Do you want to pay $0 in taxes during retirement?

With strategic tax planning, it’s possible.

Let me show you how it works:

With strategic tax planning, it’s possible.

Let me show you how it works:

First, bookmark the tweet above.

This thread is packed with lots of value.

Let's dive in...

This thread is packed with lots of value.

Let's dive in...

When building wealth, we have three main account types:

• Tax-deferred accounts (TDA) – Traditional 401(k)/IRA

• Tax-exempt accounts (TEA) – Roth IRA, Roth 401(k)

• Taxable accounts

Each of these accounts has different tax implications.

• Tax-deferred accounts (TDA) – Traditional 401(k)/IRA

• Tax-exempt accounts (TEA) – Roth IRA, Roth 401(k)

• Taxable accounts

Each of these accounts has different tax implications.

Say you are 60, are married, and want to retire.

You both have been investing all your life and have:

→ $1.5M in 401(k)

→ $100K in Roth IRA

→ $200K in a brokerage account

How do you withdraw strategically?

You both have been investing all your life and have:

→ $1.5M in 401(k)

→ $100K in Roth IRA

→ $200K in a brokerage account

How do you withdraw strategically?

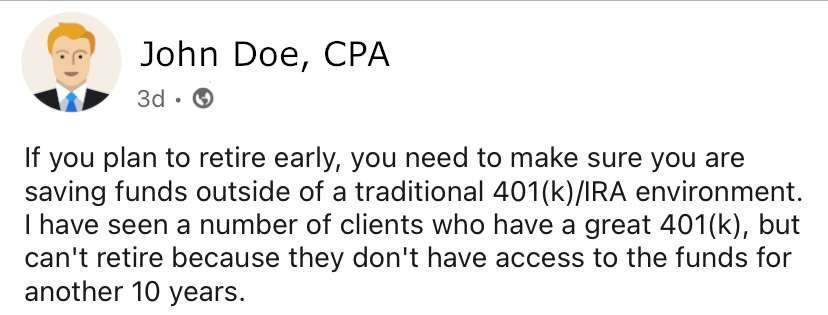

First, before Social Security Benefits (SSB) begin, we have to liquidate the tax-deferred and taxable accounts in an efficient manner.

This will help us prevent a huge tax increase later on with Required Minimum Distributions (RMDs) and SSBs.

This will help us prevent a huge tax increase later on with Required Minimum Distributions (RMDs) and SSBs.

With a 401(k), we can start withdrawing it without penalty at the age 59 1/2.

This is where we will start.

This is where we will start.

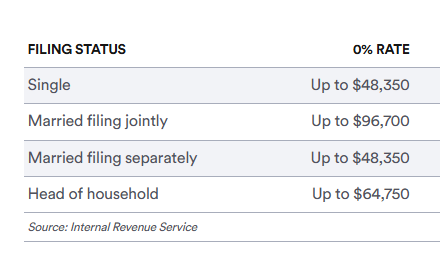

In 2025, the standard deduction for a single is $15,000 (married filing jointly is $30,000).

This means that we can withdraw $30,000 from a 401(k) and pay $0 in federal taxes.

This means that we can withdraw $30,000 from a 401(k) and pay $0 in federal taxes.

The next $23,850 is taxed at 10% for MFJ status.

If needeed, we could pull additional money from a 401(k) with minimal tax impact.

So, the total pulled is $53,850 so far, which is below the 4% of the 401(k) balance and is within the safe withdrawal rate.

If needeed, we could pull additional money from a 401(k) with minimal tax impact.

So, the total pulled is $53,850 so far, which is below the 4% of the 401(k) balance and is within the safe withdrawal rate.

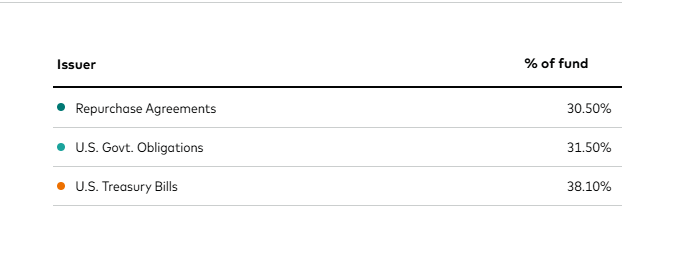

Moving on to the brokerage account, the 0% tax rate for our qualified dividends or investments sales applies below $96,700 of taxable income:

This means that we can pull $70,000+ without paying an additional tax.

In our case, we have $53,850 - $30,000 SD = $23,850 of taxable income.

With dividends/capital gains, we can pull an additional $8,000 and pay $0 in federal taxes.

In our case, we have $53,850 - $30,000 SD = $23,850 of taxable income.

With dividends/capital gains, we can pull an additional $8,000 and pay $0 in federal taxes.

So, we pulled $60,000 of cash with minimal tax impact.

As part of the withdrawal strategy, we want to minimize the future tax impact before Social Security Benefits and RMDs kick in.

This also could be the perfect time for Roth conversions.

As part of the withdrawal strategy, we want to minimize the future tax impact before Social Security Benefits and RMDs kick in.

This also could be the perfect time for Roth conversions.

In addition, with that income you would be able to stay below the IRMAA threshold, avoiding an increase in their Medicare premiums.

In higher income scenarios, you would also need to consider the impact of the 3.8% Net Investment Income Tax.

In higher income scenarios, you would also need to consider the impact of the 3.8% Net Investment Income Tax.

In our scenario, we would continue pulling from 401k + brokerage for the next few years before the SSB begins.

The goal would be to strategically live off taxable accounts and TDAs, converting to TEAs, and reducing the amount in TDAs to prevent future RMDs.

The goal would be to strategically live off taxable accounts and TDAs, converting to TEAs, and reducing the amount in TDAs to prevent future RMDs.

After SSBs kick in, we could reevaluate the strategy depending on how much you have in a 401(k)/Roth/brokerage and to analyze the full tax impact.

Bonus: Depending on your state, you might also pay $0 in state taxes on these withdrawals.

During retirement, you could move to a different state to potentially lower your state tax burden, depending on your circumstances and goals

During retirement, you could move to a different state to potentially lower your state tax burden, depending on your circumstances and goals

This is why tax planning is key.

Learned something new? If so, please:

1. follow me @money_cruncher

2. retweet the first tweet

Learned something new? If so, please:

1. follow me @money_cruncher

2. retweet the first tweet

• • •

Missing some Tweet in this thread? You can try to

force a refresh