There are a million copycats in DeFi.

So here are a the most unique yield protocols that are undervalued and will be around for a while

Bookmark this🧵👇

So here are a the most unique yield protocols that are undervalued and will be around for a while

Bookmark this🧵👇

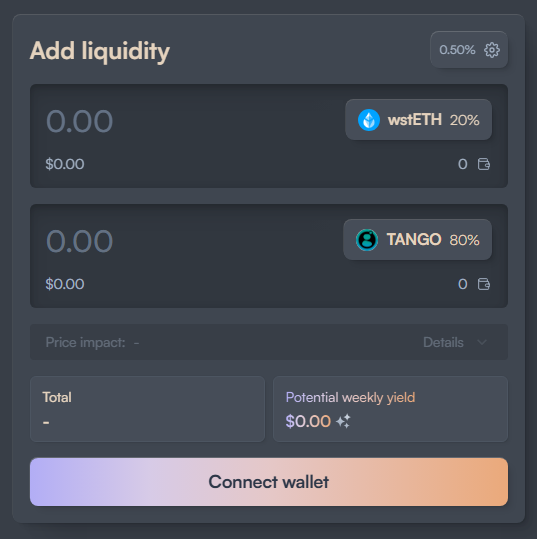

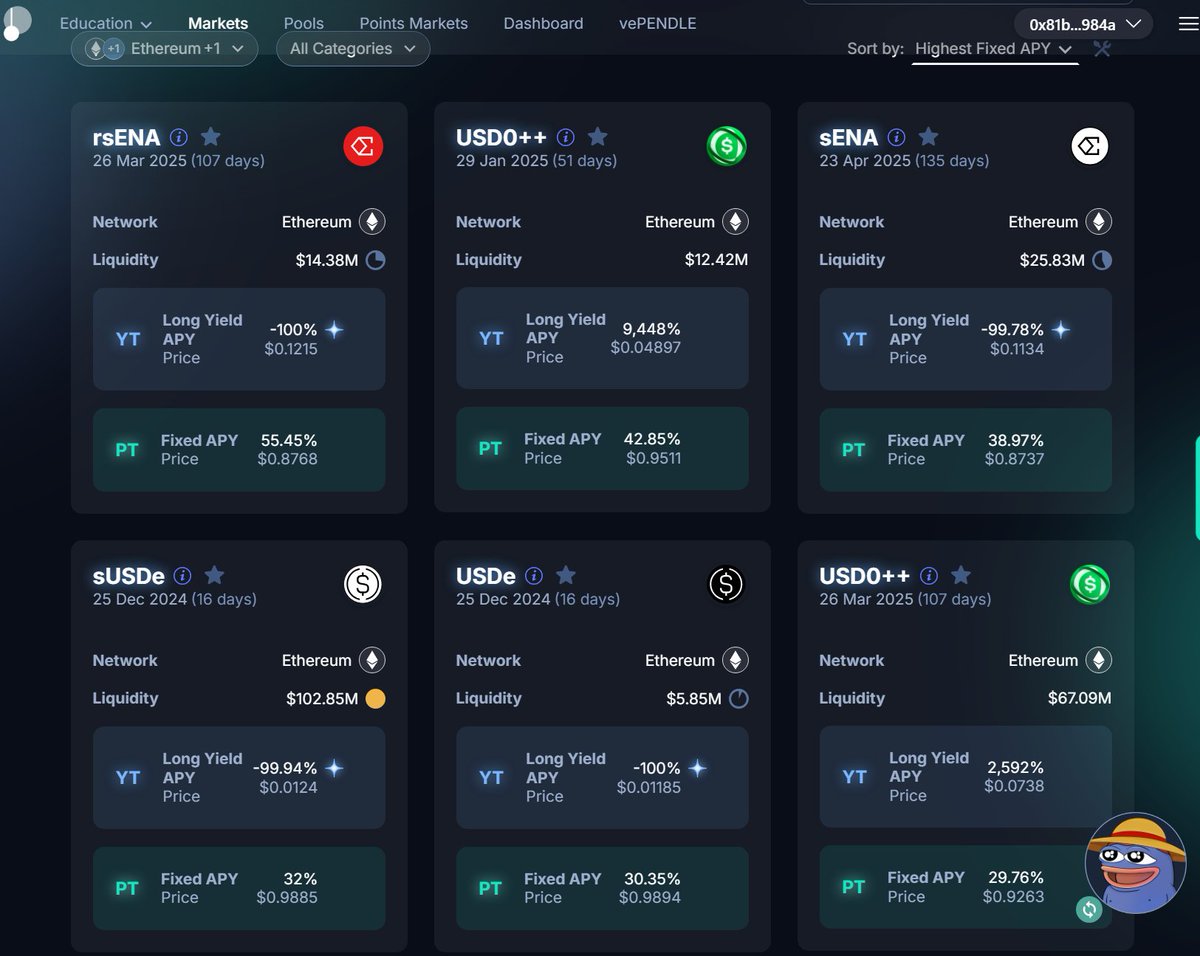

1) @pendle_fi

This one's pretty obvious.

Moat: Rate Swapping

Major Value Add(s):

► Fixed Rate / Fixed Date Yields w/ Size

► Yields on same-delta LPs

► Leveraged exposure to points / airdrops

► Hedging interest rates

Asset: $PENDLE

Link: pendle.finance

This one's pretty obvious.

