Develop profitable trading strategies, build a systematic trading process, and trade your ideas with Python—even if you’ve never done it before.

17 subscribers

How to get URL link on X (Twitter) App

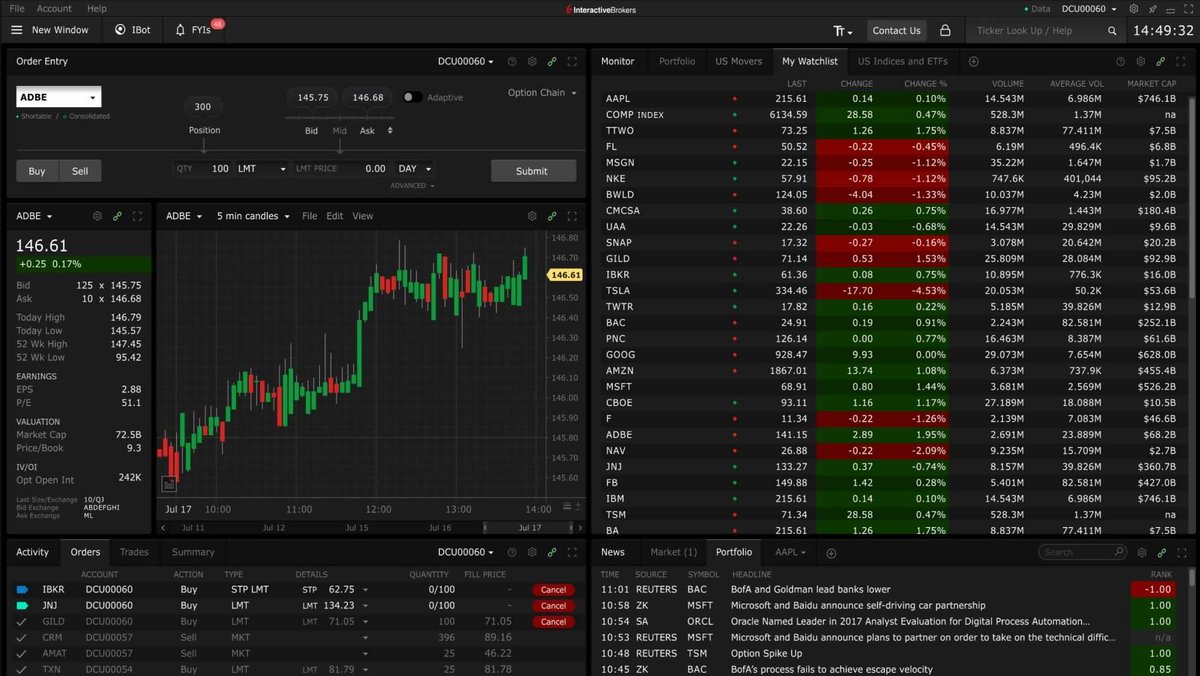

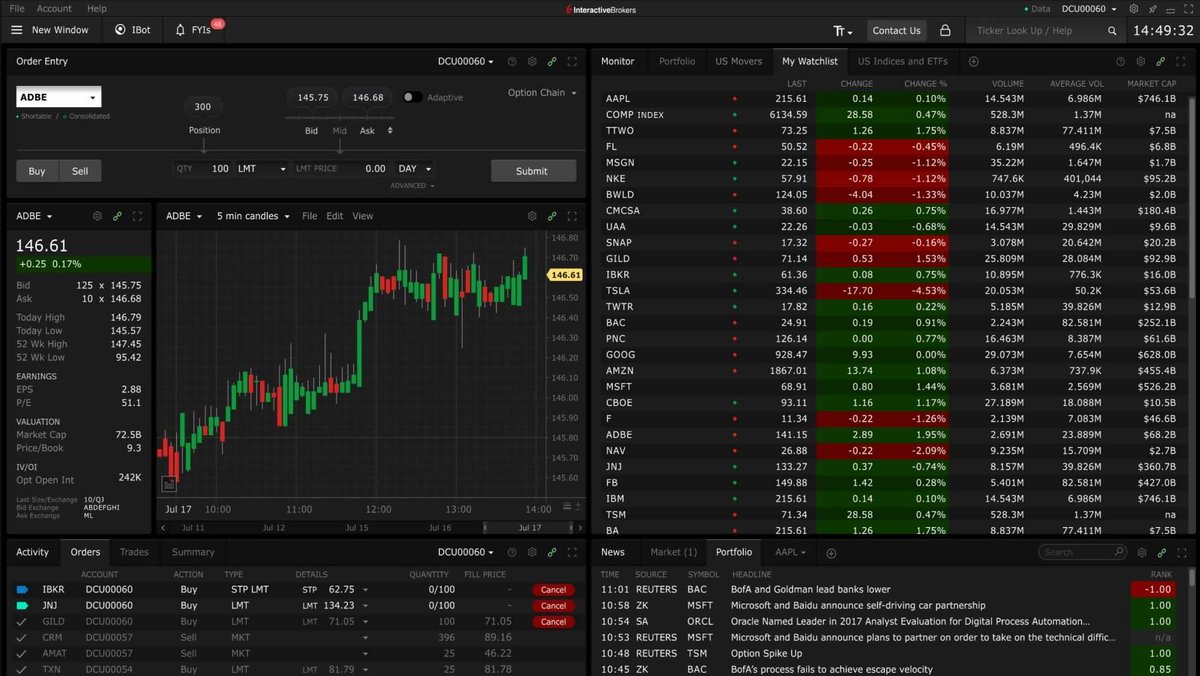

1. What is finvizfinance?

1. What is finvizfinance?

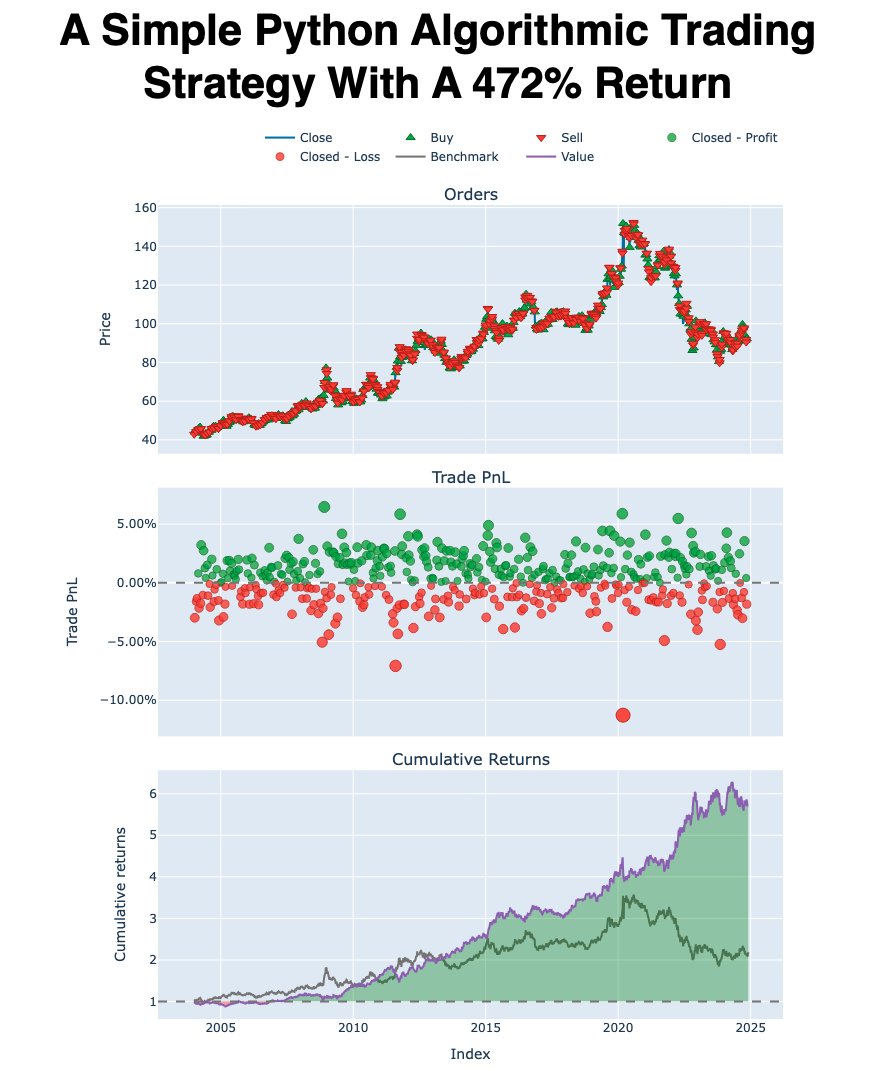

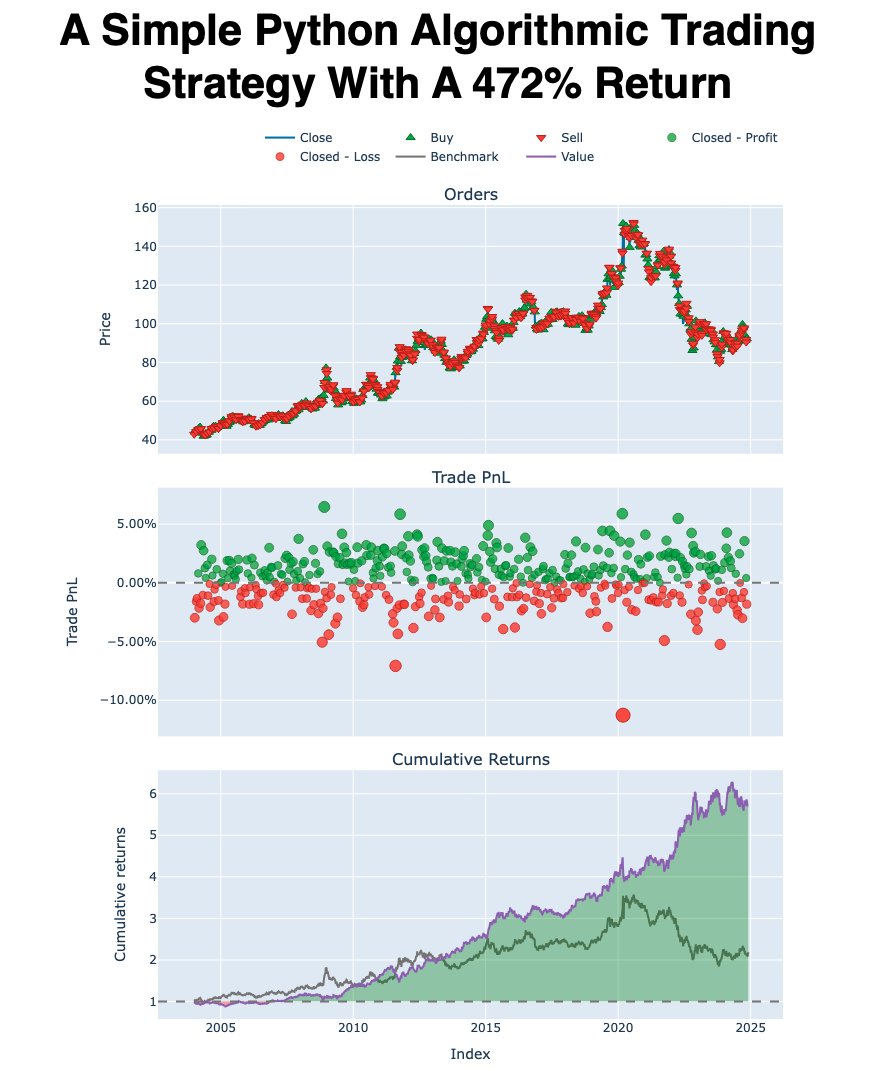

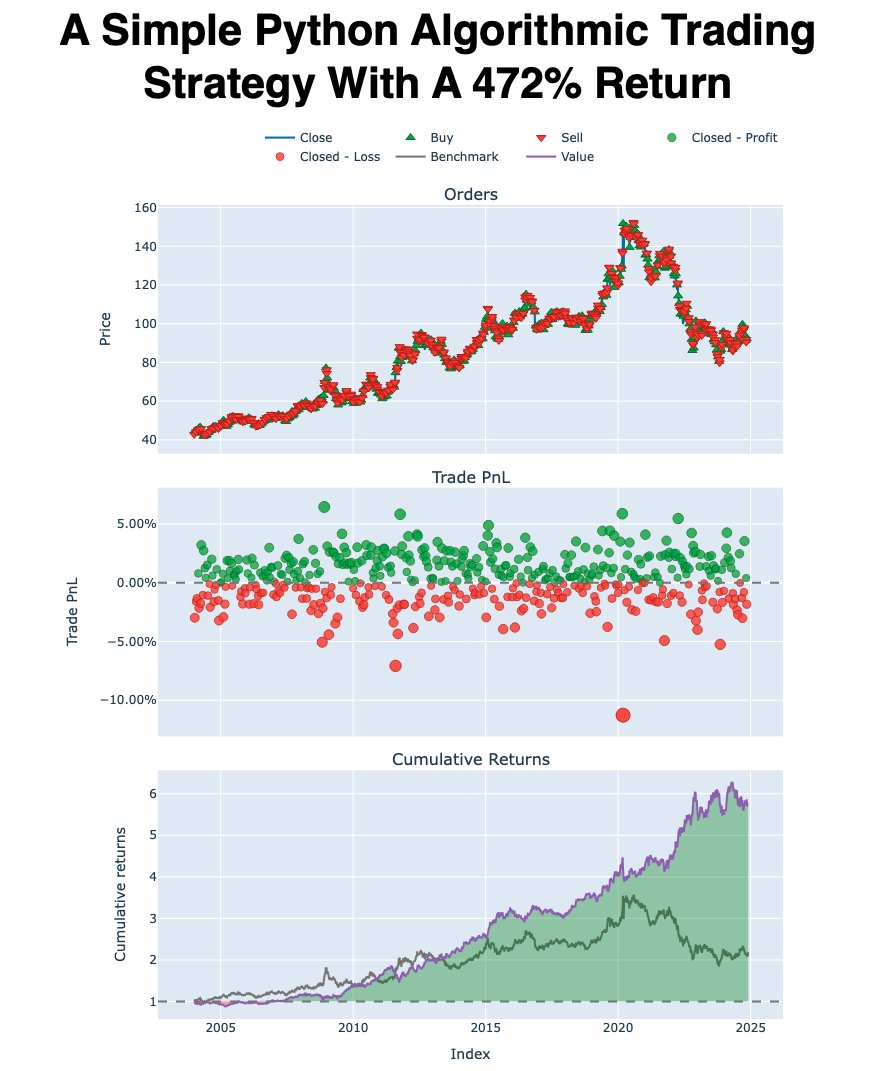

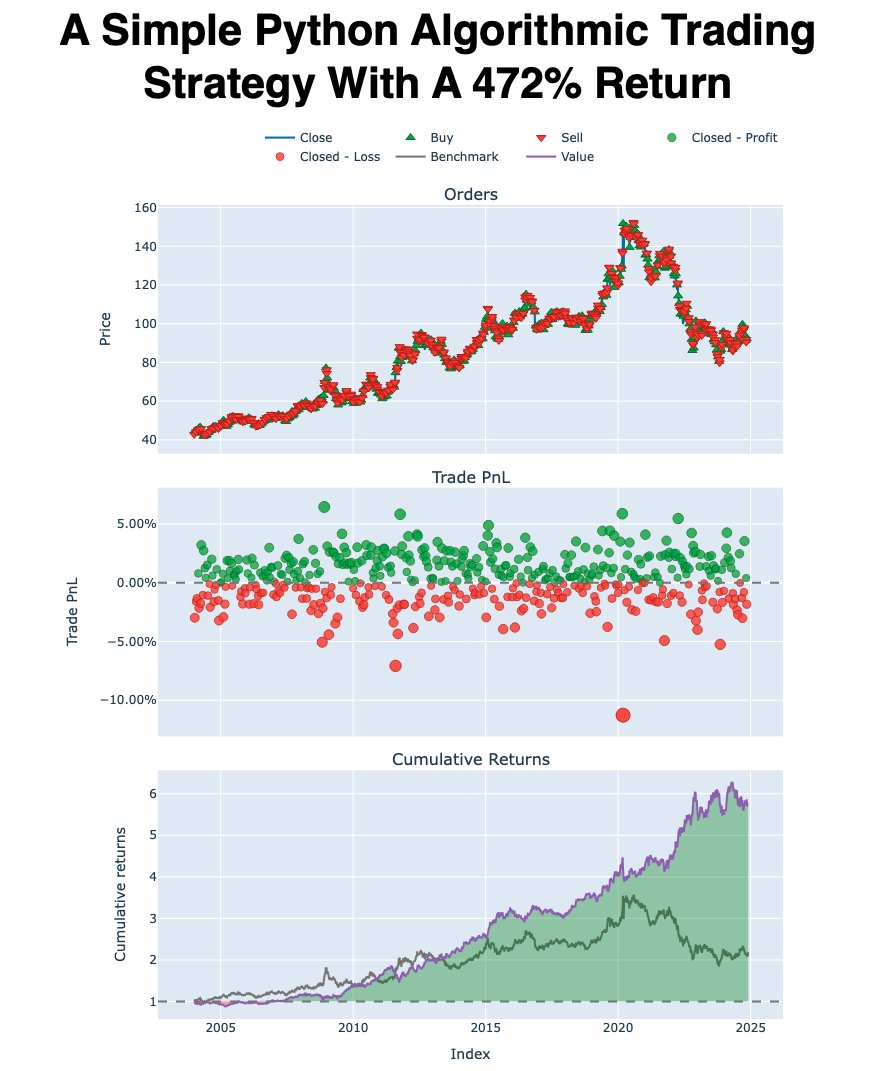

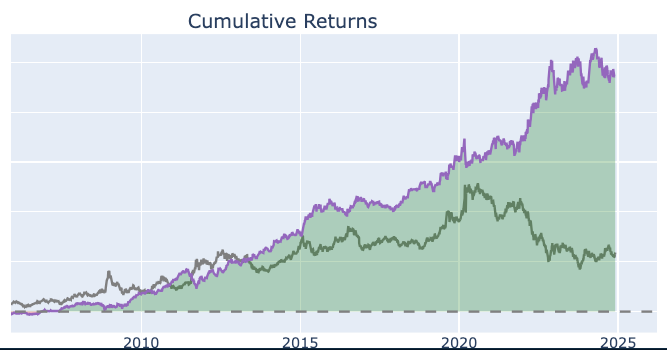

This strategy takes advantage of "flow effects", which is how certain points in time influence the value of an asset.

This strategy takes advantage of "flow effects", which is how certain points in time influence the value of an asset.

yfinance

yfinance

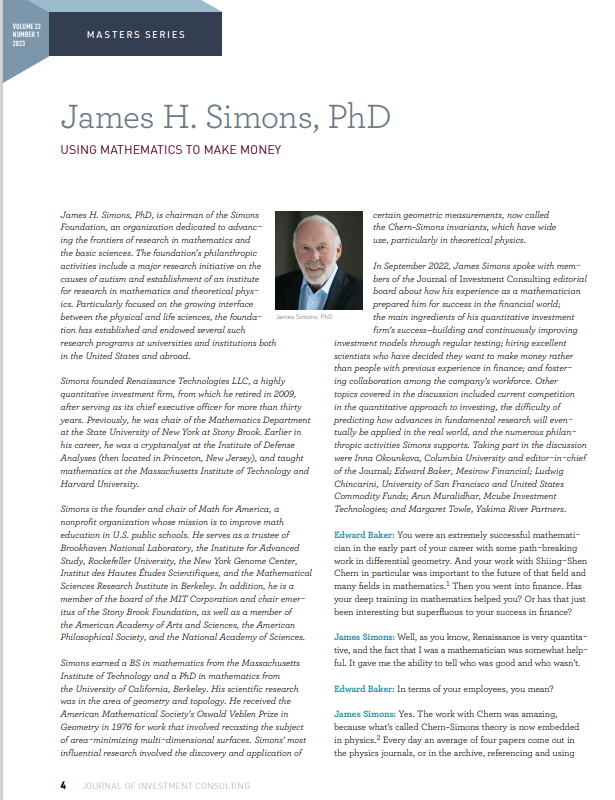

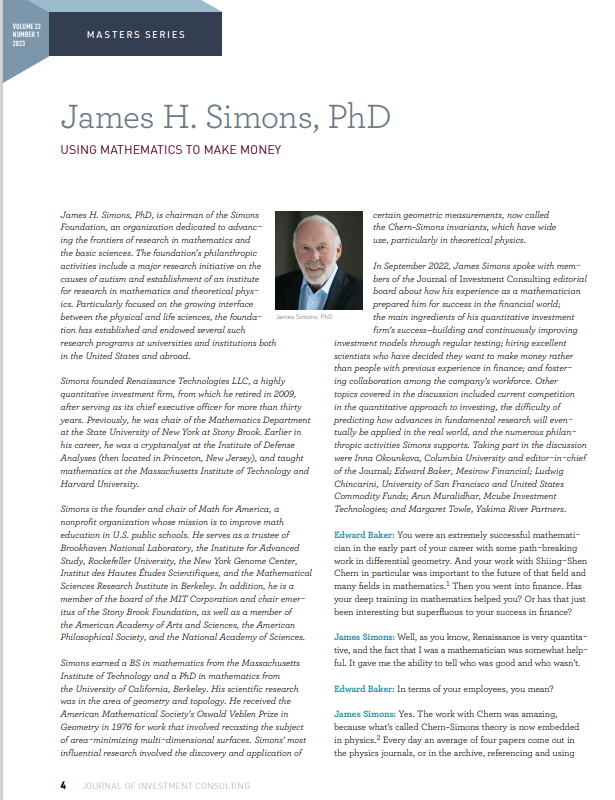

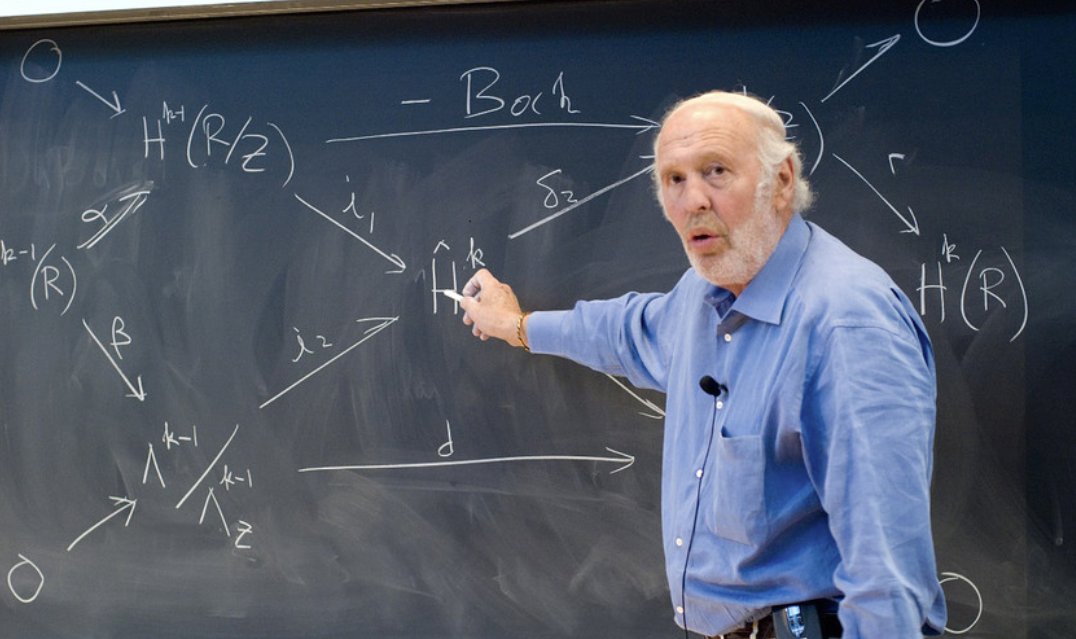

The main ingredients of RenTec's success:

The main ingredients of RenTec's success:

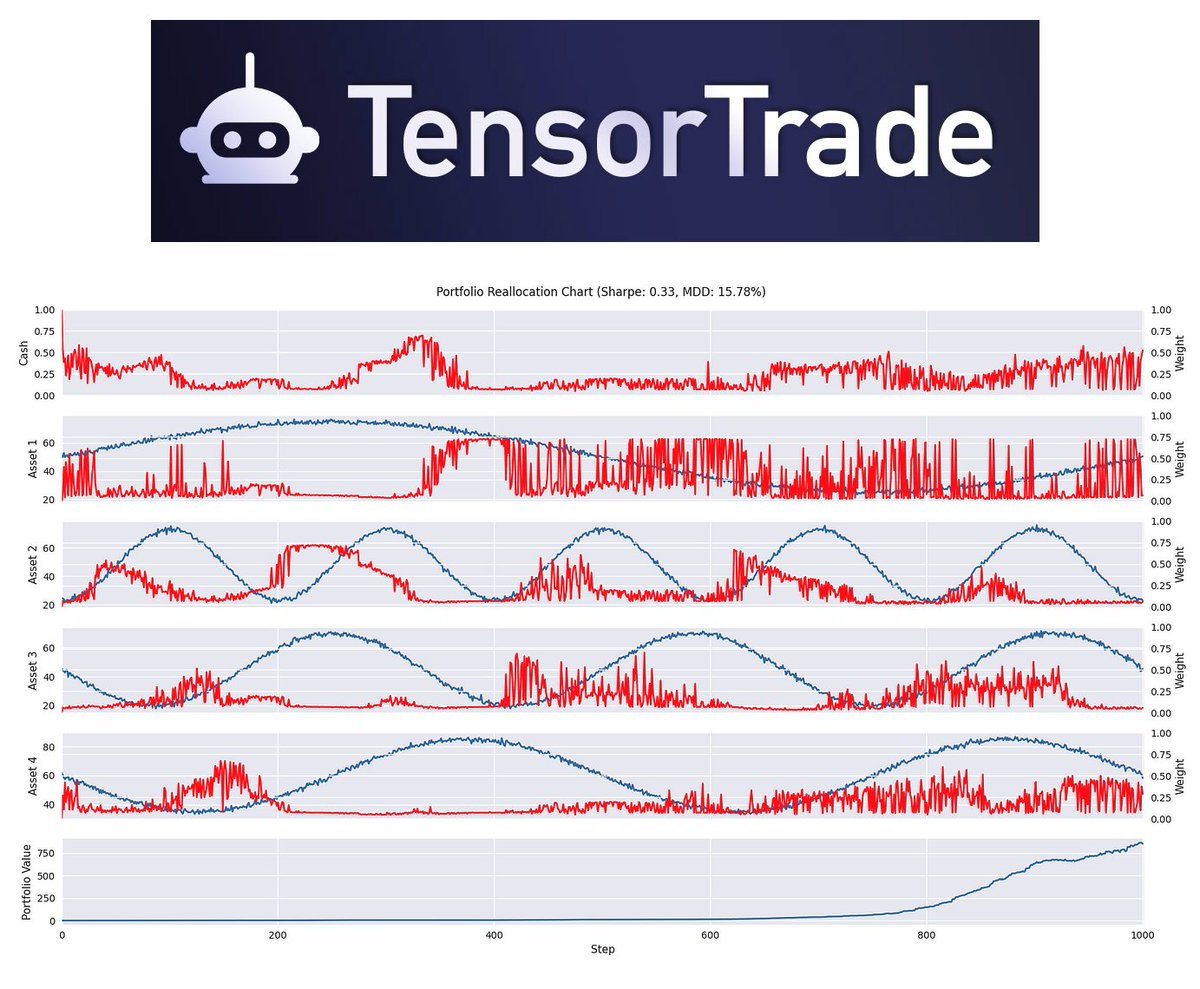

TensorTrade is an open source Python framework for building, training, evaluating, and deploying robust trading algorithms using reinforcement learning leveraging:

TensorTrade is an open source Python framework for building, training, evaluating, and deploying robust trading algorithms using reinforcement learning leveraging:

Jim Simons was no ordinary investor.

Jim Simons was no ordinary investor.

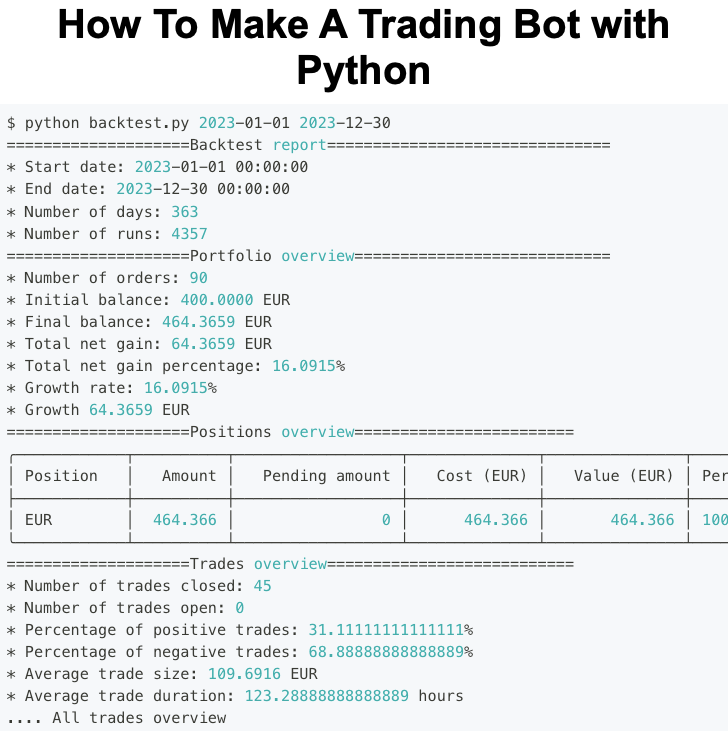

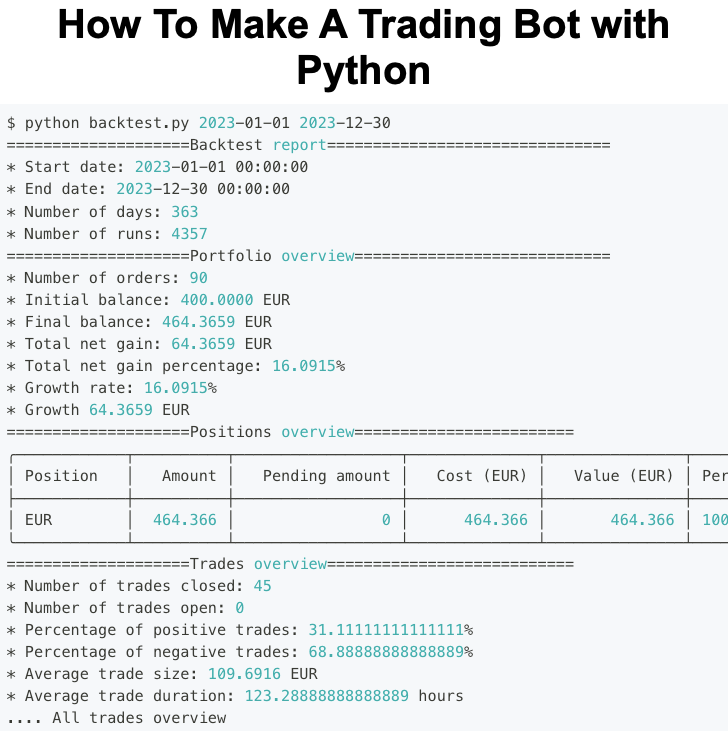

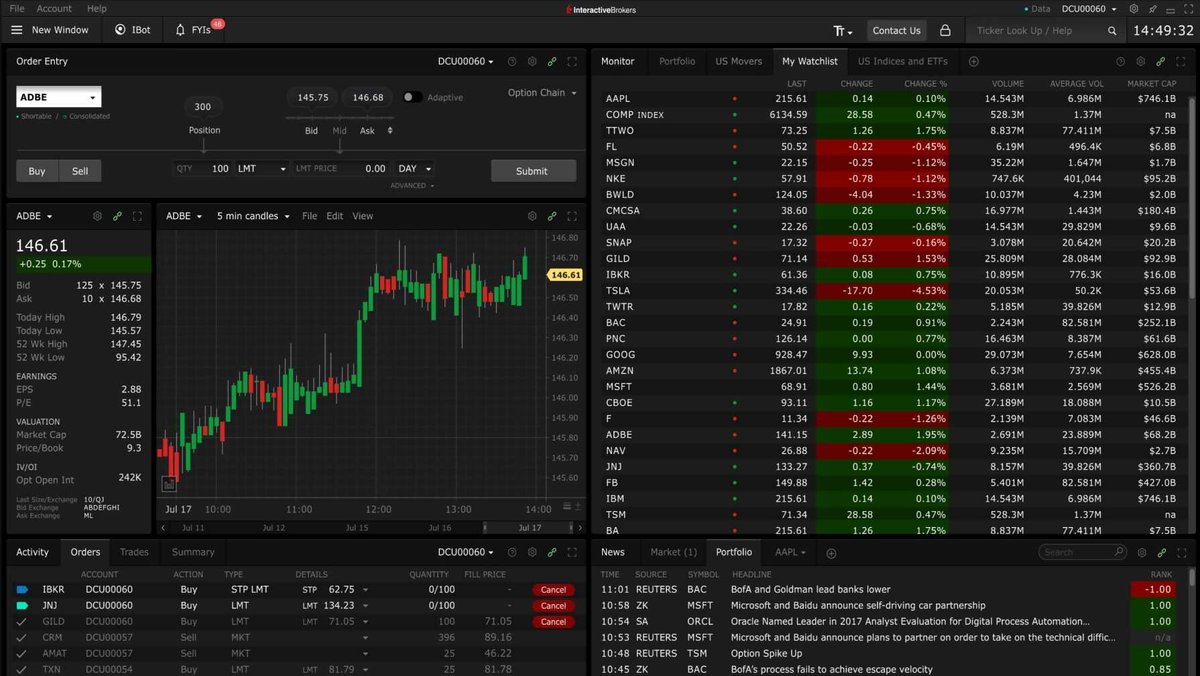

1. What is a trading bot?

1. What is a trading bot?

This strategy takes advantage of "flow effects", which is how certain points in time influence the value of an asset.

This strategy takes advantage of "flow effects", which is how certain points in time influence the value of an asset.

yfinance

yfinance

1. What is finvizfinance?

1. What is finvizfinance?