I'm just a tool builder. • Elon Musk - “Worth following” • Charlie Kirk - “You're a must follow” • Contact: datarepublicanx@proton.me • Substack: datarepublican

223 subscribers

How to get URL link on X (Twitter) App

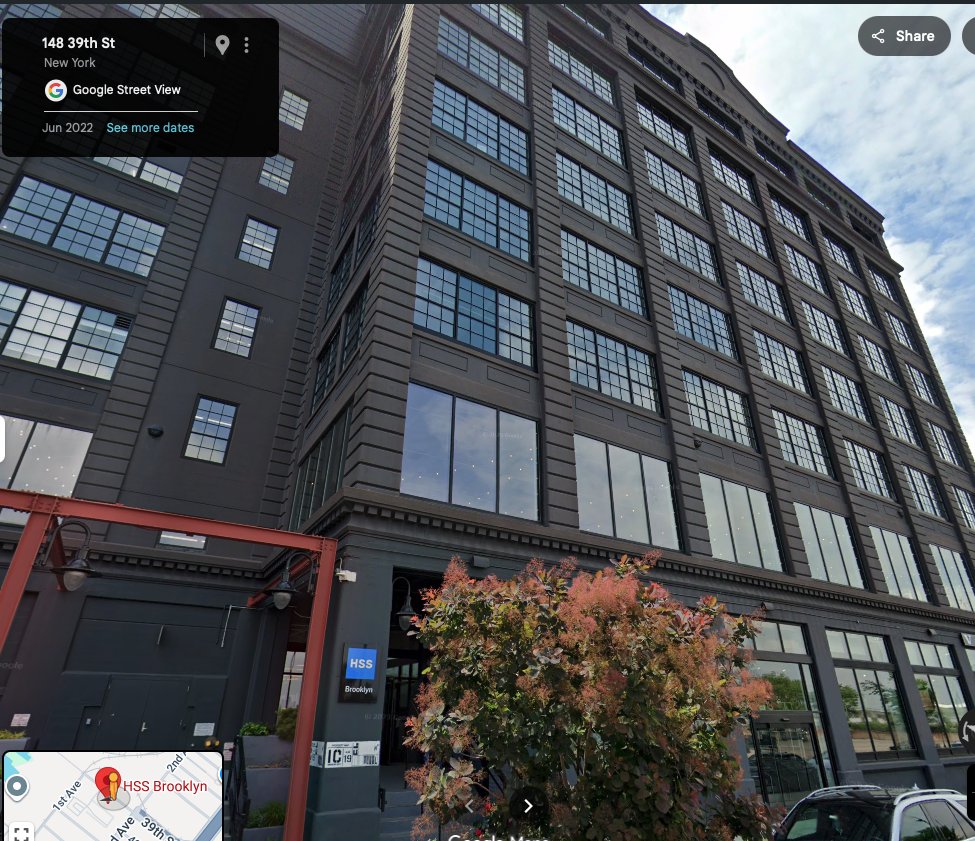

Case study NPI 1396051694: AssistCareHome Healthcare Services at 148 39th Street Building 19, 4th Floor.

Case study NPI 1396051694: AssistCareHome Healthcare Services at 148 39th Street Building 19, 4th Floor.

Here's the timeline.

Here's the timeline.

The DSA is a socialist political organization in the United States that operates alongside communist and other left-revolutionary currents. Once a candidate is endorsed, DSA chapters often mobilize substantial organizational support, including coordinated volunteer efforts, fundraising, and campaign infrastructure.

The DSA is a socialist political organization in the United States that operates alongside communist and other left-revolutionary currents. Once a candidate is endorsed, DSA chapters often mobilize substantial organizational support, including coordinated volunteer efforts, fundraising, and campaign infrastructure.

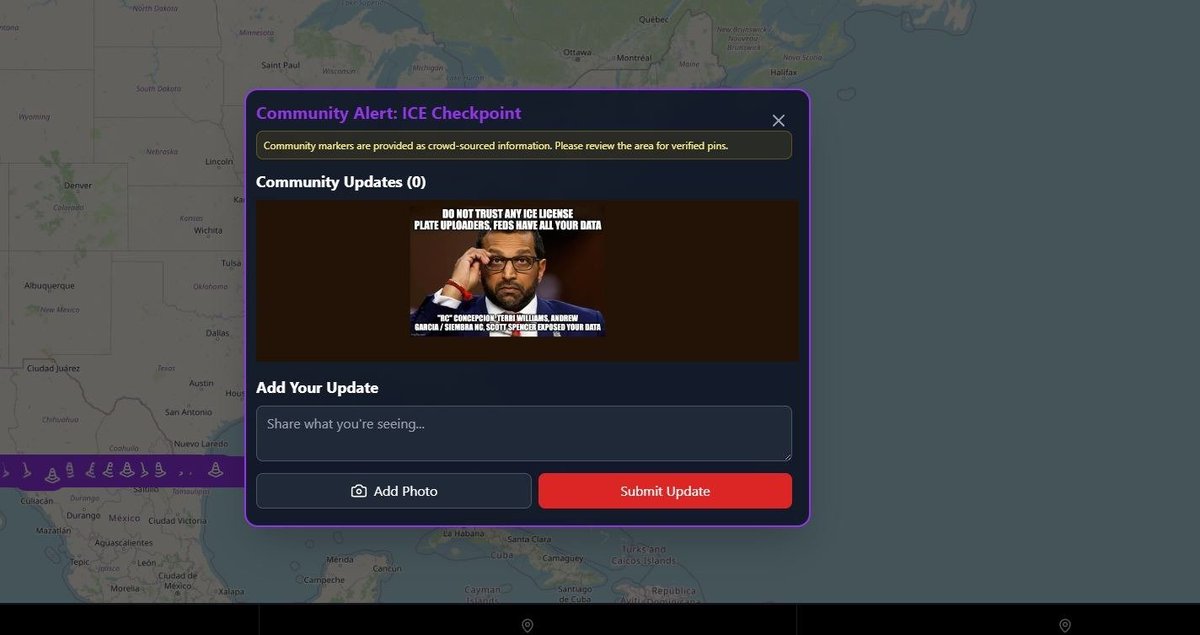

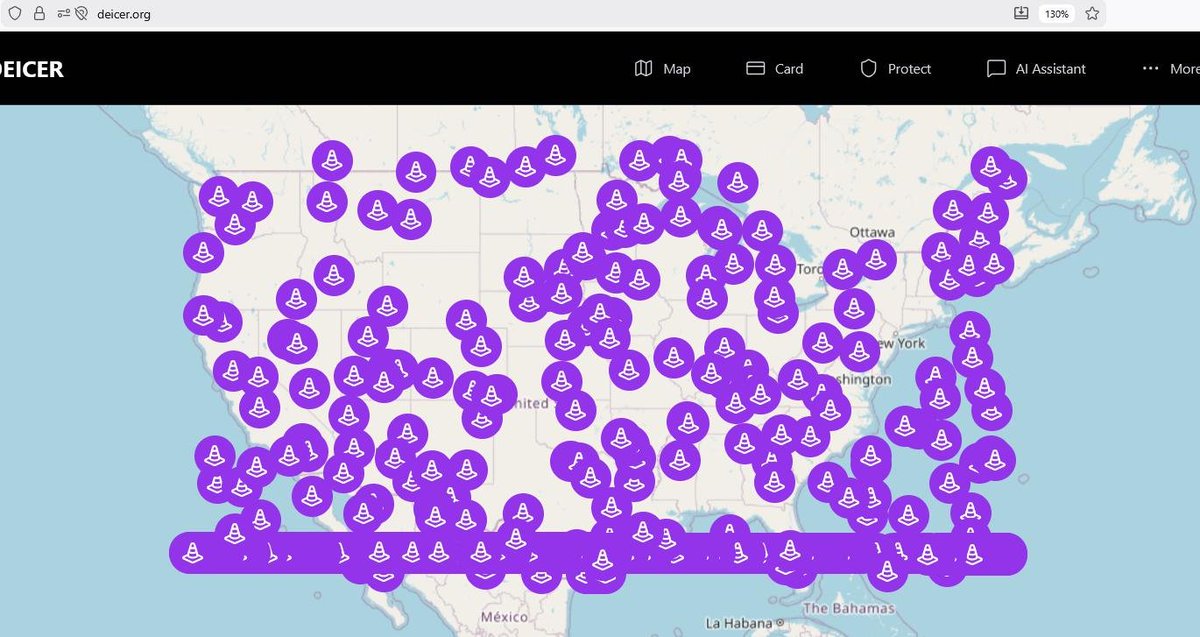

2,044 push notifications have been sent to the users of Ojo Obrero and Gyrelabs.

2,044 push notifications have been sent to the users of Ojo Obrero and Gyrelabs.

