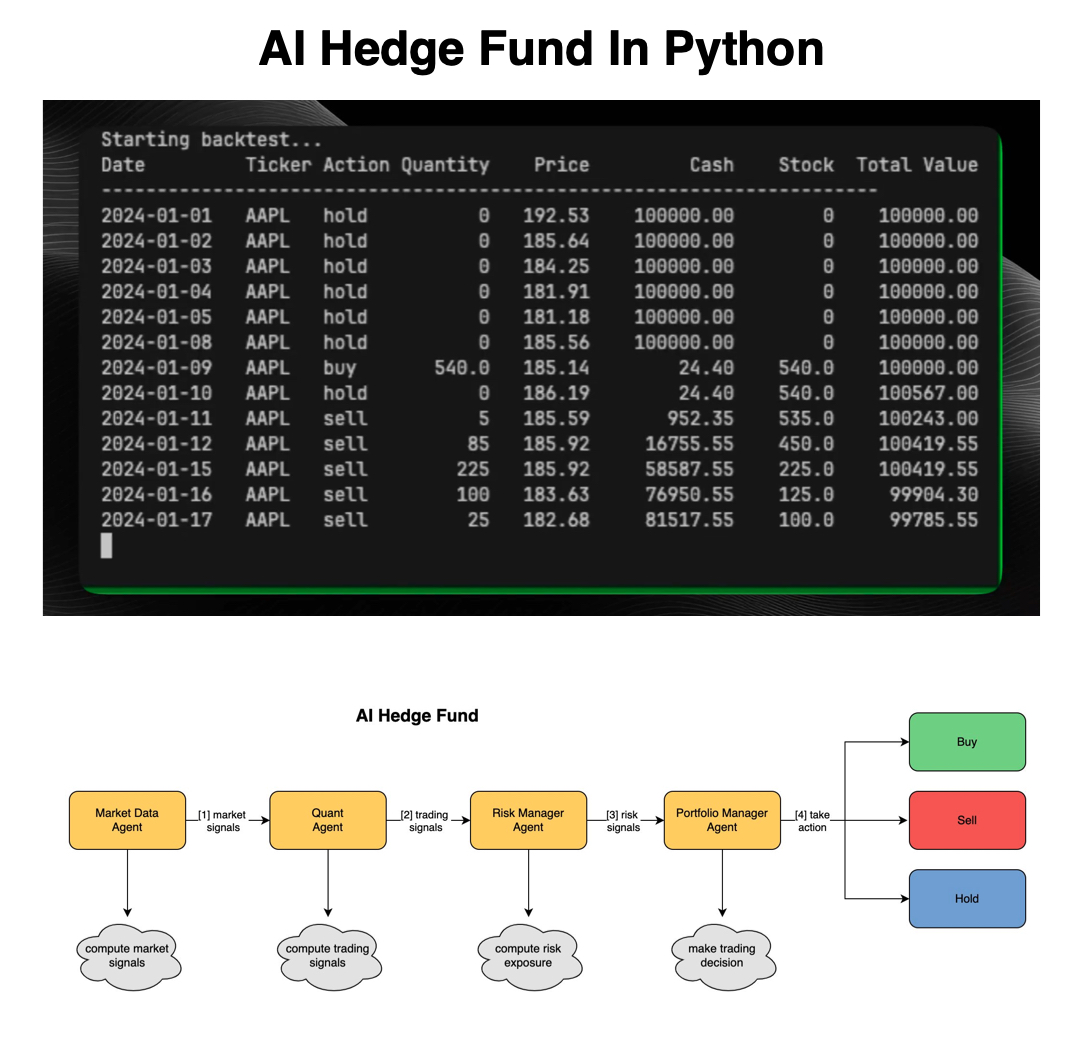

This guy made a real-world AI Hedge Fund Team in Python.

Then he made it available for everyone for free.

Here's how he did it (and how you can too).

Then he made it available for everyone for free.

Here's how he did it (and how you can too).

@virattt is doing something incredible.

He's using AI to replicate a hedge fund.

And he's open-sourced it for the world to learn.

He's using AI to replicate a hedge fund.

And he's open-sourced it for the world to learn.

https://twitter.com/137086701/status/1860443712490274996

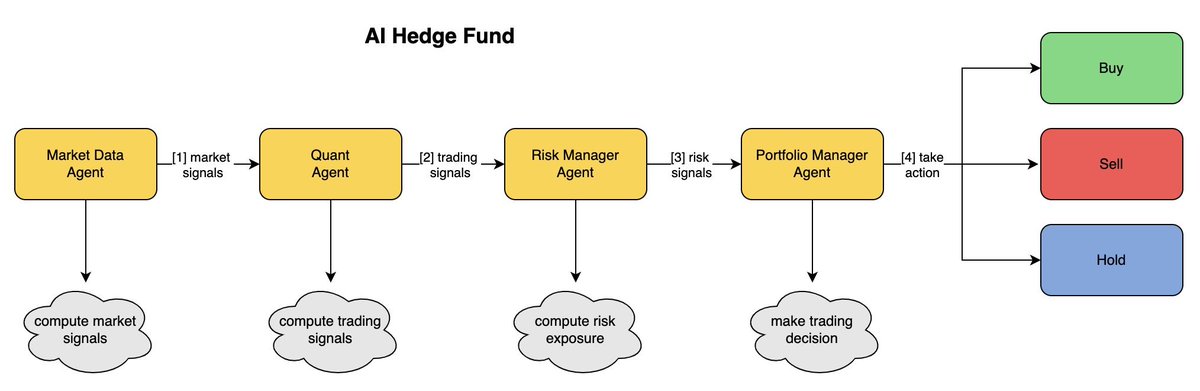

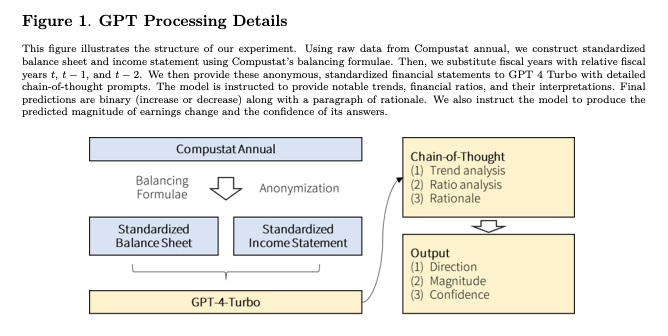

@virattt The AI team contains 4 Agents:

1 • Market Data Agent gathers market data and calculates technical signals.

2 • Quant Agent takes market data and generates a buy, sell, or hold signal.

1 • Market Data Agent gathers market data and calculates technical signals.

2 • Quant Agent takes market data and generates a buy, sell, or hold signal.

@virattt 3 • Risk Management Agent takes trading signal and generates a risk signal.

4 • Portfolio Management Agent considers all signals and makes a final trading decision.

4 • Portfolio Management Agent considers all signals and makes a final trading decision.

@virattt His GitHub repo is available for anyone to use and learn from here: github.com/virattt/ai-hed…