Moat: Rate Swapping

Major Value Add(s):

► Fixed Rate / Fixed Date Yields w/ Size

► Yields on same-delta LPs

► Leveraged exposure to points / airdrops

► Hedging interest rates

Asset: $PENDLE

Link: pendle.finance

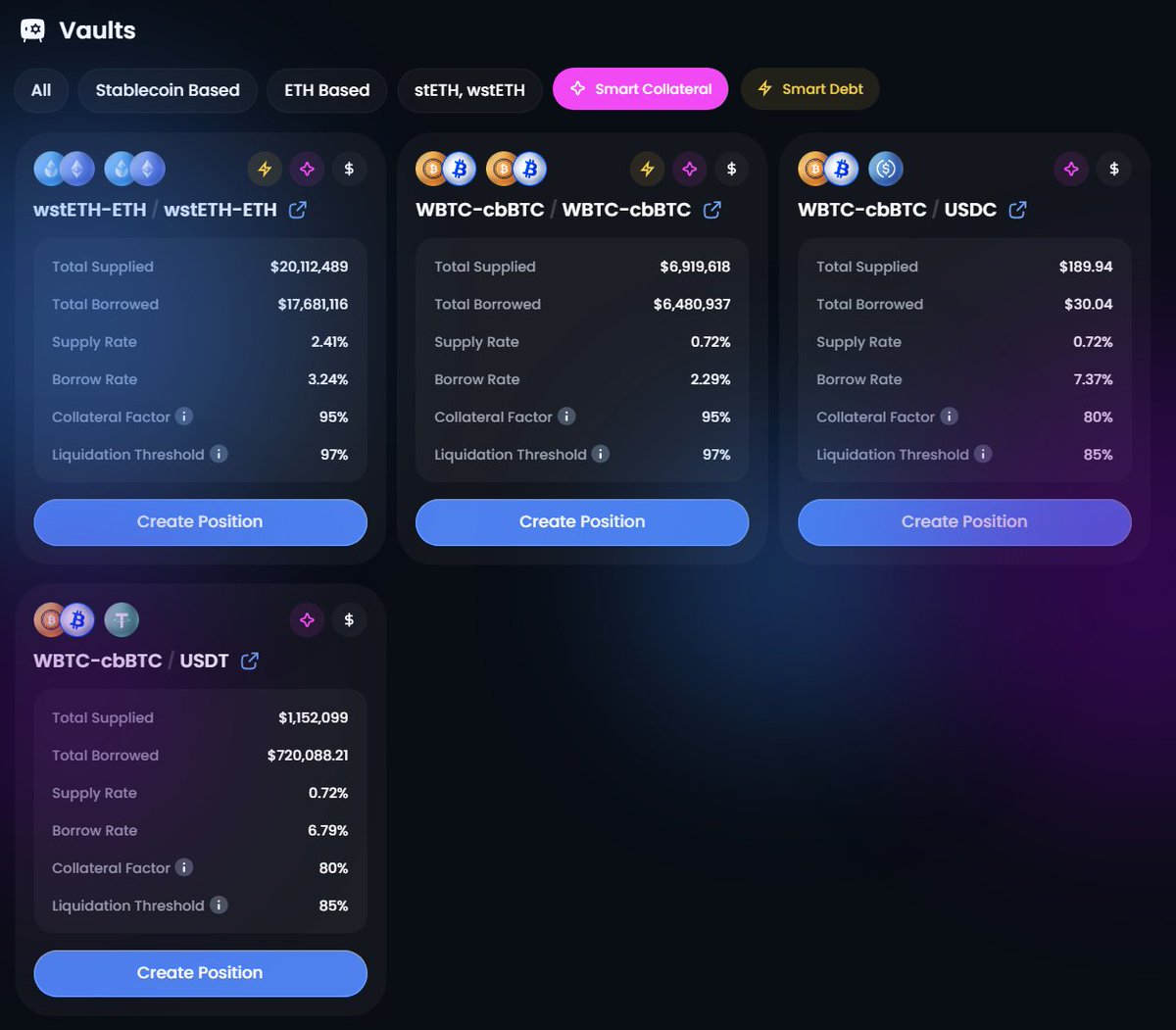

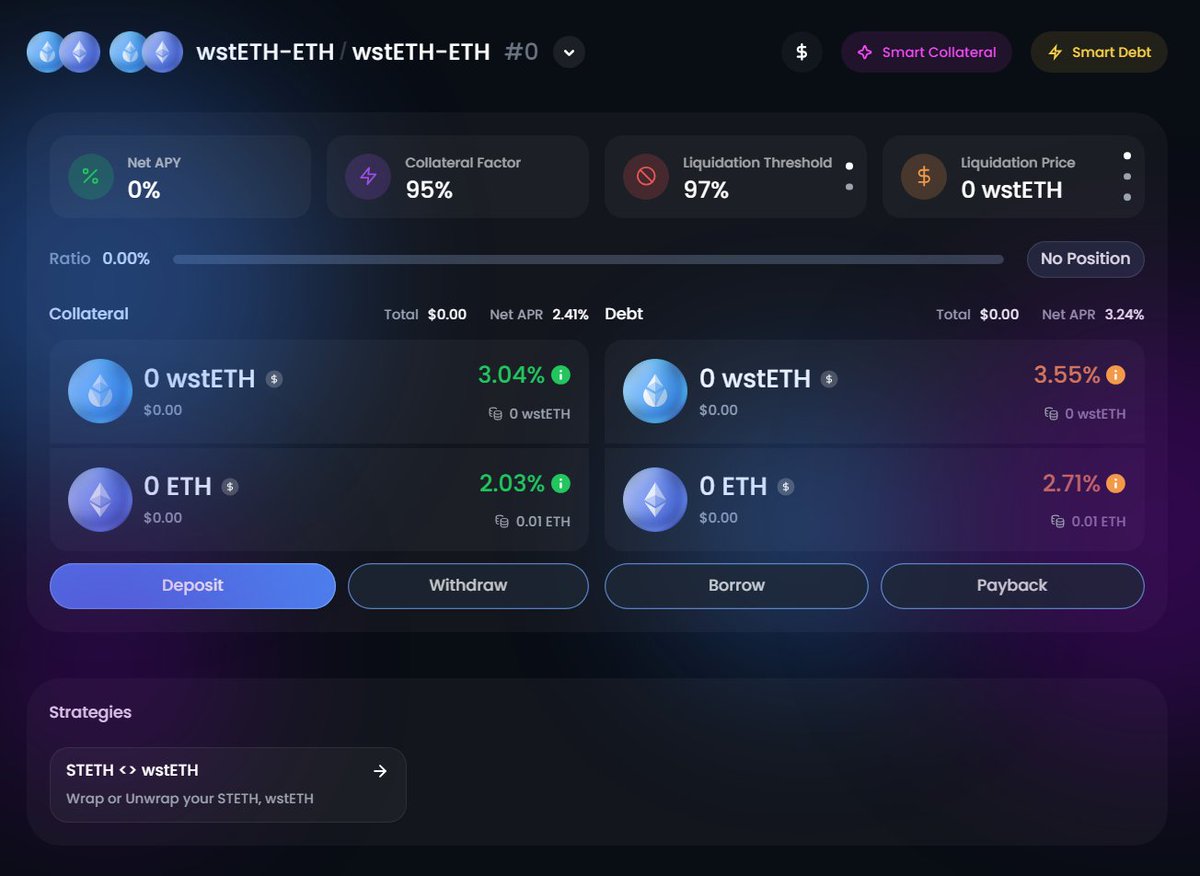

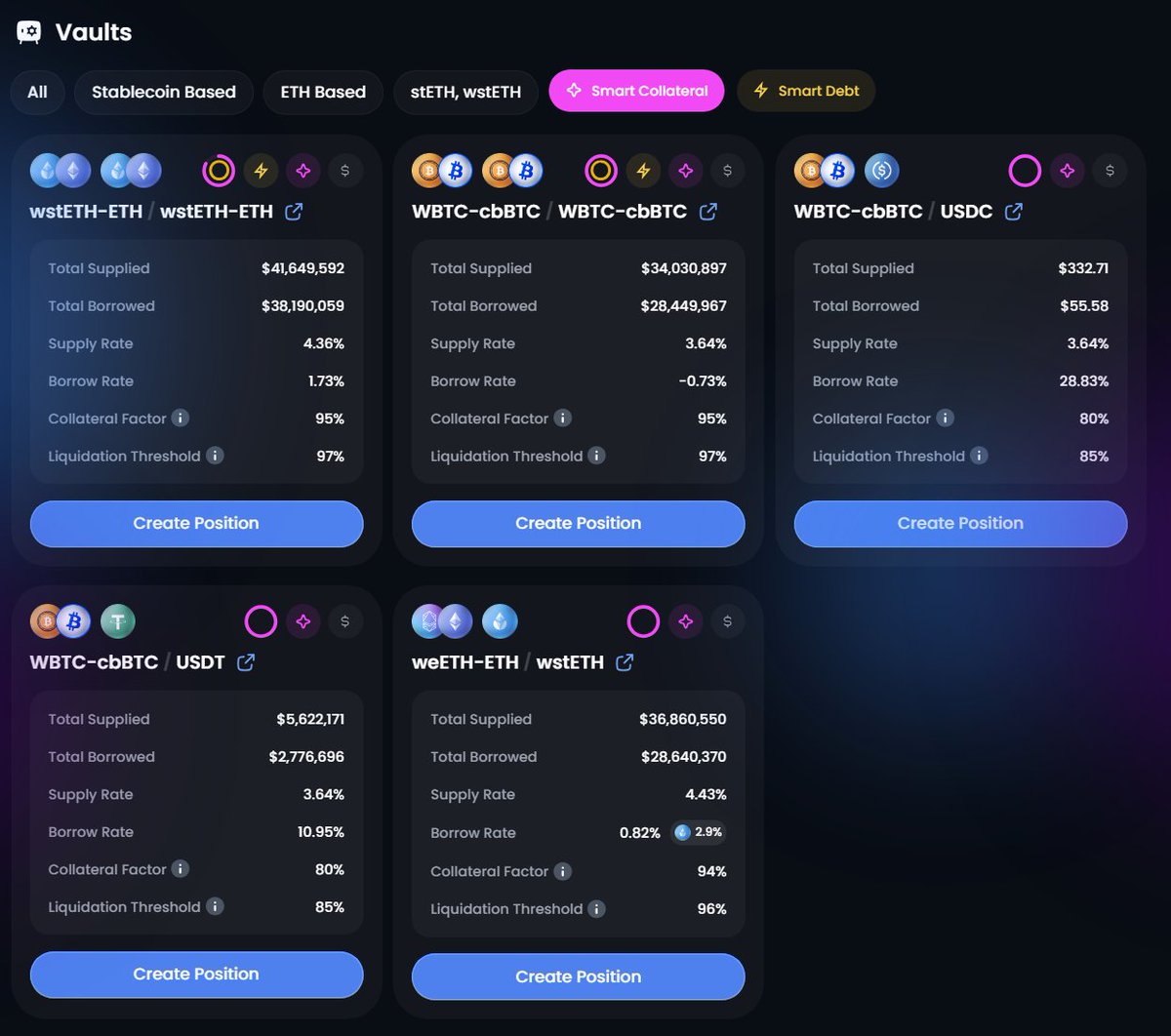

2) @0xfluid

Another pretty obvious one for those paying attention the last few weeks.

Moat: Using collateral & debt as efficient DEX liquidity.

Major Value Add(s):

► Get paid LP APR on collateral

► Get paid LP APR on debt

► Increase utilization / yield of lent liquidity

► Turn leveragers into LPs

Asset: $INST

Link: fluid.instadapp.io

Note: I wrote a thread on how this works

x.com/phtevenstrong/…

Another pretty obvious one for those paying attention the last few weeks.

Moat: Using collateral & debt as efficient DEX liquidity.

Major Value Add(s):

► Get paid LP APR on collateral

► Get paid LP APR on debt

► Increase utilization / yield of lent liquidity

► Turn leveragers into LPs

Asset: $INST

Link: fluid.instadapp.io

Note: I wrote a thread on how this works

x.com/phtevenstrong/…

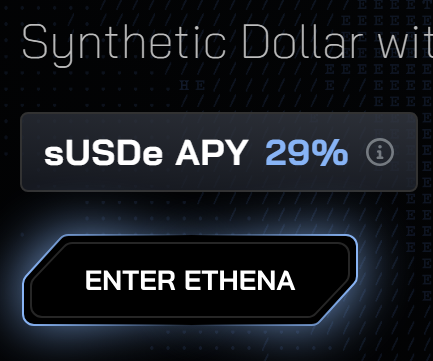

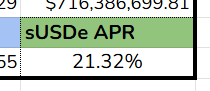

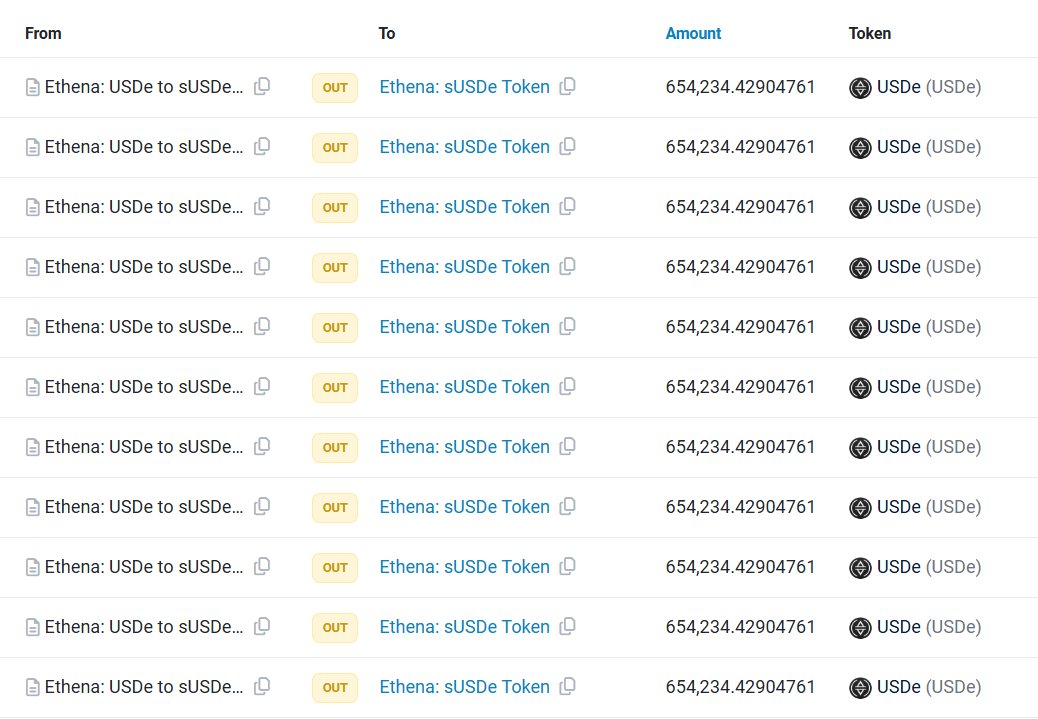

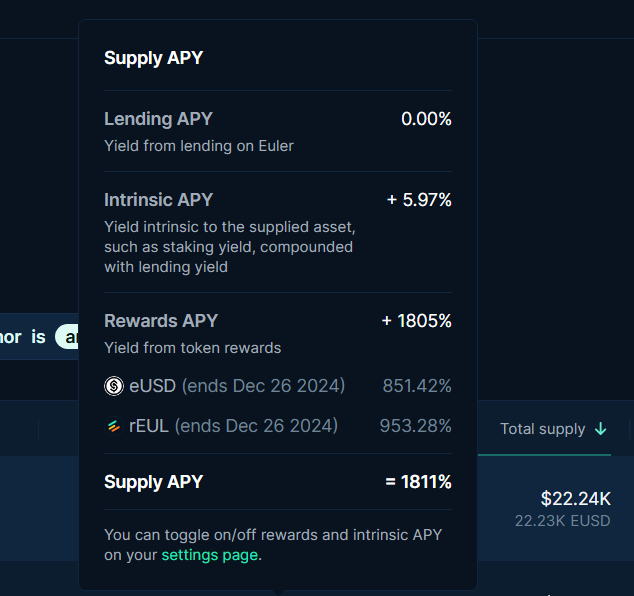

