crypto has reached escape velocity 🧑🚀🌕

people...

▪️ value cryptoassets

▪️ hold cryptoassets

▪️ trade cryptoassets

▪️ borrow cryptoassets

▪️ use crypto applications

▪️ transact with stablecoins

▪️ earn by building in crypto

▪️ can use crypto networks for ~free

a thread 🧵⬇️

people...

▪️ value cryptoassets

▪️ hold cryptoassets

▪️ trade cryptoassets

▪️ borrow cryptoassets

▪️ use crypto applications

▪️ transact with stablecoins

▪️ earn by building in crypto

▪️ can use crypto networks for ~free

a thread 🧵⬇️

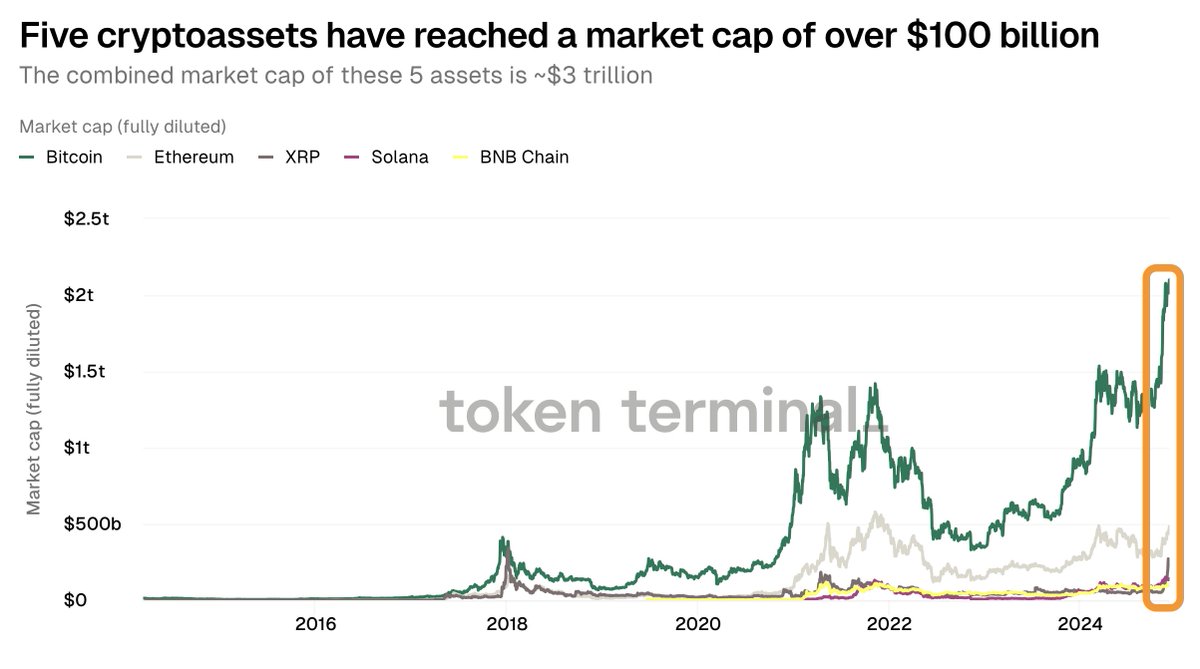

People value cryptoassets

▪️ Five cryptoassets have reached a market cap of over $100 billion

▪️ The combined market cap of these 5 assets is ~$3 trillion

▪️ Five cryptoassets have reached a market cap of over $100 billion

▪️ The combined market cap of these 5 assets is ~$3 trillion

People hold cryptoassets

▪️ Close to 1 billion unique addresses hold a cryptoasset balance

▪️ The tokenholder count has gone up 10x over the past four years

▪️ Close to 1 billion unique addresses hold a cryptoasset balance

▪️ The tokenholder count has gone up 10x over the past four years

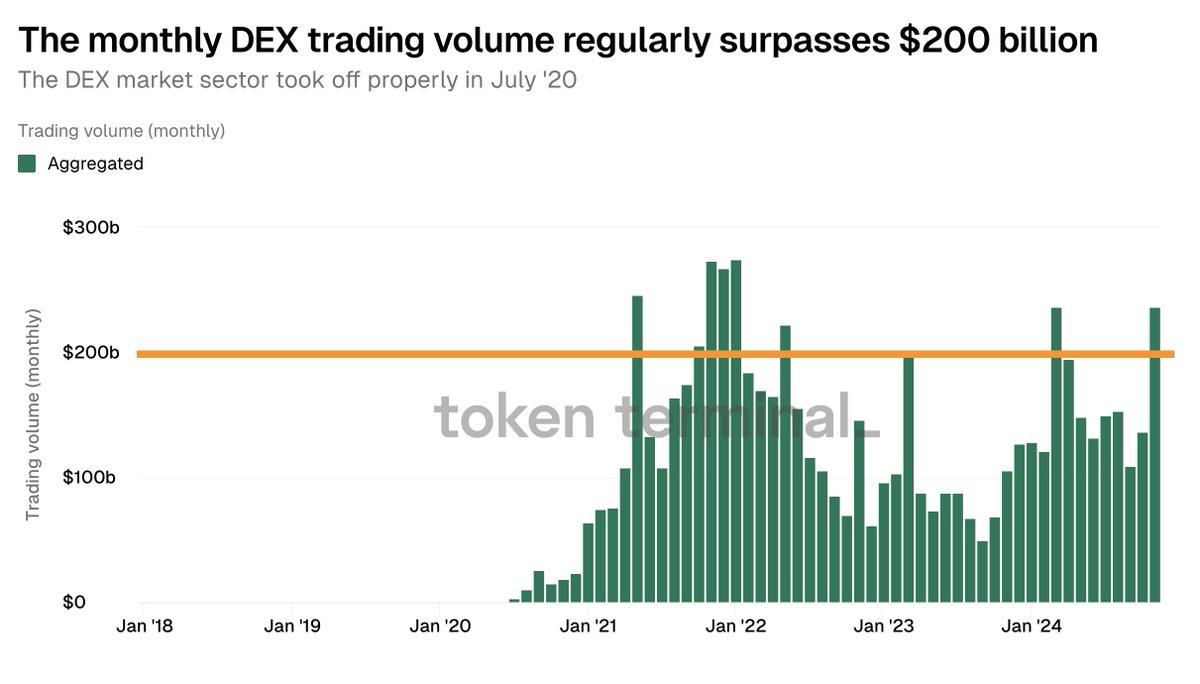

People trade cryptoassets

▪️ The monthly DEX trading volume regularly surpasses $200 billion

▪️ The DEX market sector took off properly in July '20

▪️ The monthly DEX trading volume regularly surpasses $200 billion

▪️ The DEX market sector took off properly in July '20

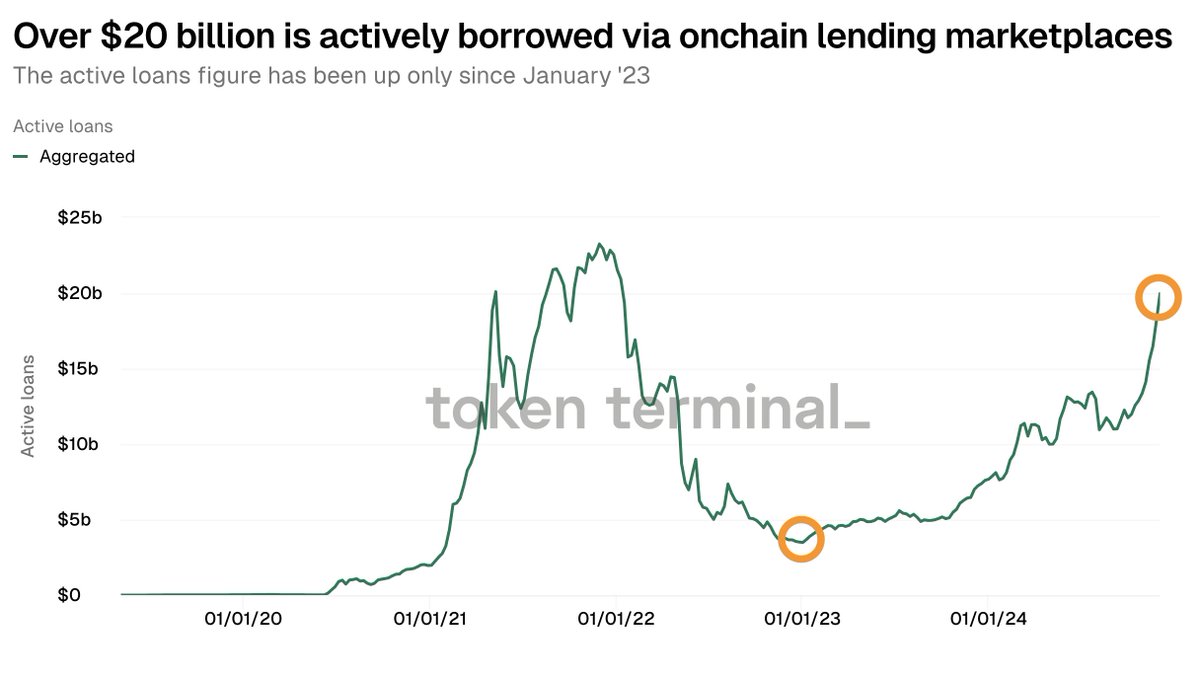

People borrow cryptoassets

▪️ Over $20 billion is actively borrowed via onchain lending marketplaces

▪️ The active loans figure has been up only since January '23

▪️ Over $20 billion is actively borrowed via onchain lending marketplaces

▪️ The active loans figure has been up only since January '23

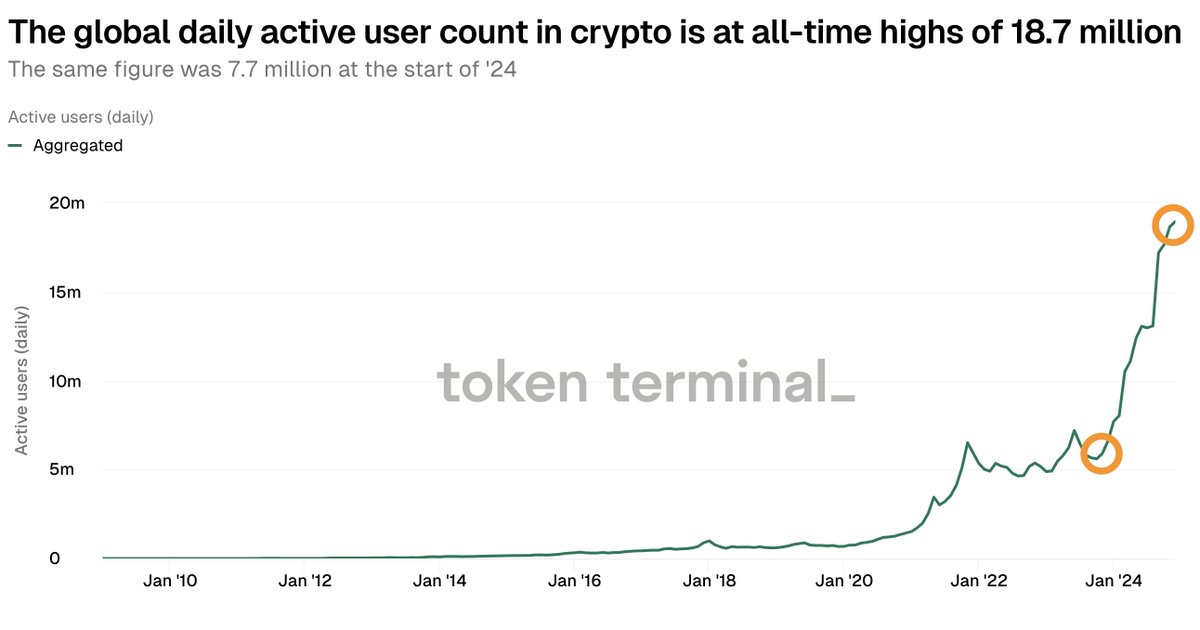

People use crypto applications

▪️ The global daily active user count in crypto is at all-time highs of 18.7 million

