We are delighted to release the 6th annual @ElectricCapital Developer Report!

We analyzed a record 902M code commits across 1.7M repos thanks to the 829 people who contributed to making this report since inception.

How did 2024 in crypto look in data?

Long thread below 👇🏽

We analyzed a record 902M code commits across 1.7M repos thanks to the 829 people who contributed to making this report since inception.

How did 2024 in crypto look in data?

Long thread below 👇🏽

2024 Takeaways:

Crypto is global & dev momentum shifted outside of N. America

Devs & use-cases are diversifying across ecosystems

Usage spans all time zones, suggesting global usage

Crypto is global & dev momentum shifted outside of N. America

Devs & use-cases are diversifying across ecosystems

Usage spans all time zones, suggesting global usage

We undercount crypto developers because we look at open source dev activity only.

Our methodology:

- We collapse dev profiles into single canonical identities

- We identify & remove bots

- We remove repos like data lists that are not reflective of dev activity

Our methodology:

- We collapse dev profiles into single canonical identities

- We identify & remove bots

- We remove repos like data lists that are not reflective of dev activity

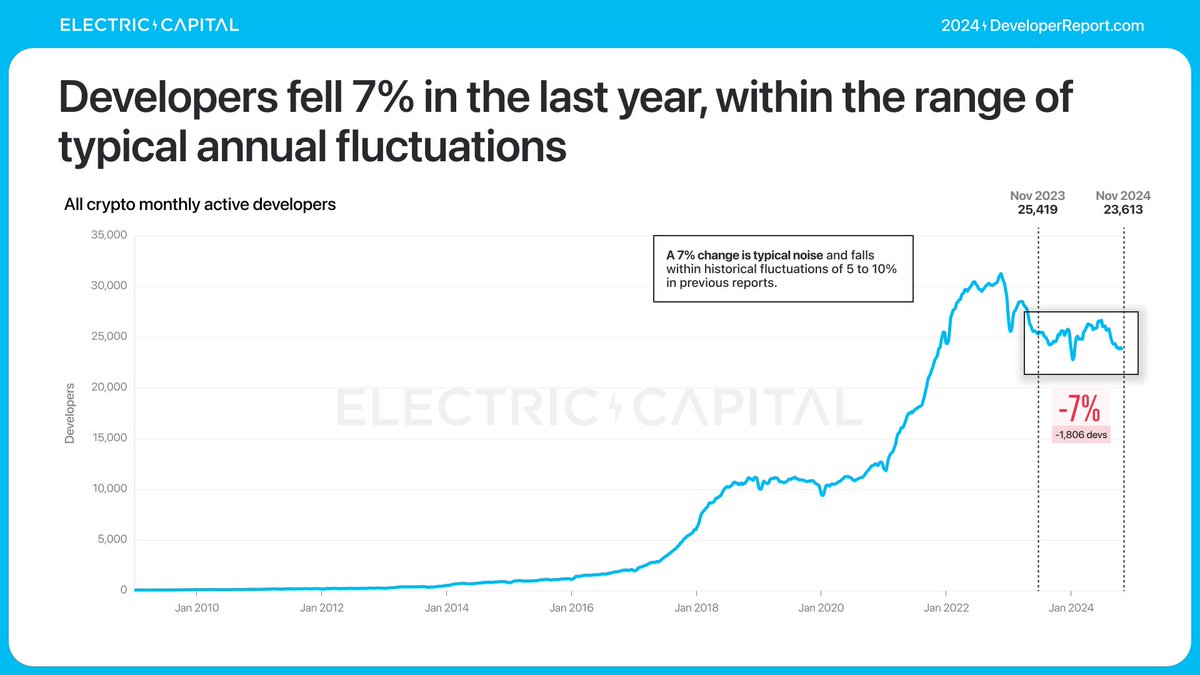

Crypto has grown at an annualized 39% since the launch of Ethereum in 2015. There were ~1,000 monthly active developers in 2015.

Today: 23,613 monthly active developers now work on crypto.

Today: 23,613 monthly active developers now work on crypto.

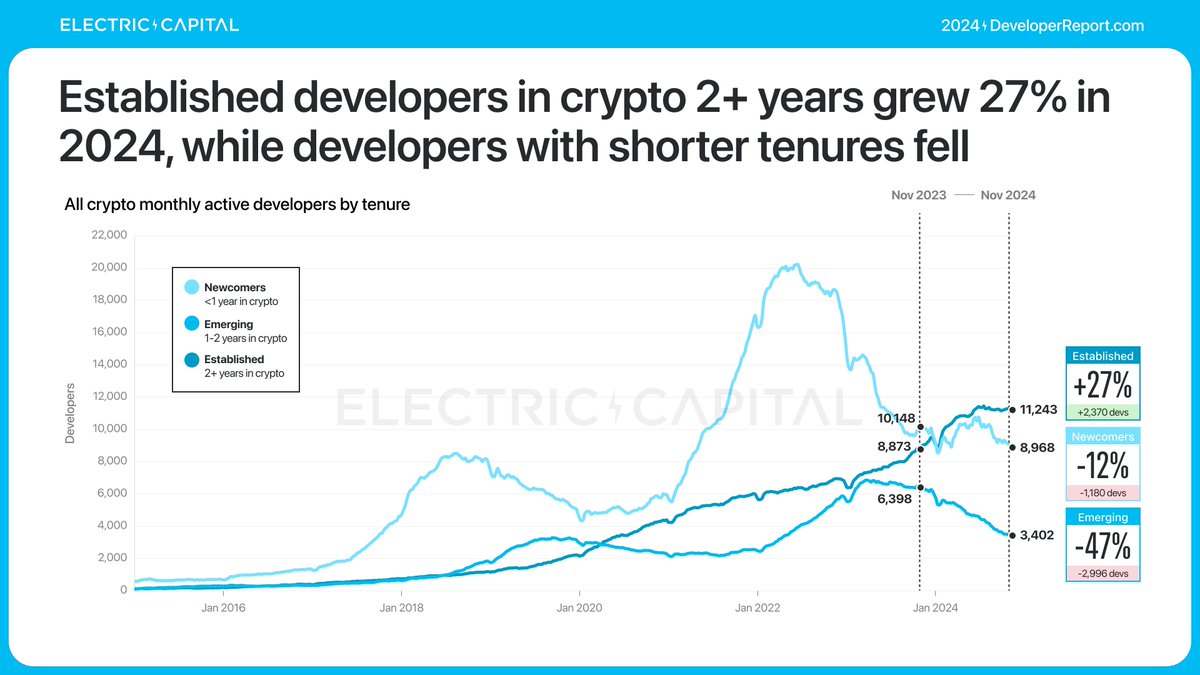

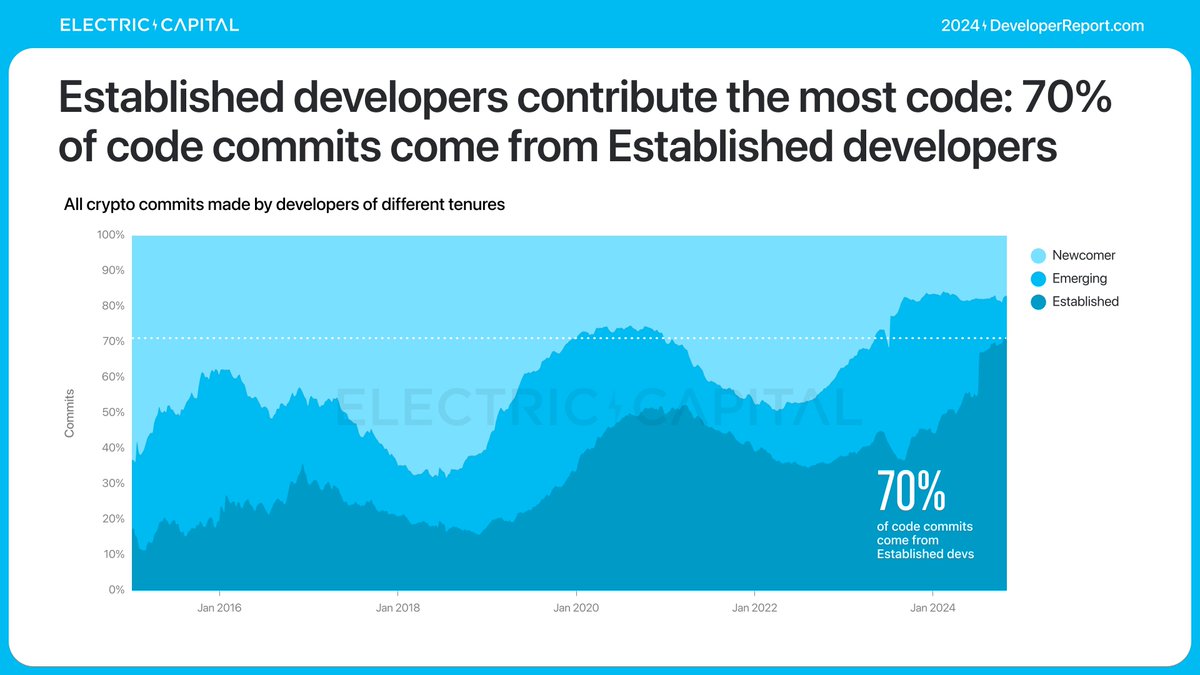

Monthly active devs marginally down -7% last year. Devs who have been in crypto for 2+ years grew 27%. These Established developers push the industry forward because they push 70% of the code commits.

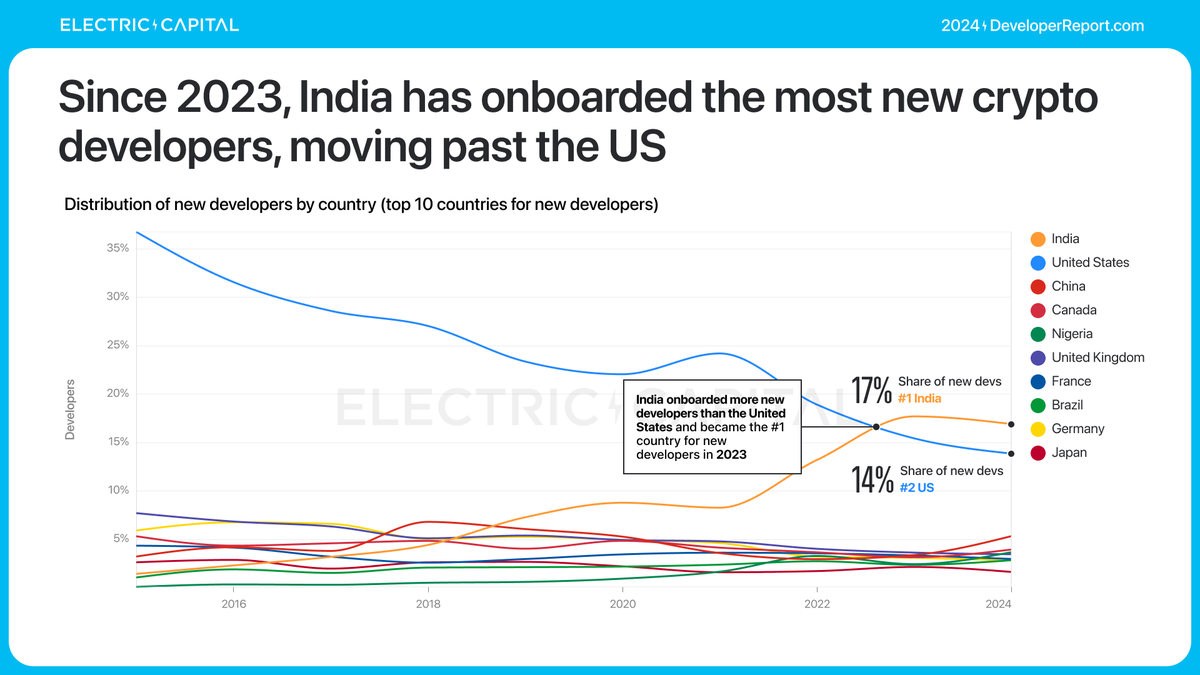

How has crypto changed since 2015? Let's look at global diversity of crypto devs.

Developer share shifted from 82% in the US & Europe to the rest of the world.

Developer share shifted from 82% in the US & Europe to the rest of the world.

Asia is now the # 1 continent by developer share. 1 in 3 crypto developers live in Asia.

Europe is # 2. North America fell from # 1 to # 3 since 2015.

Europe is # 2. North America fell from # 1 to # 3 since 2015.

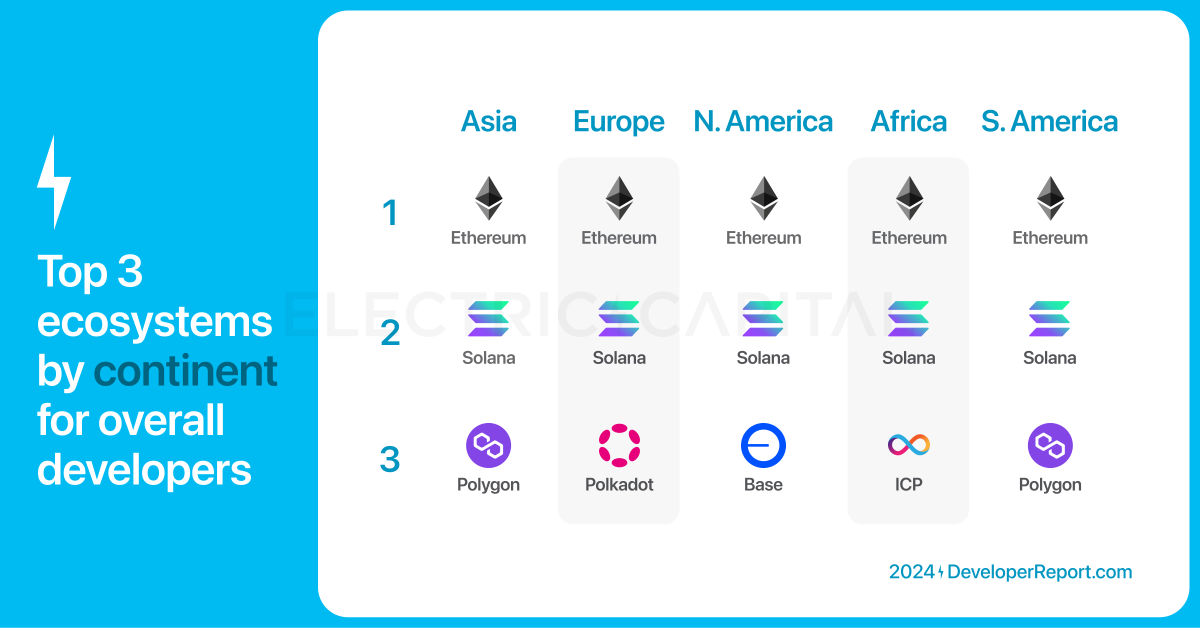

We can identify top ecosystems in these continents by developer share.

Ethereum is the # 1 ecosystem by developer share on every top continent.

@solana is # 2.

@0xPolygon is # 3 in Asia and S. America.

@Polkadot is # 3 in Europe.

@base is # 3 in N. America.

@dfinity is # 3 in Africa.

Ethereum is the # 1 ecosystem by developer share on every top continent.

@solana is # 2.

@0xPolygon is # 3 in Asia and S. America.

@Polkadot is # 3 in Europe.

@base is # 3 in N. America.

@dfinity is # 3 in Africa.

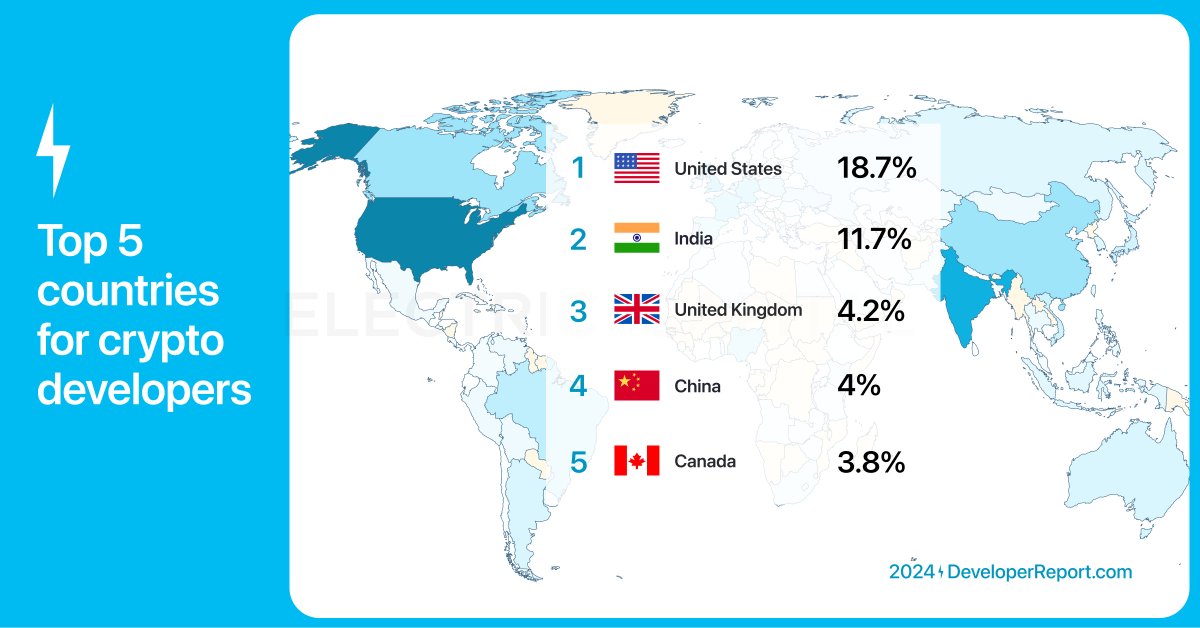

The US remains # 1 by crypto developer share, but has declined continuously since 2015. India is the # 2 country, from # 10.

Top 3 ecosystems by country by developer share:

Ethereum is # 1 in the US, UK, China, and Canada, # 2 in India.

@solana is # 1 in India, # 2 elsewhere.

@base is # 3 in US and India.

@0xPolygon is # 3 in the UK.

@NEARProtocol is # 3 in Canada.

@Polkadot is # 3 in China.

Ethereum is # 1 in the US, UK, China, and Canada, # 2 in India.

@solana is # 1 in India, # 2 elsewhere.

@base is # 3 in US and India.

@0xPolygon is # 3 in the UK.

@NEARProtocol is # 3 in Canada.

@Polkadot is # 3 in China.

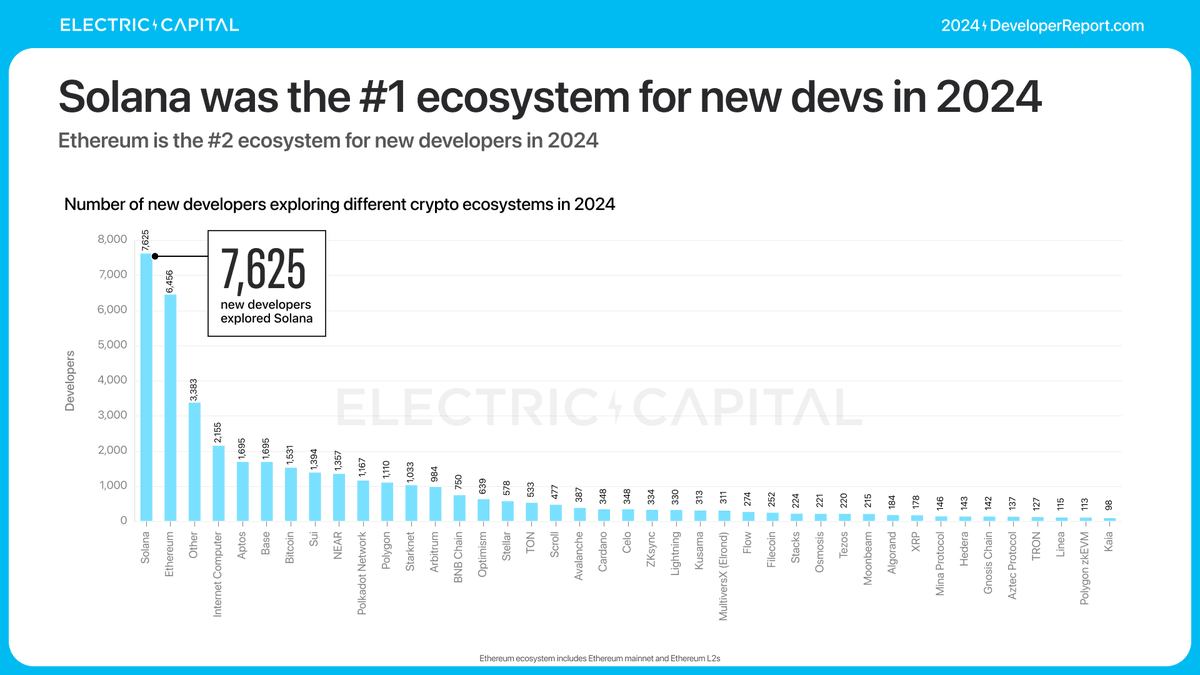

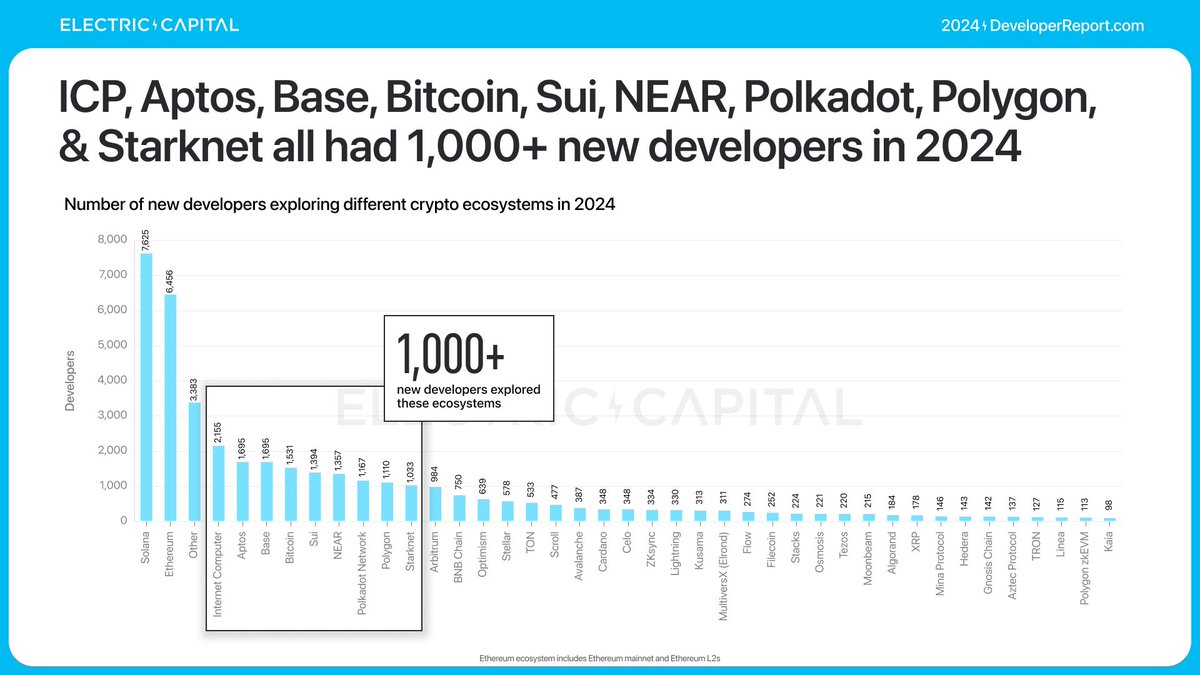

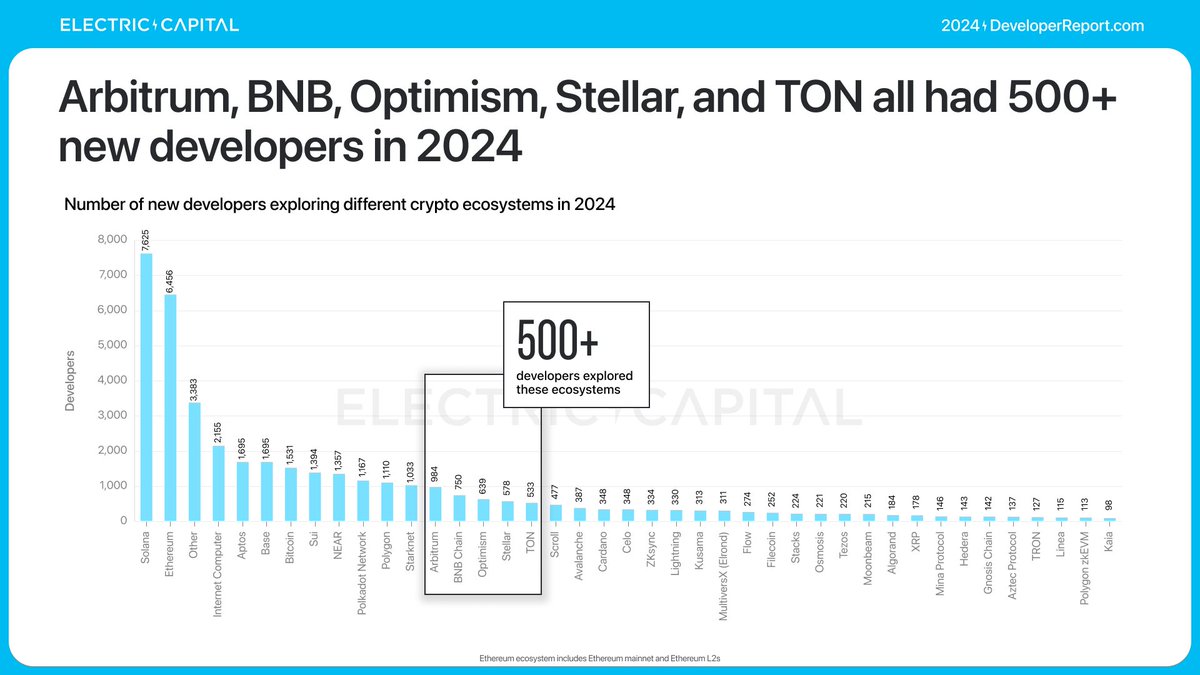

Let's zoom in on new devs -- 39,148 new developers explored crypto in 2024.

We can break down new developers by ecosystem.

@solana became the # 1 ecosystem for new monthly developers in July 2024.

We can break down new developers by ecosystem.

@solana became the # 1 ecosystem for new monthly developers in July 2024.

Overall in 2024 for new devs:

- @solana is the # 1 ecosystem for new devs

- Ethereum is # 2

- @dfinity, @Aptos, @base, Bitcoin, @SuiNetwork, @NEARProtocol, @Polkadot, @0xPolygon, & @Starknet all had 1K+ new devs in 2024

- @arbitrum, @BNBCHAIN, @Optimism, @StellarOrg, and @ton_blockchain all had 500+ new devs in 2024

- @solana is the # 1 ecosystem for new devs

- Ethereum is # 2

- @dfinity, @Aptos, @base, Bitcoin, @SuiNetwork, @NEARProtocol, @Polkadot, @0xPolygon, & @Starknet all had 1K+ new devs in 2024

- @arbitrum, @BNBCHAIN, @Optimism, @StellarOrg, and @ton_blockchain all had 500+ new devs in 2024

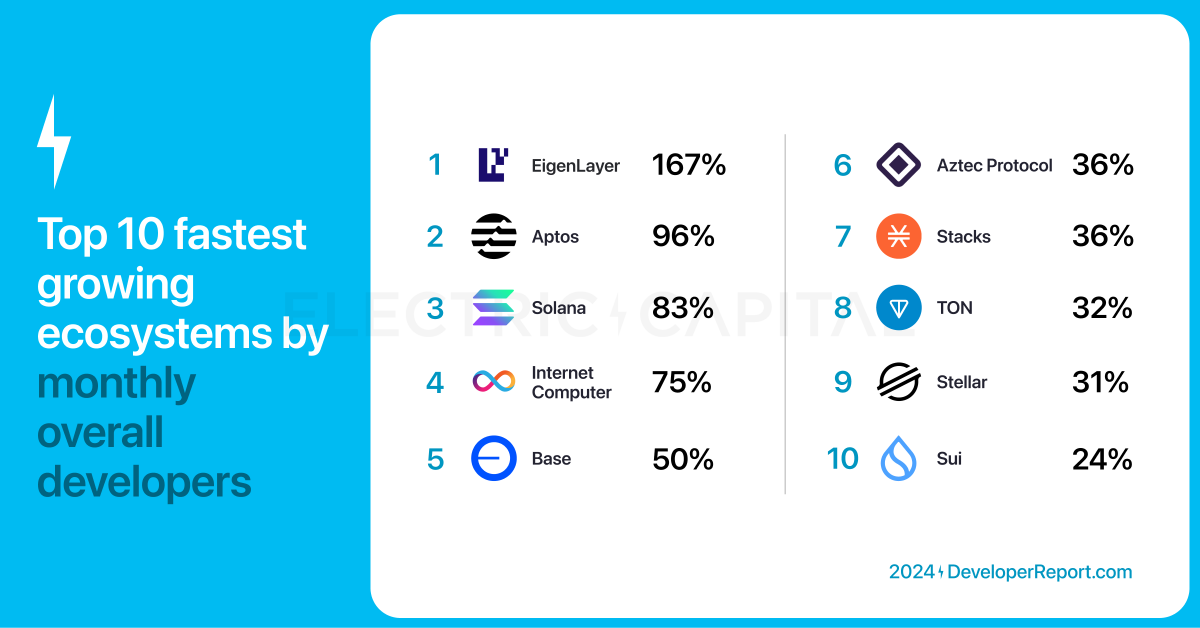

Who grew the fastest by total devs? Total devs reflect new developer and hackathon participant interest.

Top 10 fastest growing ecosystems by overall developers comparing Q3 2023 and Q4 2024:

@eigenlayer, @Aptos, @solana, @dfinity, @base, @aztecnetwork, @Stacks, @ton_blockchain, @StellarOrg, @SuiNetwork

Top 10 fastest growing ecosystems by overall developers comparing Q3 2023 and Q4 2024:

@eigenlayer, @Aptos, @solana, @dfinity, @base, @aztecnetwork, @Stacks, @ton_blockchain, @StellarOrg, @SuiNetwork

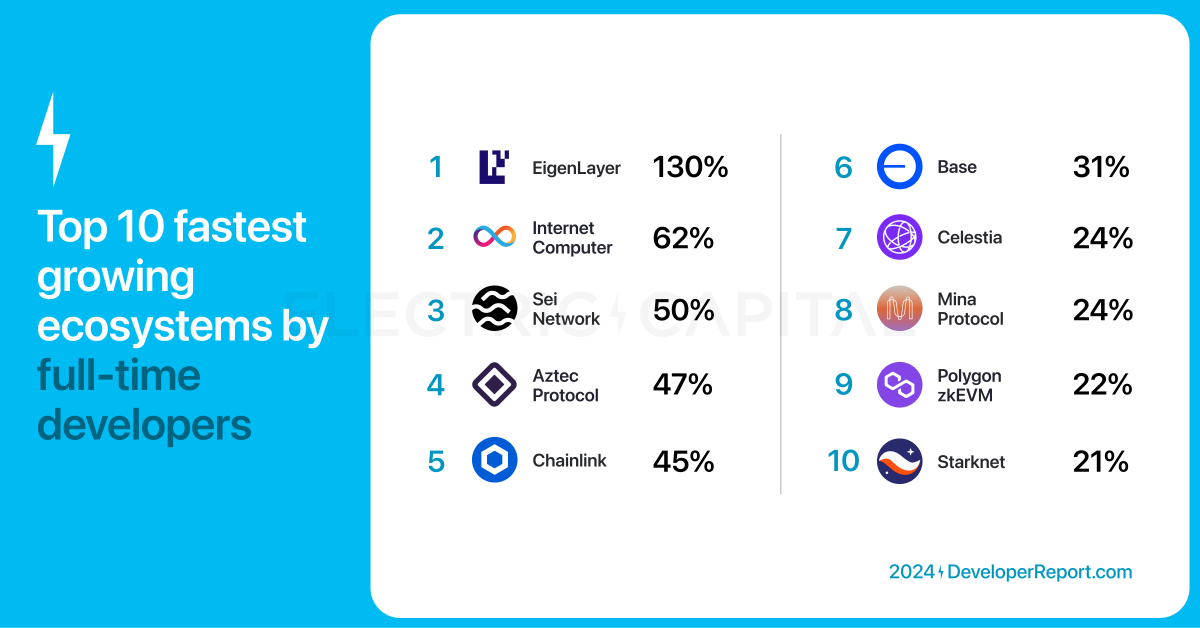

Who grew the fastest by Full-time devs? Full-time devs commit code 10+ days out of a month, so they produce steady work for the ecosystem.

Top 10 fastest growing ecosystems by Full-time developers comparing Q3 2023 and Q4 2024:

@eigenlayer, @dfinity, @SeiNetwork, @aztecnetwork, @chainlink, @base, @celestia, @MinaProtocol, @0xPolygon, @Starknet

Top 10 fastest growing ecosystems by Full-time developers comparing Q3 2023 and Q4 2024:

@eigenlayer, @dfinity, @SeiNetwork, @aztecnetwork, @chainlink, @base, @celestia, @MinaProtocol, @0xPolygon, @Starknet

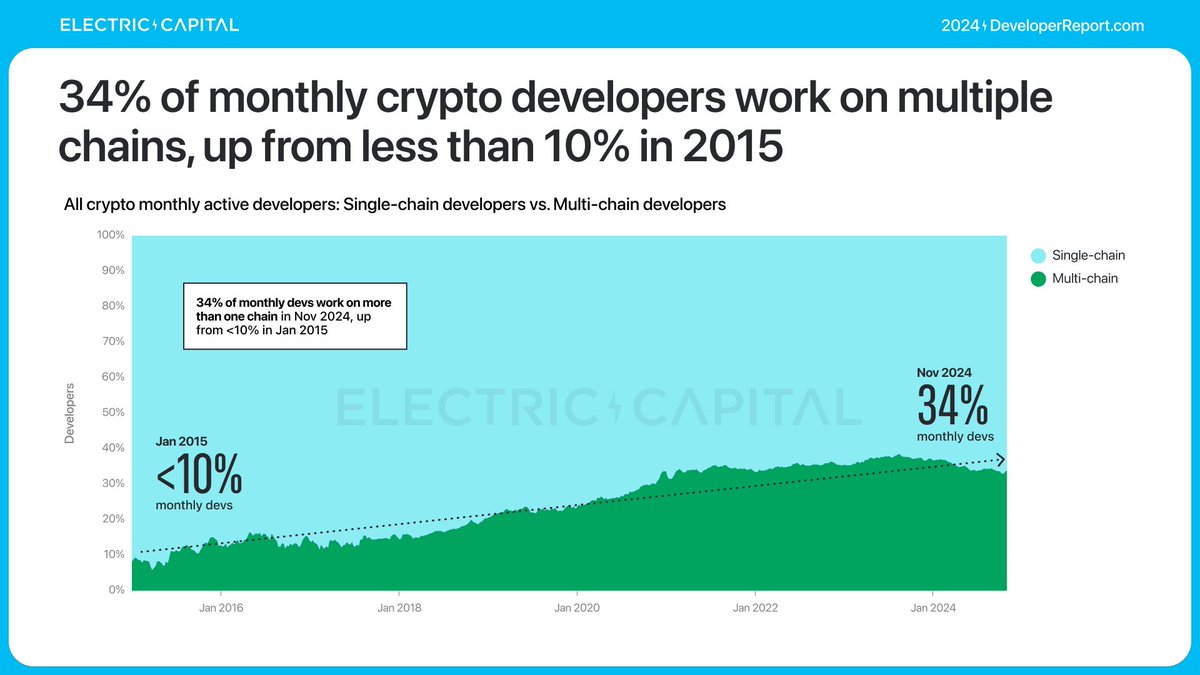

Many of these devs are on multiple chains -- 1 in 3 crypto developers now work on multiple chains, & growing.

Monthly Multi-chain developers increased from less than 10% in 2015 to 34% in 2024. The chains with the biggest share of multi-chain developers share devs with Ethereum.

Monthly Multi-chain developers increased from less than 10% in 2015 to 34% in 2024. The chains with the biggest share of multi-chain developers share devs with Ethereum.

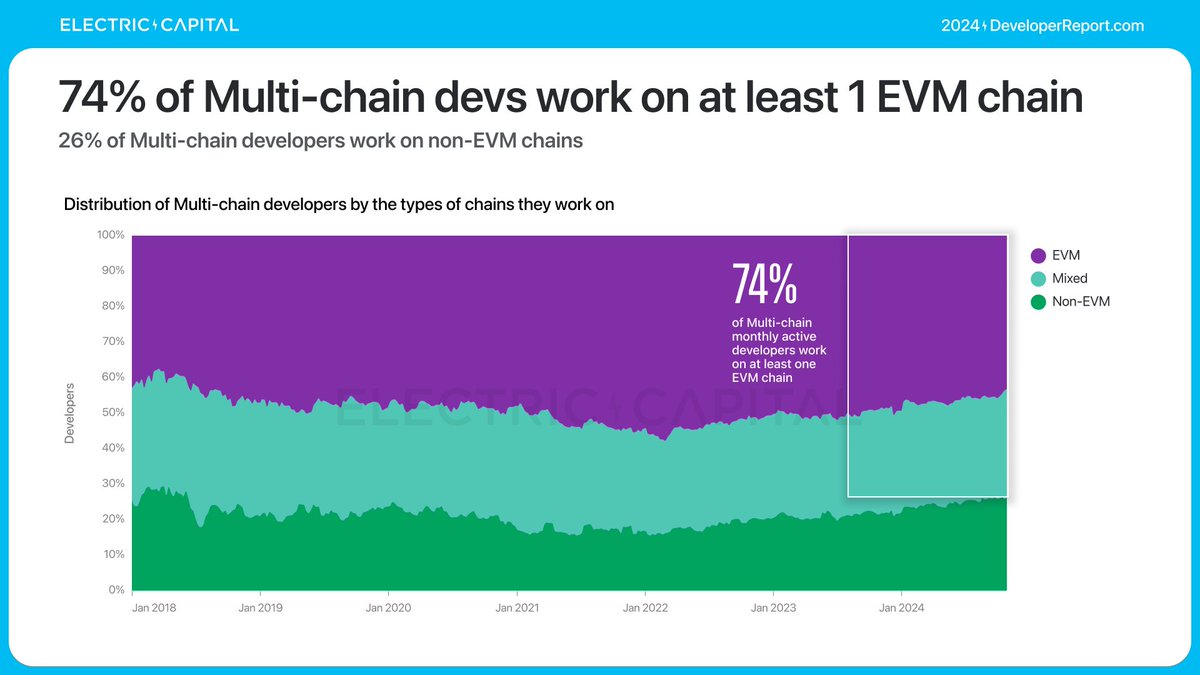

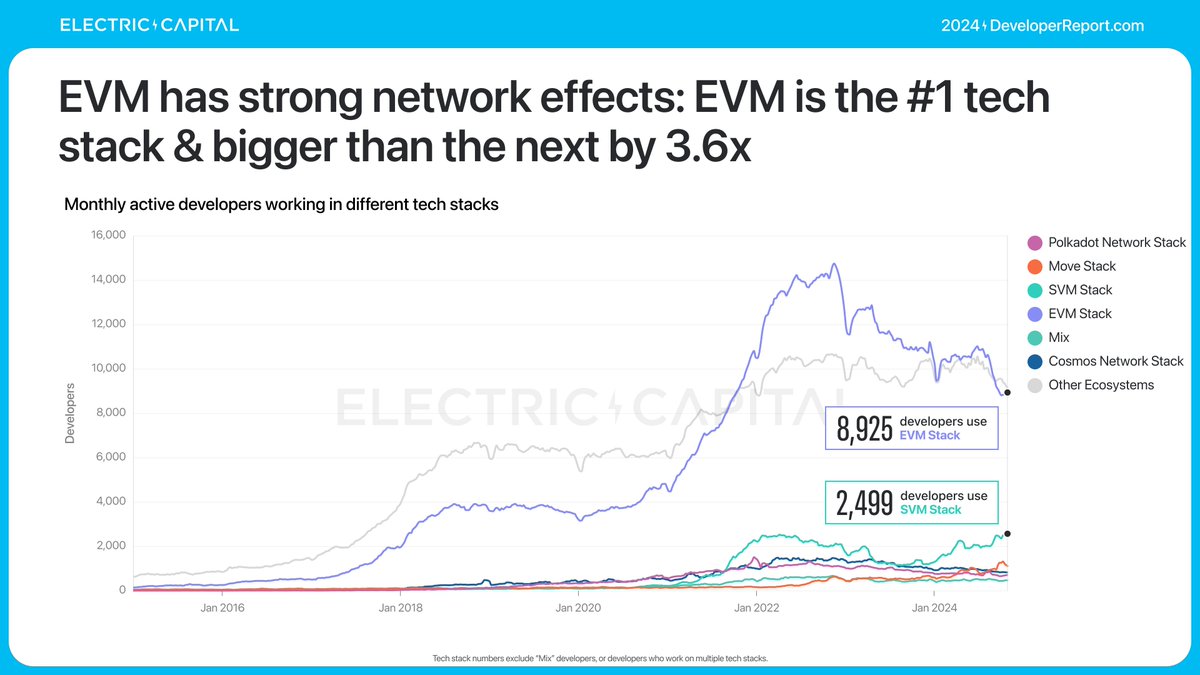

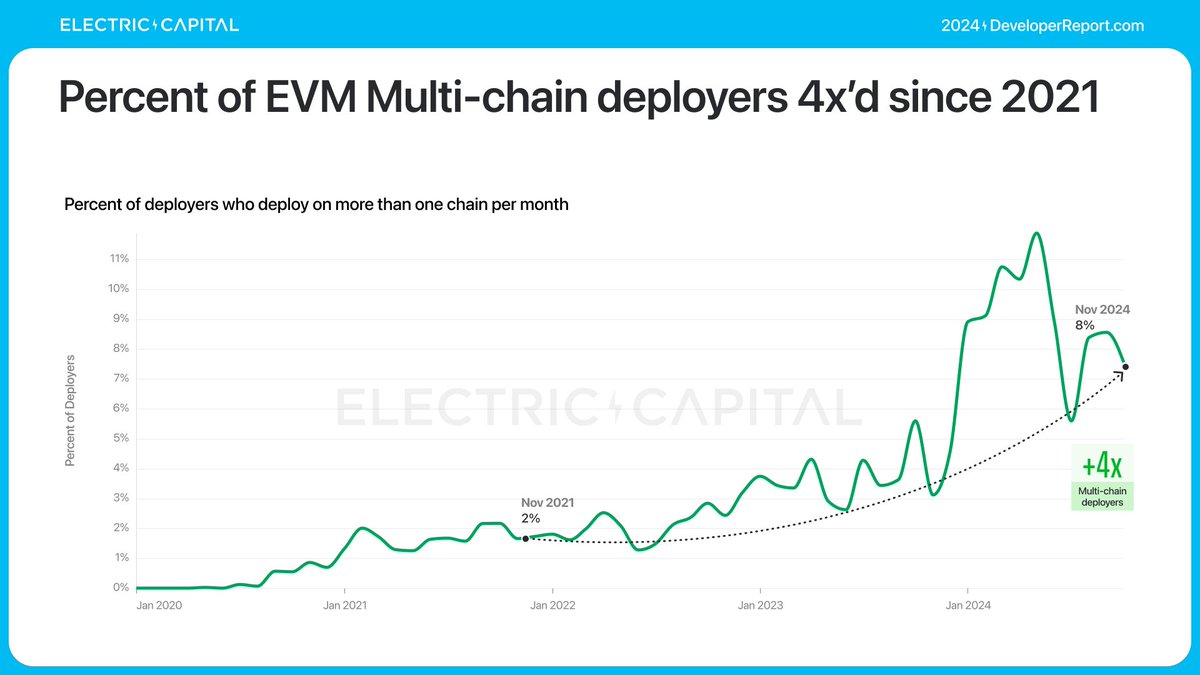

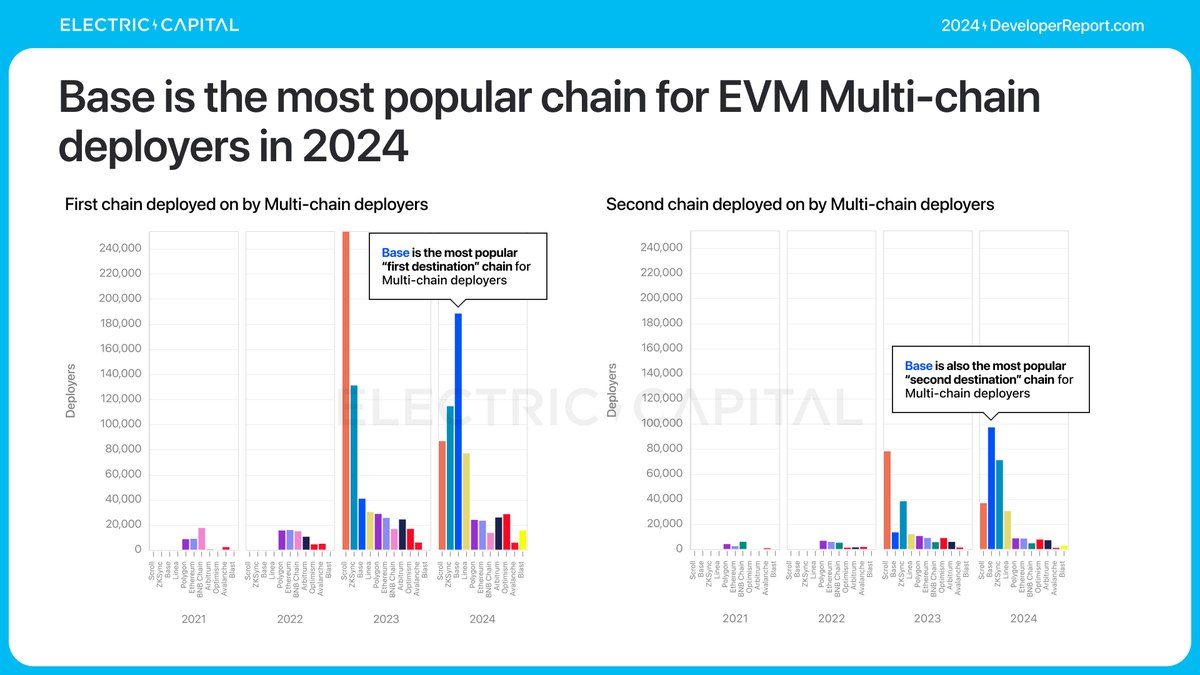

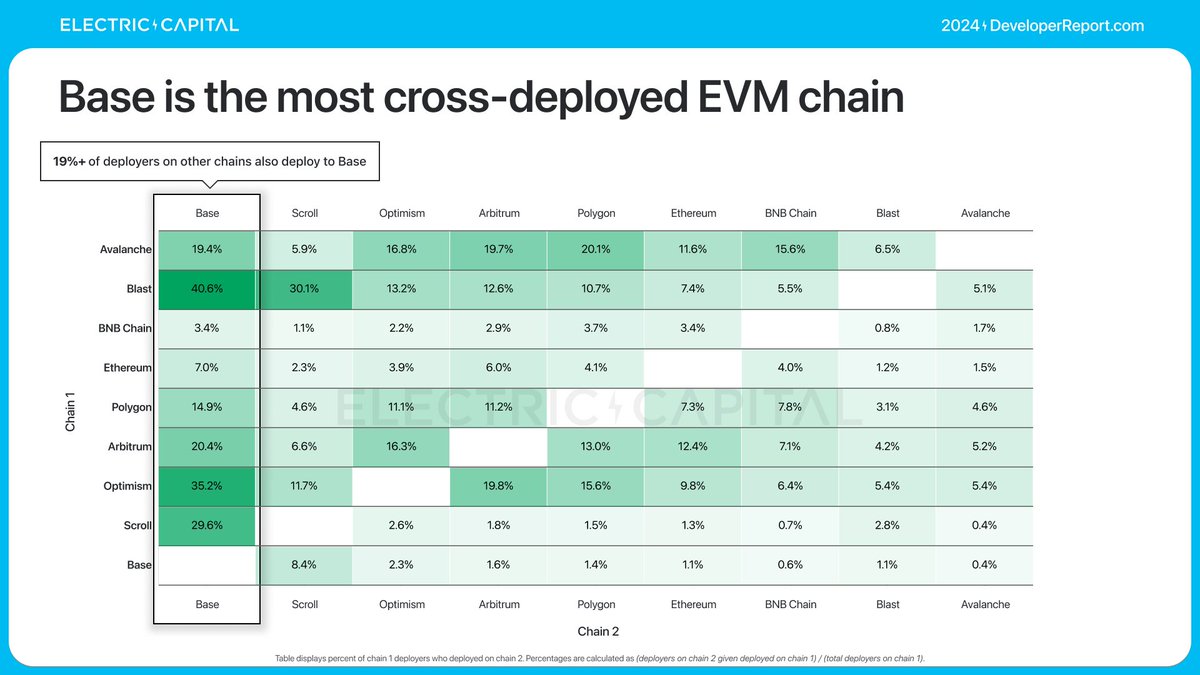

EVM chains share the most devs and have significant network effects: 74% of Multi-chain developers work on EVM. Percentage of EVM cross chain deployers 4x’d since 2021.

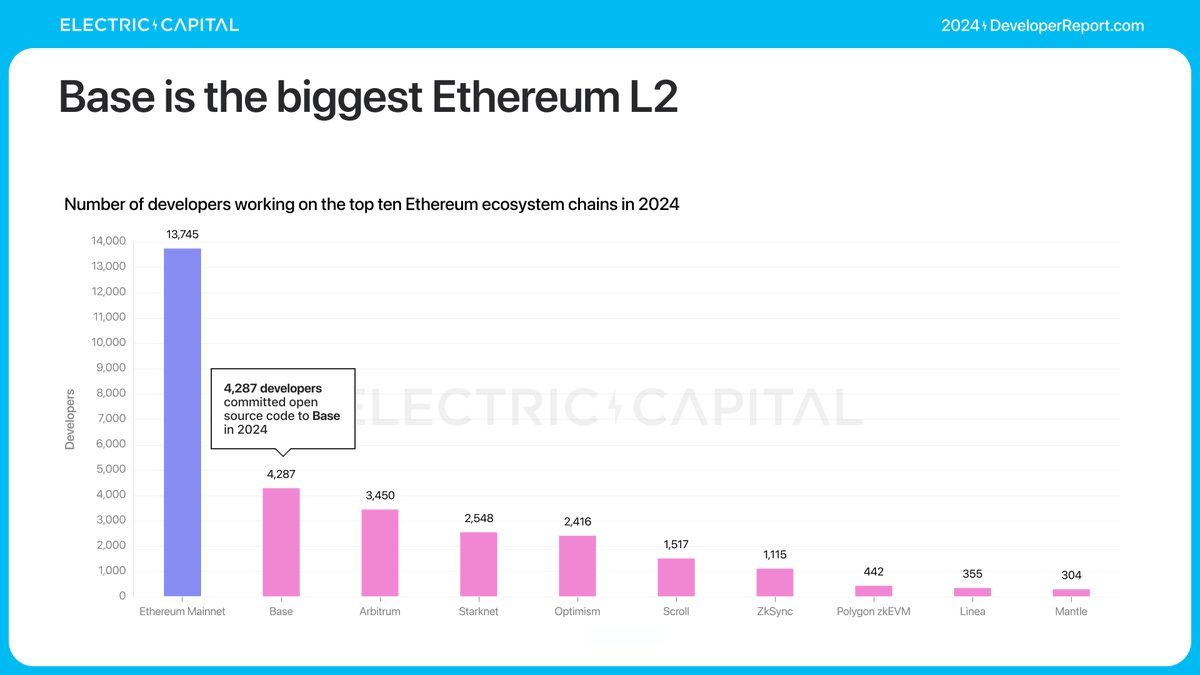

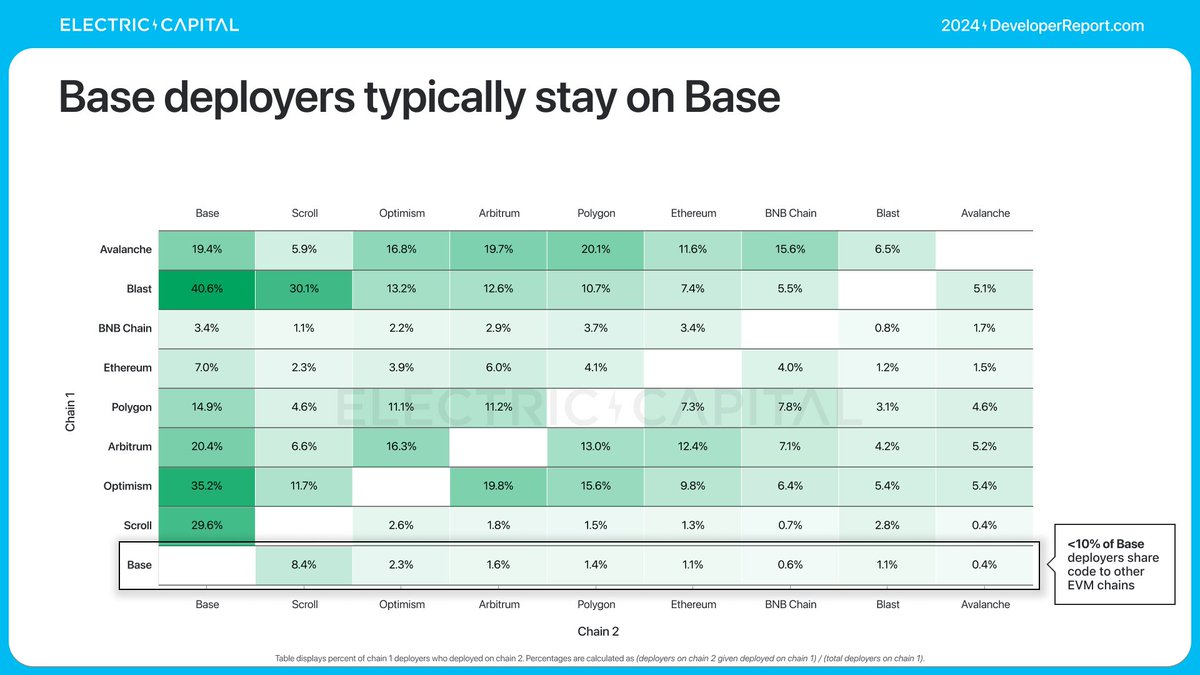

Base is the most popular chain for EVM Multi-chain deployers in 2024, but @base deployers tend to stay on Base.

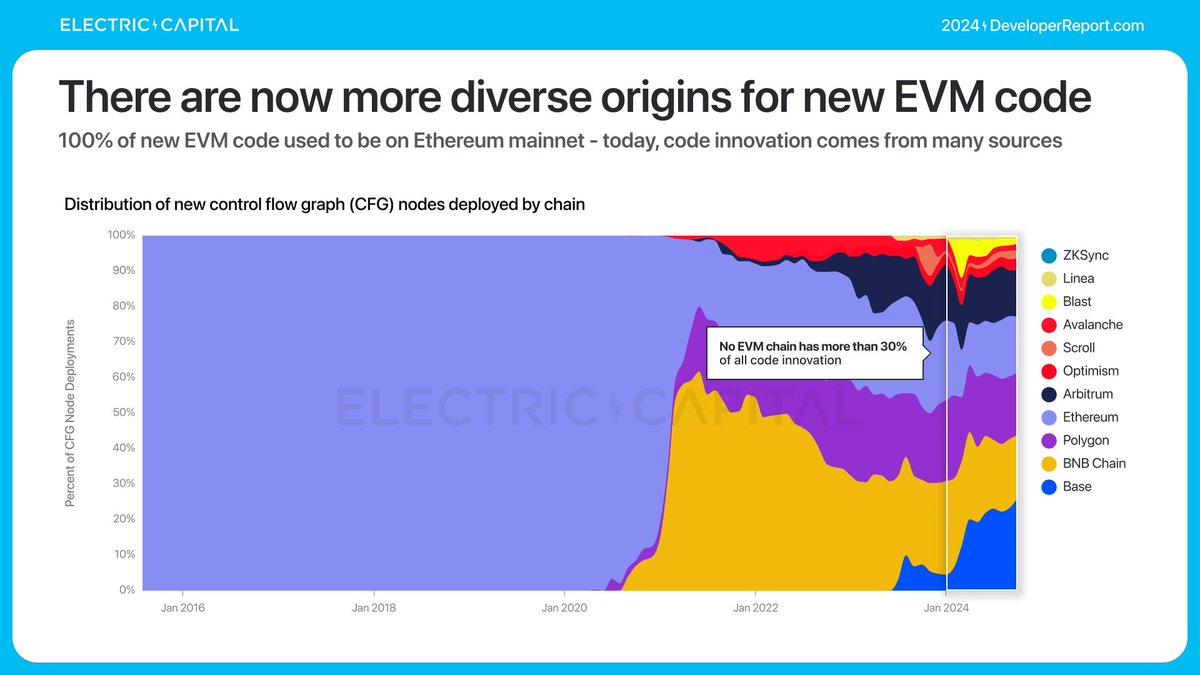

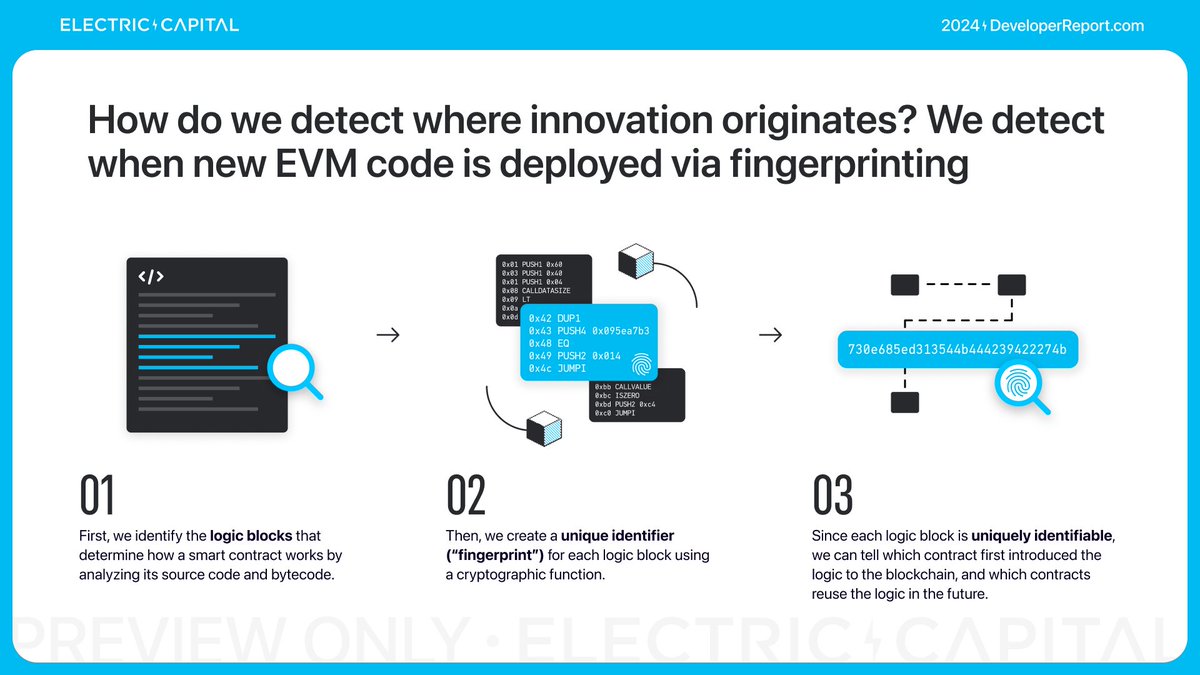

Since deployers are shipping code to multiple chains, where is most of the original code being written?

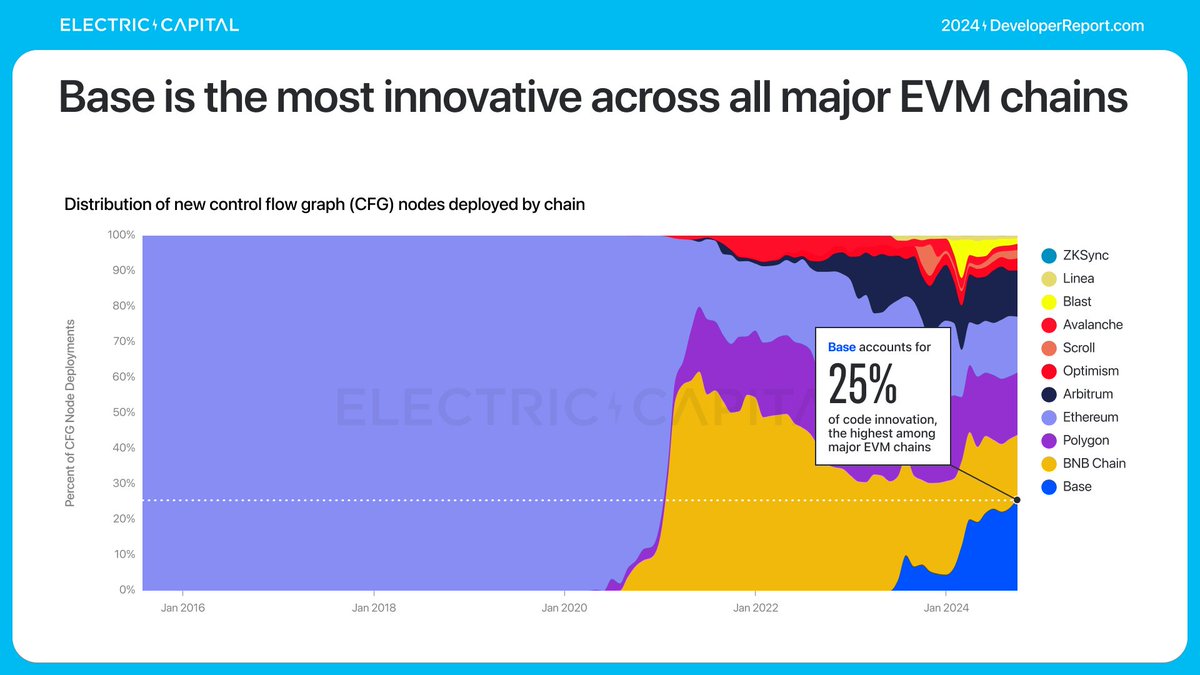

Before 2020, almost all original onchain code logic in EVM was on Ethereum.

