1/9 Survivorship bias is a trap that skews how we perceive success, especially in investing. By focusing only on winners and ignoring failures, we risk drawing incomplete conclusions. Here’s why it matters. 🧵

2/9 In investing, we often celebrate successful companies or strategies, assuming they represent the whole story. But what about the countless failed businesses, funds, or ideas that didn’t survive? Ignoring them distorts reality.

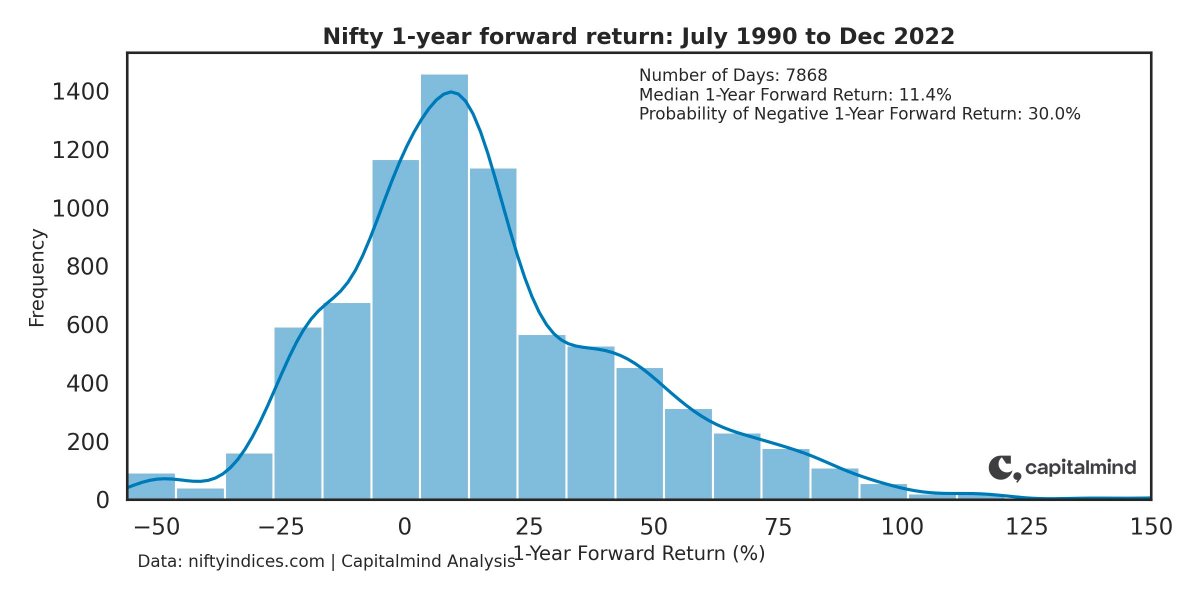

3/9 Survivorship bias affects how we view stock market indices. Failed or underperforming companies are removed from indices, so the historical data appears more favorable than what an average investor might experience.

4/9 Mutual funds show this bias too. Poorly performing funds are often shut down or merged, leaving only high-performing ones in performance data. This creates an illusion that mutual funds perform better than they actually do.

5/9 The same applies to specific stock winners. Everyone talks about companies like Apple or Amazon, but for every success, there are countless failed ventures left out of the conversation.

Ignoring failures leads to overconfidence and flawed decision-making.

Ignoring failures leads to overconfidence and flawed decision-making.

6/9 Survivorship bias teaches us an essential lesson: context matters. To avoid its pitfalls, consider the full picture, including failures, risks, and factors that contributed to success or failure.

7/9 Diversification is one way to mitigate this bias. By spreading investments across assets, industries, and geographies, you reduce the risk of focusing too heavily on perceived "winners" while ignoring broader risks.

8/9 Another solution is rigorous data analysis. Examine complete datasets—not just success stories—to understand the market's true nature. This approach reveals both opportunities and risks.

9/9 The core lesson of survivorship bias: past success doesn’t guarantee future performance. Be critical of historical data and focus on sound, balanced strategies. Read the full article here: capitalmind.in/insights/suviv…

• • •

Missing some Tweet in this thread? You can try to

force a refresh