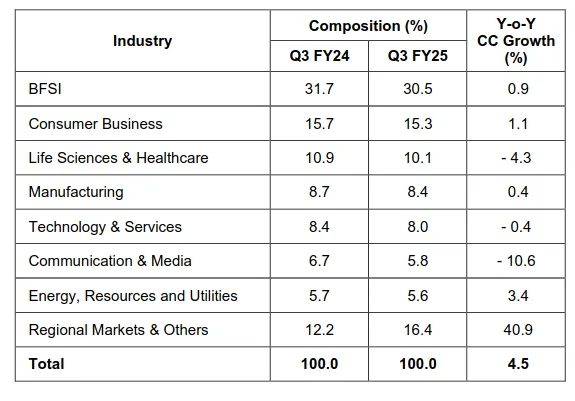

Today, we’re diving into TCS’s quarterly numbers. As India’s largest IT company, its performance gives us a good sense of how the entire sector is doing. Let’s break it down.🧵👇

First, the key numbers. TCS reported revenue of ₹63,973 crores for Q3, which is a 5.6% increase compared to last year. Their profit stood at ₹12,380 crores, up 12% year-over-year.

Now, here’s something worth noting—they landed deals worth $10.2 billion this quarter. That’s an 18.6% jump from the previous quarter and a 25.9% increase from last year. What makes this even more impressive is that these numbers were achieved without any mega-deals, which shows a more balanced demand recovery. That’s typically a good sign for long-term growth.

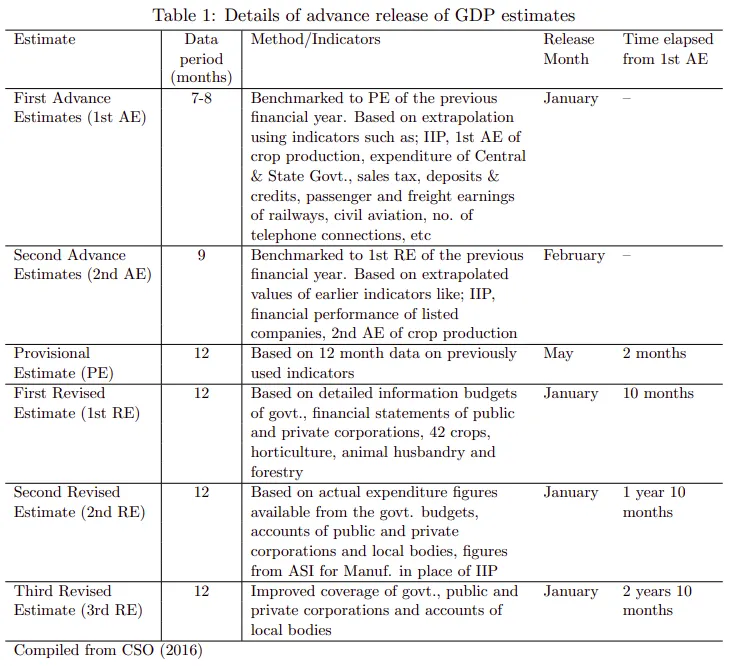

Now, let’s talk about geography. India’s growth of 70.2% looks incredible on paper, but there’s some context here. A big part of this comes from the BSNL deal, which is already about 70% complete and winding down. The Middle East grew by 15%, and Latin America by 7%, but there’s a red flag—North America, TCS’s largest market, shrank by 2.3%. Europe didn’t do much better, with Continental Europe down 1.5%.

Image: TCS

Image: TCS

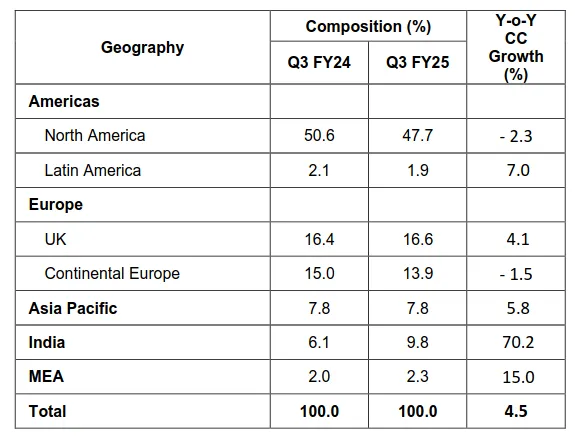

When it comes to industries, the picture is mixed. Banking and Financial Services, which make up about 30.5% of TCS’s revenue, grew by just 0.9%. The consumer business saw a small rise of 1.1%, but communications had a steep decline of 10.6%. Manufacturing, which had been strong in earlier quarters, grew by only 0.4%, and Technology & Services dipped by 0.4%. So, while the overall numbers look decent, some sectors are clearly struggling.

Image: TCS

Image: TCS

Now, let’s look at the challenges because this is where it gets interesting. According to a recent report by Bank of Baroda, four major shifts are happening in the industry that we’ll need to watch closely.

First, there’s Trump 2.0. Yes, politics is starting to influence the tech world. The report points out that Trump’s potential policies around tariffs, immigration, and especially H1-B visas could create a lot of uncertainty. Right now, most Indian IT companies have 50–80% of their U.S. workforce as non-visa-dependent. But if there’s a major change in visa rules, it could significantly impact cost structures.

Second, we’re likely heading into what analysts are calling a “higher for longer” interest rate scenario. This is a big deal for the Banking and Financial Services sector, which makes up about 30% of TCS’s revenue. Higher interest rates often mean businesses cut back on tech spending, especially in capital-heavy sectors like telecom or areas that rely on borrowing.

Third, we’re still seeing the effects of what Accenture called the “compressed transformation” phase during the pandemic. Back then, projects that would normally take 5–10 years were squeezed into 18–24 months. That created a huge but temporary spike in demand, and now the market is adjusting back to normal levels.

Fourth, there’s the AI factor, and this is where it gets interesting. While everyone is excited about Generative AI, the Bank of Baroda report suggests it might actually reduce revenue growth for the tech sector over the next 2–3 years. Why? For every dollar spent on pure Generative AI, companies need to spend around $25 on related services. That’s making it hard to see quick returns on investment.

Lastly, there’s a deeper shift happening in how companies spend on tech. The days of pure cost-cutting through outsourcing are fading. Clients now want pricing based on business outcomes. Instead of massive transformation projects, they’re breaking them into smaller, more focused tasks with clear ROI goals.

When it comes to the AI factor, it’s not just about chatbots anymore. TCS mentioned something interesting—they’re seeing demand for what they call “Agentic AI,” which goes beyond basic automation. But let’s be honest, we should take all the “AI” buzz with a pinch of salt. It’s tough to separate what’s genuinely useful from what’s just hype.

Next, there’s a shift happening in talent. While attrition has risen slightly to 13.0% from last quarter’s 12.3%, the kind of skills companies need is changing fast. TCS reduced its headcount by 5,370 this quarter, bringing it to 607,354 employees. This is their first significant reduction in a while. But it’s not necessarily bad—it reflects the shift in delivery models, where revenue growth no longer depends directly on adding more people.

On top of that, the entire commercial model for IT services might be heading for a shake-up. During the earnings call, there were questions about whether AI could push the industry toward software-based pricing instead of the traditional time-and-materials model. TCS’s management said they haven’t seen this shift yet, but it’s clearly on everyone’s radar.

What stood out most, though, was the management’s optimism—the most upbeat we’ve seen in two years. They mentioned shorter deal cycles, which typically mean faster client decision-making. They’re also seeing early signs of recovery in discretionary spending, especially in BFSI and retail. They even called out calendar year 2025 as likely to be better than 2024.

Looking ahead, there are a few key things to keep an eye on.

- First, the BSNL deal, which is 70% complete, will start tapering off next quarter. TCS’s strategy to replace that revenue will be critical.

- Second, the pace of interest rate cuts in the US could have a big impact on tech spending.

- Third, the upcoming US elections add a layer of uncertainty. And perhaps the biggest question is how quickly companies can shift their traditional services to AI-augmented offerings without losing revenue from their existing business.

- First, the BSNL deal, which is 70% complete, will start tapering off next quarter. TCS’s strategy to replace that revenue will be critical.

- Second, the pace of interest rate cuts in the US could have a big impact on tech spending.

- Third, the upcoming US elections add a layer of uncertainty. And perhaps the biggest question is how quickly companies can shift their traditional services to AI-augmented offerings without losing revenue from their existing business.

That’s the TCS update for this quarter. The big takeaway? While growth right now might look moderate, we could be at a turning point for the entire IT services industry. The real winners will be the ones who can adapt to these changes while staying profitable.

We cover this and two more interesting stories in today's Daily Brief. You can watch the episode on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts. All links here:

thedailybrief.zerodha.com/p/tcs-quarterl…

thedailybrief.zerodha.com/p/tcs-quarterl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh