The decline is accelerating:

Nasdaq 100 futures are now down -330 POINTS since the market opened just hours ago as DeepSeek takes #1 on the App Store.

This is how you know DeepSeek has become a major threat to US large cap tech.

The stock market does not lie.

(a thread)

Nasdaq 100 futures are now down -330 POINTS since the market opened just hours ago as DeepSeek takes #1 on the App Store.

This is how you know DeepSeek has become a major threat to US large cap tech.

The stock market does not lie.

(a thread)

For some background, DeepSeek is a Chinese AI startup that appears to have spawned out of nowhere.

It competes with ChatGPT and cost less than $10 million to develop.

It was developed with chips that are considered to be FAR less advanced than those used by US AI companies.

It competes with ChatGPT and cost less than $10 million to develop.

It was developed with chips that are considered to be FAR less advanced than those used by US AI companies.

Users have run multiple benchmarks between DeepSeek and ChatGPT.

In many categories, DeepSeek is actually outperforming ChatGPT.

For a product that was developed in a matter of months, this is incredible.

Is large cap tech in the US losing its dominance?

In many categories, DeepSeek is actually outperforming ChatGPT.

For a product that was developed in a matter of months, this is incredible.

Is large cap tech in the US losing its dominance?

To put this into perspective, OpenAI, the parent company of ChatGPT, has raised $17.9 BILLION in capital over 10 rounds.

The company was valued at ~$157 BILLION in October 2024.

OpenAI has ~22 TIMES more employees than DeepSeek.

This is why markets have been blindsided.

The company was valued at ~$157 BILLION in October 2024.

OpenAI has ~22 TIMES more employees than DeepSeek.

This is why markets have been blindsided.

As seen below, DeepSeek is now a top performer in AIME, MATH-500, and GPQA benchmarks.

ChatGPT still excels in coding benchmarks, but the gap is narrowing.

The speed at which DeepSeek was developed has proven that US AI dominance is at risk.

ChatGPT still excels in coding benchmarks, but the gap is narrowing.

The speed at which DeepSeek was developed has proven that US AI dominance is at risk.

On top of this, DeepSeek has become the #1 downloaded free app on the App Store.

Users are reporting that API experience is user-friendly, rate limits are not an issue, and it is likely to be integrated in agentic AI.

Agentic AI is what Nvidia said is the next big thing.

Users are reporting that API experience is user-friendly, rate limits are not an issue, and it is likely to be integrated in agentic AI.

Agentic AI is what Nvidia said is the next big thing.

It gets even better; DeepSeek is ~96% CHEAPER than ChatGPT.

- Cost of OpenAI o1: $60.00 per 1M output tokens

- Cost of DeepSeek R1: $2.19 per 1M output tokens

DeepSeek R1 is 100% Opensource and a fraction of the cost of ChatGPT.

- Cost of OpenAI o1: $60.00 per 1M output tokens

- Cost of DeepSeek R1: $2.19 per 1M output tokens

DeepSeek R1 is 100% Opensource and a fraction of the cost of ChatGPT.

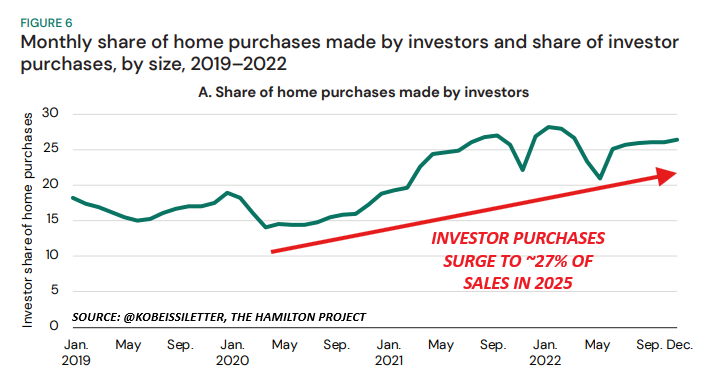

Needless to say, investors in large-cap US tech are worried.

The Magnificent 7 stocks are trading ~2 standard deviations above levels seen in 2001 compared to global equities.

Much of the bull market over the last 2 years has been on the basis of AI hardware and software.

The Magnificent 7 stocks are trading ~2 standard deviations above levels seen in 2001 compared to global equities.

Much of the bull market over the last 2 years has been on the basis of AI hardware and software.

On Friday, we posted the below alert for our premium members.

We took shorts as the S&P 500 hit 6122 and called for a sharp reversal.

Now, those shorts are up nearly +70 POINTS in hours.

This market is incredible.

Access our alerts at the link below:

thekobeissiletter.com/subscribe

We took shorts as the S&P 500 hit 6122 and called for a sharp reversal.

Now, those shorts are up nearly +70 POINTS in hours.

This market is incredible.

Access our alerts at the link below:

thekobeissiletter.com/subscribe

This explains the severe underperformance seen in Nasdaq futures at the open just 2 hours ago.

The Nasdaq is currently down DOUBLE as much as the S&P 500.

US equity markets are on track to erase over $1 trillion of market cap during Monday's session.

The Nasdaq is currently down DOUBLE as much as the S&P 500.

US equity markets are on track to erase over $1 trillion of market cap during Monday's session.

This all comes as the Magnificent 7 now reflects a record 34% of the S&P 500.

These companies have added $5 TRILLION in market value since the beginning of last year.

These 5 stocks are worth now nearly as much as China and Hong Kong's stock markets COMBINED.

These companies have added $5 TRILLION in market value since the beginning of last year.

These 5 stocks are worth now nearly as much as China and Hong Kong's stock markets COMBINED.

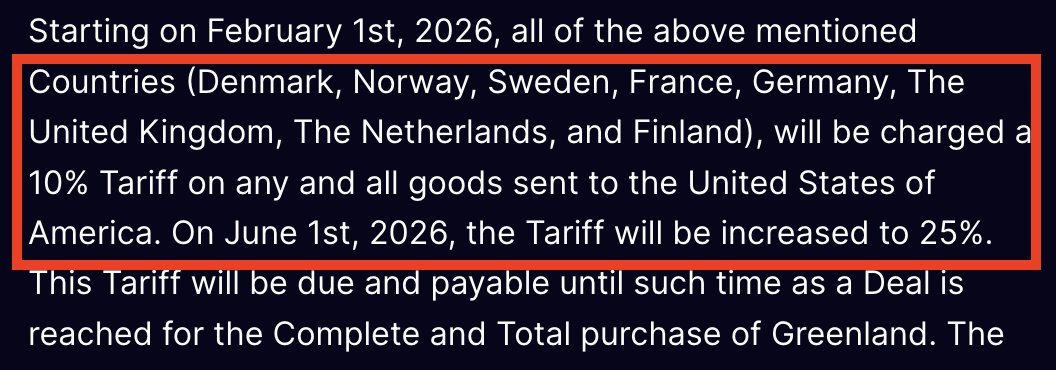

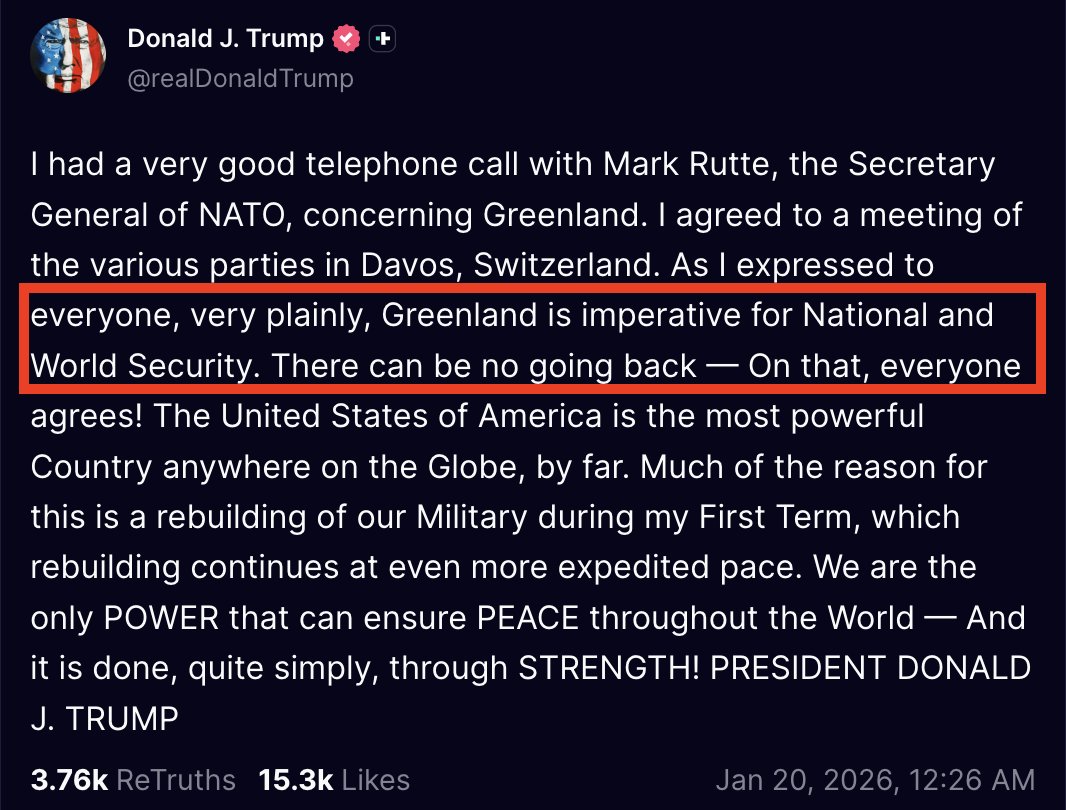

On top of the threat to US tech dominance, we are seeing trade wars escalate with new tariffs beginning.

As volatility spikes, we are trading the swings in the market.

Subscribe now at the link below to access our premium analysis and alerts:

thekobeissiletter.com/subscribe

As volatility spikes, we are trading the swings in the market.

Subscribe now at the link below to access our premium analysis and alerts:

thekobeissiletter.com/subscribe

This all comes after President Trump announced The Stargate Project, a $500 BILLION investment in AI in the US.

If DeepSeek is able to develop AI at less than 1% of the cost, is $500 billion even needed?

Follow us @KobeissiLetter for real time analysis as this develops.

If DeepSeek is able to develop AI at less than 1% of the cost, is $500 billion even needed?

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh