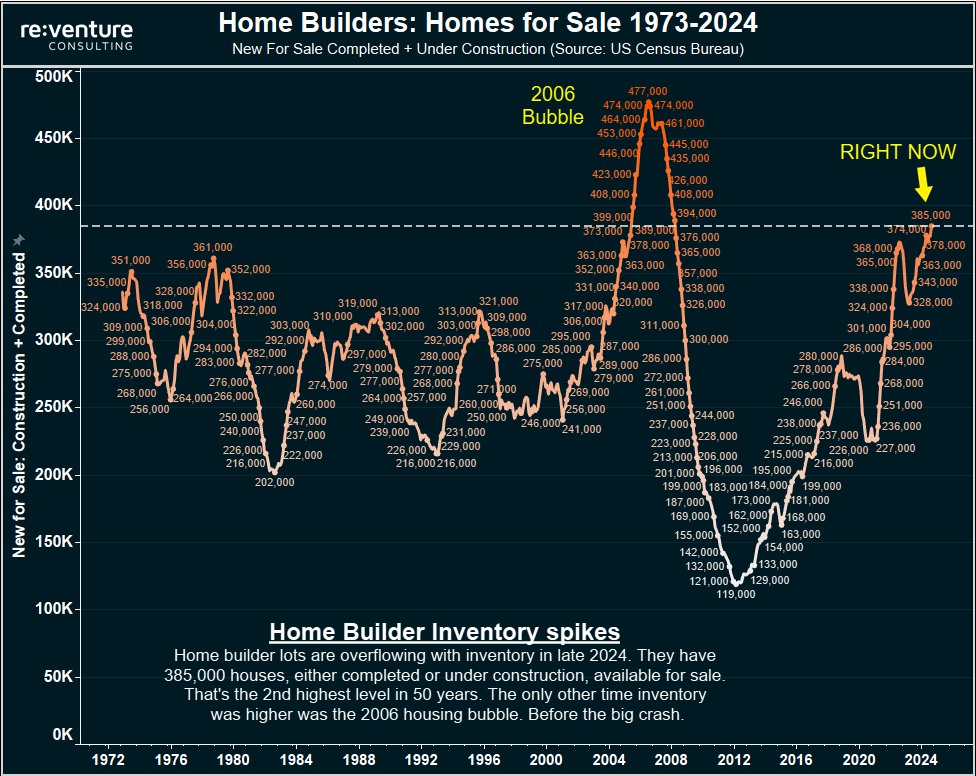

Home builder spec homes for sale just hit 2nd highest level ever.

Quite the rebound from the shortage experienced from 2012-22.

Builders are doing their part to inundate the housing market with supply.

Only other time there has been more builder spec inventory was 2008 bubble.

Quite the rebound from the shortage experienced from 2012-22.

Builders are doing their part to inundate the housing market with supply.

Only other time there has been more builder spec inventory was 2008 bubble.

1) A "spec" home is completed and sitting vacant for sale.

The builder built it intentionally without a buyer or wasn't able to find a buyer during construction.

So the home is just sitting vacant on the lot.

The builder built it intentionally without a buyer or wasn't able to find a buyer during construction.

So the home is just sitting vacant on the lot.

2) It represents "move-in ready" inventory that a homebuyer can purchase and move into immediately.

So the fact that spec inventory has skyrocketed so quickly in the last 6-12 months represents a big shift in the Housing Market.

So the fact that spec inventory has skyrocketed so quickly in the last 6-12 months represents a big shift in the Housing Market.

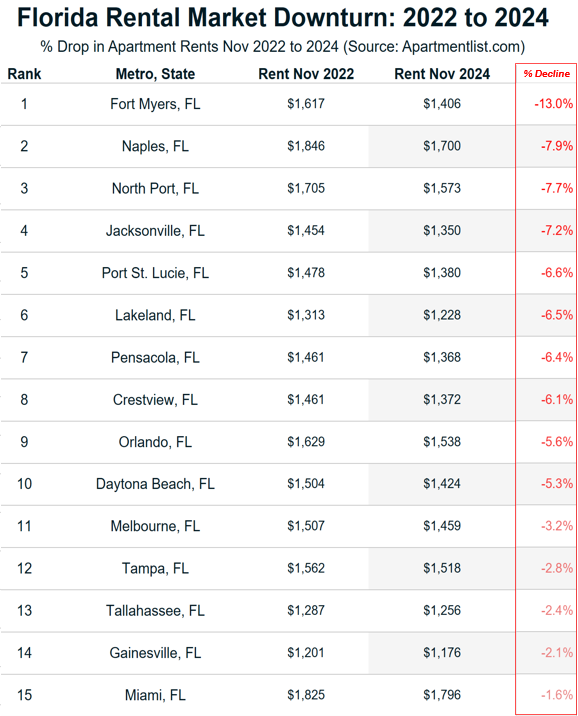

3) Especially in the South. Where builders have a majority of their spec inventory. States like TX/FL/TN are seeing an overflow of homes on builder lots available for sale.

4) We could see even more spec inventory hit the market in 2025, because the builders also have a lot of homes for sale under construction.

There's 266,000 houses for sale currently under construction.

That's also the 2nd highest level for any previous housing cycle. Only trailing the mid-2000s bubble.

There's 266,000 houses for sale currently under construction.

That's also the 2nd highest level for any previous housing cycle. Only trailing the mid-2000s bubble.

5) These statistics, sourced from the US Census Bureau, push back heavily on the notion of a "US Housing Shortage".

If there was a housing shortage, and builders needed to build more, why would we have the 2nd highest homes for sale ever on builder lots?

If there was a housing shortage, and builders needed to build more, why would we have the 2nd highest homes for sale ever on builder lots?

6) The answer of course is more complex than that.

The builders focus heavily on the South and parts of the Mountain West.

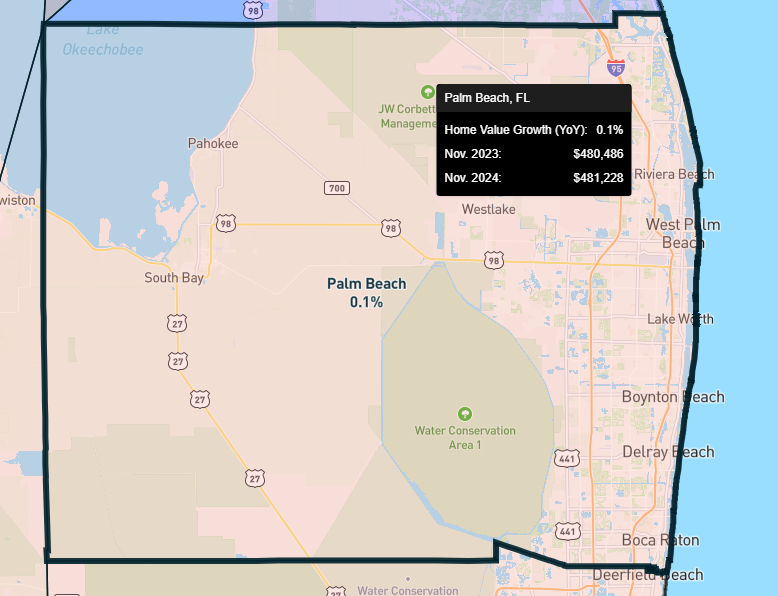

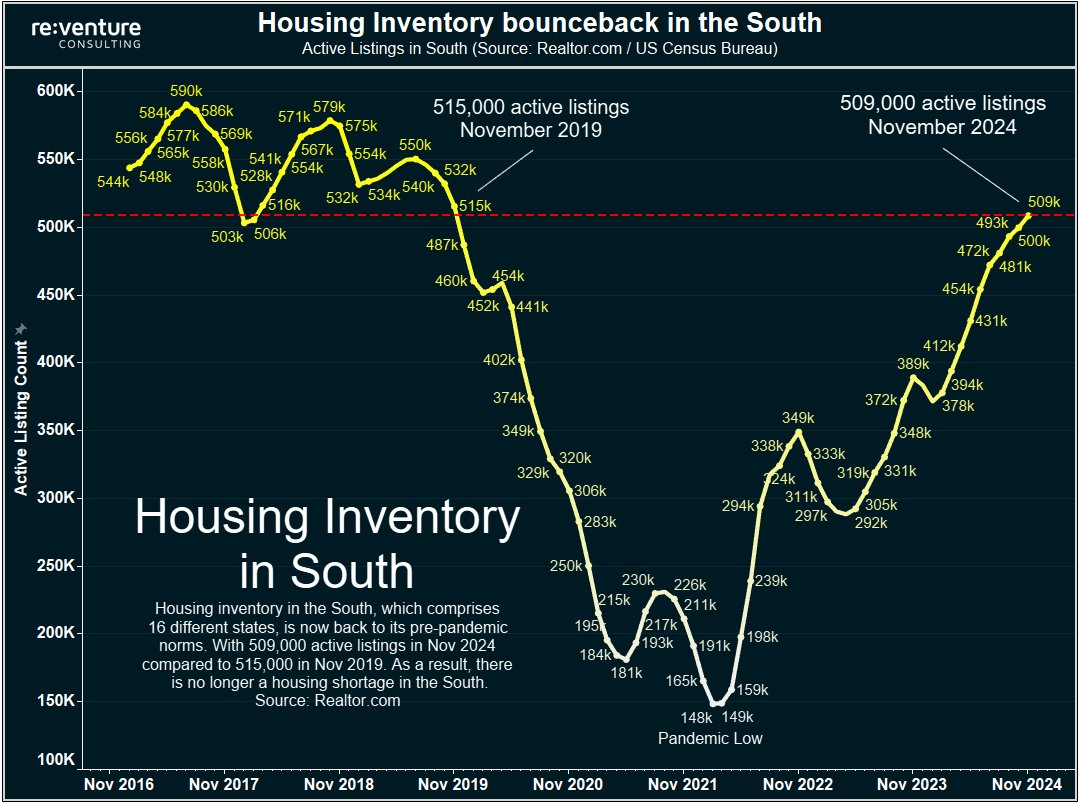

There is no more housing shortage in these regions. Active listings on the re-sale market have spiked and are back to pre-pandemic levels.

The builders focus heavily on the South and parts of the Mountain West.

There is no more housing shortage in these regions. Active listings on the re-sale market have spiked and are back to pre-pandemic levels.

7) However, there is still a persistent housing shortage in the Northeast and Midwest. Areas the builders ignore.

You can see active listings in the Northeast/Midwest on re-sale market are still in a big deficit to pre-pandemic.

While South has exploded back up.

You can see active listings in the Northeast/Midwest on re-sale market are still in a big deficit to pre-pandemic.

While South has exploded back up.

8) Don't miss the regional housing market trends in your market. Head to to access home value and inventory data for your ZIP code for free, so you can stay on top of the market and make a more educated decision.

After using the free data, upgrade to a premium plan to see Reventure's price forecasts for 2025.reventure.app

After using the free data, upgrade to a premium plan to see Reventure's price forecasts for 2025.reventure.app

• • •

Missing some Tweet in this thread? You can try to

force a refresh