Just a quick comment on how to do tariff analysis here

(wonky)

the revenue estimate on the 60% tariff on China is clearly off, which immediately raises questions about the overall quality of the work (even tho most of the other numbers look reasonable)

1/x

(wonky)

the revenue estimate on the 60% tariff on China is clearly off, which immediately raises questions about the overall quality of the work (even tho most of the other numbers look reasonable)

1/x

https://twitter.com/HayekAndKeynes/status/1877129278015303807

The revenue estimate for the 60% tariff on China is close to $250b, which comes from taking existing US imports from China (in the US data) and multiplying that times tariff rate.

but that isn't quite right ...

2/

but that isn't quite right ...

2/

The tariffs will reduce trade with China so the revenues collected from the tariff won't be a function of existing trade, but rather of the level of trade that persists after a 60% bilateral tariff.

3/

3/

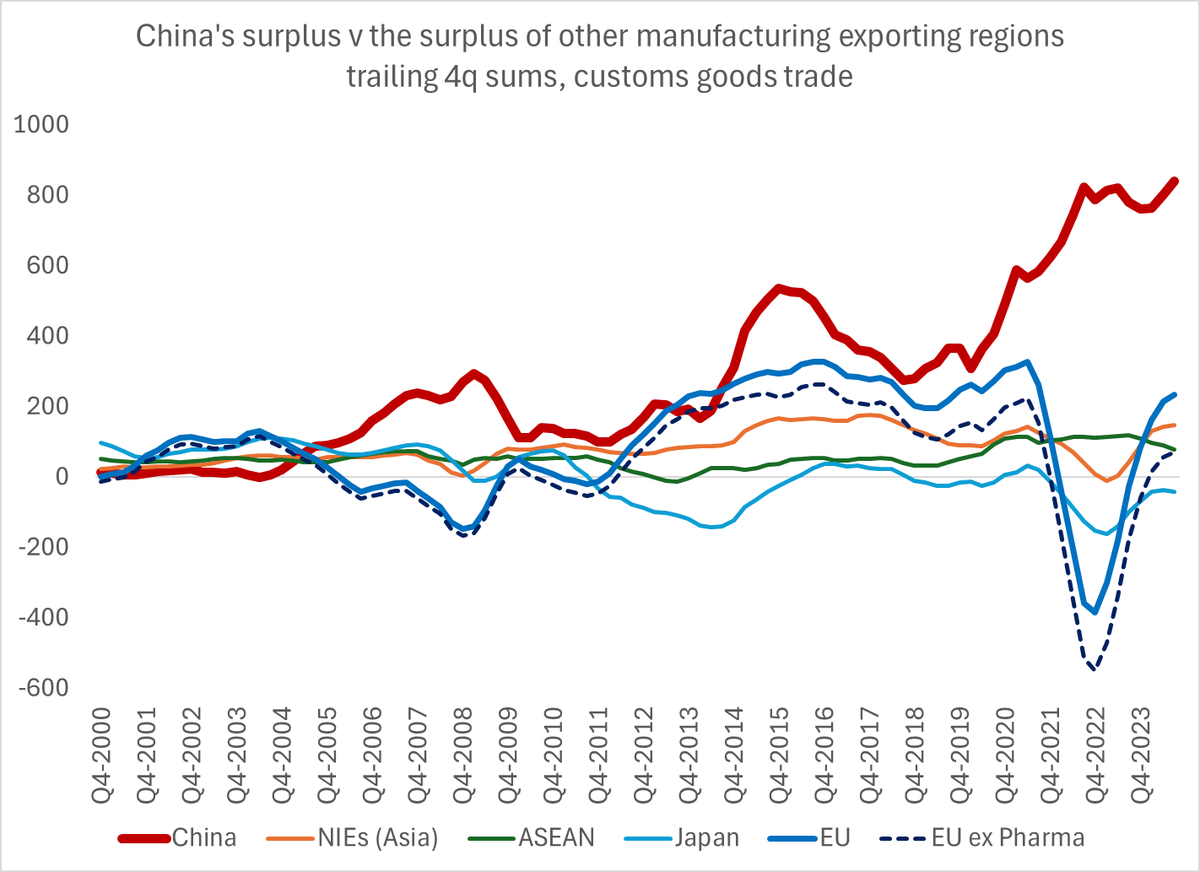

And from the existing tariffs (0, 7.5%, 25%, and higher for EVs) we have pretty good estimates of how bilateral tariffs impact bilateral trade

4/

4/

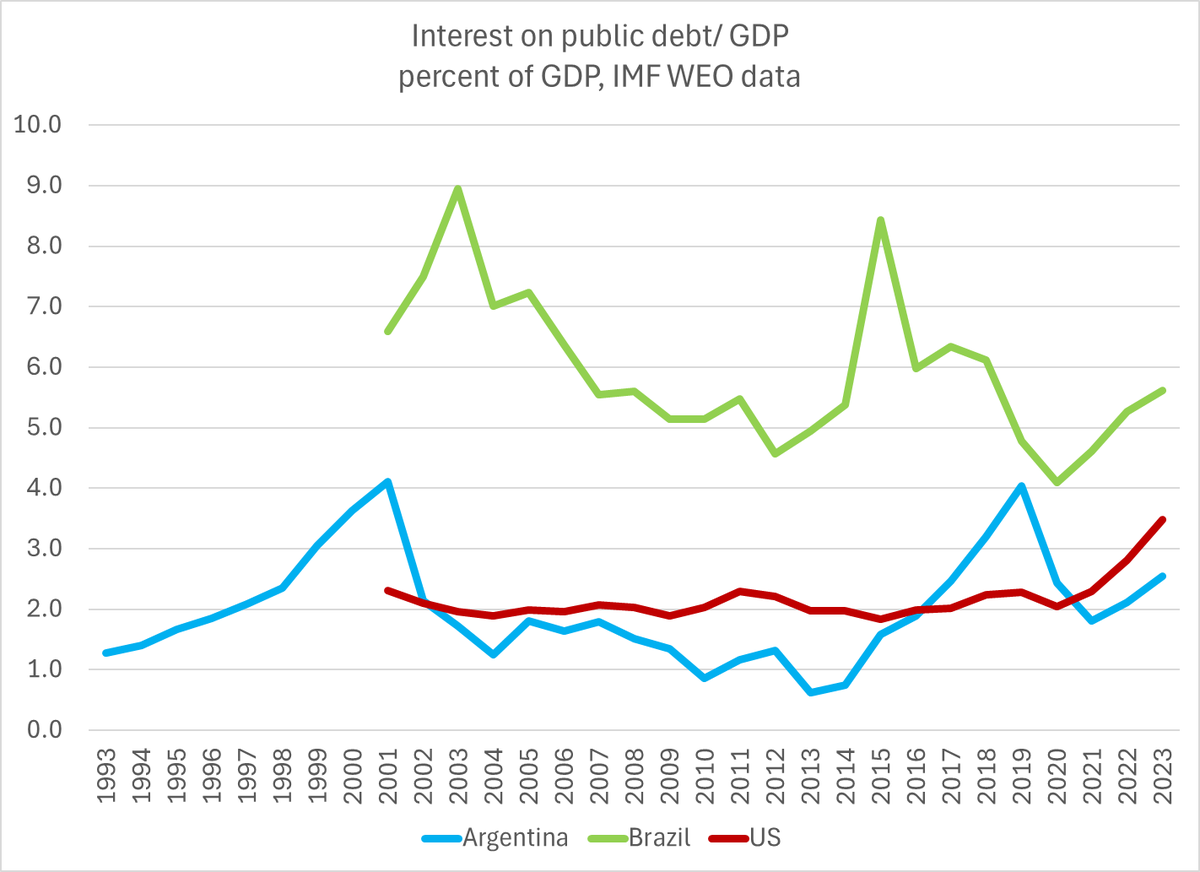

the empirical elasticity has been around 2, so a 25% tariff reduces trade by around 50%. It hasn't been 1, it hasn't 3 --

(note that this is as a share of GDP not in dollar terms)

5/

(note that this is as a share of GDP not in dollar terms)

5/

The implication of course is that a tariff of 50% or above brings bilateral trade to down to close to zero (50% = 100% fall in imports) and thus tariff revenue down to zero ...

