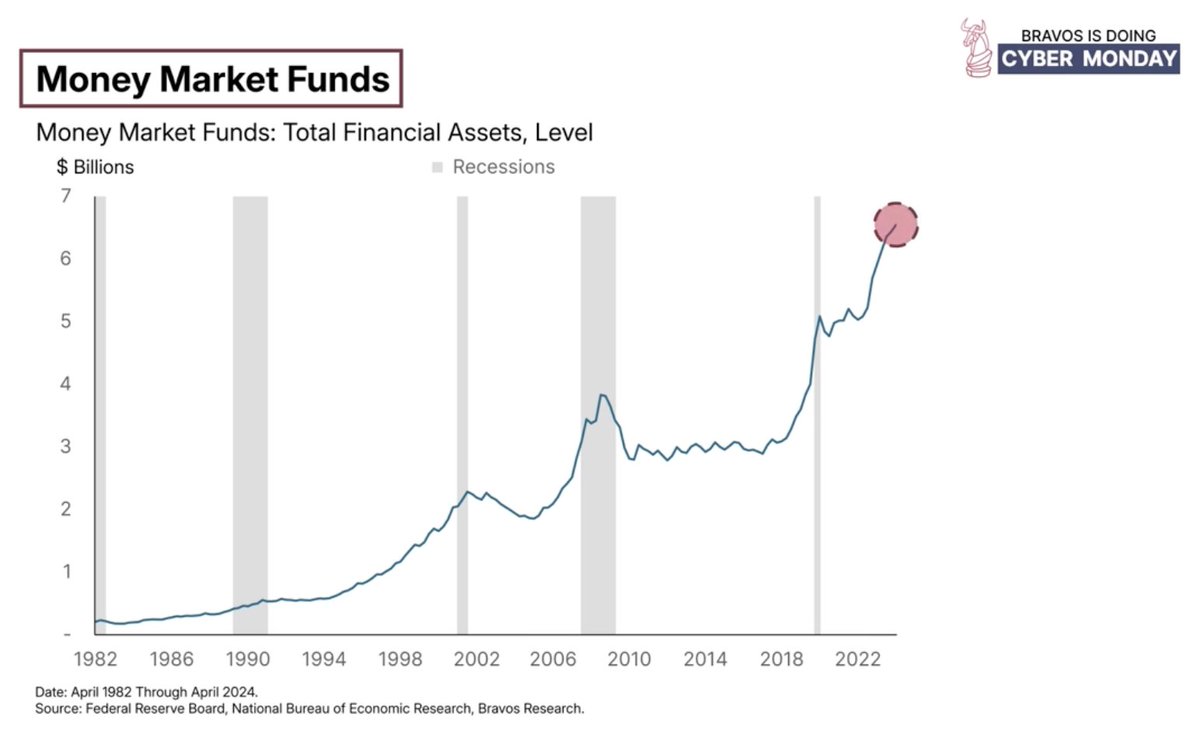

Big investors & corporations are hoarding cash like NEVER before

This is unlike anything we've seen

A thread 🧵

This is unlike anything we've seen

A thread 🧵

2/ Money market funds currently offer yields of around 5%

Which is one of the highest levels in the last 20 years

A 5% return may not sound spectacular

But in today’s environment, it’s compelling

Which is one of the highest levels in the last 20 years

A 5% return may not sound spectacular

But in today’s environment, it’s compelling

3/ Compare that 5% cash yield to the S&P 500’s earnings yield

Which is currently around 3%

And you can see that cash yield is 2% higher than the S&P 500’s earnings yield

The latter of which basically measures the ROI from holding stocks

Which is currently around 3%

And you can see that cash yield is 2% higher than the S&P 500’s earnings yield

The latter of which basically measures the ROI from holding stocks

4/ Historically, stocks outperformed cash

But today, cash offers better return

This rare setup flips the traditional investing script

With stocks yielding less than cash, investors like Buffett may see stocks as a weak long-term play

But today, cash offers better return

This rare setup flips the traditional investing script

With stocks yielding less than cash, investors like Buffett may see stocks as a weak long-term play