▪️ The same figure was 7.7 million at the start of '24

▪️ The global daily active user count in crypto is at all-time highs of 18.7 million

▪️ The same figure was 7.7 million at the start of '24

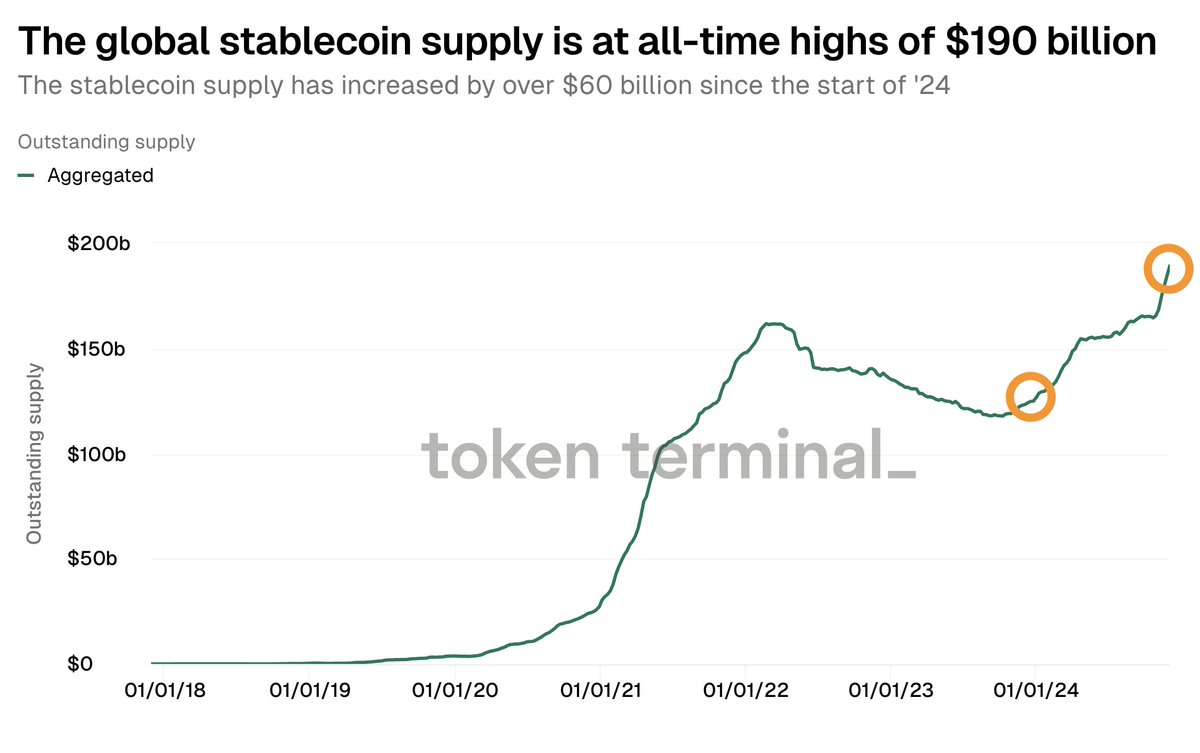

People transact with stablecoins

▪️ The global stablecoin supply is at all-time highs of $190 billion

▪️ The stablecoin supply has increased by over $60 billion since the start of '24

▪️ The global stablecoin supply is at all-time highs of $190 billion

▪️ The stablecoin supply has increased by over $60 billion since the start of '24

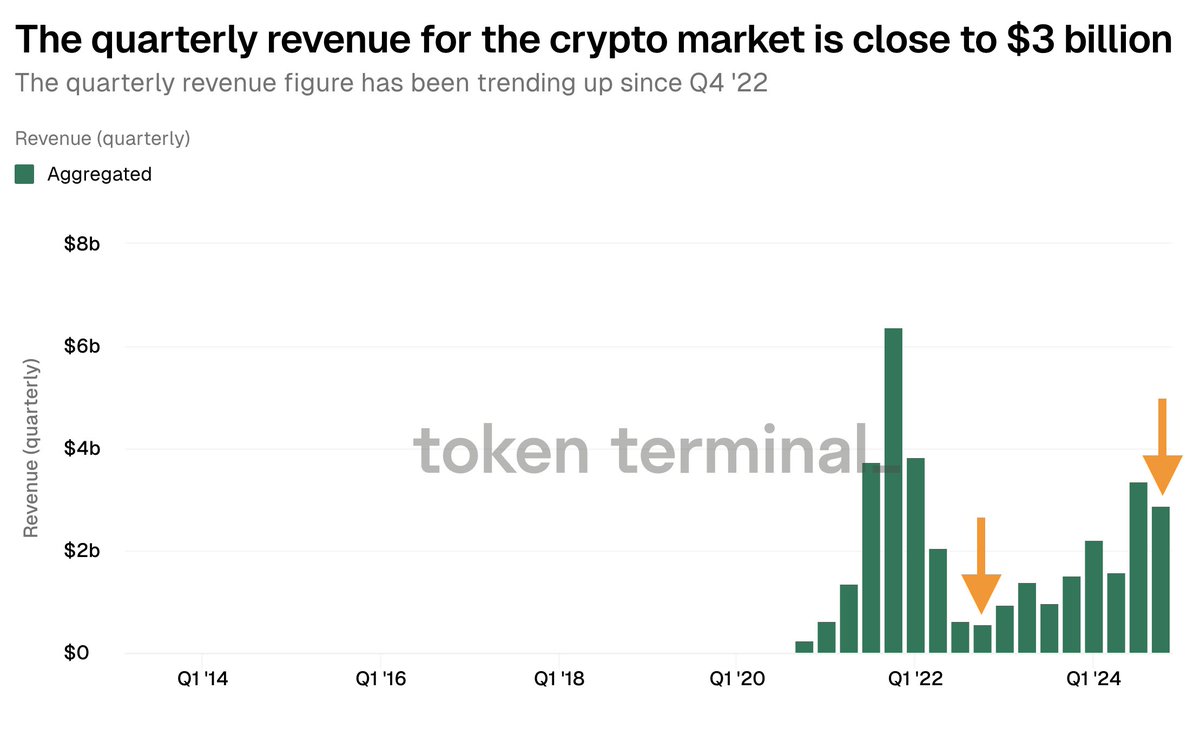

People earn by building in crypto

▪️ The quarterly revenue for the crypto market is close to $3 billion

▪️ The quarterly revenue figure has been trending up since Q4 '22

▪️ The quarterly revenue for the crypto market is close to $3 billion

