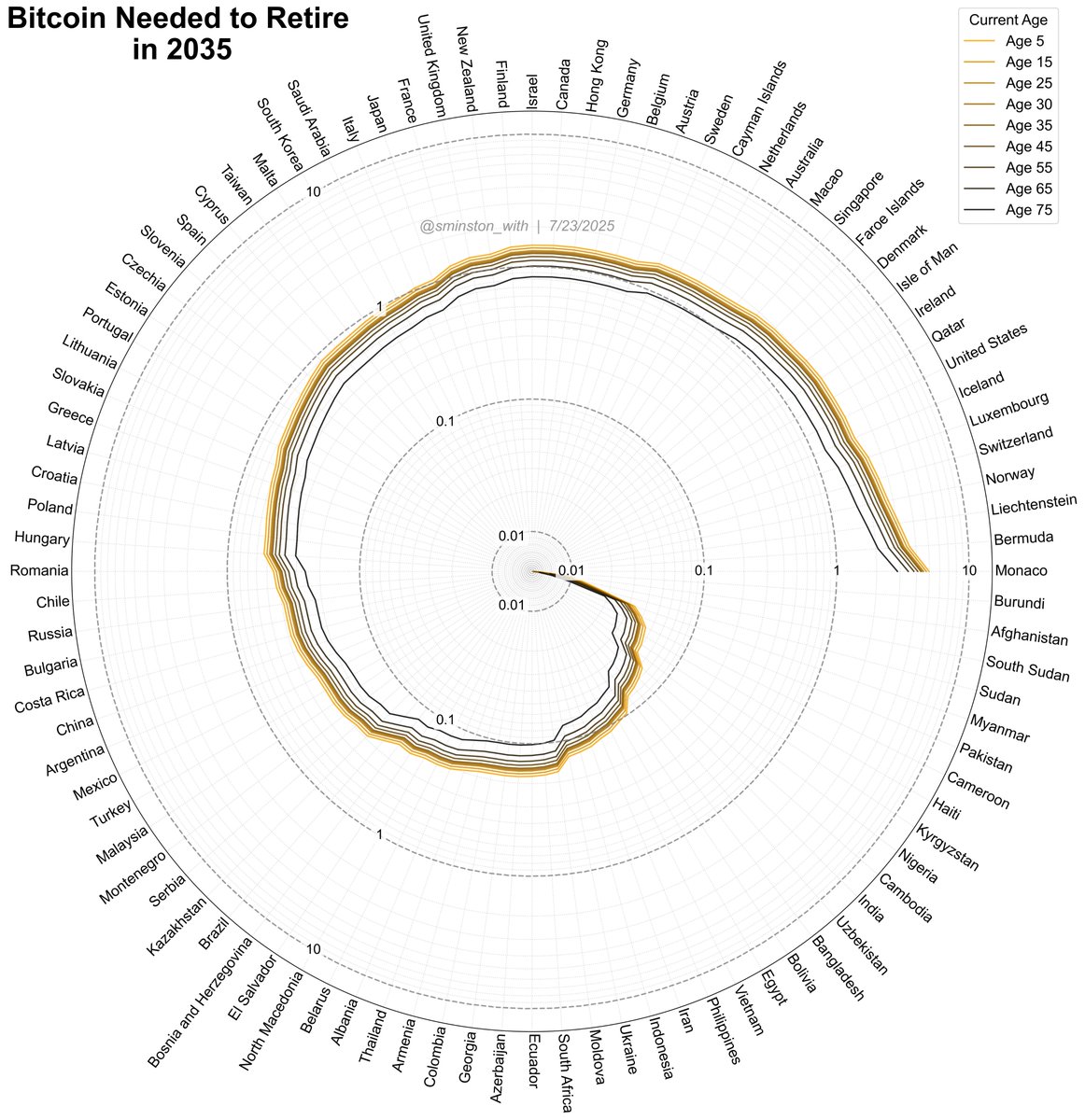

Both online and IRL, the question I continue to hear the most is "How much Bitcoin should I get?"

I've spent some time putting a visual guide together that has helped some people close to me set stacking targets based on when they expect to retire. I hope this can also be helpful to you or the people you care about.

- - -

How it works:

1) Decide the age at which you would hypothetically retire—the point at which you could live off it for the rest of your life if necessary (not that you'd actually want to sell it). There are groups of lines that represent retirement ages 35, 45, 55, 65 and 75 for simplicity.

2) Determine (in 2025 dollars) the annual expenses you expect to live on starting in your year of retirement (these are denoted by the different colors dark grey --> Bitcoin orange, $50,000/yr --> $300,000/yr)

3) Find your current age on the x-axis

4) Find where the line colored according to your expected annual living cost, within the Retire@ line group of your retirement age target, intersects with the line of your current age

The Bitcoin Needed Today (BTC) that corresponds with that point (see y-axis) is the minimum amount you should target.

If the several groups of lines are too difficult to navigate, look below in this thread's replies to see the isolated Retire@ cases by age (35, 45, 55, 65, 75).

Assumptions:

1) Future BTC price is projected by 50th percentile power law model.

2) Everyone dies at age 100.

3) Money supply (USD) grows at constant rate of 7%CAGR - meaning, whichever colored line you choose accounts for this 7% inflation from today to your retirement year, and beyond (ex: if you choose $100,000/year, in 2035 that would be about $196,715 - the model accounts for this).

4) The Bitcoin Needed Today amounts represent the minimum amount to prevent your BTC stack from hitting zero by age 100 - this is meant to be a minimum target, and therefore the individual should determine how much additional buffer BTC they should target.

5) Assumes a 'constant withdrawal rate in real 2025 USD terms', meaning the only increase year-year is to offset assumed 7% inflation.

6) Assumes no taxes will exist on withdrawals.

Disclaimers:

*this is NOT financial advice

**this is NOT a suggestion that you should sell your Bitcoin

I've spent some time putting a visual guide together that has helped some people close to me set stacking targets based on when they expect to retire. I hope this can also be helpful to you or the people you care about.

- - -

How it works:

1) Decide the age at which you would hypothetically retire—the point at which you could live off it for the rest of your life if necessary (not that you'd actually want to sell it). There are groups of lines that represent retirement ages 35, 45, 55, 65 and 75 for simplicity.

2) Determine (in 2025 dollars) the annual expenses you expect to live on starting in your year of retirement (these are denoted by the different colors dark grey --> Bitcoin orange, $50,000/yr --> $300,000/yr)

3) Find your current age on the x-axis

4) Find where the line colored according to your expected annual living cost, within the Retire@ line group of your retirement age target, intersects with the line of your current age

The Bitcoin Needed Today (BTC) that corresponds with that point (see y-axis) is the minimum amount you should target.

If the several groups of lines are too difficult to navigate, look below in this thread's replies to see the isolated Retire@ cases by age (35, 45, 55, 65, 75).

Assumptions:

1) Future BTC price is projected by 50th percentile power law model.

2) Everyone dies at age 100.

3) Money supply (USD) grows at constant rate of 7%CAGR - meaning, whichever colored line you choose accounts for this 7% inflation from today to your retirement year, and beyond (ex: if you choose $100,000/year, in 2035 that would be about $196,715 - the model accounts for this).

4) The Bitcoin Needed Today amounts represent the minimum amount to prevent your BTC stack from hitting zero by age 100 - this is meant to be a minimum target, and therefore the individual should determine how much additional buffer BTC they should target.

5) Assumes a 'constant withdrawal rate in real 2025 USD terms', meaning the only increase year-year is to offset assumed 7% inflation.

6) Assumes no taxes will exist on withdrawals.

Disclaimers:

*this is NOT financial advice

**this is NOT a suggestion that you should sell your Bitcoin

• • •

Missing some Tweet in this thread? You can try to

force a refresh