A recent report from the World Bank has revealed a troubling trend: the poorest countries in the world are struggling to climb the economic ladder. In simple terms, they’re stuck while others continue to move ahead.

But what does this really mean, and why should we care? 🧵👇

But what does this really mean, and why should we care? 🧵👇

Countries around the world are grouped based on income levels—basically, how much the average person earns in a year. The poorest of these are called low-income countries where people often survive on less than $3 a day. That’s just enough to cover the basics like food and shelter.

Countries like Ethiopia, Madagascar, Yemen, Afghanistan, and the Democratic Republic of Congo are examples of low-income nations. Right now, there are 26 countries in the world still in this category.

Countries like Ethiopia, Madagascar, Yemen, Afghanistan, and the Democratic Republic of Congo are examples of low-income nations. Right now, there are 26 countries in the world still in this category.

To give you a sense of how tough that is, think about this: a cup of coffee at Starbucks often costs more than what people in these countries have to live on for an entire day.

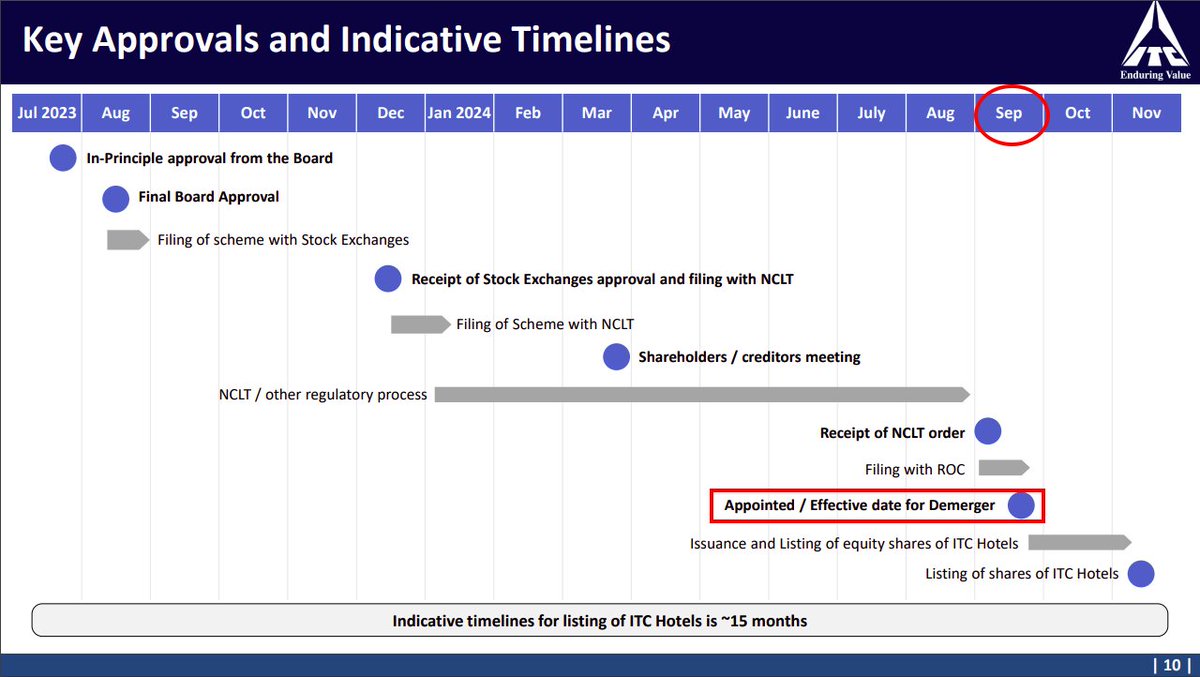

To understand what’s happening, we need to look back at the early 2000s. Back then, something hopeful was happening. Many poor countries were breaking out of poverty at an incredible pace.

Image: World Bank

To understand what’s happening, we need to look back at the early 2000s. Back then, something hopeful was happening. Many poor countries were breaking out of poverty at an incredible pace.

Image: World Bank

Let’s look at a few examples:

- India went from being a struggling economy to becoming the fifth-largest in the world.

- Bangladesh, once almost synonymous with poverty, transformed into a key manufacturing hub.

- And Vietnam, despite enduring years of war, became one of Asia’s fastest-growing economies.

- India went from being a struggling economy to becoming the fifth-largest in the world.

- Bangladesh, once almost synonymous with poverty, transformed into a key manufacturing hub.

- And Vietnam, despite enduring years of war, became one of Asia’s fastest-growing economies.

Back then, it seemed the world had found a formula for progress. Of 63 low-income countries, 39 moved up to middle-income status, proving that even the poorest nations could rise with the right support, policies, and conditions.

But that momentum has slowed dramatically. Today, 26 countries remain stuck as low-income, and only six are expected to reach middle-income status by 2050—a worrying sign of stalled progress.

Image: World Bank

But that momentum has slowed dramatically. Today, 26 countries remain stuck as low-income, and only six are expected to reach middle-income status by 2050—a worrying sign of stalled progress.

Image: World Bank

Let’s look at the numbers in these countries:

- Four in ten people live on less than $2.15 a day—barely enough to survive.

- Only one-third of the population has electricity, leaving many without basic needs like lights or the internet.

- There’s just one doctor for every 10,000 people—a dangerously low ratio.

- These challenges are not caused by a single issue but by a combination of many.

- Four in ten people live on less than $2.15 a day—barely enough to survive.

- Only one-third of the population has electricity, leaving many without basic needs like lights or the internet.

- There’s just one doctor for every 10,000 people—a dangerously low ratio.

- These challenges are not caused by a single issue but by a combination of many.

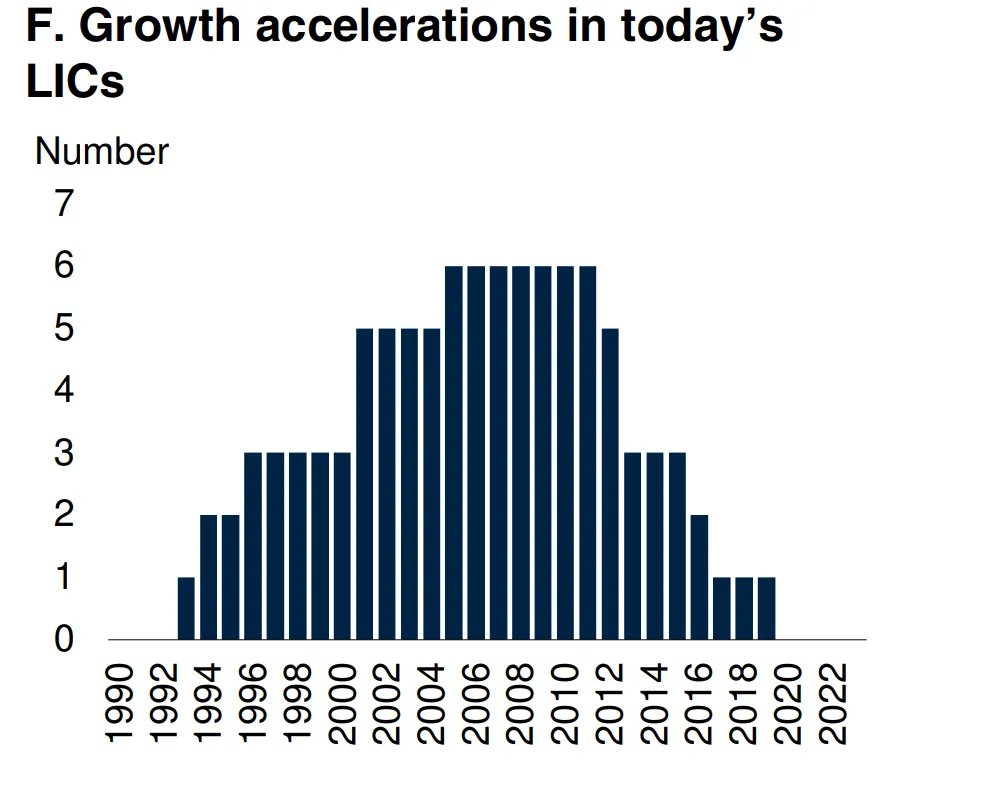

Conflict and Fragility

Two-thirds of low-income nations face fragile or war-torn situations, where wars destroy infrastructure, disrupt education, and displace millions. Over the past 20 years, deaths from conflict in these countries have been 20 times higher than in other developing nations. For instance, South Sudan’s GDP per person could be three times higher without ongoing conflicts, showing the immense opportunities lost to war.

Image: World Bank

Two-thirds of low-income nations face fragile or war-torn situations, where wars destroy infrastructure, disrupt education, and displace millions. Over the past 20 years, deaths from conflict in these countries have been 20 times higher than in other developing nations. For instance, South Sudan’s GDP per person could be three times higher without ongoing conflicts, showing the immense opportunities lost to war.

Image: World Bank

Lack of Infrastructure

Economies need essentials like roads, power, schools, and hospitals to grow. On average, people in low-income countries have access to just one-fifth of the infrastructure found in recent middle-income nations. For example, India, as a low-income country in 2000, had better infrastructure than most low-income countries today, giving it a crucial head start.

Economies need essentials like roads, power, schools, and hospitals to grow. On average, people in low-income countries have access to just one-fifth of the infrastructure found in recent middle-income nations. For example, India, as a low-income country in 2000, had better infrastructure than most low-income countries today, giving it a crucial head start.

Climate Change

Low-income nations bear the brunt of climate change. While a drought or flood in wealthier nations might slightly lower growth, in these countries, a single drought can slash growth by 1%—three times as much. Lacking resources to recover or adapt makes the situation worse.

Low-income nations bear the brunt of climate change. While a drought or flood in wealthier nations might slightly lower growth, in these countries, a single drought can slash growth by 1%—three times as much. Lacking resources to recover or adapt makes the situation worse.

Debt Burden

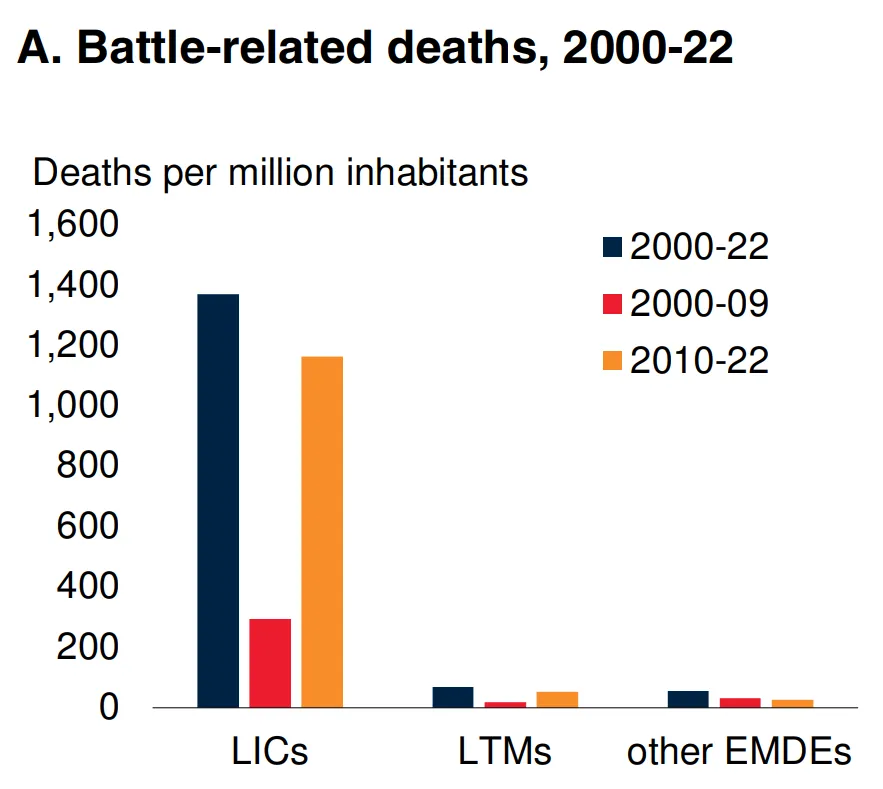

Over half of these nations are deeply in debt, often spending more on loan repayments than healthcare. Many must choose between repaying creditors and saving lives.

Image: World Bank

Over half of these nations are deeply in debt, often spending more on loan repayments than healthcare. Many must choose between repaying creditors and saving lives.

Image: World Bank

Declining International Aid

Global support is shrinking when these nations need it most. Official development aid has dropped to its lowest level in 20 years. Today, they receive the same per capita aid as middle-income countries did in 2000—despite facing much greater challenges.

Image: World Bank

Global support is shrinking when these nations need it most. Official development aid has dropped to its lowest level in 20 years. Today, they receive the same per capita aid as middle-income countries did in 2000—despite facing much greater challenges.

Image: World Bank

But despite these challenges, there’s also hope. These countries have untapped resources and opportunities that could completely change their futures. Let’s look at a few examples:

Natural Resources

Take the Democratic Republic of Congo. It holds more than 50% of the world’s cobalt reserves—a mineral that’s critical for making electric vehicle batteries. Many of these nations also have large reserves of graphite and other minerals essential for green energy. If managed well, these resources could become the backbone of their economies.

Take the Democratic Republic of Congo. It holds more than 50% of the world’s cobalt reserves—a mineral that’s critical for making electric vehicle batteries. Many of these nations also have large reserves of graphite and other minerals essential for green energy. If managed well, these resources could become the backbone of their economies.

Solar Energy

Most of these countries are located in what’s known as the “solar belt,” the region with the highest solar energy potential on Earth. With proper investment, they could use solar power to build industries and process their minerals locally, creating jobs and driving growth.

Most of these countries are located in what’s known as the “solar belt,” the region with the highest solar energy potential on Earth. With proper investment, they could use solar power to build industries and process their minerals locally, creating jobs and driving growth.

Tourism

Rwanda shows what’s possible with tourism. By making mountain gorillas a premium attraction, the country has turned tourism into a major part of its economy. Other nations could follow this example by leveraging their unique landscapes and wildlife.

Rwanda shows what’s possible with tourism. By making mountain gorillas a premium attraction, the country has turned tourism into a major part of its economy. Other nations could follow this example by leveraging their unique landscapes and wildlife.

Young Population

While much of the world is aging, these countries have a very young population. About 40% of their people are under 15. This could be a huge advantage—more workers, more energy, and more innovation—if they are given access to education and opportunities.

While much of the world is aging, these countries have a very young population. About 40% of their people are under 15. This could be a huge advantage—more workers, more energy, and more innovation—if they are given access to education and opportunities.

Now, let’s step back and see the big picture. Over 40% of the world’s extreme poor live in these countries. If these nations succeed, global poverty could drop significantly.

What’s more, their mineral resources are essential for the world’s green transition. Without their success, efforts to fight climate change could face serious delays.

What’s more, their mineral resources are essential for the world’s green transition. Without their success, efforts to fight climate change could face serious delays.

To meet basic development goals, these countries need massive investments—about 8% of their GDP every year. That’s a big number, but the potential rewards are even bigger.

This isn’t just about lifting millions out of poverty. It’s about unlocking opportunities that could benefit the entire world. With the right policies, investments, and support, these countries have the potential to become the economic powerhouses of the future.

We cover this and one more interesting story in today's Daily Brief. You can watch the episode on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts. All links here:

thedailybrief.zerodha.com/p/the-hidden-b…

thedailybrief.zerodha.com/p/the-hidden-b…

• • •

Missing some Tweet in this thread? You can try to

force a refresh