1) @pendle_fi 🤝 @ether_fi 🤝 @berachain

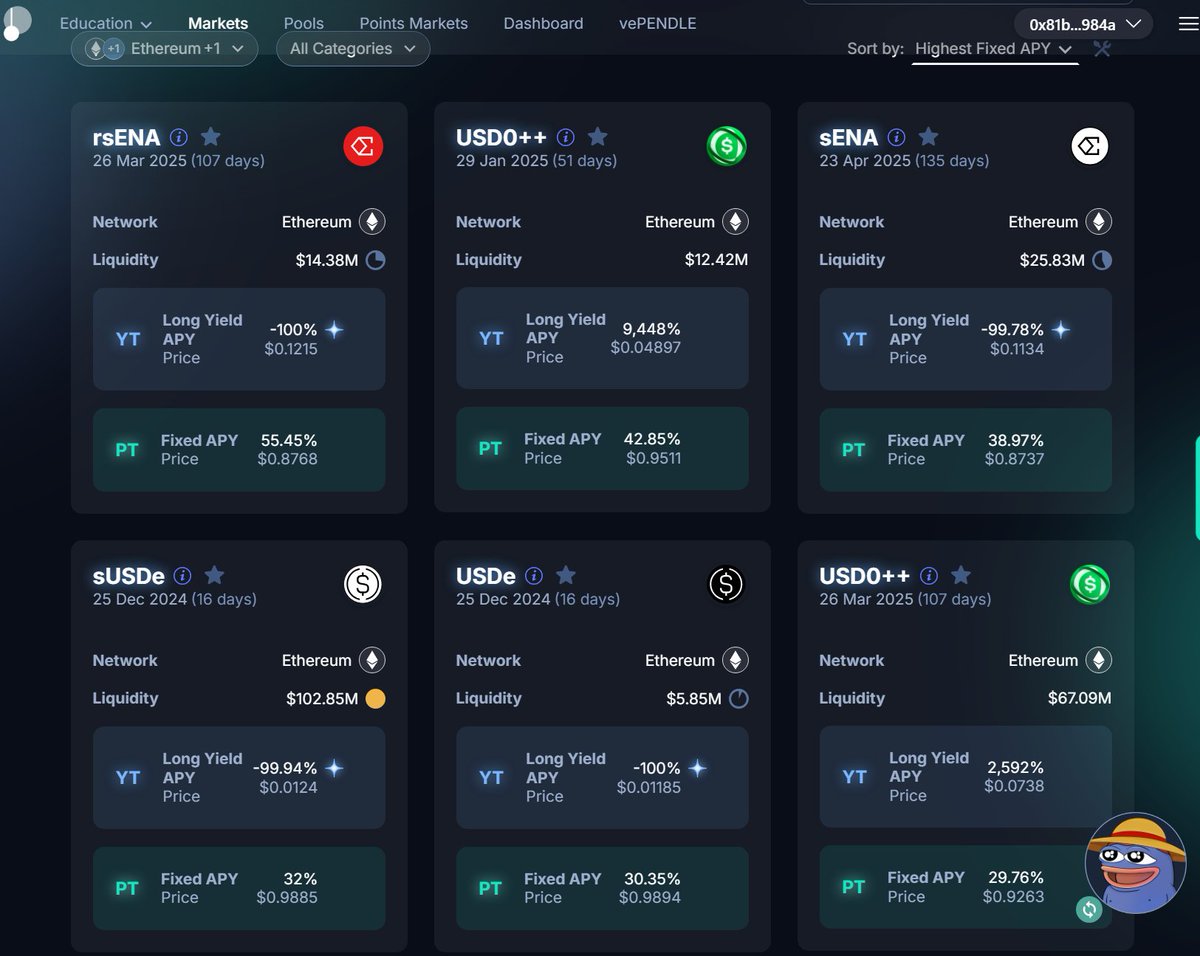

It's always Pendle

Need points? Pendle.

Want predictable risk off returns? Pendle

Want to LP for yield and points without delta? Pendle

PT APR: 20% FIXED

LP APR: 20% Variable (PLUS POINTS)

YT APR: IMO undervalued, but not a BTC yield

Nothing new under the sun.

LPs and YTs also get...

► 1x Boyco Points

► 3x Kodiak Points

► 1x Dolo Points

► 1x Goldilocks Points

► 2x Lombard Points

► 1x Babylon Points

► 4x EtherFi Points

► 3x Veda Points

AND...AND...I think there's a chance we see leverageable PTs in the not-too-distant future. But who knows, a man can dream.

It's always Pendle

Need points? Pendle.

Want predictable risk off returns? Pendle

Want to LP for yield and points without delta? Pendle

PT APR: 20% FIXED

LP APR: 20% Variable (PLUS POINTS)

YT APR: IMO undervalued, but not a BTC yield

Nothing new under the sun.

LPs and YTs also get...

► 1x Boyco Points

► 3x Kodiak Points

► 1x Dolo Points

► 1x Goldilocks Points

► 2x Lombard Points

► 1x Babylon Points

► 4x EtherFi Points

► 3x Veda Points

AND...AND...I think there's a chance we see leverageable PTs in the not-too-distant future. But who knows, a man can dream.

Alright, super hard to compete with 20% fixed.

But all things are possible with Christ.

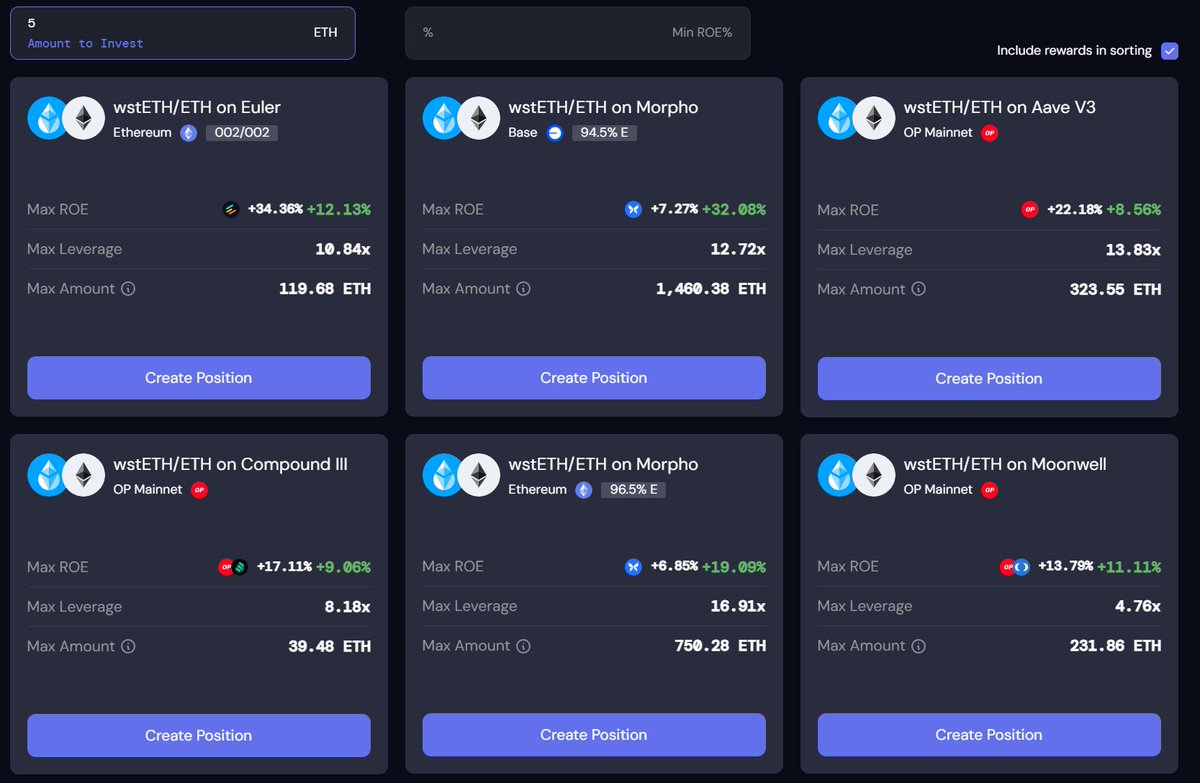

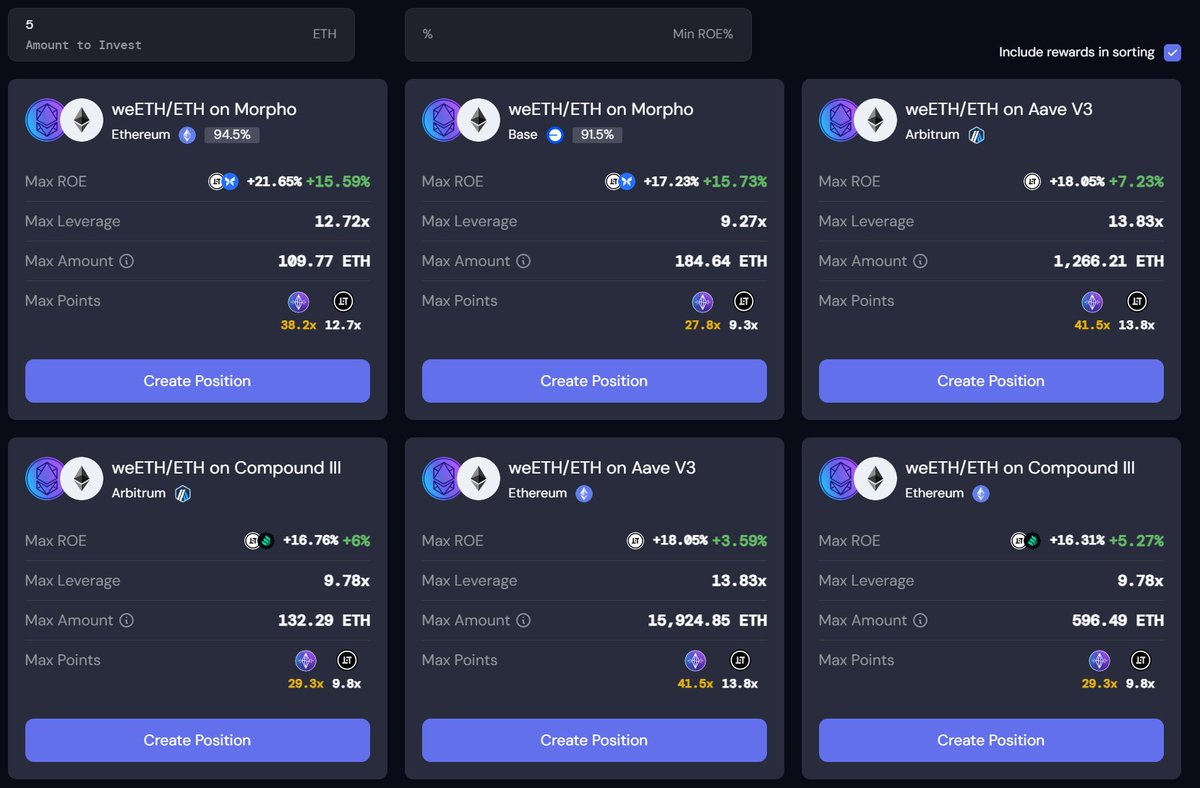

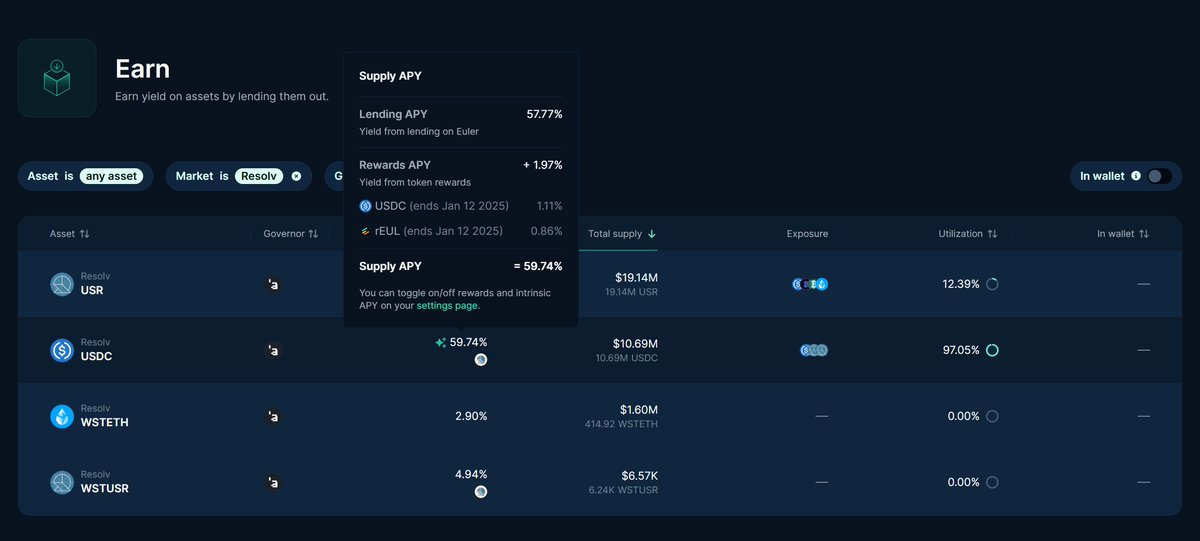

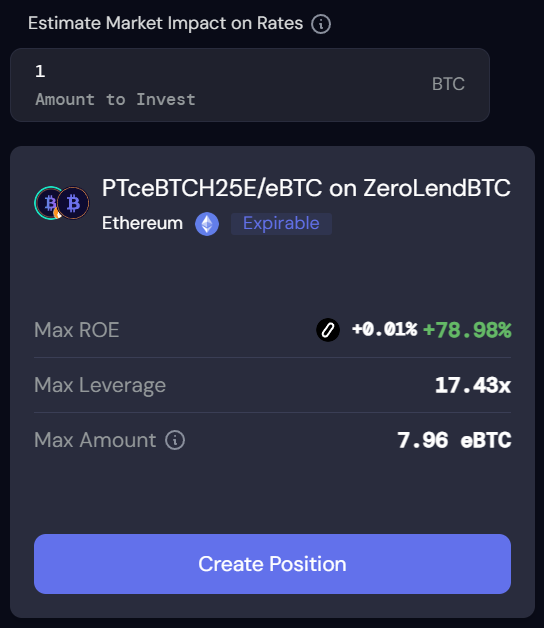

2) @zerolendxyz 🤝 @Contango_xyz

IMO, this is an insane opportunity.

@Pendle has an @ether_fi BTC market with a March expiry that currently has a 7.75% fixed rate yield.

This is ALREADY better than any reliable BTC yields from last cycle.

But @zerolendxyz let's you leverage this...A LOT.

They have E-Mode now with a max LTV of 94.5%. That's insane.

On Contango, you can autoleverage this up 17.43x. Now do be mindful, you pay 5bps on your notional when entering and exiting.

That's 0.87% when entering and exiting at max leverage.

BUT, this has a cap, which means the borrow cost isn't likely to spike, but it also means first come first serve.

But all things are possible with Christ.

2) @zerolendxyz 🤝 @Contango_xyz

IMO, this is an insane opportunity.

@Pendle has an @ether_fi BTC market with a March expiry that currently has a 7.75% fixed rate yield.

This is ALREADY better than any reliable BTC yields from last cycle.

But @zerolendxyz let's you leverage this...A LOT.

They have E-Mode now with a max LTV of 94.5%. That's insane.

On Contango, you can autoleverage this up 17.43x. Now do be mindful, you pay 5bps on your notional when entering and exiting.

That's 0.87% when entering and exiting at max leverage.

BUT, this has a cap, which means the borrow cost isn't likely to spike, but it also means first come first serve.

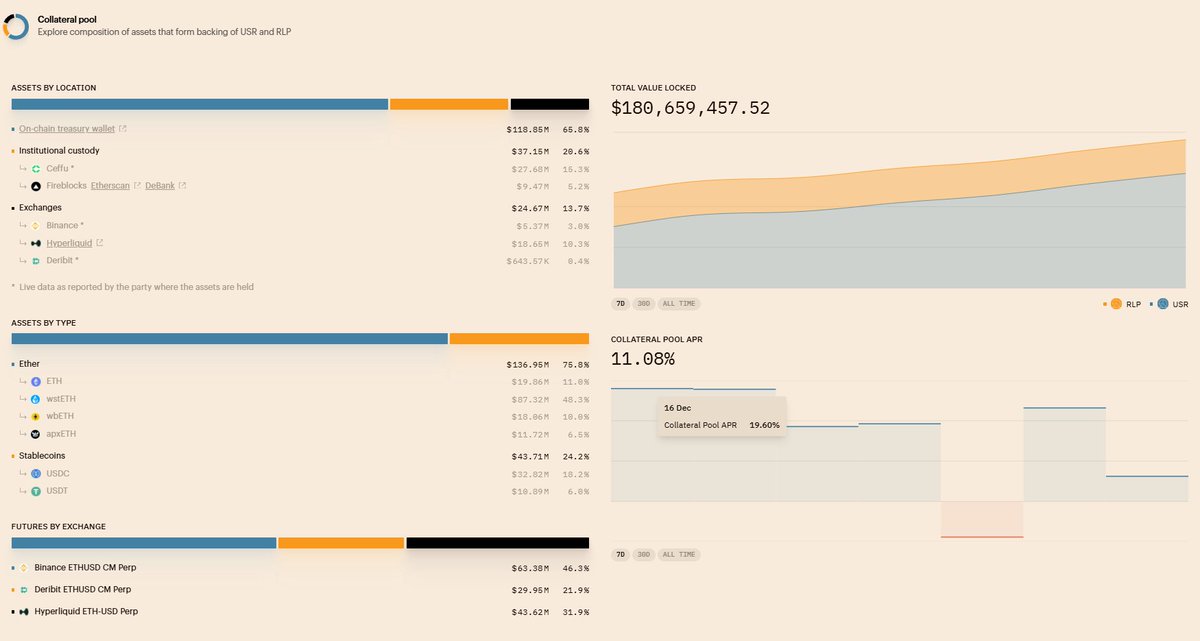

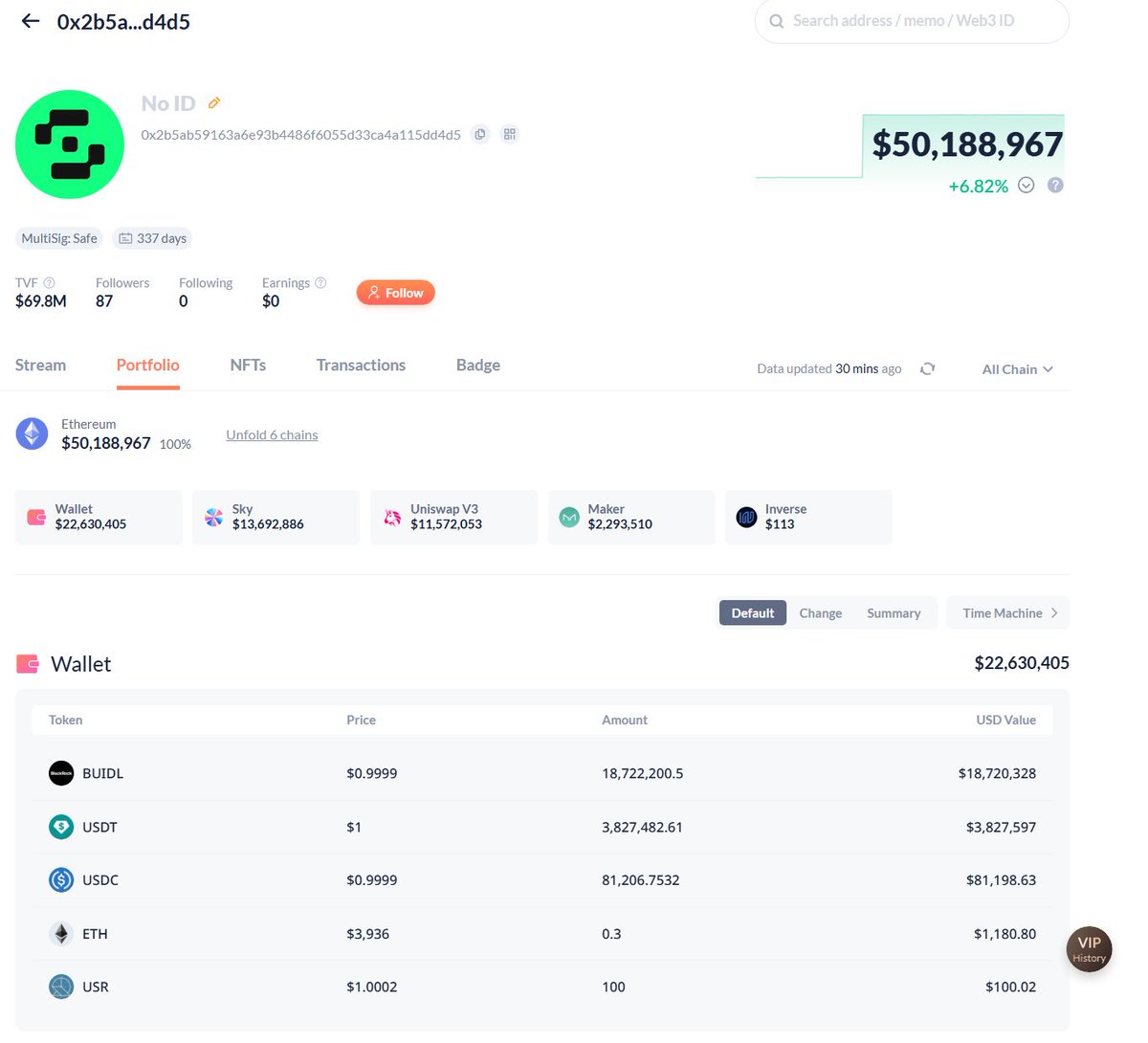

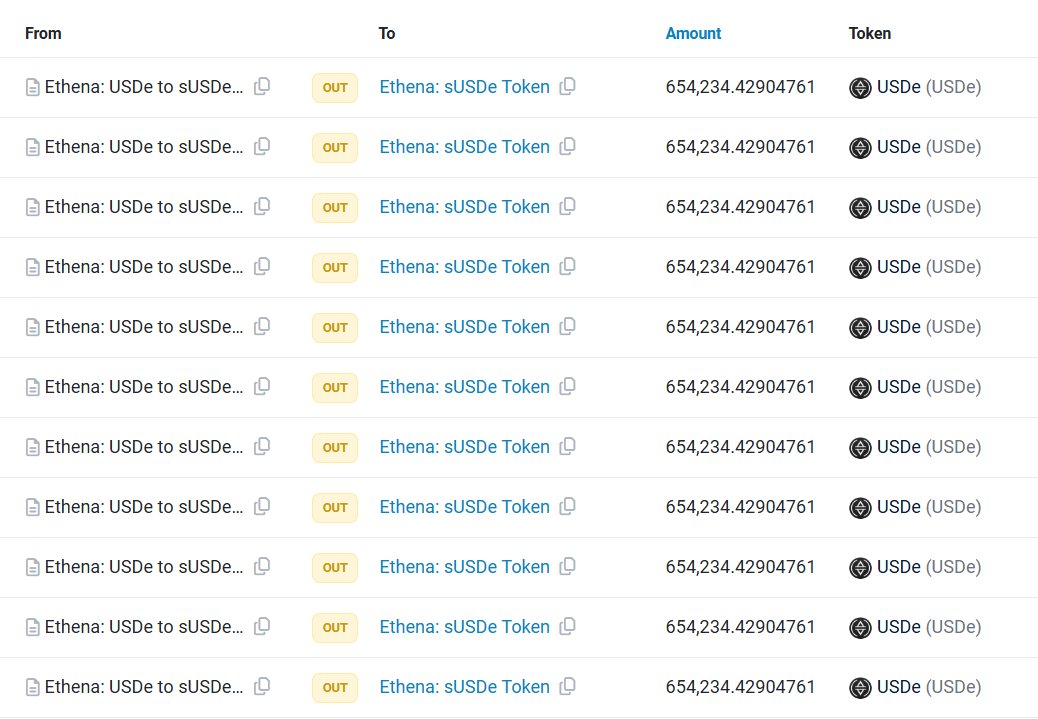

3) @ether_fi Liquid BTC Vault

APR: 15%+

Guys, I know I'm an ambassador for Ether.fi so it probably seems suss that all of the above opportunities are tangentially involving EtherFi, BUT they're genuinely one of the best places for BTC yields right now.

I chose to be an ambassador with them for a reason.

This is a brand-new vault. It's getting points galore, but it's also getting a >=15% APR.

► 2x Karak

► 4x EtherFi

► @LRTsquared

► Babylon

► 2x Lombard

► Symbiotic

► 3x Veda

It's nuts.

And you can track the vault's underlying yields here:

debank.com/profile/0x5f46…

If it misses the 15% mark (I don't think it will after learning what they're future strategy is) then there will likely be some padding with compounded ETHFI.

APR: 15%+

Guys, I know I'm an ambassador for Ether.fi so it probably seems suss that all of the above opportunities are tangentially involving EtherFi, BUT they're genuinely one of the best places for BTC yields right now.

I chose to be an ambassador with them for a reason.

This is a brand-new vault. It's getting points galore, but it's also getting a >=15% APR.

► 2x Karak

► 4x EtherFi

► @LRTsquared

► Babylon

► 2x Lombard

► Symbiotic

► 3x Veda

It's nuts.

And you can track the vault's underlying yields here:

debank.com/profile/0x5f46…

If it misses the 15% mark (I don't think it will after learning what they're future strategy is) then there will likely be some padding with compounded ETHFI.

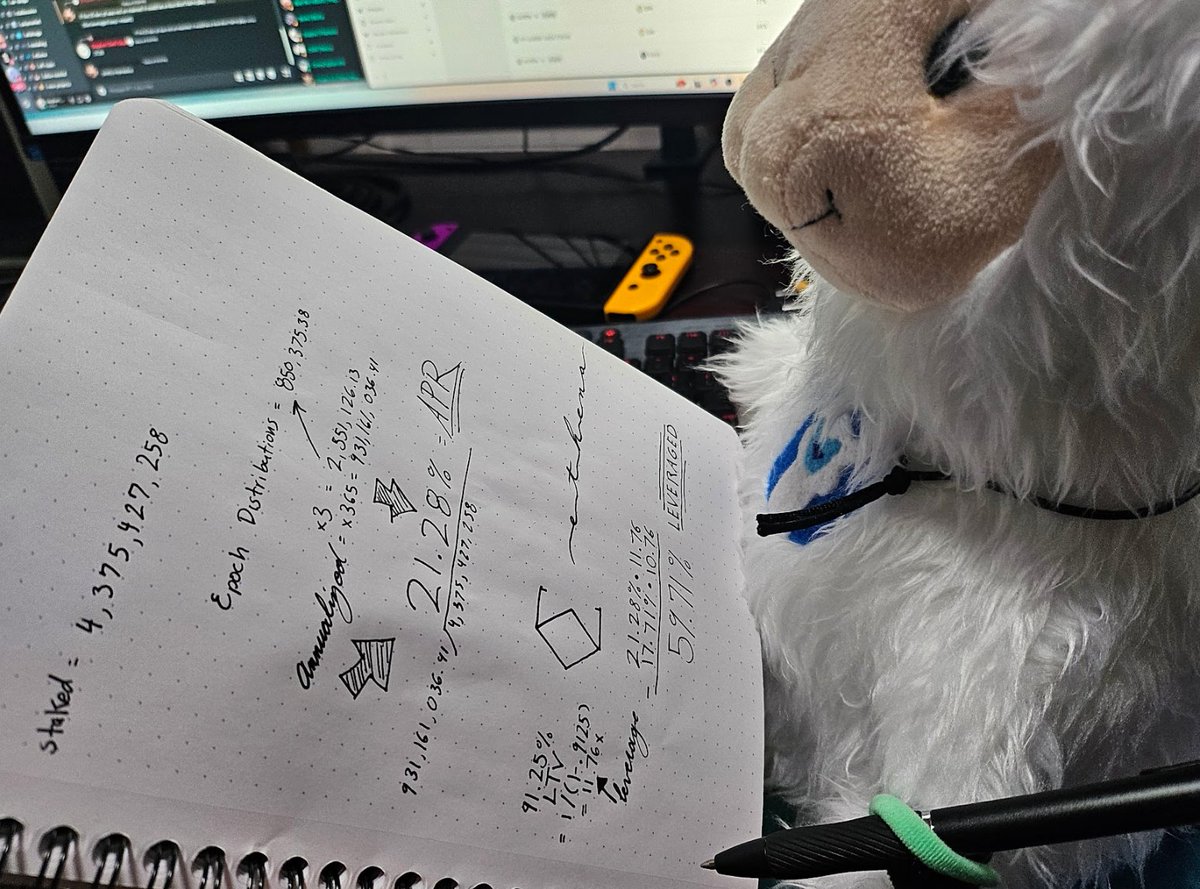

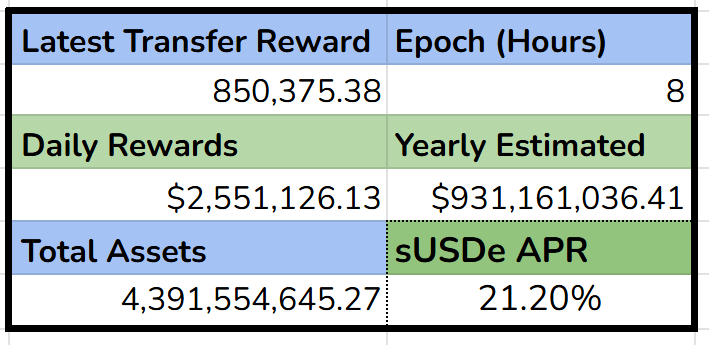

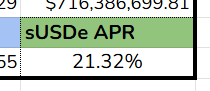

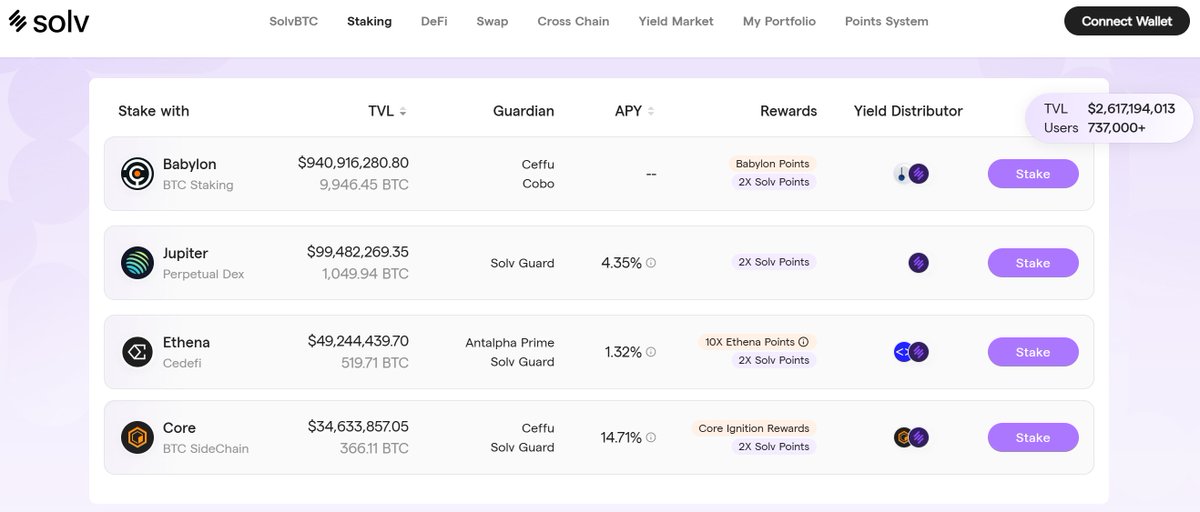

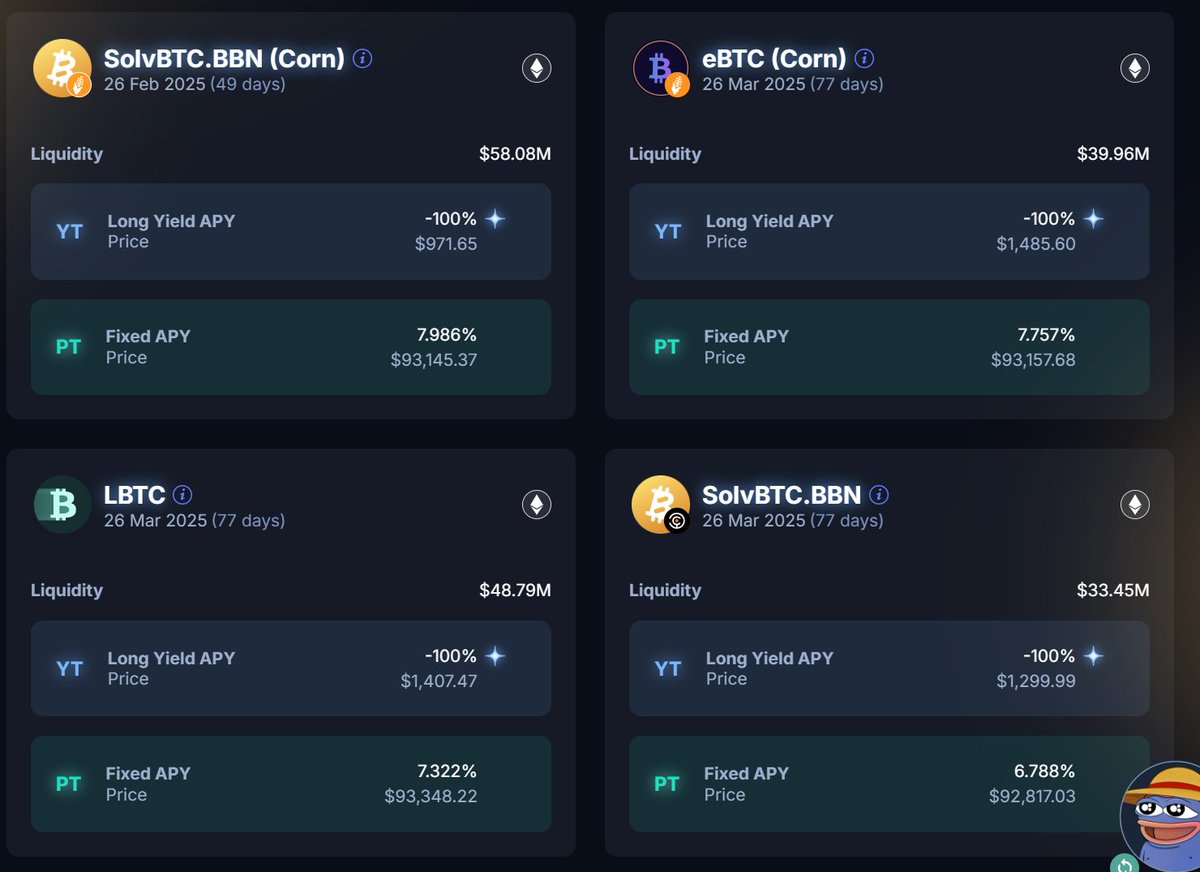

4) @SolvProtocol

Solv has various different BTC derivatives.

The @Coredao_Org BTC is getting 15% in staking incentives.

The @JupiterExchange BTC is getting 4.35% (currently) but has had yield in excess of 20% as recently as a few weeks ago.

The @ethena_labs BTC is getting 1.32% PLUS 10x ethena points

And all of these are also getting SOLV points.

YOU CAN ALSO, leverage Solv PTs on @avalonfinance_

MATH:

► 6.7% Collateral Yield (plus Avalon points)

► 1.29% Borrow Cost

► LTV: 70%

= 6.7%*3.33-1.29%*2.33

= 19.3% Plus 3.33x Avalon Points

Solv has various different BTC derivatives.

The @Coredao_Org BTC is getting 15% in staking incentives.

The @JupiterExchange BTC is getting 4.35% (currently) but has had yield in excess of 20% as recently as a few weeks ago.

The @ethena_labs BTC is getting 1.32% PLUS 10x ethena points

And all of these are also getting SOLV points.

YOU CAN ALSO, leverage Solv PTs on @avalonfinance_

MATH:

► 6.7% Collateral Yield (plus Avalon points)

► 1.29% Borrow Cost

► LTV: 70%

= 6.7%*3.33-1.29%*2.33

= 19.3% Plus 3.33x Avalon Points

5) @SolvProtocol 🤝 @D2_Finance

This is going to be nuts. Anyone who's used D2 knows the yields can get remarkably high.

And the yield for this is coming from @HyperliquidX's HLP, which is currently sitting at a smooth 21.6%.

NOW, you only have 5 more days to deposit into the strategy, so keep that in mind.

You'll also be getting Boyco incentives, participating in any number of points campaigns, and also generating derivexyz options yields.

It's A LOT.

Read more here:

x.com/D2_Finance/sta…

This is going to be nuts. Anyone who's used D2 knows the yields can get remarkably high.

And the yield for this is coming from @HyperliquidX's HLP, which is currently sitting at a smooth 21.6%.

NOW, you only have 5 more days to deposit into the strategy, so keep that in mind.

You'll also be getting Boyco incentives, participating in any number of points campaigns, and also generating derivexyz options yields.

It's A LOT.

Read more here:

x.com/D2_Finance/sta…

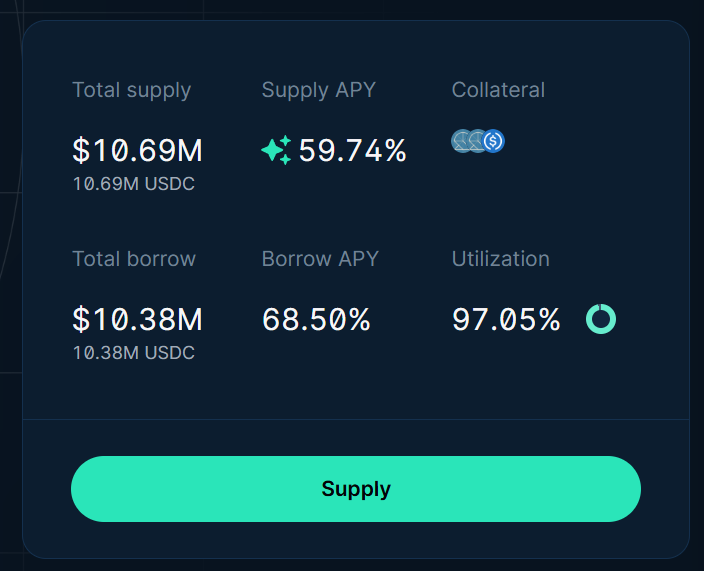

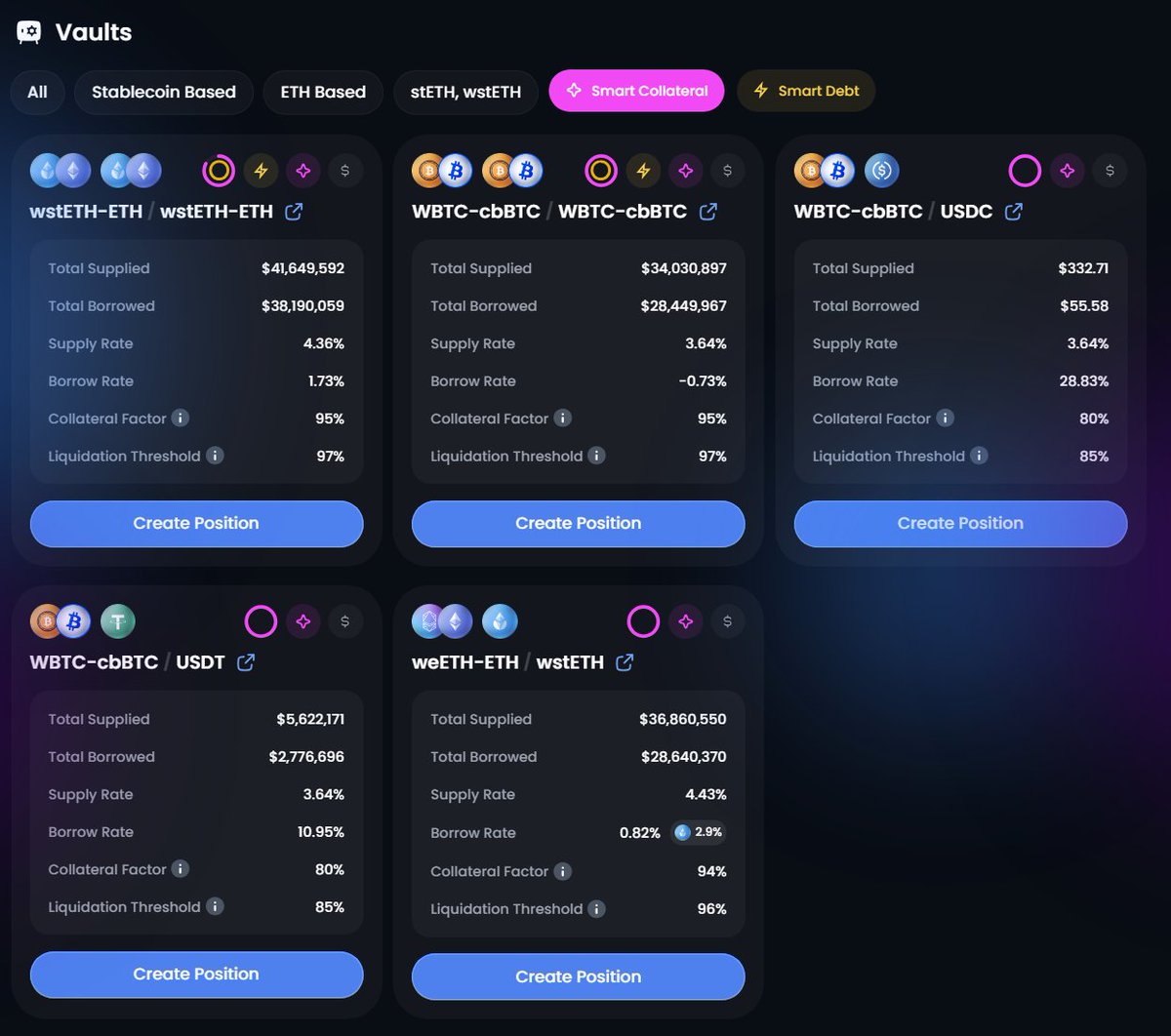

6) @0xfluid

Fluid recently introduced SMART COLLATERAL and SMART DEBT.

I've written about this before, but the TL;DR is that these are CLPs that can be used as collateral or debt and either way are paying you in swap fees.

There's a WBTC<>cbBTC : WB<>cbBTC loop that's currently generating 22.43% APR.

Let me break it down:

► WBTC<>cbBTC Collateral APR: 3.81%

► WBTC<>cbBTC Debt APR: 2.83%

► Collateral Factor: 95% LTV

► Max Leverage: 20x

Max Yield = (3.91%*20) - (2.83%*19)

= 22.43% APR

You can also leverage this automatically, which is a huge bonus.

Granted, there's limited room and a portion of the yield is paid in FLUID tokens, so do keep that in mind.

Also, always mind your oracles.

Fluid recently introduced SMART COLLATERAL and SMART DEBT.

I've written about this before, but the TL;DR is that these are CLPs that can be used as collateral or debt and either way are paying you in swap fees.

There's a WBTC<>cbBTC : WB<>cbBTC loop that's currently generating 22.43% APR.

Let me break it down:

► WBTC<>cbBTC Collateral APR: 3.81%

► WBTC<>cbBTC Debt APR: 2.83%

► Collateral Factor: 95% LTV

► Max Leverage: 20x

Max Yield = (3.91%*20) - (2.83%*19)

= 22.43% APR

You can also leverage this automatically, which is a huge bonus.

Granted, there's limited room and a portion of the yield is paid in FLUID tokens, so do keep that in mind.

Also, always mind your oracles.

As far as easy-to-enter strategies, those are my top 6.

Absolutely stellar opportunities, IMO on BTC.

BUT, there are also some more big things for BTC:

► eBTC on @aave (VERY SOON)

► @IgnitionFBTC on @growcompound (points plus USDe hedging)

► @SonicLabs Vamp / Predeposit BTC Campaigns

► Lending BTC and BTC derivs on @eulerfinance

There's SO MUCH going on in BTCfi that it's hard to go over all of it.

Absolutely stellar opportunities, IMO on BTC.

BUT, there are also some more big things for BTC:

► eBTC on @aave (VERY SOON)

► @IgnitionFBTC on @growcompound (points plus USDe hedging)

► @SonicLabs Vamp / Predeposit BTC Campaigns

► Lending BTC and BTC derivs on @eulerfinance

There's SO MUCH going on in BTCfi that it's hard to go over all of it.

Ambassadorships Mentioned:

► Pendle

► EtherFi

► Euler

► Compound

► Solv

The time to grind is now. Thank you for reading!

► Pendle

► EtherFi

► Euler

► Compound

► Solv

The time to grind is now. Thank you for reading!

• • •

Missing some Tweet in this thread? You can try to

force a refresh