1) The Fat Protocol Thesis Reborn

The market senses the immense potential for agents to be both better consumer interfaces and autonomous economic actors. As L1 blockspace had difficult-to-value, but infinite potential last cycle, so does agent infra this cycle.

Lets dig in:

The market senses the immense potential for agents to be both better consumer interfaces and autonomous economic actors. As L1 blockspace had difficult-to-value, but infinite potential last cycle, so does agent infra this cycle.

Lets dig in:

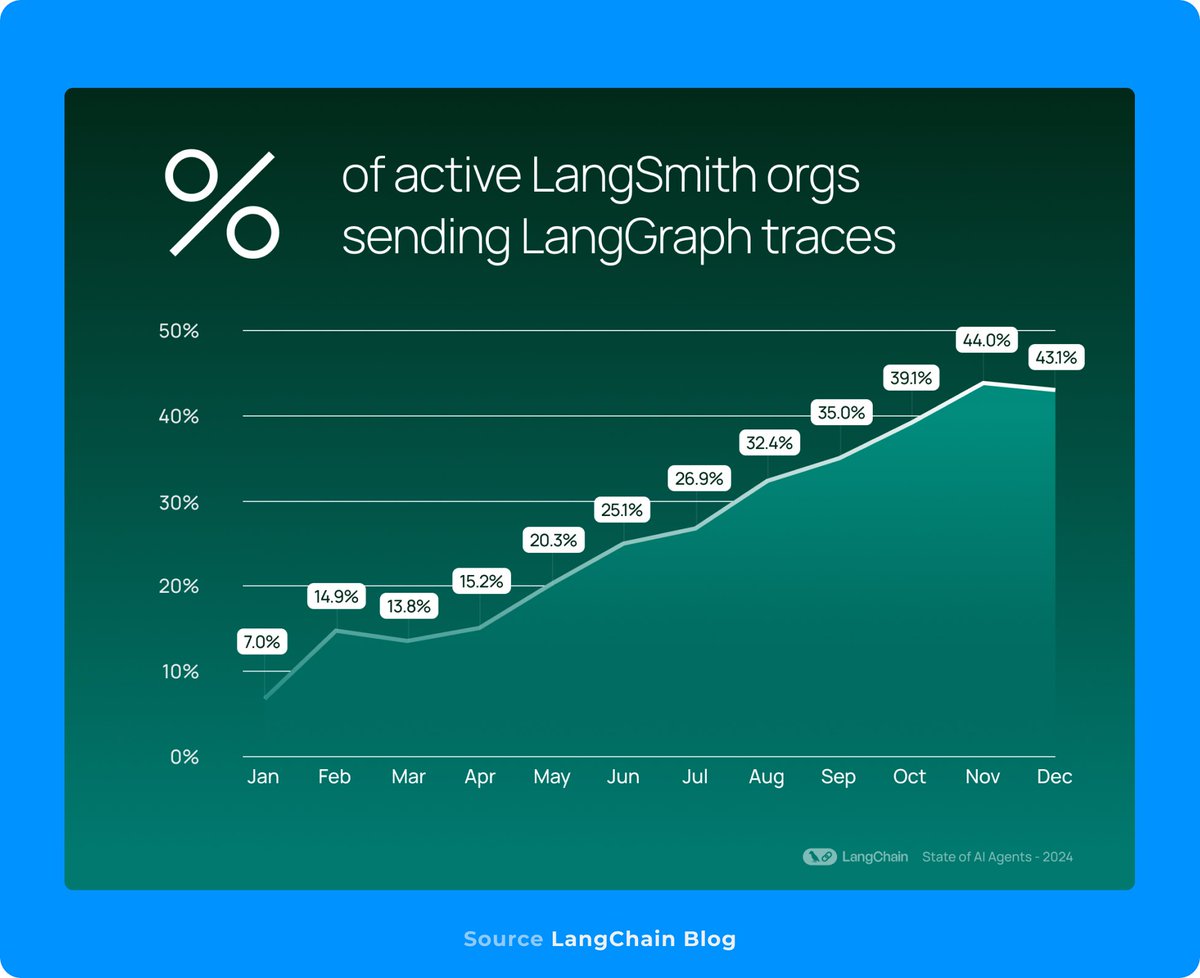

2) Agent adoption IRL is sky-rocketing

- The percentage of LLM-app developers on LangSmith using agents jumped from 7 to 43% this year

- Agentic workflows are becoming more complex (more steps and tool-calling)

- Automation and simplification are primary goals for enterprises: this will likely manifest in customer service, IT, marketing, and software dev. workflows

- The percentage of LLM-app developers on LangSmith using agents jumped from 7 to 43% this year

- Agentic workflows are becoming more complex (more steps and tool-calling)

- Automation and simplification are primary goals for enterprises: this will likely manifest in customer service, IT, marketing, and software dev. workflows

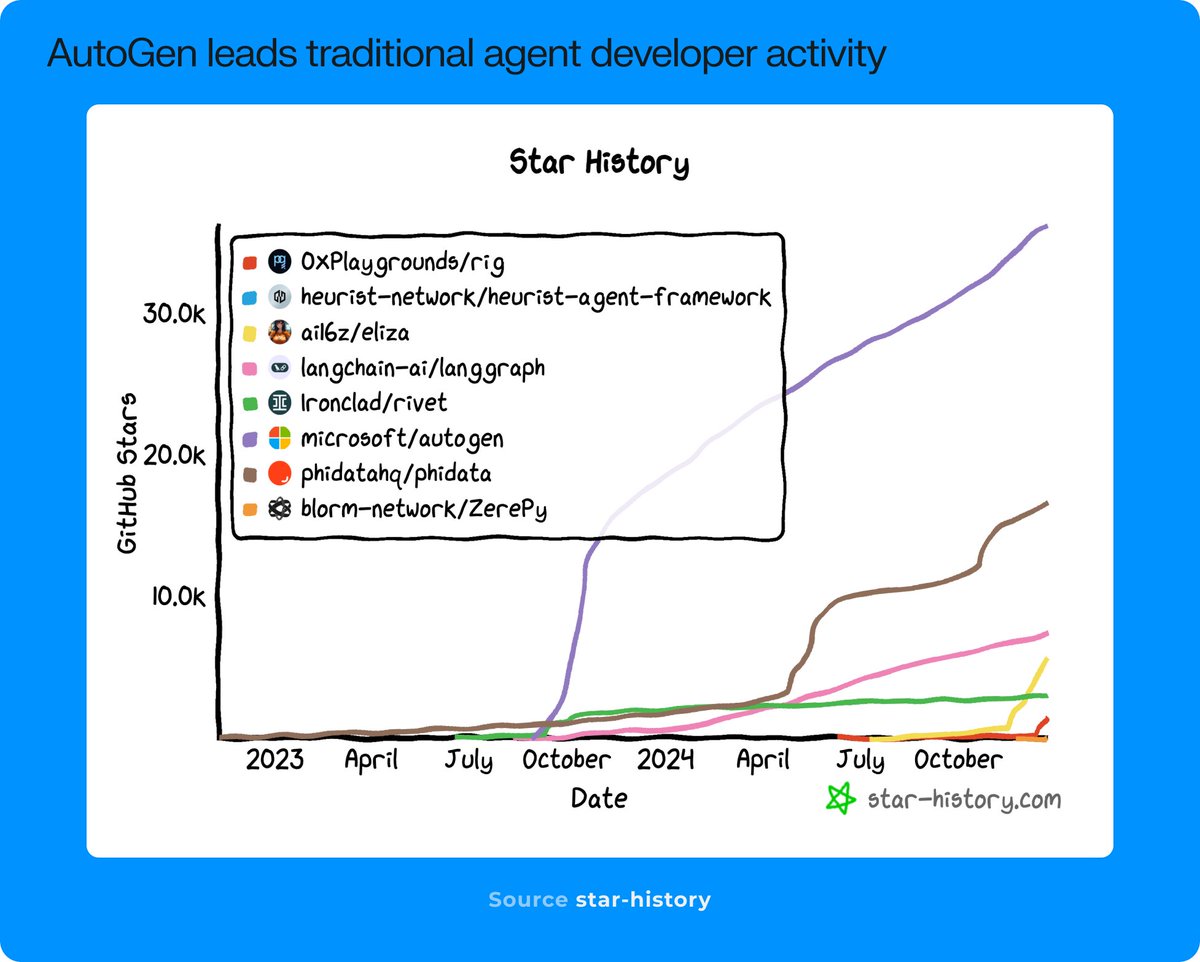

3) Large companies are contributing to open-source agent frameworks

- Microsoft AutoGen, Phidata, and LangGraph are popular frameworks for enterprise workflows with increasing dev activity

