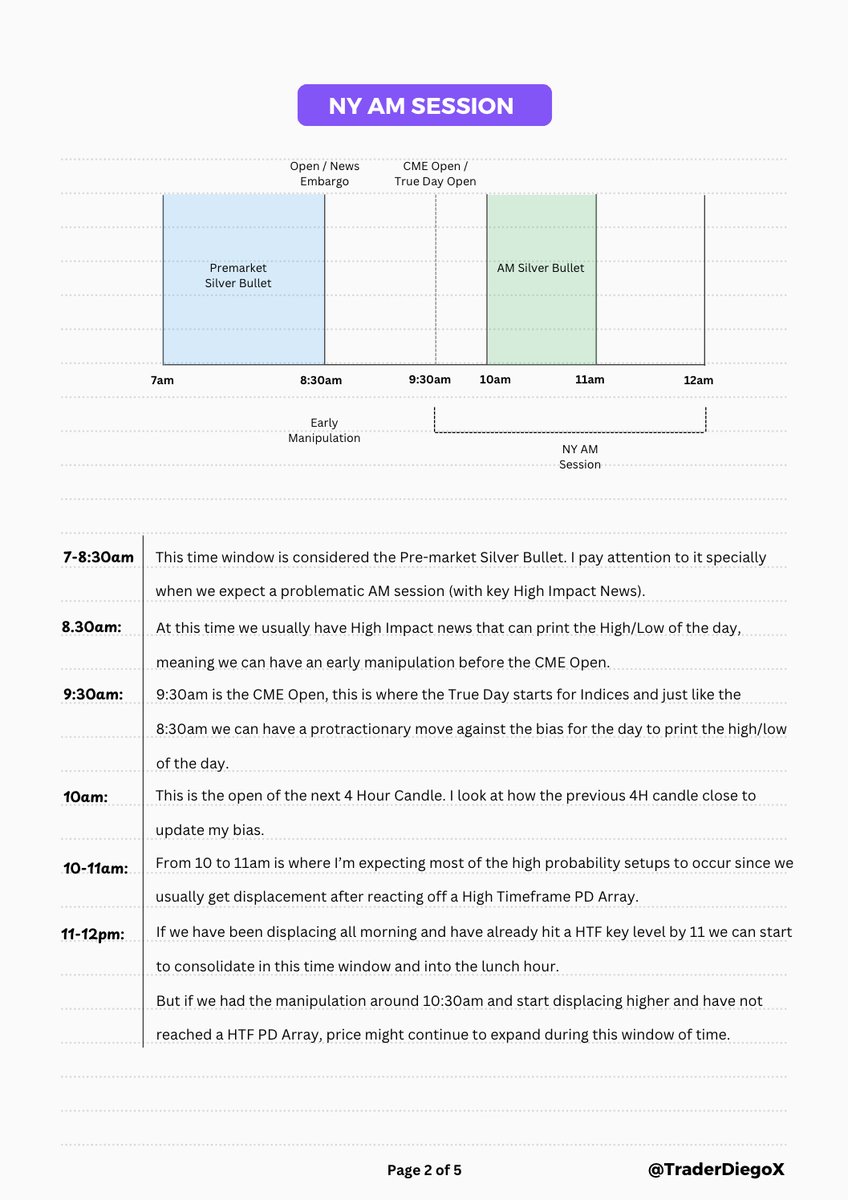

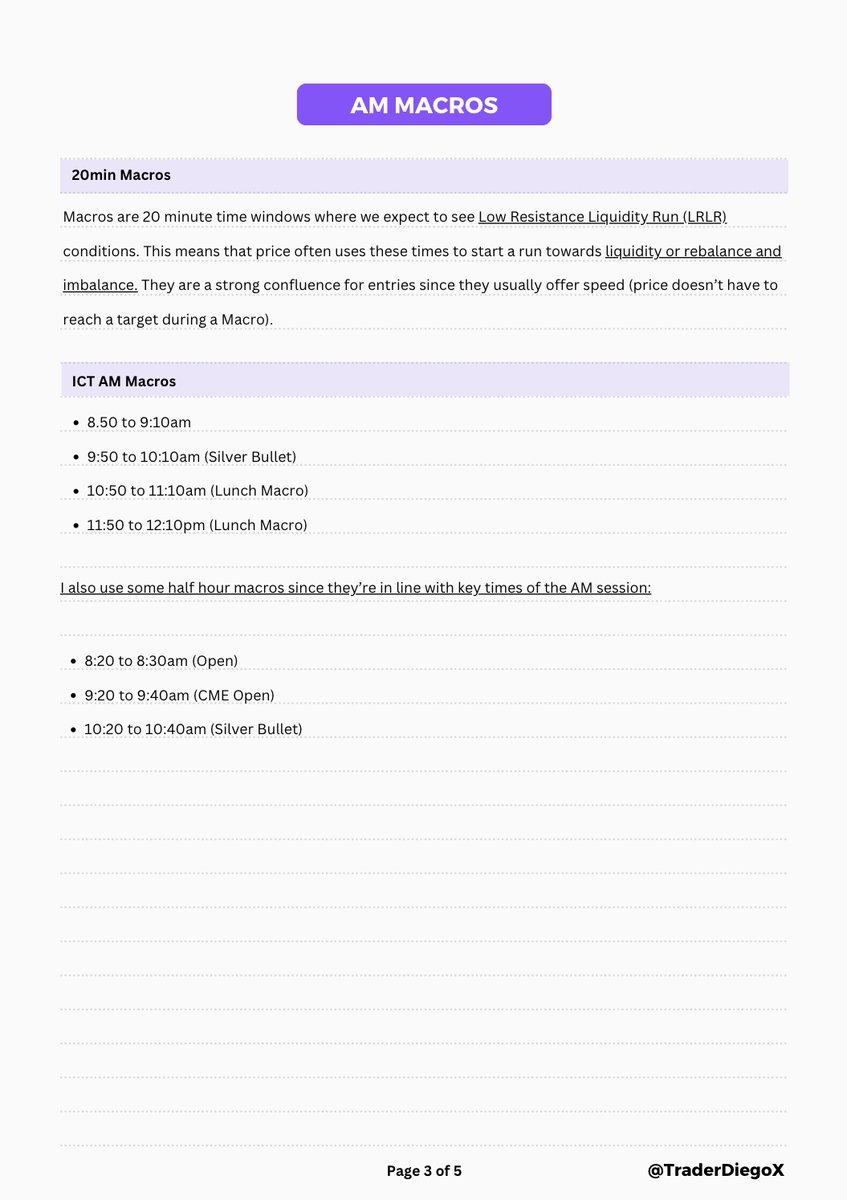

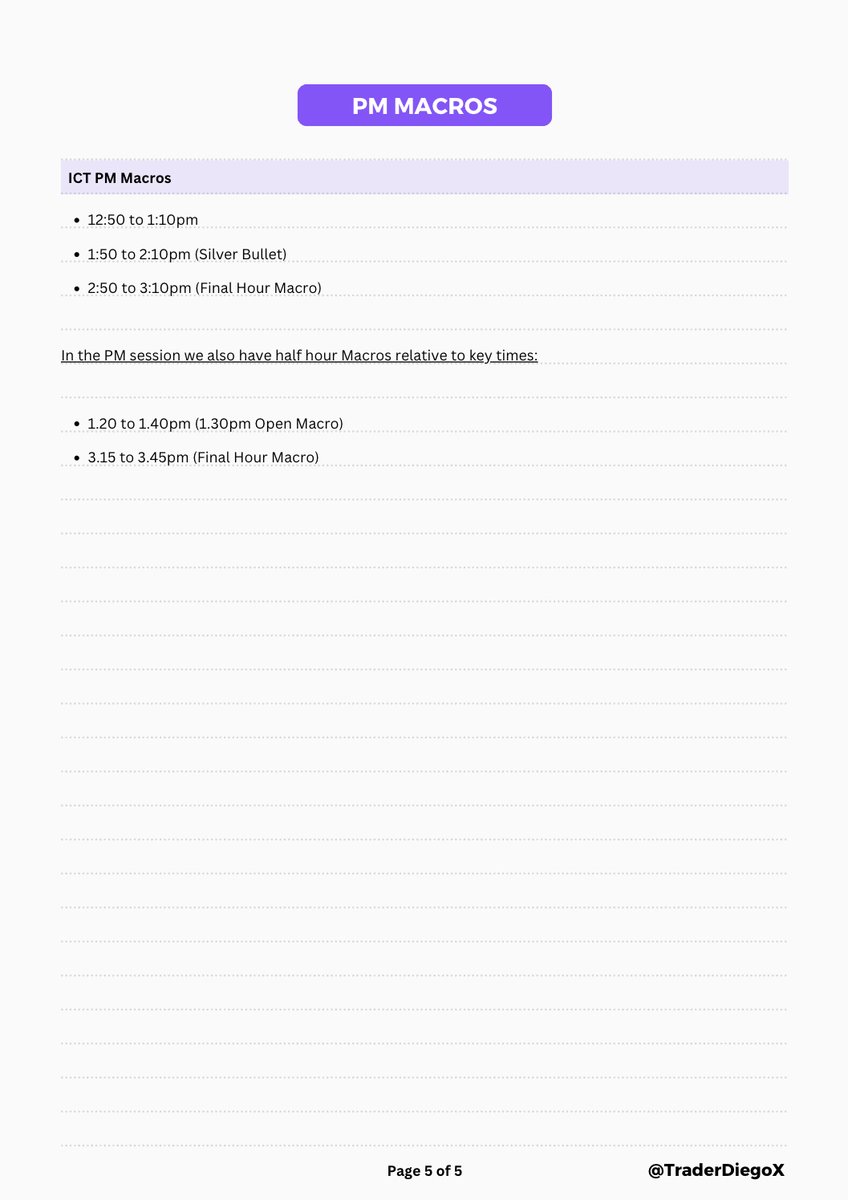

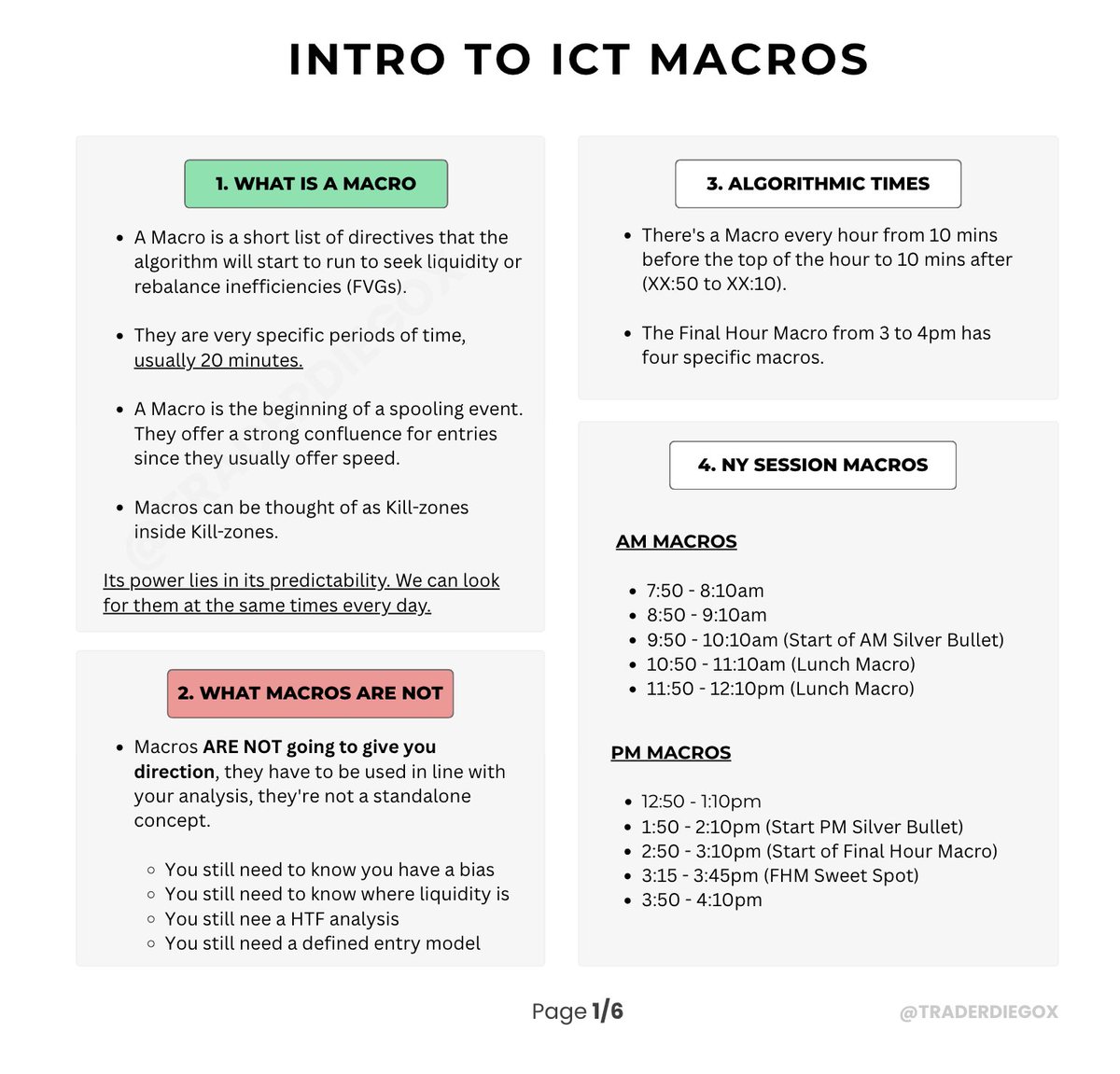

ICT INTRADAY TIMELINE

- In this quick guide I discuss the key time elements of the Pre-market, AM and PM session for Indices.

🔖Bookmark it for your own study.

- In this quick guide I discuss the key time elements of the Pre-market, AM and PM session for Indices.

🔖Bookmark it for your own study.

Get funded with the best entry level plan in the industry with No Activation Fees.

Link➡️

Use code: TRADERDIEGO mffu.traderdiego.com

Link➡️

Use code: TRADERDIEGO mffu.traderdiego.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh