I haven’t been this excited about a stock in a long time.

$NBIS is the most undervalued AI infrastructure company in the entire market, and I believe it will soon be recognized.

Here’s a detailed thread explaining the investment thesis: 🧵👇🏻

$NBIS is the most undervalued AI infrastructure company in the entire market, and I believe it will soon be recognized.

Here’s a detailed thread explaining the investment thesis: 🧵👇🏻

1. The AI revolution is upon us, reshaping industries at an extraordinary pace. As businesses embrace AI-driven solutions, the infrastructure required to sustain this transformation is emerging as a pivotal challenge.

Positioned at the forefront of the AI infrastructure market, $NBIS aims to address one of the most pressing bottlenecks in the industry.

The demand for AI infrastructure is not merely growing — it’s skyrocketing. The shift to AI requires a new generation of data centers and compute solutions, purpose-built to meet the unique demands of these technologies. $NBIS is rising to this challenge, crafting advanced infrastructure designed from the ground up to optimize AI performance.

With a vision to scale operations to hundreds of megawatts of AI compute capacity, $NBIS seeks to empower the global AI ecosystem by delivering innovative, high-performance solutions tailored for the future.

Positioned at the forefront of the AI infrastructure market, $NBIS aims to address one of the most pressing bottlenecks in the industry.

The demand for AI infrastructure is not merely growing — it’s skyrocketing. The shift to AI requires a new generation of data centers and compute solutions, purpose-built to meet the unique demands of these technologies. $NBIS is rising to this challenge, crafting advanced infrastructure designed from the ground up to optimize AI performance.

With a vision to scale operations to hundreds of megawatts of AI compute capacity, $NBIS seeks to empower the global AI ecosystem by delivering innovative, high-performance solutions tailored for the future.

2. Origins: From Yandex to Nebius Group

$NBIS's story begins within Yandex, a company often referred to as the “Russian Google” due to its dominance in search, advertising, and digital services in Russia and other former Soviet countries. However, the trajectory that led to $NBIS becoming an independent entity is rooted in one of the most turbulent periods in recent history.

When Russia invaded Ukraine in early 2022, Yandex faced severe geopolitical and financial repercussions. Trading of its shares was suspended, its founder was sanctioned, and its operations became entangled in regulatory pressures from both Western and Russian authorities.

By mid-2024, after a complex restructuring process, Yandex completed the divestiture of its Russia-based assets. Following this restructuring, $NBIS emerged as a standalone entity, fully independent and with no ties to its former parent’s Russian operations. I want to make this clear: there is absolutely no connection between Nebius and Russia. Its managers and board members changed their nationalities to either Dutch or Israeli – otherwise, they would not have been able to avoid the sanctions.

While $NBIS inherits its engineering expertise and assets — such as its AI cloud platform and Finnish data center — from Yandex, the company is charting an entirely new course. Its focus is on becoming a leading provider of AI infrastructure in Europe and beyond. $NBIS now operates with a seasoned team of engineers and researchers, many of whom were instrumental in Yandex’s success, particularly in building data centers, cloud architecture, and advanced AI tools.

As $NBIS scales its operations, it is transforming from a collection of legacy assets into a formidable AI platform. The company aims to deliver a full-stack AI solution encompassing everything from compute infrastructure to deployment and monitoring, with ambitions of establishing itself as a global leader in AI cloud services.

$NBIS's story begins within Yandex, a company often referred to as the “Russian Google” due to its dominance in search, advertising, and digital services in Russia and other former Soviet countries. However, the trajectory that led to $NBIS becoming an independent entity is rooted in one of the most turbulent periods in recent history.

When Russia invaded Ukraine in early 2022, Yandex faced severe geopolitical and financial repercussions. Trading of its shares was suspended, its founder was sanctioned, and its operations became entangled in regulatory pressures from both Western and Russian authorities.

By mid-2024, after a complex restructuring process, Yandex completed the divestiture of its Russia-based assets. Following this restructuring, $NBIS emerged as a standalone entity, fully independent and with no ties to its former parent’s Russian operations. I want to make this clear: there is absolutely no connection between Nebius and Russia. Its managers and board members changed their nationalities to either Dutch or Israeli – otherwise, they would not have been able to avoid the sanctions.

While $NBIS inherits its engineering expertise and assets — such as its AI cloud platform and Finnish data center — from Yandex, the company is charting an entirely new course. Its focus is on becoming a leading provider of AI infrastructure in Europe and beyond. $NBIS now operates with a seasoned team of engineers and researchers, many of whom were instrumental in Yandex’s success, particularly in building data centers, cloud architecture, and advanced AI tools.

As $NBIS scales its operations, it is transforming from a collection of legacy assets into a formidable AI platform. The company aims to deliver a full-stack AI solution encompassing everything from compute infrastructure to deployment and monitoring, with ambitions of establishing itself as a global leader in AI cloud services.

3. What is Nebius, and What Services Does It Offer?

At its core, $NBIS is a next-generation AI infrastructure company specializing in "compute-as-a-service". The company’s offerings are designed to address the growing demand for high-performance AI infrastructure by providing a comprehensive suite of solutions for developers, enterprises, and researchers.

$NBIS operates across three primary layers: infrastructure, platform, and applications, creating a seamless ecosystem tailored for intensive AI workloads.

1) AI-Centric Cloud Platform

$NBIS has developed an advanced cloud platform purpose-built for AI and ML workloads. It combines cutting-edge GPU clusters with scalable storage and managed services, providing the compute, storage, and tools required to develop AI models.

• Optimized for AI Workloads: The platform supports training, inference, and fine-tuning of AI models with state-of-the-art GPUs, including NVIDIA H100s and upcoming H200s.

• Flexibility: Customers can scale resources up or down on demand, catering to both small experiments and large-scale deployments.

• Reliability: Leveraging $NBIS' proprietary cloud software and in-house server design ensures low latency and minimal downtime.

2) Comprehensive AI Infrastructure

$NBIS doesn’t just offer raw computing power, it provides a fully integrated environment:

• Data Centers: Improves unit economics through increased energy efficiency and lower data center cost, while enabling scalability.

• In-House Server Design: The company designs its servers outside of NVIDIA GPUs, allowing for enhanced performance, faster deployments, and significant cost savings.

• Full Stack Control: From server manufacturing to cloud deployment, $NBIS controls the entire value chain, resulting in superior optimization and efficiency.

• Managed Services: Tools like Apache Spark and MLflow simplify operations, enabling users to focus on innovation instead of infrastructure management.

3) AI Studio

The Nebius AI Studio is a SaaS platform that integrates APIs for open-source models, simplifying AI development for businesses and researchers.

• User-Friendly Interface: Pre-configured environments reduce setup time and maximize productivity.

• Cost Efficiency: Offers some of the lowest price-per-token costs for inference in the market.

$NBIS is more than just a GPU provider, it’s a full-stack solution tailored for the AI industry. By bridging infrastructure, platform, and applications, the company empowers organizations to unlock the potential of AI while staying agile in a rapidly evolving technological landscape.

At its core, $NBIS is a next-generation AI infrastructure company specializing in "compute-as-a-service". The company’s offerings are designed to address the growing demand for high-performance AI infrastructure by providing a comprehensive suite of solutions for developers, enterprises, and researchers.

$NBIS operates across three primary layers: infrastructure, platform, and applications, creating a seamless ecosystem tailored for intensive AI workloads.

1) AI-Centric Cloud Platform

$NBIS has developed an advanced cloud platform purpose-built for AI and ML workloads. It combines cutting-edge GPU clusters with scalable storage and managed services, providing the compute, storage, and tools required to develop AI models.

• Optimized for AI Workloads: The platform supports training, inference, and fine-tuning of AI models with state-of-the-art GPUs, including NVIDIA H100s and upcoming H200s.

• Flexibility: Customers can scale resources up or down on demand, catering to both small experiments and large-scale deployments.

• Reliability: Leveraging $NBIS' proprietary cloud software and in-house server design ensures low latency and minimal downtime.

2) Comprehensive AI Infrastructure

$NBIS doesn’t just offer raw computing power, it provides a fully integrated environment:

• Data Centers: Improves unit economics through increased energy efficiency and lower data center cost, while enabling scalability.

• In-House Server Design: The company designs its servers outside of NVIDIA GPUs, allowing for enhanced performance, faster deployments, and significant cost savings.

• Full Stack Control: From server manufacturing to cloud deployment, $NBIS controls the entire value chain, resulting in superior optimization and efficiency.

• Managed Services: Tools like Apache Spark and MLflow simplify operations, enabling users to focus on innovation instead of infrastructure management.

3) AI Studio

The Nebius AI Studio is a SaaS platform that integrates APIs for open-source models, simplifying AI development for businesses and researchers.

• User-Friendly Interface: Pre-configured environments reduce setup time and maximize productivity.

• Cost Efficiency: Offers some of the lowest price-per-token costs for inference in the market.

$NBIS is more than just a GPU provider, it’s a full-stack solution tailored for the AI industry. By bridging infrastructure, platform, and applications, the company empowers organizations to unlock the potential of AI while staying agile in a rapidly evolving technological landscape.

4. Summarizing What Sets Nebius Apart

For those less familiar with the technical details of AI infrastructure, here’s a clear picture of what makes $NBIS stand out:

$NBIS is recognized as one of the most efficient and energy-conscious AI infrastructure companies globally, striking a balance between top-tier performance and sustainability. Its commitment to cost-effectiveness and operational excellence gives it a competitive edge in the rapidly growing AI market.

Industry-Leading Cost Efficiency

$NBIS delivers high-performance AI infrastructure at a significantly lower cost:

• 20–25% Lower Costs: Total GPU ownership and operational expenses are up to 25% lower compared to the average GPU provider.

• Integrated Value Chain: Full control over the AI infrastructure lifecycle — from in-house server design to proprietary cloud platforms — allows $NBIS to optimize costs and productivity while ensuring minimal downtime.

• Strategic Partnerships: Long-term relationships with leading server manufacturers (ODMs) help co-design and manufacture cost-efficient, AI-specific hardware.

Energy Efficiency and Sustainability

$NBIS prioritizes environmental sustainability without compromising on performance:

• Best-in-Class Data Centers: Achieving a Power Usage Effectiveness (PUE) of ~1.13, placing it among industry leaders like Google and Microsoft.

• Supercomputing Excellence: $NBIS operates one of the top 5% most energy-efficient supercomputers globally, reflecting its advanced engineering.

World-Class Team and Expertise

$NBIS is powered by a cohesive and highly skilled team:

• Proven Track Record: ~400 AI/ML/cloud engineers and ~850 technology professionals bring an average of 10+ years of experience in fields like AI, ML, LLMs, and cloud infrastructure.

• Future-Ready Workforce: The team is strategically sized and equipped to support the company’s growth trajectory, ensuring sustained innovation and execution at scale.

This combination of performance, cost-efficiency, and energy-conscious design positions $NBIS as a standout player in the competitive AI infrastructure landscape.

For those less familiar with the technical details of AI infrastructure, here’s a clear picture of what makes $NBIS stand out:

$NBIS is recognized as one of the most efficient and energy-conscious AI infrastructure companies globally, striking a balance between top-tier performance and sustainability. Its commitment to cost-effectiveness and operational excellence gives it a competitive edge in the rapidly growing AI market.

Industry-Leading Cost Efficiency

$NBIS delivers high-performance AI infrastructure at a significantly lower cost:

• 20–25% Lower Costs: Total GPU ownership and operational expenses are up to 25% lower compared to the average GPU provider.

• Integrated Value Chain: Full control over the AI infrastructure lifecycle — from in-house server design to proprietary cloud platforms — allows $NBIS to optimize costs and productivity while ensuring minimal downtime.

• Strategic Partnerships: Long-term relationships with leading server manufacturers (ODMs) help co-design and manufacture cost-efficient, AI-specific hardware.

Energy Efficiency and Sustainability

$NBIS prioritizes environmental sustainability without compromising on performance:

• Best-in-Class Data Centers: Achieving a Power Usage Effectiveness (PUE) of ~1.13, placing it among industry leaders like Google and Microsoft.

• Supercomputing Excellence: $NBIS operates one of the top 5% most energy-efficient supercomputers globally, reflecting its advanced engineering.

World-Class Team and Expertise

$NBIS is powered by a cohesive and highly skilled team:

• Proven Track Record: ~400 AI/ML/cloud engineers and ~850 technology professionals bring an average of 10+ years of experience in fields like AI, ML, LLMs, and cloud infrastructure.

• Future-Ready Workforce: The team is strategically sized and equipped to support the company’s growth trajectory, ensuring sustained innovation and execution at scale.

This combination of performance, cost-efficiency, and energy-conscious design positions $NBIS as a standout player in the competitive AI infrastructure landscape.

5. How Are Nebius' Data Centers So Efficient?

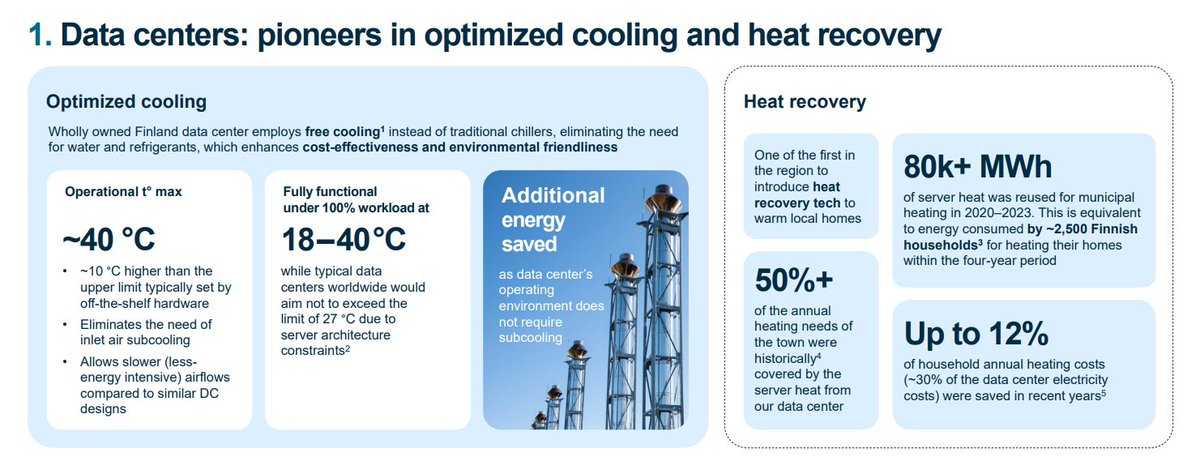

$NBIS' data centers can achieve optimized cooling and heat recovery to enhance both cost-effectiveness and environmental sustainability.

Optimized Cooling

$NBIS' Finland-based data center employs free cooling, eliminating the need for traditional chillers, water, and refrigerants. This approach not only reduces costs but also minimizes the environmental footprint.

• Higher Operating Temperatures: The data center operates at a maximum temperature of approximately 40°C, which is about 10°C higher than the typical limit set by standard hardware. This higher threshold eliminates the need for inlet air subcooling and enables slower, less energy-intensive airflows compared to conventional designs.

• Broader Workload Range: The center functions effectively under 100% workload within a temperature range of 18°C to 40°C, in contrast to most data centers that aim to stay below 27°C due to server architecture constraints. This capability eliminates the energy demands of subcooling, significantly improving energy efficiency.

• Energy Savings: By operating without subcooling requirements, the data center achieves substantial energy savings, aligning with $NBIS' focus on cost efficiency and sustainability.

Heat Recovery

In addition to optimized cooling, $NBIS has implemented an advanced heat recovery system that repurposes waste heat for municipal heating, creating additional value for the surrounding community.

• Regional Innovation: The Finland data center is a pioneer in the region, using server-generated heat to meet local heating needs.

• Energy Reuse: Between 2020 and 2023, the center reused over 80,000 MWh of server heat for municipal heating, equivalent to the energy consumed by around 2,500 Finnish households for heating over four years.

• Meeting Heating Needs: More than 50% of the annual heating requirements of the nearby town were covered by this heat recovery system.

• Cost Savings for Households: The system contributed to household heating cost reductions of up to 12%, accounting for approximately 30% of the data center’s electricity costs.

$NBIS' approach to data center design showcases its ability to balance operational efficiency with environmental responsibility. The company’s plan to replicate these best practices as it expands its data center capacity positions it as a leader in sustainable technology infrastructure. These initiatives not only generate cost savings but also create long-term value for both $NBIS and the communities it serves.

Besides this, the company designs, develops, and produces its own servers, providing several key differentiating factors that result in greater efficiency and cost savings.

$NBIS' data centers can achieve optimized cooling and heat recovery to enhance both cost-effectiveness and environmental sustainability.

Optimized Cooling

$NBIS' Finland-based data center employs free cooling, eliminating the need for traditional chillers, water, and refrigerants. This approach not only reduces costs but also minimizes the environmental footprint.

• Higher Operating Temperatures: The data center operates at a maximum temperature of approximately 40°C, which is about 10°C higher than the typical limit set by standard hardware. This higher threshold eliminates the need for inlet air subcooling and enables slower, less energy-intensive airflows compared to conventional designs.

• Broader Workload Range: The center functions effectively under 100% workload within a temperature range of 18°C to 40°C, in contrast to most data centers that aim to stay below 27°C due to server architecture constraints. This capability eliminates the energy demands of subcooling, significantly improving energy efficiency.

• Energy Savings: By operating without subcooling requirements, the data center achieves substantial energy savings, aligning with $NBIS' focus on cost efficiency and sustainability.

Heat Recovery

In addition to optimized cooling, $NBIS has implemented an advanced heat recovery system that repurposes waste heat for municipal heating, creating additional value for the surrounding community.

• Regional Innovation: The Finland data center is a pioneer in the region, using server-generated heat to meet local heating needs.

• Energy Reuse: Between 2020 and 2023, the center reused over 80,000 MWh of server heat for municipal heating, equivalent to the energy consumed by around 2,500 Finnish households for heating over four years.

• Meeting Heating Needs: More than 50% of the annual heating requirements of the nearby town were covered by this heat recovery system.

• Cost Savings for Households: The system contributed to household heating cost reductions of up to 12%, accounting for approximately 30% of the data center’s electricity costs.

$NBIS' approach to data center design showcases its ability to balance operational efficiency with environmental responsibility. The company’s plan to replicate these best practices as it expands its data center capacity positions it as a leader in sustainable technology infrastructure. These initiatives not only generate cost savings but also create long-term value for both $NBIS and the communities it serves.

Besides this, the company designs, develops, and produces its own servers, providing several key differentiating factors that result in greater efficiency and cost savings.

6. Strategic Partnership with NVIDIA: A Game-Changer for Nebius

$NBIS' long-standing collaboration with NVIDIA is a cornerstone of its growth and competitive advantage in the AI infrastructure market. This partnership not only provides access to the most advanced GPU technology but also underscores NVIDIA’s confidence in $NBIS' potential, as evidenced by its direct investment in the company.

$NBIS is at the forefront of integrating NVIDIA’s state-of-the-art hardware into its AI infrastructure:

• Blackwell GPUs: Nebius will be the first European provider to offer NVIDIA’s energy-efficient Blackwell platform in 2025, ensuring its customers have access to industry-leading compute performance.

• AI-Native Cloud Platform: Built from scratch with NVIDIA’s accelerated computing platform, $NBIS' cloud environment is purpose-designed to handle intensive and distributed AI workloads with hyperscaler-level reliability.

This alignment ensures that $NBIS customers benefit from the latest advancements in GPU technology, positioning them to innovate and scale efficiently.

The company is also leveraging NVIDIA technology to expand its global footprint:

• The company’s Kansas City GPU cluster — set to launch in Q1 2025 — will house thousands of NVIDIA Hopper GPUs, with plans to incorporate Blackwell GPUs as they become available.

• With potential capacity for 35,000 GPUs, this cluster marks a pivotal step in $NBIS' U.S. expansion, bringing low-latency, high-performance AI infrastructure closer to American customers.

NVIDIA’s Investment: A Vote of Confidence

NVIDIA’s financial backing further validates $NBIS' potential as a leader in the AI infrastructure space. This partnership not only accelerates the company's expansion plans but also reinforces its ability to secure cutting-edge GPUs, ensuring it stays ahead in a highly competitive market.

By combining $NBIS' AI infrastructure expertise with NVIDIA’s hardware and cloud capabilities, the two companies are creating a powerful synergy that positions $NBIS as a global leader in delivering high-performance, energy-efficient AI solutions.