6/

6/

That won't be perfectly true -- there will be some imported parts that are embedded in a complex design and firms will have to just pay it, but bilateral trade will fall enormously and as a result the actual revenue raised will be very small

7/

7/

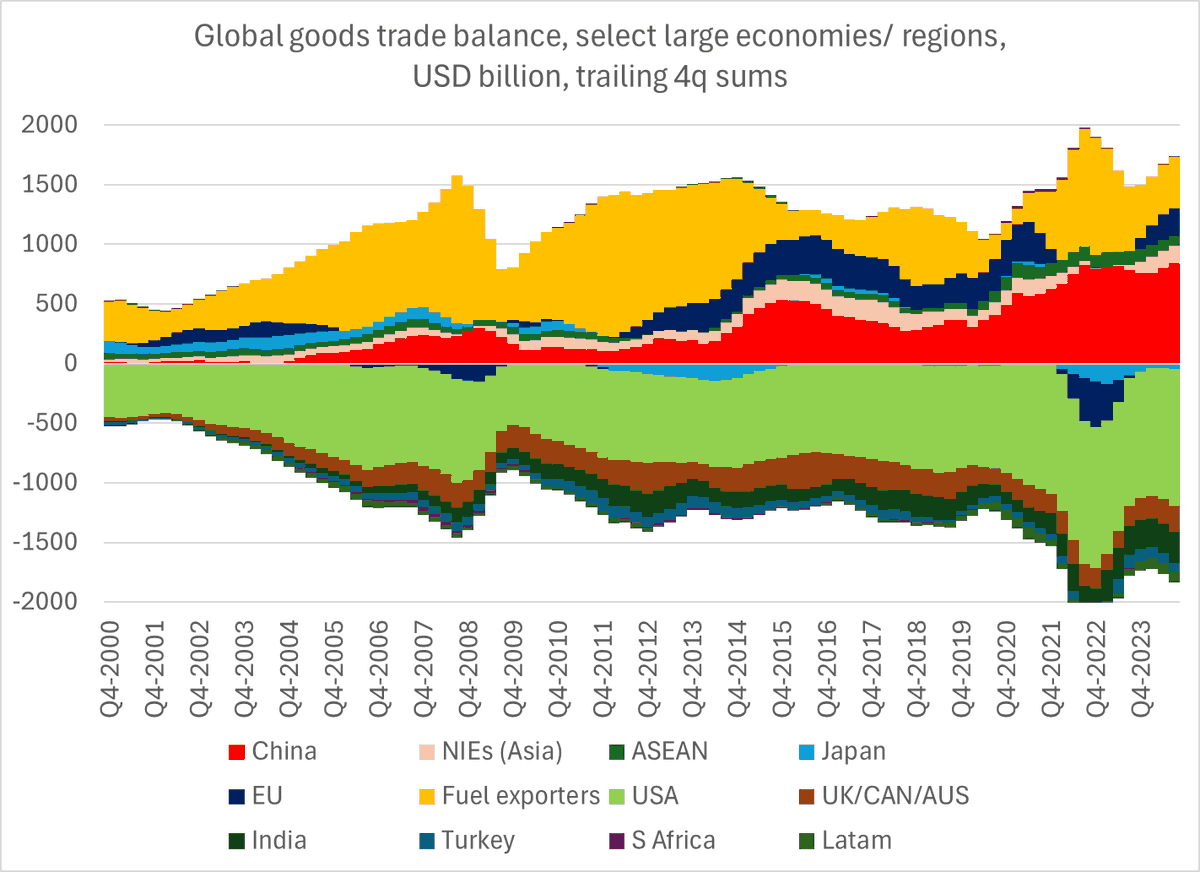

Note that these estimates are all for bilateral tariffs -- which are easy to get around (send the parts to Vietnam, Thailand or Taiwan, and do the assembly there) not for global tariffs on all goods (much harder to get around)

8/

8/

But it is the kind of error that erodes the credibility of overall work ... and it also illustrates an important empirical point -- high bilateral tariffs aren't a tool for raising revenues

9/9

9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh