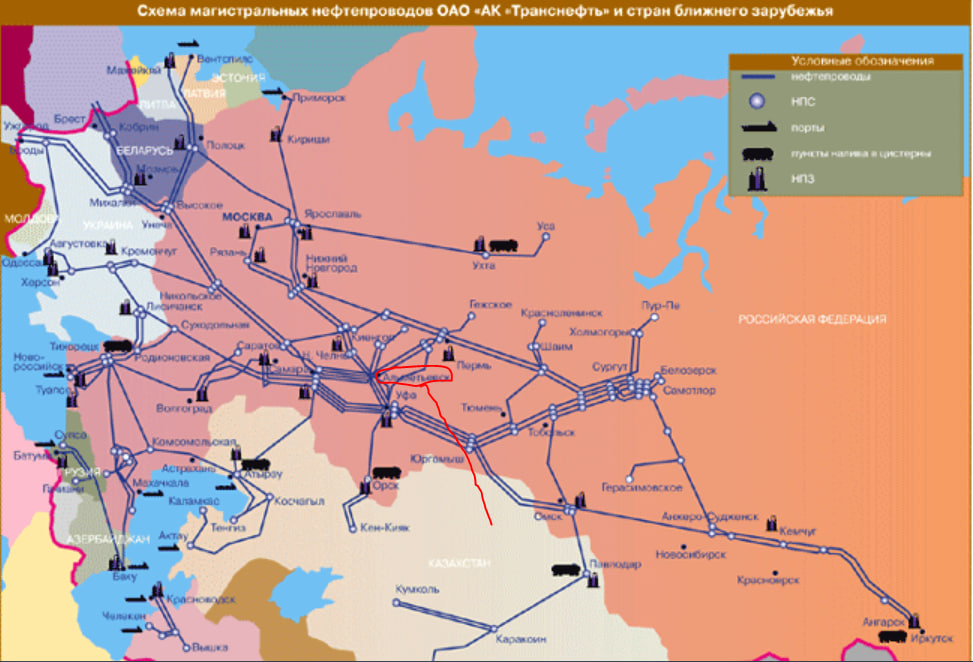

Russian Telegram channels reported that Ukrainian drones arrived in Almetyevsk, Tatarstan today. The target is the Kalaykino oil pumping station, the largest transport hub for pumping oil from Siberia to the European part of the country.

1/

1/

2/

• • •

Missing some Tweet in this thread? You can try to

force a refresh