Keep this in the back of your mind when watching markets in the coming days ...

In terms of money:

The 2018 " Campfire" wildfire cost ~$12.5 billion. That was the old wildfire record.

The current wildfires, most often referred to as "Palisades Fires" (even though there are technically five of them), are now estimated (read: educated guesses) to cost $150 to $200 billion. And the fires are still ongoing.

This wildfire is now in the running for the most expensive natural disaster in American History.

So, the financial markets are discussing a POTENTIAL contagion in the Property/Casualty insurance sector and a POTENTIAL extinction-level event for some P&C companies.

The State of California and the City of Los Angeles could face massive clean-up costs, huge subsidies to the affected, and a significant loss of tax revenues in 2025 and beyond. This could lead to significant downgrades of their municipal bonds, POTENTIALLY triggering a contagion in the larger Municipal markets.

---

POTENTIAL means this is all fluid, and these statements make many assumptions.

Nevertheless, this is the discussion all weekend.

In terms of money:

The 2018 " Campfire" wildfire cost ~$12.5 billion. That was the old wildfire record.

The current wildfires, most often referred to as "Palisades Fires" (even though there are technically five of them), are now estimated (read: educated guesses) to cost $150 to $200 billion. And the fires are still ongoing.

This wildfire is now in the running for the most expensive natural disaster in American History.

So, the financial markets are discussing a POTENTIAL contagion in the Property/Casualty insurance sector and a POTENTIAL extinction-level event for some P&C companies.

The State of California and the City of Los Angeles could face massive clean-up costs, huge subsidies to the affected, and a significant loss of tax revenues in 2025 and beyond. This could lead to significant downgrades of their municipal bonds, POTENTIALLY triggering a contagion in the larger Municipal markets.

---

POTENTIAL means this is all fluid, and these statements make many assumptions.

Nevertheless, this is the discussion all weekend.

I think I need to define financial contagion. I will keep it as simple as possible.

Financial markets are highly interrelated and complicated—so complicated that it is virtually impossible to understand how different markets interact.

In "normal" times, markets make predictable and expected moves based on anticipated events (like an economic release or earnings report). Even though the market may have large moves off these events (like bonds selling off Friday on a strong payroll report), they are anticipated and understood such moves can happen at that time.

So, while these moves impact related markets (stocks sold off on Friday's bond selloff), they are understood and not very stressful for overall financial markets. In other words, these events do not "daisy-chain" down throughout financial markets, hence the term "contagion."

However, a completely unexpected event, called a "black swan" on Wall Street, will it impact related markets in unforeseen ways.

The question is, how do these large unexpected events impact investors and related markets?

So, what do large, unexpected insurance claims, huge uninsured losses, and massive clean-up mean for P&C insurers, CA/LA munis, and other directly related markets? Will significant unexpected moves in these markets force moves and repricing in other indirectly related markets? Does this daisy chain, taking on a life of its own, cause a contagion throughout financial markets?

No one really knows how these things will play out, and markets have many questions and fears and no immediate answers. As is often said, "markets hate uncertainty."

Everyone fears that such events will "break" something in financial markets, producing giant panicky moves and significant losses. This is why talk of contagion demands so much attention.

Financial markets are highly interrelated and complicated—so complicated that it is virtually impossible to understand how different markets interact.

In "normal" times, markets make predictable and expected moves based on anticipated events (like an economic release or earnings report). Even though the market may have large moves off these events (like bonds selling off Friday on a strong payroll report), they are anticipated and understood such moves can happen at that time.

So, while these moves impact related markets (stocks sold off on Friday's bond selloff), they are understood and not very stressful for overall financial markets. In other words, these events do not "daisy-chain" down throughout financial markets, hence the term "contagion."

However, a completely unexpected event, called a "black swan" on Wall Street, will it impact related markets in unforeseen ways.

The question is, how do these large unexpected events impact investors and related markets?

So, what do large, unexpected insurance claims, huge uninsured losses, and massive clean-up mean for P&C insurers, CA/LA munis, and other directly related markets? Will significant unexpected moves in these markets force moves and repricing in other indirectly related markets? Does this daisy chain, taking on a life of its own, cause a contagion throughout financial markets?

No one really knows how these things will play out, and markets have many questions and fears and no immediate answers. As is often said, "markets hate uncertainty."

Everyone fears that such events will "break" something in financial markets, producing giant panicky moves and significant losses. This is why talk of contagion demands so much attention.

To follow up on the above, the natural answer is that the Fed will "print" money to cover these losses because this is what they always do.

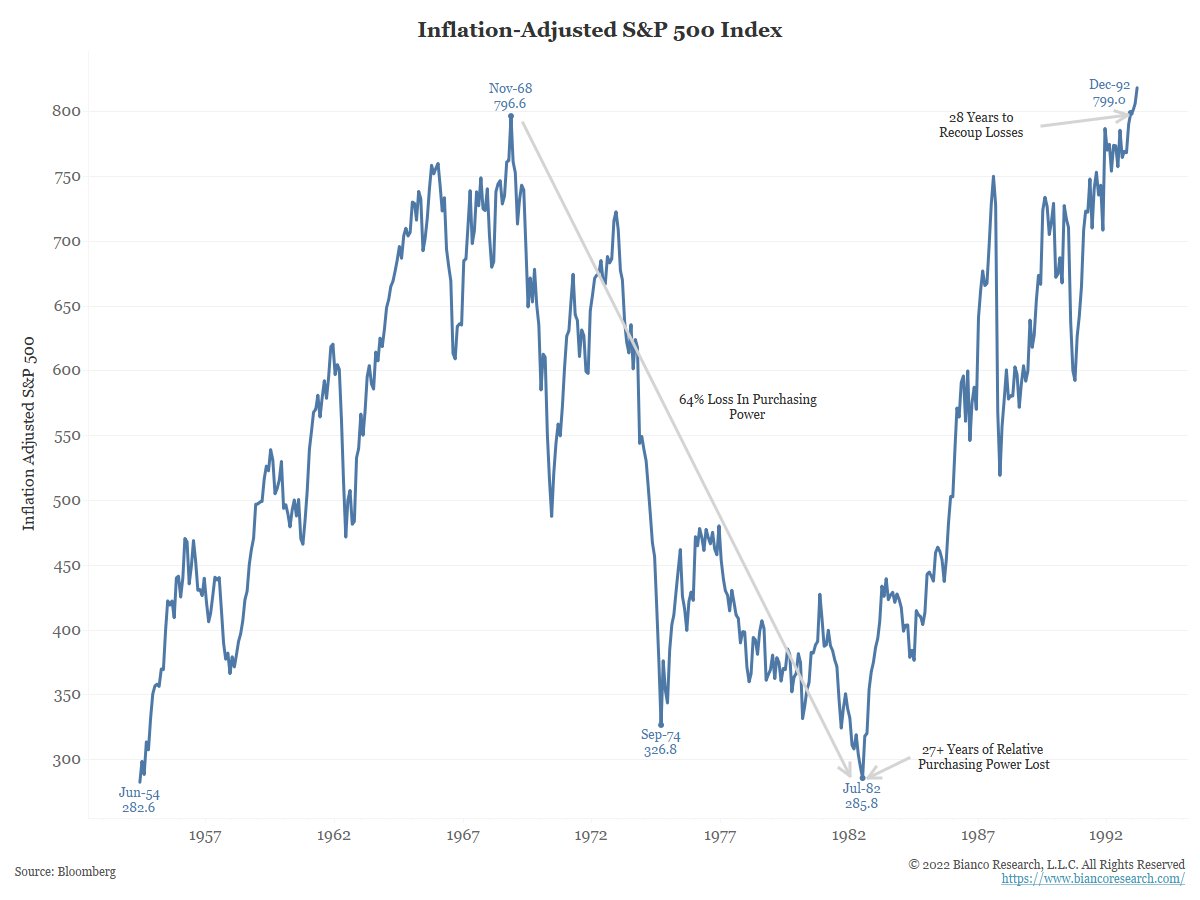

Bond prices are plunging due to inflation fears. If printing ratchets inflation fears, the Fed's action will drive interest rates even higher, lower stock prices even more, and worsen things.

This is a different cycle—an inflation cycle. One has to be very careful when applying the answers of the disinflation/deflation cycle to an inflation cycle.

Remember when several banks blew up in March 2023, highlighted by Silicon Valley Bank? Not only did the Fed not print, but they kept hiking rates right through it. They correctly understood that massive easing into an inflation concern would just tank markets.

Do we have the same issue today?

Bond prices are plunging due to inflation fears. If printing ratchets inflation fears, the Fed's action will drive interest rates even higher, lower stock prices even more, and worsen things.

This is a different cycle—an inflation cycle. One has to be very careful when applying the answers of the disinflation/deflation cycle to an inflation cycle.

Remember when several banks blew up in March 2023, highlighted by Silicon Valley Bank? Not only did the Fed not print, but they kept hiking rates right through it. They correctly understood that massive easing into an inflation concern would just tank markets.

Do we have the same issue today?

• • •

Missing some Tweet in this thread? You can try to

force a refresh