🚨BREAKING

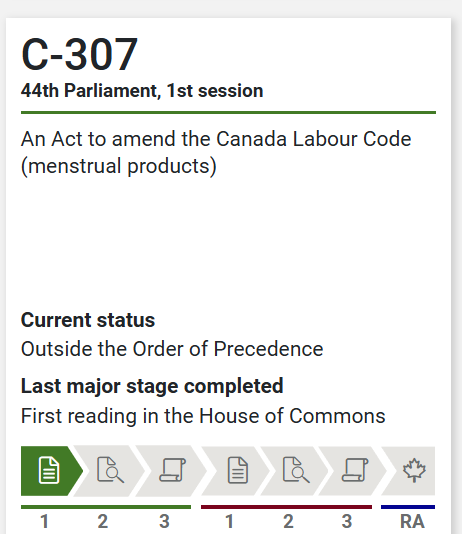

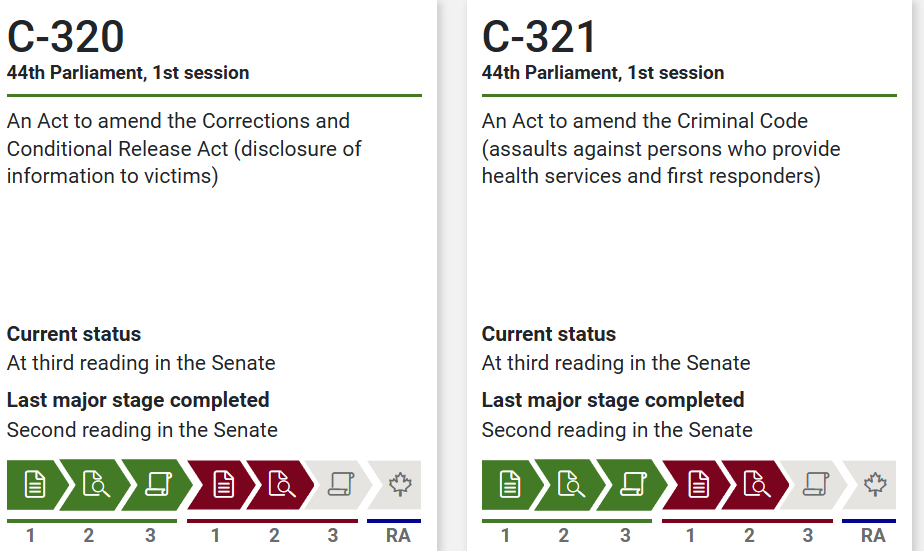

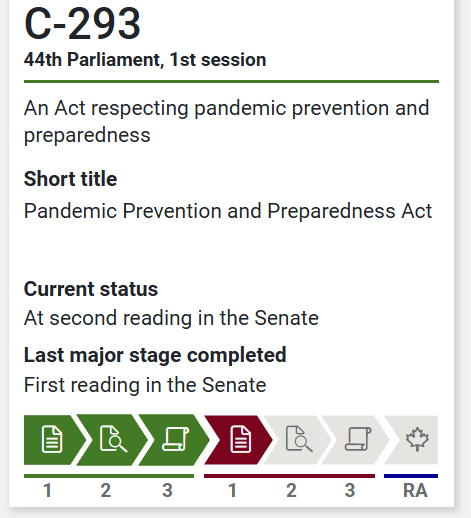

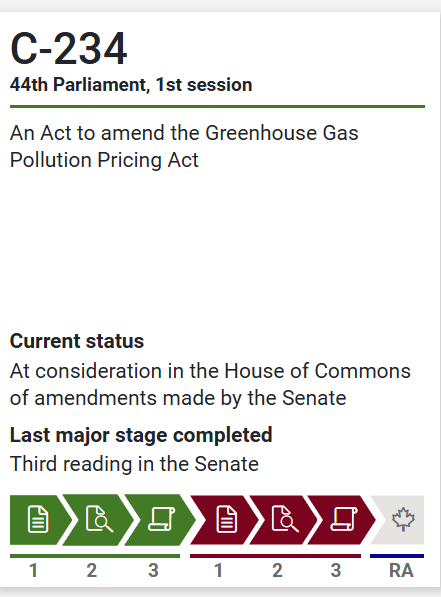

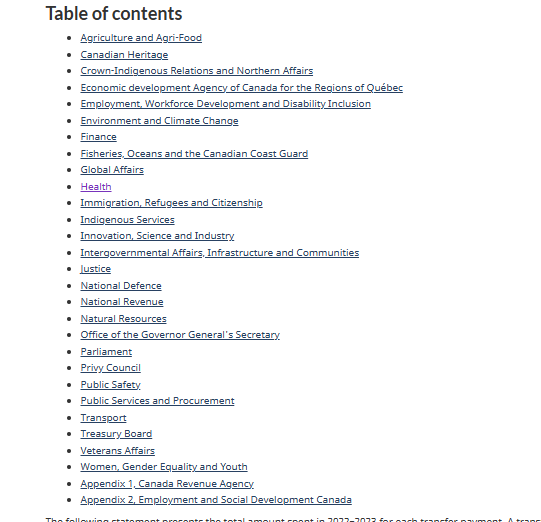

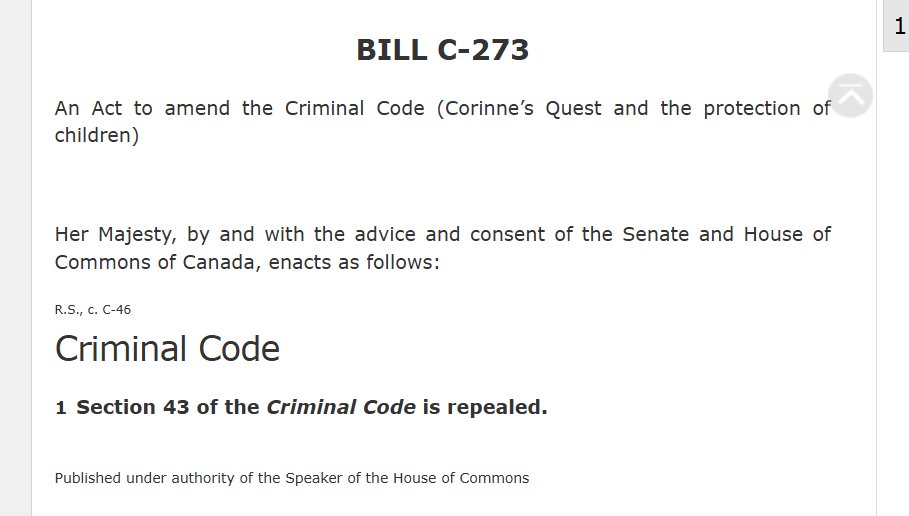

By proroguing parliament the Liberal party of Canada WIPED OUT

273 Reports, Bills and Acts

They burned ALL of their work to try and save their own jobs. (one page worth can be seen below)

By proroguing parliament the Liberal party of Canada WIPED OUT

273 Reports, Bills and Acts

They burned ALL of their work to try and save their own jobs. (one page worth can be seen below)

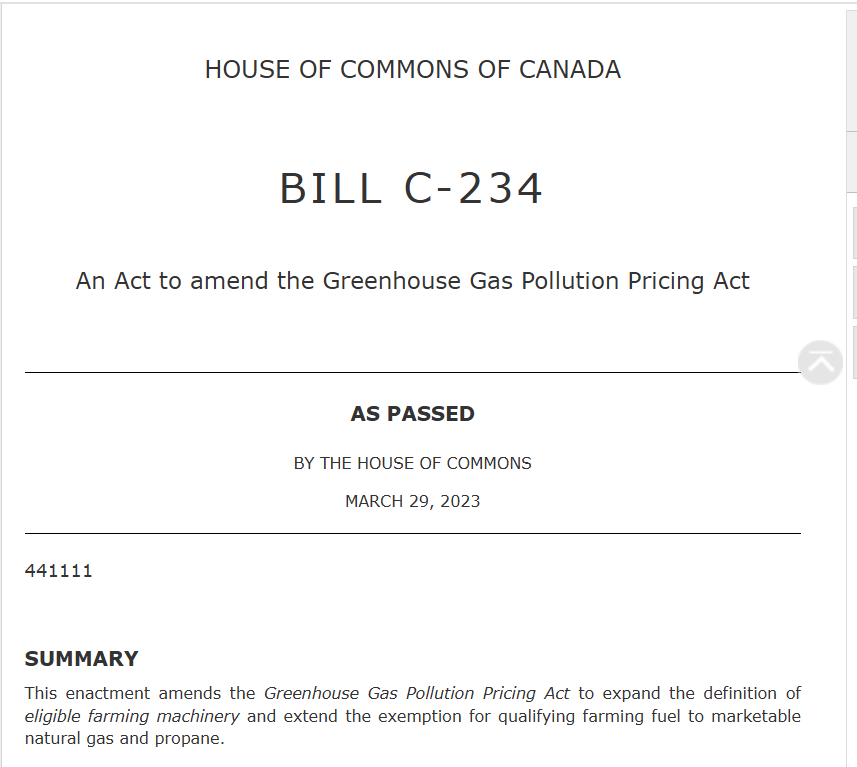

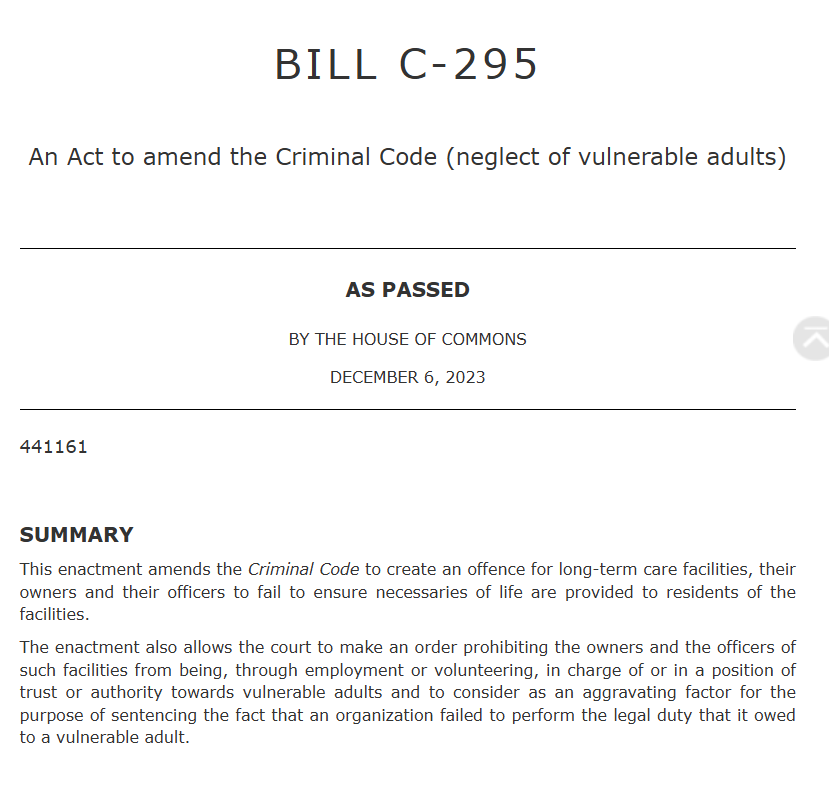

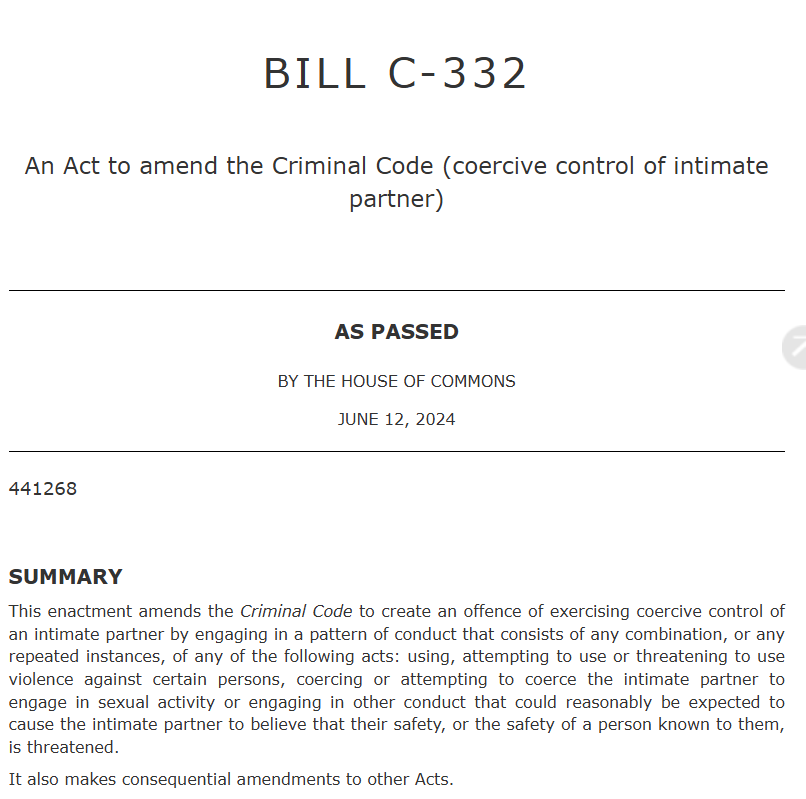

They were about to repeal the law that protected teachers and parents if they "struck" their child.

Thats now dead. You can still spank your kid.

Thats now dead. You can still spank your kid.

43 Every schoolteacher, parent or person standing in the place of a parent is justified in using force by way of correction toward a pupil or child, as the case

Not repealed.

You can still spank your kids, I think.

Not repealed.

You can still spank your kids, I think.

and yep there are ways they can revive these bills

but

how are they going to do that when they arent even working?

These bills will never see the light of day.

but

how are they going to do that when they arent even working?

These bills will never see the light of day.

• • •

Missing some Tweet in this thread? You can try to

force a refresh