This week $SPY dropped over $20 bucks in 4 days 📉

That's an average drop of $5 a day 😬

Here are some tips & tricks for trading downtrends! 🧵

That's an average drop of $5 a day 😬

Here are some tips & tricks for trading downtrends! 🧵

Pullbacks in the market are normal & healthy... But not every red day is a "buy the dip" opportunity!

Many day traders struggle to trade these downside moves, and many swing traders will buy the dip way too early.

There was a time when I would have got killed on a week like last! But these simple tips & tricks have helped me turn that into weeks like this 👇

Many day traders struggle to trade these downside moves, and many swing traders will buy the dip way too early.

There was a time when I would have got killed on a week like last! But these simple tips & tricks have helped me turn that into weeks like this 👇

Rule #1 📝

If we break under the Previous Day Low the current downtrend is resuming!

Avoid buying the dip here! I wait for the confirmation of a higher high first.

Break Previous Day Low = Lower Low = Downtrend.

Break Previous Day High = Higher High = Reversal.

Every day this week $SPY broke the PDL and continued to fade lower. Clear downtrend ⬇️

If we break under the Previous Day Low the current downtrend is resuming!

Avoid buying the dip here! I wait for the confirmation of a higher high first.

Break Previous Day Low = Lower Low = Downtrend.

Break Previous Day High = Higher High = Reversal.

Every day this week $SPY broke the PDL and continued to fade lower. Clear downtrend ⬇️

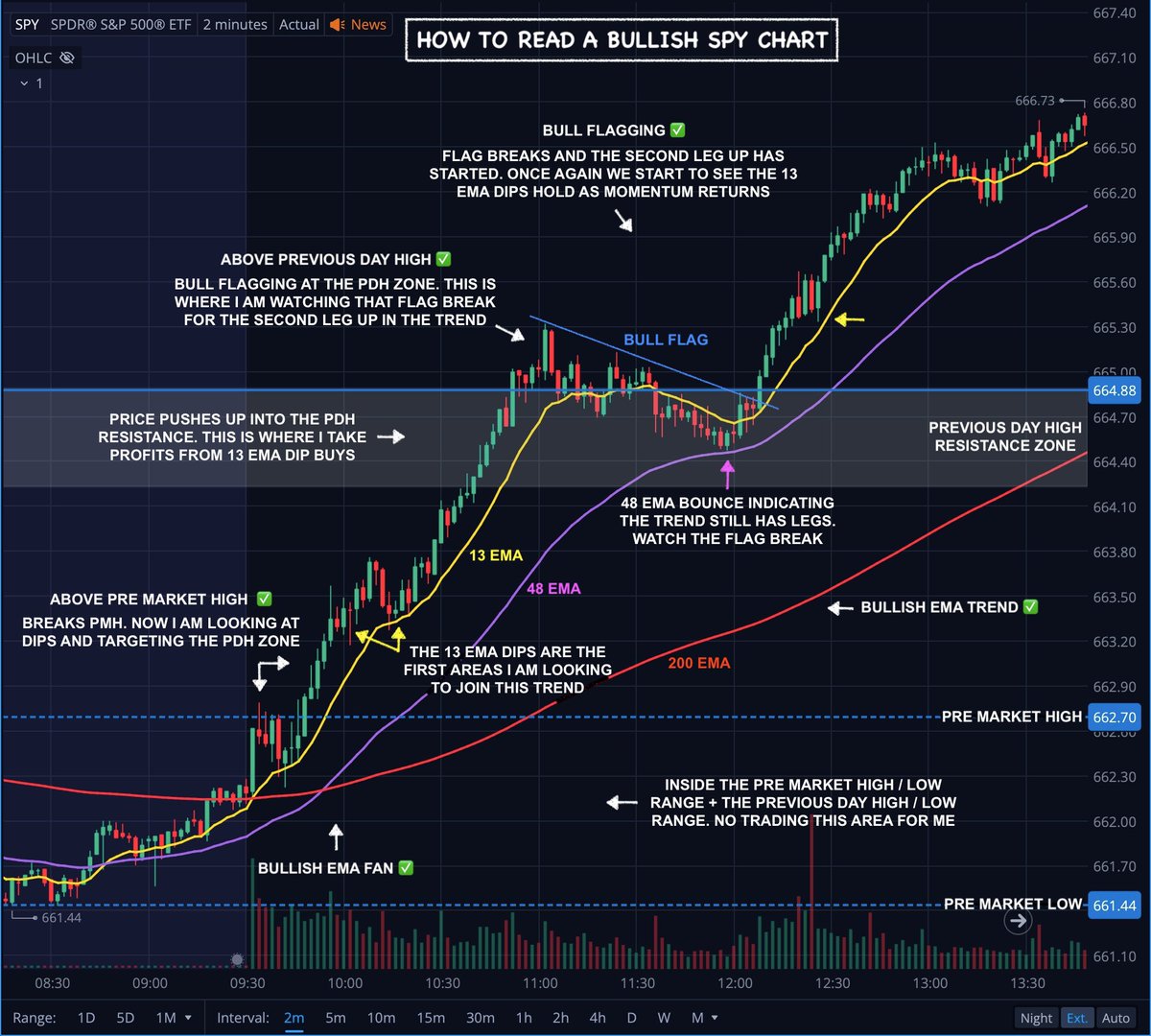

Not only is that Previous Day Low a great way to gauge direction... It is also a strong support / resistance level to trade around!

Here's an example of that last week ⬇️

Here's an example of that last week ⬇️

Rule #2 📝

Don't fade the EMA trends! Trading with them rather than against them makes life a lot easier.

Here's my simple cheat sheet for EMA trends ⬇️

Don't fade the EMA trends! Trading with them rather than against them makes life a lot easier.

Here's my simple cheat sheet for EMA trends ⬇️

Not only do these EMA trends clearly show you the momentum / direction... I also use them for pullback entries into these downtrends!

Here's an example of that from last week ⬇️

Here's an example of that from last week ⬇️

Rule #3 📝

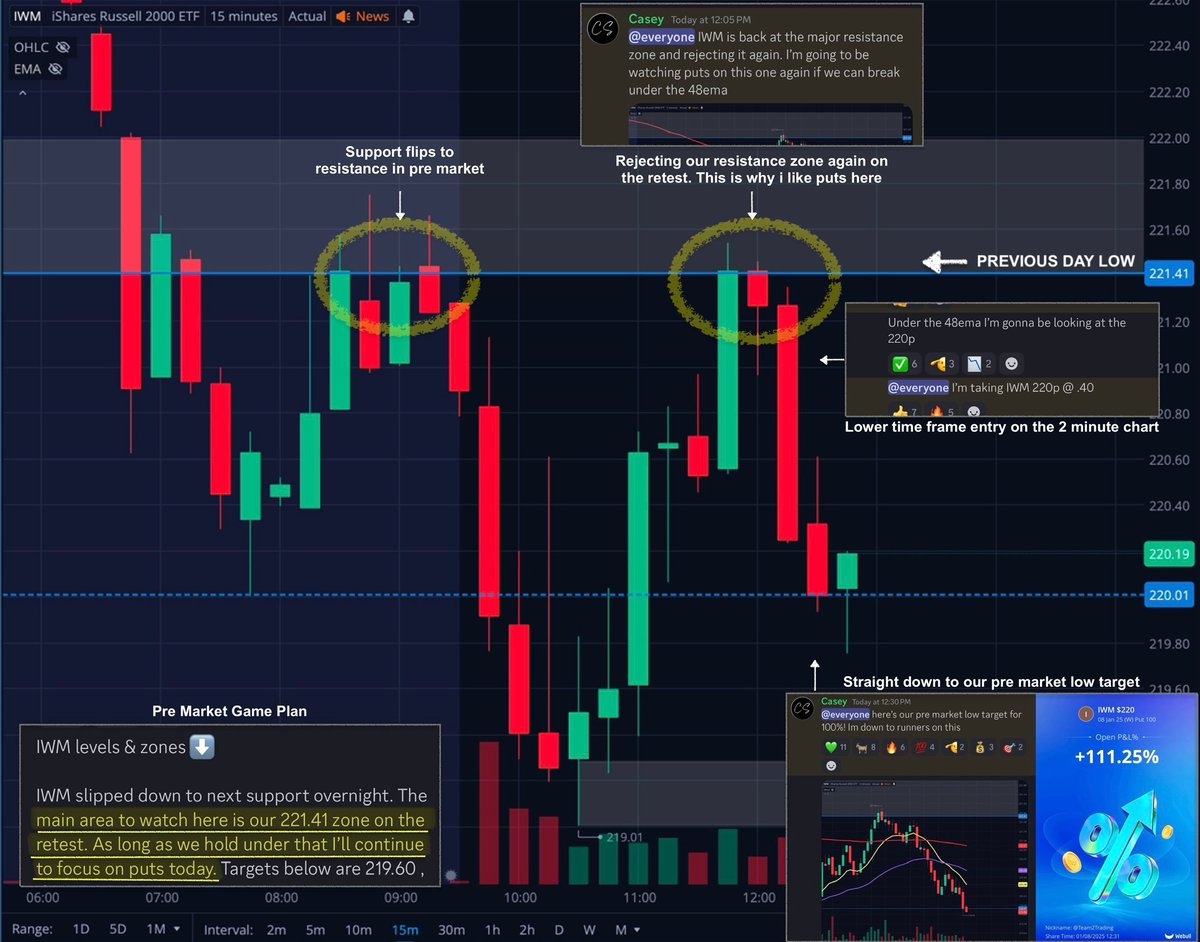

Trade the Bear Flags 🚩

Rarely will a bullish reversals start with a bear flag.

There are plenty of nice reversal patterns... Bear flags are not one of them. Keep an eye out for them on pullbacks if we are in a current downtrend! ⬇️

Trade the Bear Flags 🚩

Rarely will a bullish reversals start with a bear flag.

There are plenty of nice reversal patterns... Bear flags are not one of them. Keep an eye out for them on pullbacks if we are in a current downtrend! ⬇️

Bullet Point check list 🔽

~ Below Previous Day Low ✅

~ Bearish EMA trends ✅

~ Bear Flags ✅

These are 3 simple and effective ways to identify and trade these downtrends! 🤙

~ Below Previous Day Low ✅

~ Bearish EMA trends ✅

~ Bear Flags ✅

These are 3 simple and effective ways to identify and trade these downtrends! 🤙

• • •

Missing some Tweet in this thread? You can try to

force a refresh