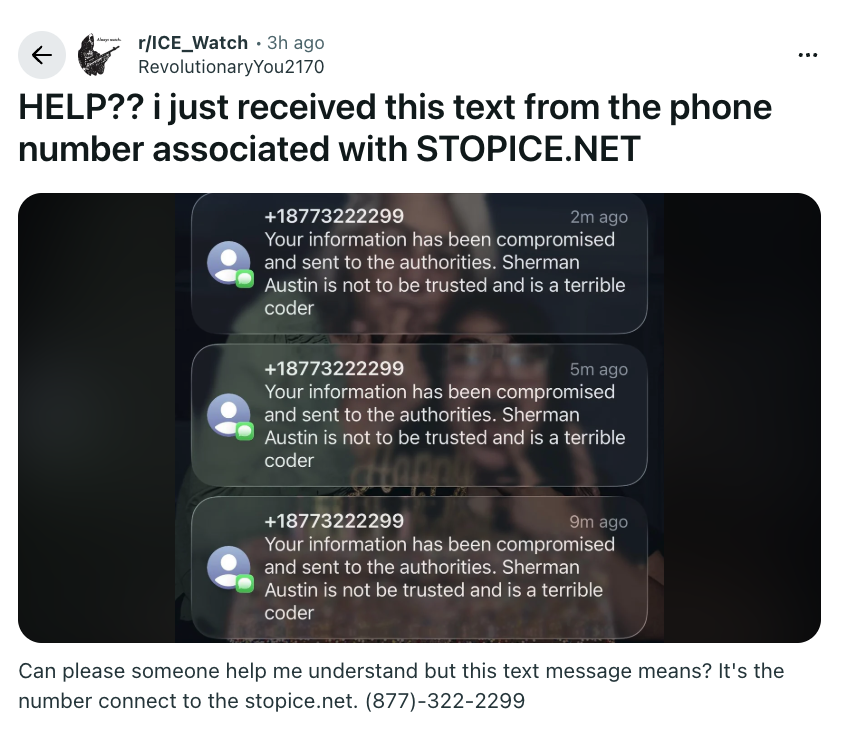

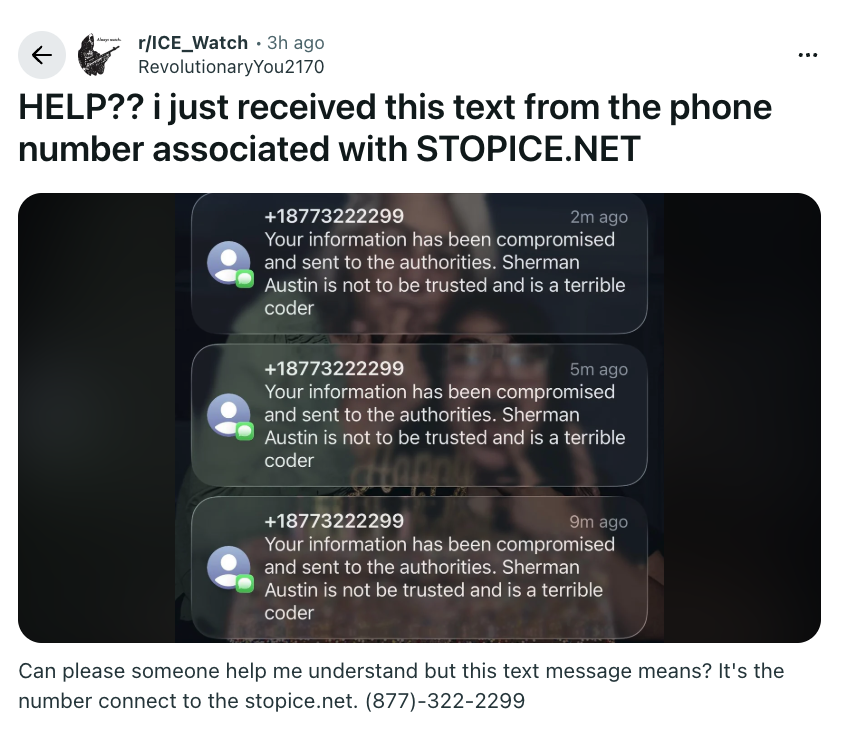

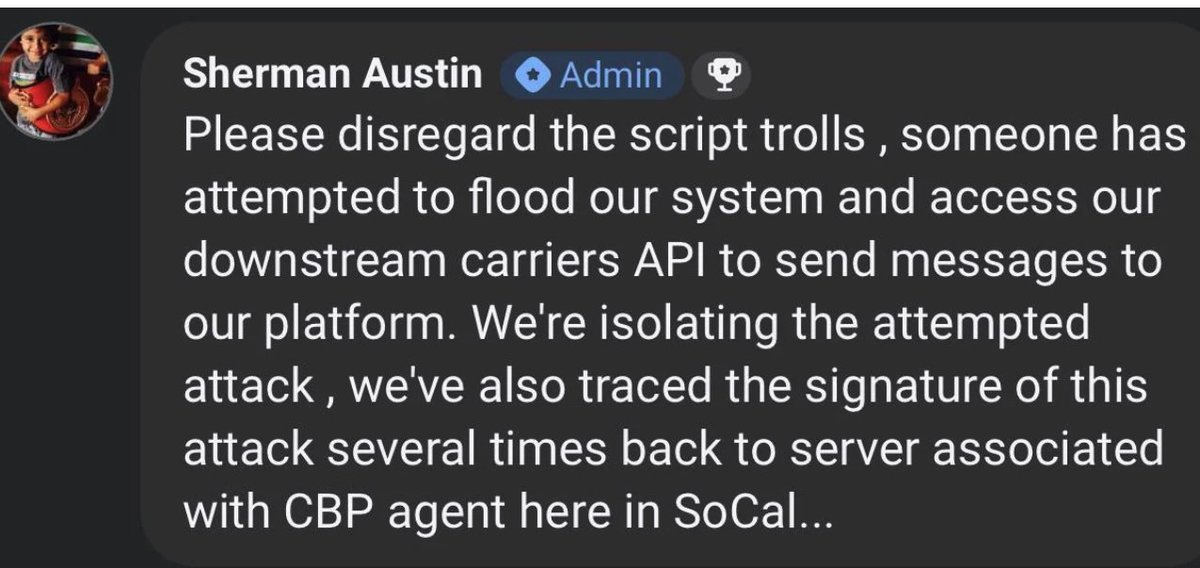

Holy crap what a piece of 💩 that Sherman Austin is. Lying to his users outright like that.

Holy crap what a piece of 💩 that Sherman Austin is. Lying to his users outright like that.

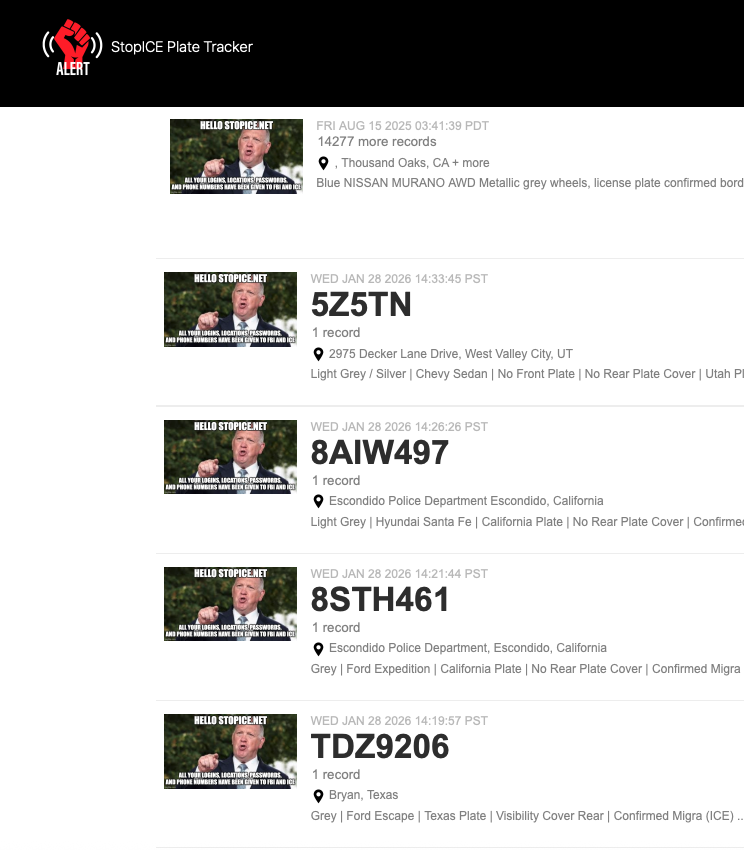

This is in plain sight: stopice.net/login/data/tem…

This is in plain sight: stopice.net/login/data/tem…

Download for yourself! Consider subscribing to me if you want to support my efforts here.

Download for yourself! Consider subscribing to me if you want to support my efforts here.

https://twitter.com/SmartMaticEng/status/2011904692549476628I mean...

https://x.com/DataRepublican/status/1987352865711747329If you don't believe me - let's go to Rachel Kleinfeld. She is perhaps the most credentialed expert with NED:

