How to get URL link on X (Twitter) App

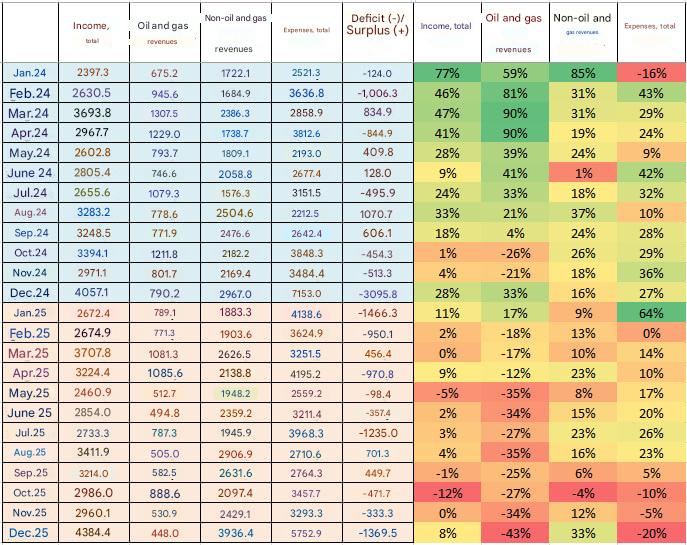

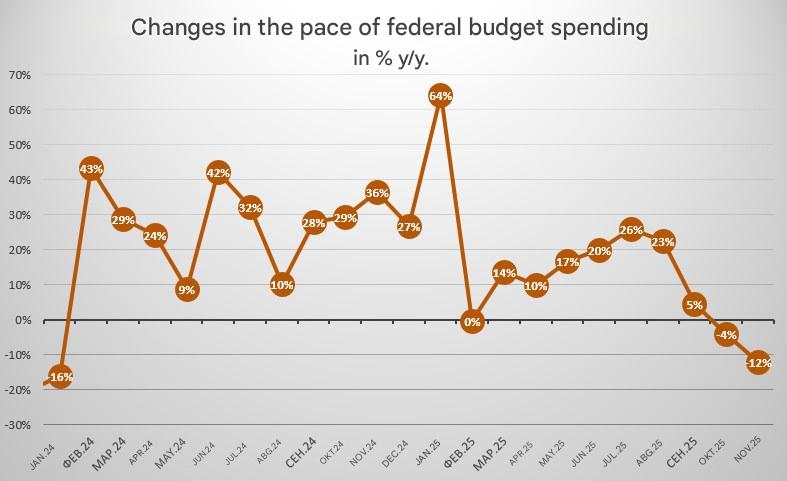

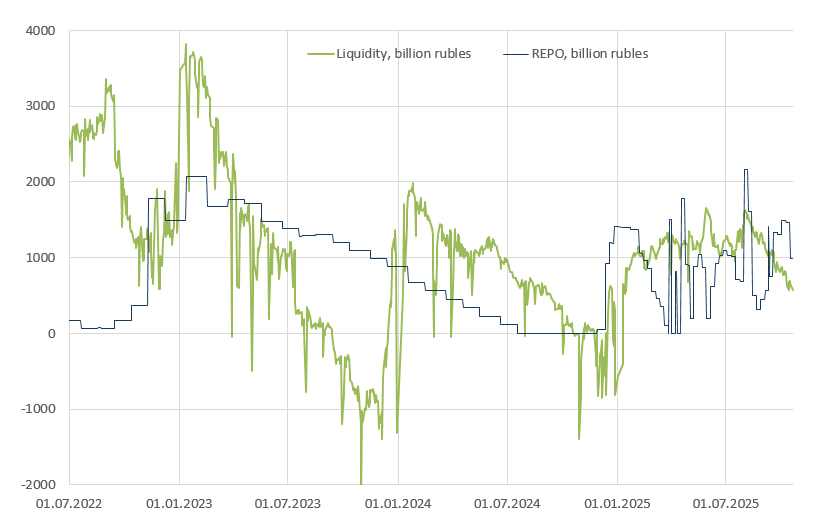

The most astonishing thing is that budget expenditures fell by 20% in December!!!!

