What just happened?

Melania Trump, the First Lady of the US, just launched her own memecoin, $MELANIA.

Less than 48 hours ago, Donald Trump launched $TRUMP which just erased $7.5 BILLION in market cap in 10 MINUTES.

Wondering what happened? Let us explain.

(a thread)

Melania Trump, the First Lady of the US, just launched her own memecoin, $MELANIA.

Less than 48 hours ago, Donald Trump launched $TRUMP which just erased $7.5 BILLION in market cap in 10 MINUTES.

Wondering what happened? Let us explain.

(a thread)

At 4:13 PM ET, Melania Trump made the below post launching her memecoin.

Just minutes later, Donald Trump reposted the post himself, while at his Victory Rally.

All of a sudden, buyer demand collapsed in Donald Trump's memecoin, $TRUMP, and supply surged.

Just minutes later, Donald Trump reposted the post himself, while at his Victory Rally.

All of a sudden, buyer demand collapsed in Donald Trump's memecoin, $TRUMP, and supply surged.

Moments later, we posted on X that the coin had launched.

Prior to Donald Trump reposting her announcement, $TRUMP was little changed.

After the repost and our breaking news post, $TRUMP fell -55% in minutes.

Consider turning on @KobeissiLetter notifications.

Prior to Donald Trump reposting her announcement, $TRUMP was little changed.

After the repost and our breaking news post, $TRUMP fell -55% in minutes.

Consider turning on @KobeissiLetter notifications.

Prior to the launch of $MELANIA, buyers had FAR outweighed sellers in $TRUMP.

Leading into the Melania launch, there had been ~38,500 sellers for every ~13,300 buyers.

That's effectively ~3 sellers for every buyer in this market.

This is why price kept on rising.

Leading into the Melania launch, there had been ~38,500 sellers for every ~13,300 buyers.

That's effectively ~3 sellers for every buyer in this market.

This is why price kept on rising.

In the moments after the launch of $MELANIA, we saw seller volume FAR outweigh buying volume.

In 1 hour, there was $352 million of seller volume for just $245 million of buyer volume.

The ratio of buyers to sellers fell to just 1.3x which led to a massive crash in price.

In 1 hour, there was $352 million of seller volume for just $245 million of buyer volume.

The ratio of buyers to sellers fell to just 1.3x which led to a massive crash in price.

Here's where it gets even more interesting:

In the minutes around the launch of Melania Trump's token, we saw MASSIVE sell orders in $TRUMP.

As seen in the flow log below, there were multiple $1+ million and $5+ million single sales in $TRUMP

Did someone know?

In the minutes around the launch of Melania Trump's token, we saw MASSIVE sell orders in $TRUMP.

As seen in the flow log below, there were multiple $1+ million and $5+ million single sales in $TRUMP

Did someone know?

The selling pressure was so strong that Solana, $SOL, the cryptocurrency itself, fell nearly 20% in minutes.

The trade went from a rush to the entrance to a rush to the exit.

Across all memecoins, well over $10 billion in market cap was erased in the minutes after launch.

The trade went from a rush to the entrance to a rush to the exit.

Across all memecoins, well over $10 billion in market cap was erased in the minutes after launch.

Currently, there are a record 824,017 holders of Donald Trump's memecoin, $TRUMP.

The question becomes, will these memecoin investors hold on?

Over the last 24 hours, we have now seen well over $2 billion in volume in this coin.

Momentum is a key component in these coins.

The question becomes, will these memecoin investors hold on?

Over the last 24 hours, we have now seen well over $2 billion in volume in this coin.

Momentum is a key component in these coins.

Donald Trump's 800 million $TRUMP coins lost ~$25 billion in value after the announcement.

Since then, it has rebounded slightly with his coins worth ~$39 billion.

These coins are locked on a vesting schedule that will take 3 years to fully vest.

Trump needs prices to hold.

Since then, it has rebounded slightly with his coins worth ~$39 billion.

These coins are locked on a vesting schedule that will take 3 years to fully vest.

Trump needs prices to hold.

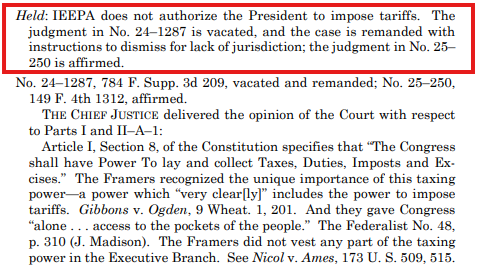

This image will go down in history.

On the day before inauguration, the launch of Melania Trump's memecoin has shocked the market.

We are bracing for severe volatility in all financial markets ahead.

Follow us @KobeissiLetter for real time analysis as this develops.

On the day before inauguration, the launch of Melania Trump's memecoin has shocked the market.

We are bracing for severe volatility in all financial markets ahead.

Follow us @KobeissiLetter for real time analysis as this develops.

Many are asking where $TRUMP can be traded.

The coin was launched on "Moonshot," which President-elect Trump mentioned.

These investments are highly risky, exercise caution, this is NOT an endorsement.

Access Moonshot at the link below:

bit.ly/42lEQDu

The coin was launched on "Moonshot," which President-elect Trump mentioned.

These investments are highly risky, exercise caution, this is NOT an endorsement.

Access Moonshot at the link below:

bit.ly/42lEQDu

What's the next memecoin that's launching?

• • •

Missing some Tweet in this thread? You can try to

force a refresh