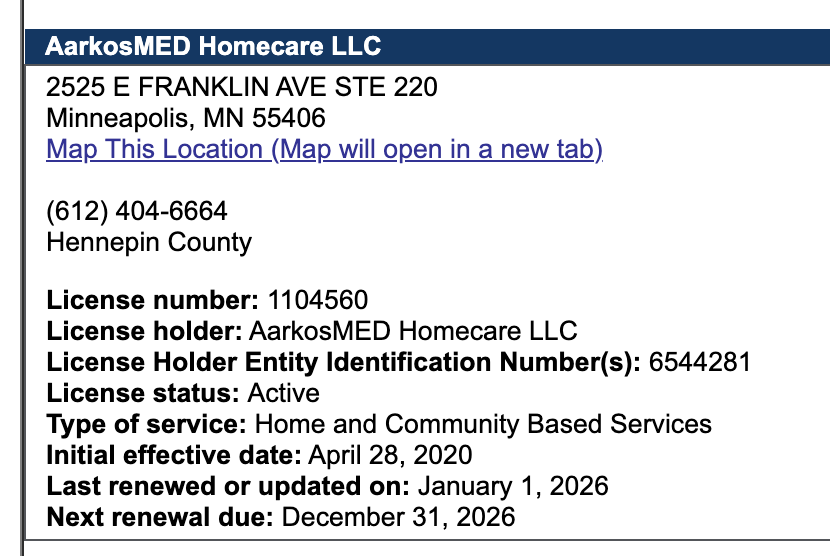

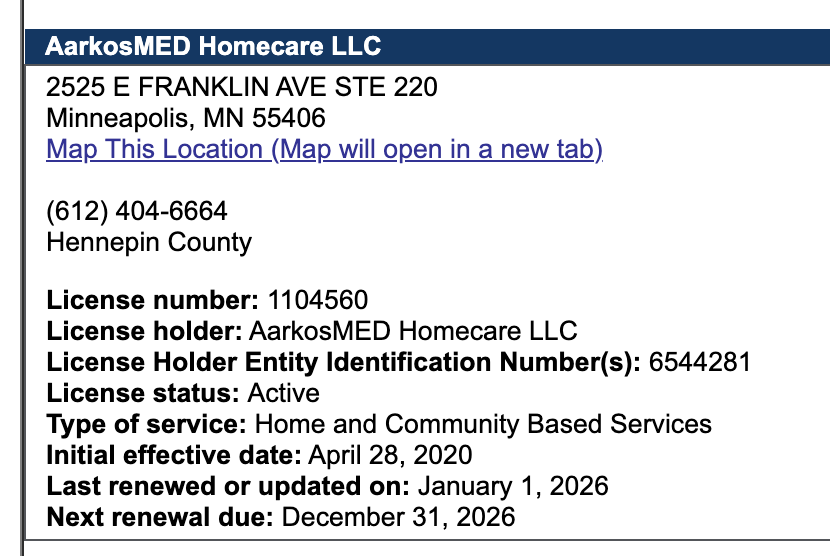

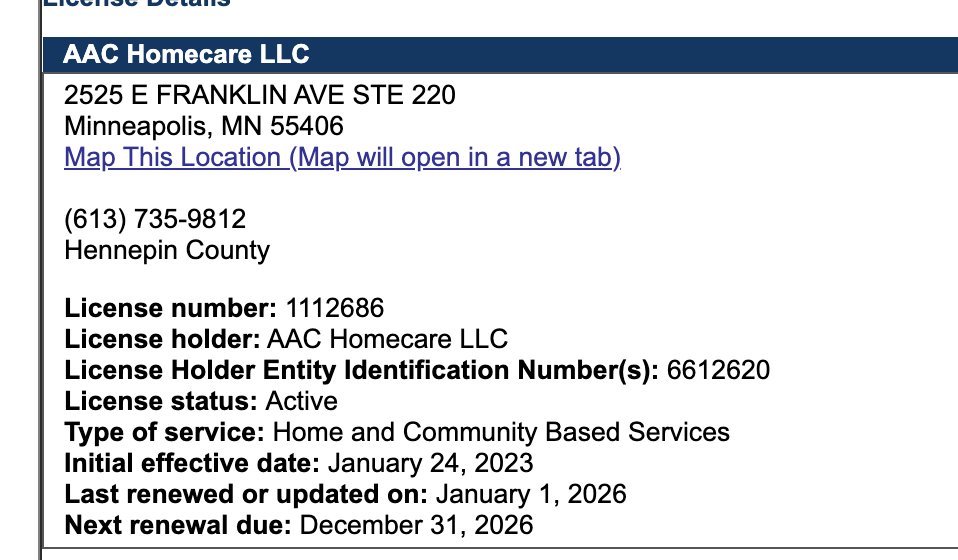

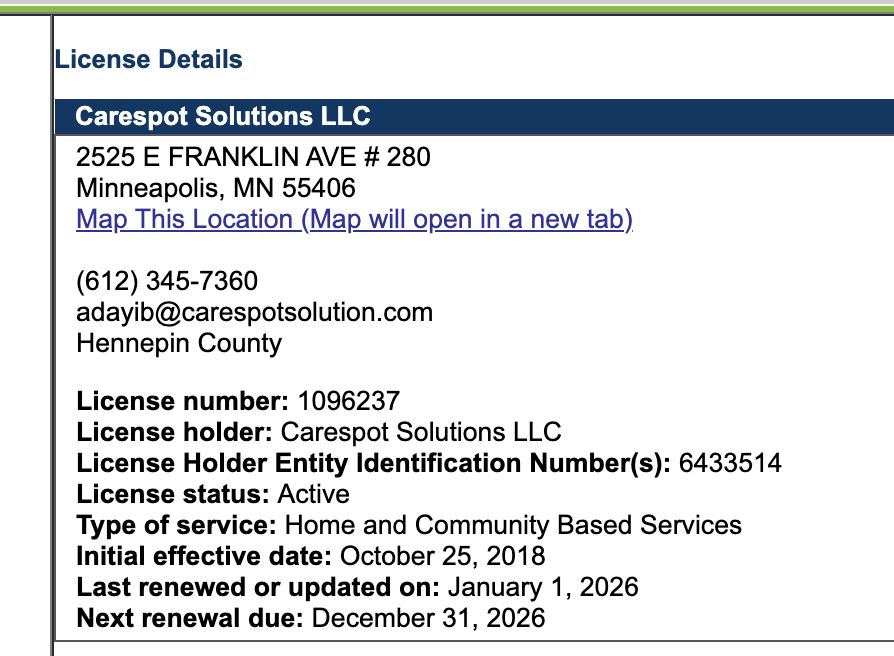

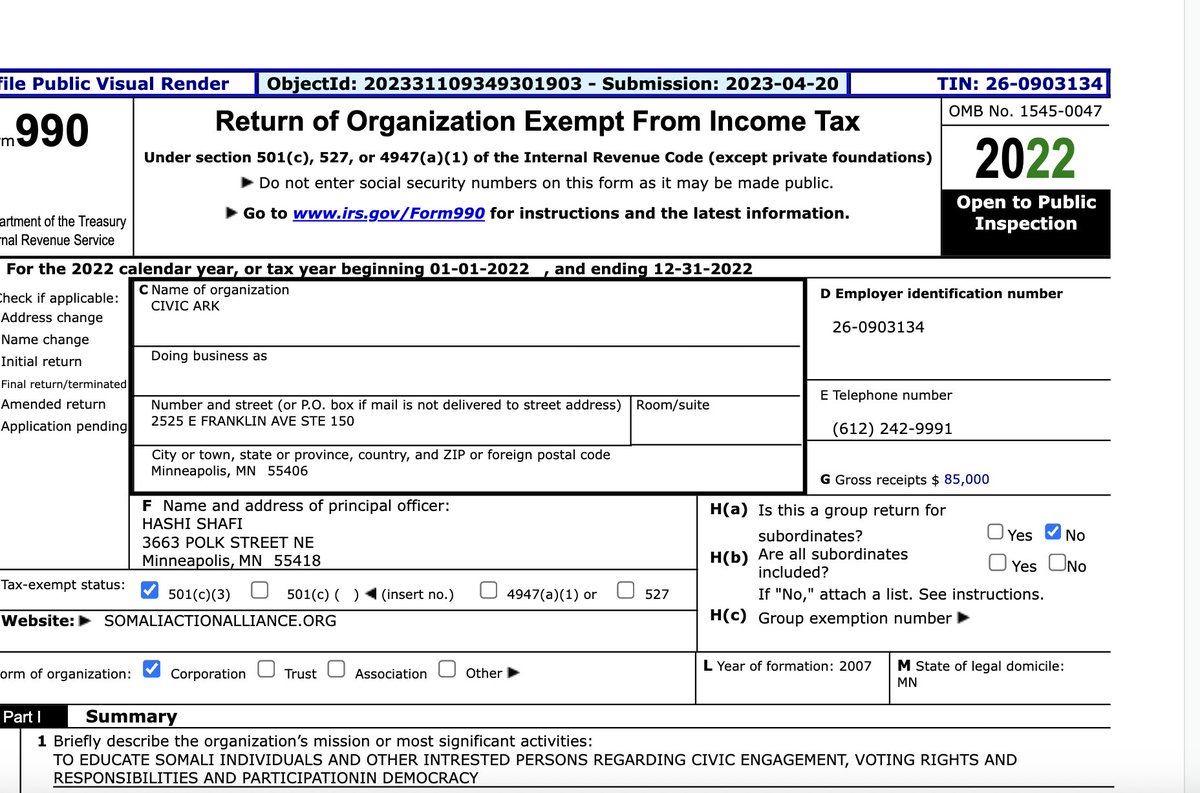

Carespot Inc is also at 2525 E Franklin Ave #280, which is the same location as Civic Ark (EIN 260903134, a Somalian "democracy" NGO) back in 2019. Interestingly, Carespot also originally was registered at being at Suite 150 rather than 280, which is where Civic Ark is now currently located.

Carespot Inc is also at 2525 E Franklin Ave #280, which is the same location as Civic Ark (EIN 260903134, a Somalian "democracy" NGO) back in 2019. Interestingly, Carespot also originally was registered at being at Suite 150 rather than 280, which is where Civic Ark is now currently located.

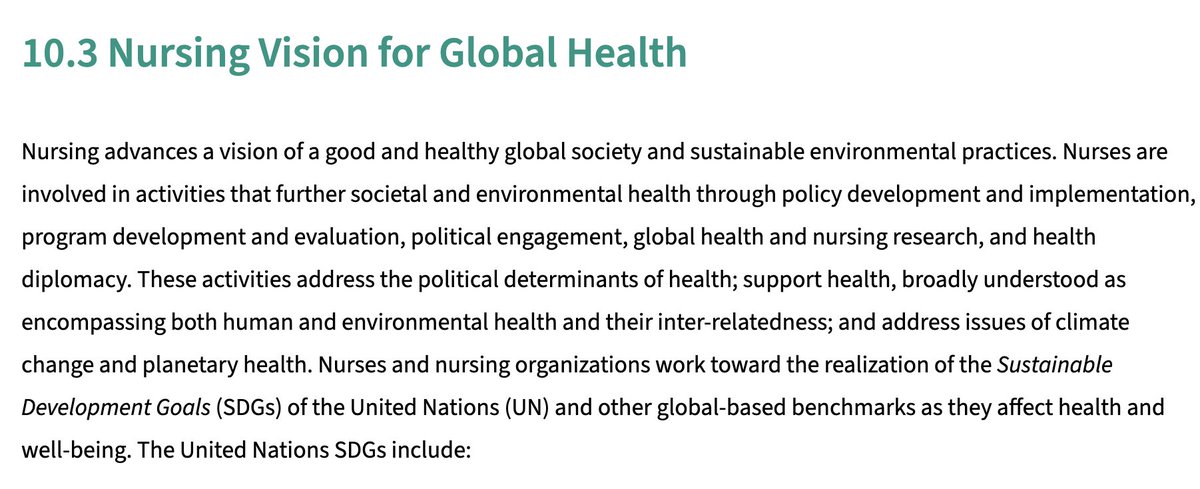

American Nursing Association (ANA) -- representing over 4 million members, states in their 2025 Code of Ethics that "Nurses and nursing organizations work toward the realization of the Sustainable Development Goals (SDGs) of the United Nations (UN)"

American Nursing Association (ANA) -- representing over 4 million members, states in their 2025 Code of Ethics that "Nurses and nursing organizations work toward the realization of the Sustainable Development Goals (SDGs) of the United Nations (UN)"

@elonmusk @ncri_io You can download the breaking report here: networkcontagion.us/reports/americ…

@elonmusk @ncri_io You can download the breaking report here: networkcontagion.us/reports/americ…

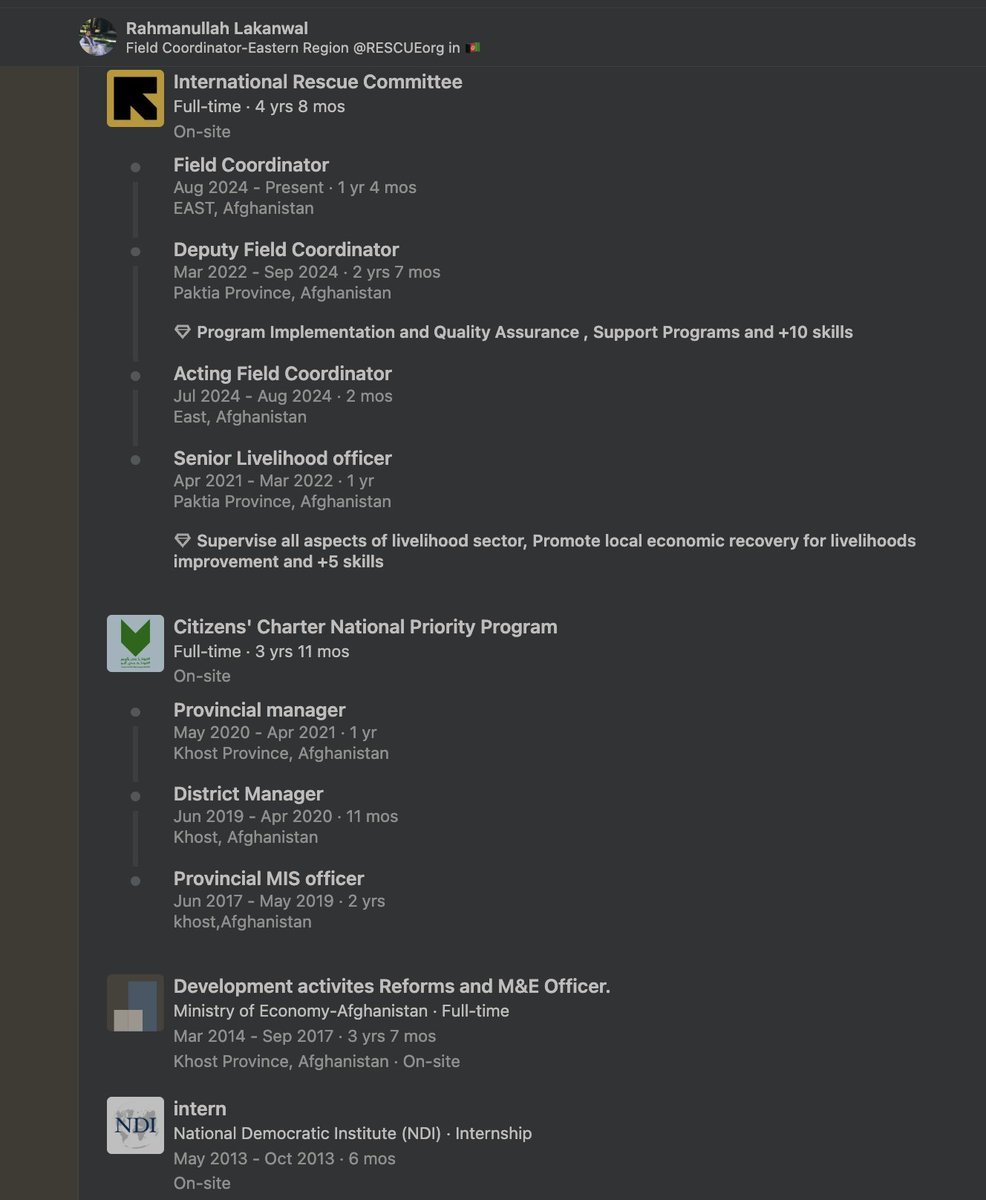

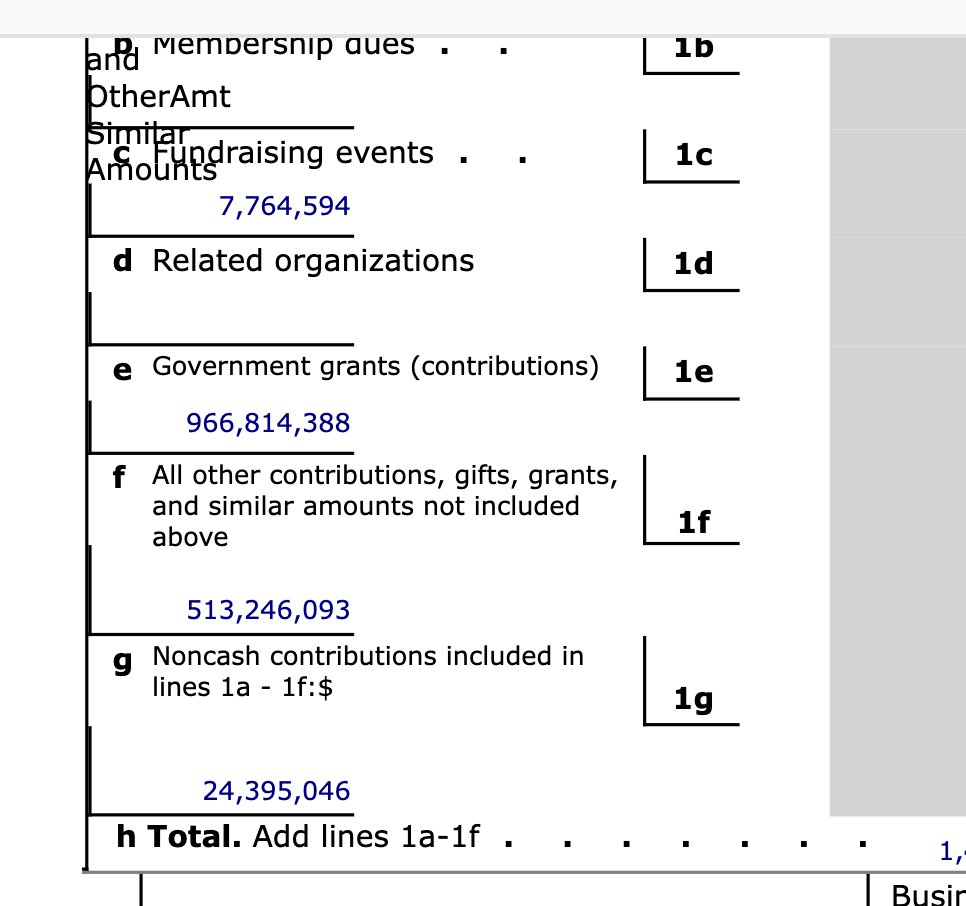

The first thing that jumps out when analyzing the IRC is its government grants. Out of its nearly 1.5 billion dollars, it has nearly a billion in grants. Their USAID grant in Afghanistan went towards "Accessible and Quality Basic Education (AQBE) Activity."

