1/ @Base has emerged as a dominant L2, suggesting that Coinbase's distribution advantage is translating into sustainable ecosystem growth.

In just a year and a half since launch, a thriving ecosystem of applications is beginning to emerge...🧵

In just a year and a half since launch, a thriving ecosystem of applications is beginning to emerge...🧵

2/ Base pulled in more inflows than Solana over the last 90 days.

It's flipped Arbitrum in TVL, leads L2s in daily transactions, and matches both in stablecoin market cap.

The growth curve is getting steeper.

It's flipped Arbitrum in TVL, leads L2s in daily transactions, and matches both in stablecoin market cap.

The growth curve is getting steeper.

3/ @AerodromeFi owns the DEX landscape, commanding 62% market share vs Uniswap's 29%.

The protocol's dominance looks sustainable heading into 2025.

The protocol's dominance looks sustainable heading into 2025.

4/ Lending markets exploded from $150M to $1B+ YTD.

@MoonwellDeFi is generating $19.6M annualized fees after the Circle integration, while @MorphoLabs leads with $294M TVL.

The growth here is just getting started.

@MoonwellDeFi is generating $19.6M annualized fees after the Circle integration, while @MorphoLabs leads with $294M TVL.

The growth here is just getting started.

5/ AI agents are the breakout story.

@virtuals_io has launched 2200+ agents, with AIXBT trading over $341M in total volume.

We expect this trend to continue into 2025.

@virtuals_io has launched 2200+ agents, with AIXBT trading over $341M in total volume.

We expect this trend to continue into 2025.

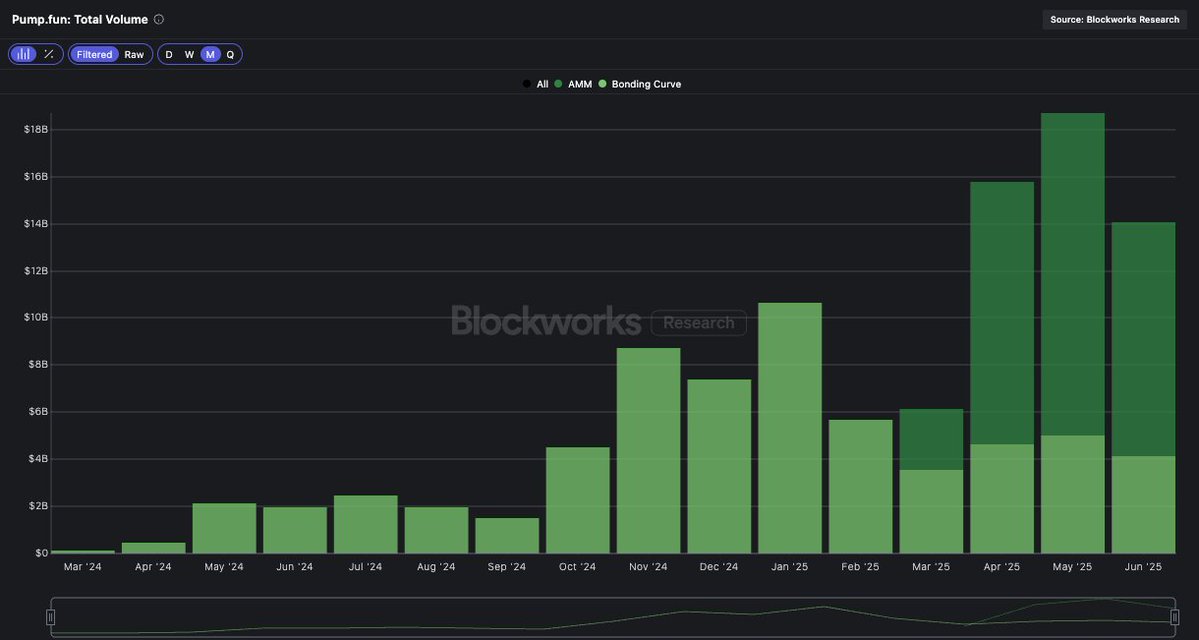

6/ Memecoin activity keeps driving volume.

Clanker has deployed 20k+ tokens, pushing consistent DEX growth since September.

Clanker has deployed 20k+ tokens, pushing consistent DEX growth since September.

7/ The Base ecosystem is maturing, but plenty of upside remains.

Read the full report with detailed analysis from @_dshap here: app.blockworksresearch.com/research/base-…

Read the full report with detailed analysis from @_dshap here: app.blockworksresearch.com/research/base-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh