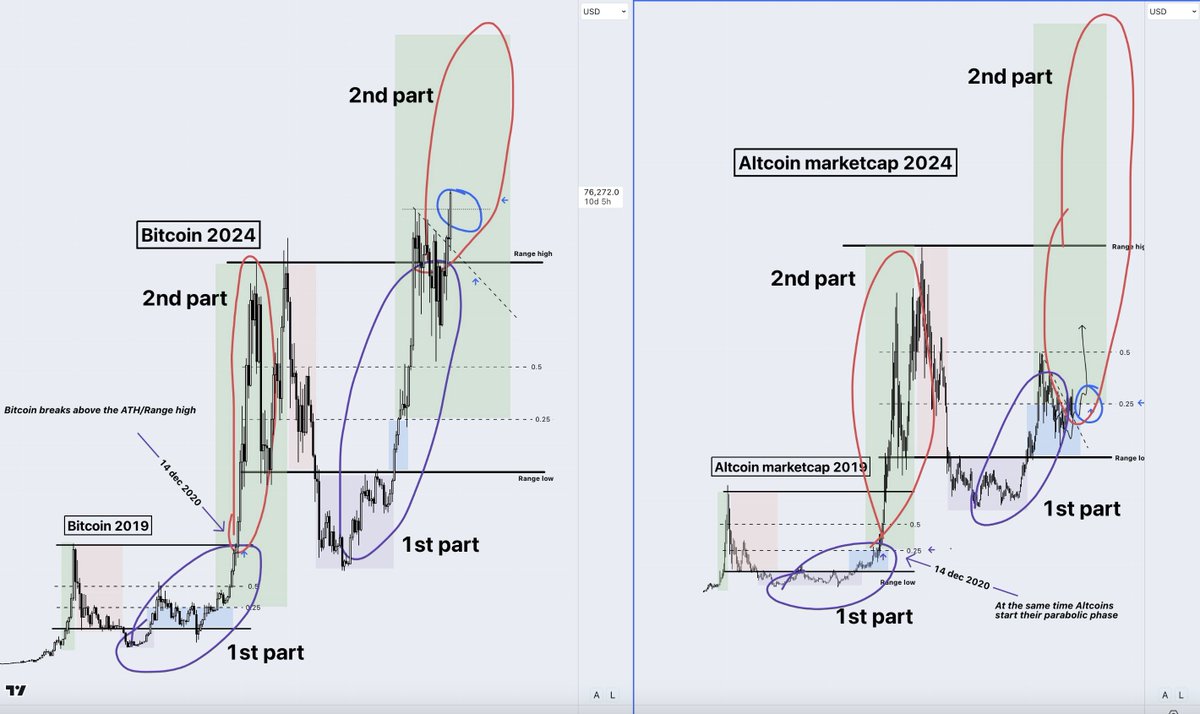

We can divide the bull run in two parts.

Part 1:

> Bitcoin reclaims the range low and rallies to the range high.

> Altcoins lag, eventually reclaiming their own range low and forming a first higher high.

> Money flows primarily into Bitcoin.

> Bitcoin dominance surges, while Altcoins lose value against Bitcoin.

Part 2:

