A recent investigation by the Securities and Exchange Board of India (SEBI) uncovered a major front-running scam worth around ₹65 crores in the stock market. And to everyone’s shock, the man at the center of it all was none other than Ketan Parekh.

You’ve probably heard of him—back in 2001, he orchestrated one of the biggest scams in India’s stock market history 🧵👇

You’ve probably heard of him—back in 2001, he orchestrated one of the biggest scams in India’s stock market history 🧵👇

A former associate of Harshad Mehta, Ketan Parekh was infamous for artificially inflating the prices of popular stocks in industries like IT, media, and telecom. He then tricked institutional investors into pouring money into those stocks. The amount involved in that fraud is believed to be as high as ₹40,000 crores.

The fallout was massive back then. SEBI, the CBI, and the Serious Fraud Investigation Office (SFIO) all went after him. He was barred from trading in the stock market for fourteen years and even spent three years in jail.

The fallout was massive back then. SEBI, the CBI, and the Serious Fraud Investigation Office (SFIO) all went after him. He was barred from trading in the stock market for fourteen years and even spent three years in jail.

But now, he’s back! This time, he built a carefully crafted network that used insider information and coordinated trades to make profits at every step.

In this story, we’ll break down what this scam was all about, how it worked, who was involved, and how SEBI pieced the puzzle together to crack the case. And, as always, we’ll also look at how this impacts the broader market — and you and us as investors.

In this story, we’ll break down what this scam was all about, how it worked, who was involved, and how SEBI pieced the puzzle together to crack the case. And, as always, we’ll also look at how this impacts the broader market — and you and us as investors.

Before we dive into the details, let’s first understand the core of this scam: front-running.

For those who are new to the markets, front-running is a type of market manipulation where someone takes advantage of confidential information about large, upcoming trades to make their own profits.

For those who are new to the markets, front-running is a type of market manipulation where someone takes advantage of confidential information about large, upcoming trades to make their own profits.

Here’s a simple example: Imagine a big investor is about to buy a stock. This will likely push the stock price up. If someone gets secret information about this trade in advance, they can buy the stock first and sell it after the price goes up, pocketing a quick profit. Front-running is illegal because it’s unfair and undermines the trust and integrity of the stock markets.

Now, back to the scam. There were five key players in this story — three were actively involved, while two didn’t realize they were being used.

1. Ketan Parekh: After being banned from the stock markets for 14 years, he’s back as the mastermind behind this scam. He organized a complex network to profit from insider information and is at the center of this scandal.

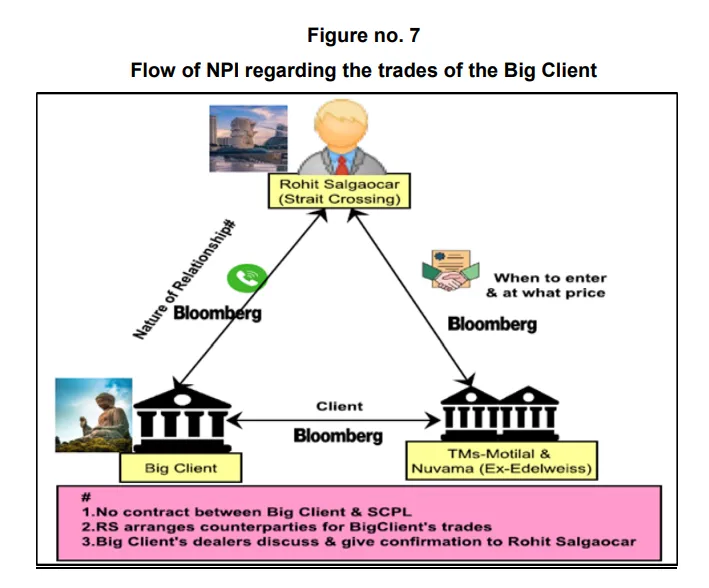

2. Rohit Salgaocar: A Singapore-based intermediary who helped foreign clients trade in India. Thanks to his role, he had access to confidential trade details and passed this information on to Ketan Parekh.

3. The Big Client: This was a large U.S.-based foreign portfolio investor making massive, legitimate stock trades in India. They unknowingly became the foundation of the scam.

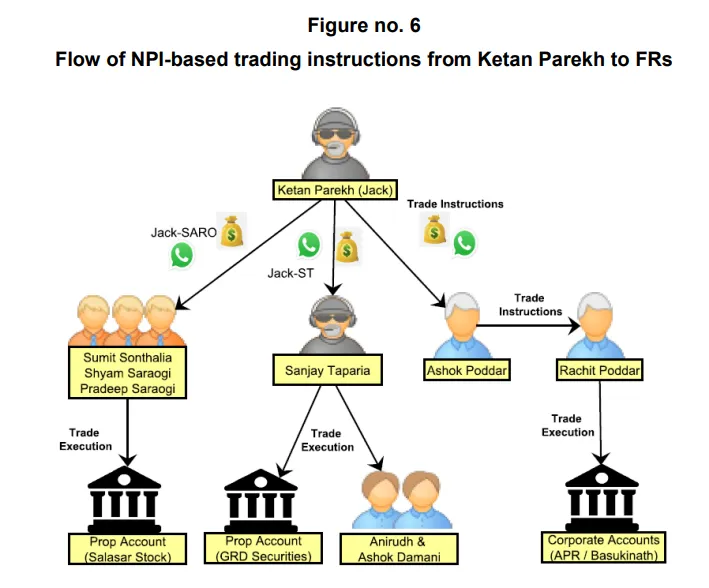

4. The Front Runners: These were Ketan Parekh’s associates, including brokers and corporate accounts. Acting on his instructions, they executed trades based on insider information.

5. Indian Brokers: Companies like Motilal Oswal and Nuvama Wealth Management facilitated the Big Client’s trades. They had valid agreements with Rohit Salgaocar and paid him commissions for bringing in the business. However, like the Big Client, they were unaware their systems were being exploited.

1. Ketan Parekh: After being banned from the stock markets for 14 years, he’s back as the mastermind behind this scam. He organized a complex network to profit from insider information and is at the center of this scandal.

2. Rohit Salgaocar: A Singapore-based intermediary who helped foreign clients trade in India. Thanks to his role, he had access to confidential trade details and passed this information on to Ketan Parekh.

3. The Big Client: This was a large U.S.-based foreign portfolio investor making massive, legitimate stock trades in India. They unknowingly became the foundation of the scam.

4. The Front Runners: These were Ketan Parekh’s associates, including brokers and corporate accounts. Acting on his instructions, they executed trades based on insider information.

5. Indian Brokers: Companies like Motilal Oswal and Nuvama Wealth Management facilitated the Big Client’s trades. They had valid agreements with Rohit Salgaocar and paid him commissions for bringing in the business. However, like the Big Client, they were unaware their systems were being exploited.

This scam was a carefully planned, multi-layered operation designed to make money at almost every step. Let’s break it down step by step in simple terms:

1. Leaking Non-Public Information (NPI)

The first part of the scam involved leaking sensitive information.

The Big Client we mentioned earlier relied on Indian brokers to carry out its trades in the Indian market. Rohit Salgaocar acted as the go-between in this process. Because of his role, he had access to crucial details about the Big Client’s trades, such as:

- Which stocks they wanted to buy or sell?

- How many shares and the price range they were targeting?

- When the trades were planned to happen.

Instead of protecting this sensitive information, Salgaocar passed it along to Ketan Parekh.

The first part of the scam involved leaking sensitive information.

The Big Client we mentioned earlier relied on Indian brokers to carry out its trades in the Indian market. Rohit Salgaocar acted as the go-between in this process. Because of his role, he had access to crucial details about the Big Client’s trades, such as:

- Which stocks they wanted to buy or sell?

- How many shares and the price range they were targeting?

- When the trades were planned to happen.

Instead of protecting this sensitive information, Salgaocar passed it along to Ketan Parekh.