Now, no EVM chain has more than 30% of all code innovation.

Before 2020, almost all original onchain code logic in EVM was on Ethereum.

Now, no EVM chain has more than 30% of all code innovation.

@base now accounts for 25% of all original onchain code logic in EVM -- the most of any major EVM chain.

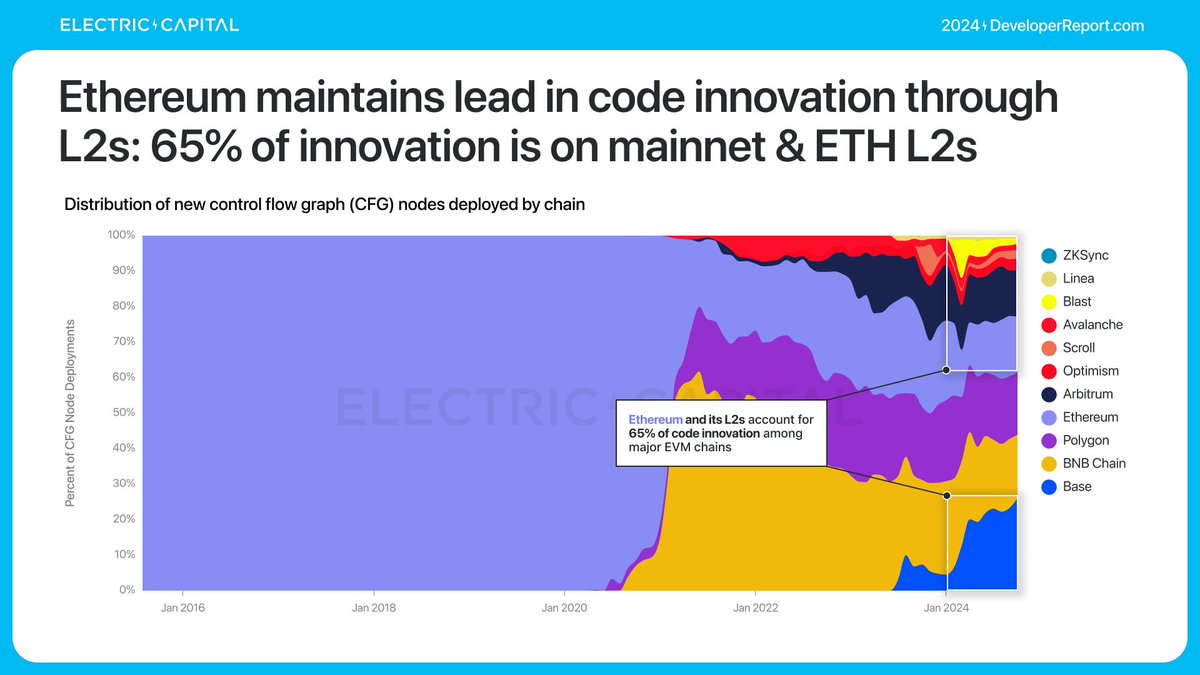

This is how Ethereum ecosystem maintains itd lead in code innovation -- through L2s. 65% of innovation is on mainnet & ETH L2s.

This is how Ethereum ecosystem maintains itd lead in code innovation -- through L2s. 65% of innovation is on mainnet & ETH L2s.

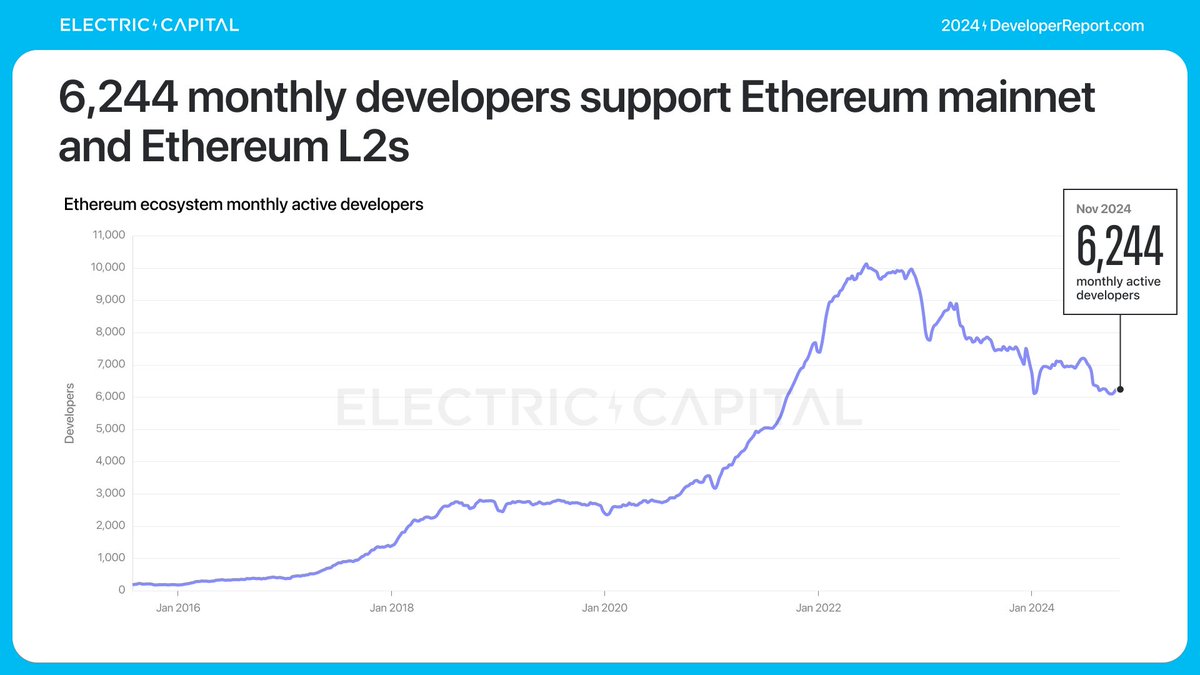

Ethereum ecosystem shows strong network effects through dominance in EVM and Multi-chain developers. How is the ecosystem doing?

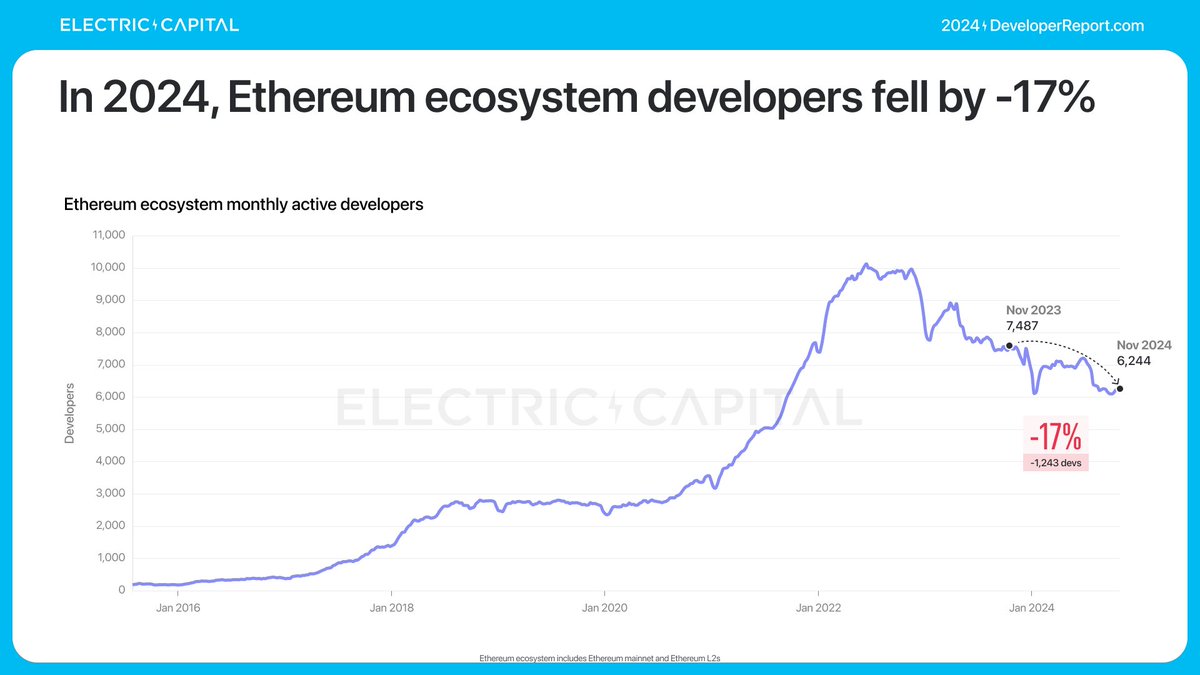

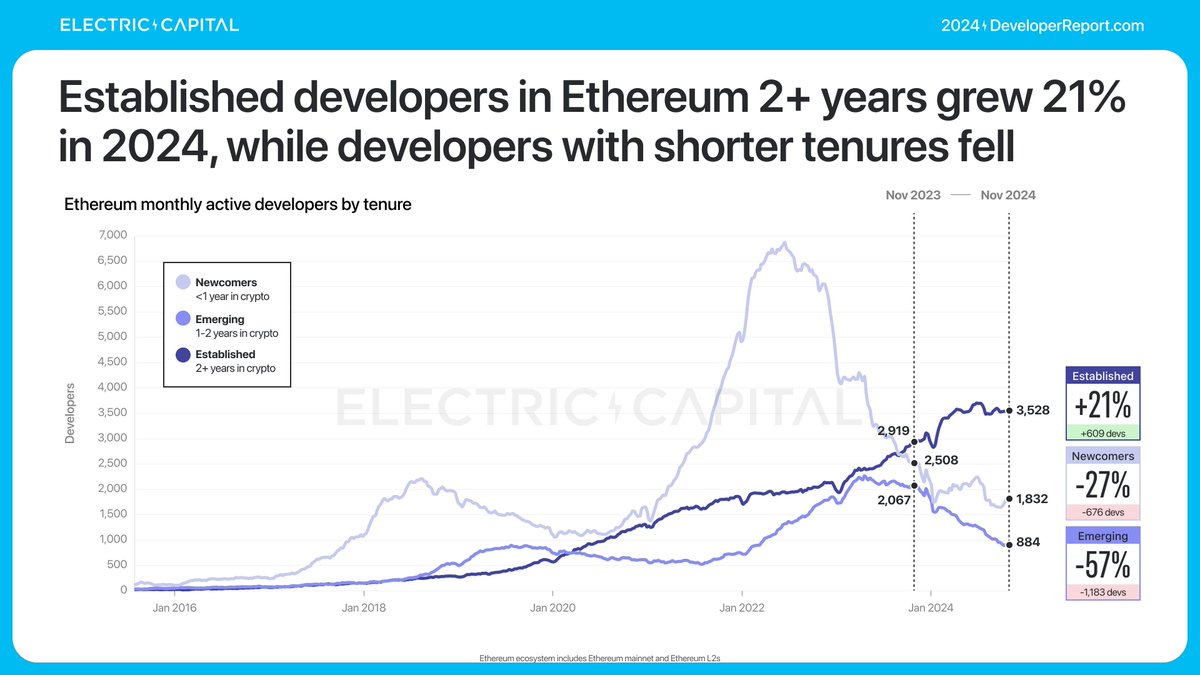

6,244 monthly active Ethereum devs, down by 17% YoY. Most of the loss is driven by devs who joined after 2021. Devs in Ethereum 2+ years grew 21%.

6,244 monthly active Ethereum devs, down by 17% YoY. Most of the loss is driven by devs who joined after 2021. Devs in Ethereum 2+ years grew 21%.

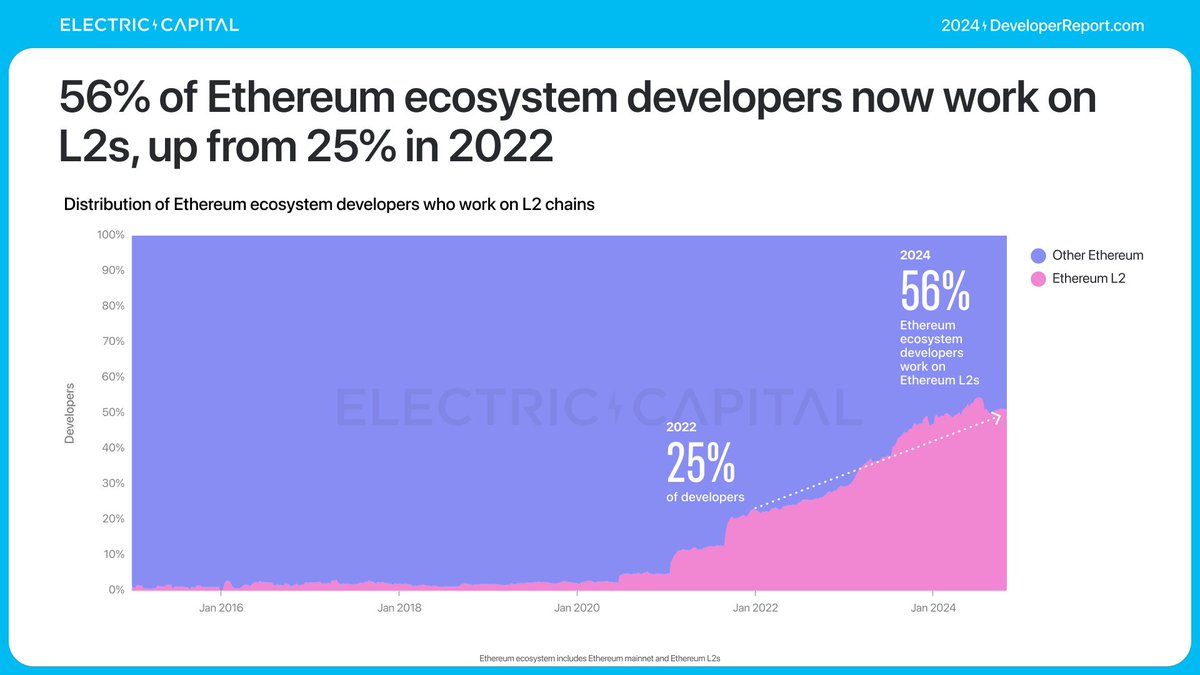

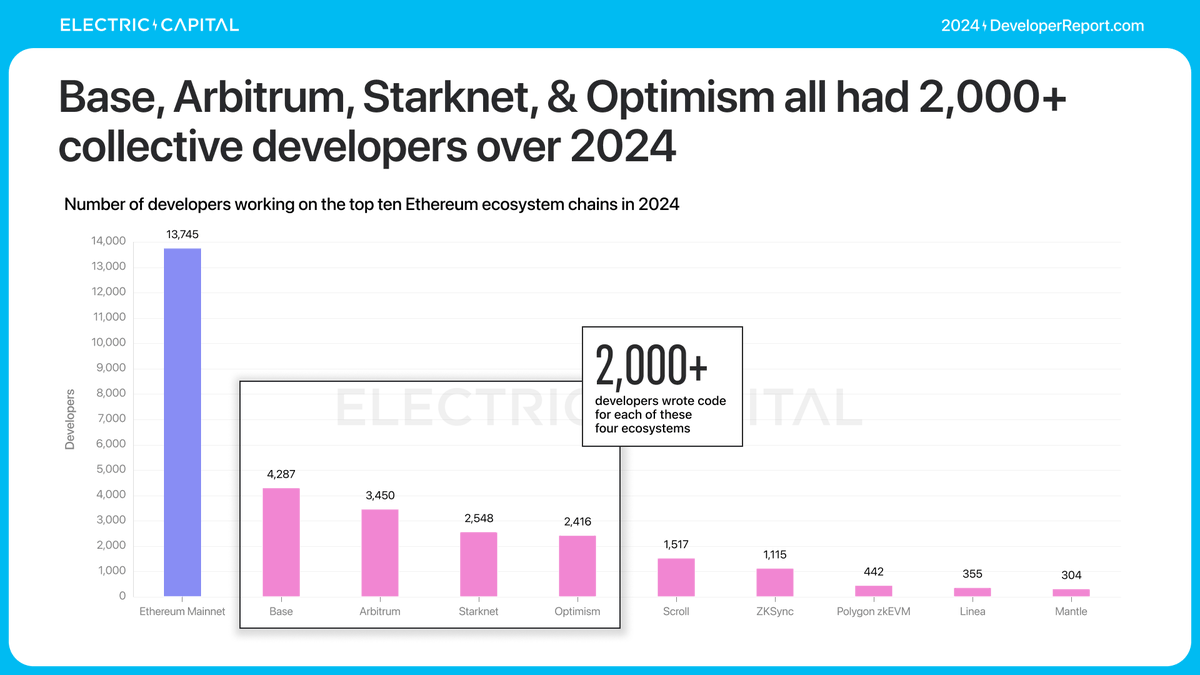

ETH L2s see dramatic developer growth in the last 4 years.

ETH L2s combined has 3,592 monthly active devs -- 67% annualized growth since @arbitrum launch in 2021.

ETH L2s combined has 3,592 monthly active devs -- 67% annualized growth since @arbitrum launch in 2021.

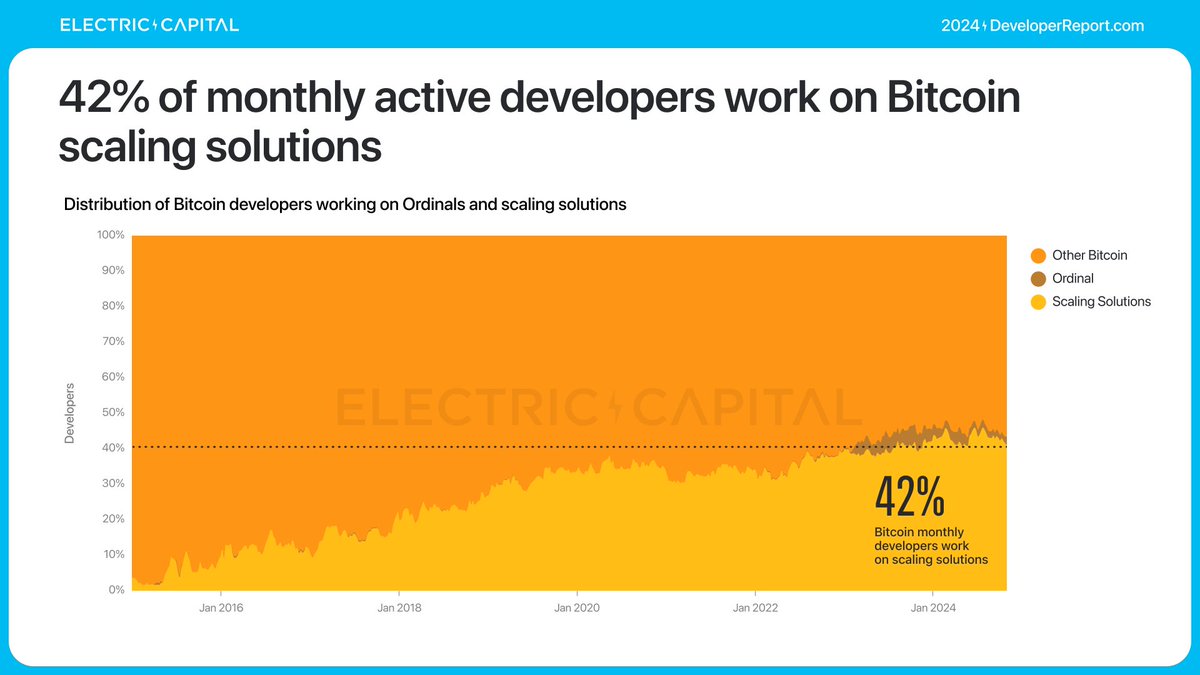

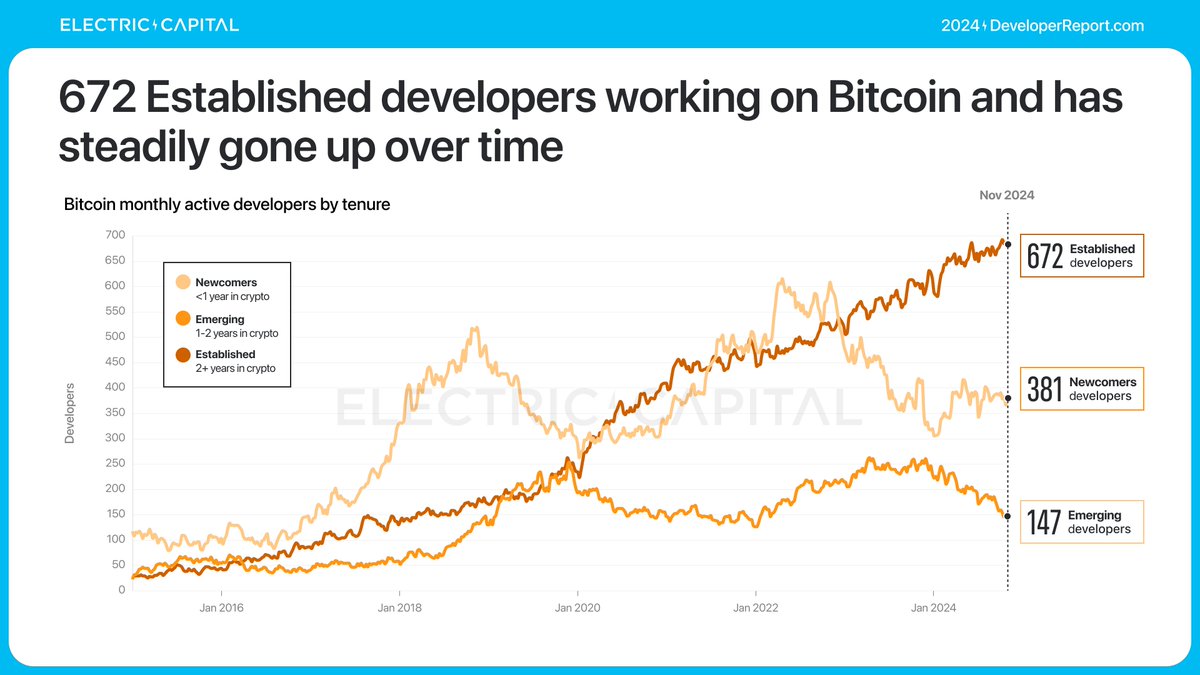

Bitcoin shows steady development and consistency.

1,200 monthly active developers, consistent over 2024.

1,200 monthly active developers, consistent over 2024.

Established Bitcoin devs (working for 2+ years) has steadily gone up. It is at its highest at 672 monthly active Established Bitcoin devs.

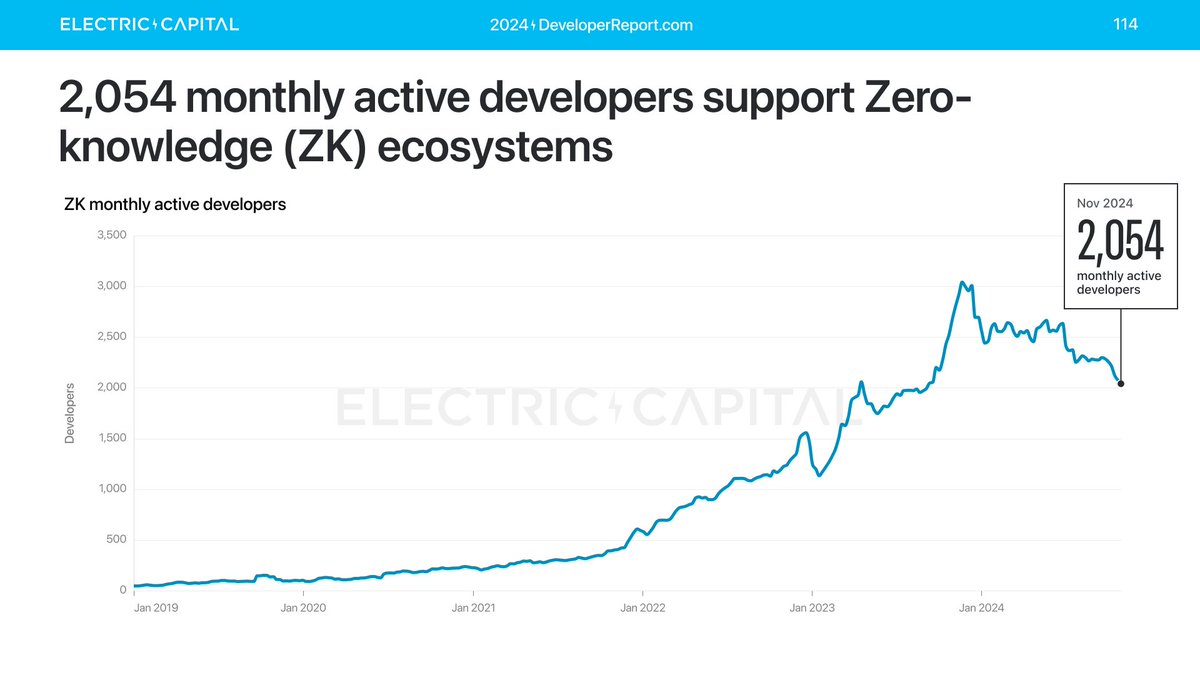

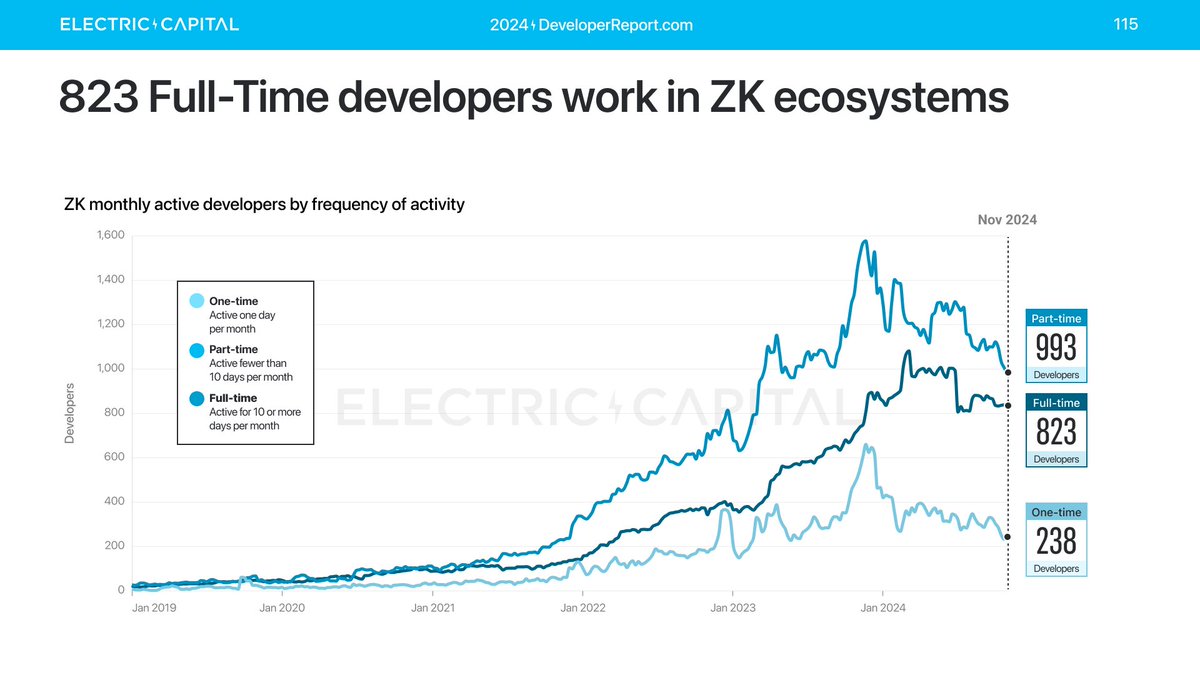

ZK is a developer focused sector coming out of research. How is that doing?

Over 2,000 monthly active developers work on ZK ecosystems. 823 monthly active devs are Full-time, committing 10+ days out of a month.

Over 2,000 monthly active developers work on ZK ecosystems. 823 monthly active devs are Full-time, committing 10+ days out of a month.

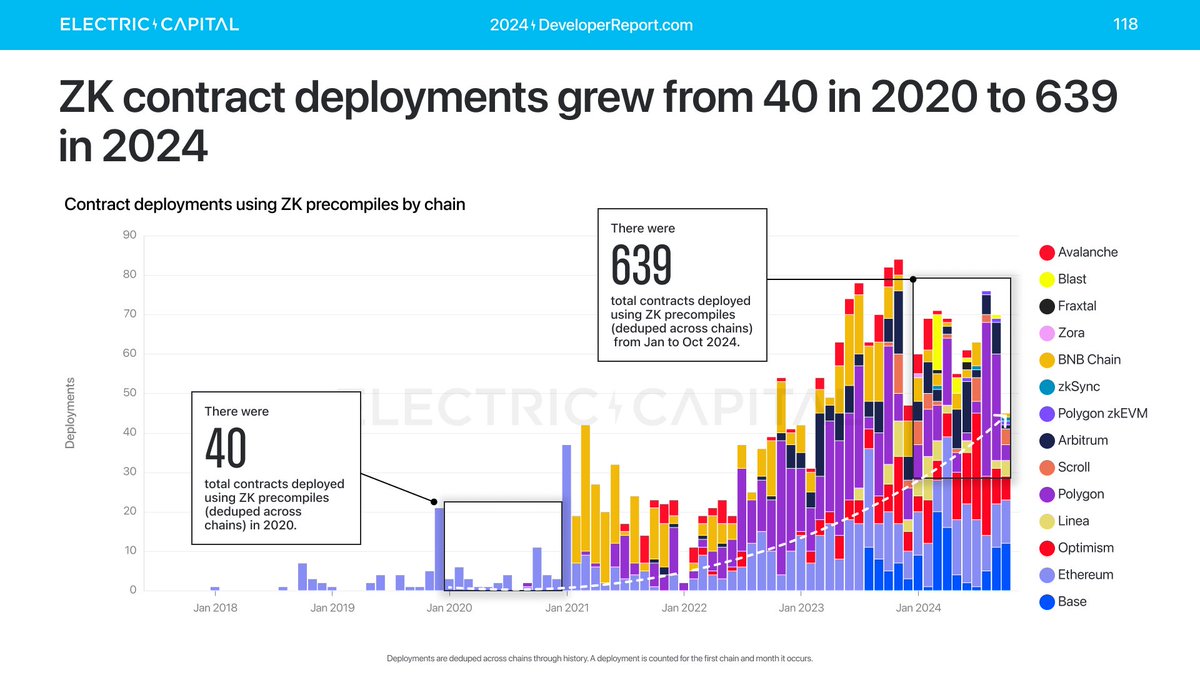

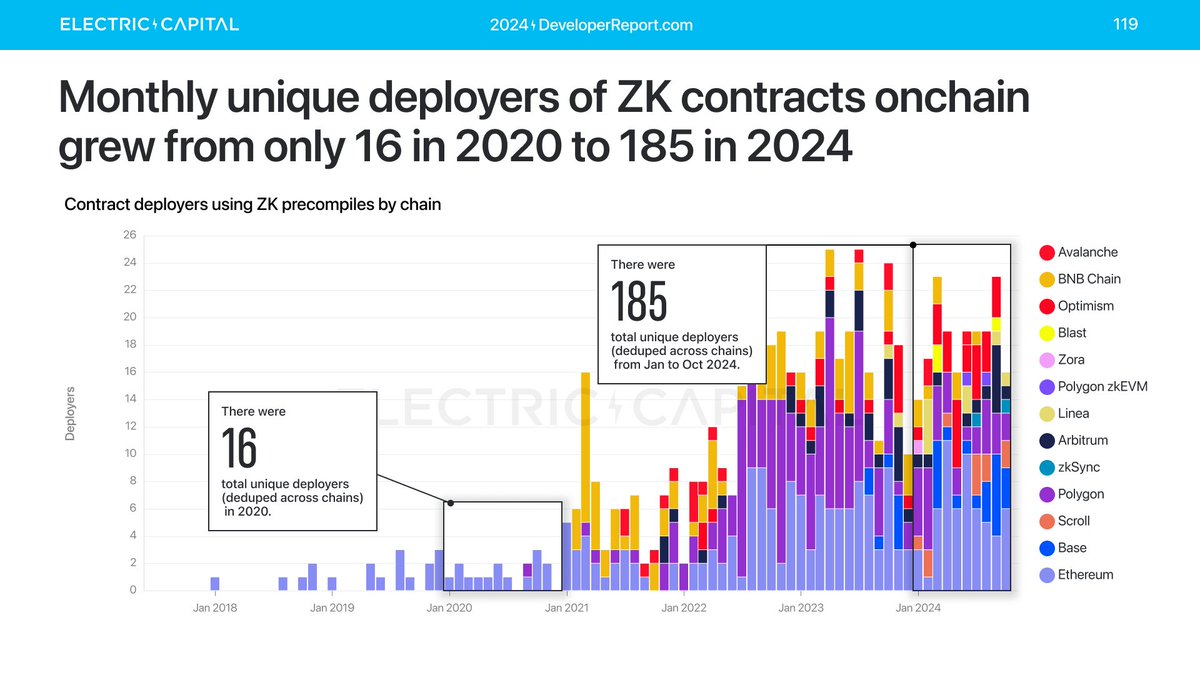

ZK deployments have also grown on chain from 40 in 2020 to 639 in 2024. Numbers are modest, but show clear growth. Deployers also grew.

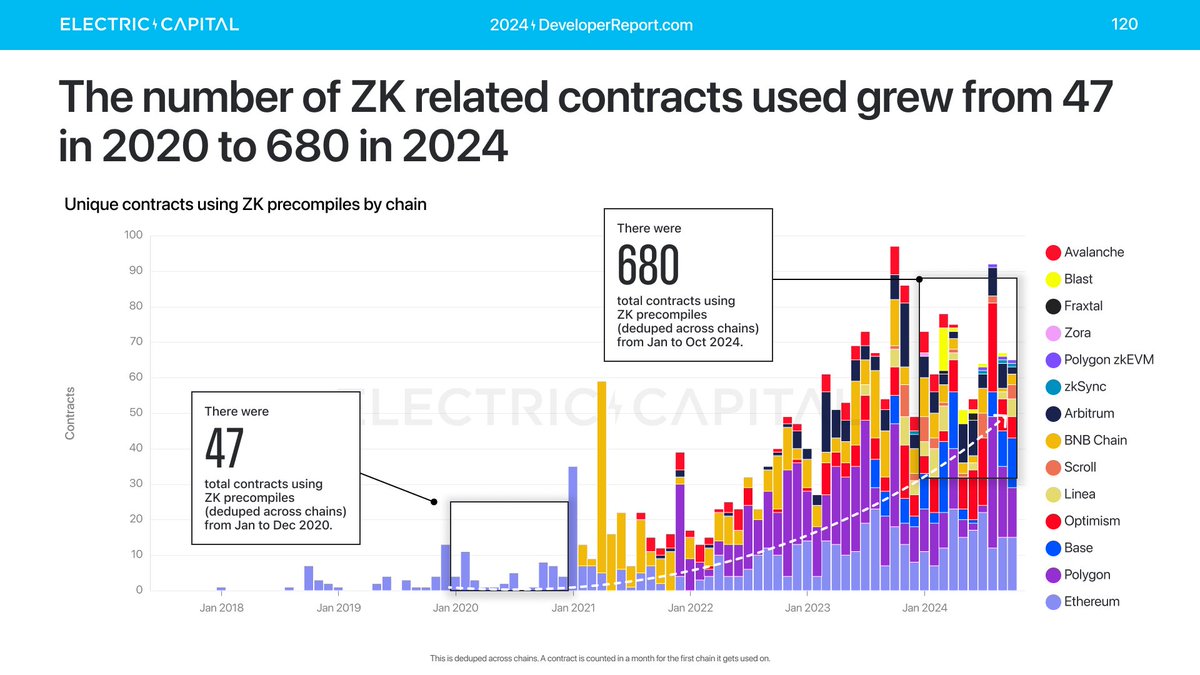

ZK is also getting usage -- contracts using ZK precompiles have grown from 47 in 2020 to 680 this year.

ZK is also getting usage -- contracts using ZK precompiles have grown from 47 in 2020 to 680 this year.

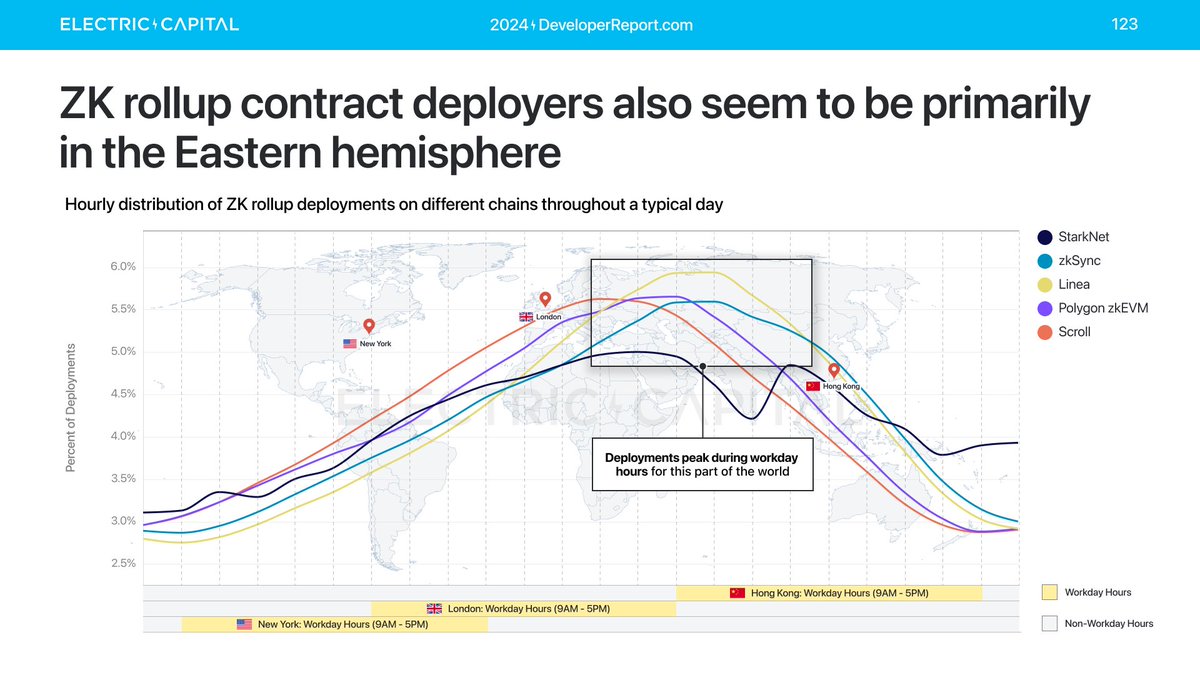

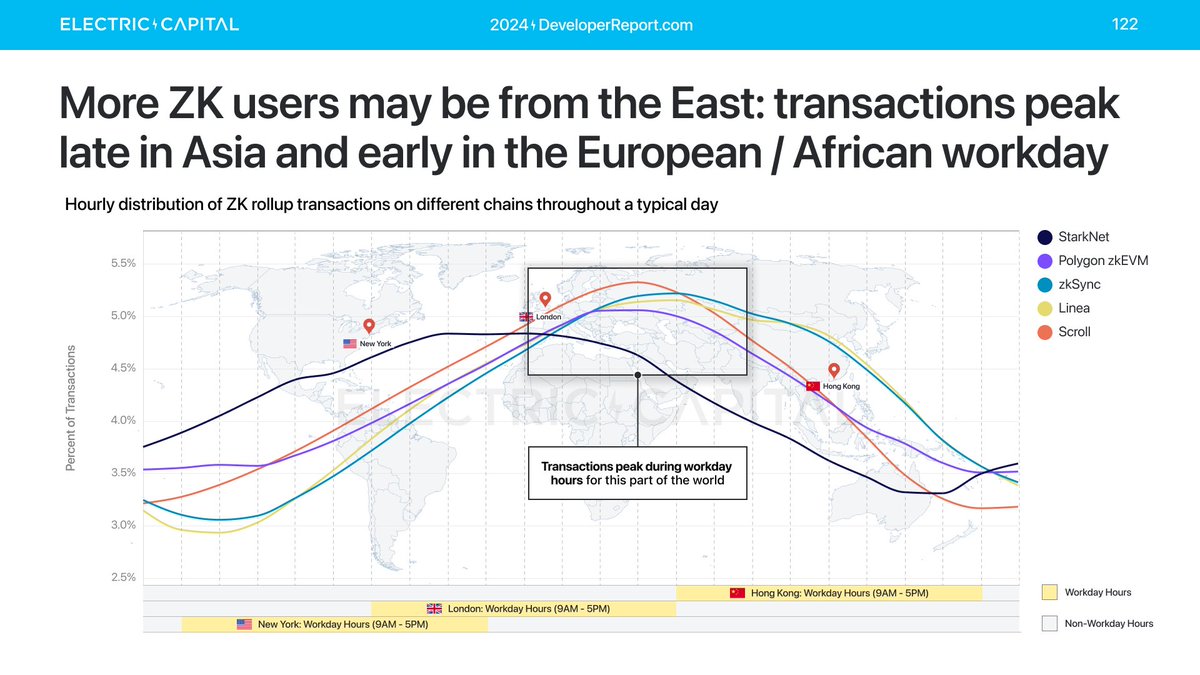

When are ZK devs and users active?

ZK rollup contract deployers are active during work hours in the Eastern hemisphere. This is the same for ZK users.

ZK users & deployers appear to concentrate in the Eastern hemisphere in Eastern Europe, Africa, and Asia.

ZK rollup contract deployers are active during work hours in the Eastern hemisphere. This is the same for ZK users.

ZK users & deployers appear to concentrate in the Eastern hemisphere in Eastern Europe, Africa, and Asia.

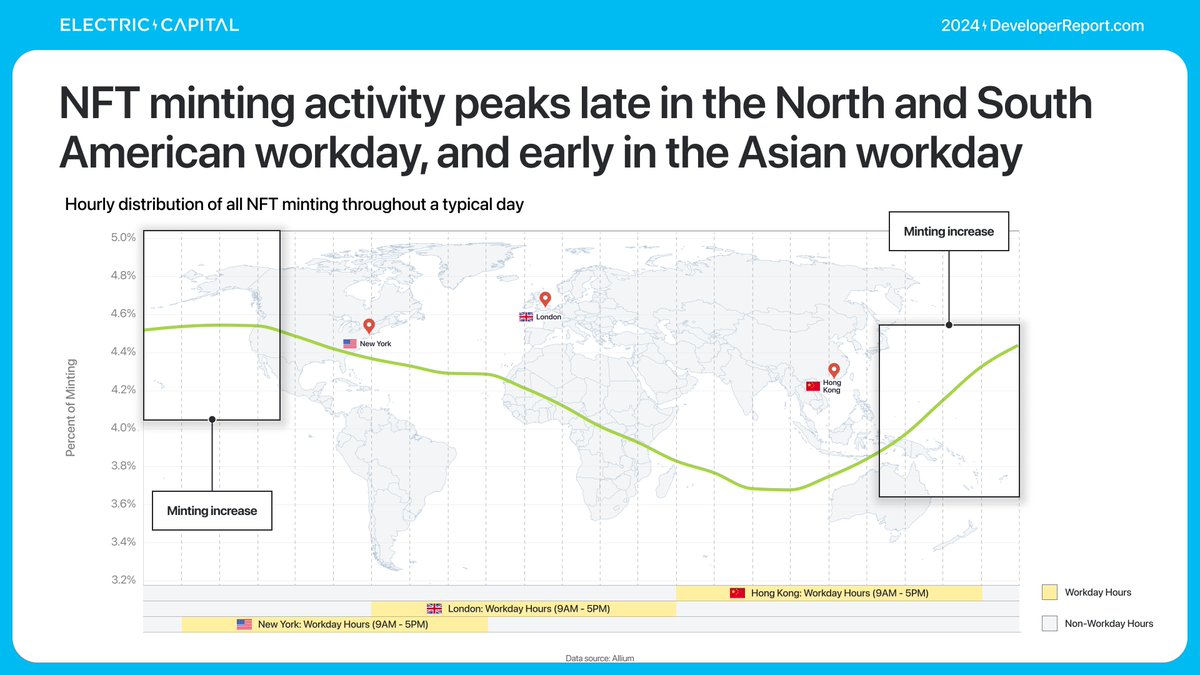

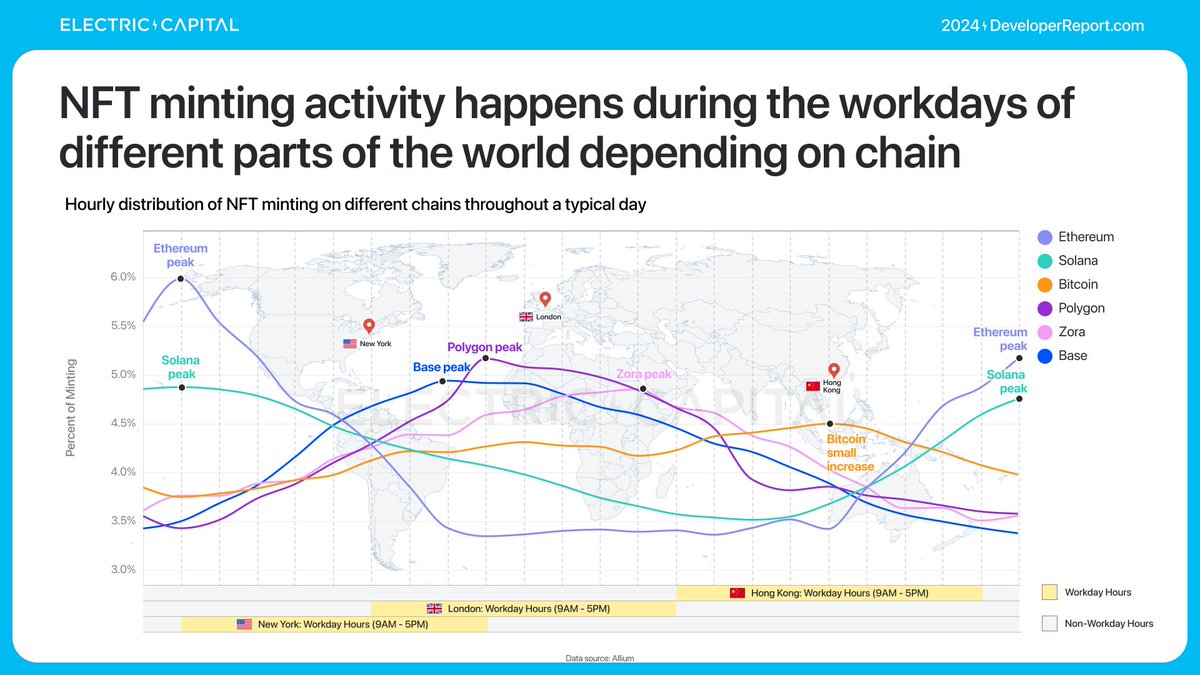

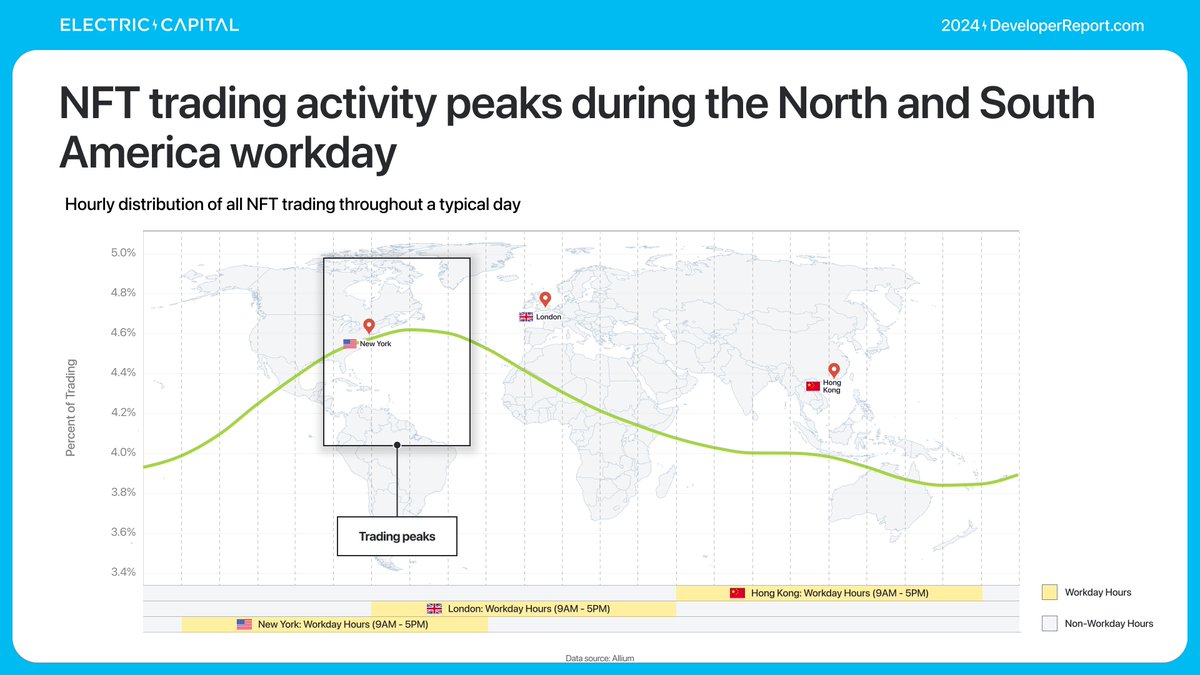

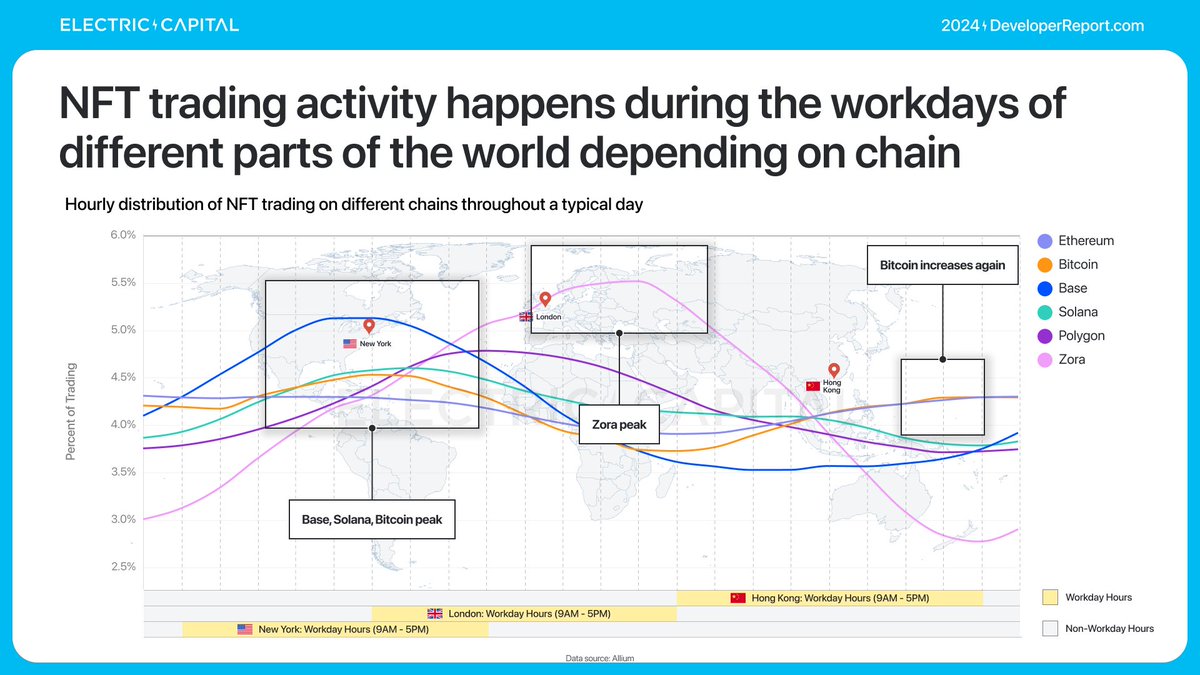

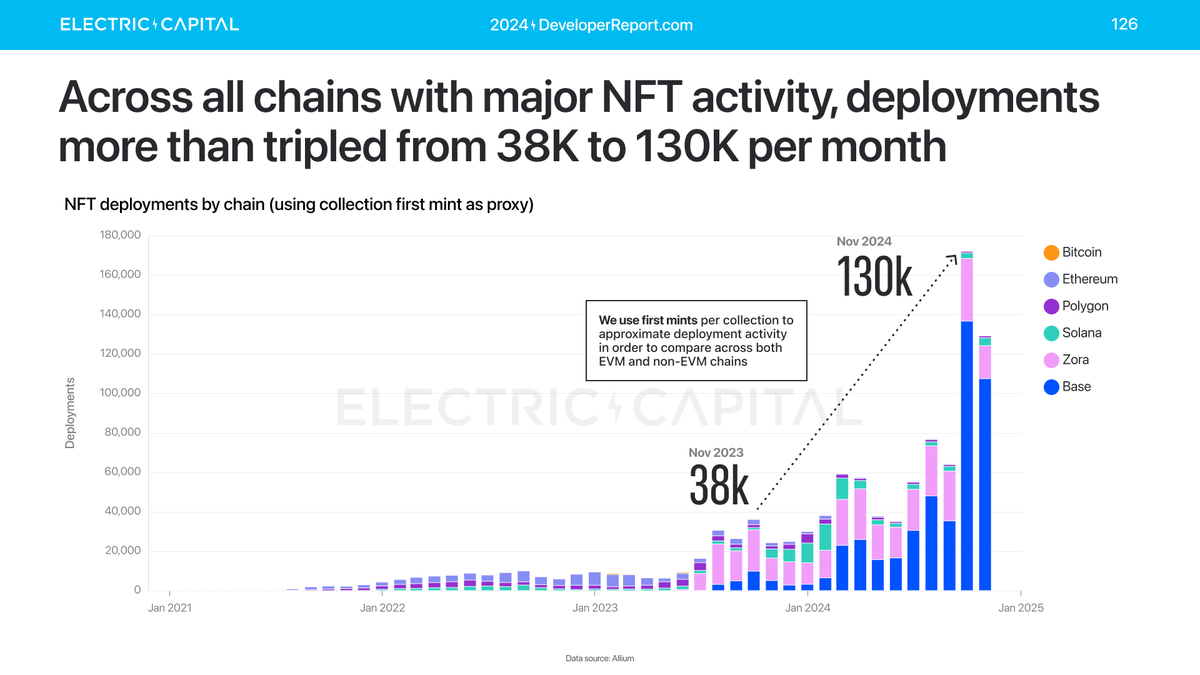

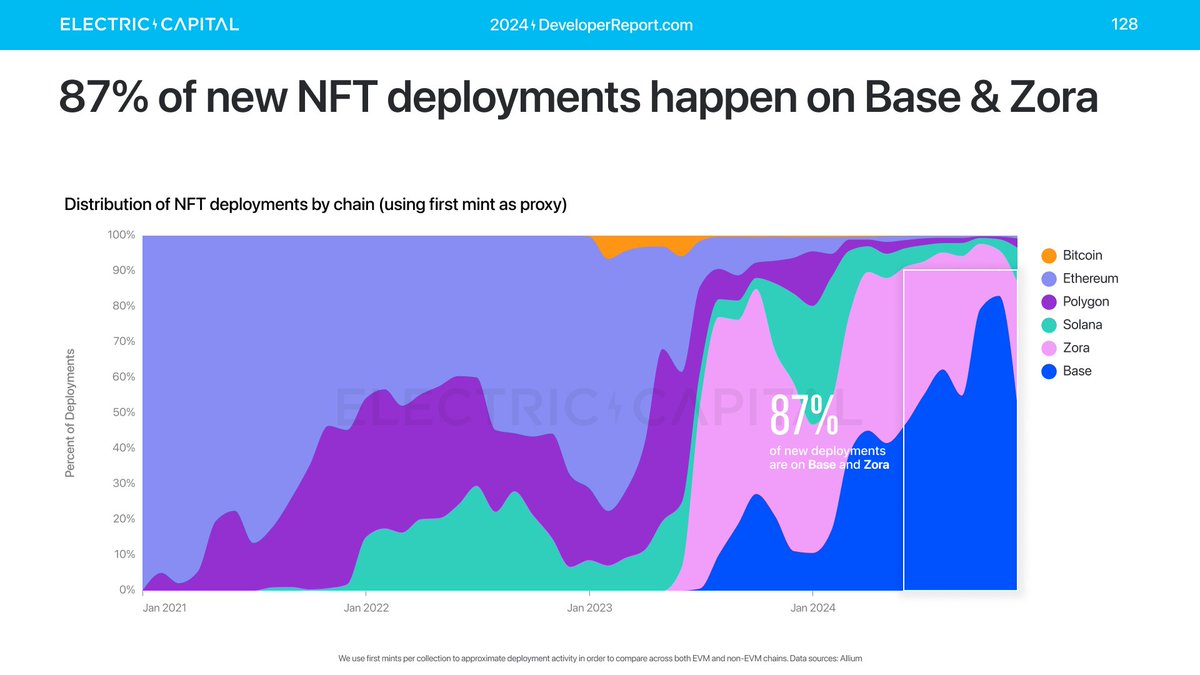

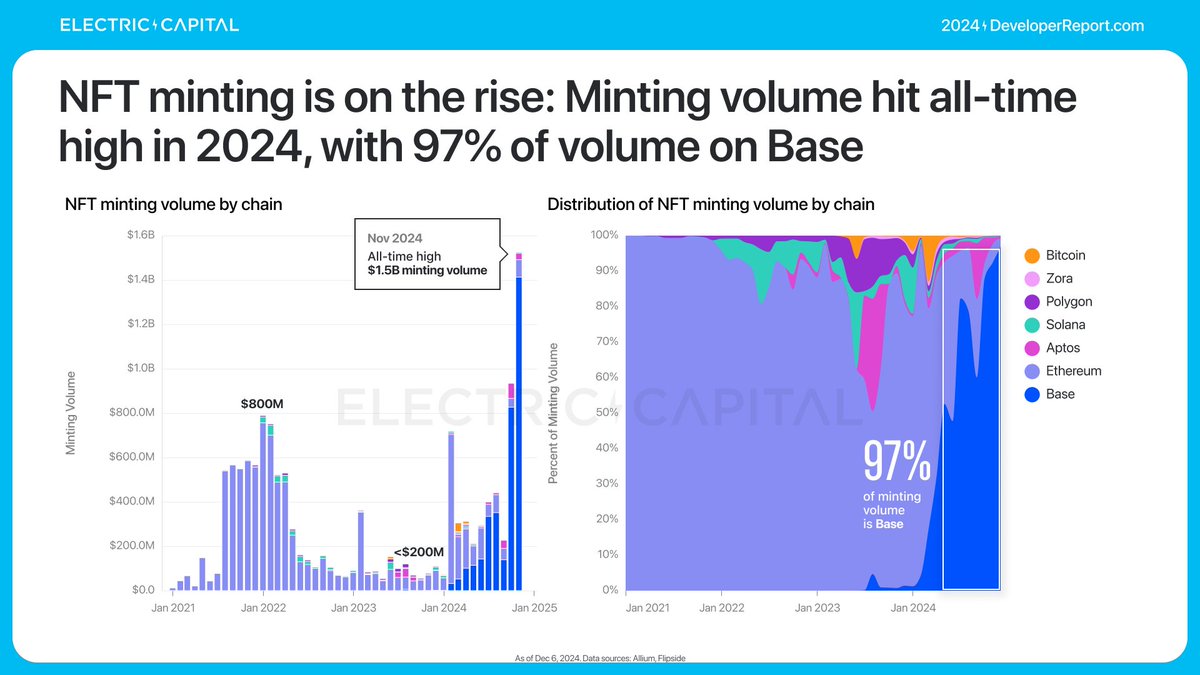

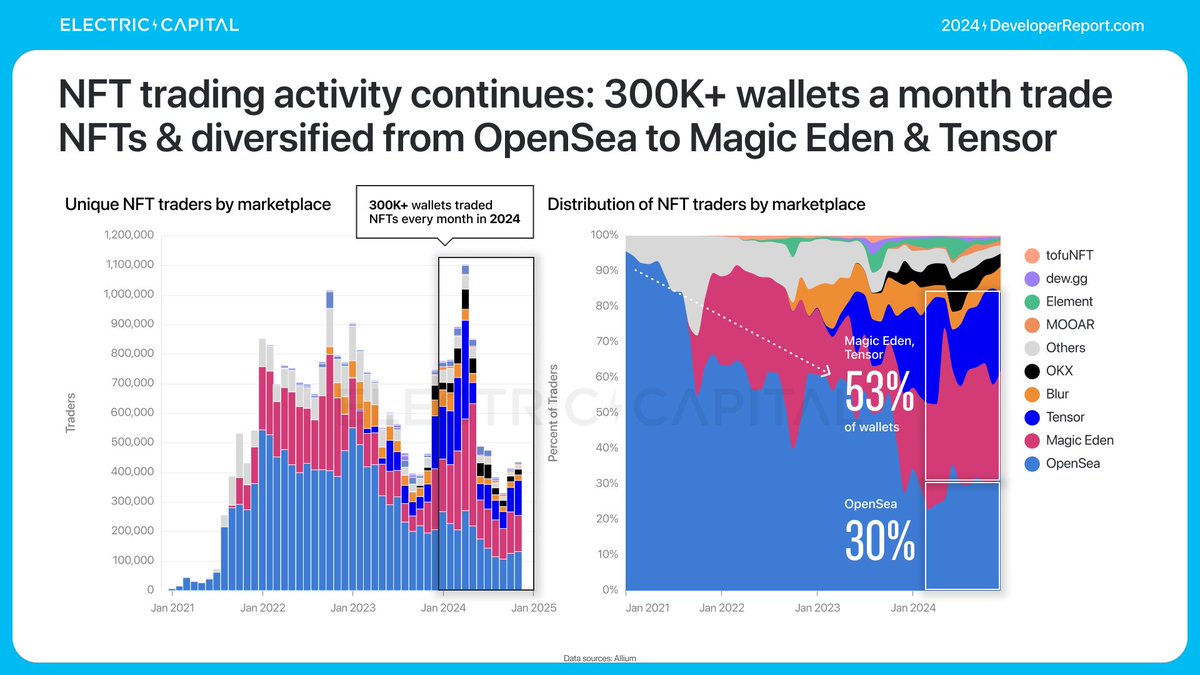

NFTs and DeFi are established use cases in crypto -- most top smart contracts relate to NFTs or DeFi. How have these use cases evolved? Let's start with NFTs.

Across all chains with major NFT activity (Bitcoin, Ethereum, Polygon, Solana, Zora, Base), NFT deployments grew more than 3x YoY.

NFT deployments are at all time highs. 87% of new deployments happen on @base and @zora.

NFT deployments are at all time highs. 87% of new deployments happen on @base and @zora.

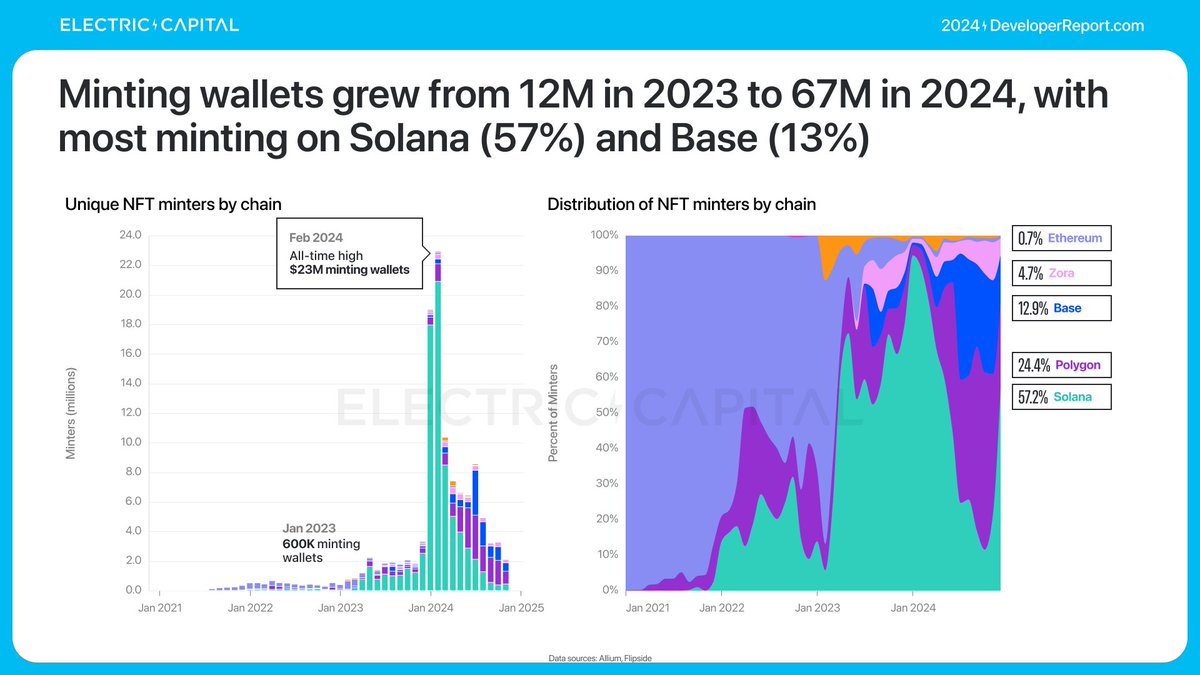

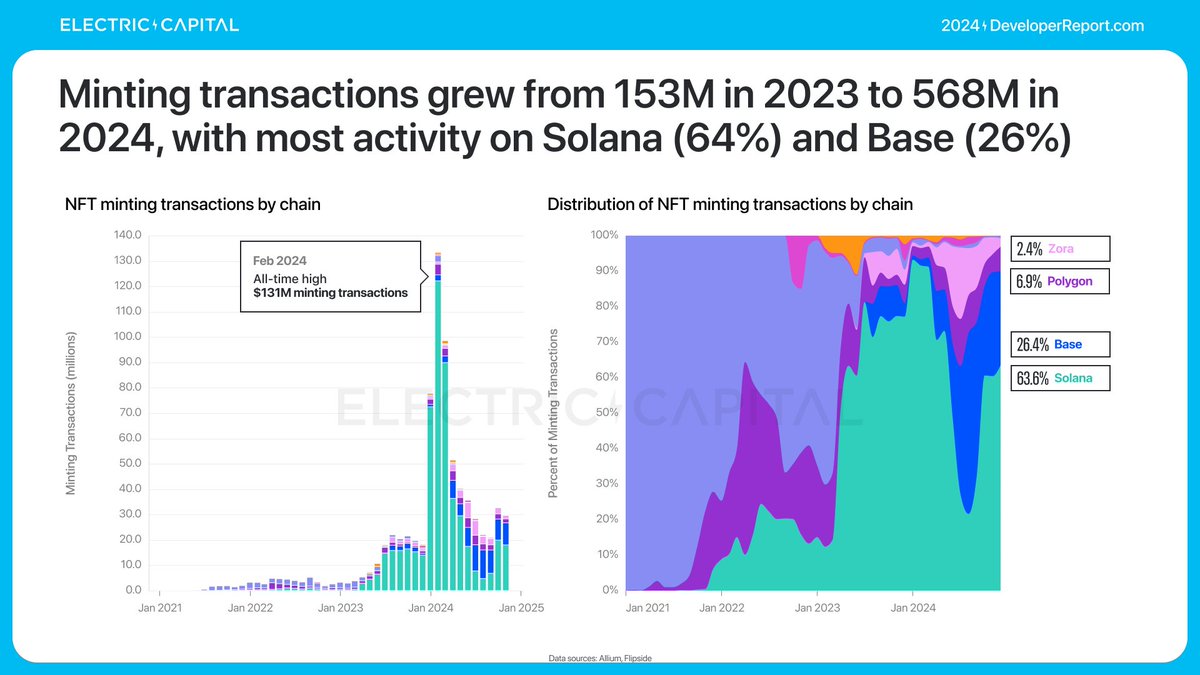

NFT activity has shifted significantly toward minting.

NFT minting hit an all-time high in 2024 and 97% happening on @base.

@solana has 57% of minting wallets and captures 64% of mint transactions.

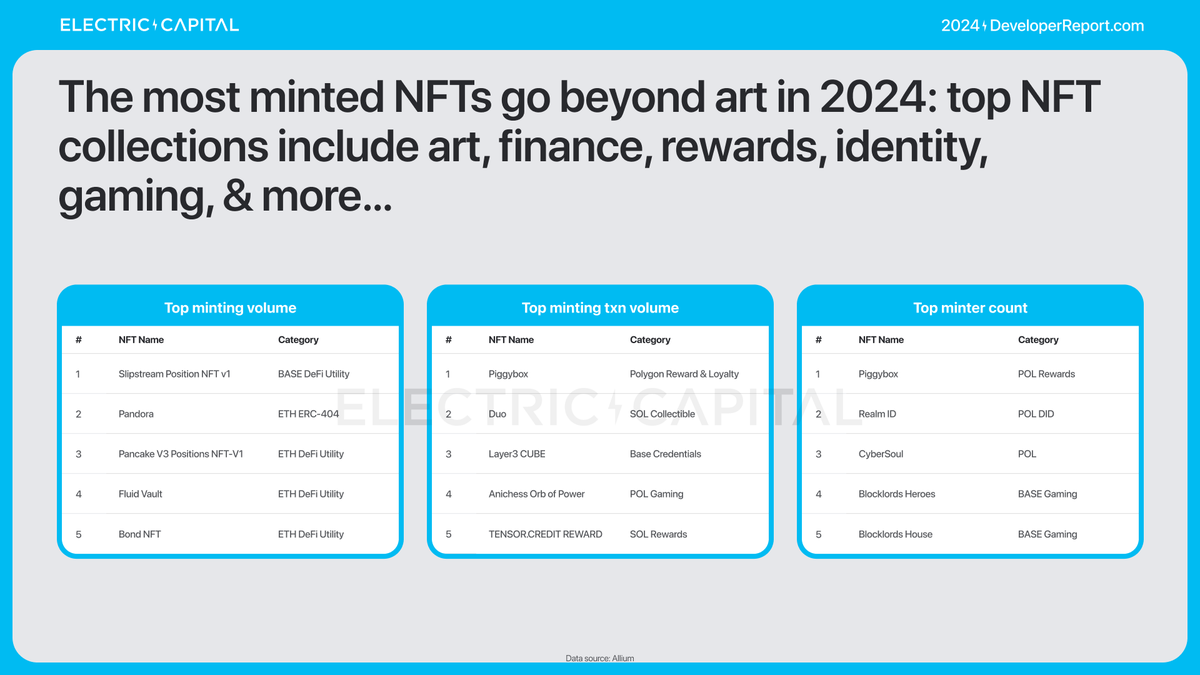

Minting activity has increased because NFTs go well beyond art in 2024.

NFT minting hit an all-time high in 2024 and 97% happening on @base.

@solana has 57% of minting wallets and captures 64% of mint transactions.

Minting activity has increased because NFTs go well beyond art in 2024.

NFT trading remains an important primitive and has diversified from OpenSea to Magic Eden and Tensor.

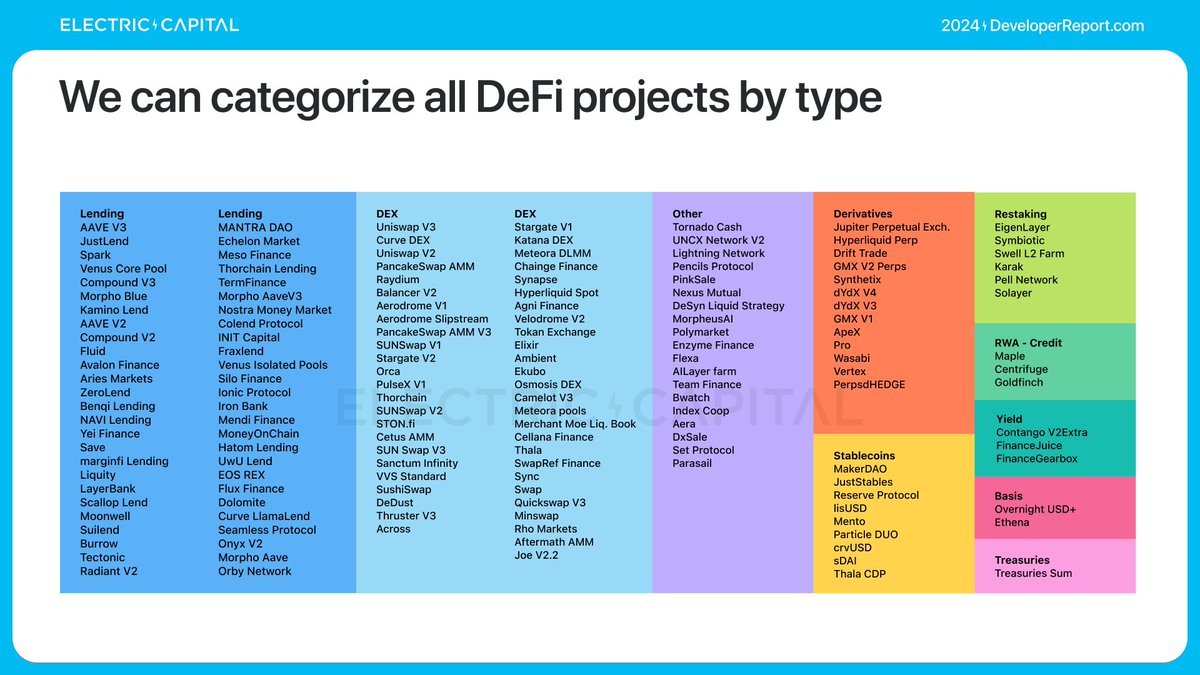

Let's explore DeFi.

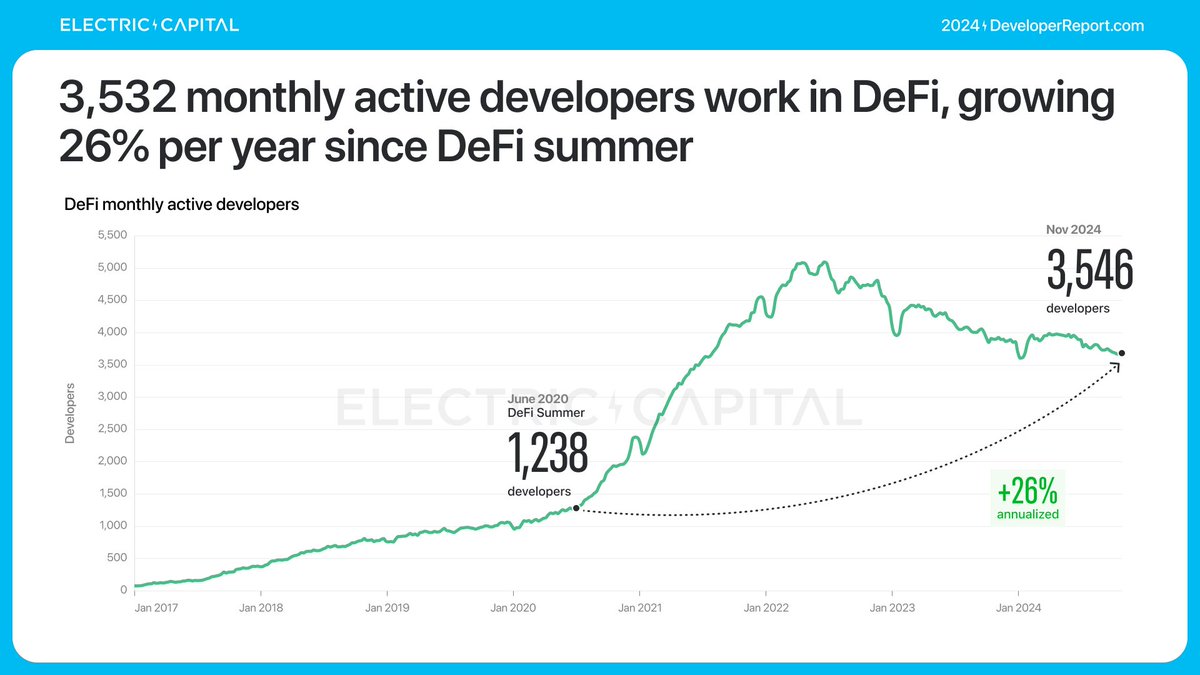

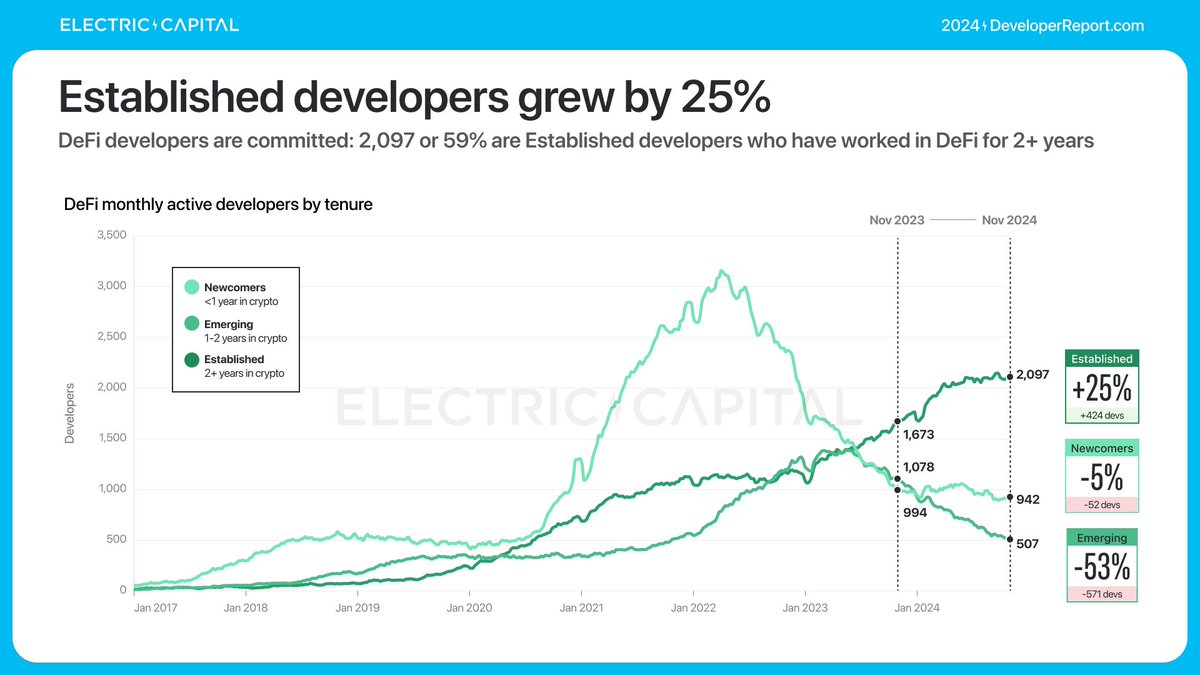

3,532 monthly active developers build in DeFi. DeFi developers are experienced -- 2097, or 59% have worked in DeFi for 2+ years.

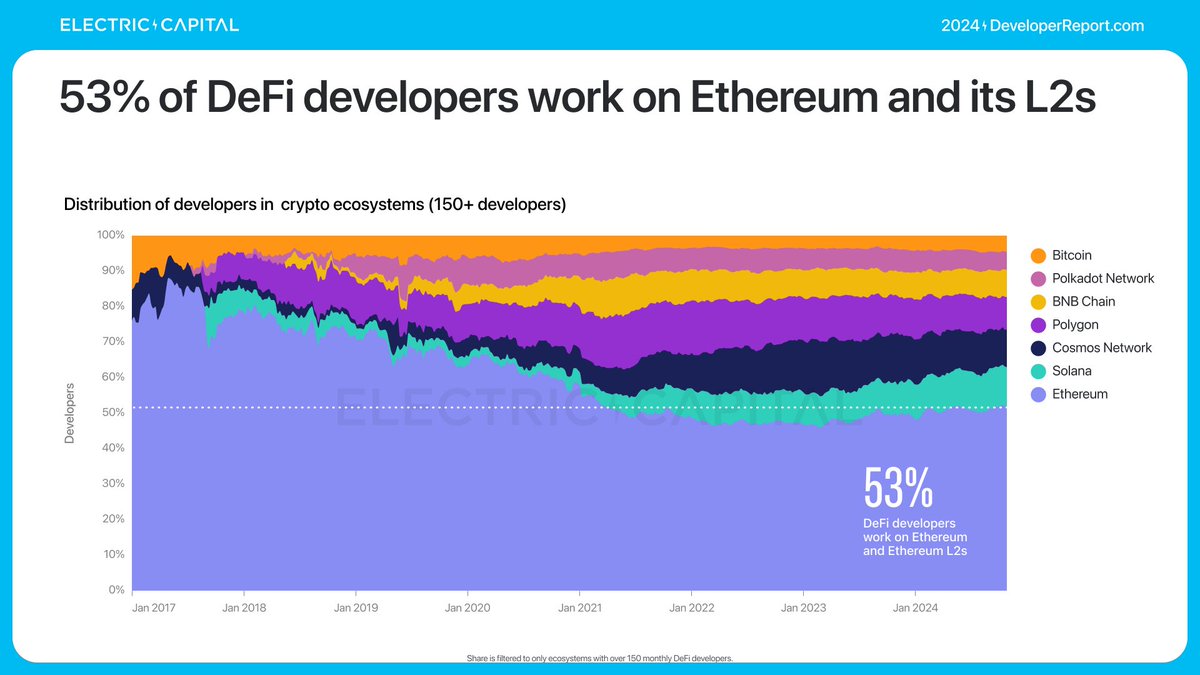

53% of DeFi developers work on Ethereum and its L2s.

3,532 monthly active developers build in DeFi. DeFi developers are experienced -- 2097, or 59% have worked in DeFi for 2+ years.

53% of DeFi developers work on Ethereum and its L2s.

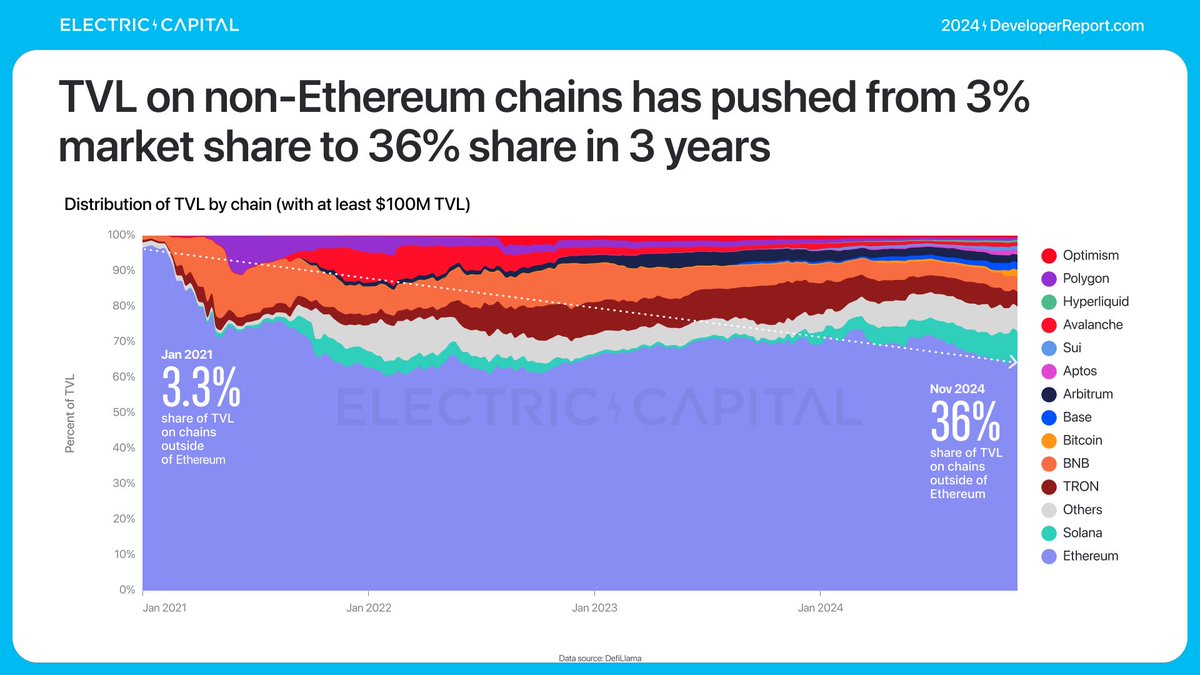

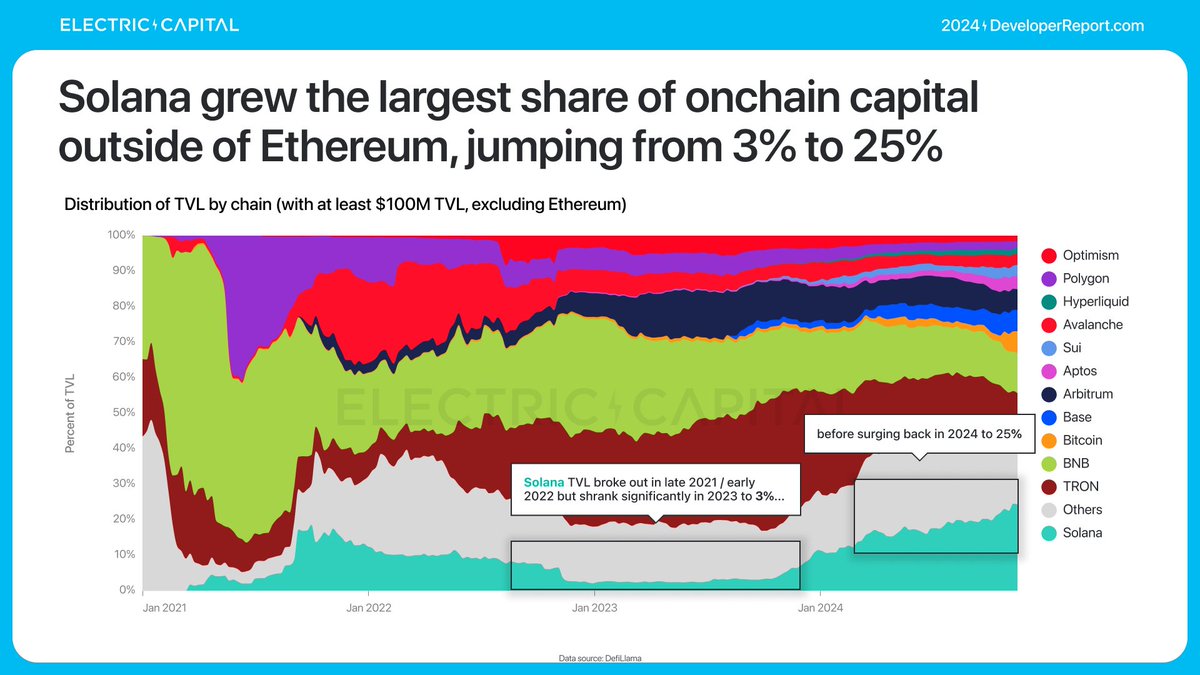

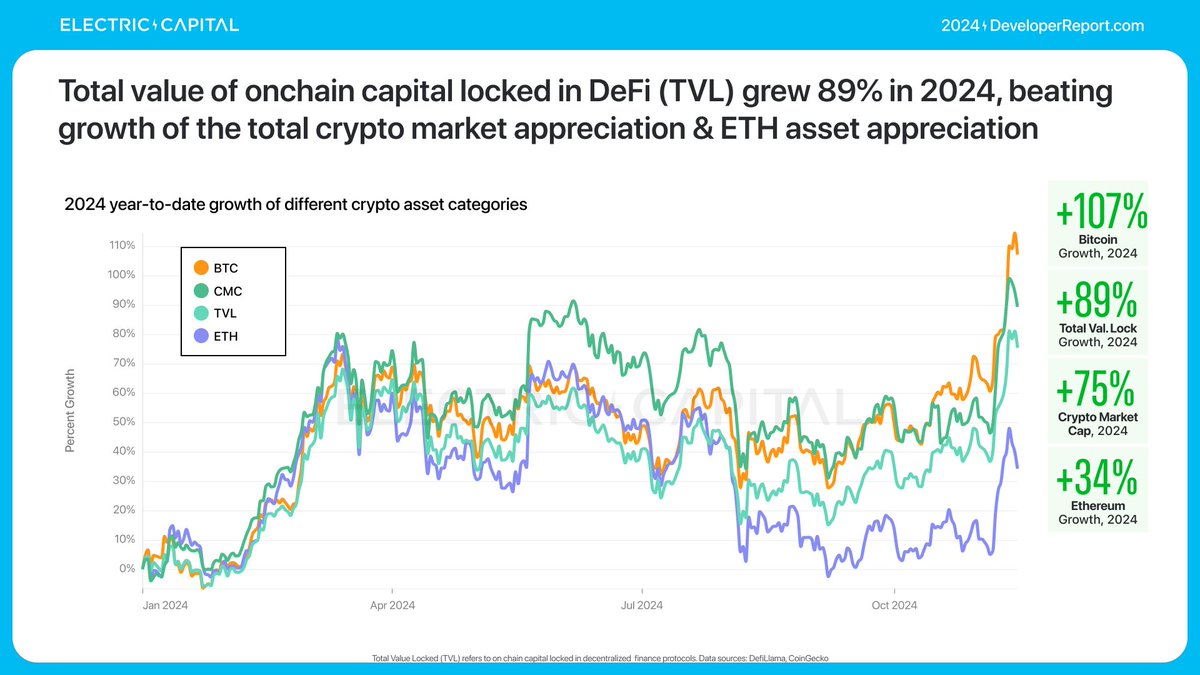

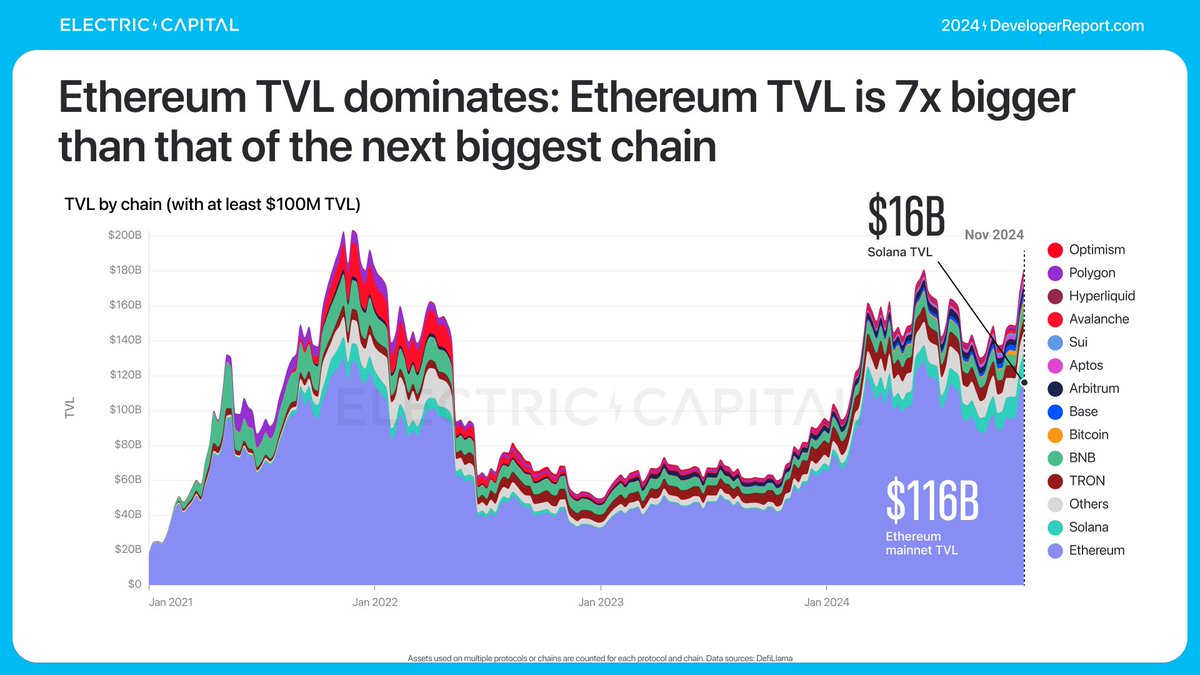

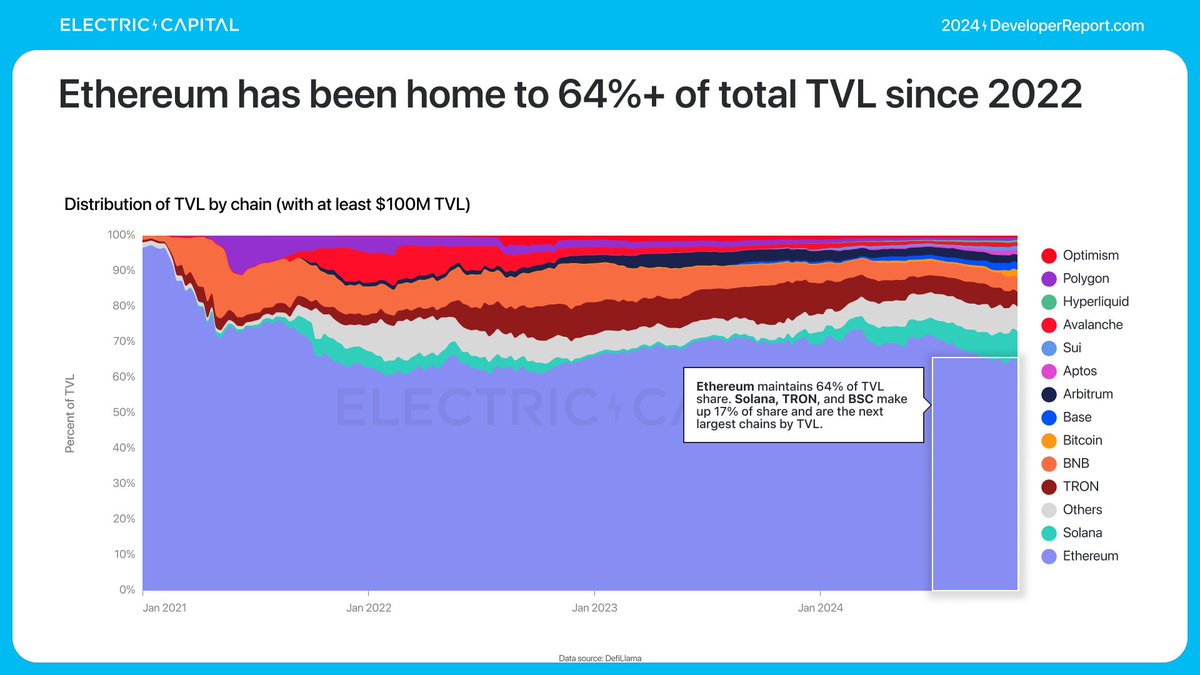

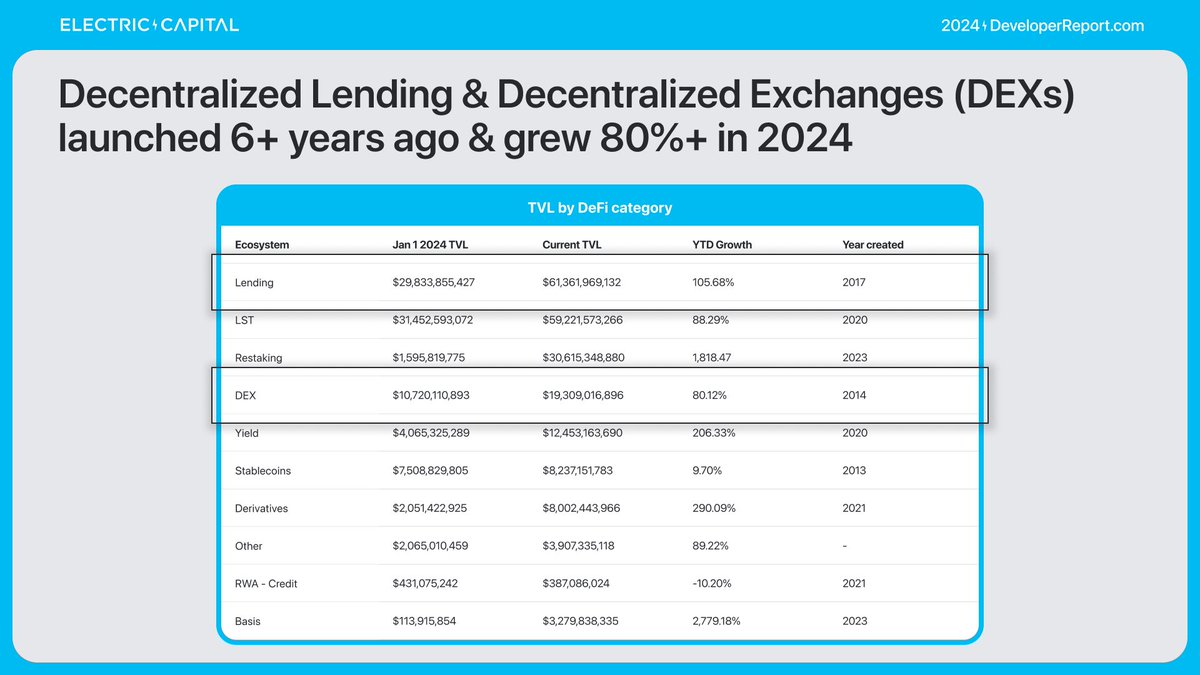

DeFi TVL grew 89% in 2024. Ethereum TVL dominates and is 7x larger than the next largest chain. The majority of TVL has always lived on Ethereum.

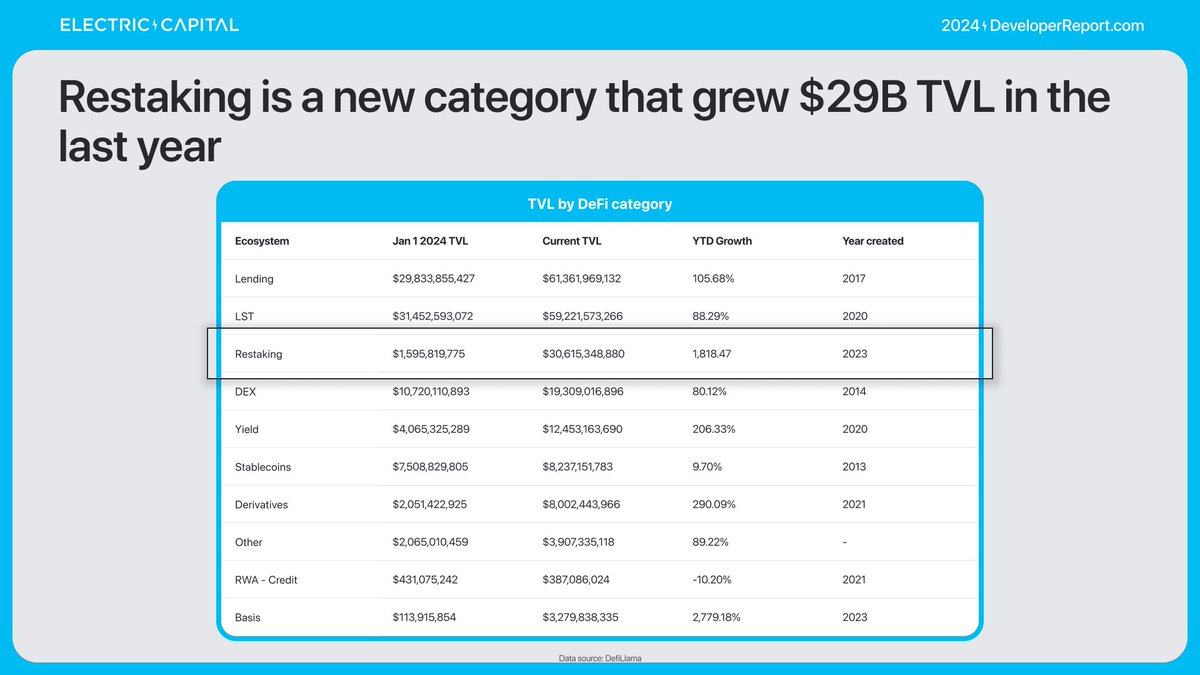

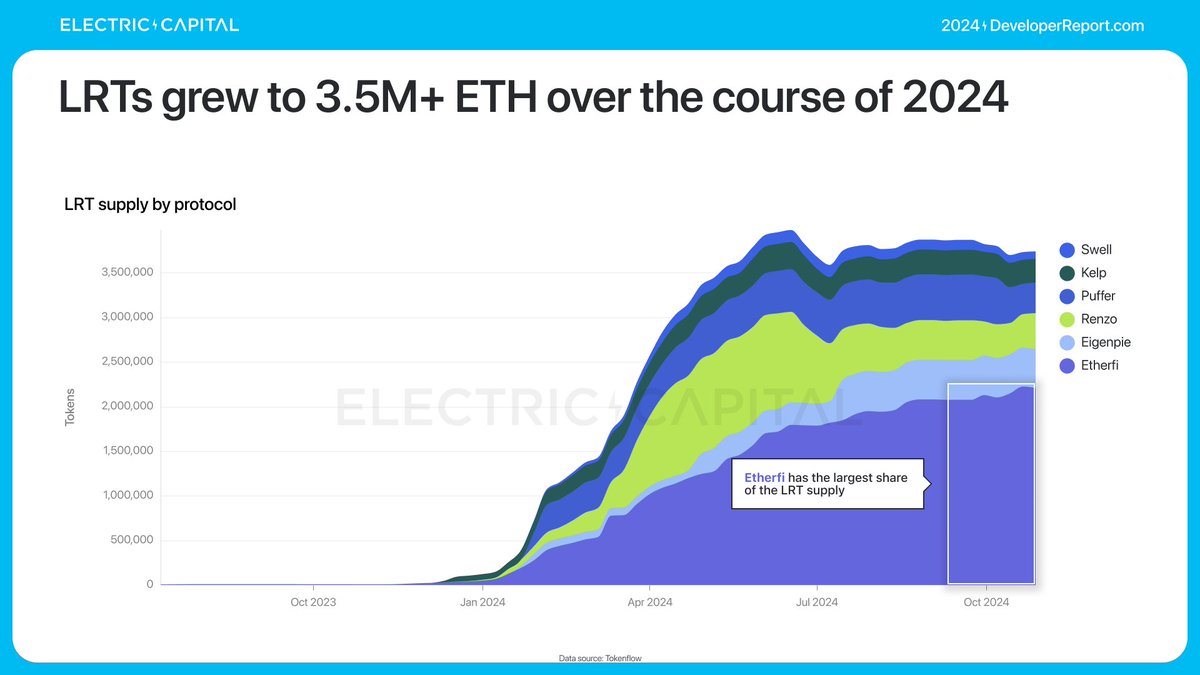

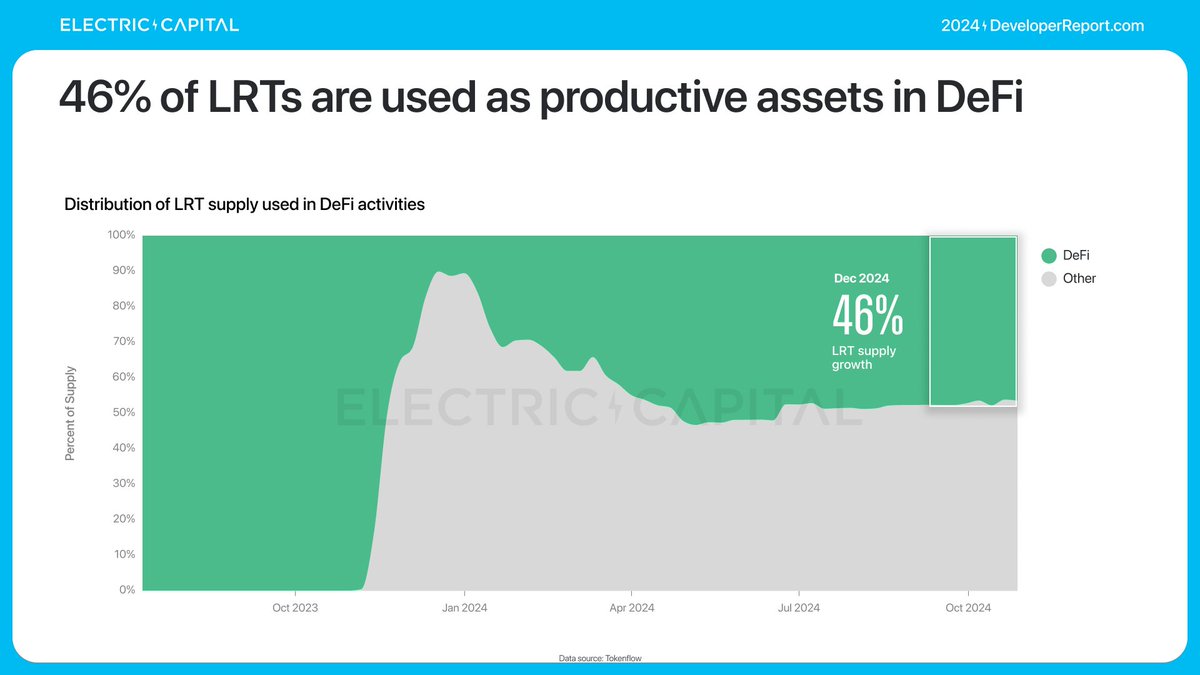

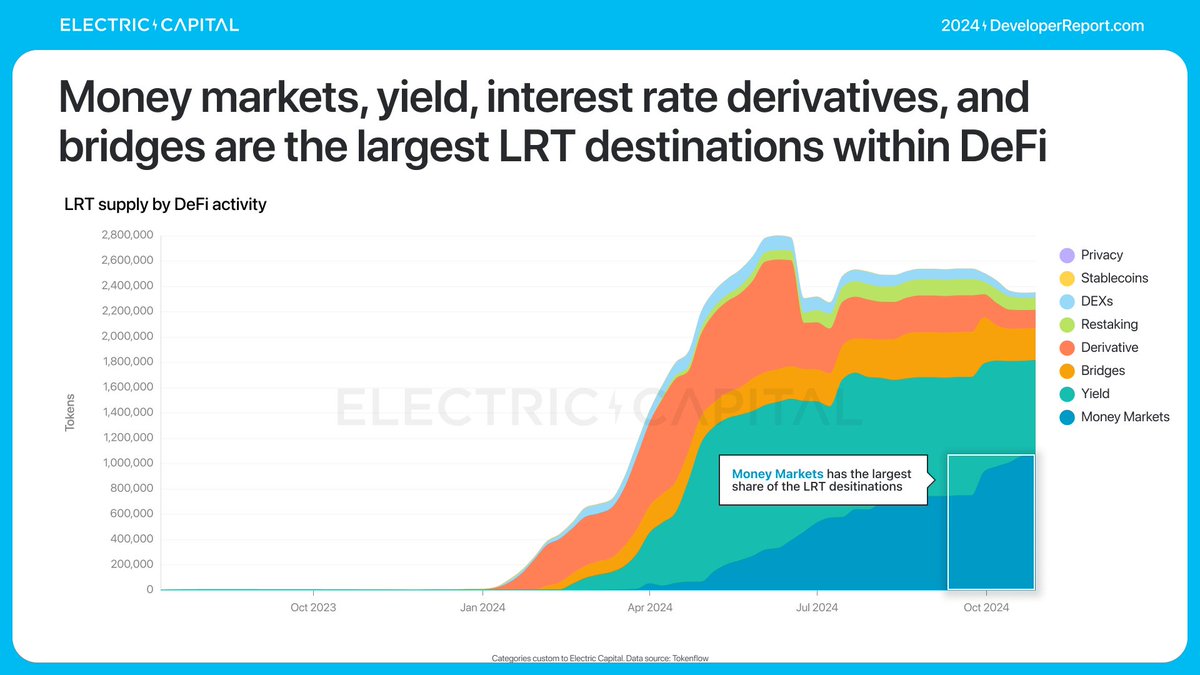

Restaking grew $29B TVL in the last year. LRTs grew to 3.5M+ ETH. 46% of LRTs are productively used in DeFi. Most LRTs are deposited into money markets, yield, interest rate derivatives, and bridges.

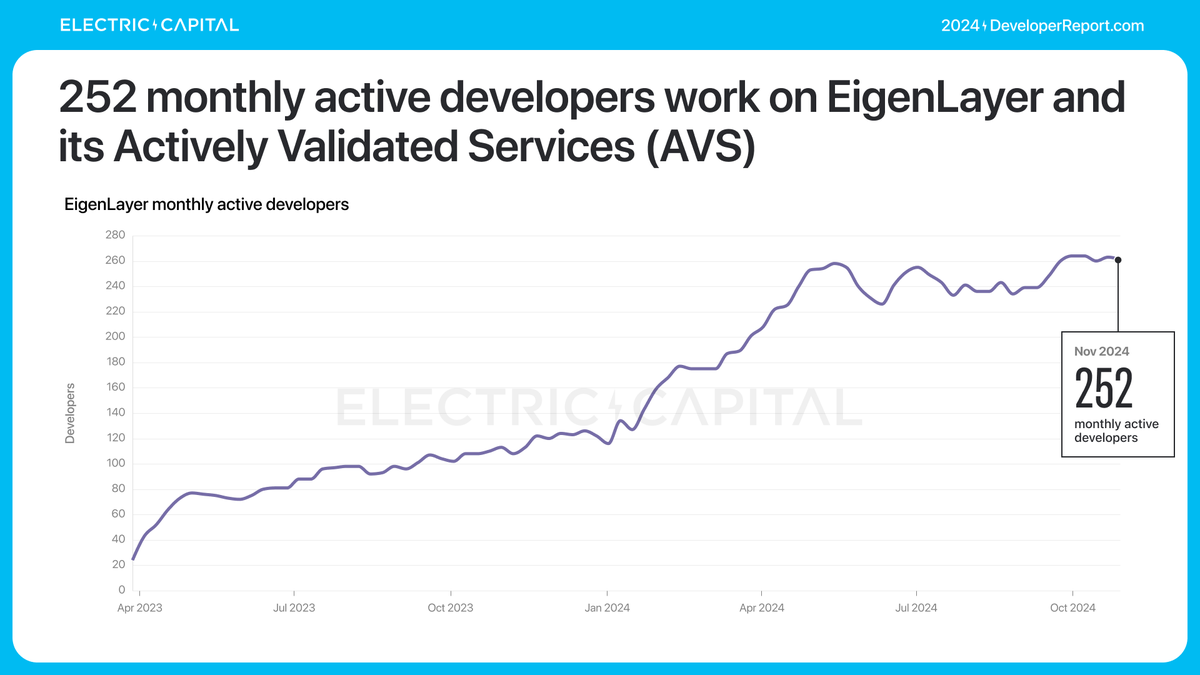

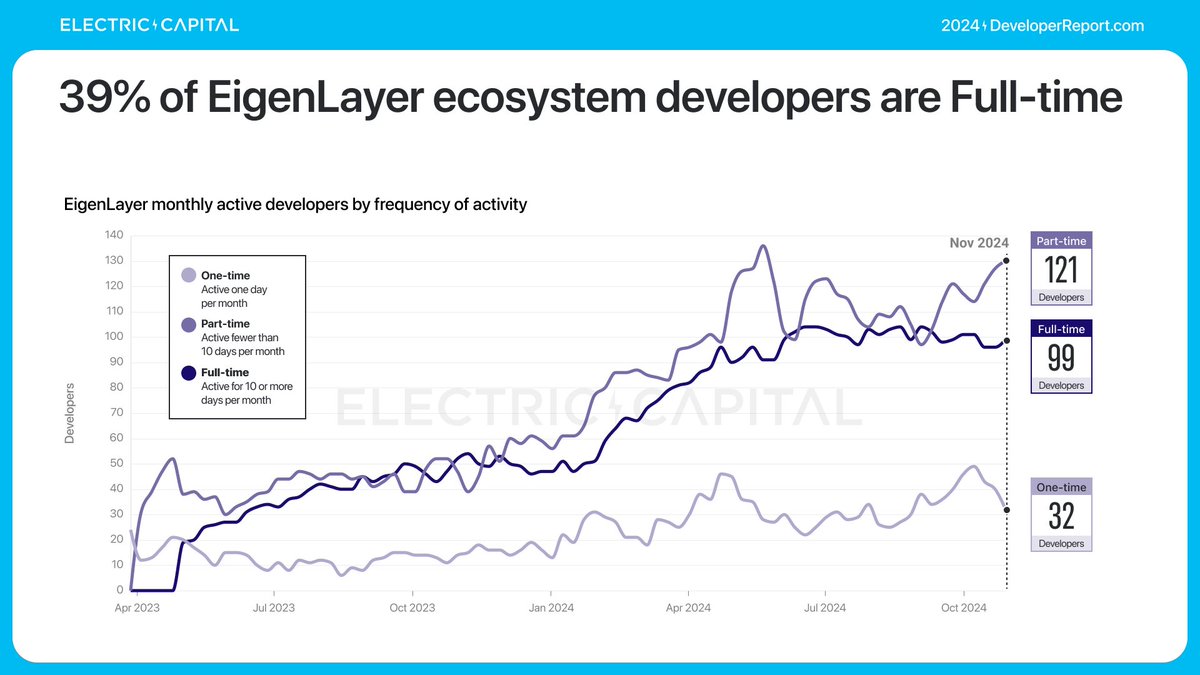

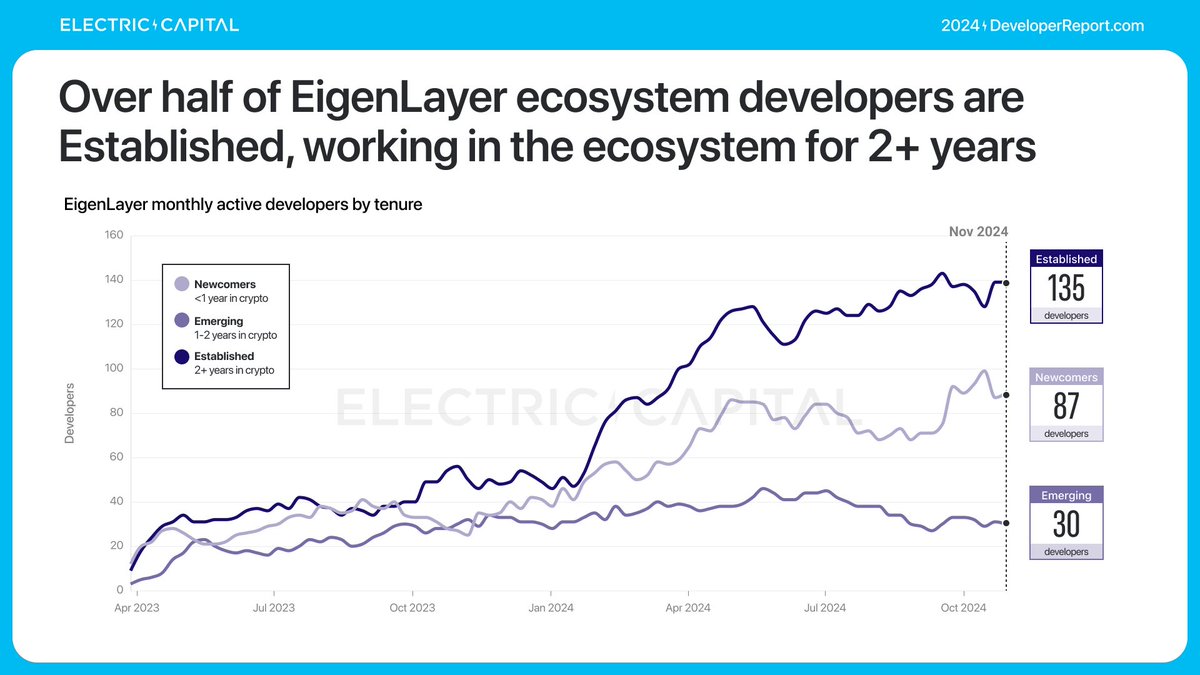

EigenLayer led to the creation of LRTs as a sector. How is the @eigenlayer developer ecosystem doing?

252 monthly active devs work in the EigenLayer ecosystem. EigenLayer developers are committed: 39% are Full-time and over half have worked in the ecosystem for 2+ years.

252 monthly active devs work in the EigenLayer ecosystem. EigenLayer developers are committed: 39% are Full-time and over half have worked in the ecosystem for 2+ years.

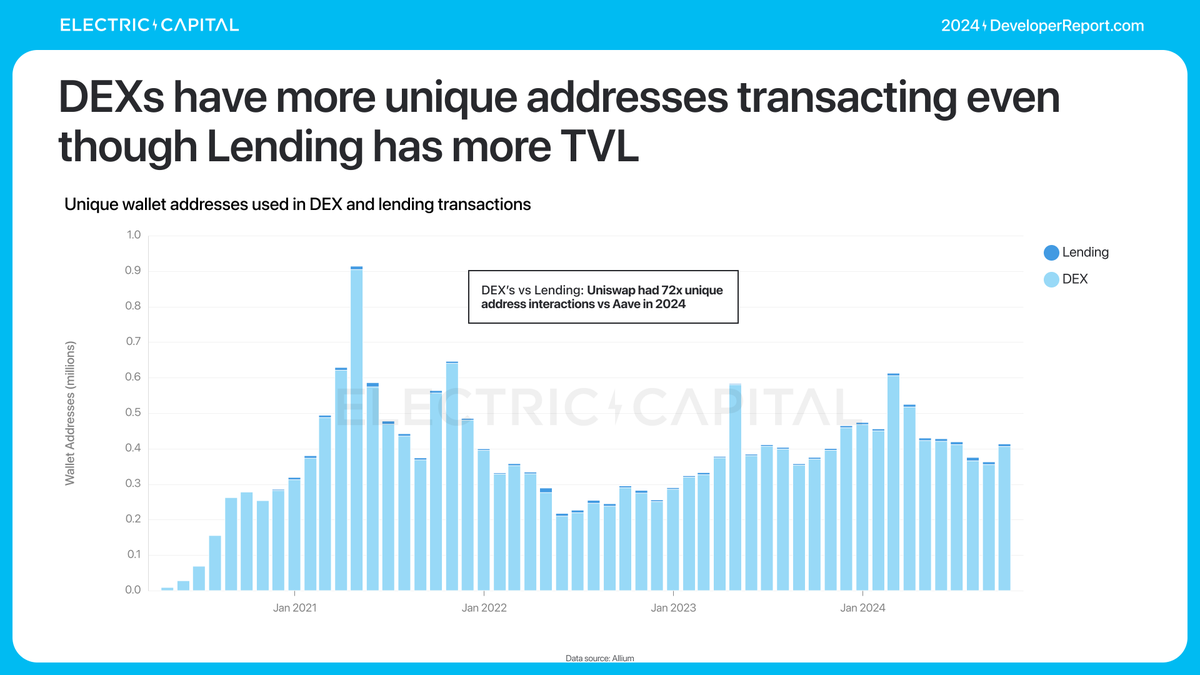

TVL is not the only metric we should look at to understand DeFi usage.

DEXes have more unique addresses transacting even though Lending has 3x more TVL.

As an example -- DEXes vs Lending: @uniswap had 72x unique address interactions vs @aave in 2024

DEXes have more unique addresses transacting even though Lending has 3x more TVL.

As an example -- DEXes vs Lending: @uniswap had 72x unique address interactions vs @aave in 2024

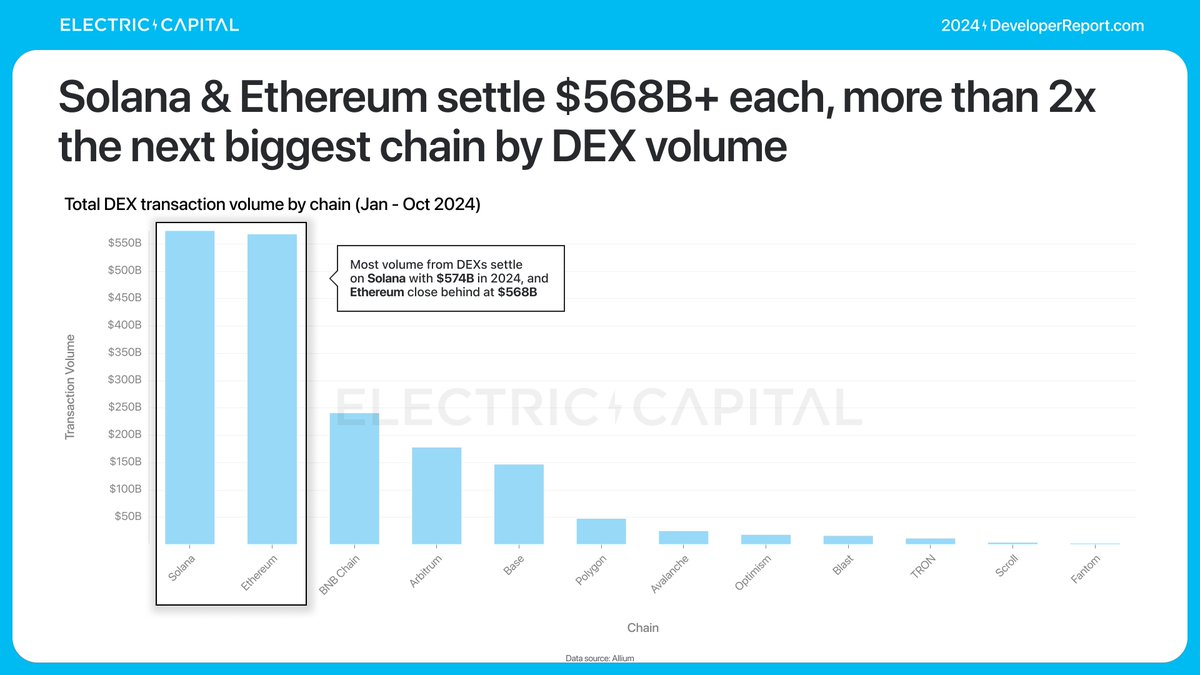

DEX volume almost doubled in 2024 to $209B a month! @solana & Ethereum settle the most volume -- more than 2x the next biggest chain by DEX volume.

