🚨🚨 $ASTS WEEK IN REVIEW🚨🚨

A transformational Ligado deal, Los Angeles in crisis, an FCC permit, and a lighting a very large BONG...

A transformational Ligado deal, Los Angeles in crisis, an FCC permit, and a lighting a very large BONG...

💎Arbitrage

One man's expensive to deploy spectrum is another man's gold.

One man's expensive to deploy spectrum is another man's gold.

https://x.com/mc_khristina/status/1877441098865348979

📔Ligado Background

Ligado, formerly known as Lightsquared, was plagued by interference issues that prevented the company from utilizing its spectrum. Ligado had significant payment obligations to Inmarsat, which Viasat acquired. Ligado had tried to build a 4G LTE network but was blocked because the spectrum would interfere with GPS signals. The Company filed for bankruptcy the first time in 2012. Ligado arose from LightSquared's bankruptcy in 2015. It then managed to score approvals from the FCC for its plan, this time focusing on 5G. That last attempt fell apart after complications with the DoD

The lawsuit, linked out below, is a fascinating read

ligado.com/wp-content/upl…

Ligado, formerly known as Lightsquared, was plagued by interference issues that prevented the company from utilizing its spectrum. Ligado had significant payment obligations to Inmarsat, which Viasat acquired. Ligado had tried to build a 4G LTE network but was blocked because the spectrum would interfere with GPS signals. The Company filed for bankruptcy the first time in 2012. Ligado arose from LightSquared's bankruptcy in 2015. It then managed to score approvals from the FCC for its plan, this time focusing on 5G. That last attempt fell apart after complications with the DoD

The lawsuit, linked out below, is a fascinating read

ligado.com/wp-content/upl…

💩Spectrum Background - The Bear Case

Ligado has been trying to put its L-band spectrum to use since 2010. In a filing late last year, Ligado claimed the US military is secretly using its L-band spectrum holdings, alleging the Pentagon conducted a "misinformation and disparagement campaign" to prevent Ligado from launching its own 5G operations in that band.

lightreading.com/satellite/ast-…

Ligado has been trying to put its L-band spectrum to use since 2010. In a filing late last year, Ligado claimed the US military is secretly using its L-band spectrum holdings, alleging the Pentagon conducted a "misinformation and disparagement campaign" to prevent Ligado from launching its own 5G operations in that band.

lightreading.com/satellite/ast-…

🪙Spectrum Value

Inmarsat has received $1.7bn during its partnership with Ligado for its spectrum, which is one proxy for a floor value of the spectrum. T-Mobile paid $3.6BN for a 13.5MHz slice of spectrum in the 800 MHz Band

Inmarsat has received $1.7bn during its partnership with Ligado for its spectrum, which is one proxy for a floor value of the spectrum. T-Mobile paid $3.6BN for a 13.5MHz slice of spectrum in the 800 MHz Band

🌳Option Value

$ASTS now has an option on a huge chunk of spectrum and paid $200MM if the deal breaks, including if Ligado's DoD lawsuit adversely affects the transaction

$ASTS now has an option on a huge chunk of spectrum and paid $200MM if the deal breaks, including if Ligado's DoD lawsuit adversely affects the transaction

🕐Summary of Timing

Now we have an entirely separate event path for value creation we hadn't expected

Now we have an entirely separate event path for value creation we hadn't expected

https://x.com/spacanpanman/status/1877743092519825545

🎙️Space Joe Rogan Strikes Again

Anpanman spreads the word

Anpanman spreads the word

https://x.com/spacanpanman/status/1876981744827564459

🇳🇴Audun Iversen Interview

En stor tenker deler sine tanker

En stor tenker deler sine tanker

https://x.com/spacanpanman/status/1877377195233952069

🇩🇪Sell Side Notes by DB

Damn straight $ASTS is "legitimate."

Damn straight $ASTS is "legitimate."

https://x.com/rhetthunter/status/1877367809488941263

🇮🇳ISRO Watch

Evidence building that our next launch is sooner than later, and maybe, just maybe, more than 1 satellite getting launched in the near term

x.com/DrOllie1979/st…

x.com/CatSE___ApeX__…

x.com/ndtv/status/18…

Evidence building that our next launch is sooner than later, and maybe, just maybe, more than 1 satellite getting launched in the near term

x.com/DrOllie1979/st…

x.com/CatSE___ApeX__…

x.com/ndtv/status/18…

😭California Fires

A common theme on all the news casts were reporters noting that they did not have cell service. Newsome fakes a call to Biden without service. A governor cannot talk to the President. Do we need to say more?

x.com/MyViciousTwin/…

x.com/HaydukeAbbey/s…

A common theme on all the news casts were reporters noting that they did not have cell service. Newsome fakes a call to Biden without service. A governor cannot talk to the President. Do we need to say more?

x.com/MyViciousTwin/…

x.com/HaydukeAbbey/s…

🔌Elena Explains

This goes to the importance of having mobility. You are only as independent as your power supply is robust

This goes to the importance of having mobility. You are only as independent as your power supply is robust

https://x.com/elenaneira/status/1878081561934885044

🔛Starlink Compatibility

Starlink requires special chips and unlikely to be backward compatible

Starlink requires special chips and unlikely to be backward compatible

https://x.com/CatSE___ApeX___/status/1878168270328475852

🫦Can't Sleep Yourself To the Top

Guess Italy worried that Musk was going to just call an Uber instead of stay for breakfast

Guess Italy worried that Musk was going to just call an Uber instead of stay for breakfast

https://x.com/WalkerFran80950/status/1876903892841038206

🏭Limits of Conventional Satellite

True broadband is a big deal

True broadband is a big deal

https://x.com/elonmusk/status/1878548886962212964

🔭Starlink Altitude

This shows the power of the telescope stakeholder group

This shows the power of the telescope stakeholder group

https://x.com/FrankMakrides/status/1878181786829619469

🔧Use Cases

Industry participants talk about use cases

Industry participants talk about use cases

https://x.com/CatSE___ApeX___/status/1877297240940671019

🤼FCC Meeting This Week

$ASTS:

@FCC

To Hold Open Commission Meeting on Wednesday, January 15, 2025 at 10:30 AM. Open Meetings are streamed live at: fcc.gov/live and on the FCC’s YouTube channel.

x.com/defiantclient/…

$ASTS:

@FCC

To Hold Open Commission Meeting on Wednesday, January 15, 2025 at 10:30 AM. Open Meetings are streamed live at: fcc.gov/live and on the FCC’s YouTube channel.

x.com/defiantclient/…

🤠Another Spaces.

I didn't listen, but saw it circulated

I didn't listen, but saw it circulated

https://x.com/SpaceInvestor_D/status/1877158536213365057

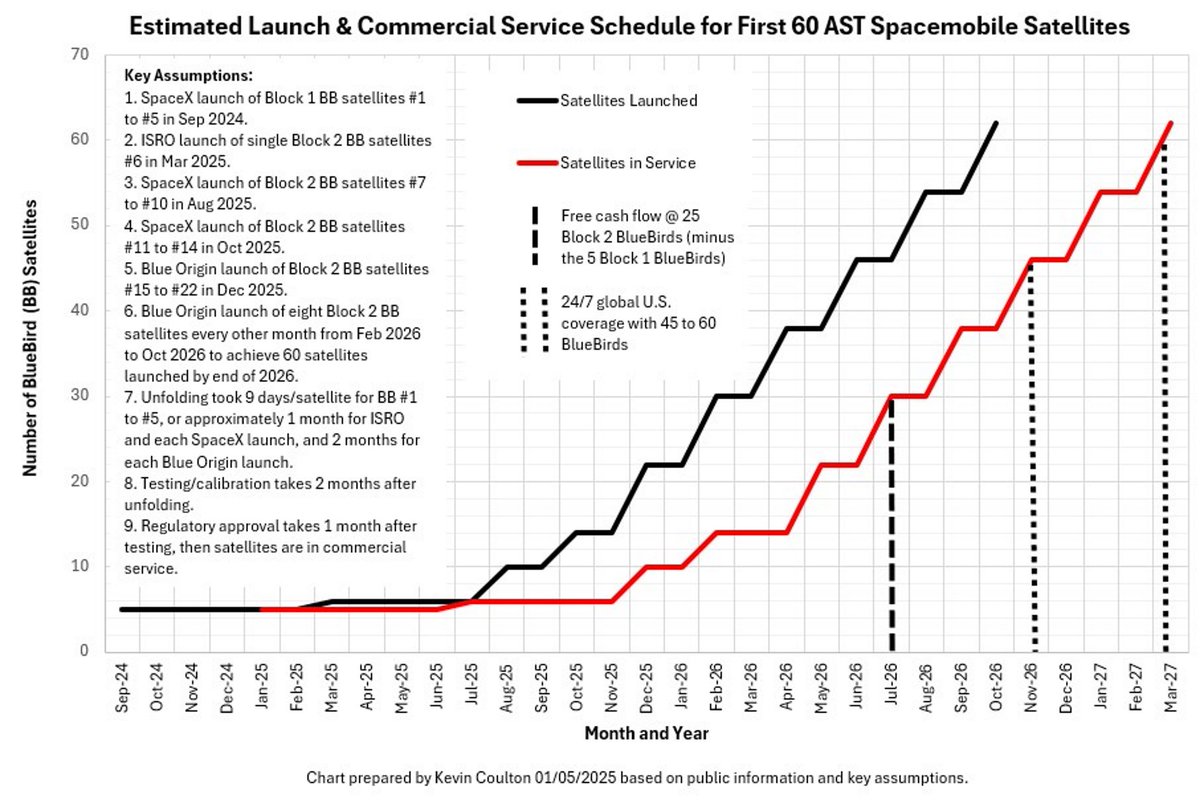

🔬The chart that will drive the stock

I think acceleration against these curves is all that will matter.

I think acceleration against these curves is all that will matter.

• • •

Missing some Tweet in this thread? You can try to

force a refresh