Thread. Today is a working day in Russia.

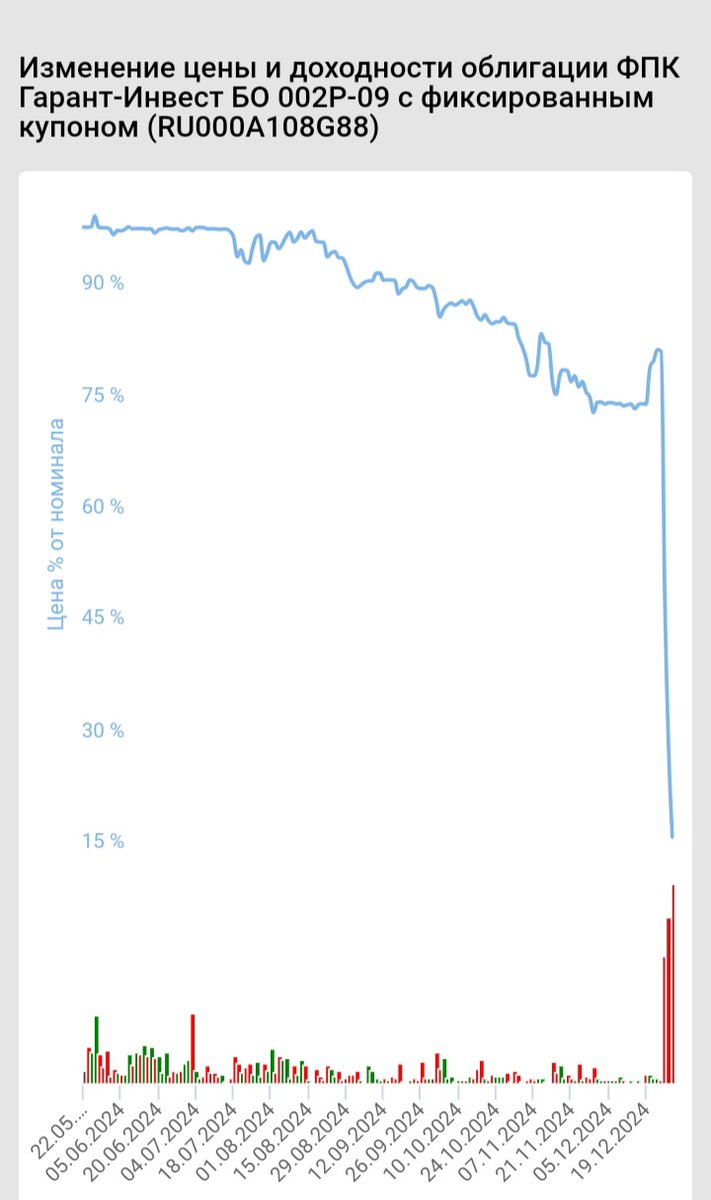

Bonds of the Financial and Industrial Corporation "Garant-Invest" continue to fall for the third day. The price has dropped to 18% of the face value.

1/

Bonds of the Financial and Industrial Corporation "Garant-Invest" continue to fall for the third day. The price has dropped to 18% of the face value.

1/

The corporation owns a chain of shopping malls in Moscow. Two days ago, the Central Bank of the Russian Federation revoked the license of the bank owned by the corporation.

Judging by the bond price chart, default is very close

2/

Judging by the bond price chart, default is very close

2/

yield 334%

🤣🤣🤣

3/

🤣🤣🤣

3/

• • •

Missing some Tweet in this thread? You can try to

force a refresh