The most astonishing thing is that budget expenditures fell by 20% in December!!!!

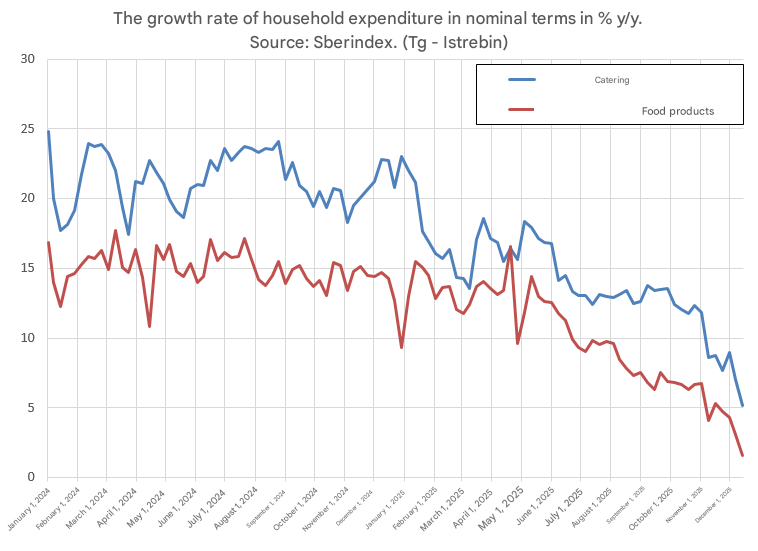

3. Utility rates increased by 21% over the year, with heating and hot water rates increasing by 24% year-on-year.

3. Utility rates increased by 21% over the year, with heating and hot water rates increasing by 24% year-on-year.

2/3

2/3

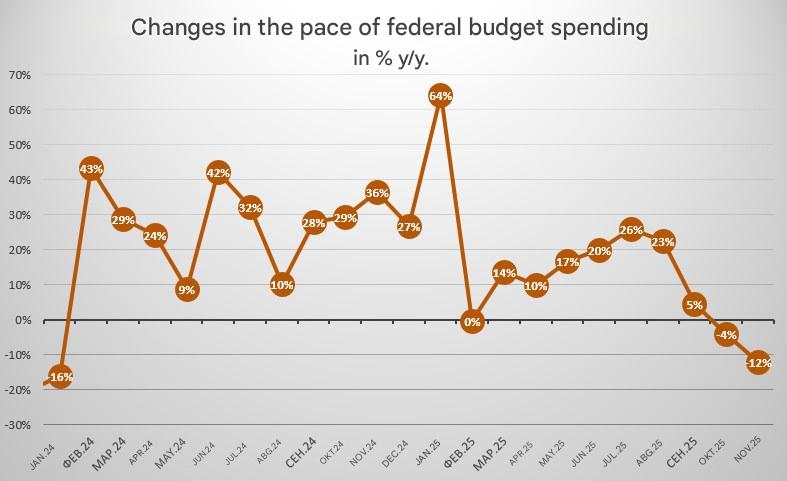

Revenues for November did not increase.

Revenues for November did not increase.

Revenue in October: RUB 2,986 billion (-12%)

Revenue in October: RUB 2,986 billion (-12%)

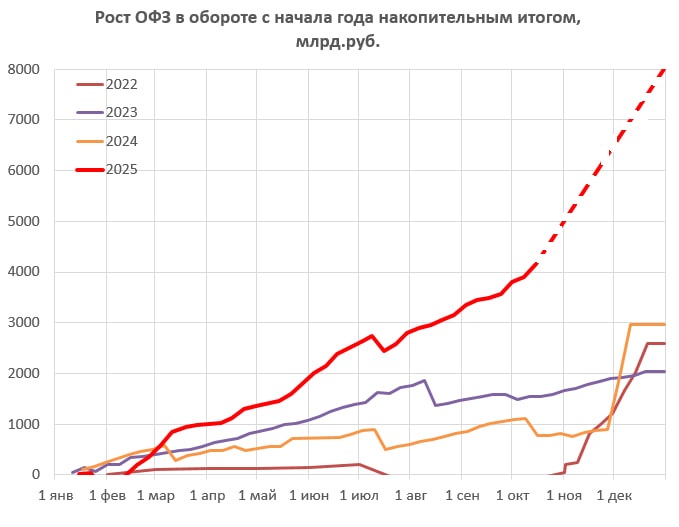

issues bonds and sells them on the market, with the proceeds going to the budget to cover the deficit.

issues bonds and sells them on the market, with the proceeds going to the budget to cover the deficit.

Oil and gas revenues fell by 25% in September.

Oil and gas revenues fell by 25% in September.

Perhaps from state reserves. After the elections, sales from the reserves were closed. Gasoline sales on the exchange have been 25% below the August average for the third day running, which is about 7,000 tons per day lost. Prices aren't rising because they're being held down

Perhaps from state reserves. After the elections, sales from the reserves were closed. Gasoline sales on the exchange have been 25% below the August average for the third day running, which is about 7,000 tons per day lost. Prices aren't rising because they're being held down

The captions are the names of the ships standing for loading at the time of the attack.

The captions are the names of the ships standing for loading at the time of the attack.

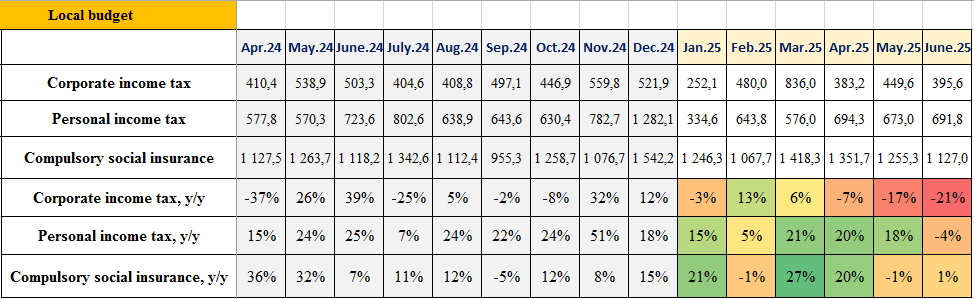

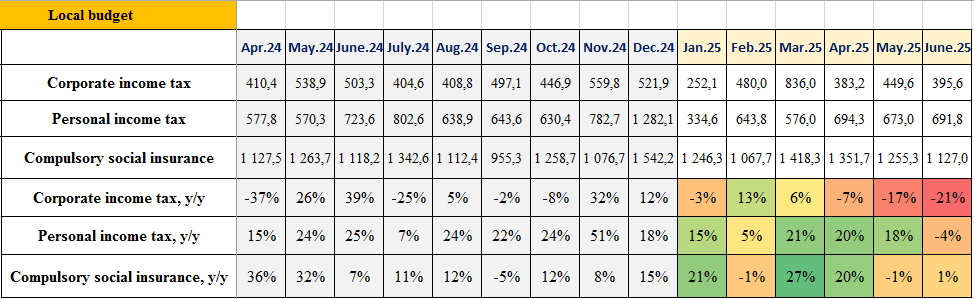

Explanation. I took the consolidated budget data, subtracted the federal budget figures to clear the noise on some taxes and see more or less clean dynamics, since some taxes changed their rates from the new year and innovations were introduced in taxation.

Explanation. I took the consolidated budget data, subtracted the federal budget figures to clear the noise on some taxes and see more or less clean dynamics, since some taxes changed their rates from the new year and innovations were introduced in taxation.

