.@THORChain is insolvent

In the event of any large debt redemption and/or savers & synths deleveraging, it is certain that TC cannot meet its bitcoin and eth denominated obligations.

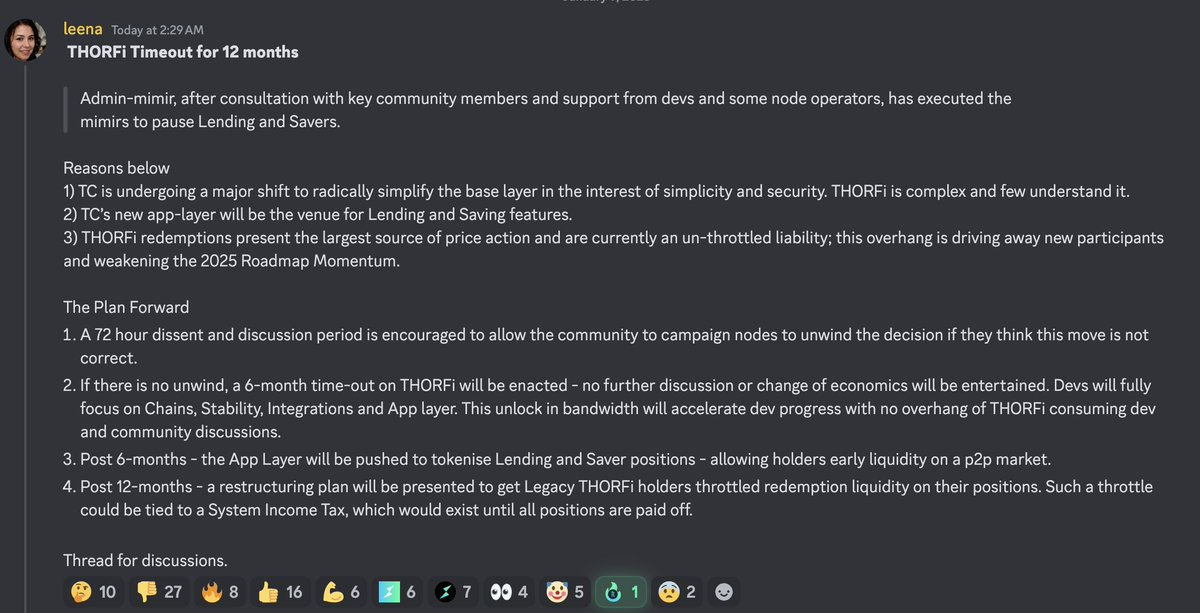

Validators decided to pause the network while they vote a restructuring plan

🔽🧵

In the event of any large debt redemption and/or savers & synths deleveraging, it is certain that TC cannot meet its bitcoin and eth denominated obligations.

Validators decided to pause the network while they vote a restructuring plan

🔽🧵

I'm not going to beat around the bush and act like everything is allright. It isn't.

Thorchain's liabilities :

- $97m of lending liabilities ($eth $btc)

- Approximately $102m worth of savers and synths ($eth $btc)

Thorchain's liabilities :

- $97m of lending liabilities ($eth $btc)

- Approximately $102m worth of savers and synths ($eth $btc)

Thorchain's assets are $107m of exogenous liquidity into the liquidity pools

This can also be pulled by LPs at any time or sold into by $rune holders if there is panic.

This can also be pulled by LPs at any time or sold into by $rune holders if there is panic.

Lending obligations are met by minting $RUNE and selling it into the pools, it makes the design highly reflective and even worst than it looks

Repaying $4m $rune of liabilities yesterday resulted in the protocol owing a few million $rune extra

Repaying $4m $rune of liabilities yesterday resulted in the protocol owing a few million $rune extra

By design the protocol is short btc and eth

I have been warning about the danger of hidden leverage since I joined this community (since ILP).

I've argued for deleveraging since the streaming swaps launched, the protocol simply needs less capital to fill since active liquidity can now participate in filling them.

I'm not writing this with a happy heart please don't shoot the messenger, I am stepping up here because Thorchain has gotten so complicated that only a handful of people fully understands how the leveraged feature & liquidity works with each other and affects the underlying assets.

If nothing is done it will be a race to the exit and the entire protocol's value will vanish.

I have been warning about the danger of hidden leverage since I joined this community (since ILP).

I've argued for deleveraging since the streaming swaps launched, the protocol simply needs less capital to fill since active liquidity can now participate in filling them.

I'm not writing this with a happy heart please don't shoot the messenger, I am stepping up here because Thorchain has gotten so complicated that only a handful of people fully understands how the leveraged feature & liquidity works with each other and affects the underlying assets.

If nothing is done it will be a race to the exit and the entire protocol's value will vanish.

Thorchain has two options :

1. Let things continue and about 5-7% of the value will be extracted by a handful of people exiting first, $rune will go on a downward spiral and @THORChain will be destroyed

2. Default on the debt, go bankrupt and salvage the valuable part, and try to grow it enough to repay creditors without affecting the protocol viability

1. Let things continue and about 5-7% of the value will be extracted by a handful of people exiting first, $rune will go on a downward spiral and @THORChain will be destroyed

2. Default on the debt, go bankrupt and salvage the valuable part, and try to grow it enough to repay creditors without affecting the protocol viability

Option 1 : $75m of people who exit first get made whole, $1.5b is wiped out of the map

Option 2 : The value of the network is preserved and everyone works together to grow it to make that $200m of capital whole

Option 2 : The value of the network is preserved and everyone works together to grow it to make that $200m of capital whole

To make Option 2 possible, we need to have as guiding principle to save the network and grow it's value

This starts with LPs, I will elaborate further down, I just want LPs to read this to know that if this proposal is accepted, they will be first class citizens once again

This starts with LPs, I will elaborate further down, I just want LPs to read this to know that if this proposal is accepted, they will be first class citizens once again

Thorchain is valuable, it has generated $30m+ in fees last year and is currently at a higher run rate, it can grow out of this

I have been working with the few people who truly understand Thorchain's economic design to propose this. Proof of Steve will post it in the Dev Discord, he is a better writer then I am.

The current proposal is an equivalent to chapter 11 bankruptcy

Bitfinex did something similar and ended up eventually making users whole.

I have been working with the few people who truly understand Thorchain's economic design to propose this. Proof of Steve will post it in the Dev Discord, he is a better writer then I am.

The current proposal is an equivalent to chapter 11 bankruptcy

Bitfinex did something similar and ended up eventually making users whole.

There are two classes with liquidity in the ecosystem that are needed for swap to keep proceeding :

- LPs need to be protect first and foremost.

- Arbitrageurs using trade accounts are not affected by this freeze.

- LPs need to be protect first and foremost.

- Arbitrageurs using trade accounts are not affected by this freeze.

Thorchain is too complex and needs to get back to first principle to be able to grow. Until then no smart capital can buy $rune or LP, the risks are too great.

A large debt publicly known becomes a magnet towards liquidation as we have seen many times in DEFI.

A large debt publicly known becomes a magnet towards liquidation as we have seen many times in DEFI.

Here is what we think @thorchain needs to do if it is to survive this crisis and thrive on the other side of it :

- All lending and savers positions are to remain frozen permanently.

- Take a snapshot of the debt (Value for savers, BTC/ETH - debt for lenders).

- All lending and savers positions are to remain frozen permanently.

- Take a snapshot of the debt (Value for savers, BTC/ETH - debt for lenders).

- Tokenize all lending and savers claims.

- Create a “Unwind Module”, which automatically gets funneled 10% of system income.

- Create a buyer-determined auction where tokenized debt holders can sell their claims at any given time for the available liquidity in the Unwind Module, any seller claiming that liquidity burns their claim.

- Create a “Unwind Module”, which automatically gets funneled 10% of system income.

- Create a buyer-determined auction where tokenized debt holders can sell their claims at any given time for the available liquidity in the Unwind Module, any seller claiming that liquidity burns their claim.

- Create a secondary market for tokenized claims so that they can be sold P2P.

- Implement a killswitch and incentivize runepool withdrawal, close runepool within a month.

- Burn the keys to all POL wallets, thereby preventing central planners from tinkering any further with POL

- Implement a killswitch and incentivize runepool withdrawal, close runepool within a month.

- Burn the keys to all POL wallets, thereby preventing central planners from tinkering any further with POL

Thorchain's value has been depressed because it was unbuyable for so long.

Smart capital wouldn't LP, once they analyzed the complexity of it, they saw something was wrong

The product itself is not only succeeding, it's thriving generating approximately $200k a day in fees

Smart capital wouldn't LP, once they analyzed the complexity of it, they saw something was wrong

The product itself is not only succeeding, it's thriving generating approximately $200k a day in fees

It needs a clean start if it is to grow and have any chance at making users whole. Any debt overhang that's unsustainable

Mitch Will of CRV had what seemed like a relatively reasonable amount of leverage and despite gaining adoption CRV dumped until he got liquidated. I believe we are close to this vision becoming a consensus with Thorchain.

In thorchains case the debt is at the protocol level and its more reflexive than $crv since the protocol is short bitcoin and is selling non circulating $rune. What is shown as 'collateral' in dashboards is backed by non circulating $rune, not liquidity.

Not only does a loan redemption sell rune mechanically but the protocol is effectively short 175m usd of btc/eth/others.

With lenders this collateral has been swapped for rune to reduce rune supply.

On the way out thorchain have to mint rune to sell it for btc/eth and pay it back.

Because of price action since loans started we are already looking at a shortfall of 30m rune from loan activities, it would probably hit the killswitch if all redeemed in a disorderly fashion. That would be sub $1 $rune. There would still be $100m of savers to redeem.

This future sell pressure is going into pools that are progressively less liquid than ever. And when you add in the markets reaction as the contagion spreads. We simply cannot risk ending up with a cratering rune price and not paying back these people.

In thorchains case the debt is at the protocol level and its more reflexive than $crv since the protocol is short bitcoin and is selling non circulating $rune. What is shown as 'collateral' in dashboards is backed by non circulating $rune, not liquidity.

Not only does a loan redemption sell rune mechanically but the protocol is effectively short 175m usd of btc/eth/others.

With lenders this collateral has been swapped for rune to reduce rune supply.

On the way out thorchain have to mint rune to sell it for btc/eth and pay it back.

Because of price action since loans started we are already looking at a shortfall of 30m rune from loan activities, it would probably hit the killswitch if all redeemed in a disorderly fashion. That would be sub $1 $rune. There would still be $100m of savers to redeem.

This future sell pressure is going into pools that are progressively less liquid than ever. And when you add in the markets reaction as the contagion spreads. We simply cannot risk ending up with a cratering rune price and not paying back these people.

Again, Thorchain's saving grace is 30m+ annually in fees from swaps & a growing revenue run rate, it still has a great business, it needs to get rid of the toxic debt on the balance sheet. ThorFI needs to be viewed as a mistake and we need to get back to Thorchain original ethos : first principle

The situation can still be rectified and we can have all this cleared in the week ahead. If we let market panic set in and everyone sells rune and redeem assets it will be insolvency. Each passing day matters and in these situations once the market has understood and panicked its already too late.

This will have the effect of getting Thorchain back to first principle : LPs and trade accounts will be providing liquidity for the swaps.

There is no scenario where everyone immediately gets made whole. This scenario preserves the people at the table who are essential for the protocol to keep functioning securely.

There is no scenario where everyone immediately gets made whole. This scenario preserves the people at the table who are essential for the protocol to keep functioning securely.

All of those incentives had as a goal to grow liquidity to an irrational level. The amount of liquidity in the pools need to be first principle based. It's a factor of yield and expected volatility. The more volume per pool dept / fees connected the more liquidity will naturally join the liquidity pools. All of those incentives created extra impermanent losses and the LPs got the worst of it. They had the worst seat in the house. From here on they will have the best one.

The team original founders designed and pushed for implementation of those reflective leveraged features.

Please don't shoot the messengers or the current dev team. They are picking up the broken pots.

Both OG founders are out of daily operations.

Please don't shoot the messengers or the current dev team. They are picking up the broken pots.

Both OG founders are out of daily operations.

After this is said and done I will propose to create an economic design council group to help 9r ensure @thorchain can succeed by :

- improving capital efficiency

- leverage features never gets built again into it

- rujira can't endenger the L1 ecosystem

I got 3 people in mind, the smartest minds in DEFI when it comes to this.

- improving capital efficiency

- leverage features never gets built again into it

- rujira can't endenger the L1 ecosystem

I got 3 people in mind, the smartest minds in DEFI when it comes to this.

I had a few page written about capital efficiency optimisation but I will keep this for another ADR, this is important because if we are to give a percentage of revenues to debt, the LPs will still need to beat impermanent losses. We need to do more with less.

This is the most fucked up situation I and other devs have been part. Some of them are puking. If there was any other way I would suggest it. It's a life or limb situation.

I was against lending / savers / ILP / POL the entire time. I have suggested my delegators to vote against it, some of them did, not enough.

If I have one lesson learned is sometimes its better to start a civil war when you can anticipate a certain outcome than to step out of the way.

I am so sorry it has come to this, I've barely slept for the last few days knowing what was inevitable.

The $12m loan redemption accelerated the timeline.

I was against lending / savers / ILP / POL the entire time. I have suggested my delegators to vote against it, some of them did, not enough.

If I have one lesson learned is sometimes its better to start a civil war when you can anticipate a certain outcome than to step out of the way.

I am so sorry it has come to this, I've barely slept for the last few days knowing what was inevitable.

The $12m loan redemption accelerated the timeline.

• • •

Missing some Tweet in this thread? You can try to

force a refresh