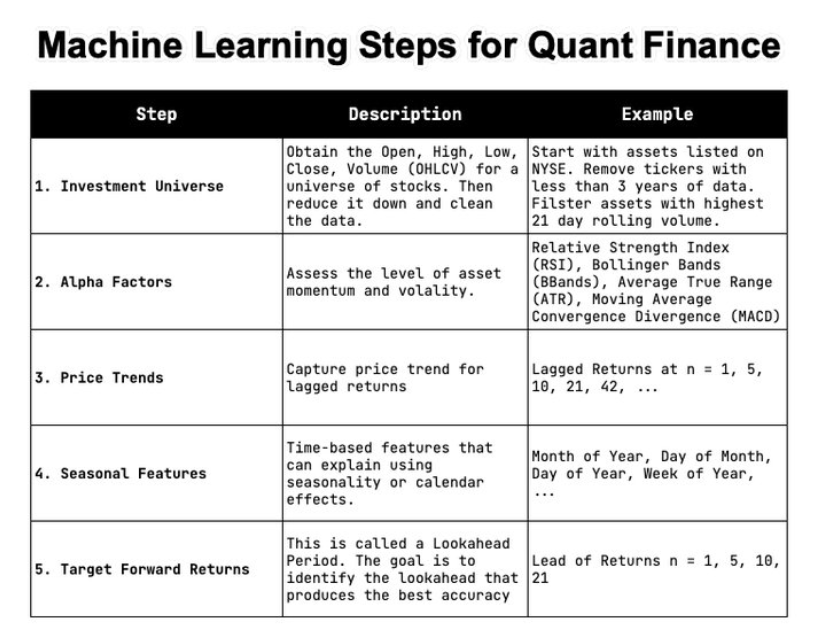

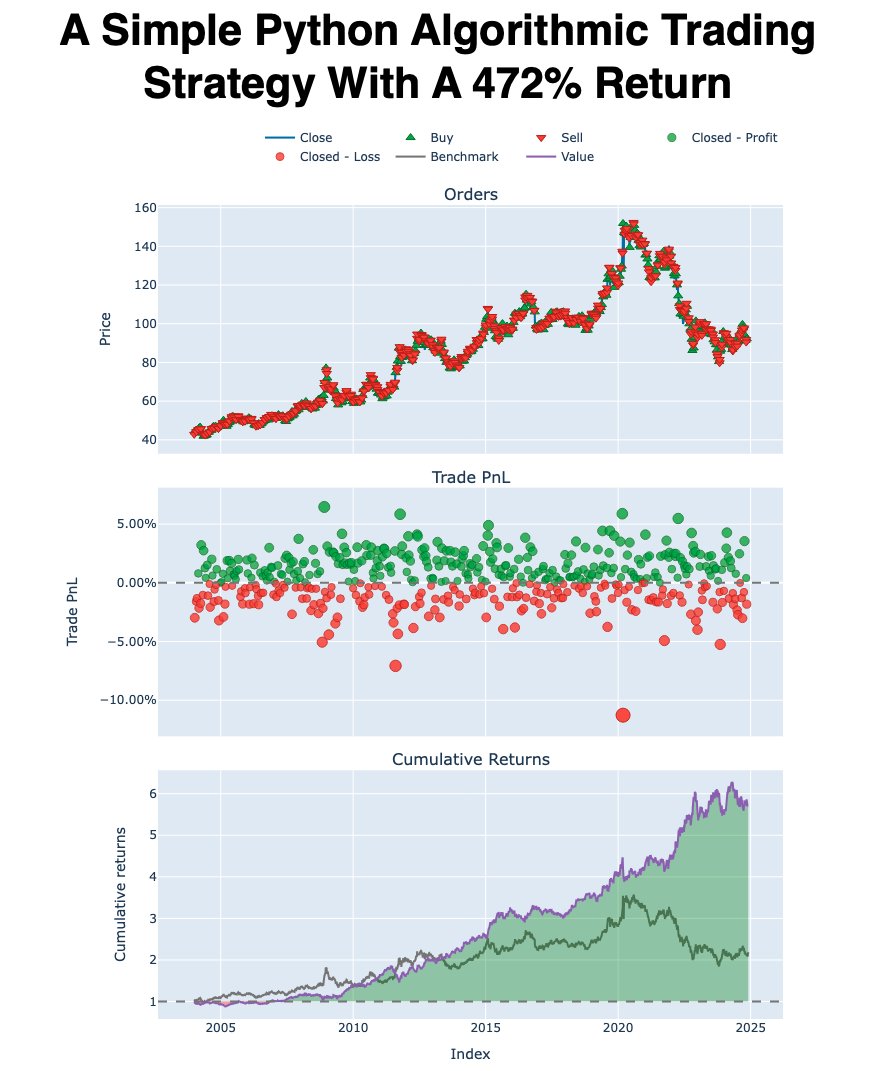

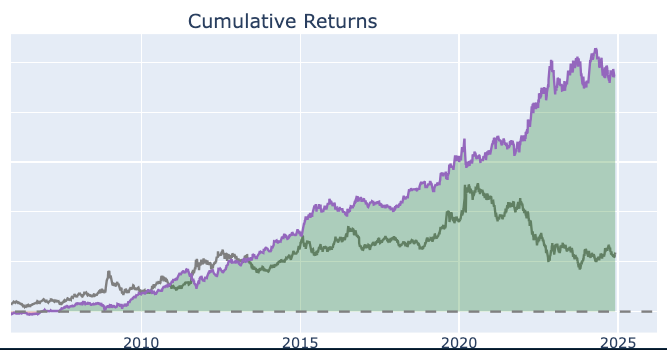

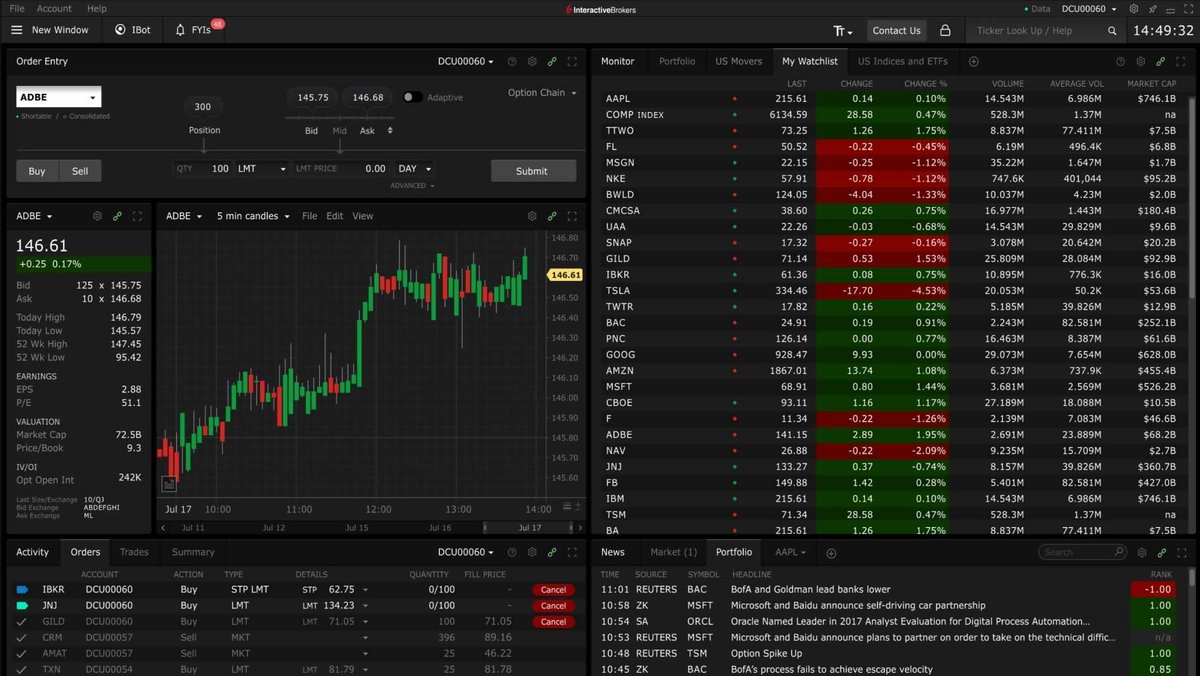

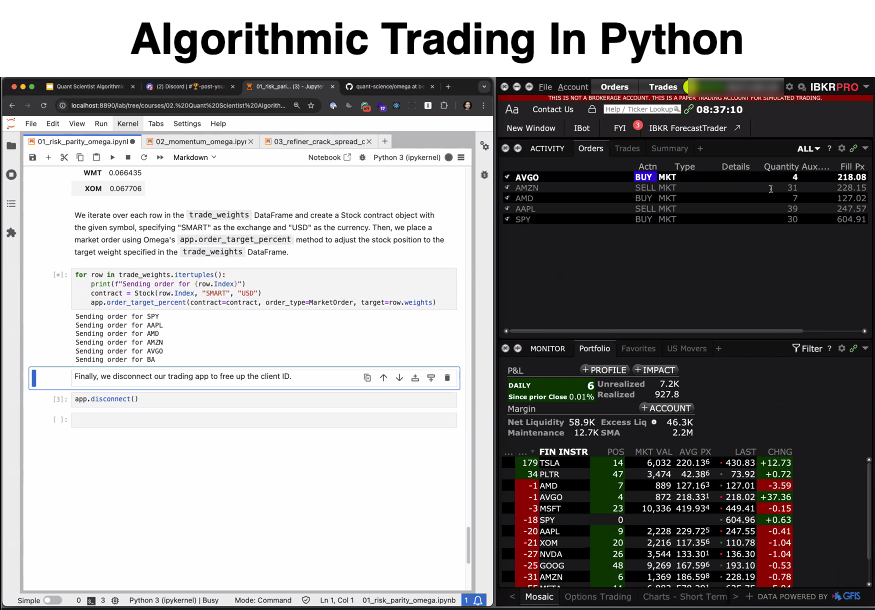

@virattt Want to learn how to get started with algorithmic trading with Python?

Then join us on January 28th for a live webinar, how to Build Algorithmic Trading Strategies (that actually get results)

Register here (780+ registered): learn.quantscience.io/qs-register

Then join us on January 28th for a live webinar, how to Build Algorithmic Trading Strategies (that actually get results)

Register here (780+ registered): learn.quantscience.io/qs-register

P.S. - Want to learn Algorithmic Trading Strategies that actually work?

I'm hosting a live workshop. Join here: learn.quantscience.io/qs-register

I'm hosting a live workshop. Join here: learn.quantscience.io/qs-register

• • •

Missing some Tweet in this thread? You can try to

force a refresh