Insurance stocks are set to collapse:

LA wildfires have officially spread over 40,000 acres with insurance losses crossing $20 billion.

Since the market closed on Friday, estimated damages have TRIPLED to $150 billion.

Could this cause an economic ripple effect?

(a thread)

LA wildfires have officially spread over 40,000 acres with insurance losses crossing $20 billion.

Since the market closed on Friday, estimated damages have TRIPLED to $150 billion.

Could this cause an economic ripple effect?

(a thread)

Heading into the weekend, estimates of insurance losses were high, but not likely to exceed ~$10-15 billion.

Now, estimated losses are up to $20 BILLION for insurers.

This is ~60% more than the inflation adjusted value of the previous most expensive wildfire in US history.

Now, estimated losses are up to $20 BILLION for insurers.

This is ~60% more than the inflation adjusted value of the previous most expensive wildfire in US history.

Here's Mercury General, $MCY, an insurance company with heavy exposure to the Palisades area.

The stock lost ~26% of its market cap heading into Friday, erasing ~$1 billion of market cap.

As damage estimates have doubled since, we could see this stock down MUCH more.

The stock lost ~26% of its market cap heading into Friday, erasing ~$1 billion of market cap.

As damage estimates have doubled since, we could see this stock down MUCH more.

Here's a list of some of the largest insurance companies in the US.

Total market cap losses have now exceeded $19 BILLION in these insurance companies.

This is before the market digests this weekend's events as the fire has spread.

Smaller insurance companies are in trouble.

Total market cap losses have now exceeded $19 BILLION in these insurance companies.

This is before the market digests this weekend's events as the fire has spread.

Smaller insurance companies are in trouble.

Estimated damages were ~$50 billion going into the weekend.

Since then, the fire has spread to an additional 10,000+ acres and wind has proliferated it.

As of now, the wildfire is still less than 20% contained which is why damage estimates continue to rise rapidly.

Since then, the fire has spread to an additional 10,000+ acres and wind has proliferated it.

As of now, the wildfire is still less than 20% contained which is why damage estimates continue to rise rapidly.

The economic effects are spreading beyond insurance companies as well.

Southern California Edison has erased ~$6 BILLION of market cap as of Friday.

Bloomberg estimates California’s wildfires are a $9 billion threat to power companies.

Power lines are a suspected cause.

Southern California Edison has erased ~$6 BILLION of market cap as of Friday.

Bloomberg estimates California’s wildfires are a $9 billion threat to power companies.

Power lines are a suspected cause.

Furthermore, the California FAIR Plan could collapse.

An assessment over $1 billion has never been done for the FAIR Plan.

Now, losses to the Plan are set to exceed a whopping $24 billion.

Where will California get the money from to pay out the victims of this tragedy?

An assessment over $1 billion has never been done for the FAIR Plan.

Now, losses to the Plan are set to exceed a whopping $24 billion.

Where will California get the money from to pay out the victims of this tragedy?

Victoria Roach, president of the California FAIR Plan, warned a state legislative committee last year:

“We are one event away from a large assessment.”

She also said, “We don’t have the money on hand [to pay every claim] and we have a lot of exposure.”

So, what now?

“We are one event away from a large assessment.”

She also said, “We don’t have the money on hand [to pay every claim] and we have a lot of exposure.”

So, what now?

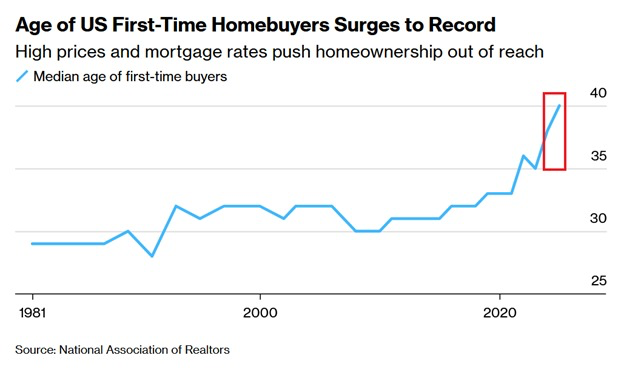

Beyond corporations, many individuals will sadly lose much of their wealth in these fires.

According to LendingTree, ~10% of home in Los Angeles are uninsured.

75% of homeowners may not have enough insurance to fully cover losses after a disaster, per FORTUNE.

According to LendingTree, ~10% of home in Los Angeles are uninsured.

75% of homeowners may not have enough insurance to fully cover losses after a disaster, per FORTUNE.

We expect insurance, power company, and other corporate bankruptcies to emerge from this.

As seen with the PG&E bankruptcy in 2019 after the Camp Fire disaster, these events can create economic ripple effects.

Many bonds will be downgraded to "Junk" rating in the near future.

As seen with the PG&E bankruptcy in 2019 after the Camp Fire disaster, these events can create economic ripple effects.

Many bonds will be downgraded to "Junk" rating in the near future.

Beyond the economic impact, our thoughts and prayers are with the victims of this disaster.

These fires will change California as a whole forever.

What must change to ensure this never happens again?

Follow us @KobeissiLetter for real time analysis as this develops.

These fires will change California as a whole forever.

What must change to ensure this never happens again?

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh