Analysis of the Russian corporate debt market. Defaults are near!

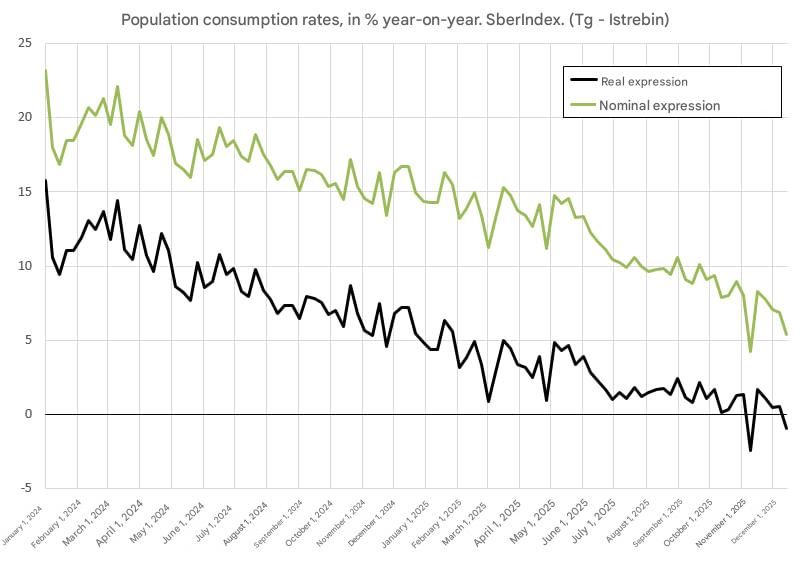

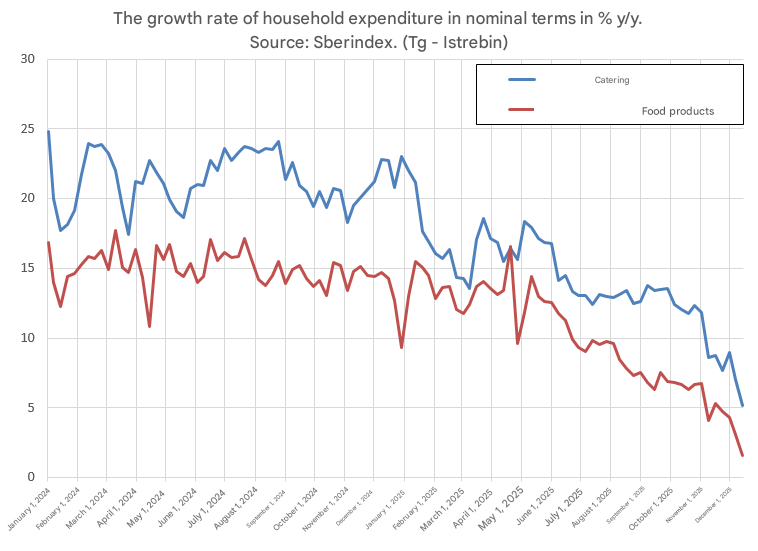

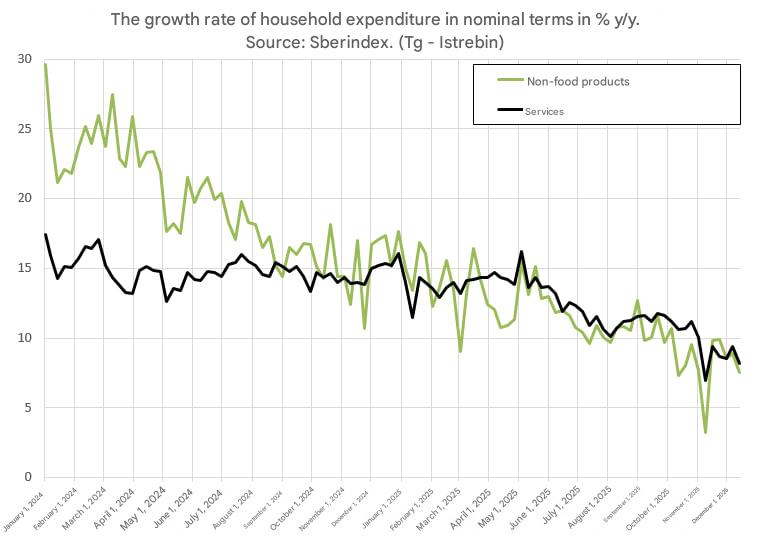

The latest inflation data in Russia shows poor dynamics, which means that the Central Bank will raise the key rate again. This will affect many companies. Well, let's figure out what is happening in Russia.

1/

The latest inflation data in Russia shows poor dynamics, which means that the Central Bank will raise the key rate again. This will affect many companies. Well, let's figure out what is happening in Russia.

1/

In the chart above, we see the dynamics of credit spreads by industry sectors. Let's figure out what happened and why there is such a huge spread.