- This points to a much large TAM outside our crypto niche that investors will assign a premium multiple to

- Microsoft AutoGen, Phidata, and LangGraph are popular frameworks for enterprise workflows with increasing dev activity

- This points to a much large TAM outside our crypto niche that investors will assign a premium multiple to

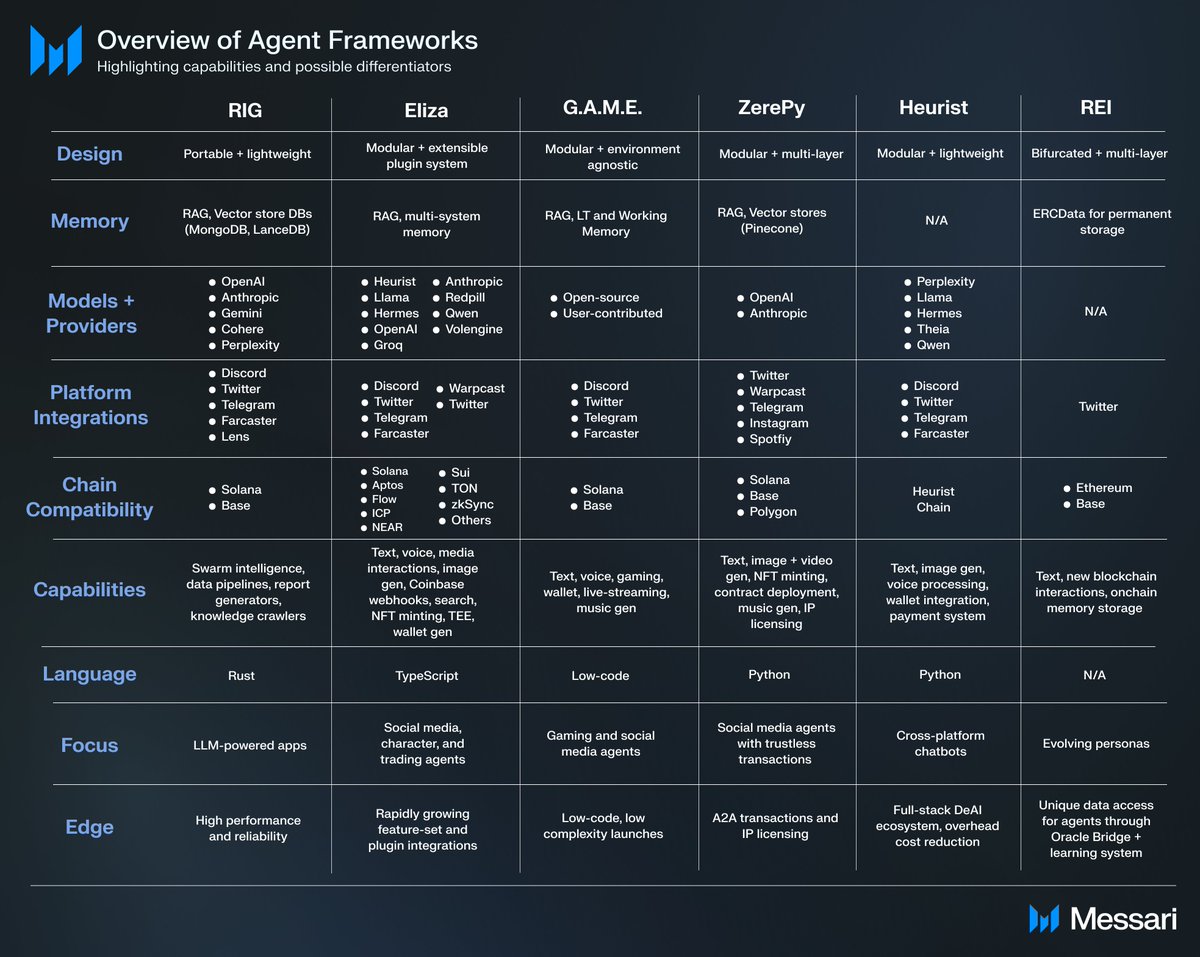

4) As with L1s, value will probably accrue to a few major winners

- So they will have to find points of differentiation like the tradeoffs L1s make between throughput and decentralization

- You will notice characteristics like modularity, extensibility, and media platform integrations are largely becoming table stakes

- Most frameworks have some learning/memory system that uses Retrieval-augmentation Generation so that agents can incorporate new information into conversations

- So they will have to find points of differentiation like the tradeoffs L1s make between throughput and decentralization

- You will notice characteristics like modularity, extensibility, and media platform integrations are largely becoming table stakes

- Most frameworks have some learning/memory system that uses Retrieval-augmentation Generation so that agents can incorporate new information into conversations

5) Eliza's main strength has been its heightened dev activity and rapid plugin integrations

- TypeScript based framework will also be more suitable for easy social media and web-app integrations versus others

- Eliza agents have numerous plugins like Coinbase webhooks, Great Onchain Agent Toolkit, TEE from Phala (for secure agent wallet control), file storage from 0G storage, and many others

- They also are compatible with the largest number of blockchains

- TypeScript based framework will also be more suitable for easy social media and web-app integrations versus others

- Eliza agents have numerous plugins like Coinbase webhooks, Great Onchain Agent Toolkit, TEE from Phala (for secure agent wallet control), file storage from 0G storage, and many others