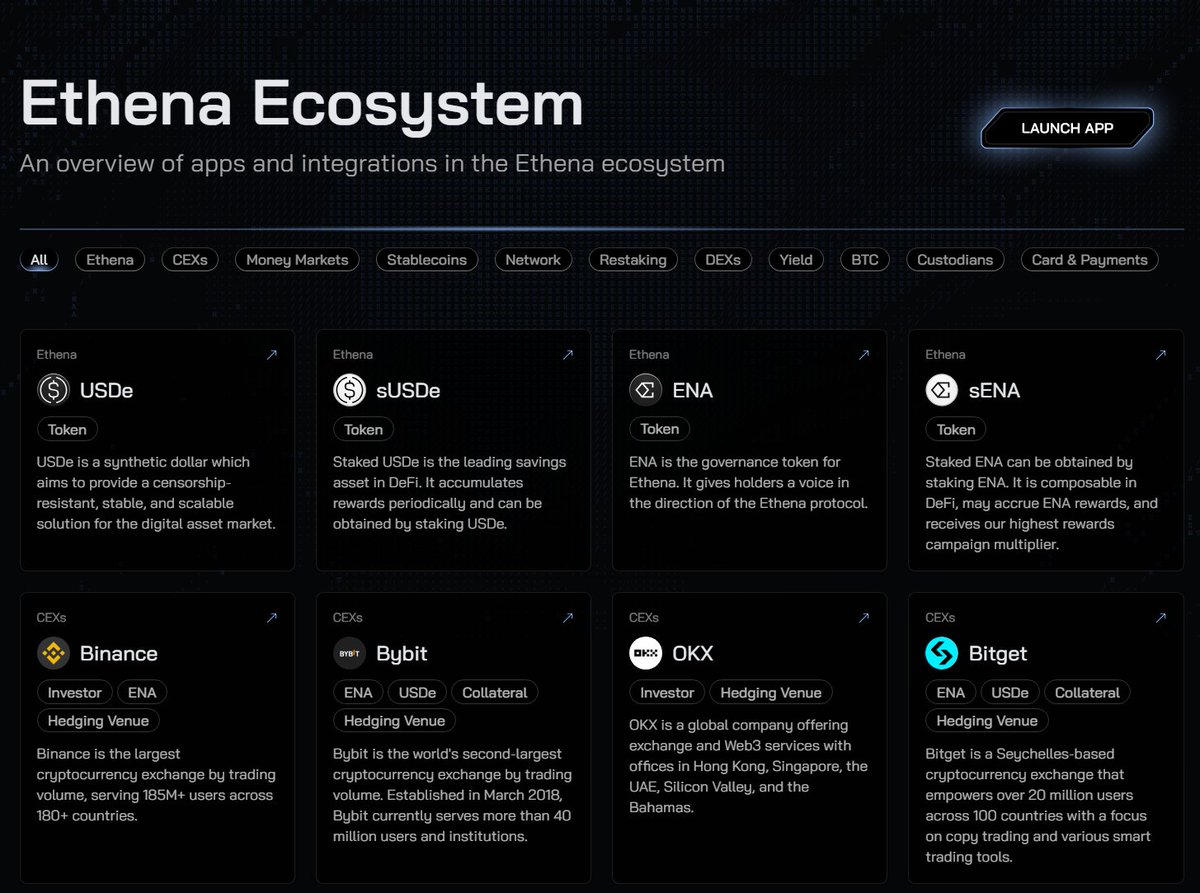

3) @ethena_labs

This one will be equal parts obvious and controversial.

Ethena has built the most yieldy stablecoin of this cycle, currently printing ~19.45% INSTRINSIC yield PLUS points.

Moat: Using a novel custodial solution to tap into a scalable basis trade mechanism backing a stablecoin asset.

Major Value Add(s):

► Insane stablecoin APR

► Yieldy stable collateral all across DeFi

► Yieldy margin on some perp exchanges

► Speculative exposure to funding rates via stablecoin

Asset: $ENA

Link: ethena.fi

This one will be equal parts obvious and controversial.

Ethena has built the most yieldy stablecoin of this cycle, currently printing ~19.45% INSTRINSIC yield PLUS points.

Moat: Using a novel custodial solution to tap into a scalable basis trade mechanism backing a stablecoin asset.

Major Value Add(s):

► Insane stablecoin APR

► Yieldy stable collateral all across DeFi

► Yieldy margin on some perp exchanges

► Speculative exposure to funding rates via stablecoin

Asset: $ENA

Link: ethena.fi

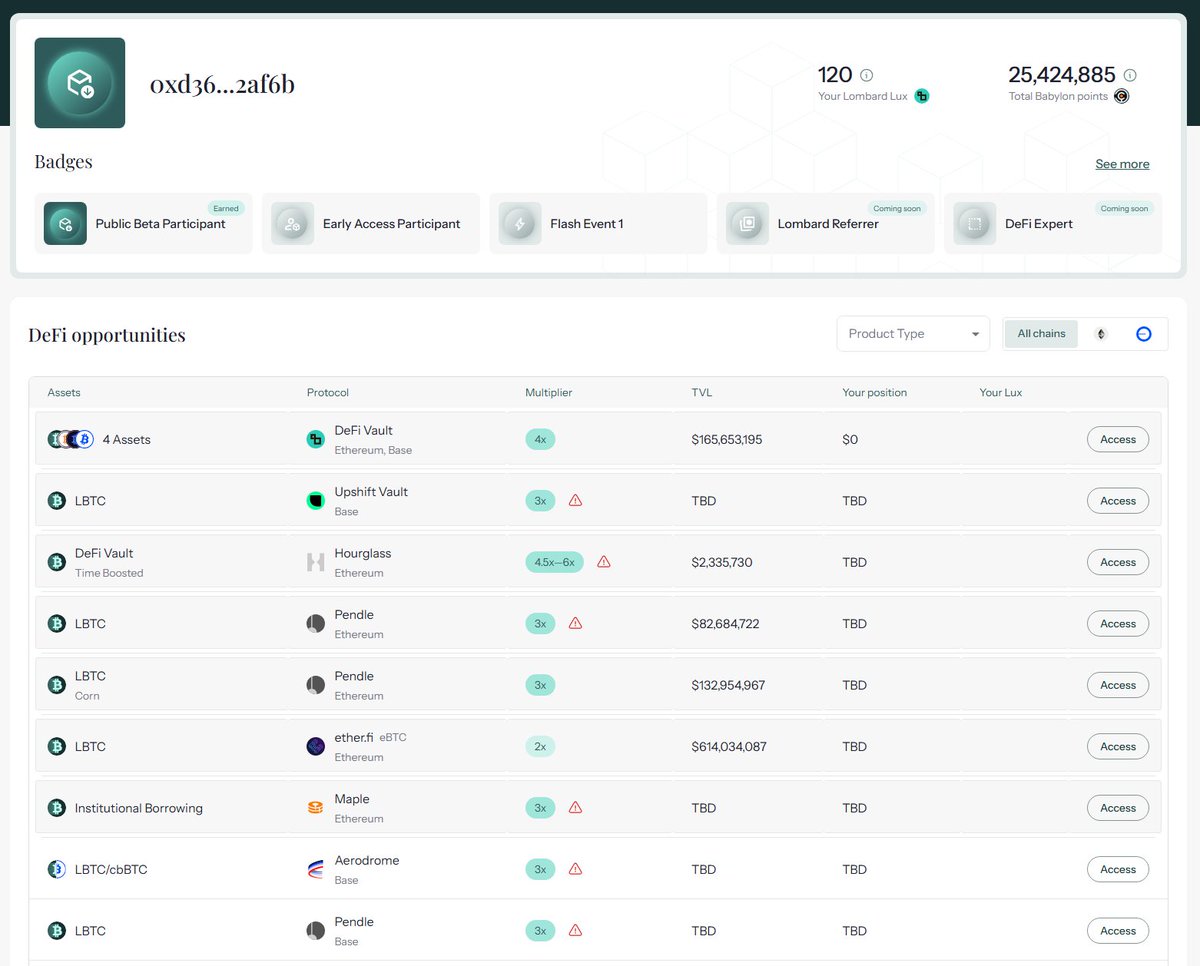

4) @Lombard_Finance / @babylonlabs_io

These two are like bread and butter, so I'm pairing them.

Moat: Using staked $BTC derivatives to provide economic security via restaking mechanisms.

Major Value Add(s):

► Fixed-rate yields on BTC via @pendle_fi

► Point / Airdrop generating BTC

► Eventual yieldy BTC via AVSs

► Increased composability for BTCfi

Asset: TBD (Airdrops coming soon?)

Link(s):

lombard.finance

babylonlabs.io

These two are like bread and butter, so I'm pairing them.

Moat: Using staked $BTC derivatives to provide economic security via restaking mechanisms.

Major Value Add(s):

► Fixed-rate yields on BTC via @pendle_fi

► Point / Airdrop generating BTC

► Eventual yieldy BTC via AVSs

► Increased composability for BTCfi

Asset: TBD (Airdrops coming soon?)

Link(s):

lombard.finance

babylonlabs.io

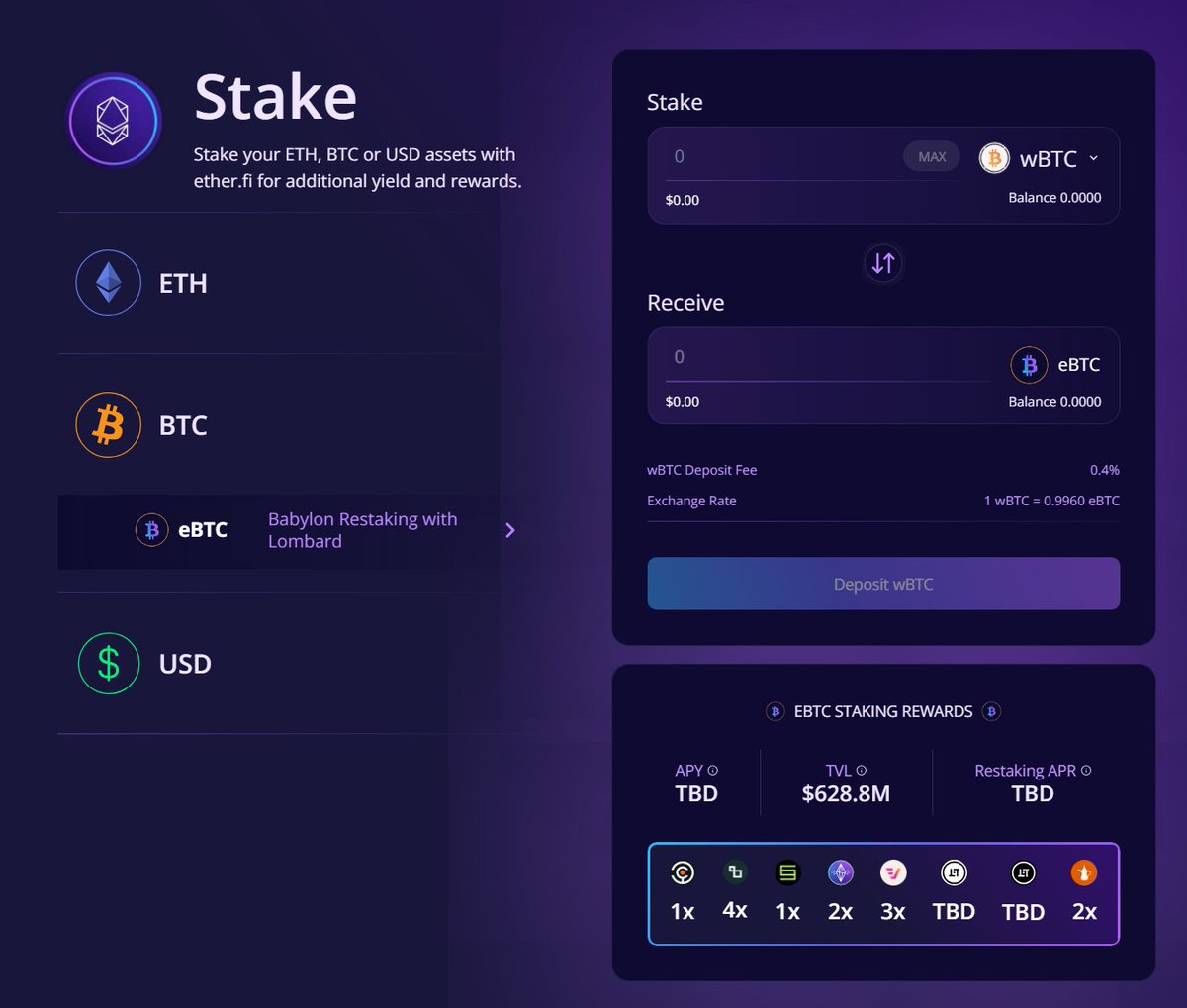

5) @ether_fi

But Stephen, that's just one of many restaking protocols, how does it have a moat???

Hear me out:

1) BTC Restaking Index

2) ETH Restaking Index

3) STABLECOIN Restaking Index

4) Yield via restaking index token

They're more than just an Eigen-wrapper.

Moat: Liquid wrapping index of all major restaking products.

Major Value Add(s):

► Perpetual yield "Seasons"

► Index exposure to restaking narrative

► Composability on majors like Aave, Pendle, etc

► Leverage exposure to restaking airdrops

Asset: $ETHFI

Link(s): ether.fi

Note: I have an ambassadorship with EtherFi

But Stephen, that's just one of many restaking protocols, how does it have a moat???

Hear me out:

1) BTC Restaking Index

2) ETH Restaking Index

3) STABLECOIN Restaking Index

4) Yield via restaking index token

They're more than just an Eigen-wrapper.

Moat: Liquid wrapping index of all major restaking products.

Major Value Add(s):

► Perpetual yield "Seasons"

► Index exposure to restaking narrative

► Composability on majors like Aave, Pendle, etc

► Leverage exposure to restaking airdrops

Asset: $ETHFI

Link(s): ether.fi

Note: I have an ambassadorship with EtherFi

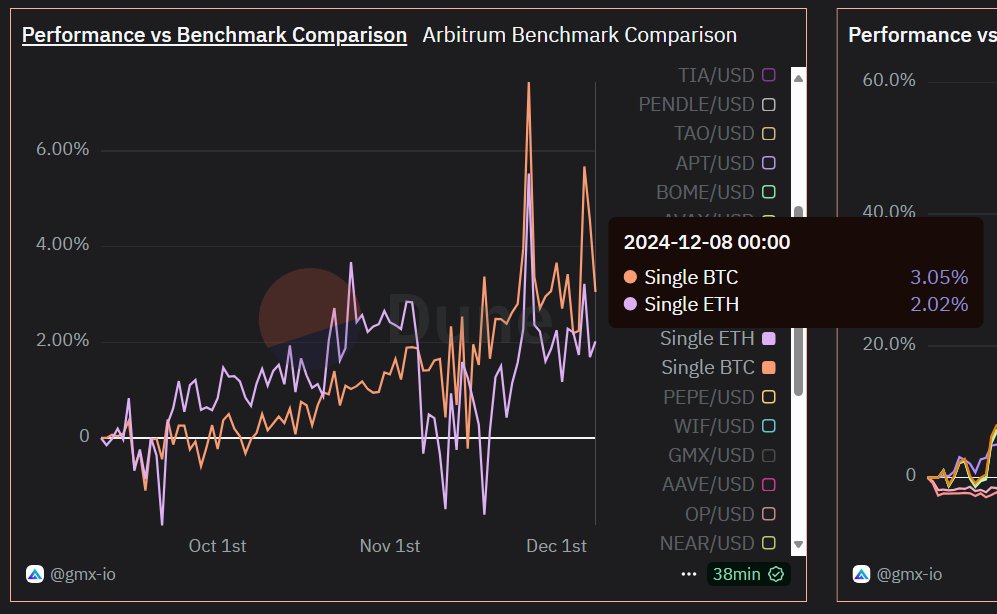

6) @GMX_IO

Again, hear me out. GMX has been copied ad nauseum. So much so that I had to coin the term "CPV" (counter party vault) to describe all the forked GLP products proliferating in DeFi.

GMX was a MASSIVE innovation last cycle, but they've introduced something this cycle that I believe gives them a new moat.

Moat: Single-Delta CPVs w/ Relatively Low PnL Vol

Major Value Add(s):

► Double-Digit Yield on ETH CPV

► Double-Digit Yield on BTC CPV

► Composability on CPVs on @Dolomite_io

► Micro IL 0.5x Delta Exposure CPVs for Majors

Asset: $GMX

Link(s): app.gmx.io

Again, hear me out. GMX has been copied ad nauseum. So much so that I had to coin the term "CPV" (counter party vault) to describe all the forked GLP products proliferating in DeFi.

GMX was a MASSIVE innovation last cycle, but they've introduced something this cycle that I believe gives them a new moat.

Moat: Single-Delta CPVs w/ Relatively Low PnL Vol

Major Value Add(s):

► Double-Digit Yield on ETH CPV

► Double-Digit Yield on BTC CPV

► Composability on CPVs on @Dolomite_io

► Micro IL 0.5x Delta Exposure CPVs for Majors

Asset: $GMX

Link(s): app.gmx.io

NOTABLE INNOVATIVE MENTIONS:

@eigenlayer (obviously)

► Making staked assets more yieldy and someday bringing AVS yield to bluechips

@HyperliquidX

► Hyper efficient Perp Dex Appchain with one of the best CPVs (HLP) currently printing nearly 40% APR AND being one of the best places for FR Arbitrage (also thanks for the massive airdrop)

@pumpdotfun

► Totally degenerate, but I can't deny this has been a huge innovation this cycle. Not super yield-focused, but the ability for anyone to launch a token easily that isn't a honeypot and that allows people to speculate on social memetics is interesting.

@virtuals_io

► Spinning up AI Agents like memes is somewhat interesting. I'm not fully sold on the agentic narrative yet, but I think it will likely be around for a while and could potentially innovate CT engagement.

@_kaitoai

► Not a protocol, but they deserve a shoutout. INCREDIBLE tool for tracking mindshare, influence, smartmoney, discords, updates, and narratives. This has absolutely innovated how narratives are analyzed.

@AnzenFinance

► Stablecoin backed by credit notes. This should have staying power even in a bear market and even when TBILL yields are lackluster. I think this could be a protocol we see survive the bear and become a mainstay in the RWA space long-term. They do have some hurdles to clear first (like liquidity).

@Contango_xyz

► They turned a money market aggregator into a one-stop shop for yield AND also gave it a perp-dex interface for easy leveraging sans-funding-rates. On top of that, they're active in getting and emitting grants to users from chains. Once they dial in the fees to the perfect supply/demand numbers, I think they'll take and maintain hegemony in their space.

@DefiLlama

► The OG defi data aggregation layer. It's still the best place to get verified links, to track asset yields, to look for places to borrow or lend, to find quick info on protocols, check flows, look at fundamentals, etc. @0xngmi is a giant in this space and I couldn't make this thread without giving them a shoutout.

Wen llamaswap but for bridging?

@eigenlayer (obviously)

► Making staked assets more yieldy and someday bringing AVS yield to bluechips

@HyperliquidX

► Hyper efficient Perp Dex Appchain with one of the best CPVs (HLP) currently printing nearly 40% APR AND being one of the best places for FR Arbitrage (also thanks for the massive airdrop)

@pumpdotfun

► Totally degenerate, but I can't deny this has been a huge innovation this cycle. Not super yield-focused, but the ability for anyone to launch a token easily that isn't a honeypot and that allows people to speculate on social memetics is interesting.

@virtuals_io

► Spinning up AI Agents like memes is somewhat interesting. I'm not fully sold on the agentic narrative yet, but I think it will likely be around for a while and could potentially innovate CT engagement.

@_kaitoai

► Not a protocol, but they deserve a shoutout. INCREDIBLE tool for tracking mindshare, influence, smartmoney, discords, updates, and narratives. This has absolutely innovated how narratives are analyzed.

@AnzenFinance

► Stablecoin backed by credit notes. This should have staying power even in a bear market and even when TBILL yields are lackluster. I think this could be a protocol we see survive the bear and become a mainstay in the RWA space long-term. They do have some hurdles to clear first (like liquidity).

@Contango_xyz

► They turned a money market aggregator into a one-stop shop for yield AND also gave it a perp-dex interface for easy leveraging sans-funding-rates. On top of that, they're active in getting and emitting grants to users from chains. Once they dial in the fees to the perfect supply/demand numbers, I think they'll take and maintain hegemony in their space.

@DefiLlama

► The OG defi data aggregation layer. It's still the best place to get verified links, to track asset yields, to look for places to borrow or lend, to find quick info on protocols, check flows, look at fundamentals, etc. @0xngmi is a giant in this space and I couldn't make this thread without giving them a shoutout.

Wen llamaswap but for bridging?

I'm sure I'm missing many greats.

Please shill them to me in the comments.

I'm considering accumulating a bag of alts before the next rotation and I'm always looking for assets with moats.

And if you want to stay on the cutting edge of yields, market sentiment, and even memecoin analysis, come join the DeFi Dojo Discord.

It's the best decentralized thinktank in crypto.

whop.com/defi-dojo/

Please shill them to me in the comments.

I'm considering accumulating a bag of alts before the next rotation and I'm always looking for assets with moats.

And if you want to stay on the cutting edge of yields, market sentiment, and even memecoin analysis, come join the DeFi Dojo Discord.

It's the best decentralized thinktank in crypto.

whop.com/defi-dojo/

• • •

Missing some Tweet in this thread? You can try to

force a refresh