What just happened?

At 9:44 PM ET on a casual Friday night, president-elect Trump launched the biggest memecoin in history, $TRUMP.

Since then, the coin is up 9,500% with $2.2 BILLION of volume traded in under 12 hours.

What does this all mean? Let us explain.

(a thread)

At 9:44 PM ET on a casual Friday night, president-elect Trump launched the biggest memecoin in history, $TRUMP.

Since then, the coin is up 9,500% with $2.2 BILLION of volume traded in under 12 hours.

What does this all mean? Let us explain.

(a thread)

The initial launch of the coin was so hard to believe, it came with skepticism.

Traders figured Donald Trump's account was hacked.

However, no statement on a hack surfaced so the coin kept rising.

At 12:45 AM ET, $TRUMP broke above $10.00 and the rally accelerated rapidly.

Traders figured Donald Trump's account was hacked.

However, no statement on a hack surfaced so the coin kept rising.

At 12:45 AM ET, $TRUMP broke above $10.00 and the rally accelerated rapidly.

In fact, not even Elon Musk was sure that Donald Trump's X account had not been hacked.

Nearly 12 hours later, it is clear that this coin is legitimately launched by Trump.

Donald Trump is now the first president in history to launch a memecoin.

Nearly 12 hours later, it is clear that this coin is legitimately launched by Trump.

Donald Trump is now the first president in history to launch a memecoin.

In the early hours, traders were making unprecedented returns on the swings.

In the first 2 hours, one trader made $50,000 into nearly $1.1 MILLION.

The coin, $TRUMP, outperformed the S&P 500's last 30-year return in the first 2 hours.

And, it's still rising as we speak.

In the first 2 hours, one trader made $50,000 into nearly $1.1 MILLION.

The coin, $TRUMP, outperformed the S&P 500's last 30-year return in the first 2 hours.

And, it's still rising as we speak.

For example, $100 invested in the S&P 500 in 1994 would be worth $2,250 today.

That's a 2,150% return over the last 3 decades in the index.

Trump's memecoin, $TRUMP, returned +4,000%+ in under 4 hours after it launched last night.

The million Dollar question: Can it hold?

That's a 2,150% return over the last 3 decades in the index.

Trump's memecoin, $TRUMP, returned +4,000%+ in under 4 hours after it launched last night.

The million Dollar question: Can it hold?

First, it's important to note that only 20% of MAXIMUM supply is currently on the market.

This means that supply currently stands at 200 million coins.

Over the next 36 months, the remaining 800 million coins can enter supply.

It is believed that Trump holds those 800 million.

This means that supply currently stands at 200 million coins.

Over the next 36 months, the remaining 800 million coins can enter supply.

It is believed that Trump holds those 800 million.

This explains Market Cap versus the Fully Diluted Valuation (FDV) of the coin.

If total supply of 1 billion was circulating now, total market cap would be ~$21 billion.

But since only 200 million out of 1 billion coins are circulating (20%), the market cap is ~$4.2 billion.

If total supply of 1 billion was circulating now, total market cap would be ~$21 billion.

But since only 200 million out of 1 billion coins are circulating (20%), the market cap is ~$4.2 billion.

The question is:

Can demand keep up when the remaining 80% of supply hits the market?

Here's the $TRUMP coin emission schedule which shows how maximum supply will be reached.

Skeptics say this will send the coin to $0, bulls say its a gradual emission schedule.

Can demand keep up when the remaining 80% of supply hits the market?

Here's the $TRUMP coin emission schedule which shows how maximum supply will be reached.

Skeptics say this will send the coin to $0, bulls say its a gradual emission schedule.

Here's a potential interpretation of this emissions curve.

In the first 3 months, likely 0 tokens are released due to cliffs.

From there, token supply increases from 16.7 million per month to 33.3 million per month after year 1.

Can the market handle this supply?

In the first 3 months, likely 0 tokens are released due to cliffs.

From there, token supply increases from 16.7 million per month to 33.3 million per month after year 1.

Can the market handle this supply?

We are now beginning to see some WILD trades.

One trader invested $1.1 million into the $TRUMP coin around launch time.

This morning, that position was worth $120.3 MILLION, for ~$119 million in profit.

Another trader reportedly turned $800 into $300,000+.

One trader invested $1.1 million into the $TRUMP coin around launch time.

This morning, that position was worth $120.3 MILLION, for ~$119 million in profit.

Another trader reportedly turned $800 into $300,000+.

Google Search interest in "Trump Coin" continues to stand at a record high as Americans see the news.

The timing was strange as launching the coin on a Friday night resulted in many missing the initial news.

Could this be the coin that spurs mainstream adoption of crypto?

The timing was strange as launching the coin on a Friday night resulted in many missing the initial news.

Could this be the coin that spurs mainstream adoption of crypto?

It will be interesting to see how this all unfolds as the coin is still under 1 day old.

Millions of dollars of volume are flowing per minute with hundreds of trades at $1M+.

Are you buying the $TRUMP coin?

Follow us @KobeissiLetter for real time analysis as this develops.

Millions of dollars of volume are flowing per minute with hundreds of trades at $1M+.

Are you buying the $TRUMP coin?

Follow us @KobeissiLetter for real time analysis as this develops.

For all of those asking, this coin was listed on an exchange called “Moonshot.”

See below for more information on how to sign up:

moonshot.money/?ref=InniCfxje7

See below for more information on how to sign up:

moonshot.money/?ref=InniCfxje7

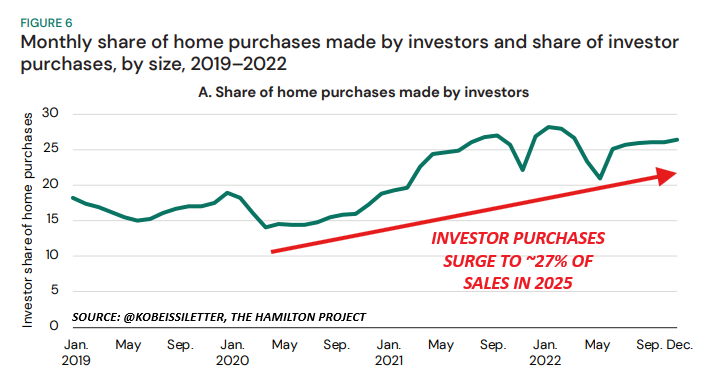

If this doesn't emphasize risk appetite in the market, it's not clear what would.

We expect a more volatility 2025 for markets.

Our analysis covers stocks, commodities and bonds.

Subscribe to our premium analysis and alerts at the link below:

thekobeissiletter.com/subscribe

We expect a more volatility 2025 for markets.

Our analysis covers stocks, commodities and bonds.

Subscribe to our premium analysis and alerts at the link below:

thekobeissiletter.com/subscribe

• • •

Missing some Tweet in this thread? You can try to

force a refresh