🚀 $ASTS WEEK IN REVIEW 🚀

🌐 Vodafone Deal:

10-yr agreement, >20 Mbps speeds, covers 60+ markets. France locked w/ #1 (Orange) & #2 (Altice). A game-changer for MNO partnerships!

📡 Global Expansion:

Gateways going live globally. Big 2025 marketing push incoming. 🌍

💸 Revenue Potential:

DB sees $4.5B by 2030 (50/50 split). Long-term deals boosting EXIM financing. 📈

📶 Tech Edge:

Spectral efficiency now 4 bps/Hz. Adaptive modulation = reliable satellite-to-phone connections.

🛡️ Military & Regulatory Wins:

DoD & Navy partnerships in play. FCC fast-tracking permits. 🛰️

📈 TAM Growth:

Beyond mobile – laptops, AR/VR devices, & more. ASTS redefines connectivity!

🔥 Competitive Advantage:

Starlink? Meet your match. ASTS's commercial moat keeps growing.

🎥 Narrative Power:

Documentaries & killer visuals drive the $ASTS story forward.

#ASTS #SpaceMobile #SatelliteBroadband

🌐 Vodafone Deal:

10-yr agreement, >20 Mbps speeds, covers 60+ markets. France locked w/ #1 (Orange) & #2 (Altice). A game-changer for MNO partnerships!

📡 Global Expansion:

Gateways going live globally. Big 2025 marketing push incoming. 🌍

💸 Revenue Potential:

DB sees $4.5B by 2030 (50/50 split). Long-term deals boosting EXIM financing. 📈

📶 Tech Edge:

Spectral efficiency now 4 bps/Hz. Adaptive modulation = reliable satellite-to-phone connections.

🛡️ Military & Regulatory Wins:

DoD & Navy partnerships in play. FCC fast-tracking permits. 🛰️

📈 TAM Growth:

Beyond mobile – laptops, AR/VR devices, & more. ASTS redefines connectivity!

🔥 Competitive Advantage:

Starlink? Meet your match. ASTS's commercial moat keeps growing.

🎥 Narrative Power:

Documentaries & killer visuals drive the $ASTS story forward.

#ASTS #SpaceMobile #SatelliteBroadband

🌐Vodafone DA

- 10 Year Agreement Covers Vodafone Home Markets as well as other markets via its Partner Markets Program

- Vodafone operates in more than 20 markets and has partnerships that cover another 40 markets

- Confirmed speeds of greater than 20 Mbps on 5 Mhz of spectrum

- The service: These gateways will then connect to Vodafone's existing network infrastructure to route the broadband data to users' devices, as well as to access third-party Apps and the Internet

businesswire.com/news/home/2024…

- 10 Year Agreement Covers Vodafone Home Markets as well as other markets via its Partner Markets Program

- Vodafone operates in more than 20 markets and has partnerships that cover another 40 markets

- Confirmed speeds of greater than 20 Mbps on 5 Mhz of spectrum

- The service: These gateways will then connect to Vodafone's existing network infrastructure to route the broadband data to users' devices, as well as to access third-party Apps and the Internet

businesswire.com/news/home/2024…

🪶Coverage of Vodafone

A gateway is being installed in a first country - to be disclosed next year. ASTS disclosed, “We are installing five gateways in the United States and have gateways installed or nearing completion in half a dozen other countries.”

spacenews.com/ast-spacemobil…

A gateway is being installed in a first country - to be disclosed next year. ASTS disclosed, “We are installing five gateways in the United States and have gateways installed or nearing completion in half a dozen other countries.”

spacenews.com/ast-spacemobil…

📣Vodafone Team Comments

I cannot imagine the complexity here. Congrats to everyone. It would take people leaning in to get something done this quickly

I cannot imagine the complexity here. Congrats to everyone. It would take people leaning in to get something done this quickly

https://x.com/ASTS_Investors/status/1866475304216367605

💰Sell Side Research

DB out after Vodafone. 50/50 revenue share. DB doing math that says $4.5bn of revenue by 2030.

DB out after Vodafone. 50/50 revenue share. DB doing math that says $4.5bn of revenue by 2030.

🏦Vodafone and EXIM

Long-term contracts give a form of credit support that will help EXIM financing down the line

Long-term contracts give a form of credit support that will help EXIM financing down the line

https://x.com/spacanpanman/status/1866129612776120343

🪑Anpanman Breaks It Down

A very good conversation about the Vodafone deal

A very good conversation about the Vodafone deal

https://x.com/spacanpanman/status/1866169082795507945

🥰Global Coverage

A reminder of just how large ASTS's addressable market is, and the progress in covering it thus far. This is the commercial moat.

A reminder of just how large ASTS's addressable market is, and the progress in covering it thus far. This is the commercial moat.

https://x.com/thekookreport/status/1866191825675178406

🙋♂️Emoji Visualization

Imagine entering each country one by one without a channel partner?

Imagine entering each country one by one without a channel partner?

https://x.com/kingtutcap/status/1866110421867934099

🧮Math Exam

Back to the game of "what it is not worth"

Back to the game of "what it is not worth"

https://x.com/heroinvstr/status/1866170557919875562

🗼Block 1 Deployment

As we continue to learn about the process of approvals, a little more "learning" occurs (code for wrong initial expectations). Confirming Block 1 is deployed seems like an obviously pre-condition for the FCC to want before authorization an STA

licensing.fcc.gov/myibfs/downloa…

As we continue to learn about the process of approvals, a little more "learning" occurs (code for wrong initial expectations). Confirming Block 1 is deployed seems like an obviously pre-condition for the FCC to want before authorization an STA

licensing.fcc.gov/myibfs/downloa…

🇬🇧ASTS Goes To UK

Remember how FUDsters said global operations couldn't happen?

advanced-television.com/2024/12/09/ast…

Remember how FUDsters said global operations couldn't happen?

advanced-television.com/2024/12/09/ast…

✖️0⃣Not A Zero

A nice update from Hennessy Funds, which was among the first institutions to come out on $ASTS a year ago

hennessyfunds.com/insights/Focus…

A nice update from Hennessy Funds, which was among the first institutions to come out on $ASTS a year ago

hennessyfunds.com/insights/Focus…

🅰️Seeking Alpha

This write-up hits all the points. The author is a civil engineer.

seekingalpha.com/article/474409…

This write-up hits all the points. The author is a civil engineer.

seekingalpha.com/article/474409…

🎇Tut Recap

A great recap of what $ASTS has accomplished in 2024

A great recap of what $ASTS has accomplished in 2024

https://x.com/kingtutcap/status/1866683842162983190

🎙️The Narrative

It's good to think critically about the events over 12 months, and then the expected months 12 months hence

It's good to think critically about the events over 12 months, and then the expected months 12 months hence

https://x.com/ModestLosses/status/1867302247002185966

🐣Knowledge Gap

Always remember how much more you know than the average investor

Always remember how much more you know than the average investor

https://x.com/Astsistheone/status/1866521402624664016

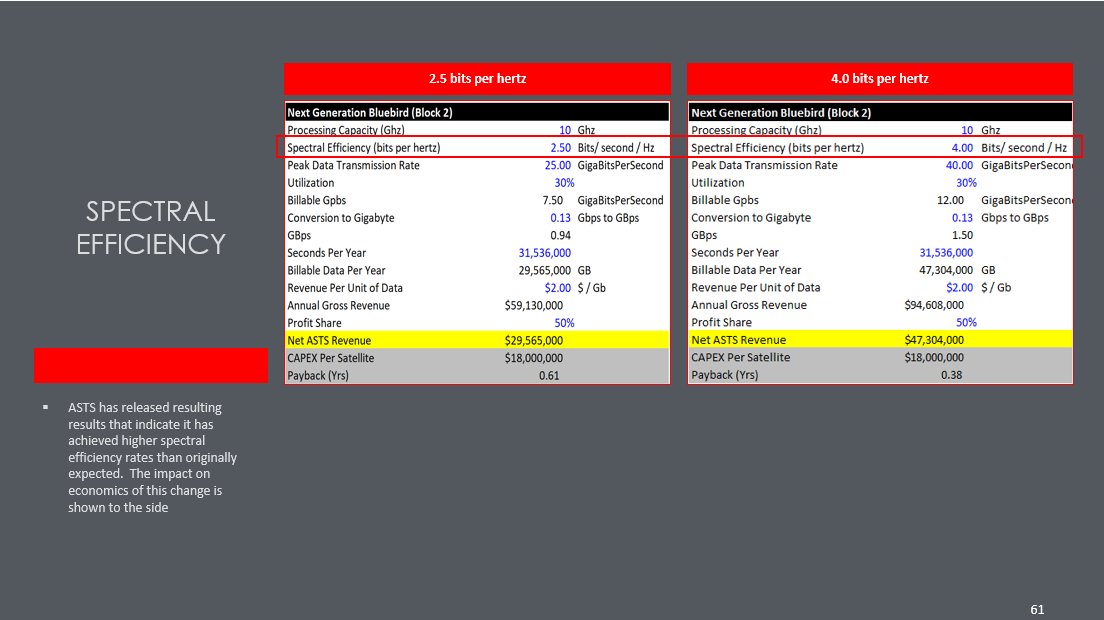

🏃♂️Spectral Efficiency

ASTS has been disclosing data transmission rates that imply 4 bits per second of spectral efficiency. Original estimates were done with 2.5 bits per second

ASTS has been disclosing data transmission rates that imply 4 bits per second of spectral efficiency. Original estimates were done with 2.5 bits per second

🐈⬛Cat Attack

We will discuss this on the Spaces

We will discuss this on the Spaces

https://x.com/CatSE___ApeX___/status/1866111164607857095

🇨🇭UBS Conference Nugget

Goes back to the TAM related to taking back terrestrial assets and putting it to satellite

Goes back to the TAM related to taking back terrestrial assets and putting it to satellite

https://x.com/peterlindmark/status/1866581516614013034

🍔FirstNet Nothing Burger

No splashing PR but continued talk about satellites

No splashing PR but continued talk about satellites

https://x.com/CytoplasmicANA/status/1866895089248903498

🦐Apple Capacity

$GSAT's new system is just not in the same league.

$GSAT's new system is just not in the same league.

https://x.com/spacanpanman/status/1866545338032509398

📶More Cellular Demand

This is going to need full broadband, not $GSAT.

bloomberg.com/news/articles/…

This is going to need full broadband, not $GSAT.

bloomberg.com/news/articles/…

🐢First Mover vs. Best Mover

A surprising chart that just shows how quickly customers adopt "better"

A surprising chart that just shows how quickly customers adopt "better"

https://x.com/aleximm/status/1867257473671082356

🗻First Mover vs. Best Mover

Good summary here using my favorite example of VHS vs. BetaMax.

advanced-television.com/2024/12/12/sta…

Good summary here using my favorite example of VHS vs. BetaMax.

advanced-television.com/2024/12/12/sta…

💀Competing is Futile

Pack it up. It's too hard.

Pack it up. It's too hard.

https://x.com/MarioNawfal/status/1866533620820717814

🤣TSLAQ and ASTSQ

A good trip down memory lane just to see how Wall Street can miss by a mile

A good trip down memory lane just to see how Wall Street can miss by a mile

https://x.com/MarioNawfal/status/1866179200836632946

🍄AI Is Not Hallucinating

As per the above, interesting that Grok seems to know ASTS's position

As per the above, interesting that Grok seems to know ASTS's position

https://x.com/scott_m_powell/status/1867304726074884318

🛸Why ASTS Is Better

A great diagram showing the differences in the beams.

A great diagram showing the differences in the beams.

https://x.com/NomadBets/status/1839635938063872503

👩⚖️Starlink Truth In Advertising

MNOs are sobering up.

MNOs are sobering up.

https://x.com/kingtutcap/status/1865924667678306646

🪖ASTS In Crystal City

Chris Ivory (AST CCO) will speak at the annual Department of Defense (DoD) Commercial Satcom Workshop taking place Dec 16-18 in Crystal City.

Chris Ivory (AST CCO) will speak at the annual Department of Defense (DoD) Commercial Satcom Workshop taking place Dec 16-18 in Crystal City.

https://x.com/kingtutcap/status/1866200091339391375

🤸US Gets Friendly

FAA is streamlining launch, but are we seeing overall streamlining at the FCC as well?

FAA is streamlining launch, but are we seeing overall streamlining at the FCC as well?

https://x.com/MarioNawfal/status/1867683444760977418

🐇ASTS STA Permits

Catse notes that applications are getting faster attention. FCC employees looking to avoid getting DOGE'd? "What did you do last week?"

Catse notes that applications are getting faster attention. FCC employees looking to avoid getting DOGE'd? "What did you do last week?"

https://x.com/CatSE___ApeX___/status/1867650773599105493

📲FCC Talking about SCS

FCC set the stage for some positive change

FCC set the stage for some positive change

https://x.com/defiantclient/status/1866752073112621100

🇮🇳ASTS Investing In India

Our next launch is in India, we are partnered with Vodafone, and we have a large engineering center. Tut tracking closely.

Our next launch is in India, we are partnered with Vodafone, and we have a large engineering center. Tut tracking closely.

https://x.com/kingtutcap/status/1867266301120409791

🛰️SDA Contracts

A detailed analysis about the SDA opportunity

A detailed analysis about the SDA opportunity

https://x.com/CatSE___ApeX___/status/1867581145346412679

🔥SDA Heating Up

Good slides as the SDA talks more and more about their program

Good slides as the SDA talks more and more about their program

https://x.com/SpaceflightNow/status/1867229833677480311

🚨Regulator Crack Down

Rollout with SALT has been delayed. And why? "Interference with neighboring countries."

Rollout with SALT has been delayed. And why? "Interference with neighboring countries."

https://x.com/redrum_2001/status/1867730304041202011

🎬Spacemob Documentary

Chris comes out with another banger. This story will be told again and again. Abel is a great inventor.

Chris comes out with another banger. This story will be told again and again. Abel is a great inventor.

https://x.com/TheRealCPHPhD/status/1867680255299006558

• • •

Missing some Tweet in this thread? You can try to

force a refresh