The first thing that jumps out when analyzing the IRC is its government grants. Out of its nearly 1.5 billion dollars, it has nearly a billion in grants. Their USAID grant in Afghanistan went towards "Accessible and Quality Basic Education (AQBE) Activity."

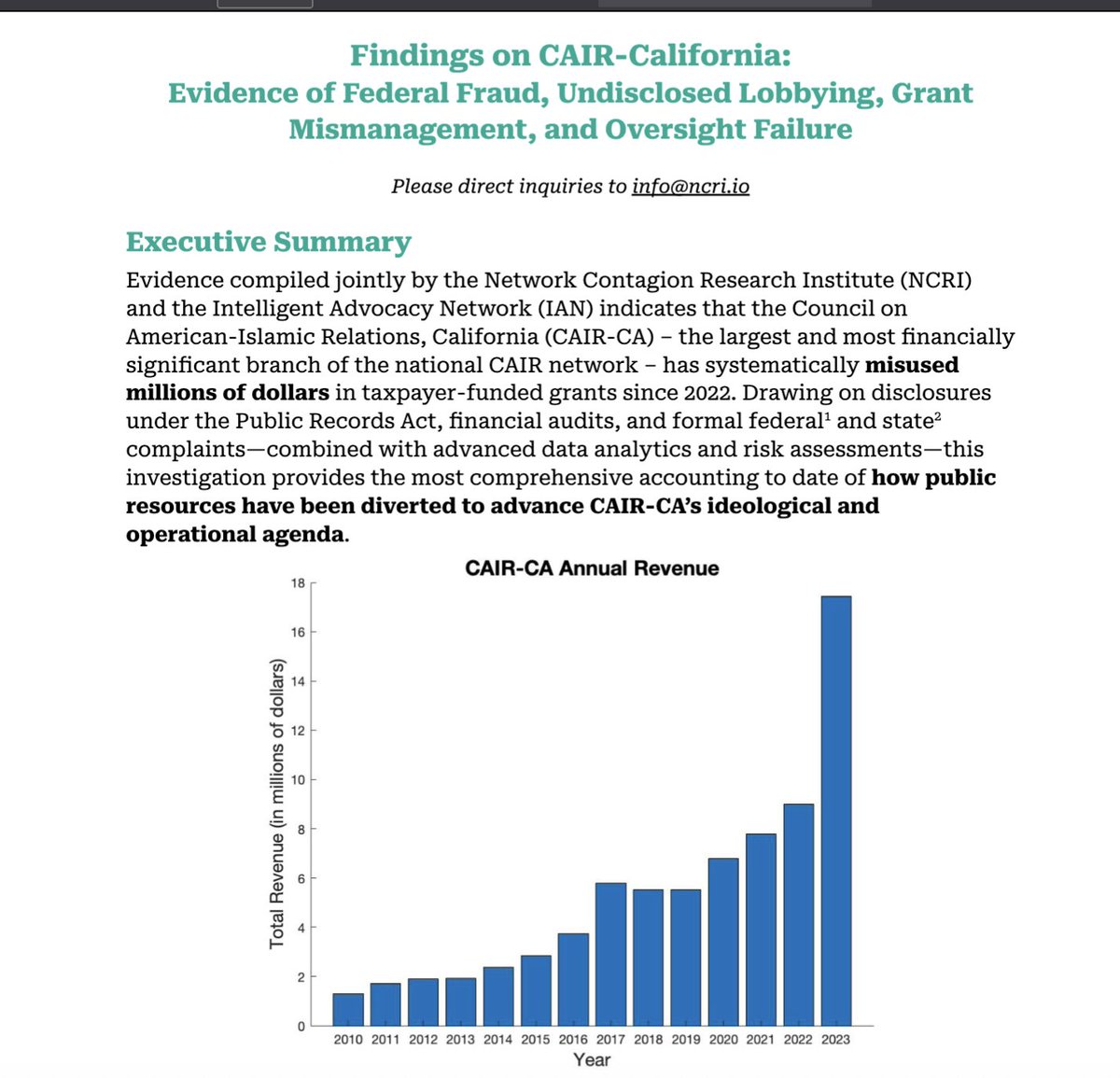

The report opens with a startling claim - that CAIR-CA has abused millions of dollars.

The report opens with a startling claim - that CAIR-CA has abused millions of dollars.

https://twitter.com/NatalieforUtah/status/1989350816176890069This is the project that Ermiya Fanaeian of SLC Armed Queers allegedly helped define.

https://x.com/DataRepublican/status/1967821704438354295

Here's a prior thread on the master coup.

Here's a prior thread on the master coup. https://x.com/DataRepublican/status/1987550101703909532

He loves the kids so much.

He loves the kids so much.

https://x.com/DataRepublican/status/1986304148367941912