$NBIS' long-standing collaboration with NVIDIA is a cornerstone of its growth and competitive advantage in the AI infrastructure market. This partnership not only provides access to the most advanced GPU technology but also underscores NVIDIA’s confidence in $NBIS' potential, as evidenced by its direct investment in the company.

$NBIS is at the forefront of integrating NVIDIA’s state-of-the-art hardware into its AI infrastructure:

• Blackwell GPUs: Nebius will be the first European provider to offer NVIDIA’s energy-efficient Blackwell platform in 2025, ensuring its customers have access to industry-leading compute performance.

• AI-Native Cloud Platform: Built from scratch with NVIDIA’s accelerated computing platform, $NBIS' cloud environment is purpose-designed to handle intensive and distributed AI workloads with hyperscaler-level reliability.

This alignment ensures that $NBIS customers benefit from the latest advancements in GPU technology, positioning them to innovate and scale efficiently.

The company is also leveraging NVIDIA technology to expand its global footprint:

• The company’s Kansas City GPU cluster — set to launch in Q1 2025 — will house thousands of NVIDIA Hopper GPUs, with plans to incorporate Blackwell GPUs as they become available.

• With potential capacity for 35,000 GPUs, this cluster marks a pivotal step in $NBIS' U.S. expansion, bringing low-latency, high-performance AI infrastructure closer to American customers.

NVIDIA’s Investment: A Vote of Confidence

NVIDIA’s financial backing further validates $NBIS' potential as a leader in the AI infrastructure space. This partnership not only accelerates the company's expansion plans but also reinforces its ability to secure cutting-edge GPUs, ensuring it stays ahead in a highly competitive market.

By combining $NBIS' AI infrastructure expertise with NVIDIA’s hardware and cloud capabilities, the two companies are creating a powerful synergy that positions $NBIS as a global leader in delivering high-performance, energy-efficient AI solutions.

7. Data Centers and Future Investment Plans

$NBIS is investing heavily in its infrastructure to meet the surging demand for AI compute power.

$1B Investment in European AI Infrastructure

$NBIS has committed to investing over $1B by mid-2025 to expand its data center capacity across Europe. This ambitious program includes:

• Expanding Existing Facilities: The flagship data center in Mäntsälä, Finland, will see its capacity tripled to 75 MW, supporting up to 60,000 GPUs. At full capacity, this site alone has an estimated annual revenue potential exceeding $1B.

• Greenfield Sites: $NBIS is planning new, custom-built GPU clusters at greenfield locations, further strengthening its presence in Europe.

• Colocation Facilities: Strategic deployment of additional capacity through partnerships with colocations, including the newly announced GPU cluster in Paris.

The Paris GPU cluster, scheduled for launch in late 2025, will be among the first in Europe to offer NVIDIA’s H200 Tensor Core GPUs. This facility, along with the Finnish data center, will also feature the energy-efficient NVIDIA Blackwell platform, reinforcing $NBIS' technological leadership.

$NBIS' total power capacity is expected to grow dramatically:

• From ~30 MW in 2024 to 60–100 MW by 2025.

• Medium-term plans (2027-2028) target 240+ MW, supporting GPU capacity of up to 240,000 units. 🤯

This aggressive build-out of data centers aligns with the company's vision of becoming a leading global provider of AI infrastructure.

$NBIS is investing heavily in its infrastructure to meet the surging demand for AI compute power.

$1B Investment in European AI Infrastructure

$NBIS has committed to investing over $1B by mid-2025 to expand its data center capacity across Europe. This ambitious program includes:

• Expanding Existing Facilities: The flagship data center in Mäntsälä, Finland, will see its capacity tripled to 75 MW, supporting up to 60,000 GPUs. At full capacity, this site alone has an estimated annual revenue potential exceeding $1B.

• Greenfield Sites: $NBIS is planning new, custom-built GPU clusters at greenfield locations, further strengthening its presence in Europe.

• Colocation Facilities: Strategic deployment of additional capacity through partnerships with colocations, including the newly announced GPU cluster in Paris.

The Paris GPU cluster, scheduled for launch in late 2025, will be among the first in Europe to offer NVIDIA’s H200 Tensor Core GPUs. This facility, along with the Finnish data center, will also feature the energy-efficient NVIDIA Blackwell platform, reinforcing $NBIS' technological leadership.

$NBIS' total power capacity is expected to grow dramatically:

• From ~30 MW in 2024 to 60–100 MW by 2025.

• Medium-term plans (2027-2028) target 240+ MW, supporting GPU capacity of up to 240,000 units. 🤯

This aggressive build-out of data centers aligns with the company's vision of becoming a leading global provider of AI infrastructure.

8. All in all, $NBIS stands out as a leading AI infrastructure provider by offering tailored solutions specifically designed for AI developers and businesses.

With full control over the value chain, efficient GPU operations, and expertise in managing data centers, $NBIS delivers cost-effective and highly reliable services. Its strong partnerships, particularly with NVIDIA, and a top-tier engineering team further solidify its position.

Unlike competitors, $NBIS combines flexibility, scalability, and customer-focused support, making it a versatile and innovative player in the AI infrastructure landscape.

With full control over the value chain, efficient GPU operations, and expertise in managing data centers, $NBIS delivers cost-effective and highly reliable services. Its strong partnerships, particularly with NVIDIA, and a top-tier engineering team further solidify its position.

Unlike competitors, $NBIS combines flexibility, scalability, and customer-focused support, making it a versatile and innovative player in the AI infrastructure landscape.

9. Market Opportunity: A Large And Rapidly Expanding TAM

The total addressable market for AI infrastructure is witnessing explosive growth, and $NBIS is well-positioned to capitalize on this trend. According to its internal estimates:

• The TAM is projected to grow from $33B in 2023 to over $260B by 2030, representing a CAGR of 35%. This exponential growth is fueled by the increasing adoption of AI across industries and the rising demand for compute-intensive solutions tailored to AI workloads.

• A key driver of this demand will be inference workloads, which are expected to constitute 64% of AI server spending by 2027, up from 34% in 2023. As AI applications transition from development (training) to deployment (inference), $NBIS' comprehensive AI infrastructure is uniquely suited to meet these evolving needs.

External factors contributing to this opportunity include the rapid expansion of GPU-as-a-Service and AI cloud markets, which are anticipated to grow eightfold over the next seven years. This creates an immense runway for growth for infrastructure providers like $NBIS.

Internally, $NBIS is leveraging its competitive advantages to capture this market opportunity:

• Client Base Expansion: The company is focused on securing long-term contracts with existing clients while expanding into new customer segments. It also supports existing customers as they scale their AI workloads.

• Value-Added Services: By continually expanding its product range — such as API SaaS for open-source models — $NBIS ensures that it can address diverse customer needs, from developers to enterprises.

As the generative AI market grows, $NBIS is not just keeping pace but actively shaping the ecosystem with its focus on high-performance, cost-efficient, and sustainable AI infrastructure. With its ambitious expansion plans and strong strategic partnerships, the company is primed to capture a significant share of this booming market.

The total addressable market for AI infrastructure is witnessing explosive growth, and $NBIS is well-positioned to capitalize on this trend. According to its internal estimates:

• The TAM is projected to grow from $33B in 2023 to over $260B by 2030, representing a CAGR of 35%. This exponential growth is fueled by the increasing adoption of AI across industries and the rising demand for compute-intensive solutions tailored to AI workloads.

• A key driver of this demand will be inference workloads, which are expected to constitute 64% of AI server spending by 2027, up from 34% in 2023. As AI applications transition from development (training) to deployment (inference), $NBIS' comprehensive AI infrastructure is uniquely suited to meet these evolving needs.

External factors contributing to this opportunity include the rapid expansion of GPU-as-a-Service and AI cloud markets, which are anticipated to grow eightfold over the next seven years. This creates an immense runway for growth for infrastructure providers like $NBIS.

Internally, $NBIS is leveraging its competitive advantages to capture this market opportunity:

• Client Base Expansion: The company is focused on securing long-term contracts with existing clients while expanding into new customer segments. It also supports existing customers as they scale their AI workloads.

• Value-Added Services: By continually expanding its product range — such as API SaaS for open-source models — $NBIS ensures that it can address diverse customer needs, from developers to enterprises.

As the generative AI market grows, $NBIS is not just keeping pace but actively shaping the ecosystem with its focus on high-performance, cost-efficient, and sustainable AI infrastructure. With its ambitious expansion plans and strong strategic partnerships, the company is primed to capture a significant share of this booming market.

10. Now let's take a look at $NBIS' numbers 👇🏻

First, it’s important to note that the company has a super solid balance sheet with over $2B in cash and no debt. This financial strength provides ample runway to support $NBIS' ambitious expansion plans and capitalize on the booming generative AI infrastructure market.

Explosive ARR Growth

The company’s Annual Recurring Revenue experienced phenomenal growth, surging from $21M at the end of 2023 to a projected $170–190M by the end of 2024 (to be reported) — an 8–9x increase within just a year. This explosive growth has been fueled by:

• Client Base Expansion: The number of active clients grew from just 10 to 40+, with robust growth expected to continue as $NBIS penetrates new segments.

• Massive Capacity Expansion: GPU capacity skyrocketed from ~2,000 GPUs to 20,000+ GPUs, enabling the company to handle significantly higher workloads.

• Growing Consumption: Existing clients scaled up their AI workloads, driving repeat business and sustained revenue growth.

2025 Outlook

$NBIS expects to maintain this growth trajectory in 2025, targeting:

• $750M to $1B in ARR by year-end.

• Revenue between $500–700M, with the company achieving adjusted EBITDA profitability.

• $600M to $1.5B in CAPEX, primarily invested in: NVIDIA GB200 GPUs to expand computational capacity and data center expansion, including owned, greenfield, and colocation facilities, to support higher volumes for both existing and new customers.

Medium-Term Vision

Looking beyond 2025, $NBIS aims to drive multibillion-dollar annual revenue, supported by:

• Leveraging GPUaaS and AI Cloud growth: Capturing market share in these rapidly expanding verticals.

• Infrastructure Expansion: Significantly increasing GPU capacity and building more data centers (already discussed in a previous post).

• Client Diversification: Expanding into new customer segments, securing additional long-term contracts, and increasing its market penetration.

• Product Innovation: Introducing more value-added services, such as API SaaS offerings for open-source models, to better meet the needs of a growing and diverse client base.

With a combination of financial stability, aggressive growth strategies, and a market-ready infrastructure, $NBIS is poised to become a dominant player in the AI infrastructure landscape.

First, it’s important to note that the company has a super solid balance sheet with over $2B in cash and no debt. This financial strength provides ample runway to support $NBIS' ambitious expansion plans and capitalize on the booming generative AI infrastructure market.

Explosive ARR Growth

The company’s Annual Recurring Revenue experienced phenomenal growth, surging from $21M at the end of 2023 to a projected $170–190M by the end of 2024 (to be reported) — an 8–9x increase within just a year. This explosive growth has been fueled by:

• Client Base Expansion: The number of active clients grew from just 10 to 40+, with robust growth expected to continue as $NBIS penetrates new segments.

• Massive Capacity Expansion: GPU capacity skyrocketed from ~2,000 GPUs to 20,000+ GPUs, enabling the company to handle significantly higher workloads.

• Growing Consumption: Existing clients scaled up their AI workloads, driving repeat business and sustained revenue growth.

2025 Outlook

$NBIS expects to maintain this growth trajectory in 2025, targeting:

• $750M to $1B in ARR by year-end.

• Revenue between $500–700M, with the company achieving adjusted EBITDA profitability.

• $600M to $1.5B in CAPEX, primarily invested in: NVIDIA GB200 GPUs to expand computational capacity and data center expansion, including owned, greenfield, and colocation facilities, to support higher volumes for both existing and new customers.

Medium-Term Vision

Looking beyond 2025, $NBIS aims to drive multibillion-dollar annual revenue, supported by:

• Leveraging GPUaaS and AI Cloud growth: Capturing market share in these rapidly expanding verticals.

• Infrastructure Expansion: Significantly increasing GPU capacity and building more data centers (already discussed in a previous post).

• Client Diversification: Expanding into new customer segments, securing additional long-term contracts, and increasing its market penetration.

• Product Innovation: Introducing more value-added services, such as API SaaS offerings for open-source models, to better meet the needs of a growing and diverse client base.

With a combination of financial stability, aggressive growth strategies, and a market-ready infrastructure, $NBIS is poised to become a dominant player in the AI infrastructure landscape.

11. But $NBIS is more than just its core business, it has three other divisions that further enhance the company's value.

Toloka

Data partner for AI development: Toloka provides human-powered data solutions, enabling businesses and researchers to gather, label, and evaluate large datasets crucial for training and improving AI models.

AVRIDE

Autonomous driving technology: AVRIDE specializes in developing autonomous driving technology for self-driving cars and delivery robots.

tripleten

Edtech player: tripleten is an educational technology company that focuses on reskilling individuals for careers in tech. They offer online courses, training programs, and career guidance to help people acquire the skills needed for in-demand tech roles.

ClickHouse (~28% stake)

Open-source database: ClickHouse is the creator of a popular open-source column-oriented database management system (DBMS). Their database is known for its high performance and efficiency in handling large volumes of data, making it suitable for analytical workloads and data warehousing.

Let's understand a bit more about each of these divisions 👇🏻

Toloka

Data partner for AI development: Toloka provides human-powered data solutions, enabling businesses and researchers to gather, label, and evaluate large datasets crucial for training and improving AI models.