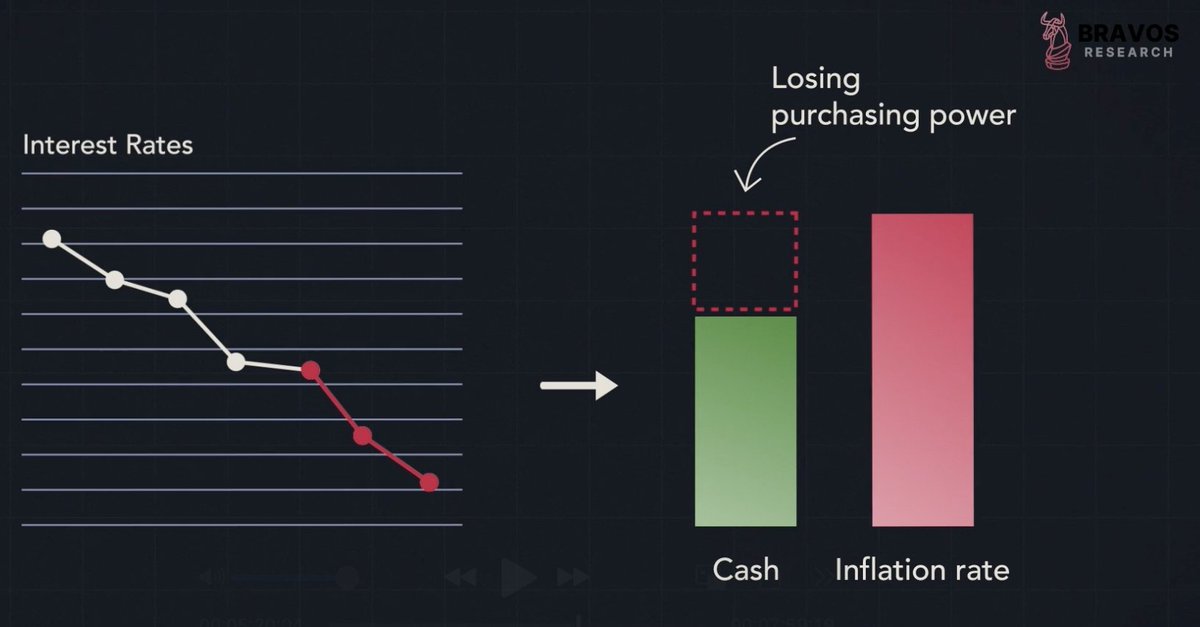

5/ Add low inflation, and cash becomes even more appealing, thanks to positive real interest rates

Positive real interest rates occur when cash yields outpace inflation, preserving purchasing power

This shift is significant after decades of negative real rates, where inflation ate away at cash returns

Positive real interest rates occur when cash yields outpace inflation, preserving purchasing power

This shift is significant after decades of negative real rates, where inflation ate away at cash returns

6/ Negative real interest rates—very common over the last 30 years—encouraged spending and investing

Today’s positive rates mark a fundamental shift, changing how both businesses and individuals allocate capital

Today’s positive rates mark a fundamental shift, changing how both businesses and individuals allocate capital

7/ Real interest rates, adjusted for inflation, are now around +2%

Historically, such levels have often been followed by US recessions

Why?

Because they create conditions that favor saving over spending

Historically, such levels have often been followed by US recessions

Why?

Because they create conditions that favor saving over spending

8/ When real rates are positive, households and businesses prioritize saving over investing or consuming

This reduces demand, raises unemployment, and slows economic growth

Which are classic precursors to a recession

This reduces demand, raises unemployment, and slows economic growth

Which are classic precursors to a recession

9/ Economist John Maynard Keynes summed it up well:

“The propensity to save will defeat its own purpose”

So basically saying high savings reduce demand, slowing the economy

“The propensity to save will defeat its own purpose”

So basically saying high savings reduce demand, slowing the economy

10/ Indeed, corporations are hoarding cash instead of investing today

Large time deposits have surged in recent years

Mirroring patterns seen before the 2008 financial crisis

Large time deposits have surged in recent years

Mirroring patterns seen before the 2008 financial crisis

11/ But not all economists agree with Keynes

Milton Friedman argued that savings are crucial for long-term growth

And fuel investments that drive productivity and innovation

Milton Friedman argued that savings are crucial for long-term growth

And fuel investments that drive productivity and innovation

12/ Indeed, a company or individual that has saved up enough money will be able to take on larger new projects that require a certain starting capital

Something that it wouldn't be able to do without saving

And this can fuel economic prosperity

This is a core concept behind the theory of the business cycle

Something that it wouldn't be able to do without saving

And this can fuel economic prosperity

This is a core concept behind the theory of the business cycle

13/ Savings can lay the foundation for recovery

During downturns, cash piles up

Once conditions improve, this cash is deployed into major investments, fueling the next economic boom

This is called “pent-up demand”

During downturns, cash piles up

Once conditions improve, this cash is deployed into major investments, fueling the next economic boom

This is called “pent-up demand”

14/ This “pent-up demand” is a critical part of the business cycle

The question is: when will today’s $6.5 trillion in cash reserves start flowing back into the economy?

Historically, cash in money market funds is only deployed during or after economic downturns

The question is: when will today’s $6.5 trillion in cash reserves start flowing back into the economy?

Historically, cash in money market funds is only deployed during or after economic downturns

15/ The trigger?

Negative real interest rates, which makes holding cash unattractive

Negative real rates occur when cash yields fall below inflation, eroding purchasing power

This pushes investors to redeploy funds into higher-yielding assets, kickstarting economic growth

Negative real interest rates, which makes holding cash unattractive

Negative real rates occur when cash yields fall below inflation, eroding purchasing power

This pushes investors to redeploy funds into higher-yielding assets, kickstarting economic growth

16/ But historically, rates only turn negative during or after recessions

When the Fed aggressively cuts rates to stimulate the economy

They’ve never gone negative without a recession first

When the Fed aggressively cuts rates to stimulate the economy

They’ve never gone negative without a recession first

17/ Find such key insights with 3 actionable investment strategy videos every week

And also get access to real-time buy and sell alerts at:

bit.ly/BravosResearch

And also get access to real-time buy and sell alerts at:

bit.ly/BravosResearch

18/ Thanks for reading!

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

If you enjoyed this thread, please ❤️ and 🔁 the first tweet below

And follow @bravosresearch for more market insights, finance and investment strategies

https://x.com/bravosresearch/status/1870531600955359716

• • •

Missing some Tweet in this thread? You can try to

force a refresh