▪️ The quarterly revenue figure has been trending up since Q4 '22

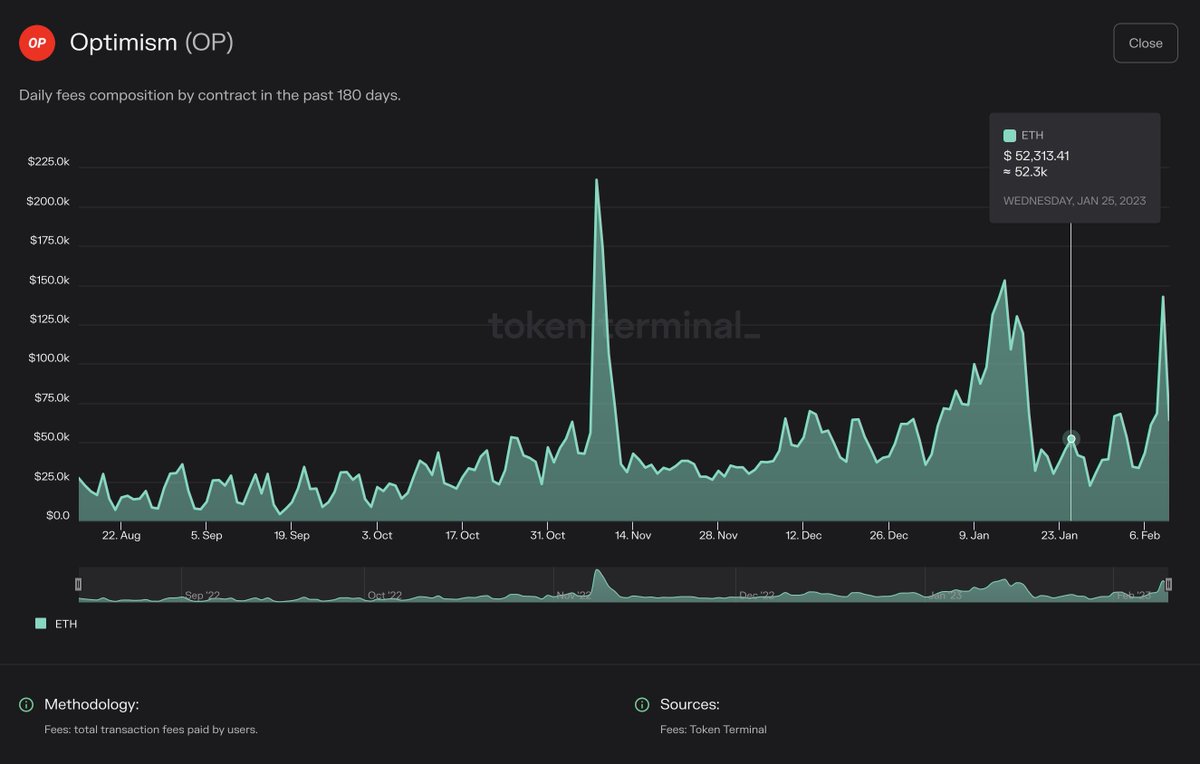

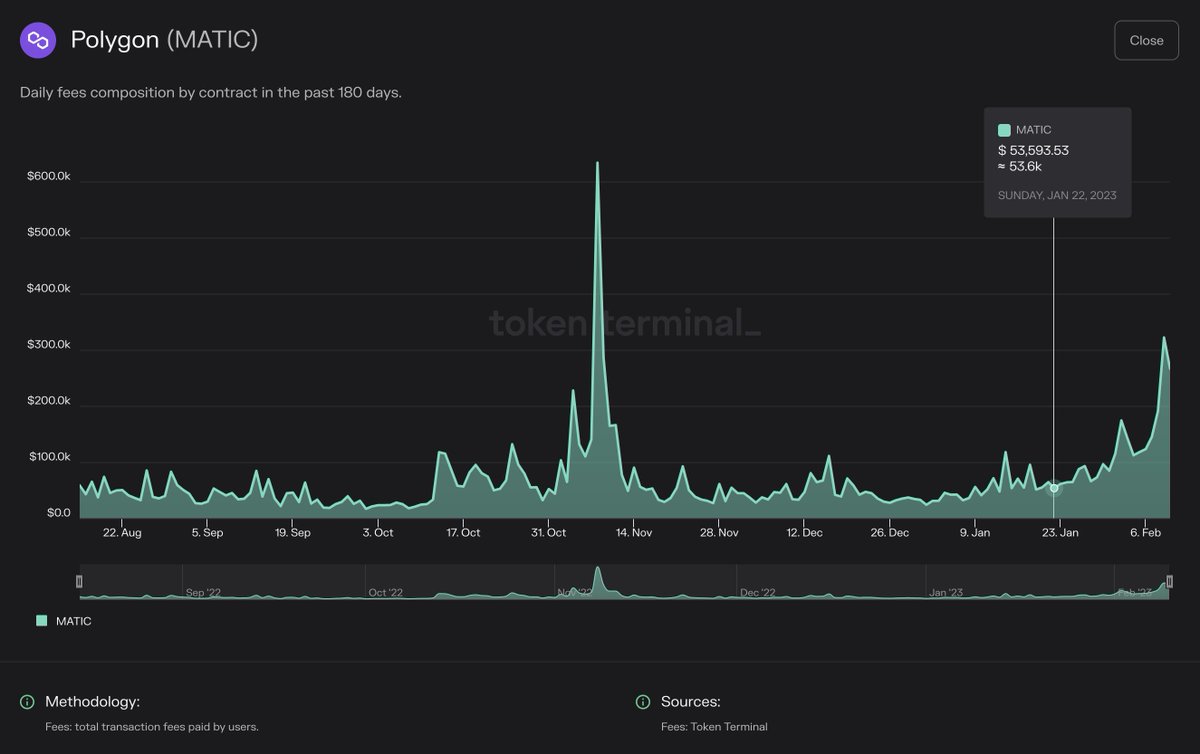

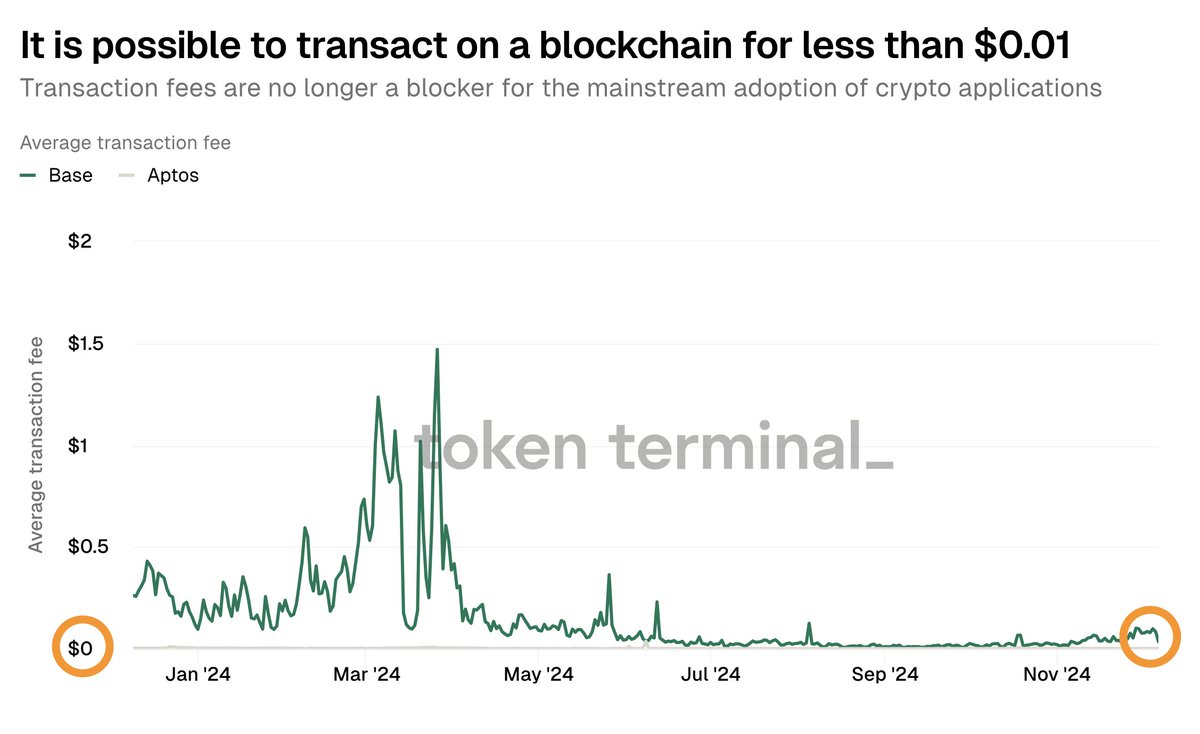

People can use crypto networks for ~free

▪️ It is possible to transact on a blockchain for less than $0.01

▪️ Transaction fees are no longer a blocker for the mainstream adoption of crypto applications

▪️ It is possible to transact on a blockchain for less than $0.01

▪️ Transaction fees are no longer a blocker for the mainstream adoption of crypto applications

• • •

Missing some Tweet in this thread? You can try to

force a refresh