🚨 NGO / GOVERNMENT GRANT TRACKING TOOL 🚨

🔍 FOLLOW THE GRANTS: CONNECT NGOs TO YOUR TAX DOLLARS 💵

Ever wonder exactly which government grants fund nonprofits? Now you can know—because I’ve cracked the code.

Unlike older tools that only sift through nonprofit 990s (which don’t directly show government dollars), I’ve mined the USASpending database to create fuzzy matches between nonprofits and their linked government grants.

All grants are active. All grants are ongoing.

Here’s what this tool can do:

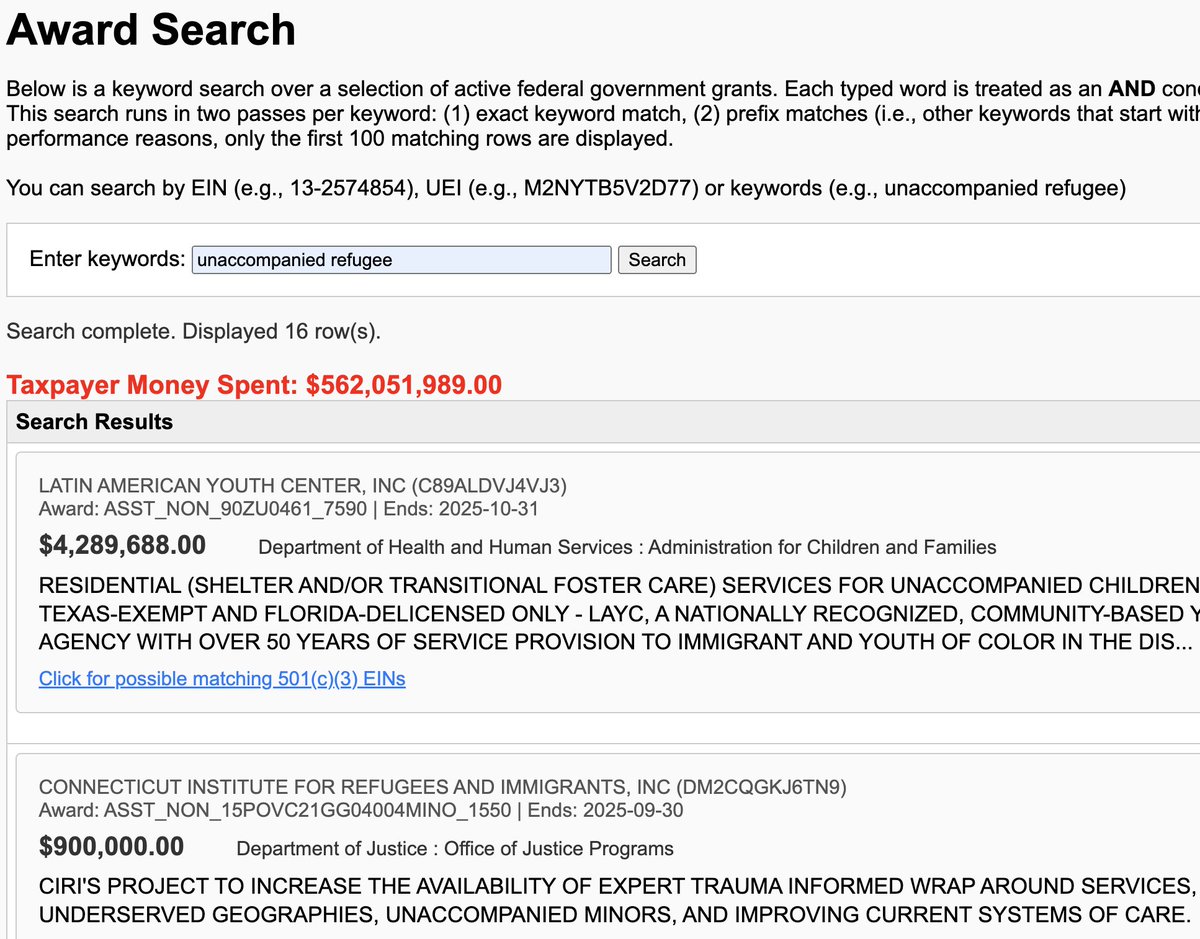

✅ Search by EIN, Keywords, UEI, or Recipient Name: Zero in on the nonprofit or grant you want to investigate.

✅ View the Award ID & Funding Agency: See where the money came from—and how much.

✅ Dollar Amounts Matched to EINs: Transparent numbers, no guesswork.

✅ Location-Based Matching: Only UEIs and grants with address matches to nonprofits are included.

This means you can now trace your tax dollars with precision—from the grant to the nonprofit and back to the government agency funding it.

💡 If you're an advocate, watchdog, or just curious about accountability, this tool will empower you to dig deeper than ever before.

Ready to see how government money flows? Try it now and uncover the truth.

⚠️ Heads-up: It’s data-heavy, but I made it as efficient as possible. Link below! 👇

🔍 FOLLOW THE GRANTS: CONNECT NGOs TO YOUR TAX DOLLARS 💵

Ever wonder exactly which government grants fund nonprofits? Now you can know—because I’ve cracked the code.

Unlike older tools that only sift through nonprofit 990s (which don’t directly show government dollars), I’ve mined the USASpending database to create fuzzy matches between nonprofits and their linked government grants.

All grants are active. All grants are ongoing.

Here’s what this tool can do:

✅ Search by EIN, Keywords, UEI, or Recipient Name: Zero in on the nonprofit or grant you want to investigate.

✅ View the Award ID & Funding Agency: See where the money came from—and how much.

✅ Dollar Amounts Matched to EINs: Transparent numbers, no guesswork.

✅ Location-Based Matching: Only UEIs and grants with address matches to nonprofits are included.

This means you can now trace your tax dollars with precision—from the grant to the nonprofit and back to the government agency funding it.

💡 If you're an advocate, watchdog, or just curious about accountability, this tool will empower you to dig deeper than ever before.

Ready to see how government money flows? Try it now and uncover the truth.

⚠️ Heads-up: It’s data-heavy, but I made it as efficient as possible. Link below! 👇

Here's the link: joeisdone.github.io/award_search/

Hey @TheRabbitHole84 - pinging you as requested.

Don't forget to check out the other accompanying tools:

501(c)(3) search: joeisdone.github.io/nonprofit

501(c)(3) search: joeisdone.github.io/nonprofit

Grant diagram network:

joeisdone.github.io/expose/

joeisdone.github.io/expose/

Please consider subscribing on X or Substack to support efforts! Completely and 100% voluntary.

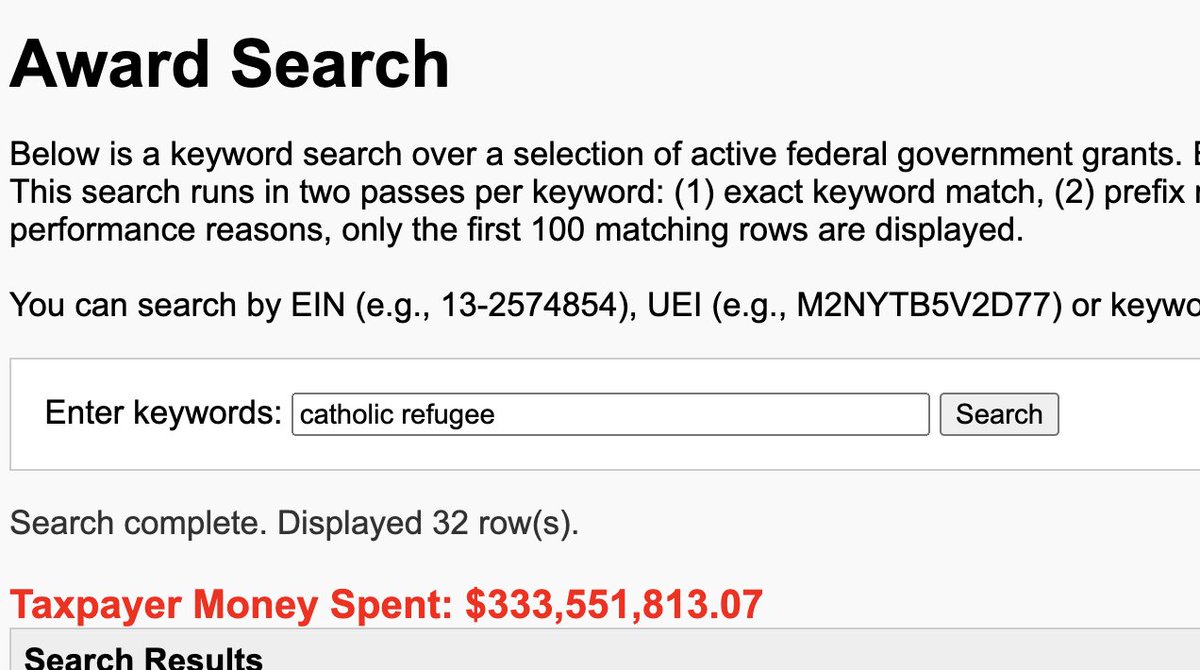

I pushed in a re-indexing that will boost large grant amounts to the top. So do a browser refresh and try searching for a keyword like "refugee" and be even more enraged.

FYI - what makes this tool different from USASpending or other search tools is that I built a multi-layer reverse index specifically over the awards description, keywords, etc. This greatly speeds up text search by a factor of like 99%. Not what PostgreSQL is designed to do.

• • •

Missing some Tweet in this thread? You can try to

force a refresh