2. Front-running with Sensitive Information

With this leaked information in hand, Ketan Parekh took the next step: front-running. Here’s how it worked:

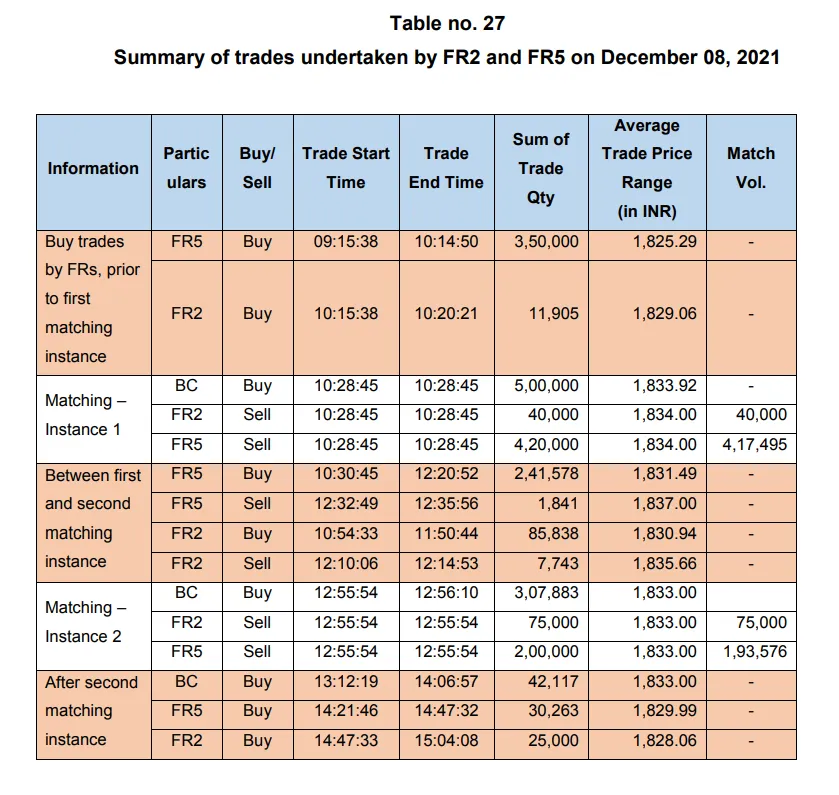

Step 1: Parekh’s network, which included brokers and corporate accounts, would buy stocks that the Big Client was planning to purchase—but they did it before the Big Client could.

Step 2: When the Big Client’s large orders hit the market, they pushed up the stock prices. Parekh’s network then sold their holdings at a higher price, pocketing the difference.

With this leaked information in hand, Ketan Parekh took the next step: front-running. Here’s how it worked:

Step 1: Parekh’s network, which included brokers and corporate accounts, would buy stocks that the Big Client was planning to purchase—but they did it before the Big Client could.

Step 2: When the Big Client’s large orders hit the market, they pushed up the stock prices. Parekh’s network then sold their holdings at a higher price, pocketing the difference.

Let’s look at a quick example:

- Suppose the Big Client planned to buy 1 lakh shares of a stock at ₹100 per share. Parekh’s team would jump in first and buy the shares at ₹100.

- When the Big Client’s massive order came through, it pushed the stock price up to ₹105. That’s when Parekh’s team would immediately sell their shares, making a quick ₹5 profit per share.

- Suppose the Big Client planned to buy 1 lakh shares of a stock at ₹100 per share. Parekh’s team would jump in first and buy the shares at ₹100.

- When the Big Client’s massive order came through, it pushed the stock price up to ₹105. That’s when Parekh’s team would immediately sell their shares, making a quick ₹5 profit per share.

3. The Role of Counterparties

Now, let’s talk about the third layer of the scam: counterparties.

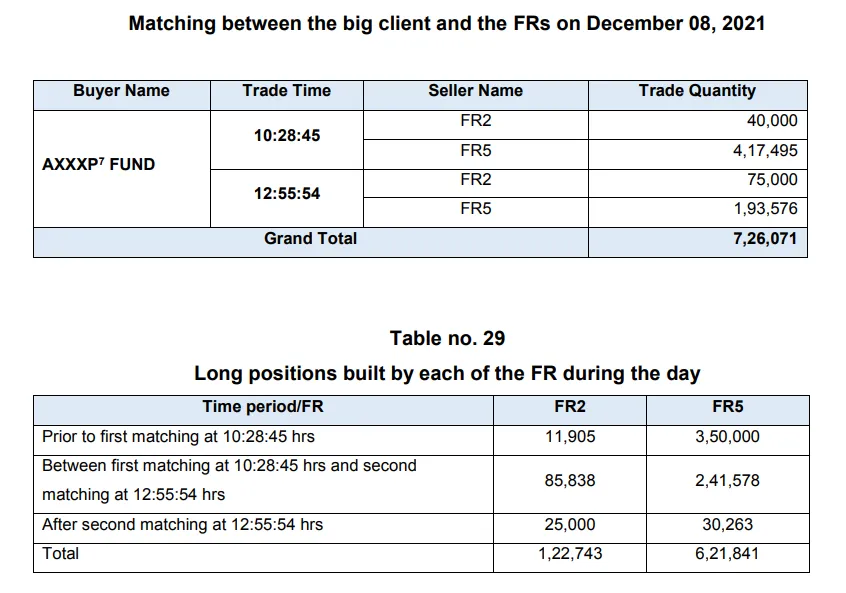

In the stock market, every trade needs someone on the other side. If you want to buy a share, someone else has to sell it to you at the same time. This becomes especially tricky for large trades in less liquid stocks, where finding enough buyers or sellers is tough.

Counterparties solve this problem. They can be individual traders or institutions that step in to take the other side of a big order, ensuring the trade happens smoothly.

In this case, Rohit Salgaocar used Ketan Parekh’s associates as counterparties for the Big Client’s trades. Essentially, Parekh’s network was directly involved in fulfilling the Big Client’s orders, making the scam even more efficient.

Now, let’s talk about the third layer of the scam: counterparties.

In the stock market, every trade needs someone on the other side. If you want to buy a share, someone else has to sell it to you at the same time. This becomes especially tricky for large trades in less liquid stocks, where finding enough buyers or sellers is tough.

Counterparties solve this problem. They can be individual traders or institutions that step in to take the other side of a big order, ensuring the trade happens smoothly.

In this case, Rohit Salgaocar used Ketan Parekh’s associates as counterparties for the Big Client’s trades. Essentially, Parekh’s network was directly involved in fulfilling the Big Client’s orders, making the scam even more efficient.

Basically, if the Big Client wanted to buy a stock, Parekh’s network would step in and sell it to them. This ensured they made a profit on the transaction.

Similarly, if the Big Client wanted to sell a stock, Parekh’s network would buy it, knowing they could sell it later at a higher price and make a profit that way too.

In fact, according to a statement Rohit Salgaocar gave to SEBI, about 90% of all the counterparties he arranged were from Ketan Parekh’s network itself!

Similarly, if the Big Client wanted to sell a stock, Parekh’s network would buy it, knowing they could sell it later at a higher price and make a profit that way too.

In fact, according to a statement Rohit Salgaocar gave to SEBI, about 90% of all the counterparties he arranged were from Ketan Parekh’s network itself!

4. Cash settlements through the Angadiya network

And that brings us to the fourth layer of the scam: cash settlements through the Angadiya network.

As you can imagine, running a scam isn’t easy. There’s always a risk of getting caught, so people often look for ways to keep their operations under the radar.

In this case, Ketan Parekh relied on the Angadiya network. This is an old, informal system used to move money or valuables between places. It’s commonly trusted by jewellers and traders to safely and quickly transport cash or precious items.

And that brings us to the fourth layer of the scam: cash settlements through the Angadiya network.

As you can imagine, running a scam isn’t easy. There’s always a risk of getting caught, so people often look for ways to keep their operations under the radar.

In this case, Ketan Parekh relied on the Angadiya network. This is an old, informal system used to move money or valuables between places. It’s commonly trusted by jewellers and traders to safely and quickly transport cash or precious items.

While this system isn’t strictly regulated, it has been around for generations, built on strong trust and personal relationships within the network. By using the Angadiya network, Ketan Parekh could quickly settle profits with his associates and move money without leaving any trace in the formal banking system.

Now that we’ve covered all the basic pieces, let’s talk about how SEBI uncovered this scam.

The investigation started when SEBI noticed unusual trading patterns. The Big Client’s trades were often preceded by similar trades from other accounts, which immediately raised red flags.

Here’s how SEBI pieced it all together:

The investigation started when SEBI noticed unusual trading patterns. The Big Client’s trades were often preceded by similar trades from other accounts, which immediately raised red flags.

Here’s how SEBI pieced it all together:

SEBI analyzed thousands of trades and found a clear pattern.

- Parekh’s network consistently traded in the same stocks as the Big Client, just minutes before the Big Client’s orders were executed.

- These trades were highly profitable, which strongly suggested that someone had access to insider information.

- Parekh’s network consistently traded in the same stocks as the Big Client, just minutes before the Big Client’s orders were executed.

- These trades were highly profitable, which strongly suggested that someone had access to insider information.

SEBI carried out search and seizure operations at 17 locations, uncovering key evidence. They seized:

- Mobile phones and electronic devices.

- Trading records and financial documents.

- Mobile phones and electronic devices.

- Trading records and financial documents.

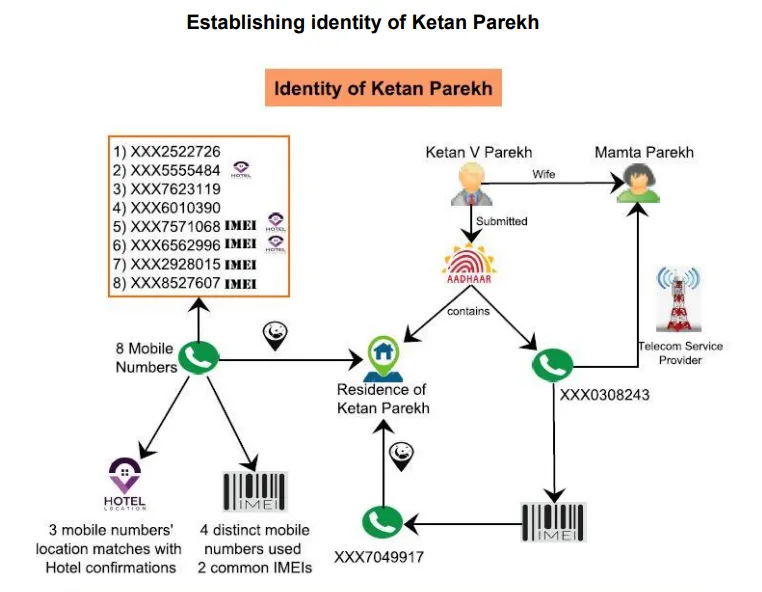

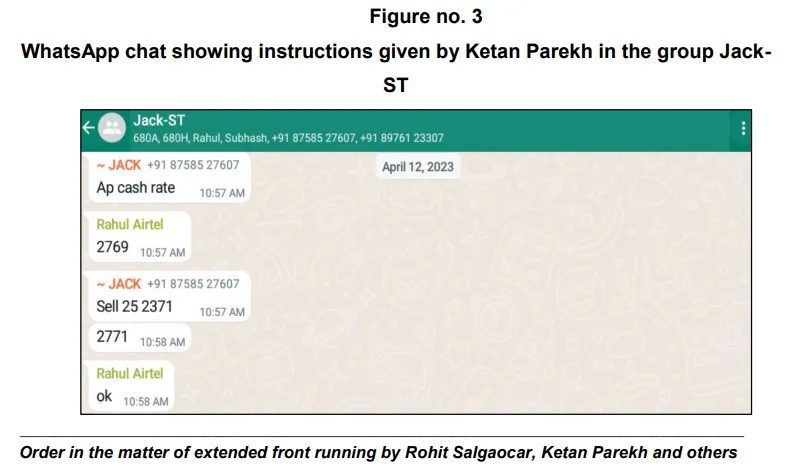

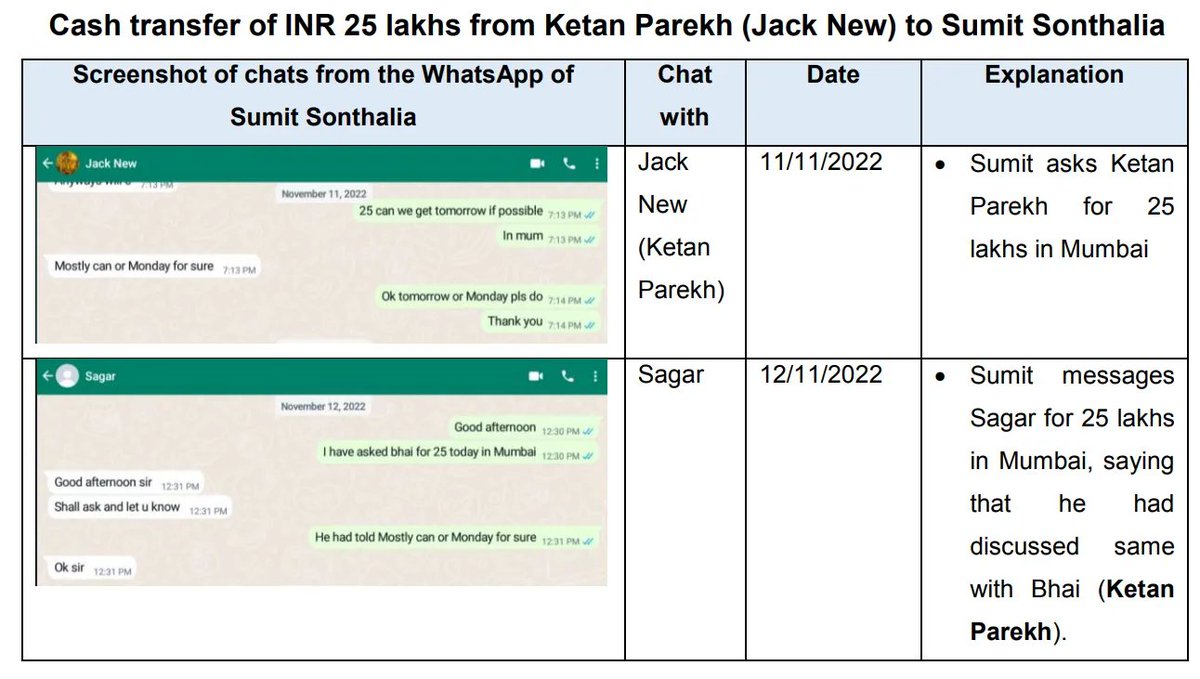

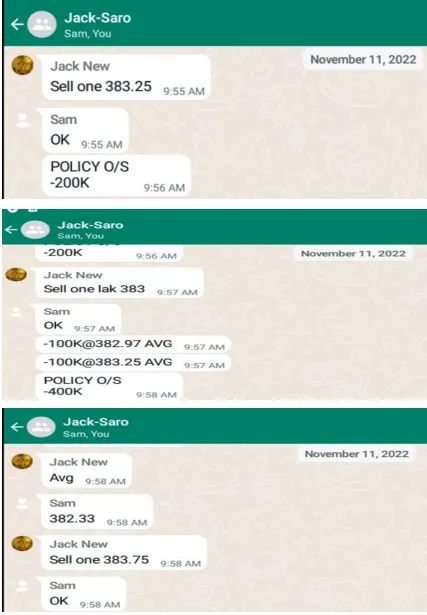

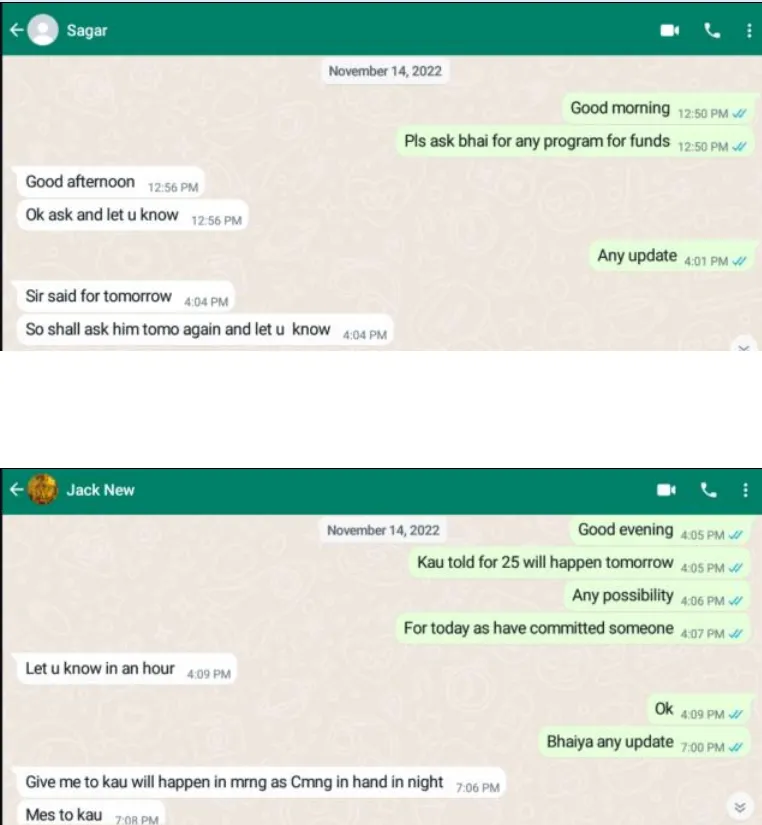

SEBI also decoded WhatsApp chats and pseudonyms that were used to hide the scam.

Ketan Parekh used multiple phone numbers and nicknames like “Jack” and “Boss” to coordinate the operation. The WhatsApp chats revealed:

- Real-time instructions to his network on which trades to execute.

- Evidence of his communication with Rohit Salgaocar.

Ketan Parekh used multiple phone numbers and nicknames like “Jack” and “Boss” to coordinate the operation. The WhatsApp chats revealed:

- Real-time instructions to his network on which trades to execute.

- Evidence of his communication with Rohit Salgaocar.

SEBI then connected all the dots by following the trail of money. They uncovered:

- Cash movements through the Angadiya network.

- Profit-sharing among Parekh’s associates.

- Cash movements through the Angadiya network.

- Profit-sharing among Parekh’s associates.

It’s important to note that the investigation isn’t over yet. This case is still in its early stages. However, to protect the markets and maintain investor trust, SEBI acted quickly by issuing a temporary order:

- Ketan Parekh, Rohit Salgaocar, and others involved were immediately barred from trading.

- They were required to close all existing derivative positions within three months.

- Ketan Parekh, Rohit Salgaocar, and others involved were immediately barred from trading.

- They were required to close all existing derivative positions within three months.

SEBI is continuing to dig deeper to ensure no other parties involved in the scam are overlooked.

In summary, the Ketan Parekh scam is a stark reminder that some individuals will go to great lengths to exploit the financial system. While SEBI’s vigilance brought this operation to light, it also shows the ongoing need for strict oversight and accountability in the markets.

In summary, the Ketan Parekh scam is a stark reminder that some individuals will go to great lengths to exploit the financial system. While SEBI’s vigilance brought this operation to light, it also shows the ongoing need for strict oversight and accountability in the markets.

For investors like us, this case is a valuable lesson. While markets rely on trust, it’s always worth staying aware and questioning who might be pulling the strings behind the scenes.

We cover this and one more interesting story in today's Daily Brief. You can watch the episode on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts. All links here:

thedailybrief.zerodha.com/p/sebis-big-ca…

thedailybrief.zerodha.com/p/sebis-big-ca…

• • •

Missing some Tweet in this thread? You can try to

force a refresh