AVRIDE

Autonomous driving technology: AVRIDE specializes in developing autonomous driving technology for self-driving cars and delivery robots.

tripleten

Edtech player: tripleten is an educational technology company that focuses on reskilling individuals for careers in tech. They offer online courses, training programs, and career guidance to help people acquire the skills needed for in-demand tech roles.

ClickHouse (~28% stake)

Open-source database: ClickHouse is the creator of a popular open-source column-oriented database management system (DBMS). Their database is known for its high performance and efficiency in handling large volumes of data, making it suitable for analytical workloads and data warehousing.

Let's understand a bit more about each of these divisions 👇🏻

12. Avride: One of the Pioneers in Autonomous Mobility Solutions

Yandex Self-Driving division was established in 2016, and Avride is essentially the result of almost a decade of developments.

Avride is a cutting-edge player in the autonomous driving sector, focused on both self-driving vehicles and delivery robots. The division stands out for its dual expertise, leveraging shared technologies to advance both passenger and logistics solutions.

Core Capabilities

• Team Expertise: Avride boasts over 200 engineers and developers specializing in self-driving technology, with more than seven years of experience in autonomous systems. Their operations span multiple R&D hubs in the USA, Israel, Serbia, and South Korea.

• Strategic Partnerships: The company collaborates with Uber to enable autonomous delivery and mobility solutions, underlining its role as a commercial leader in the space.

Technology Development

• Self-Driving Vehicles: Avride develops fully autonomous cars for applications such as ride-hailing, logistics, and food delivery. Testing has been conducted in the US, South Korea, and EMEA, culminating in robotaxi deployment within two years of public testing. The fleet has completed 47,000+ passenger rides, covering over 22M autonomous kilometers with zero serious accidents.

• Delivery Robots: Designed for diverse conditions, Avride's delivery robots operate on sidewalks and indoors, achieving speeds of up to 8 km/h with a range of 55 km. These robots have delivered over 200,000 client orders globally, showcasing their reliability in restaurant, grocery, and small-scale logistics.

Key Differentiators

• Efficiency and Safety: Avride achieves remarkable fleet efficiency, logging more kilometers per vehicle than competitors like Waymo and Cruise. Its technology has been tested in extreme conditions, maintaining an outstanding safety record.

• Commercial Viability: With ~$310M invested since inception, Avride operates at a fraction of its competitors’ costs, making it a highly efficient autonomous vehicle provider.

• Production Strength: In-house robot designs and a manufacturing partnership in Taiwan allow Avride to rapidly scale production while optimizing costs.

Growth Trajectory

• 2024: Deployment of 10–20 vehicles for R&D and over 100 delivery robots.

• 2025: Expansion to 100+ autonomous vehicles and 1,000+ robots, with monetization milestones and breakeven on contribution profit.

• 2026+: Unsupervised public launches in multiple cities, targeting double-digit million USD revenues with a fleet size exceeding 200 vehicles and 3,000 robots.

Avride's ability to rapidly deploy and integrate into commercial ecosystems positions it as a leader in autonomous mobility. Its ongoing partnerships, such as with Uber Eats in Austin, highlight its capability to expand operations globally. With an estimated funding need of up to $150M in the mid-term, Avride is set to further solidify its market position and deliver significant value to $NBIS.

Yandex Self-Driving division was established in 2016, and Avride is essentially the result of almost a decade of developments.

Avride is a cutting-edge player in the autonomous driving sector, focused on both self-driving vehicles and delivery robots. The division stands out for its dual expertise, leveraging shared technologies to advance both passenger and logistics solutions.

Core Capabilities

• Team Expertise: Avride boasts over 200 engineers and developers specializing in self-driving technology, with more than seven years of experience in autonomous systems. Their operations span multiple R&D hubs in the USA, Israel, Serbia, and South Korea.

• Strategic Partnerships: The company collaborates with Uber to enable autonomous delivery and mobility solutions, underlining its role as a commercial leader in the space.

Technology Development

• Self-Driving Vehicles: Avride develops fully autonomous cars for applications such as ride-hailing, logistics, and food delivery. Testing has been conducted in the US, South Korea, and EMEA, culminating in robotaxi deployment within two years of public testing. The fleet has completed 47,000+ passenger rides, covering over 22M autonomous kilometers with zero serious accidents.

• Delivery Robots: Designed for diverse conditions, Avride's delivery robots operate on sidewalks and indoors, achieving speeds of up to 8 km/h with a range of 55 km. These robots have delivered over 200,000 client orders globally, showcasing their reliability in restaurant, grocery, and small-scale logistics.

Key Differentiators

• Efficiency and Safety: Avride achieves remarkable fleet efficiency, logging more kilometers per vehicle than competitors like Waymo and Cruise. Its technology has been tested in extreme conditions, maintaining an outstanding safety record.

• Commercial Viability: With ~$310M invested since inception, Avride operates at a fraction of its competitors’ costs, making it a highly efficient autonomous vehicle provider.

• Production Strength: In-house robot designs and a manufacturing partnership in Taiwan allow Avride to rapidly scale production while optimizing costs.

Growth Trajectory

• 2024: Deployment of 10–20 vehicles for R&D and over 100 delivery robots.

• 2025: Expansion to 100+ autonomous vehicles and 1,000+ robots, with monetization milestones and breakeven on contribution profit.

• 2026+: Unsupervised public launches in multiple cities, targeting double-digit million USD revenues with a fleet size exceeding 200 vehicles and 3,000 robots.

Avride's ability to rapidly deploy and integrate into commercial ecosystems positions it as a leader in autonomous mobility. Its ongoing partnerships, such as with Uber Eats in Austin, highlight its capability to expand operations globally. With an estimated funding need of up to $150M in the mid-term, Avride is set to further solidify its market position and deliver significant value to $NBIS.

13. Toloka: Powering Data-Driven AI with Scalable Solutions

Toloka delivers high-quality data and innovative solutions to support the development and scaling of AI technologies.

• Revenue Expansion Across Offerings: Focused on growing revenue across all product lines, while solidifying its presence in a rapidly growing market.

• Customer Growth and Retention: Securing new customers and increasing wallet share with existing clients through Classic and Evolved GenAI solutions.

• Tapping into Growing AI Demand: Capitalizing on the rising need for advanced AI solutions, including non-core GenAI services and a self-serve platform.

• Trusted by Industry Leaders: Toloka AI is relied upon by Big Tech, Fortune-500 companies (such as Microsoft and ServiceNow), and A-class startups. This trust is underpinned by the team's extensive ML expertise and robust research partnerships.

👉🏻 Projected Financial Highlights: 2025E revenue is estimated to be between $50M and $70M.

Toloka delivers high-quality data and innovative solutions to support the development and scaling of AI technologies.

• Revenue Expansion Across Offerings: Focused on growing revenue across all product lines, while solidifying its presence in a rapidly growing market.

• Customer Growth and Retention: Securing new customers and increasing wallet share with existing clients through Classic and Evolved GenAI solutions.

• Tapping into Growing AI Demand: Capitalizing on the rising need for advanced AI solutions, including non-core GenAI services and a self-serve platform.

• Trusted by Industry Leaders: Toloka AI is relied upon by Big Tech, Fortune-500 companies (such as Microsoft and ServiceNow), and A-class startups. This trust is underpinned by the team's extensive ML expertise and robust research partnerships.

👉🏻 Projected Financial Highlights: 2025E revenue is estimated to be between $50M and $70M.

14. TripleTen and ClickHouse

TripleTen is a top-rated EdTech platform in the US, known for its high employment rates, excellent student feedback, and solid graduate outcomes. It offers a flexible, AI-powered e-learning platform that provides accessible pricing for learners and scalable operations for the business. TripleTen is expanding its presence in B2B and B2C markets, particularly in the US and LATAM, opening significant growth opportunities.

Key Differentiators

• Affordable Pricing: TripleTen leverages AI-driven automation and diversified trainer sourcing to optimize training costs, enabling highly competitive pricing.

• Top-Rated in the US: Achieves high employment rates (87% of graduates employed within six months of graduation) and excellent student satisfaction, outperforming industry benchmarks.

• Proprietary Technology: Offers a robust tech stack for seamless course launches and localization with minimal cost overhead.

• Extensive Support: Provides personalized guidance through expert tutors and real-world problem-solving scenarios to maximize student outcomes.

Growth Levers

Market Share Expansion in Existing Regions: Growing its footprint in the US to gain market share and expanding alumni networks to enhance enrollment efficiency and reduce customer acquisition costs (CAC).

• B2C Offering Growth: Launching new programs, including Cyber Analyst and UI/UX Design, to cater to emerging job market demands.

• Geographic Expansion into LATAM: Deep localization to better address local needs and rapid scaling of existing courses to penetrate LATAM markets.

• B2B Product Expansion: Developing corporate bootcamps in English and Spanish, and introducing role-specific assessments for data and development specialists.

Business Model Strength

TripleTen operates a highly efficient cost structure where CAC is fully covered by initial customer payments, ensuring robust financial sustainability.

2025 Financial Expectations: Revenue: $40–$60M.

Regarding ClickHouse, $NBIS owns only a minority interest in the company (~28%), so it doesn't hold the same level of importance.

TripleTen is a top-rated EdTech platform in the US, known for its high employment rates, excellent student feedback, and solid graduate outcomes. It offers a flexible, AI-powered e-learning platform that provides accessible pricing for learners and scalable operations for the business. TripleTen is expanding its presence in B2B and B2C markets, particularly in the US and LATAM, opening significant growth opportunities.

Key Differentiators

• Affordable Pricing: TripleTen leverages AI-driven automation and diversified trainer sourcing to optimize training costs, enabling highly competitive pricing.

• Top-Rated in the US: Achieves high employment rates (87% of graduates employed within six months of graduation) and excellent student satisfaction, outperforming industry benchmarks.

• Proprietary Technology: Offers a robust tech stack for seamless course launches and localization with minimal cost overhead.

• Extensive Support: Provides personalized guidance through expert tutors and real-world problem-solving scenarios to maximize student outcomes.

Growth Levers

Market Share Expansion in Existing Regions: Growing its footprint in the US to gain market share and expanding alumni networks to enhance enrollment efficiency and reduce customer acquisition costs (CAC).

• B2C Offering Growth: Launching new programs, including Cyber Analyst and UI/UX Design, to cater to emerging job market demands.

• Geographic Expansion into LATAM: Deep localization to better address local needs and rapid scaling of existing courses to penetrate LATAM markets.

• B2B Product Expansion: Developing corporate bootcamps in English and Spanish, and introducing role-specific assessments for data and development specialists.

Business Model Strength

TripleTen operates a highly efficient cost structure where CAC is fully covered by initial customer payments, ensuring robust financial sustainability.

2025 Financial Expectations: Revenue: $40–$60M.

Regarding ClickHouse, $NBIS owns only a minority interest in the company (~28%), so it doesn't hold the same level of importance.

15. Valuation - A bargain with significant upside and minimal downside

Based on its current cash reserves, $NBIS has an EV of ~$5B.

As mentioned, the company expects to generate $500–700M in revenue in 2025 and close the year with $750M–1B in ARR.

Assuming it achieves the high end of guidance (which is highly likely), $NBIS is trading at 7–8x EV/Fwd Revenue. While this is not a cheap multiple in absolute terms, it is relatively attractive compared to similar companies, especially when factoring in its explosive growth of 4–5x YoY in 2025 and likely 100%+ growth in 2026 (with continued rapid expansion over the following years, driven by GPU deployment plans).

If we assume the full deployment of 240k GPUs by 2028, the company could achieve over $4B in ARR by that time.

Applying a 30% normalized EBITDA margin (a reasonable estimate based on comparable companies) and a 15x multiple, would result in at least an $18B valuation — representing a 37% CAGR over three years.

Of course, these estimates may be completely wrong, but there’s a strong likelihood they are achievable.

Importantly, this valuation gives ZERO value to $NBIS' other divisions.

For instance, Waymo was recently valued at $45B. While Avride is not as developed, I think it could easily be worth at least 5% of Waymo’s valuation, or $2.25B. This alone would account for a significant portion of $NBIS' current market cap — essentially being "free" at the current price.

Additionally, Toloka, TripleTen, and the 28% stake in ClickHouse could contribute another $500M–1B to the valuation.

In summary, I strongly believe the market has yet to recognize $NBIS' intrinsic value. At its current price, I see a significant opportunity to achieve over 30% CAGR returns over the next few years, far exceeding the expectations of most investors.

Based on its current cash reserves, $NBIS has an EV of ~$5B.

As mentioned, the company expects to generate $500–700M in revenue in 2025 and close the year with $750M–1B in ARR.

Assuming it achieves the high end of guidance (which is highly likely), $NBIS is trading at 7–8x EV/Fwd Revenue. While this is not a cheap multiple in absolute terms, it is relatively attractive compared to similar companies, especially when factoring in its explosive growth of 4–5x YoY in 2025 and likely 100%+ growth in 2026 (with continued rapid expansion over the following years, driven by GPU deployment plans).

If we assume the full deployment of 240k GPUs by 2028, the company could achieve over $4B in ARR by that time.

Applying a 30% normalized EBITDA margin (a reasonable estimate based on comparable companies) and a 15x multiple, would result in at least an $18B valuation — representing a 37% CAGR over three years.

Of course, these estimates may be completely wrong, but there’s a strong likelihood they are achievable.

Importantly, this valuation gives ZERO value to $NBIS' other divisions.

For instance, Waymo was recently valued at $45B. While Avride is not as developed, I think it could easily be worth at least 5% of Waymo’s valuation, or $2.25B. This alone would account for a significant portion of $NBIS' current market cap — essentially being "free" at the current price.

Additionally, Toloka, TripleTen, and the 28% stake in ClickHouse could contribute another $500M–1B to the valuation.

In summary, I strongly believe the market has yet to recognize $NBIS' intrinsic value. At its current price, I see a significant opportunity to achieve over 30% CAGR returns over the next few years, far exceeding the expectations of most investors.

16. Why is it so cheap? 🤔

• Execution Concerns: Investors are wary of the company’s ability to successfully execute its ambitious growth plans. Scaling operations to such explosive levels comes with risks, particularly around managing costs, maintaining quality, and achieving operational efficiency.

• Cash Burn and Financing: The rapid expansion and heavy investment in GPUs and other initiatives require significant capital. Concerns over potential cash burn and the possibility of additional equity financing (which could dilute existing shareholders) weigh on investor sentiment.

• Lack of Analyst Coverage: $NBIS is largely underfollowed, with no meaningful analyst coverage. This means many investors are unaware of the company’s true potential. The lack of visibility contributes to its undervaluation.

• Perceived Risks: Some investors may still associate $NBIS with geopolitical risks, despite the fact that the company no longer has any exposure to Russia. This misconception has likely kept some investors on the sidelines.

• Competitive Landscape: Operating in fields dominated by strong players, such as AI and autonomous systems, probably raises doubts about $NBIS' competitive advantages and ability to succeed against established giants. While the company has demonstrated impressive progress, skepticism about its differentiation and scalability remains a hurdle.

These concerns create a unique opportunity for investors who recognize the company's potential and understand that many of these risks are either overstated or manageable. As $NBIS continues to execute its plans and improve its visibility in the market, these factors should fade, leading to a re-rating of the stock.

• Execution Concerns: Investors are wary of the company’s ability to successfully execute its ambitious growth plans. Scaling operations to such explosive levels comes with risks, particularly around managing costs, maintaining quality, and achieving operational efficiency.

• Cash Burn and Financing: The rapid expansion and heavy investment in GPUs and other initiatives require significant capital. Concerns over potential cash burn and the possibility of additional equity financing (which could dilute existing shareholders) weigh on investor sentiment.

• Lack of Analyst Coverage: $NBIS is largely underfollowed, with no meaningful analyst coverage. This means many investors are unaware of the company’s true potential. The lack of visibility contributes to its undervaluation.

• Perceived Risks: Some investors may still associate $NBIS with geopolitical risks, despite the fact that the company no longer has any exposure to Russia. This misconception has likely kept some investors on the sidelines.

• Competitive Landscape: Operating in fields dominated by strong players, such as AI and autonomous systems, probably raises doubts about $NBIS' competitive advantages and ability to succeed against established giants. While the company has demonstrated impressive progress, skepticism about its differentiation and scalability remains a hurdle.

These concerns create a unique opportunity for investors who recognize the company's potential and understand that many of these risks are either overstated or manageable. As $NBIS continues to execute its plans and improve its visibility in the market, these factors should fade, leading to a re-rating of the stock.

17. Insiders' Alignment

The Founder and CEO of $NBIS, Arkady Volozh, brings an exceptional track record and strong alignment of interests with shareholders. Volozh previously founded and led Yandex, growing it into one of Europe’s largest tech companies, with a valuation exceeding $30B at its peak. His vision and leadership were instrumental in building Yandex’s dominance in search, AI, and other technology sectors.

He holds ~15% of $NBIS, representing around 90% of his personal net worth. This deep financial commitment ensures his incentives are fully aligned with those of other shareholders. With ~60% voting power, Volozh retains the ability to steer the company decisively, ensuring that long-term growth takes precedence over short-term market pressures.

Now a dual citizen of the Netherlands and Israel, Arkady has distanced himself from Russia and its geopolitical risks. He has been openly critical of Vladimir Putin, condemning his "barbaric" actions, which underscores his commitment to ethical leadership and operating in global markets.

Arkady's track record of scaling Yandex into a tech powerhouse and his substantial personal investment in $NBIS suggest that he is highly motivated to replicate his past success. His leadership and alignment with shareholders provide a solid foundation for $NBIS to achieve its ambitious growth plans.

The Founder and CEO of $NBIS, Arkady Volozh, brings an exceptional track record and strong alignment of interests with shareholders. Volozh previously founded and led Yandex, growing it into one of Europe’s largest tech companies, with a valuation exceeding $30B at its peak. His vision and leadership were instrumental in building Yandex’s dominance in search, AI, and other technology sectors.

He holds ~15% of $NBIS, representing around 90% of his personal net worth. This deep financial commitment ensures his incentives are fully aligned with those of other shareholders. With ~60% voting power, Volozh retains the ability to steer the company decisively, ensuring that long-term growth takes precedence over short-term market pressures.

Now a dual citizen of the Netherlands and Israel, Arkady has distanced himself from Russia and its geopolitical risks. He has been openly critical of Vladimir Putin, condemning his "barbaric" actions, which underscores his commitment to ethical leadership and operating in global markets.

Arkady's track record of scaling Yandex into a tech powerhouse and his substantial personal investment in $NBIS suggest that he is highly motivated to replicate his past success. His leadership and alignment with shareholders provide a solid foundation for $NBIS to achieve its ambitious growth plans.

18. Conclusion

All in all, I firmly believe that $NBIS represents a compelling opportunity for investors seeking exposure to the AI infrastructure market without the inflated valuations seen in many of its peers. The company possesses the critical ingredients for success: cutting-edge technology, a world-class team, and a strategic position in a rapidly expanding market.

With its proven track record of innovation and execution, I am confident that $NBIS has the potential to not only replicate but exceed Yandex’s past achievements in the Western world.

As $NBIS garners greater recognition from institutional investors and the broader market, its valuation is likely to reflect its intrinsic value. I anticipate 2025 will be a breakout year for shareholder returns, as the company’s growth trajectory and untapped potential become increasingly apparent.

All in all, I firmly believe that $NBIS represents a compelling opportunity for investors seeking exposure to the AI infrastructure market without the inflated valuations seen in many of its peers. The company possesses the critical ingredients for success: cutting-edge technology, a world-class team, and a strategic position in a rapidly expanding market.

With its proven track record of innovation and execution, I am confident that $NBIS has the potential to not only replicate but exceed Yandex’s past achievements in the Western world.

As $NBIS garners greater recognition from institutional investors and the broader market, its valuation is likely to reflect its intrinsic value. I anticipate 2025 will be a breakout year for shareholder returns, as the company’s growth trajectory and untapped potential become increasingly apparent.

19. That's it! 🫡

I currently don’t hold a position in $NBIS, but I plan to initiate one very soon.

While I typically avoid these types of companies, $NBIS stands out as a clear leader in the AI infrastructure market.

IMO it’s a rare opportunity that’s hard to overlook.

I currently don’t hold a position in $NBIS, but I plan to initiate one very soon.

While I typically avoid these types of companies, $NBIS stands out as a clear leader in the AI infrastructure market.

IMO it’s a rare opportunity that’s hard to overlook.

• • •

Missing some Tweet in this thread? You can try to

force a refresh