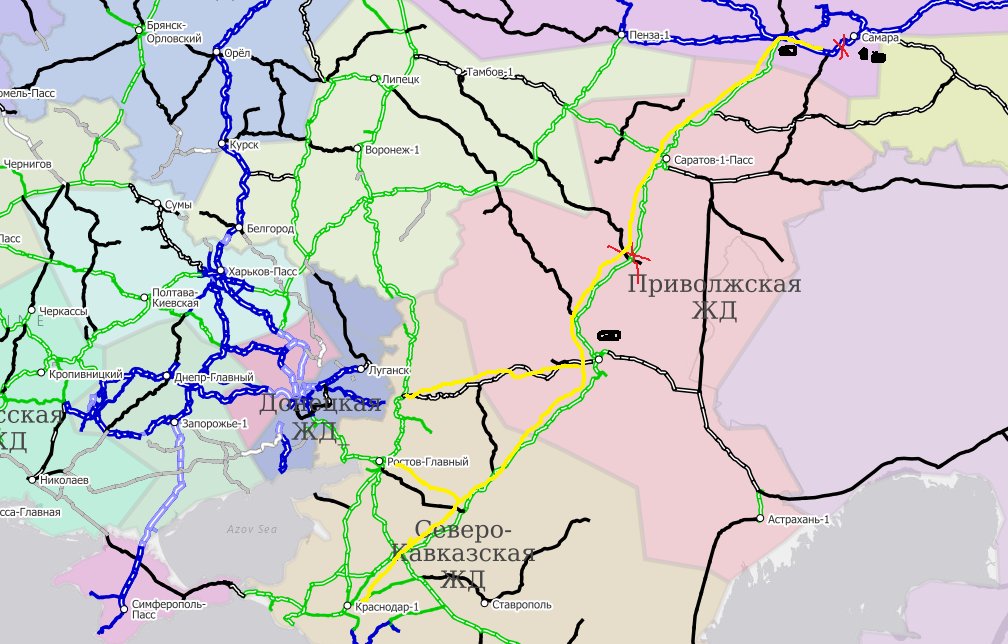

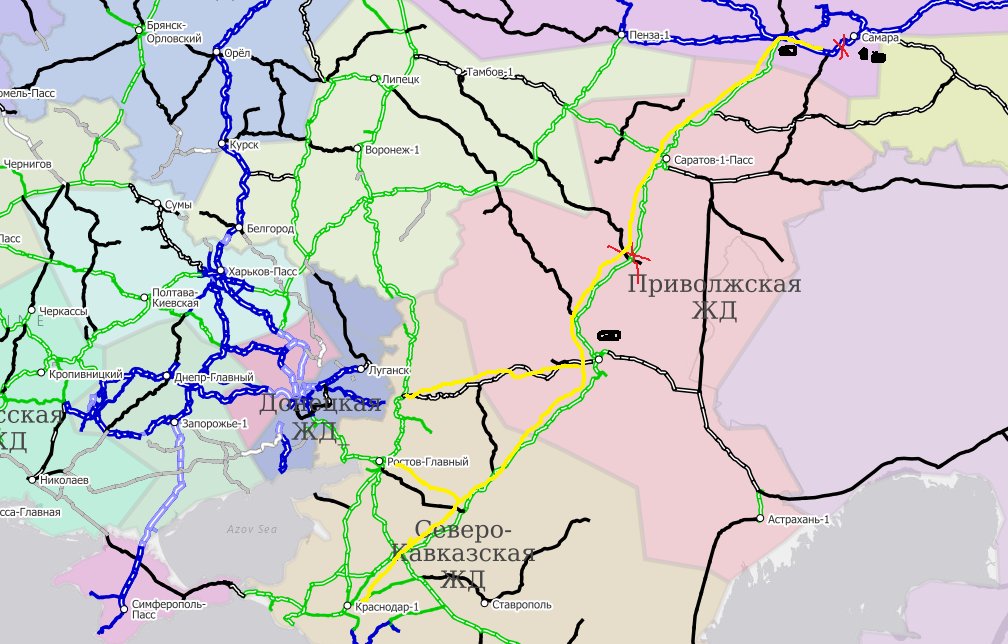

Gasoline and diesel are delivered to the south of Russia from the Samara group of refineries (Kuibyshevsky, Novokuibyshevsky and Syzransky refineries) as well as from the Volgograd refinery (delivery line in yellow)

Gasoline and diesel are delivered to the south of Russia from the Samara group of refineries (Kuibyshevsky, Novokuibyshevsky and Syzransky refineries) as well as from the Volgograd refinery (delivery line in yellow)

Specifically, the cryogenic gas condensate/gas fractionation unit suffered critical damage. It is the “heart” of the gas processing complex: rectification and separation of components take place here, which are then either exported or used as raw materials for the Baltic Gas