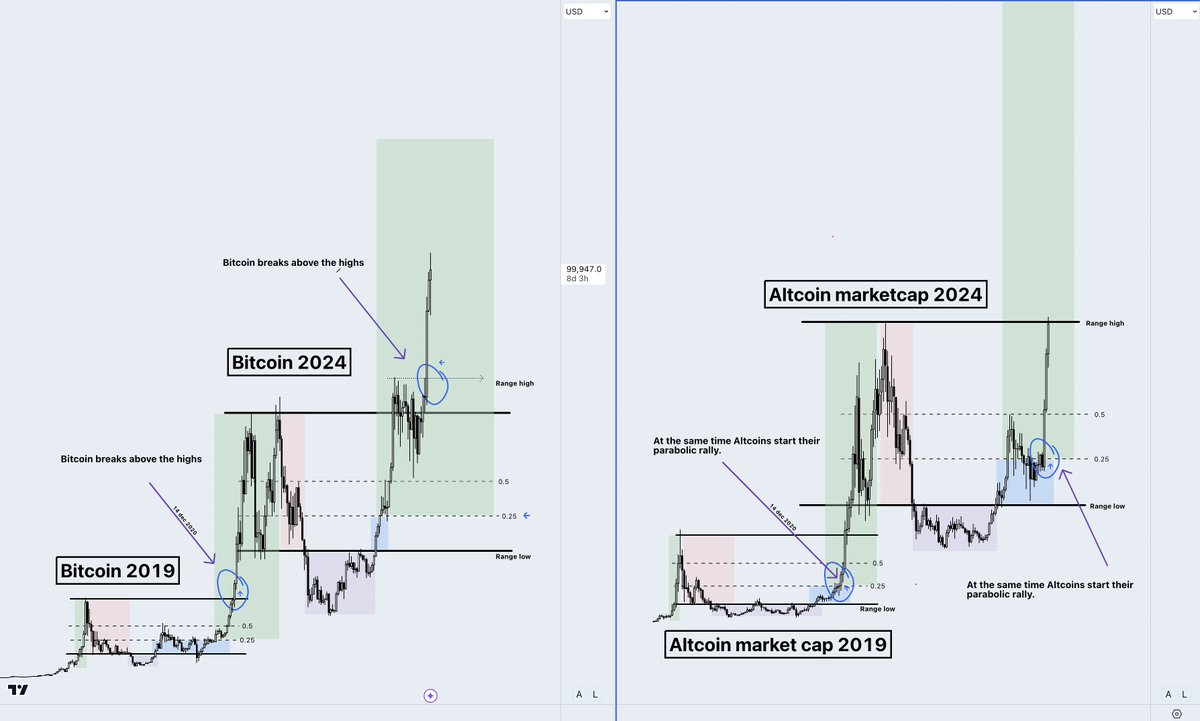

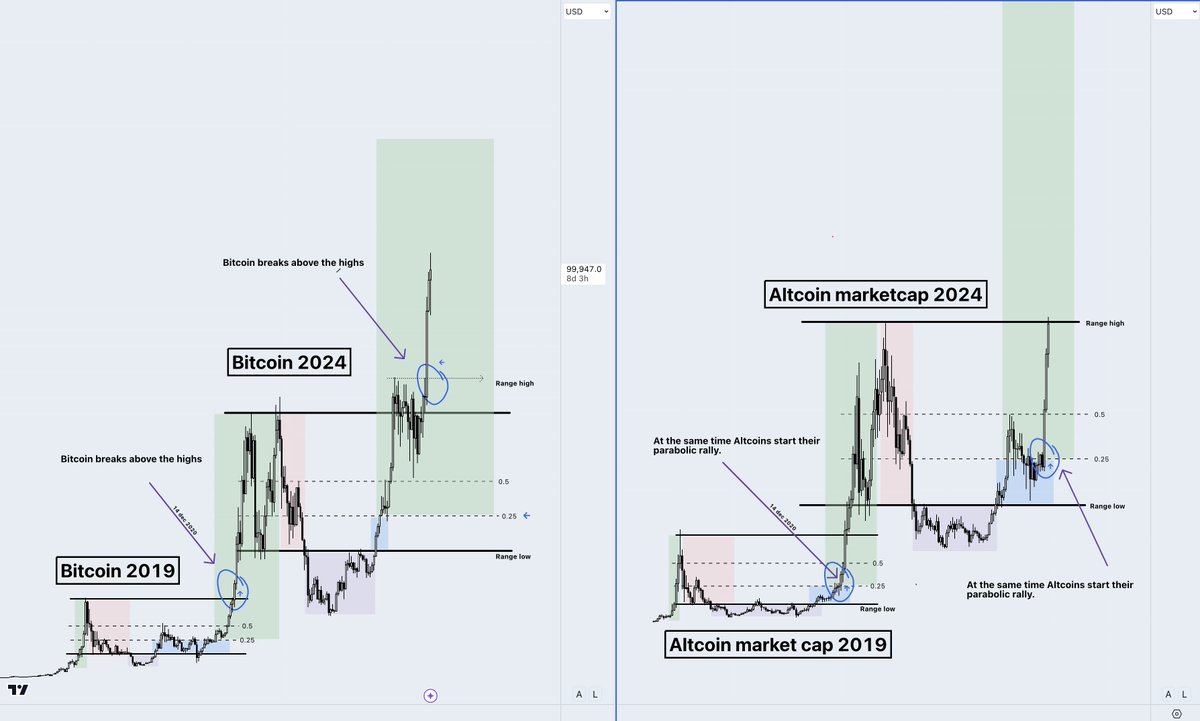

> Bitcoin breaks above the range high and enters price discovery.

> Altcoins, which lagged, now enter their own parabolic stage 5.

> Money shifts mainly into Altcoins.

> Bitcoin dominance drops as Altcoins gain value against Bitcoin.

Once Bitcoin breaks its previous cycle’s ATH, Altcoins enter parabolic stage 5.

This happened weeks ago, and it an extra confirmation to me that it was time for Altcoins and the start of bull market phase 2—The Altcoins parabolic run.

before > after

And here's where it's getting interesting.

We can divide the bull run in two parts.

Part 1:

> Bitcoin reclaims the range low and rallies to the range high.

> Altcoins lag, eventually reclaiming their own range low and forming a first higher high.

> Money flows primarily into Bitcoin.

> Bitcoin dominance surges, while Altcoins lose value against Bitcoin.

Part 2:

> Bitcoin breaks above the range high and enters price discovery.

> Altcoins, which lagged, now enter their own parabolic stage 5.

> Money shifts mainly into Altcoins.

> Bitcoin dominance drops as Altcoins gain value against Bitcoin.

Once Bitcoin breaks its previous cycle’s ATH, Altcoins enter parabolic stage 5.

This happened weeks ago, and it an extra confirmation to me that it was time for Altcoins and the start of bull market phase 2—The Altcoins parabolic run.

before > after

1) Only memes, or also other Altcoins?

Regarding the Altcoin sectors, there's a significant difference between the first bull market part and the second bull market part.

1st part where money flows mainly into Bitcoin -> only 1 or 2 sectors are doing well

2nd part where money flows into Altcoins, -> more room for other sectors (we are arriving here now imo)

PVP = player versus player

First part of the bull is mainly Bitcoin rising. Bitcoin dominance pumps, and Altcoins lose value against Bitcoin. New money enters Bitcoin, not Altcoins yet.

The only ones gambling on Altcoins are us, the degens who are always here—not new money.

It’s us against us, moving money around within a limited set of niches and tokens—high level of PVP and often only room for 1 or 2 Altcoin sectors to do well. Last cycle DeFi and this cycle imo Memes (and AI)

As shown on the chart below, Bitcoin breaks its all-time high in the second part of the bull, historically marking when Altcoins catch up and start a similar parabolic move.

Bitcoin dominance tops and drops, and Altcoins gain value against Bitcoin. More new money flows into Crypto, now mainly into Altcoins.

It’s no longer just us lifetime Altcoin degens against each other; it’s us plus a much larger pool of market and new money players.

The market will always be PVP, but there will be more room for multiple niches and tokens to do well.

That is the first reason why I expect more money to flow into utility tokens rather than just in meme coins.

Regarding the Altcoin sectors, there's a significant difference between the first bull market part and the second bull market part.

1st part where money flows mainly into Bitcoin -> only 1 or 2 sectors are doing well

2nd part where money flows into Altcoins, -> more room for other sectors (we are arriving here now imo)

PVP = player versus player

First part of the bull is mainly Bitcoin rising. Bitcoin dominance pumps, and Altcoins lose value against Bitcoin. New money enters Bitcoin, not Altcoins yet.

The only ones gambling on Altcoins are us, the degens who are always here—not new money.

It’s us against us, moving money around within a limited set of niches and tokens—high level of PVP and often only room for 1 or 2 Altcoin sectors to do well. Last cycle DeFi and this cycle imo Memes (and AI)

As shown on the chart below, Bitcoin breaks its all-time high in the second part of the bull, historically marking when Altcoins catch up and start a similar parabolic move.

Bitcoin dominance tops and drops, and Altcoins gain value against Bitcoin. More new money flows into Crypto, now mainly into Altcoins.

It’s no longer just us lifetime Altcoin degens against each other; it’s us plus a much larger pool of market and new money players.

The market will always be PVP, but there will be more room for multiple niches and tokens to do well.

That is the first reason why I expect more money to flow into utility tokens rather than just in meme coins.

1st bull phase: Altcoins in stage 4—1-2 sectors outperform. Last cycle: DeFi & Onchain (2019-2020). This cycle: AI & memes.

Start of 2nd bull phase: Bitcoin breaks ATH; Altcoin market cap enters stage 5, heading to range highs. Other niches wake up, like Gaming, L2s, and DeFi.

This is where we are right now.

Start of 2nd bull phase: Bitcoin breaks ATH; Altcoin market cap enters stage 5, heading to range highs. Other niches wake up, like Gaming, L2s, and DeFi.

This is where we are right now.

2nd bull stage (later):

Money flows: Bitcoin → Majors (Total 3) → Medium-cap Altcoins (Others chart) happens slowly at this stage.

As this stage progresses, more room opens for altcoin niches.

Things will get wild when the Others chart hits new highs (it lags due to rotation)

Money flows: Bitcoin → Majors (Total 3) → Medium-cap Altcoins (Others chart) happens slowly at this stage.

As this stage progresses, more room opens for altcoin niches.

Things will get wild when the Others chart hits new highs (it lags due to rotation)

The Others chart shows the total crypto market cap minus Bitcoin, Ethereum, and the top 10 Altcoins representing medium caps.

Bitcoin is above highs, and the majors (Total 3) are breaking out, but the 'Others' chart is just above mid-range.

This is normal at this part but shows mid-cap Altcoins are just starting.

The outperforming niches and their mid-caps were doing well, but they were a rarity and not visible on our total mid-cap chart, which is now starting to break out = which means other niches are finally beginning.

More Altcoin niches will pump when new money, Bitcoin money, and Major Altcoin money flow into Others.

Bitcoin is above highs, and the majors (Total 3) are breaking out, but the 'Others' chart is just above mid-range.

This is normal at this part but shows mid-cap Altcoins are just starting.

The outperforming niches and their mid-caps were doing well, but they were a rarity and not visible on our total mid-cap chart, which is now starting to break out = which means other niches are finally beginning.

More Altcoin niches will pump when new money, Bitcoin money, and Major Altcoin money flow into Others.

TLDR:

In the 1st bull phase, only 1-2 niches perform as it's mostly existing players and new money flowing into Bitcoin.

In the 2nd phase, new money and existing Bitcoin money flows into Altcoins, more niches thrive, and the market becomes less PvP.

In the 1st bull phase, only 1-2 niches perform as it's mostly existing players and new money flowing into Bitcoin.

In the 2nd phase, new money and existing Bitcoin money flows into Altcoins, more niches thrive, and the market becomes less PvP.

This is also clear in ETHBTC bottoming.

> In the 1st bull phase, ETHBTC always dumps.

> In the 2nd phase, it bottoms and pumps through the cycle.

When Ethereum pumps, its ecosystem and beta plays will attract more inflow, shifting the ratio away from Solana.

ETH on-chain is more utility-focused, while Solana leans more toward meme coins (pumpdotfun).

> In the 1st bull phase, ETHBTC always dumps.

> In the 2nd phase, it bottoms and pumps through the cycle.

When Ethereum pumps, its ecosystem and beta plays will attract more inflow, shifting the ratio away from Solana.

ETH on-chain is more utility-focused, while Solana leans more toward meme coins (pumpdotfun).

It is also very visible on the ETHBTC monthly chart:

> Range low reclaim and retest now

> Stage 4

> Massive Monthly support

> Range low reclaim and retest now

> Stage 4

> Massive Monthly support

We’re at the start of the shift from the 1st bull phase (1-2 niches thriving) to the 2nd phase (more niches doing well).

The shift so far:

> Bitcoin breaking new highs

> ETHBTC hitting support

> Dominance breaks 800-day uptrend line.

Slow bounces across sectors show the early signs.

Real money flow begins when:

> Dominance trends down

> ETHBTC rallies from support

> Others chart breaks into new highs.

The shift so far:

> Bitcoin breaking new highs

> ETHBTC hitting support

> Dominance breaks 800-day uptrend line.

Slow bounces across sectors show the early signs.

Real money flow begins when:

> Dominance trends down

> ETHBTC rallies from support

> Others chart breaks into new highs.

2. How to spot other hot sections.

There are so many sections now, but thank God the market always tips its hand:

> Look for signs.

> Think logically.

> signs:

- Sectors that dominate in the first part of the bull when the total altcoin market cap is still in stages 3 and 4; this cycle is memes and AI.

- Sectors that had some interest in the initial part of the bull: RWA, for example, or Gambling by the early run of Rollbit and later the prediction markets.

These will return, even wilder, in the second part of the cycle during altseason.

Outperformers keep outperforming.

- Use the charts from the tools to show you what sectors are doing well at specific points, such as when ETHBTC is bottoming. Currently, I've seen strong bounces on DeFi, Gaming, and L2s.

Use macrocycle charts of market leaders, like AAVE for DeFi, to time or confirm trends.

- Even before the bull started, we had a narrative: SocialFi died when the Crypto bull run started, and attention shifted, but it might come back after. It feels similar to the NFT run before the 2021 bull run and then coming back after the crypto top.

Logical plays:

- RWA driven by Fink

- ETH bottoming: ETH memes, beta plays, L2, DeFi

- AI: Real-world interest makes crypto the gateway for normies

Last cycle: Part 1 (just degens) was DeFi and Onchain. Part 2 (real-world interest) saw Metaverse take over.

There are so many sections now, but thank God the market always tips its hand:

> Look for signs.

> Think logically.

> signs:

- Sectors that dominate in the first part of the bull when the total altcoin market cap is still in stages 3 and 4; this cycle is memes and AI.

- Sectors that had some interest in the initial part of the bull: RWA, for example, or Gambling by the early run of Rollbit and later the prediction markets.

These will return, even wilder, in the second part of the cycle during altseason.

Outperformers keep outperforming.

- Use the charts from the tools to show you what sectors are doing well at specific points, such as when ETHBTC is bottoming. Currently, I've seen strong bounces on DeFi, Gaming, and L2s.

Use macrocycle charts of market leaders, like AAVE for DeFi, to time or confirm trends.

- Even before the bull started, we had a narrative: SocialFi died when the Crypto bull run started, and attention shifted, but it might come back after. It feels similar to the NFT run before the 2021 bull run and then coming back after the crypto top.

Logical plays:

- RWA driven by Fink

- ETH bottoming: ETH memes, beta plays, L2, DeFi

- AI: Real-world interest makes crypto the gateway for normies

Last cycle: Part 1 (just degens) was DeFi and Onchain. Part 2 (real-world interest) saw Metaverse take over.

TLDR:

I think MEMES will keep outperforming as the most dominant narrative so far.

But while MEMES have upside, their charts are often in stage 5 (parabolic), making them harder to enter.

Other narratives like AI, RWA, DeFi, and Gaming are still in macro stage 3 or 4—less interest and better risk/reward.

My portfolio already has many MEME and AI tokens, so I’m excited to explore other sectors.

I think MEMES will keep outperforming as the most dominant narrative so far.

But while MEMES have upside, their charts are often in stage 5 (parabolic), making them harder to enter.

Other narratives like AI, RWA, DeFi, and Gaming are still in macro stage 3 or 4—less interest and better risk/reward.

My portfolio already has many MEME and AI tokens, so I’m excited to explore other sectors.

Sectors I'm watching:

- MEMES (cycle domination so far)

- AI/DePin (Early mover this cycle + real-world attention)

- RWA (Momentum in 1st part cycle)

- Gambling

- SOL eco (strength all cycle)

- BTC eco (Momentum in 1st part cycle)

- DeFi (ETHBTC Bottom)

- L2 (ETH beta play)

- SocialFi (run before the cycle)

- MEMES (cycle domination so far)

- AI/DePin (Early mover this cycle + real-world attention)

- RWA (Momentum in 1st part cycle)

- Gambling

- SOL eco (strength all cycle)

- BTC eco (Momentum in 1st part cycle)

- DeFi (ETHBTC Bottom)

- L2 (ETH beta play)

- SocialFi (run before the cycle)

In the coming week(s), I'll share more long posts and threads about the Altcoin positions I have or am eyeing to enter per sector and dive deeper into them.

Thanks for reading again,

Amsterdam! 🫡

Thanks for reading again,

Amsterdam! 🫡

• • •

Missing some Tweet in this thread? You can try to

force a refresh