How to get URL link on X (Twitter) App

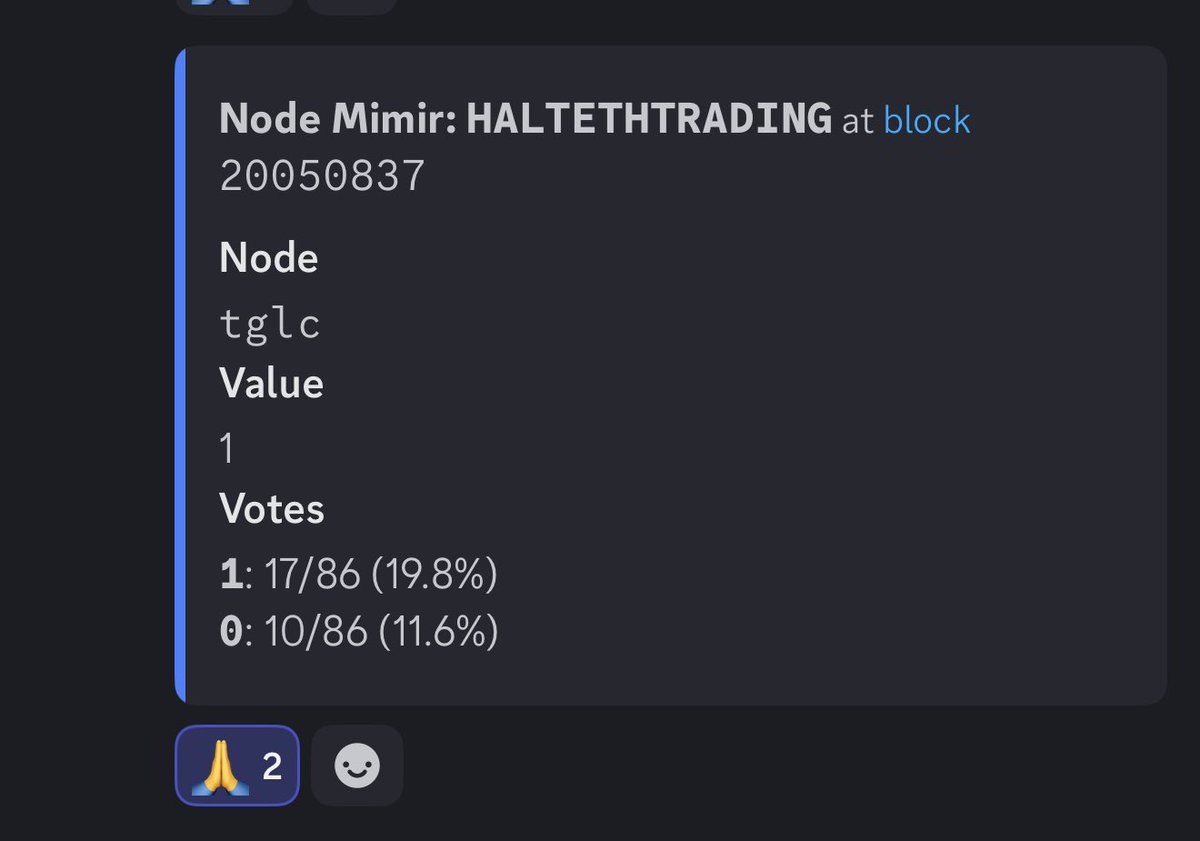

There is no risk of death spiral, the features have been suspended.

There is no risk of death spiral, the features have been suspended.

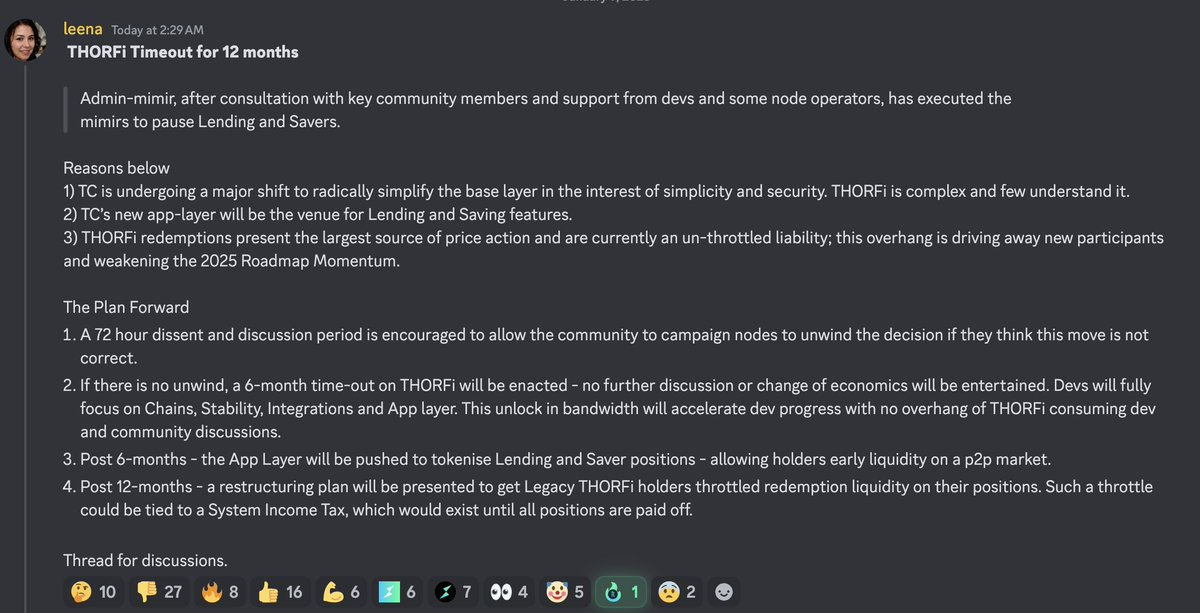

While I agree with the sentiment that we need to strip out @THORChain's leverage, I think it was the wrong way to go about it.

While I agree with the sentiment that we need to strip out @THORChain's leverage, I think it was the wrong way to go about it.

@THORChain is a decentralized binance that offers native assets like Bitcoin and Ethereum on a DEX

@THORChain is a decentralized binance that offers native assets like Bitcoin and Ethereum on a DEX