Specifically, the cryogenic gas condensate/gas fractionation unit suffered critical damage. It is the “heart” of the gas processing complex: rectification and separation of components take place here, which are then either exported or used as raw materials for the Baltic Gas

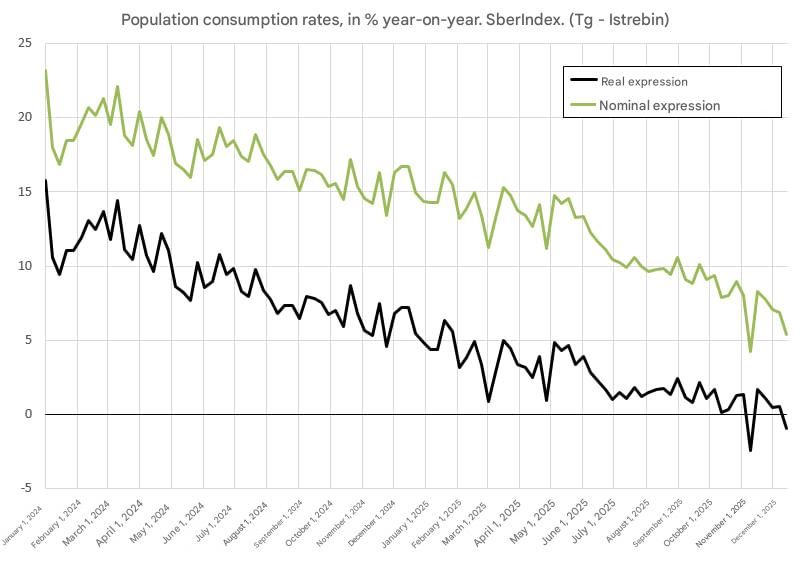

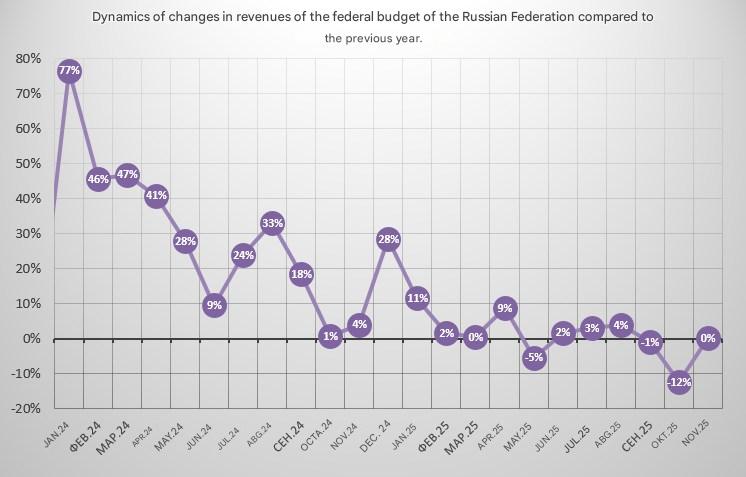

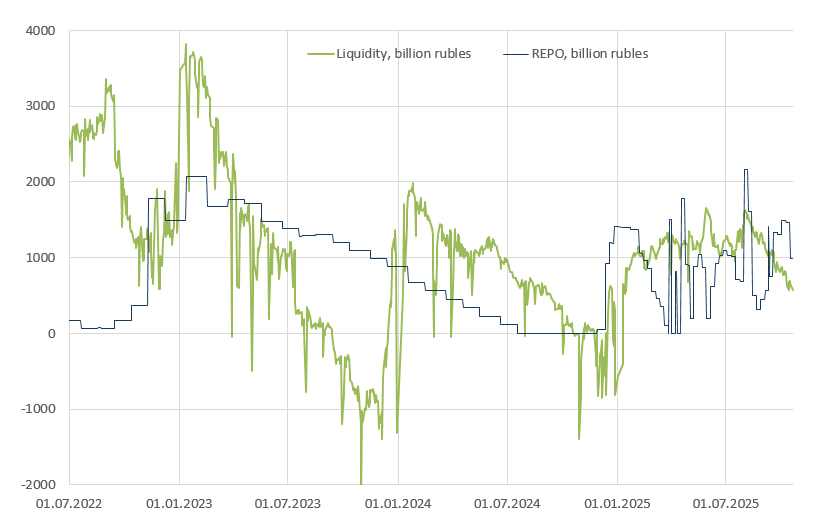

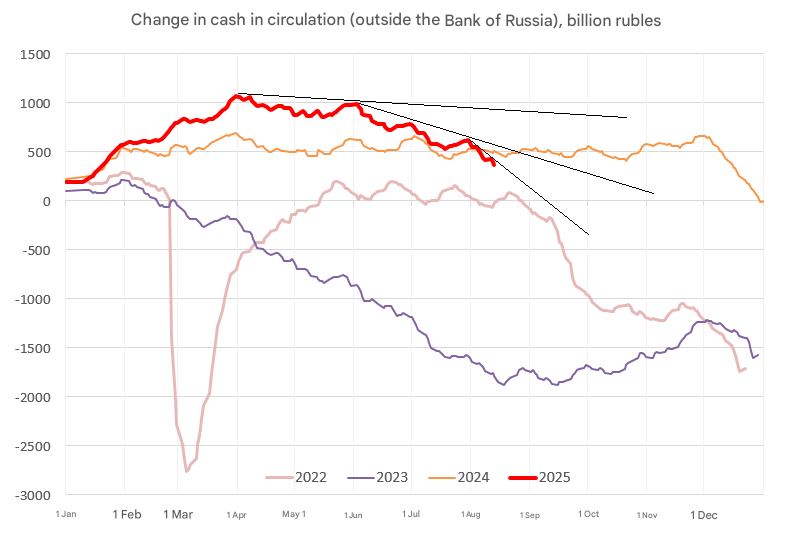

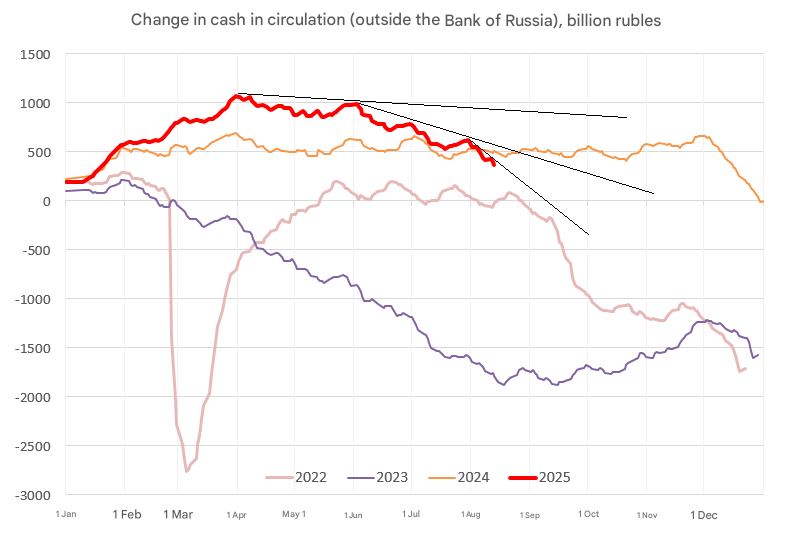

2. A general decline in liquidity of the entire banking system, which will lead to a decline in lending to the economy, and as a consequence, a slowdown in the economy.

2. A general decline in liquidity of the entire banking system, which will lead to a decline in lending to the economy, and as a consequence, a slowdown in the economy.

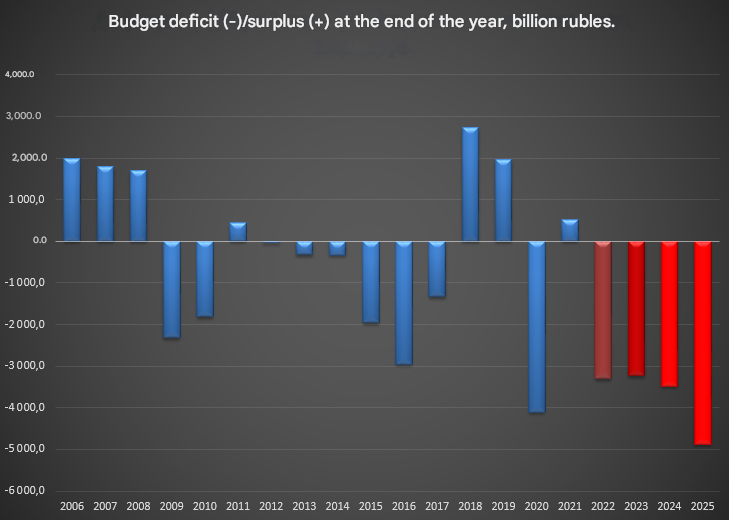

According to the results of 7 months, the deficit is 4.879 trillion rubles

According to the results of 7 months, the deficit is 4.879 trillion rubles

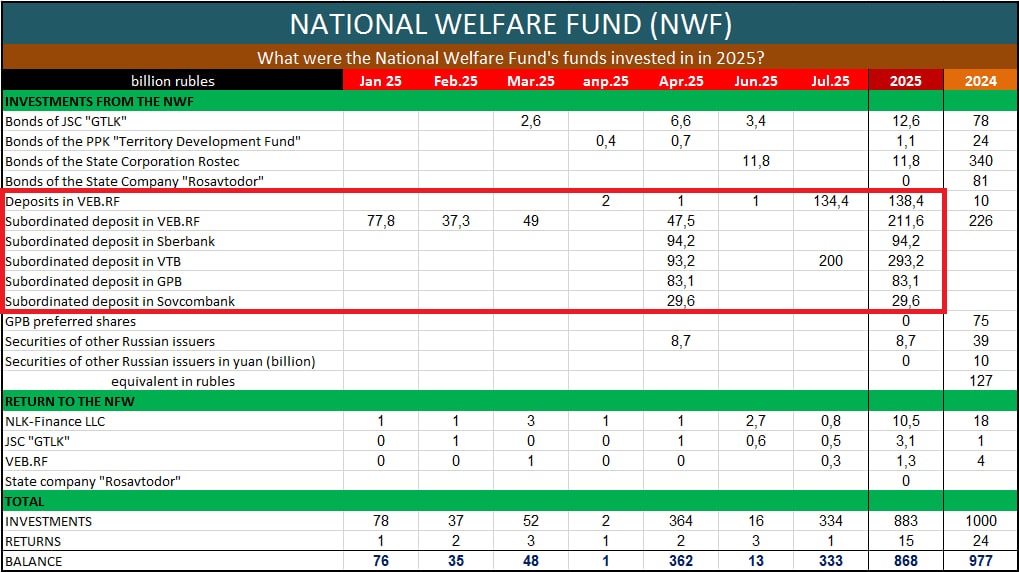

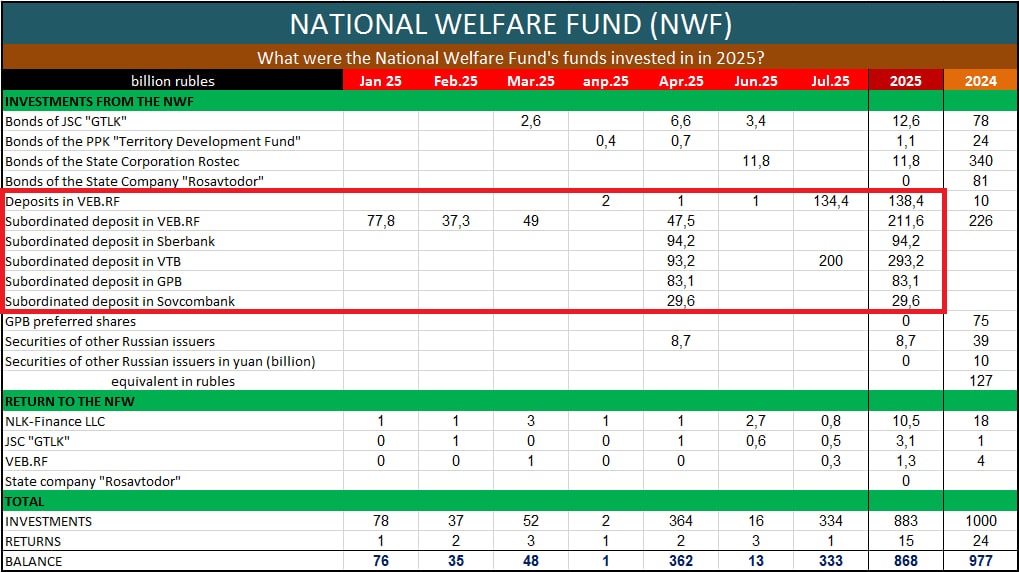

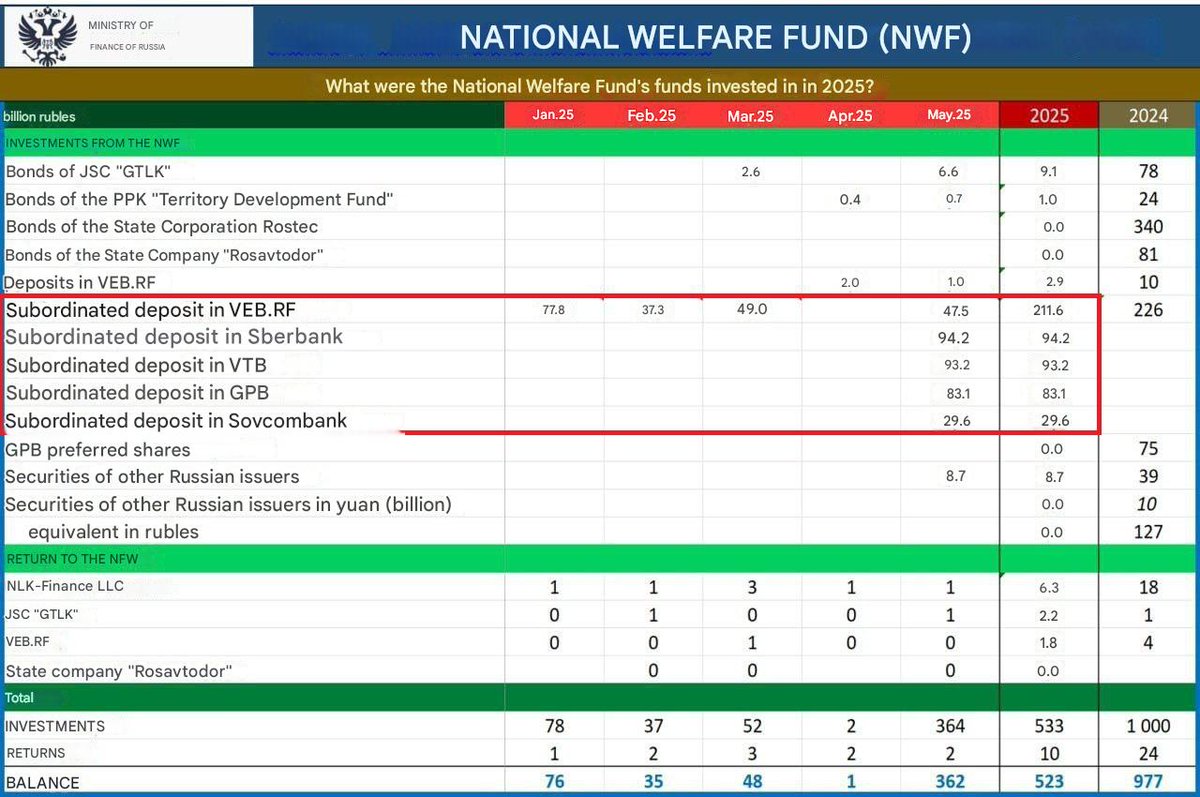

The Ministry of Finance published a report on operations with the National Welfare Fund for July. VEB and VTB received new deposits for 335 billion rubles to improve the liquidity situation.

The Ministry of Finance published a report on operations with the National Welfare Fund for July. VEB and VTB received new deposits for 335 billion rubles to improve the liquidity situation.

Of course, the Central Bank denied everything, but it's all a lie. It's enough to look at how many subloans the banks received from the National Welfare Fund

Of course, the Central Bank denied everything, but it's all a lie. It's enough to look at how many subloans the banks received from the National Welfare Fund

sheets of banks.

sheets of banks.