The corporate debt market in Ru has been actively growing for many years. So this year, 264 issuers placed bonds for 14 trill rub

2/

The corporate debt market in Ru has been actively growing for many years. So this year, 264 issuers placed bonds for 14 trill rub

2/

After the sanctions were imposed, issuers were forced to switch to the domestic loan market. Which led to multiple growth. In 2023, bonds worth 5.9 trillion rubles were placed there.

In 2024, already for 6.3 trillion rubles

3/

In 2024, already for 6.3 trillion rubles

3/

And everything was fine with them until they started placing bonds with floating rates

2022 - 10%

2023 -25%

2024 - 35%

Nobody expected that the tightening cycle of monetary policy would go so far.

4/

2022 - 10%

2023 -25%

2024 - 35%

Nobody expected that the tightening cycle of monetary policy would go so far.

4/

But in the current high-rate environment, the most correct indicator is the interest coverage ratio ICR. This is the ratio of EBITDA to interest expenses. That is, ICR shows how much operating income covers interest payments. The higher this indicator, the better.

6/

6/

The worst situation is in real estate, telecom and the consumer sector

7/

7/

Since banks hold more than half of the bonds, let's see what the safety margin of Russian banks is?

Oh, the capital adequacy ratio is at a 10-year low. A bad sign for banks.

8/

Oh, the capital adequacy ratio is at a 10-year low. A bad sign for banks.

8/

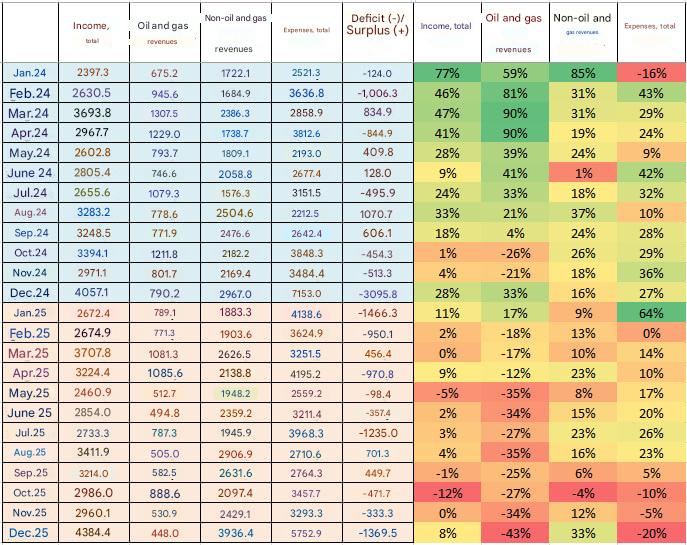

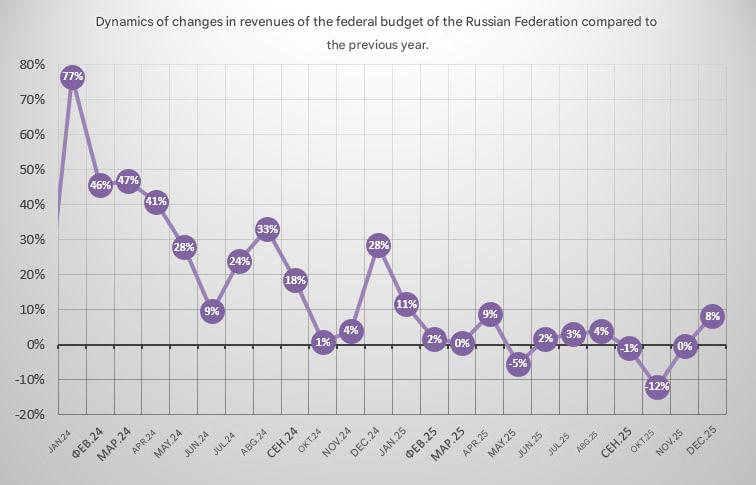

Now let's take another look at the first chart, who has the highest credit spreads

Real estate - 1520 bp

Finance - 918 bp

Healthcare and consumer sector - 740 bp

IT - 718 bp

Industry - 570 bp

9/

Real estate - 1520 bp

Finance - 918 bp

Healthcare and consumer sector - 740 bp

IT - 718 bp

Industry - 570 bp

9/

Looking at these huge credit spreads, it is already obvious that the market has assessed the risks. But what will happen if the key rate is 23%...25%...27%?

Also, no one wants to think about how long this will last, and what the safety margin of the companies is,

10/

Also, no one wants to think about how long this will last, and what the safety margin of the companies is,

10/

until they enter into losses and eat up their own capital

And what is most important, no one wants to think about who will take the hit from the deolts? Banks? I doubt it. The state will save only 3 state banks. There is not enough money for the rest.

11/

And what is most important, no one wants to think about who will take the hit from the deolts? Banks? I doubt it. The state will save only 3 state banks. There is not enough money for the rest.

11/

There will be a cascade effect, with hyperinflation. I hope it happens very soon. Buy some popcorn, we will wait!

12/12

12/12

• • •

Missing some Tweet in this thread? You can try to

force a refresh