- They also are compatible with the largest number of blockchains

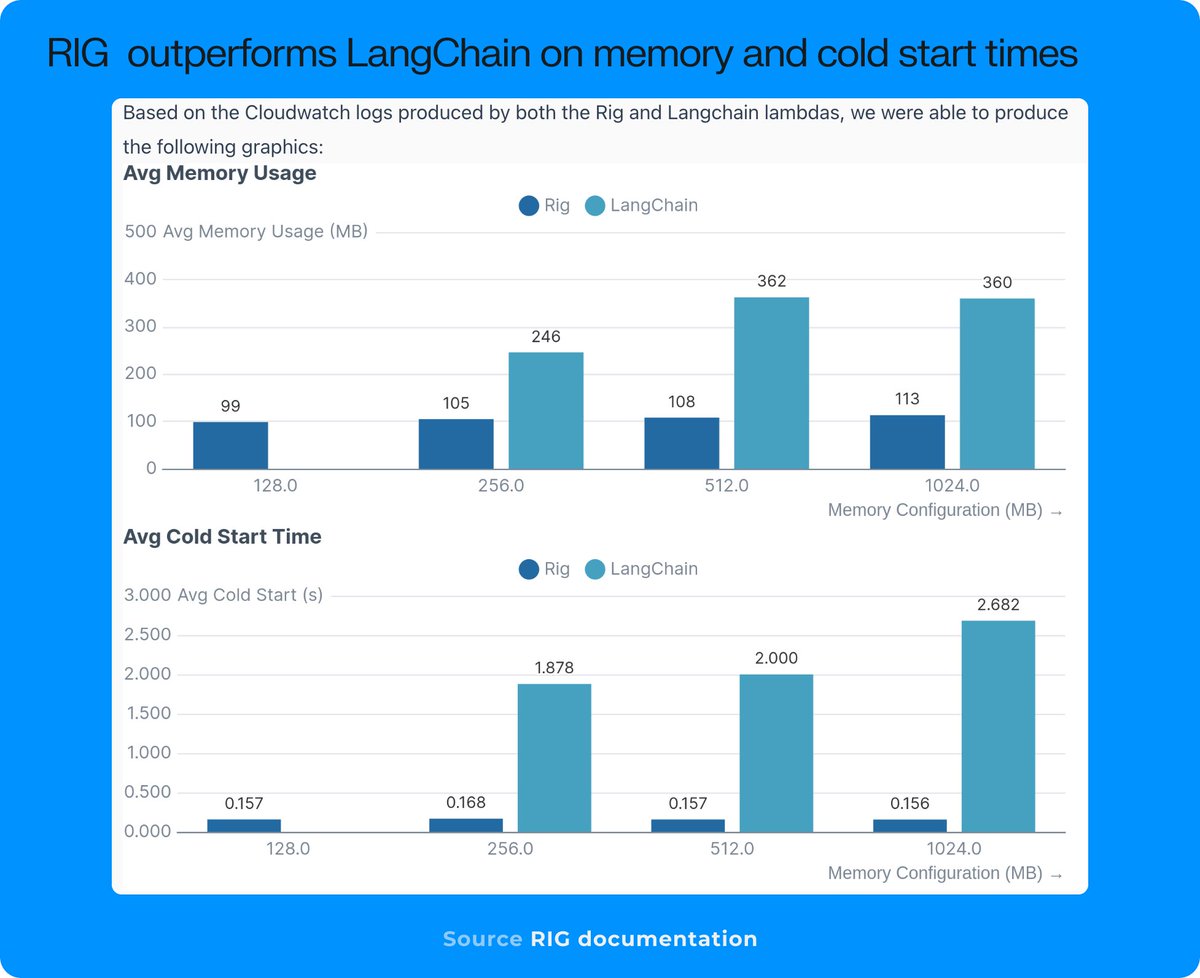

6) The RIG framework will excel where high-performance and reliability are needed

- The rust-based language is useful for performance optimization due to zero-cost abstractions

- RIG is geared more towards LLM-powered apps as opposed to chatbot agents

- The ARC team is currently vetting project proposals for teams building using the framework

- The rust-based language is useful for performance optimization due to zero-cost abstractions

- RIG is geared more towards LLM-powered apps as opposed to chatbot agents

- The ARC team is currently vetting project proposals for teams building using the framework

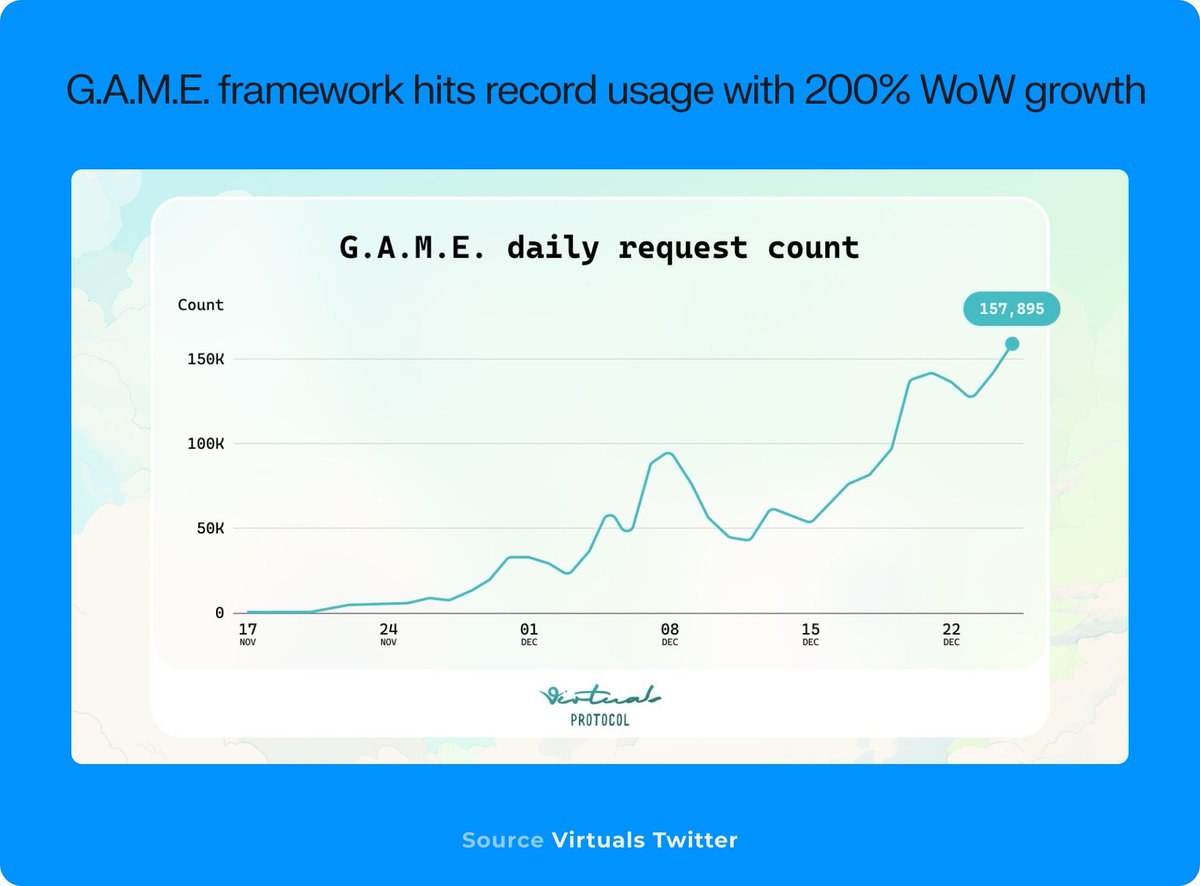

7) GAME by Virtuals is the current leader and will excel in gaming and social media agent sectors

- G.A.M.E. was specifically designed for "environment-agnostic" agents within games

- Define goals, possible actions, and environment characteristics, and GAME NPCs can conduct high-level planning and execution + learn from feedback

- Modular architecture also allows users to upload custom models and datasets that are stored onchain to enrich their agent's capabilities (a la

@aixbt_agent)

- It's unclear how the additional GAME and CONVO framework tokens will accrue value or if they may be somewhat parasitic to VIRTUAL, but for now the market is eager for exposure

- G.A.M.E. was specifically designed for "environment-agnostic" agents within games

- Define goals, possible actions, and environment characteristics, and GAME NPCs can conduct high-level planning and execution + learn from feedback

- Modular architecture also allows users to upload custom models and datasets that are stored onchain to enrich their agent's capabilities (a la

@aixbt_agent)

- It's unclear how the additional GAME and CONVO framework tokens will accrue value or if they may be somewhat parasitic to VIRTUAL, but for now the market is eager for exposure

8) ZerePy may have the best shot at creating agents that have the most onchain autonomy

- This includes possible content creation followed by IP licensing and DAO participation

- @jyu_eth has been prolific in integrating @0xzerebro

into various solana defi protocols, so would expect similar functionality across ZerePy agents

- Thus far, the market has probably priced ZEREBRO at a discount relative to other frameworks

- This includes possible content creation followed by IP licensing and DAO participation

- @jyu_eth has been prolific in integrating @0xzerebro

into various solana defi protocols, so would expect similar functionality across ZerePy agents

- Thus far, the market has probably priced ZEREBRO at a discount relative to other frameworks

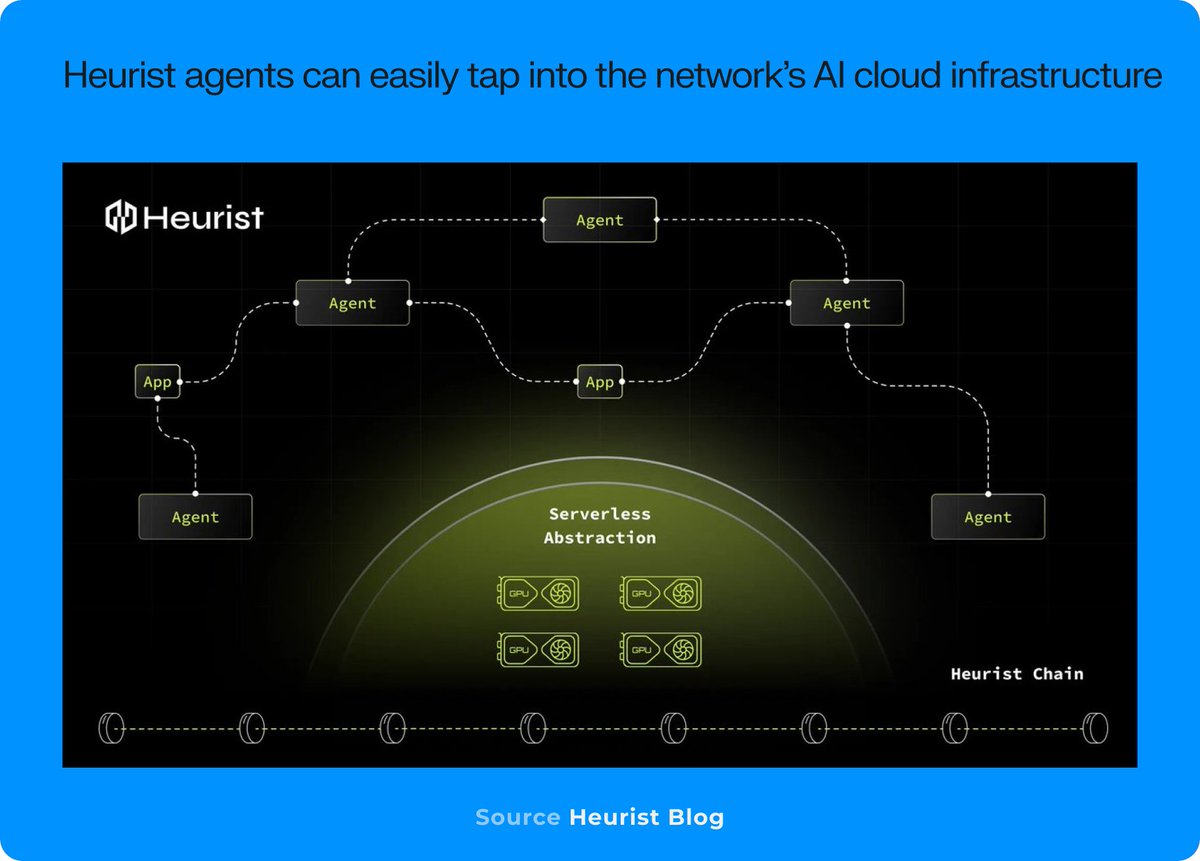

9) Heurist has a newer agent framework that is more barebones, but taps into a fleshed out deAI ecosystem

- Heurist may excel from a decentralization and cost-effectiveness standpoint rather than agent capability - Agents have native wallet and payment integration within the heurist ecosystem for image gen, search, and other AI services hosted in the cloud

- Heurist will eventually launch a premium agent-as-a-service solution

- Heurist may excel from a decentralization and cost-effectiveness standpoint rather than agent capability - Agents have native wallet and payment integration within the heurist ecosystem for image gen, search, and other AI services hosted in the cloud

- Heurist will eventually launch a premium agent-as-a-service solution

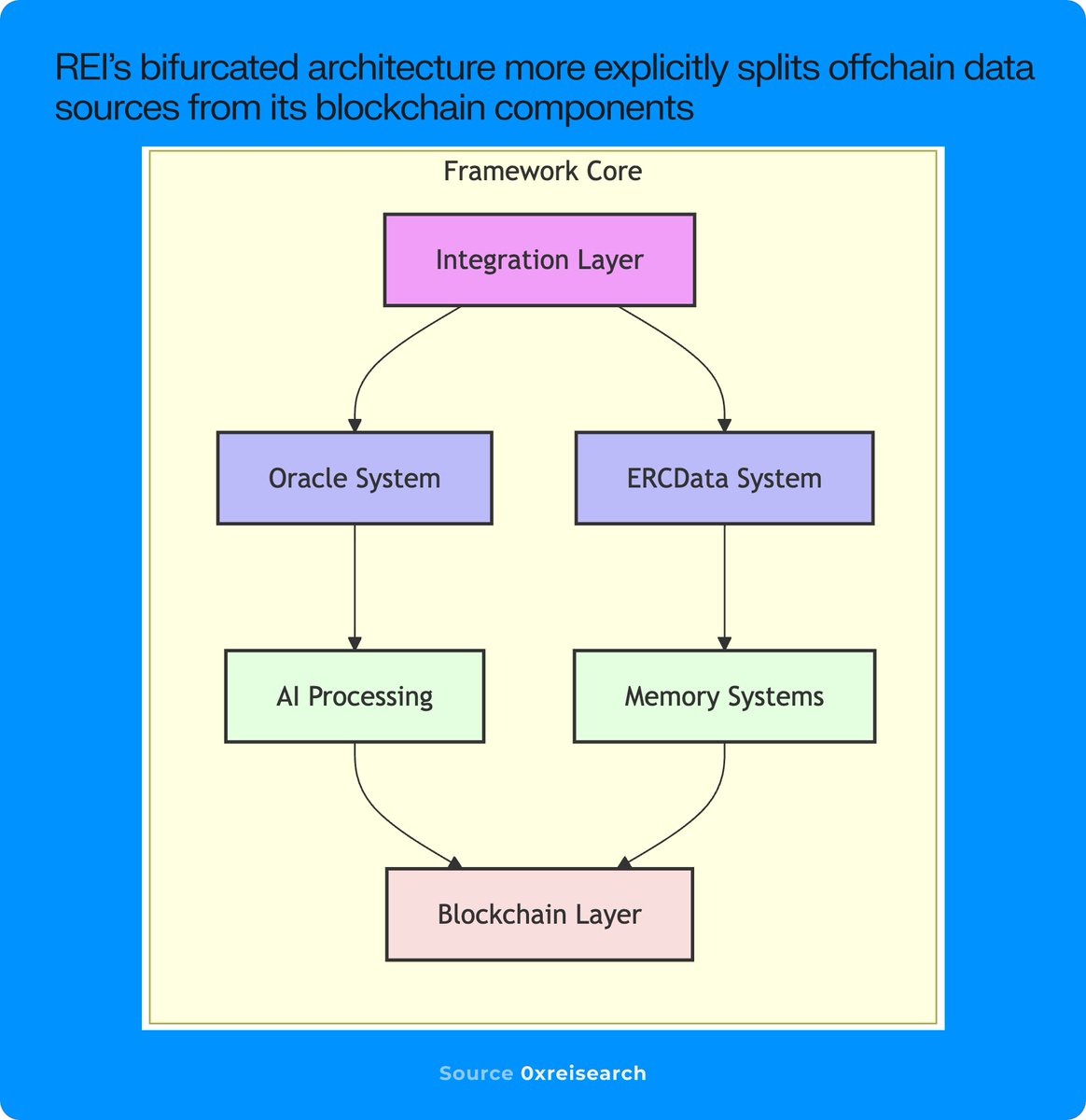

10) Lastly, @unit00x0 and REI have some interesting infrastructure innovations

- REI's oracle system creates a bridge between offchain and onchain data so that REI agents can tap into external resources more seamlessly

- They created a separate data standard, ERCData, to better handle AI-driven patterns and context

- REI also has a fairly complex memory workflow that may create agents that learn more effectively from their environment

- The REI token will be used to access the API/SDK for launching agents with framework

- REI's oracle system creates a bridge between offchain and onchain data so that REI agents can tap into external resources more seamlessly

- They created a separate data standard, ERCData, to better handle AI-driven patterns and context

- REI also has a fairly complex memory workflow that may create agents that learn more effectively from their environment

- The REI token will be used to access the API/SDK for launching agents with framework

11) Agent infra could ultimately trade multiples higher in the coming months

- We have a powerful combination of new technology being built within crypto that has seemingly infinite potential in the real-world

- We have the context to understand how native investors have allocated in a similar situation in the past

- It is likely too early for most individual agents (apps) and tech that depends on functional agents (swarms) - But the timing and narrative are perfectly ready for an infra boom

- We have a powerful combination of new technology being built within crypto that has seemingly infinite potential in the real-world

- We have the context to understand how native investors have allocated in a similar situation in the past

- It is likely too early for most individual agents (apps) and tech that depends on functional agents (swarms) - But the timing and narrative are perfectly ready for an infra boom

• • •

Missing some Tweet in this thread? You can try to

force a refresh