Develop profitable trading strategies, build a systematic trading process, and trade your ideas with Python—even if you’ve never done it before.

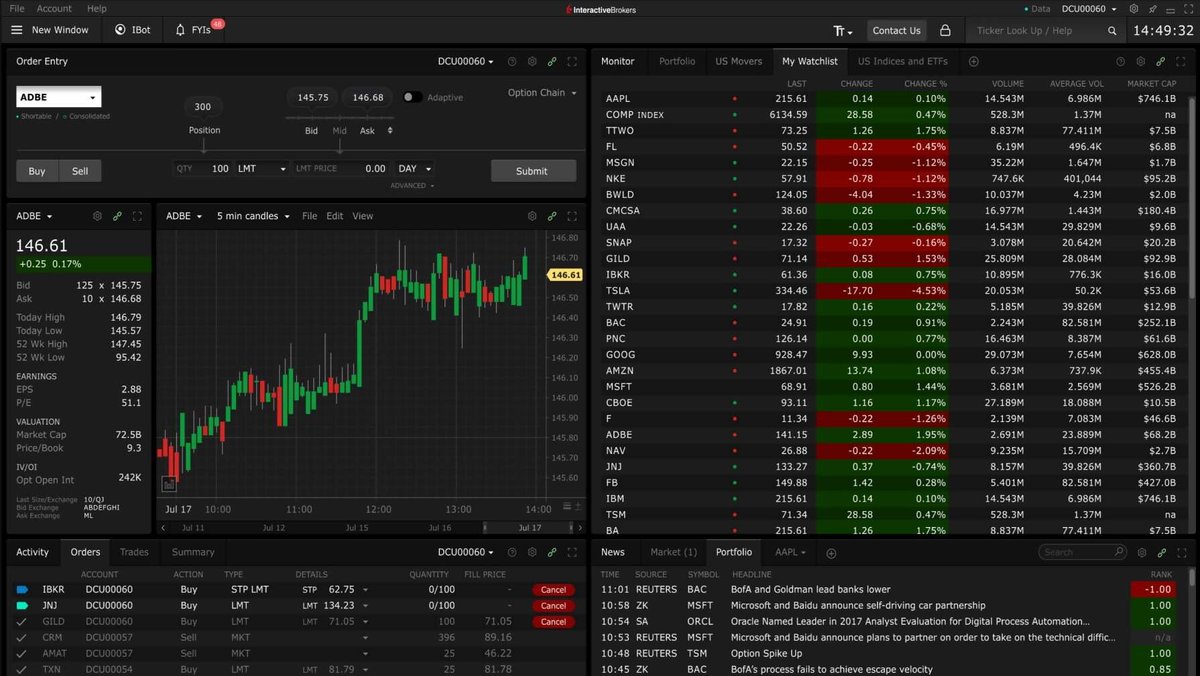

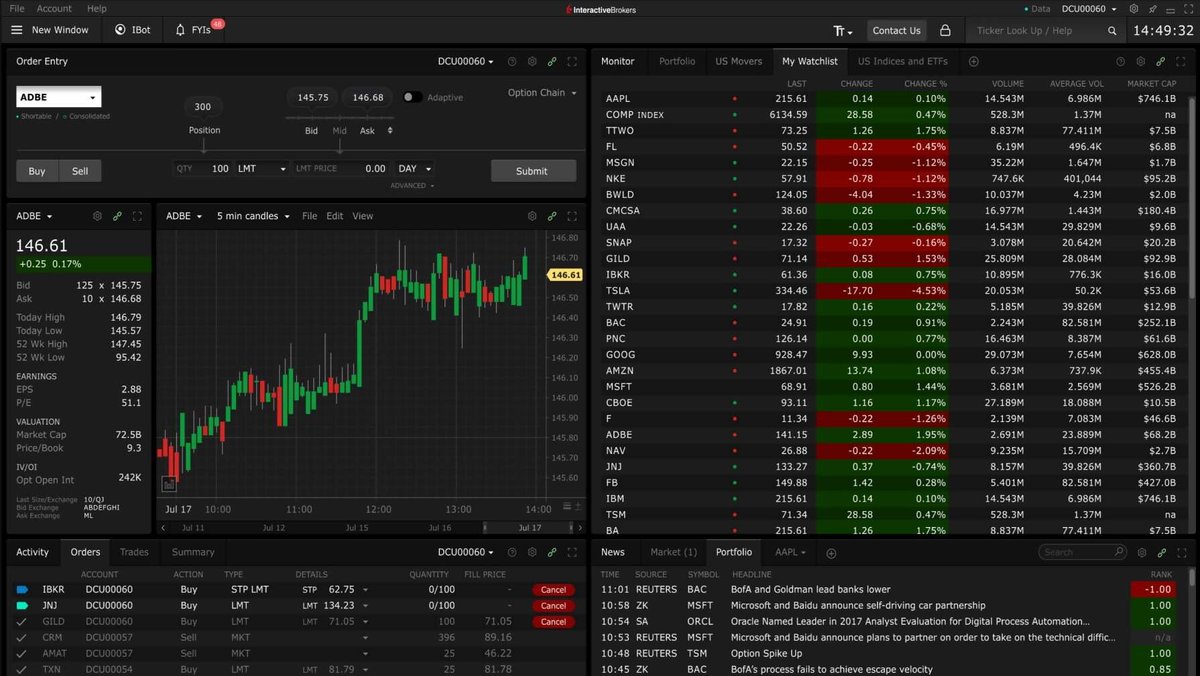

15 subscribers

How to get URL link on X (Twitter) App

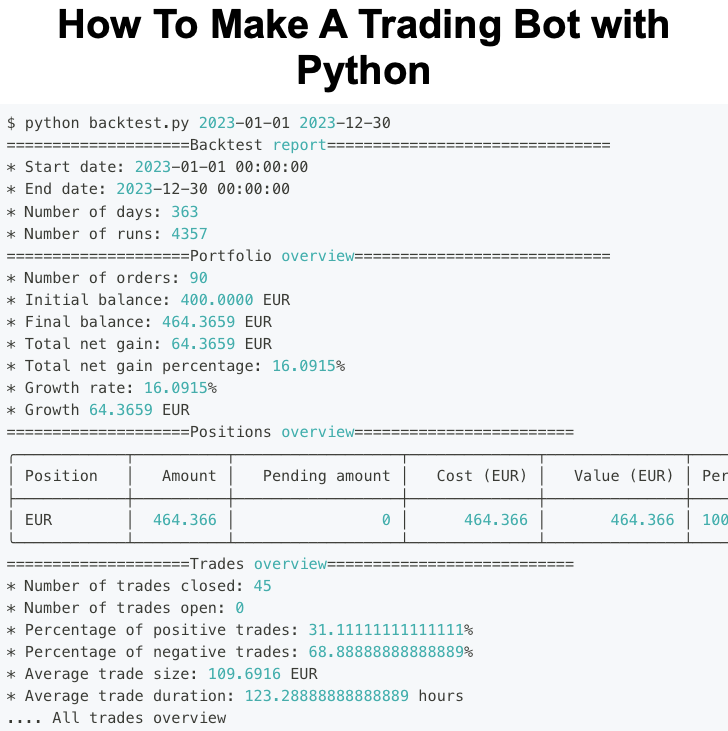

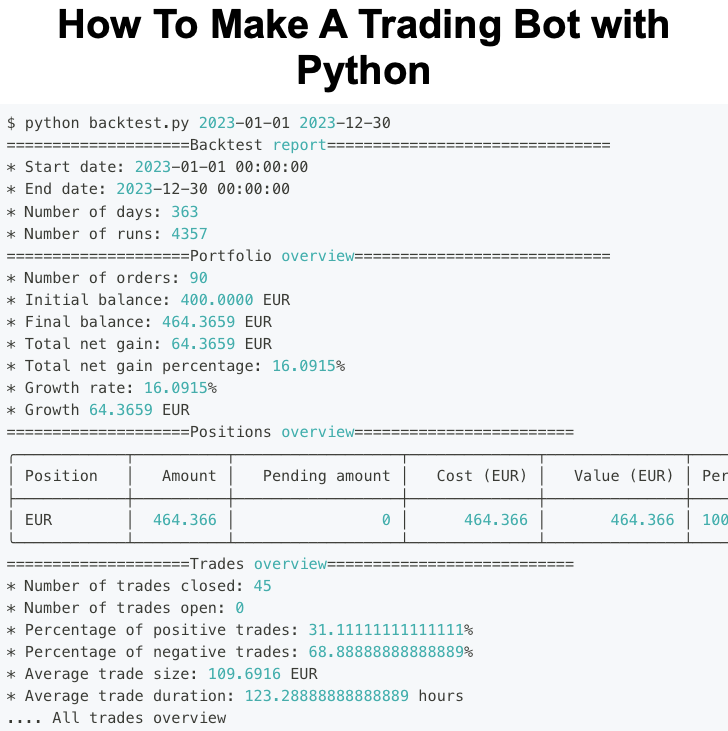

1. What is a trading bot?

1. What is a trading bot?

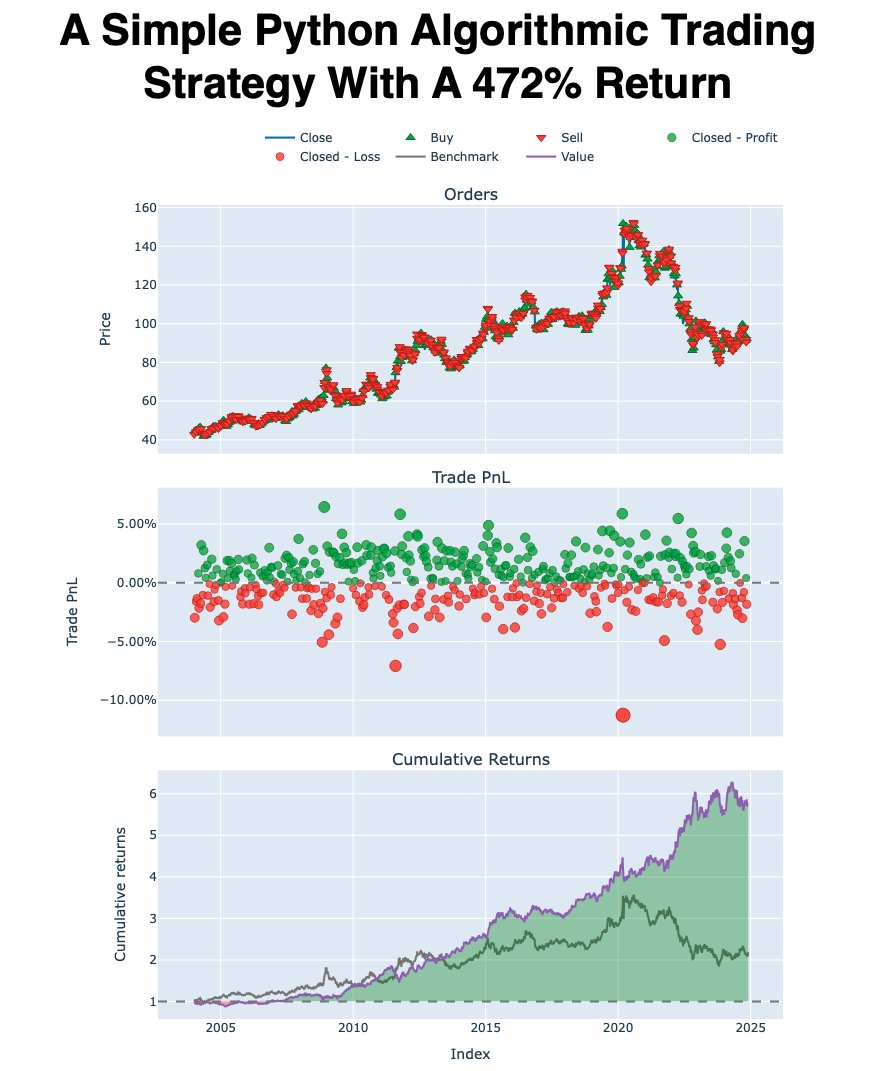

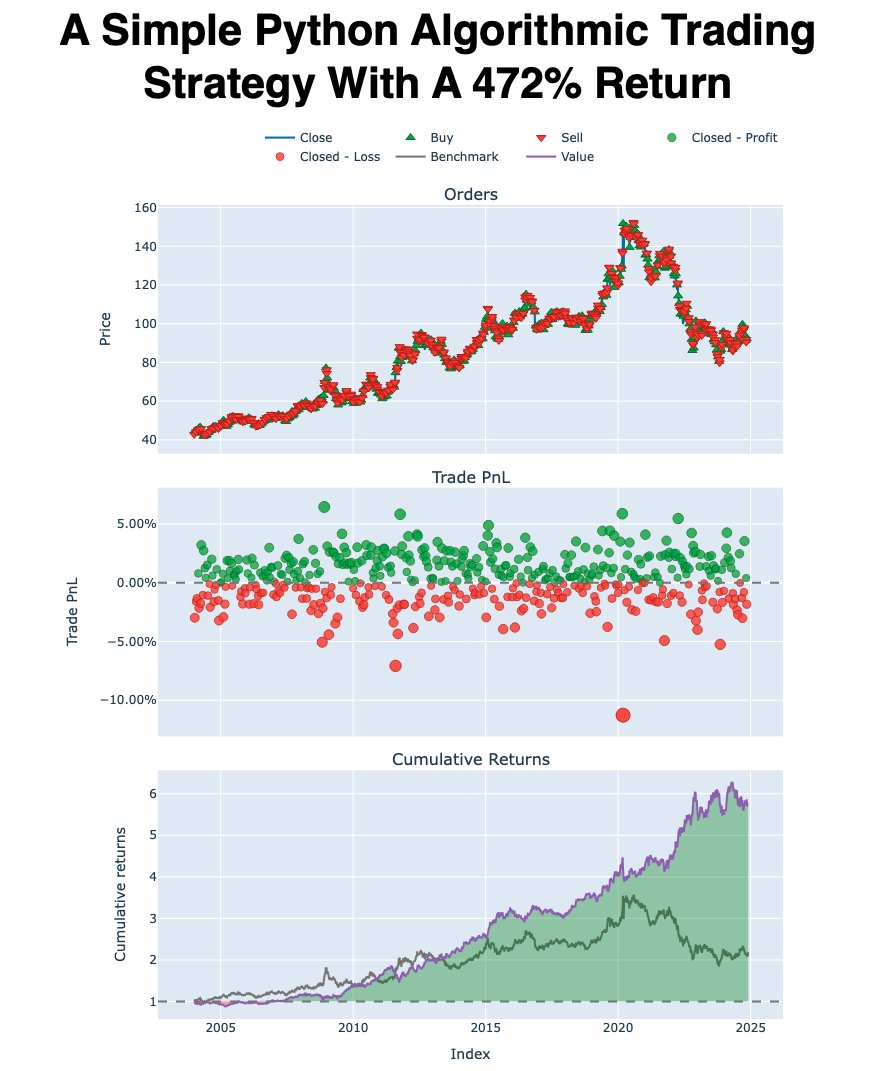

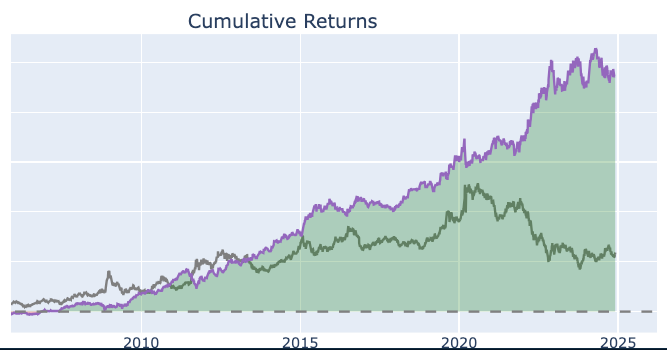

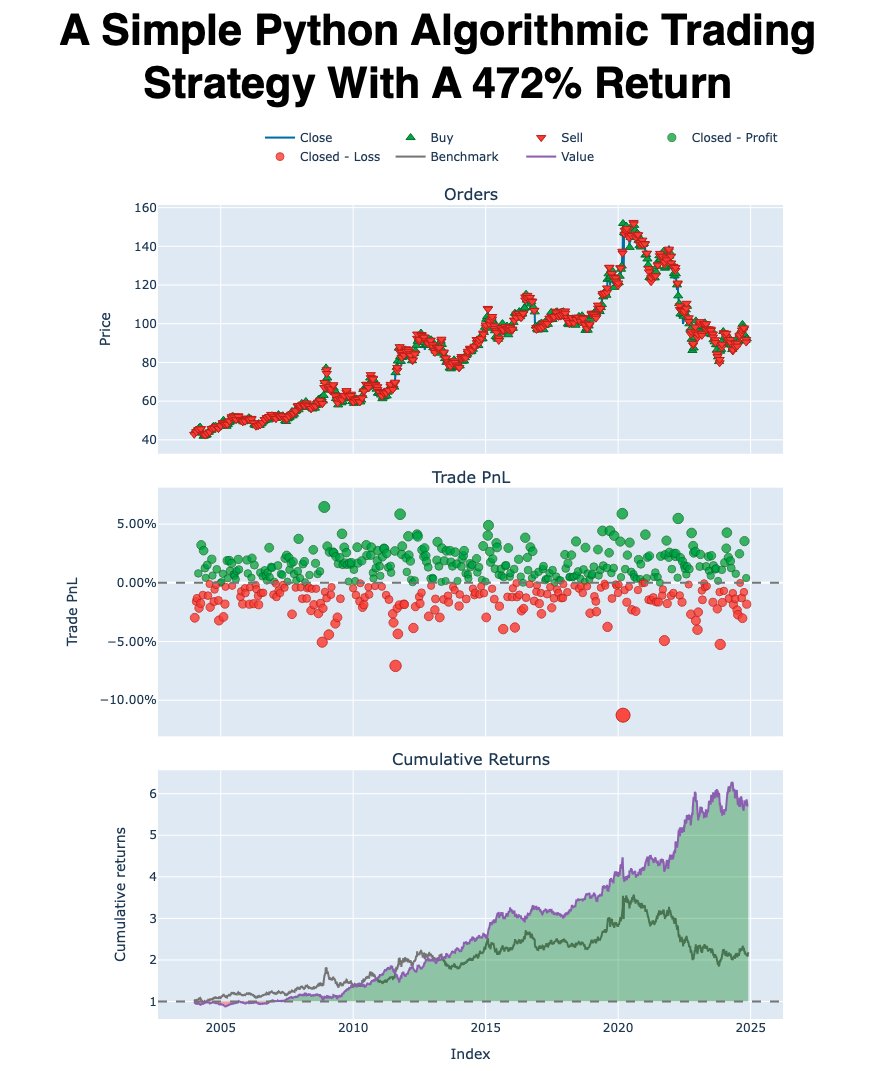

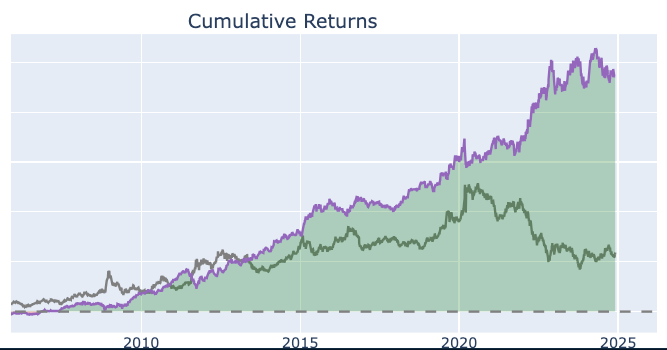

This strategy takes advantage of "flow effects", which is how certain points in time influence the value of an asset.

This strategy takes advantage of "flow effects", which is how certain points in time influence the value of an asset.

yfinance

yfinance

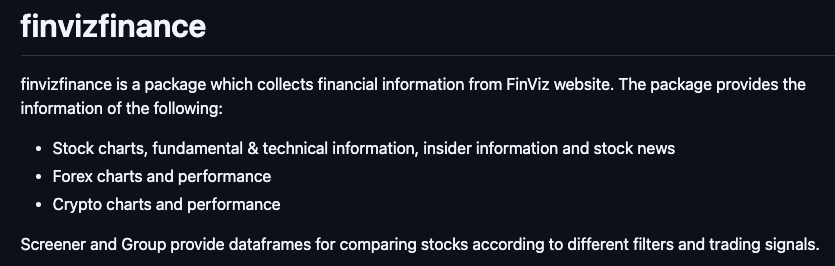

1. What is finvizfinance?

1. What is finvizfinance?

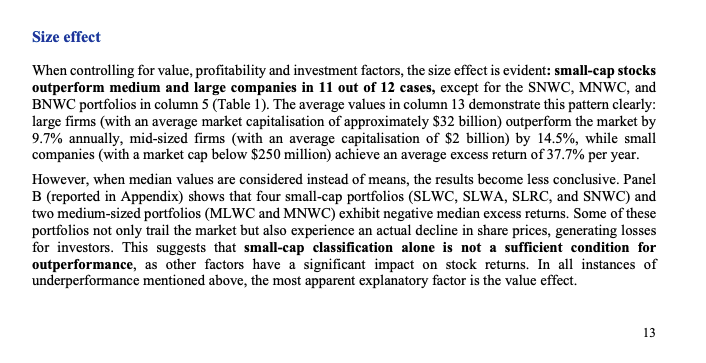

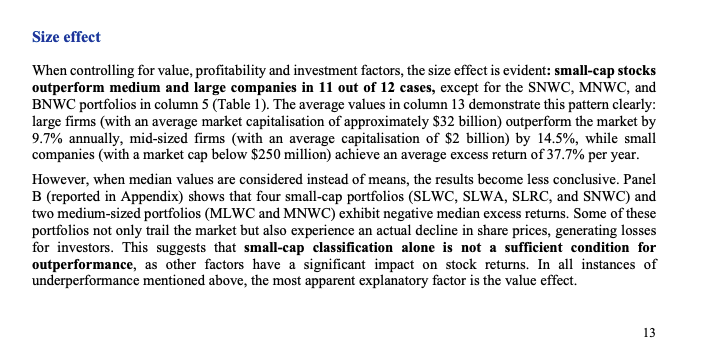

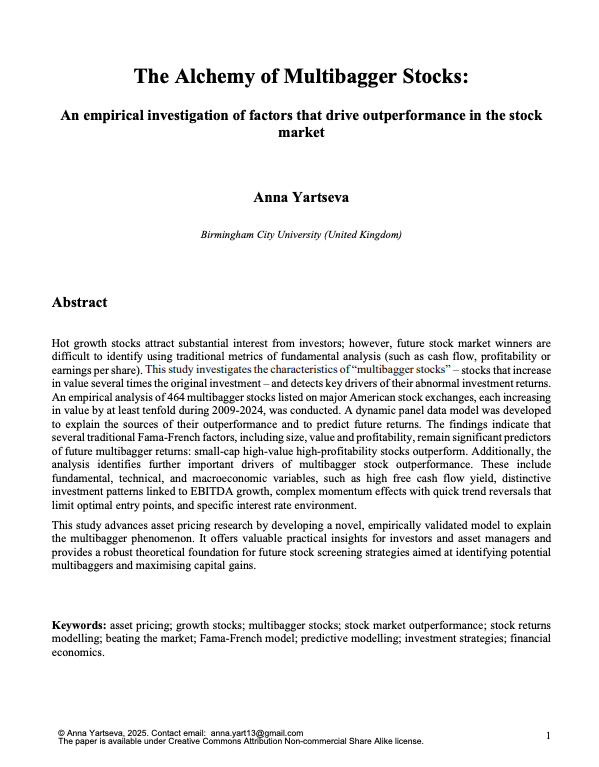

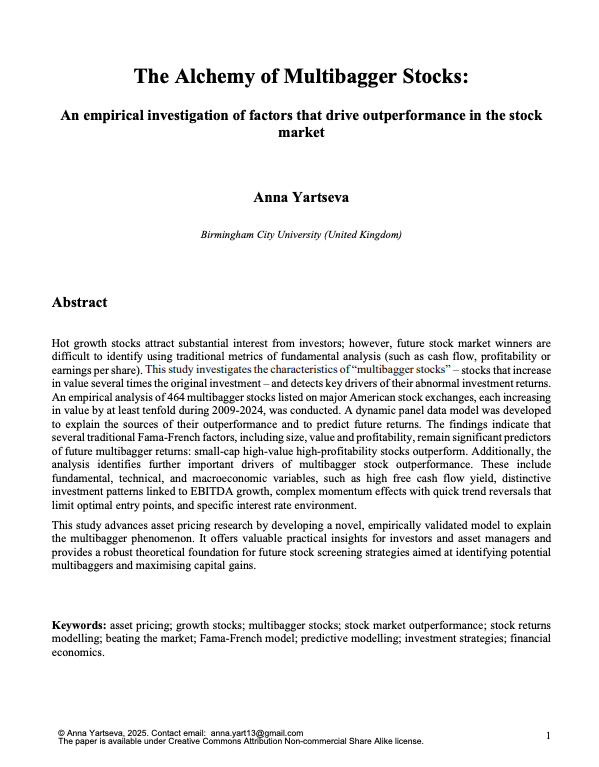

1. Size Effect

1. Size Effect

1. What is finvizfinance?

1. What is finvizfinance?

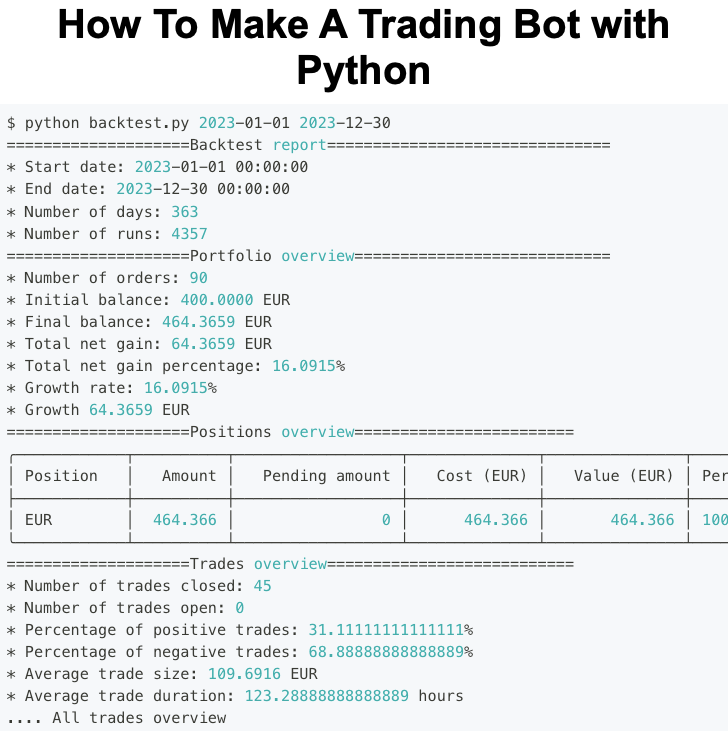

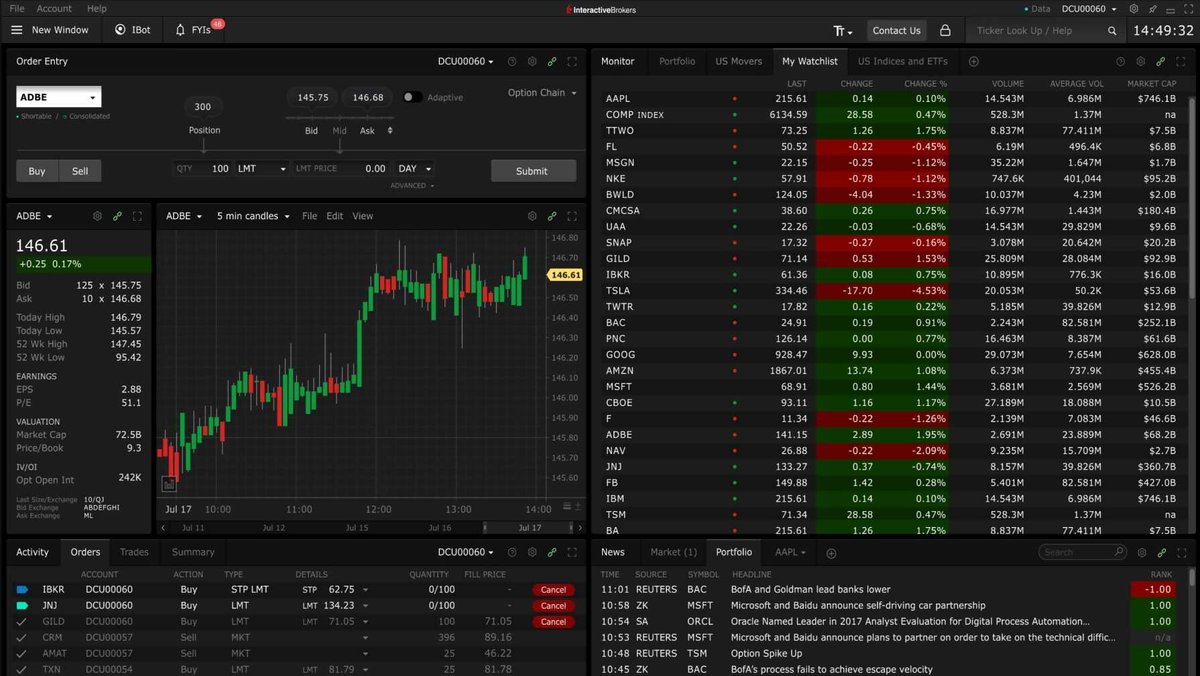

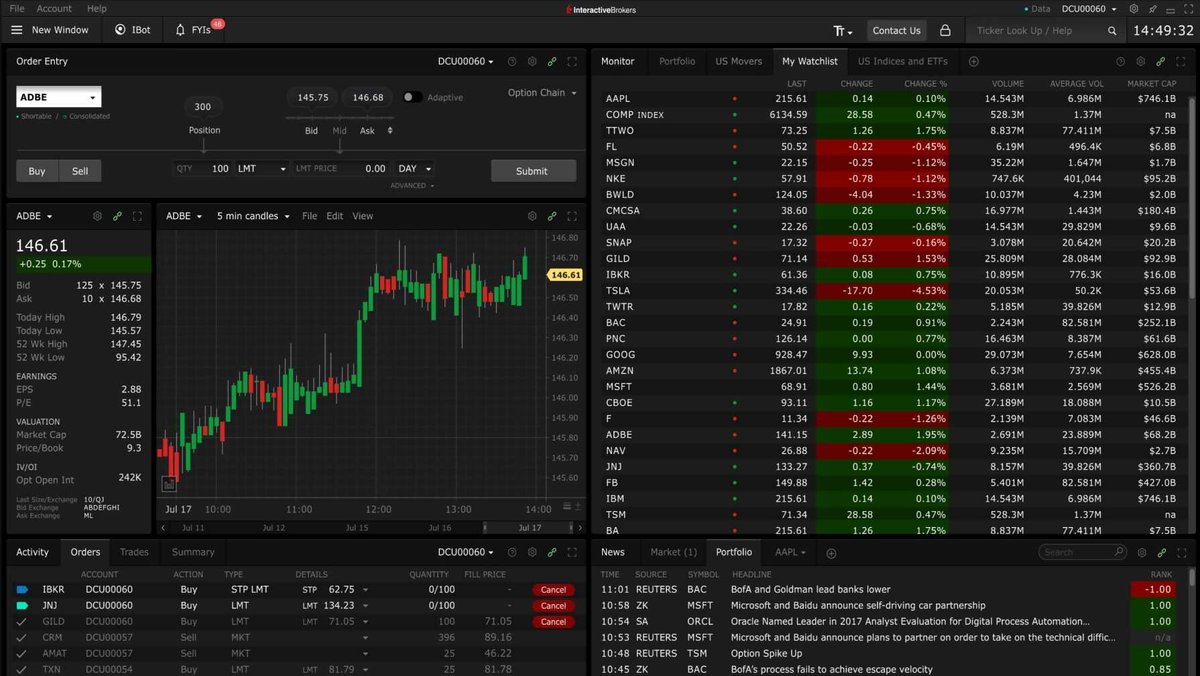

1. What is a trading bot?

1. What is a trading bot?

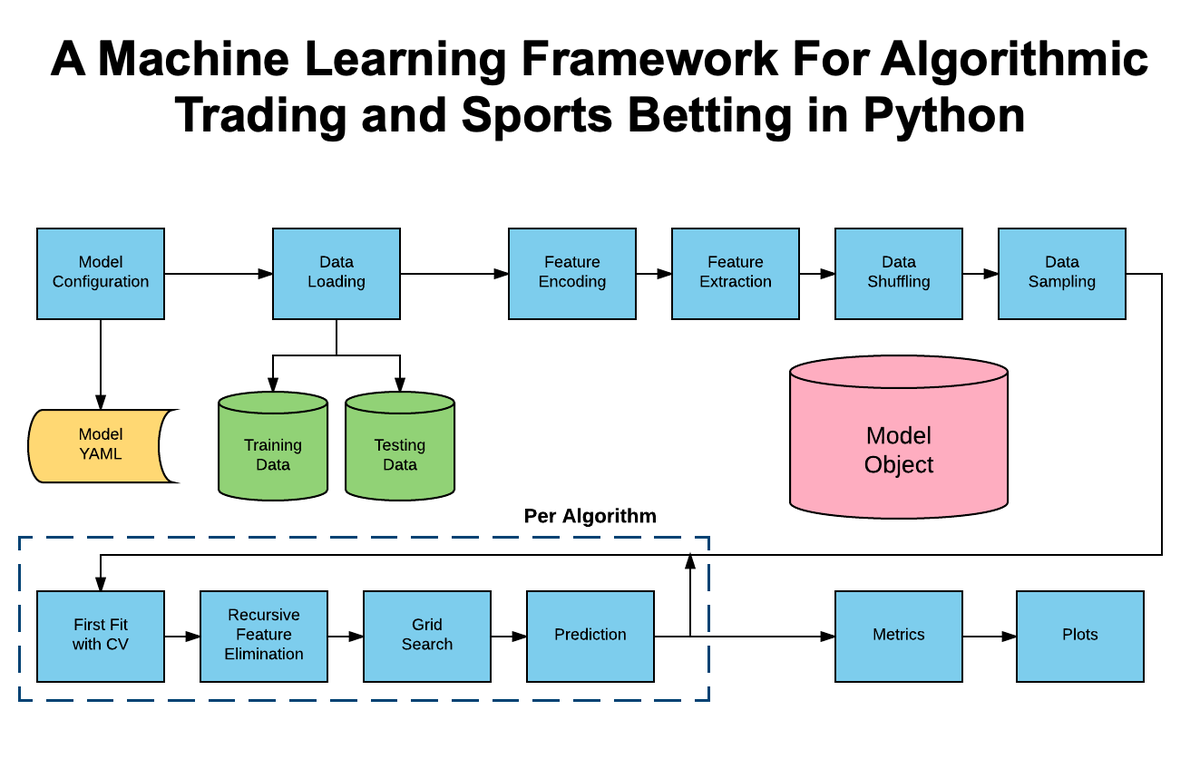

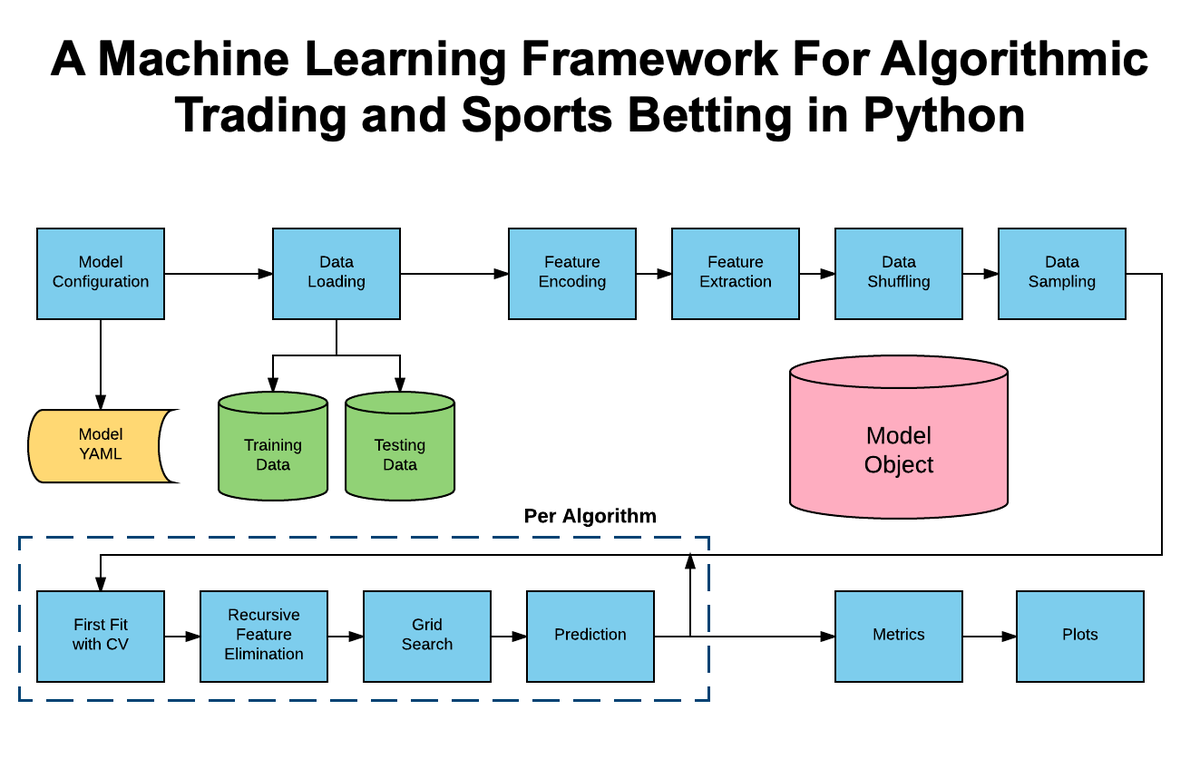

AlphaPy is a machine learning framework for both speculators and data scientists.

AlphaPy is a machine learning framework for both speculators and data scientists.

This strategy takes advantage of "flow effects", which is how certain points in time influence the value of an asset.

This strategy takes advantage of "flow effects", which is how certain points in time influence the value of an asset.

yfinance

yfinance

1. Size Effect

1. Size Effect