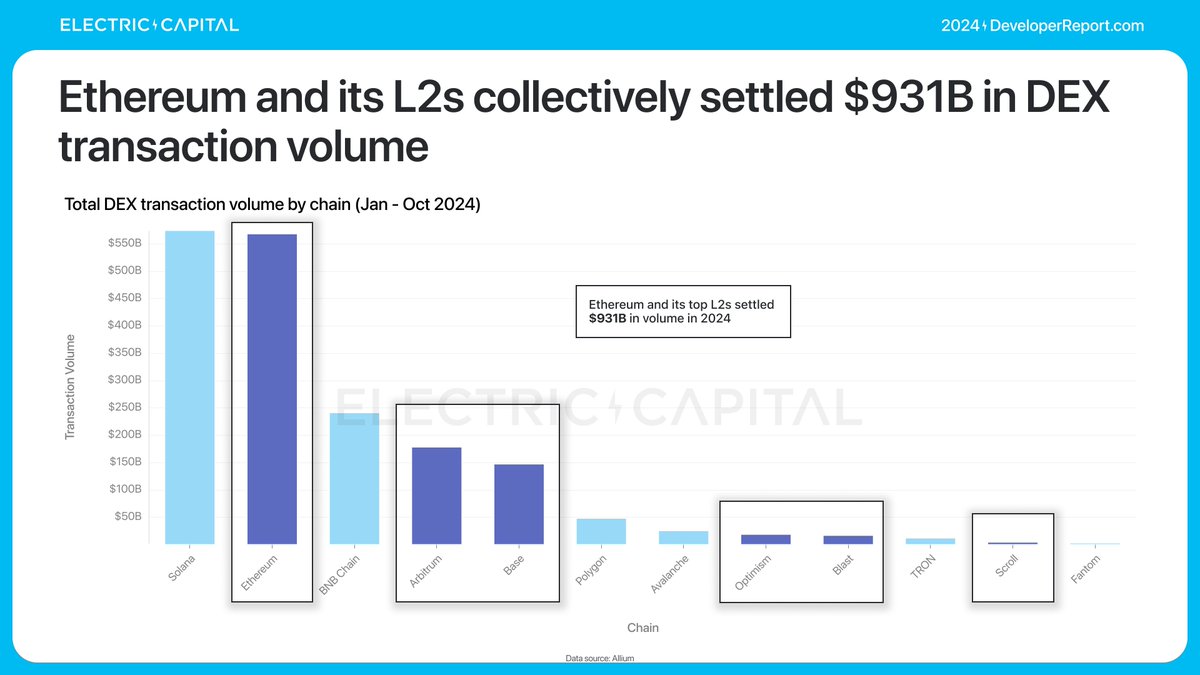

Solana settled the most in 2024 at $574B. The Ethereum mainnet and its L2s collectively settled $931B in DEX transaction volume.

Solana settled the most in 2024 at $574B. The Ethereum mainnet and its L2s collectively settled $931B in DEX transaction volume.

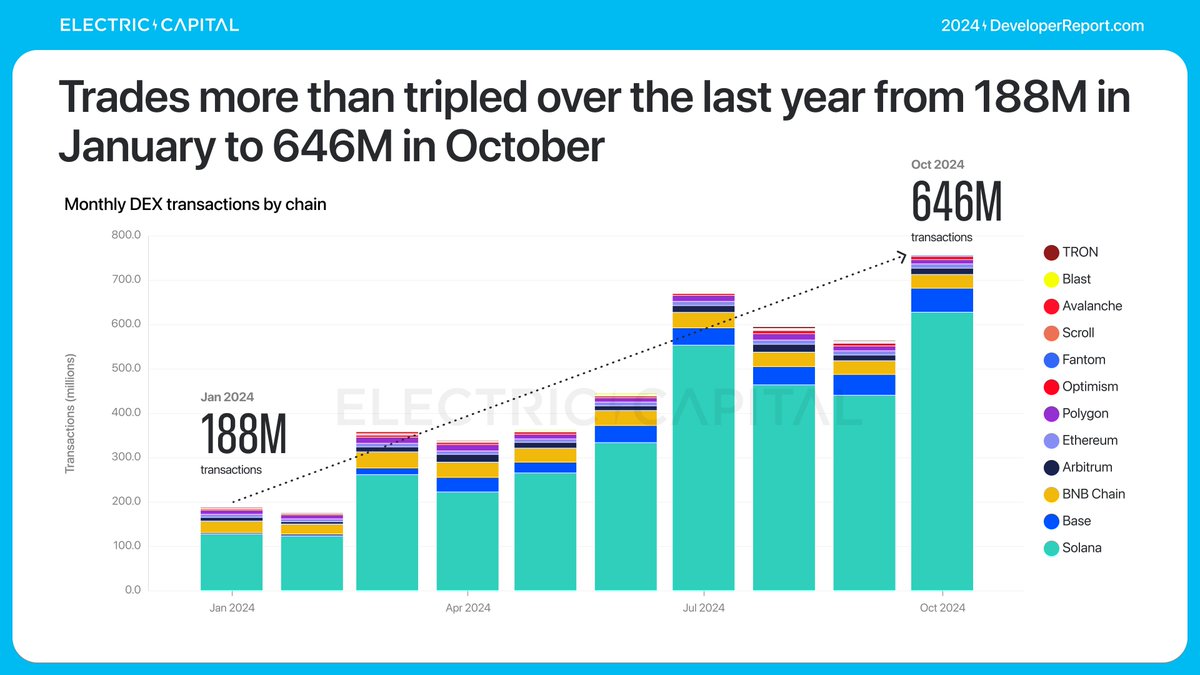

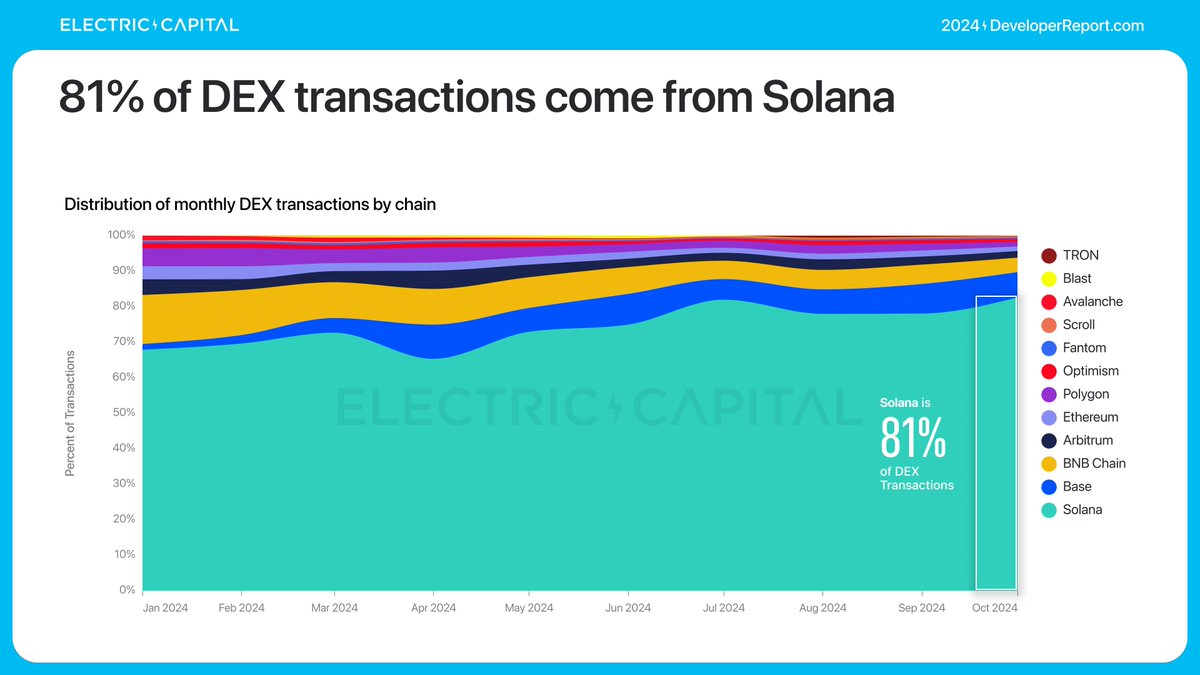

@solana dominates the low-fee DEX use case. Trades more than tripled over 2024 to 646M transactions in a single month.

81% of DEX transactions come from Solana.

81% of DEX transactions come from Solana.

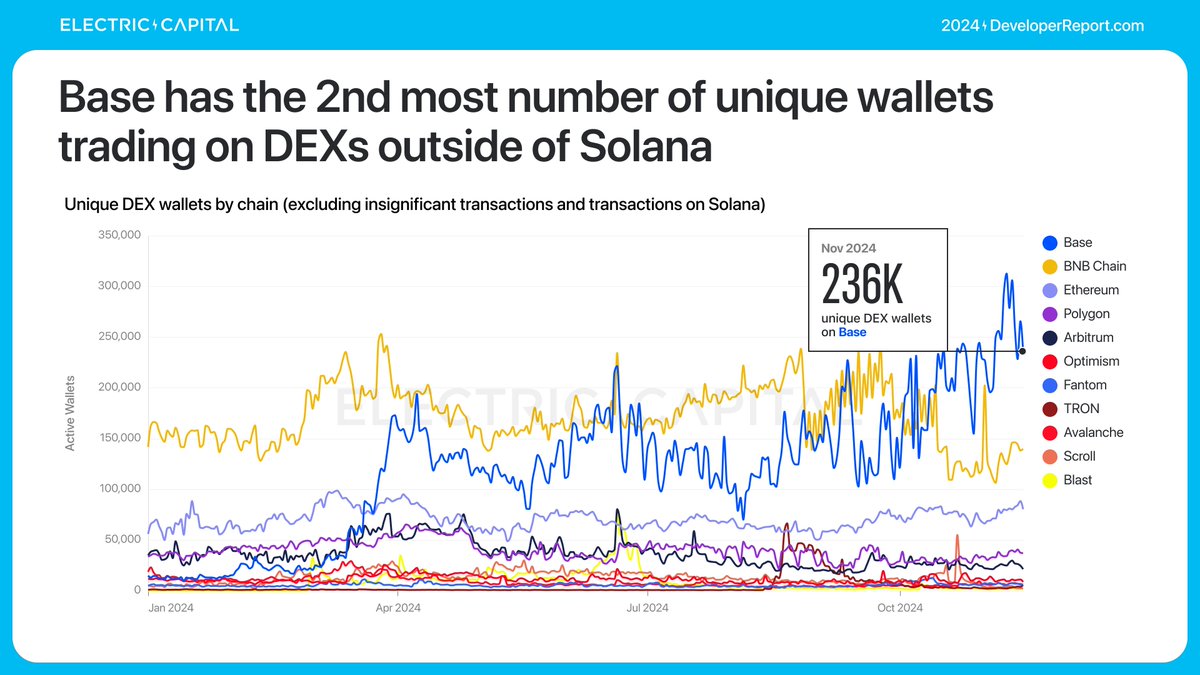

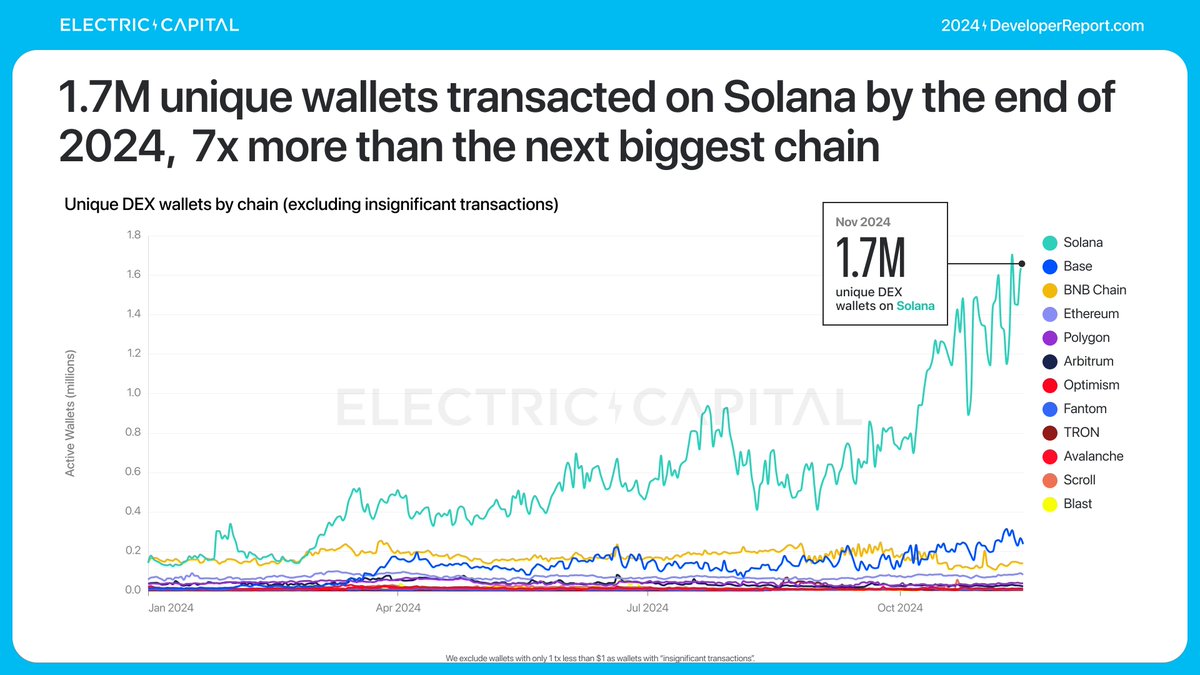

What about by number of transacting wallets? We exclude wallets with only 1 tx less than $1 as wallets with “insignificant transactions”.

@solana has the most unique wallets transacting, 7x the next biggest chain.

@solana has the most unique wallets transacting, 7x the next biggest chain.

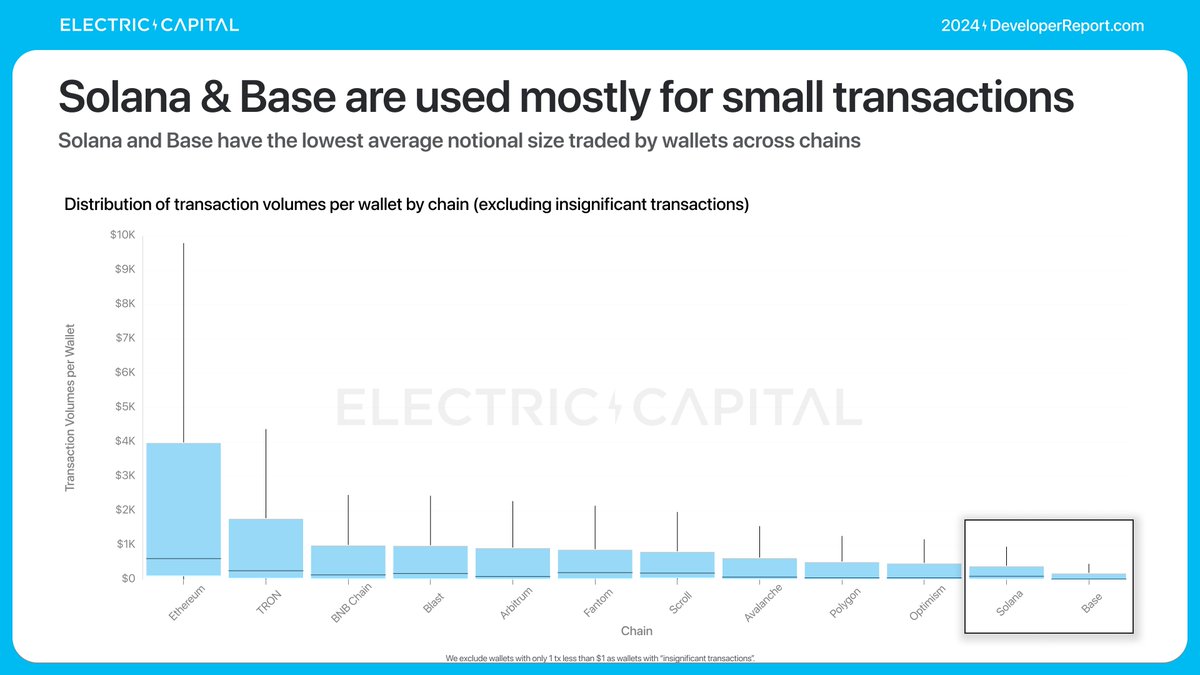

@base & @solana are popular for small transfers. Wallets on these chains transact the lowest average notional size.

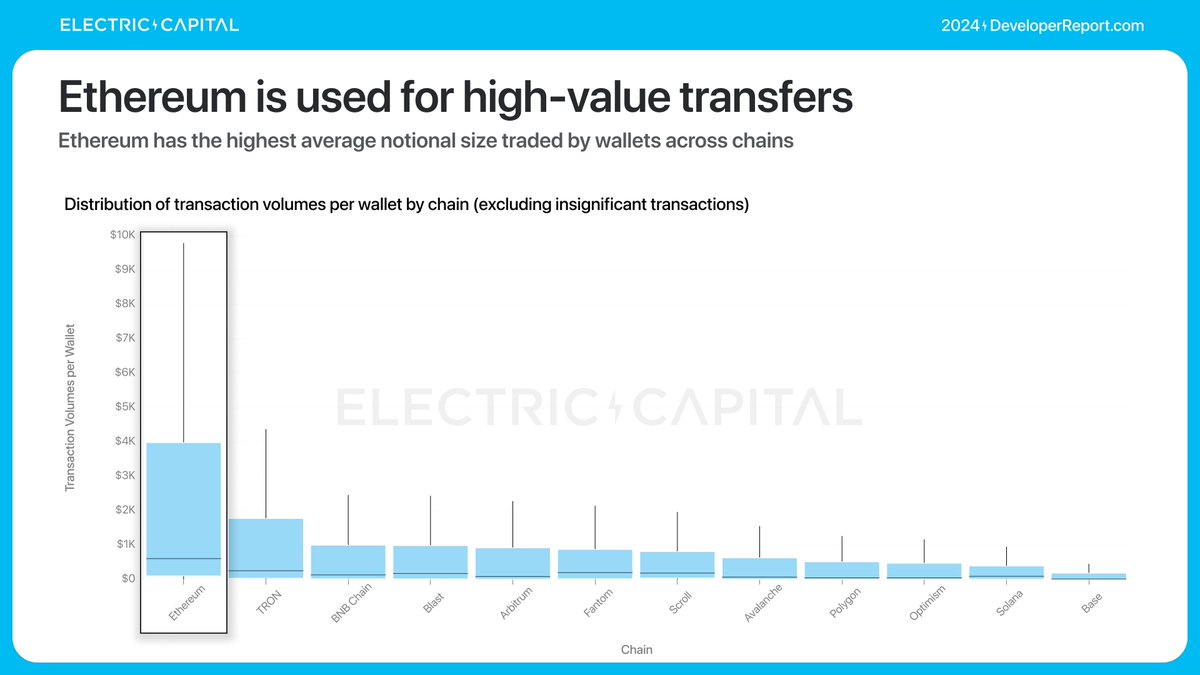

Ethereum is most popular for high-value transfers. Wallets on Ethereum transact the highest average notional size.

Ethereum is most popular for high-value transfers. Wallets on Ethereum transact the highest average notional size.

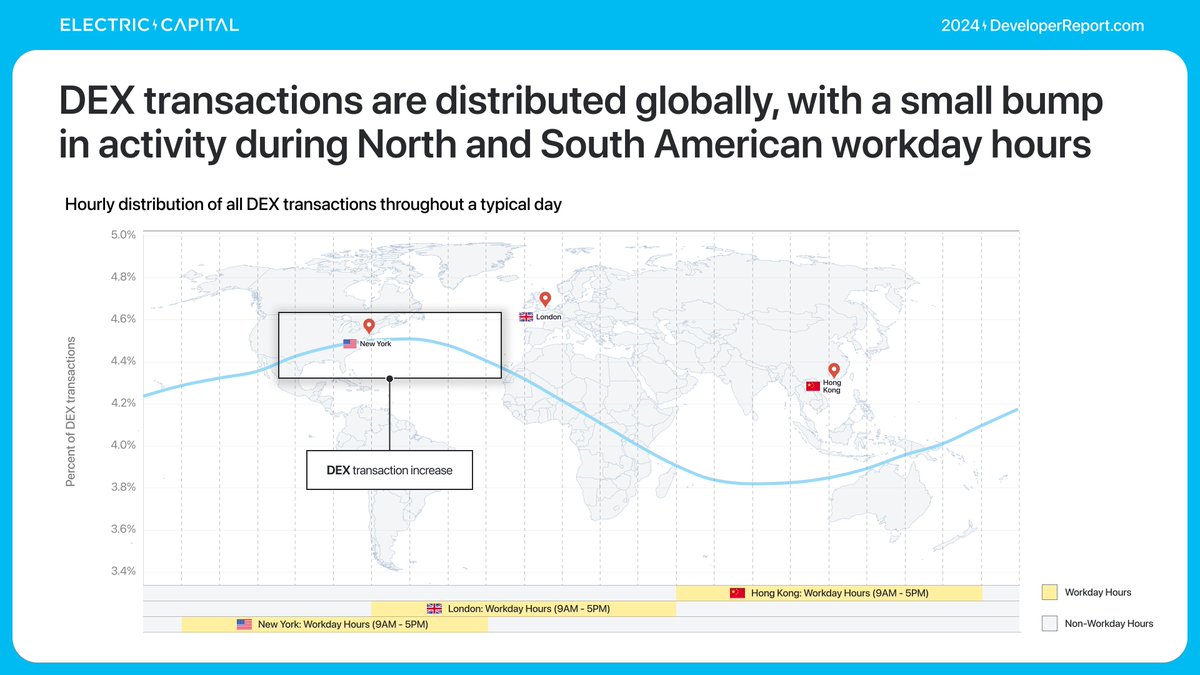

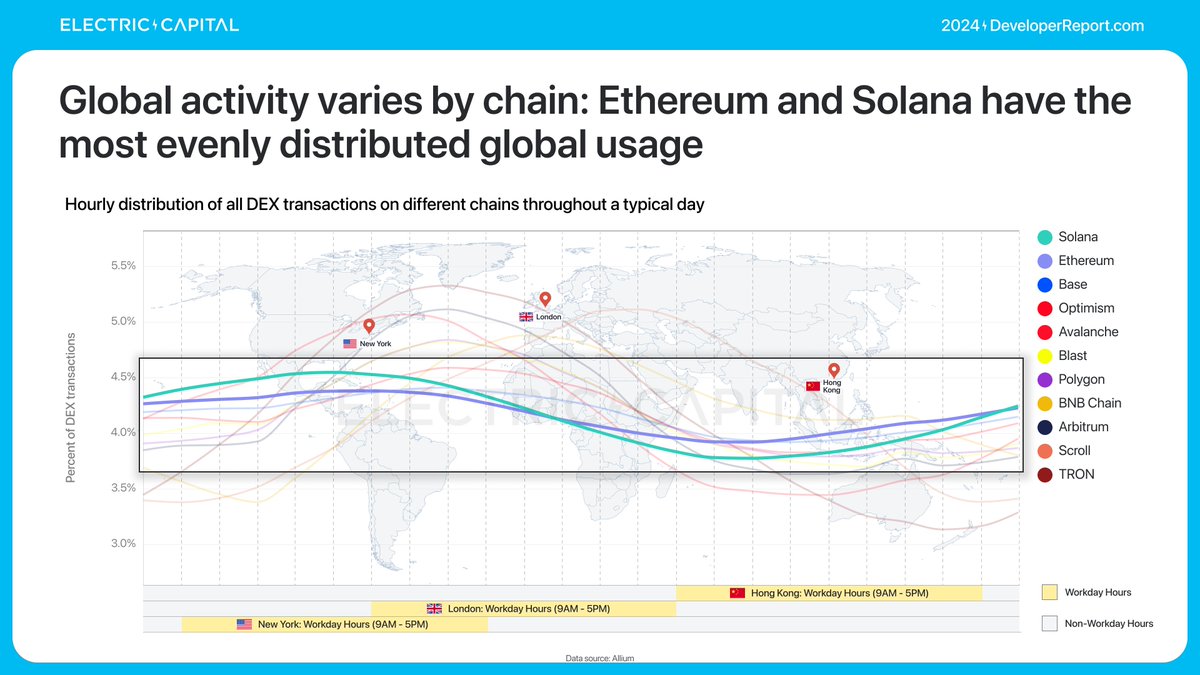

Where are all these DEX users?

We can use DEXes to understand DeFi usage because financial activity tend to start or end with DEXes.

Global activity varies by chain -- the flatter the activity, the most global the usage. Ethereum & Solana have the most evenly distributed usage.

We can use DEXes to understand DeFi usage because financial activity tend to start or end with DEXes.

Global activity varies by chain -- the flatter the activity, the most global the usage. Ethereum & Solana have the most evenly distributed usage.

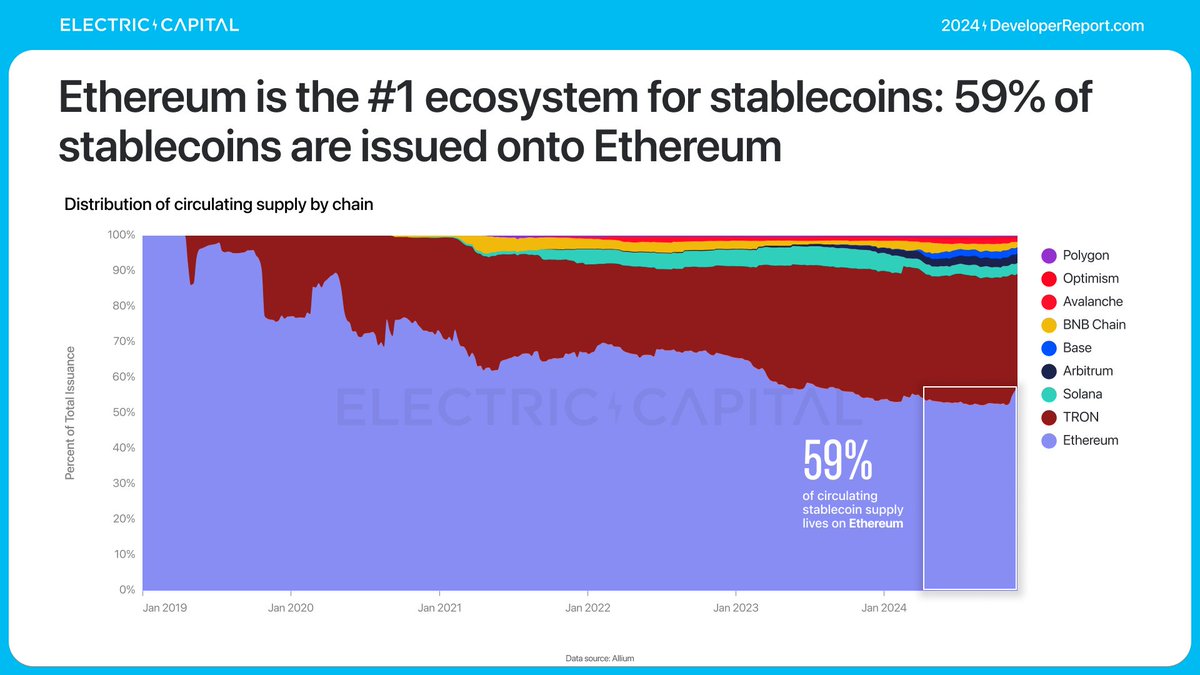

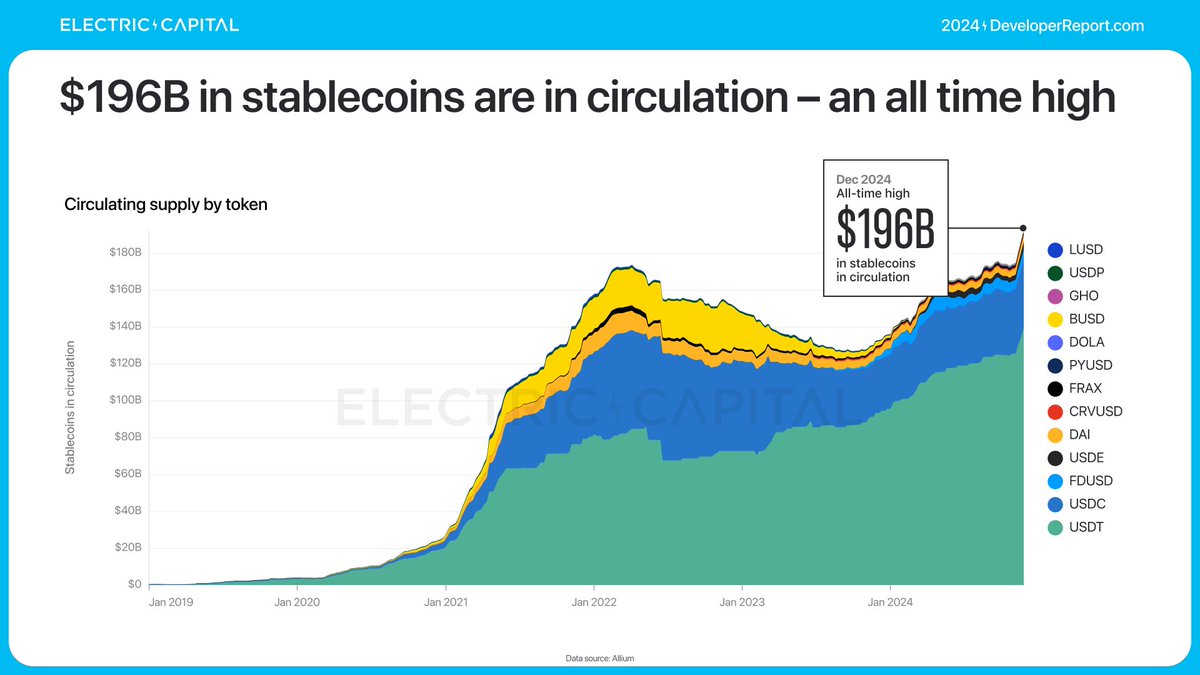

Stablecoins are one of the biggest crypto use cases globally. How are stablecoins doing?

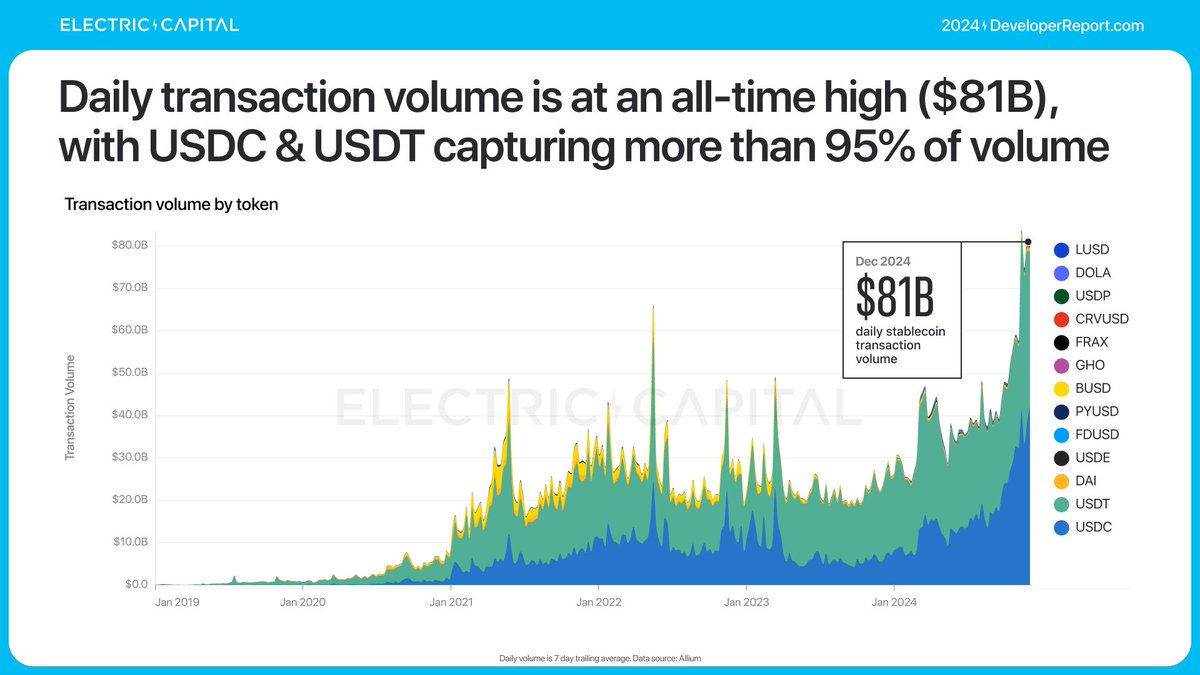

Stablecoin usage is at an all-time high: $196B of stablecoins are in circulation and $81B in volume is transacted per day -- both all-time highs for stablecoins. USDC & USDT are 95% of volume.

Stablecoin usage is at an all-time high: $196B of stablecoins are in circulation and $81B in volume is transacted per day -- both all-time highs for stablecoins. USDC & USDT are 95% of volume.

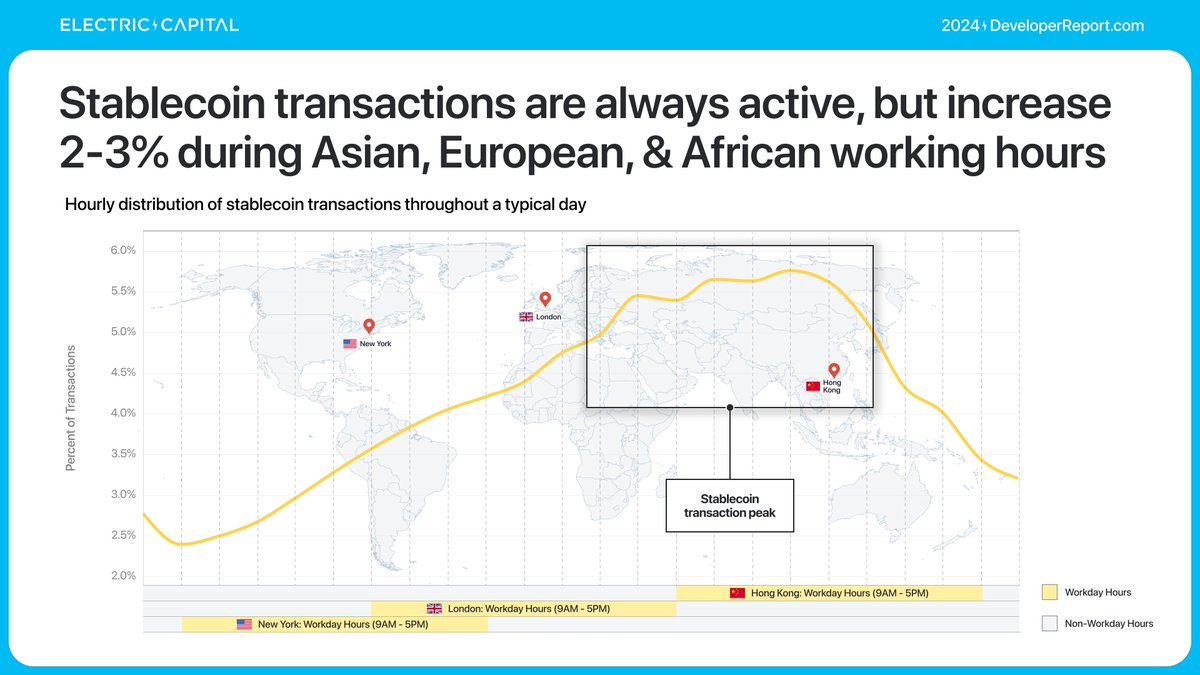

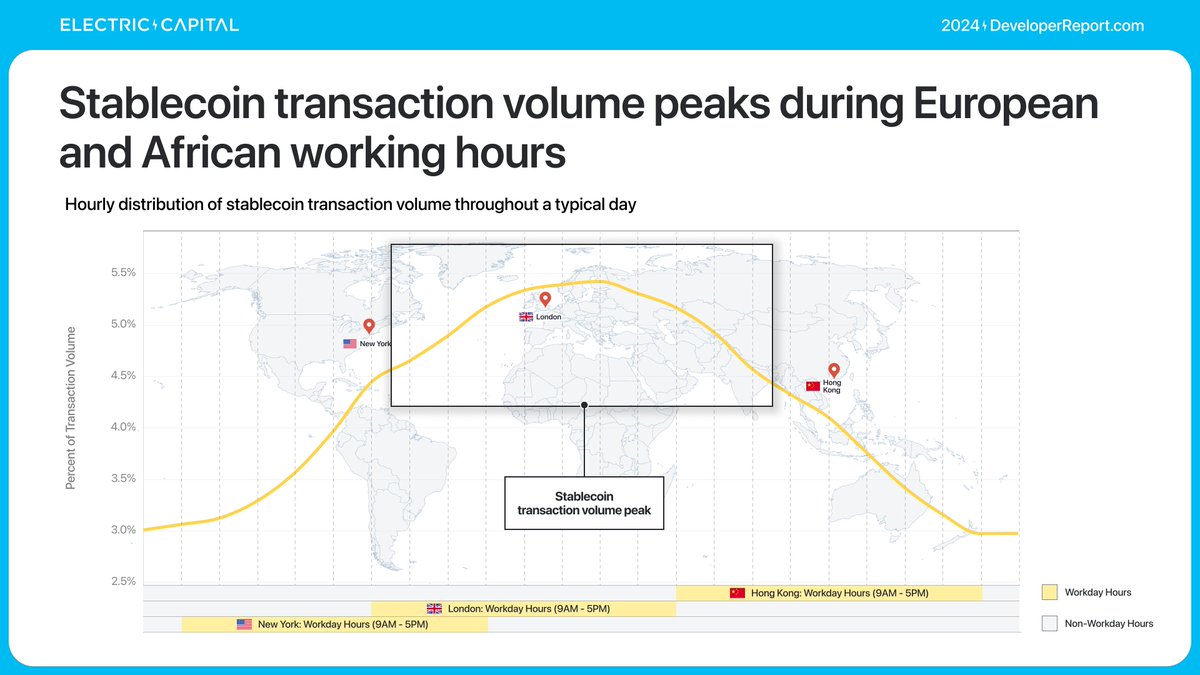

What does stablecoin activity look like around the world?

Stablecoins are always active, but increase 2-3% during Asian, European, & African working hours.

But while stablecoin transactions peak during Eastern hours, volume skews more toward the West.

Stablecoins are always active, but increase 2-3% during Asian, European, & African working hours.

But while stablecoin transactions peak during Eastern hours, volume skews more toward the West.

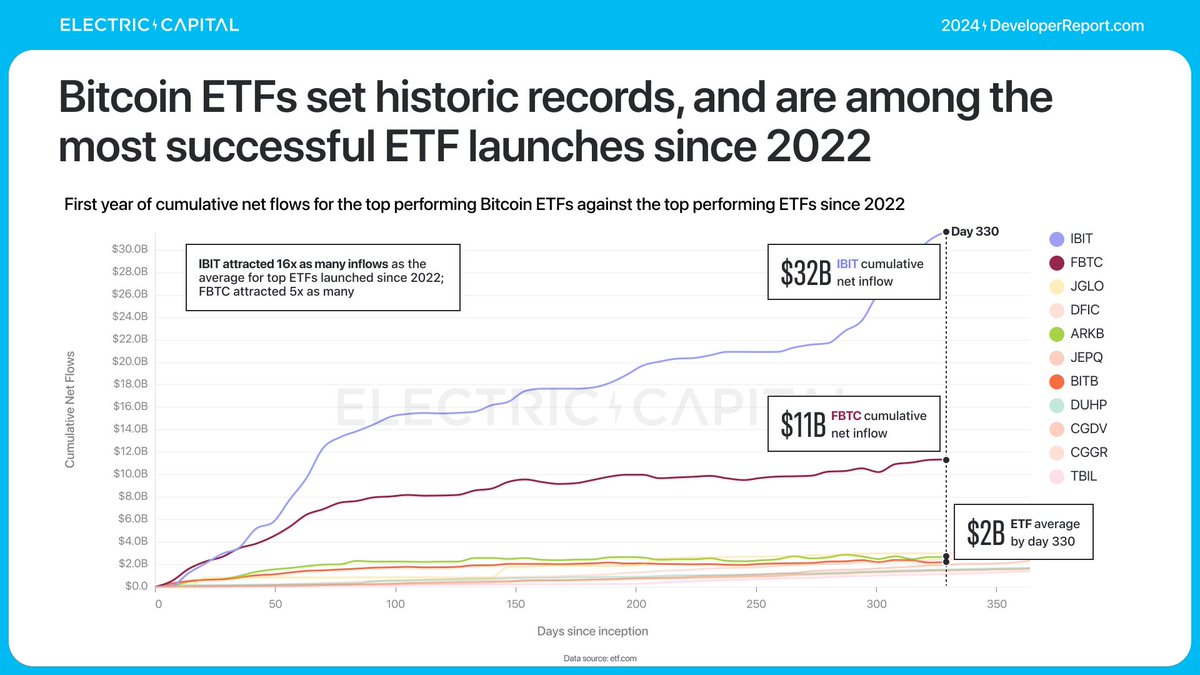

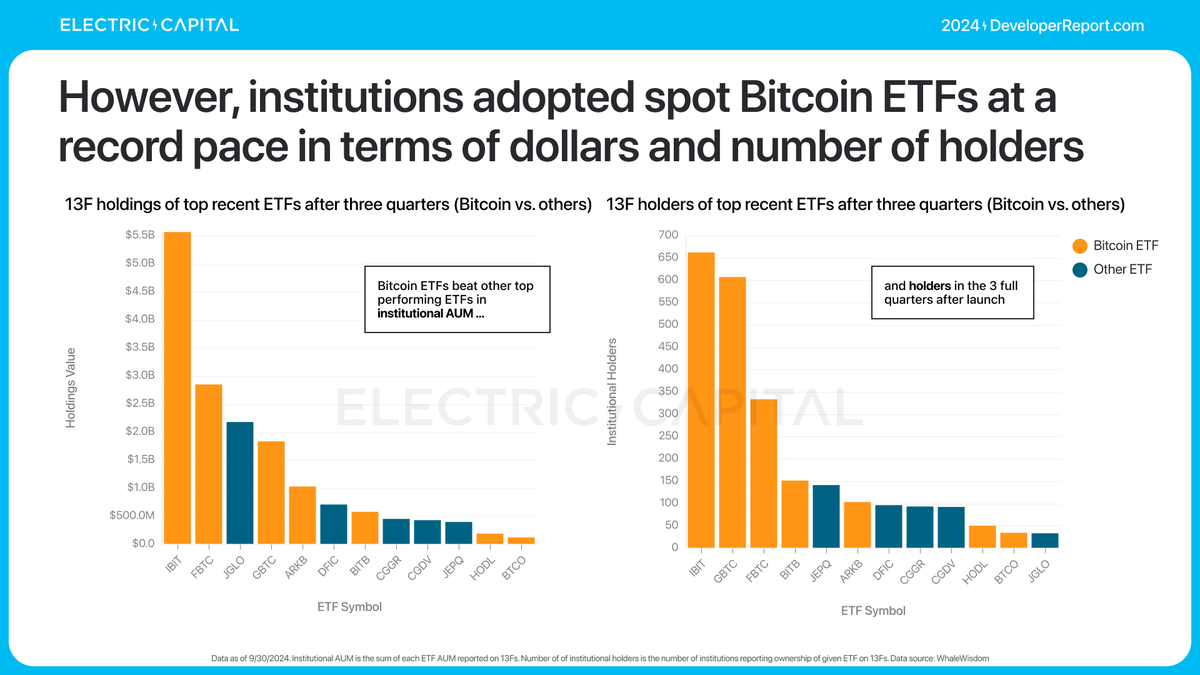

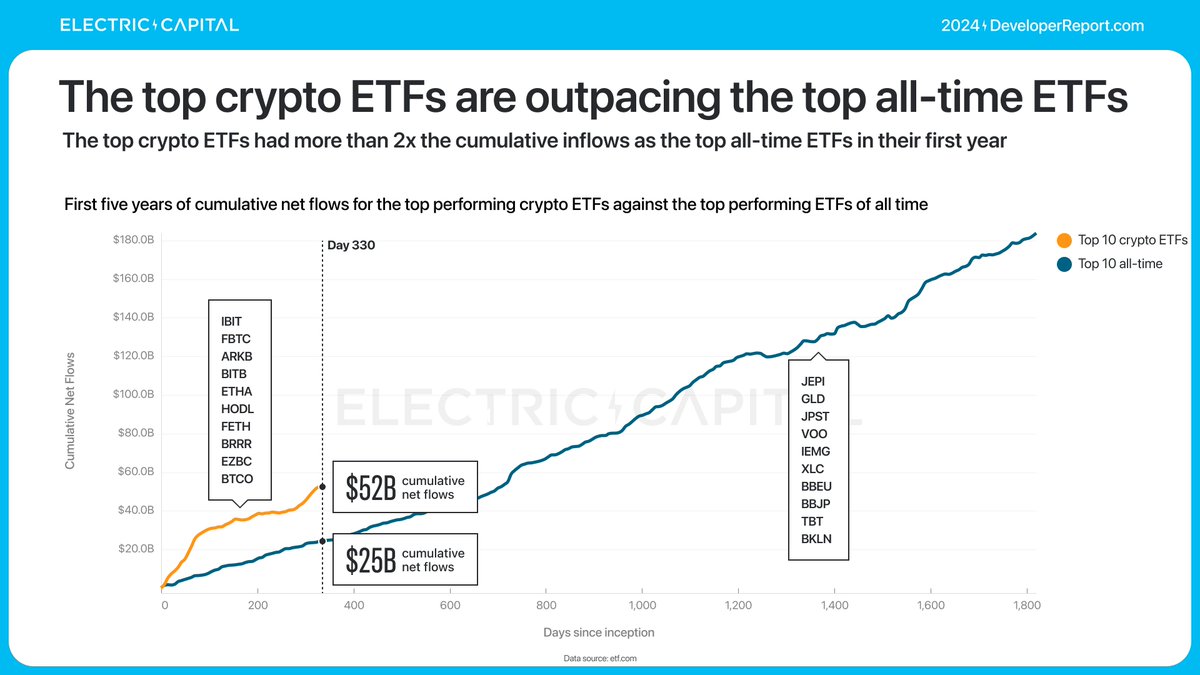

Bitcoin and Ethereum ETFs launched this year, giving off-chain capital easy access to onchain assets.

Bitcoin ETFs attracted $50B+ in net inflows & rank among the most successful ETFs ever launched.

Bitcoin ETFs attracted $50B+ in net inflows & rank among the most successful ETFs ever launched.

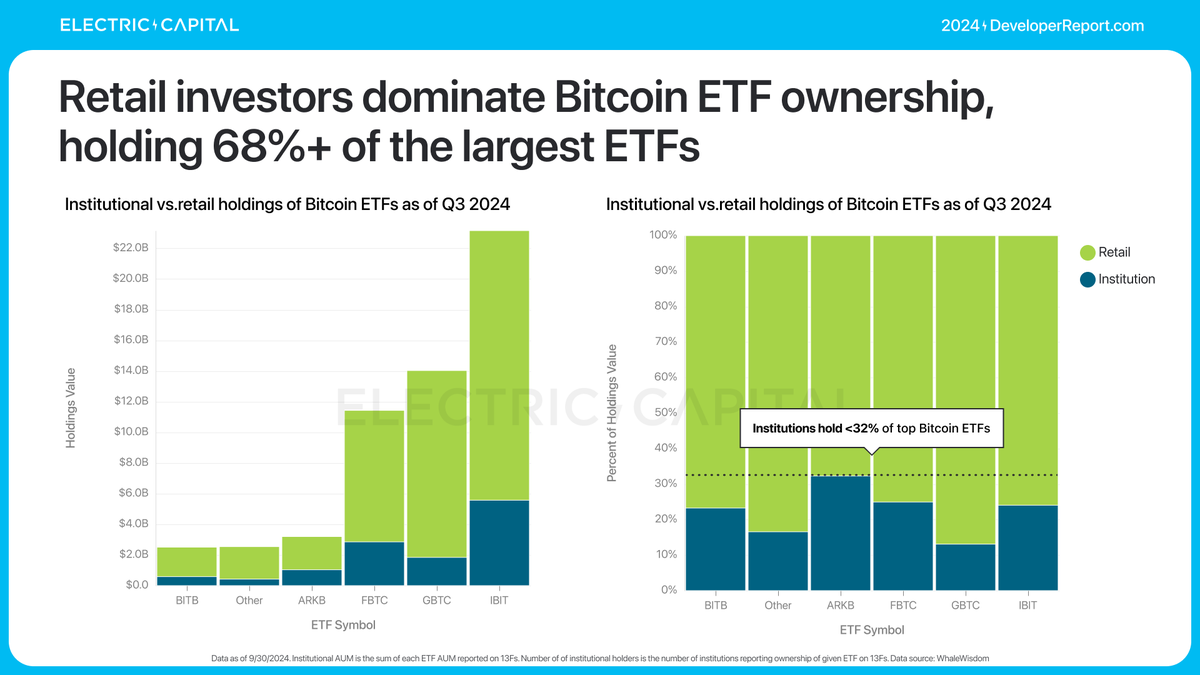

Most of Bitcoin ETF volume is driven by retail. Institutions still adopted spot Bitcoin ETFs at a record pace given its nascency.

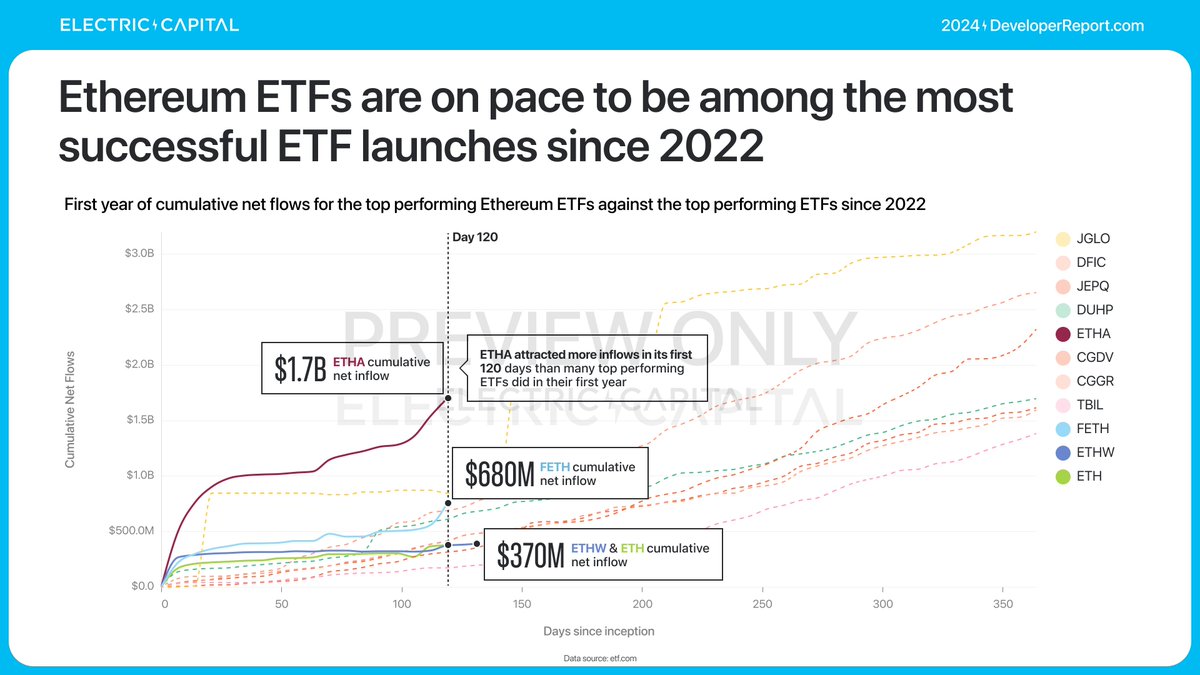

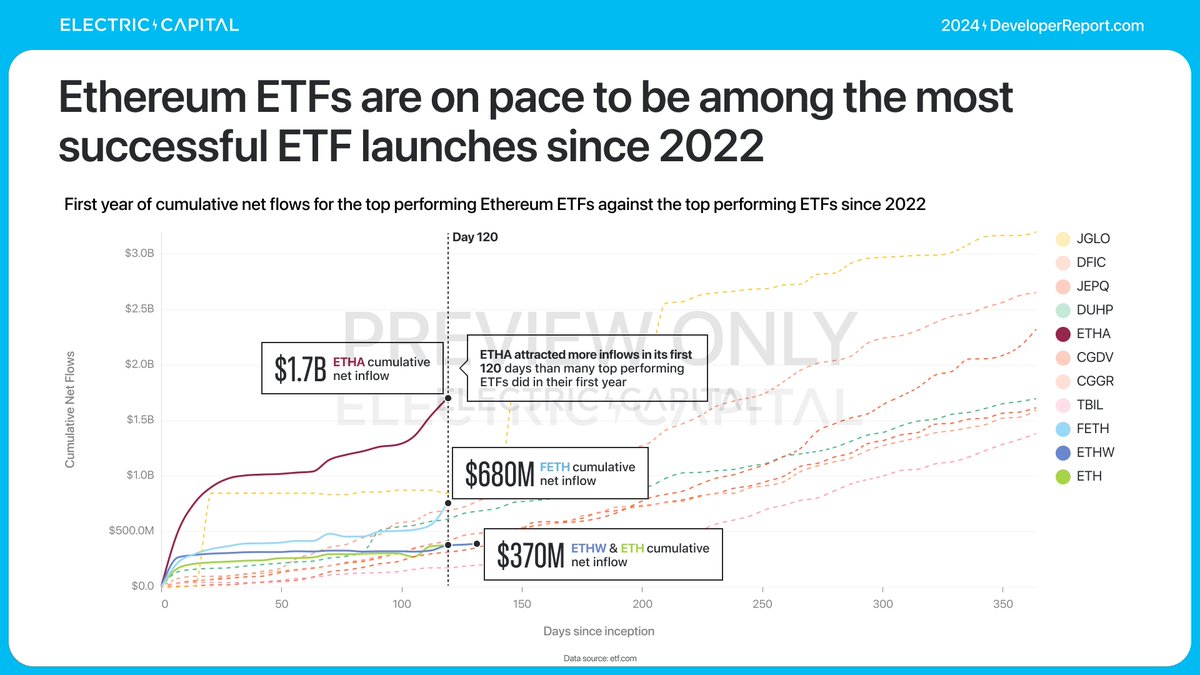

Ethereum ETFs launched this year in July.

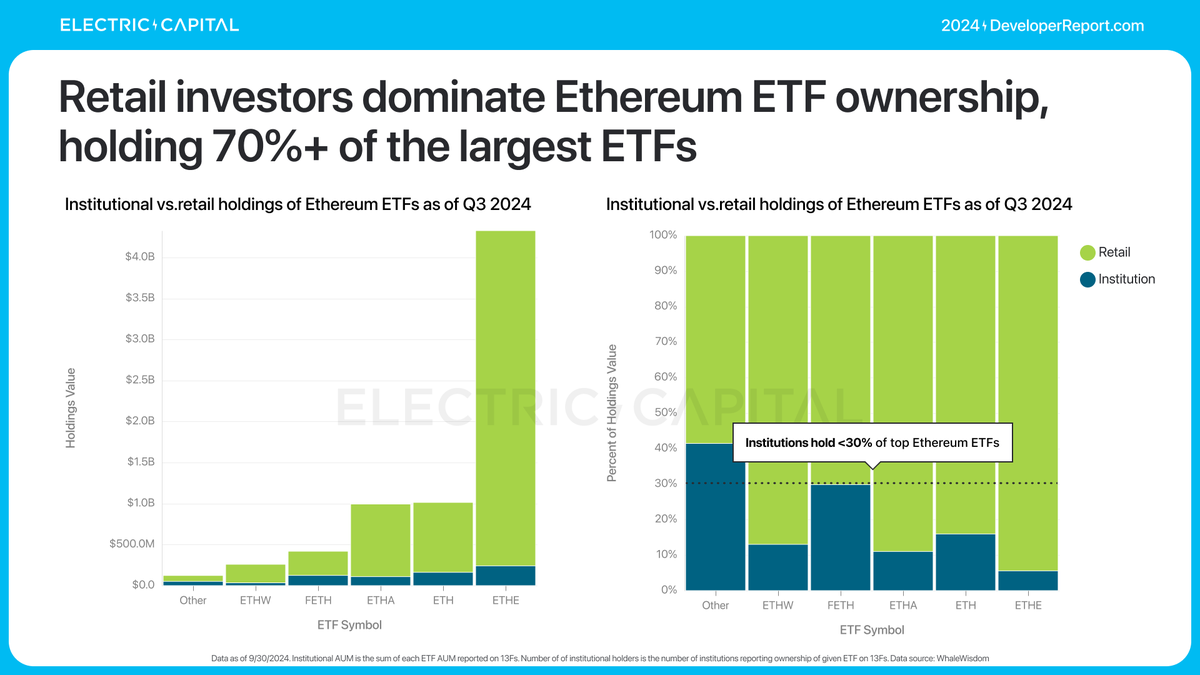

Ethereum ETFs now hold $13B AUM and attracted $3.5B in net inflows. This is on pace with the most successful ETF launches since 2022 (excluding the Bitcoin ETF).

This is also driven mostly by retail.

Ethereum ETFs now hold $13B AUM and attracted $3.5B in net inflows. This is on pace with the most successful ETF launches since 2022 (excluding the Bitcoin ETF).

This is also driven mostly by retail.

Ethereum ETFs launched this year in July.

Ethereum ETFs now hold $13B AUM and attracted $3.5B in net inflows. This is on pace with the most successful ETF launches since 2022 (excluding the Bitcoin ETF).

This is also driven mostly by retail.

Ethereum ETFs now hold $13B AUM and attracted $3.5B in net inflows. This is on pace with the most successful ETF launches since 2022 (excluding the Bitcoin ETF).

This is also driven mostly by retail.

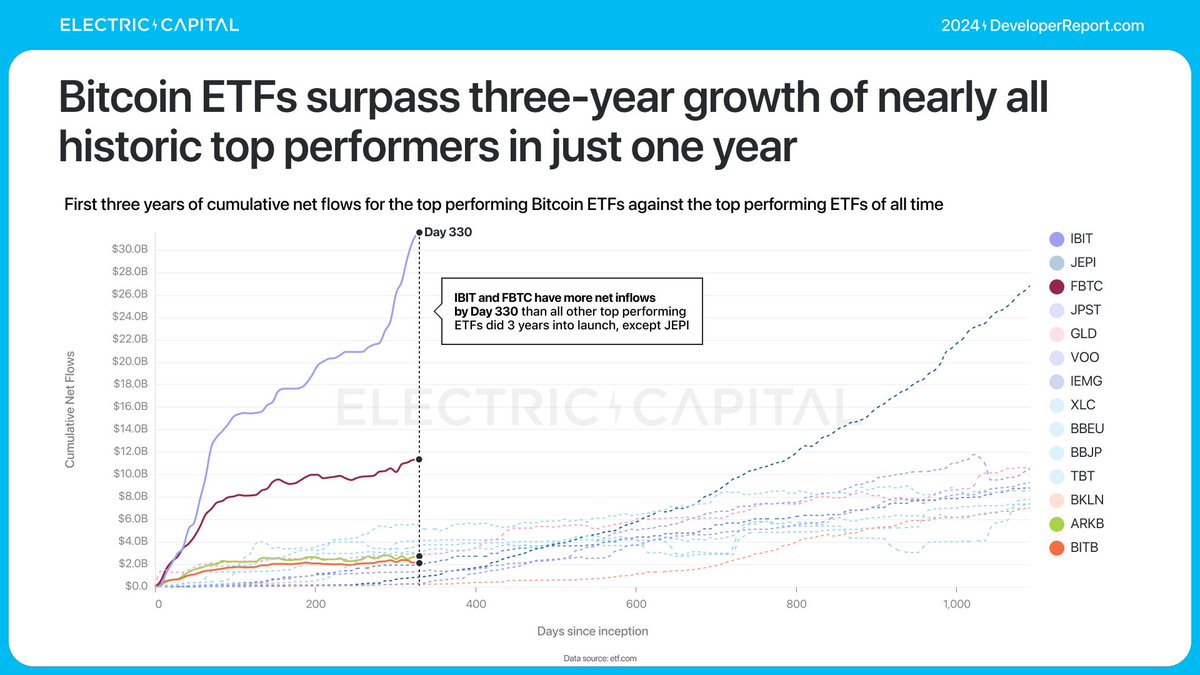

Bitcoin and Ethereum ETFs are record-breaking.

They now have more than 2x the cumulative inflows as the top ALL TIME ETFs in their first year.

They now have more than 2x the cumulative inflows as the top ALL TIME ETFs in their first year.

To close -- crypto is global across both usage and developer activity. It is incredible to ship this report for the 6th year and see the industry's growth.

Read the full report here (believe it or not -- this thread only covers ~50%):

developerreport.com

Read the full report here (believe it or not -- this thread only covers ~50%):

developerreport.com

The Developer Report is a huge team effort. It takes an incredible amount of research, data analysis, engineering, design, and more to make this report happen.

Follow the team for more data on crypto! They’ll have their own takes on the data to share in the coming days 📈

Research & Engineering:

Aditya: @koowal

Curtis: @jubos

Emre: @n4motto

Gary: @garythung

Geoff: @0x9e0ff

Kate: @kateli_nyc

Ken: @puntium

Lucas: @lucasg_dev

Mark: @sheatgm

Mitchell: @mitchelljhammer

Ren: @0xren_cf

Sid: @sidmvenkat

Swati: @swatimardia

Tony: @scinocco_a

Yizhao: @yizhaotan_

Design:

Danielle: @LookLookStudio

Misha: @mishafrolov

Contributors:

Avichal: @avichal

Emily: @EmilyMMeyers

Martha: @martha_shear

Sanjay: @sanjaypshah

Sara: @sarawampler

Animations & Graphics:

Chloe: @chloepark

Follow the team for more data on crypto! They’ll have their own takes on the data to share in the coming days 📈

Research & Engineering:

Aditya: @koowal

Curtis: @jubos

Emre: @n4motto

Gary: @garythung

Geoff: @0x9e0ff

Kate: @kateli_nyc

Ken: @puntium

Lucas: @lucasg_dev

Mark: @sheatgm

Mitchell: @mitchelljhammer

Ren: @0xren_cf

Sid: @sidmvenkat

Swati: @swatimardia

Tony: @scinocco_a

Yizhao: @yizhaotan_

Design:

Danielle: @LookLookStudio

Misha: @mishafrolov

Contributors:

Avichal: @avichal

Emily: @EmilyMMeyers

Martha: @martha_shear

Sanjay: @sanjaypshah

Sara: @sarawampler

Animations & Graphics:

Chloe: @chloepark

• • •

Missing some Tweet in this thread? You can try to

force a refresh