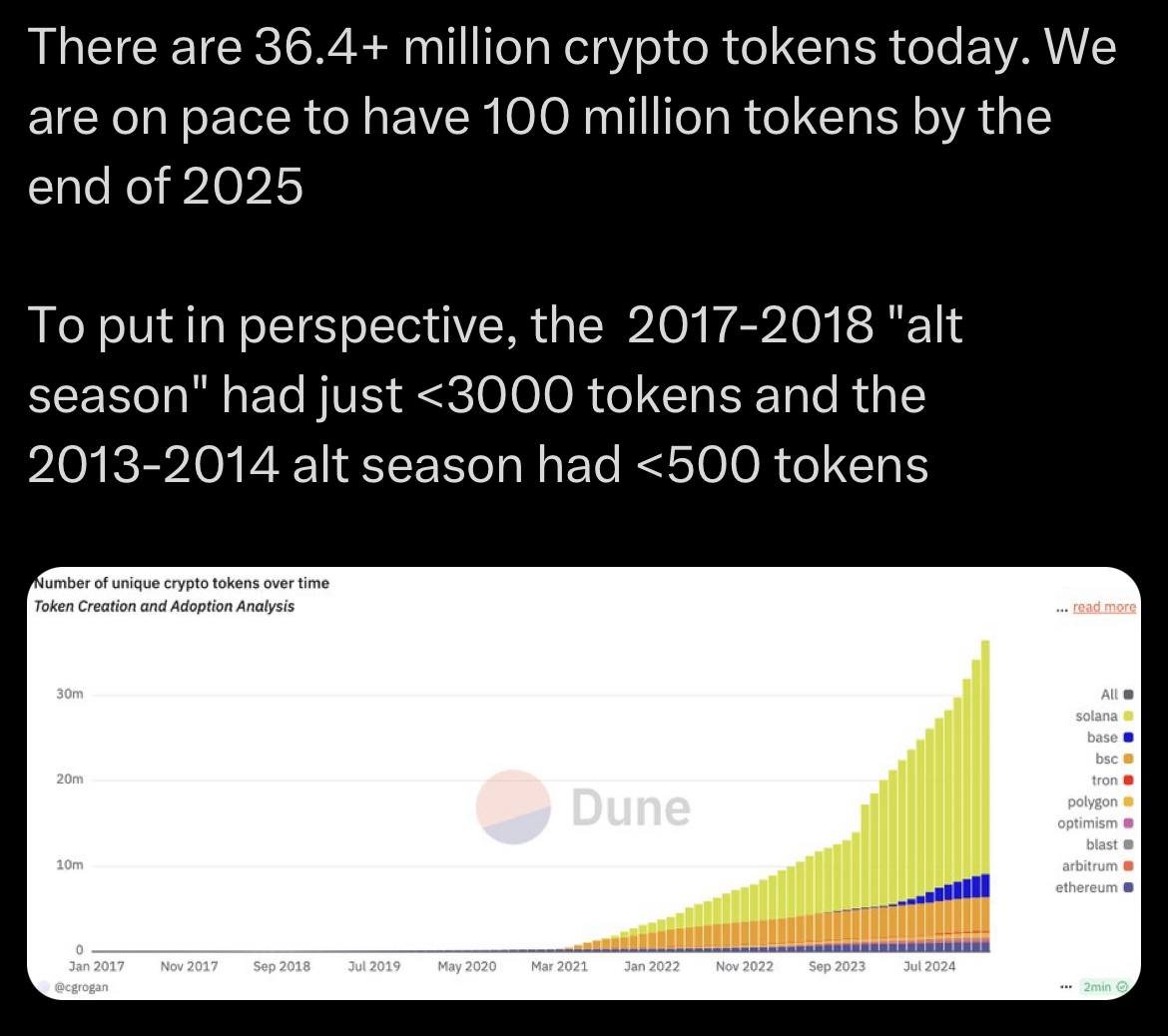

Too many tokens. Infinite more to come. Supply of tokens is greater than demand.

This illustrates why expecting an "alt season" where everything goes up for an extended period of time is misplaced. Alt season will continue to happen, but for shorter spans, from a few days to a few weeks at most.

Adjust your expectations. And re-balance your portfolios accordingly.

The absence of such alt season greatly explains the sentiment malaise among crypto investors, in a market where the aggregated market cap has risen dramatically.

Being a good coin picker is now very hard. Just as being a good stocks picker is also very hard. Now more than ever given the AI revolution, a majority of stocks underperforms the S&P 500—even more so the Nasdaq 100.

This illustrates why expecting an "alt season" where everything goes up for an extended period of time is misplaced. Alt season will continue to happen, but for shorter spans, from a few days to a few weeks at most.

Adjust your expectations. And re-balance your portfolios accordingly.

The absence of such alt season greatly explains the sentiment malaise among crypto investors, in a market where the aggregated market cap has risen dramatically.

Being a good coin picker is now very hard. Just as being a good stocks picker is also very hard. Now more than ever given the AI revolution, a majority of stocks underperforms the S&P 500—even more so the Nasdaq 100.

• • •

Missing some Tweet in this thread? You can try to

force a refresh