Alright, let's talk about BERA incentive math for Boyco, since there's clearly a lot of confusion and misinformation getting spread.

I'll talk through some of the model, the design decisions for Boyco incentives, and a bunch of common questions & misconceptions.

I'll talk through some of the model, the design decisions for Boyco incentives, and a bunch of common questions & misconceptions.

https://twitter.com/NewPaguinfo/status/1884874548602102059

Let's first talk about what Boyco actually is -

Yes, it's a pre-deposit program.

Yes, it's a way to get liquidity into dApps.

It's also a giant game of chicken, due to the depositor's inability to withdraw until the expiration of the markets & variable rate markets.

Yes, it's a pre-deposit program.

Yes, it's a way to get liquidity into dApps.

It's also a giant game of chicken, due to the depositor's inability to withdraw until the expiration of the markets & variable rate markets.

Because of this, the game-theory optimal move for many folks (especially large funds & whales) is to wait as late as possible to deploy. This allows them to see where rates settle on a per-market basis, and then make the best yield decision.

So, expect Sunday to get crazy.

So, expect Sunday to get crazy.

Let's start with some common points of concern:

1/ Third Party Deposits are 15x higher than Major Deposits!

For the reason I mentioned above, major deposits will come in primarily on Sunday. Until we see where major TVL ends up, it's far too early to say that things are imbalanced. If 10 figures of majors come in on Sunday, things will look significantly more normalized.

1/ Third Party Deposits are 15x higher than Major Deposits!

For the reason I mentioned above, major deposits will come in primarily on Sunday. Until we see where major TVL ends up, it's far too early to say that things are imbalanced. If 10 figures of majors come in on Sunday, things will look significantly more normalized.

1 cont/ on top of this, for the sake of simplicity, we counted 100% of pre-pre deposit allocations as third-party/hybrid. That's not necessarily true. In fact, some vaults like Stakestone will be supplying some of their wBTC/wETH into Major markets.

It's impossible to know the exact breakdown until vaults allocate into their Boyco markets.

It's impossible to know the exact breakdown until vaults allocate into their Boyco markets.

2/ StakeStone vault has depegged!

No, it hasn't. It never expected to maintain peg. A three month locked asset will not trade at par with the underlying unlocked. This is basically how TBills work. It's a liquid receipt token.

No, it hasn't. It never expected to maintain peg. A three month locked asset will not trade at par with the underlying unlocked. This is basically how TBills work. It's a liquid receipt token.

3/ Berachain doesn't have withdrawals to trap you!

No, it's because we wanted to keep everything on-chain. For Boyco, depositing into a market adds a leaf to the Merkle Tree that's used to process withdrawals. It's difficult to go back rows to remove a deposit leaf, so we are forced to lock on deposit.

That's why we made it very clear on deposit that there are no withdrawals.

No, it's because we wanted to keep everything on-chain. For Boyco, depositing into a market adds a leaf to the Merkle Tree that's used to process withdrawals. It's difficult to go back rows to remove a deposit leaf, so we are forced to lock on deposit.

That's why we made it very clear on deposit that there are no withdrawals.

4/ Why did they break things out into buckets?

I explain this in-depth in this tweet:

But in the next couple tweets, I'll give folks a sneak peek behind the modeling that went into Boyco, and how we arrived at this framework.

I explain this in-depth in this tweet:

But in the next couple tweets, I'll give folks a sneak peek behind the modeling that went into Boyco, and how we arrived at this framework.

https://x.com/capnjackbearow/status/1884669594620838006

4 cont/ This also isn't new- Even a month ago I mentioned both that there would be bucketing in a quote tweet to CBB's concerns about dilution, and specifically pointed out that pre-pre vaults would be subject to dilution before seeing all Boyco Markets live.

We are also extremely clear that this was just a portion of full Boyco, that vaults were run by third parties, that we had no agency or ownership over them, and that they were separate from the full Boyco coming later.

We are also extremely clear that this was just a portion of full Boyco, that vaults were run by third parties, that we had no agency or ownership over them, and that they were separate from the full Boyco coming later.

4 cont/ To start, assume that you have some amount of TVL across different buckets that you NEED filled for the chain to succeed:

- $100-150m in Major Stableswaps

- $100-250m in Single Sided Major Supply on Lending

- $250-500m in Volatile Major LP

How do you gurantee that you get close to that when the hurdle rate of third party assets is unclear? Bucketing.

- $100-150m in Major Stableswaps

- $100-250m in Single Sided Major Supply on Lending

- $250-500m in Volatile Major LP

How do you gurantee that you get close to that when the hurdle rate of third party assets is unclear? Bucketing.

Model/

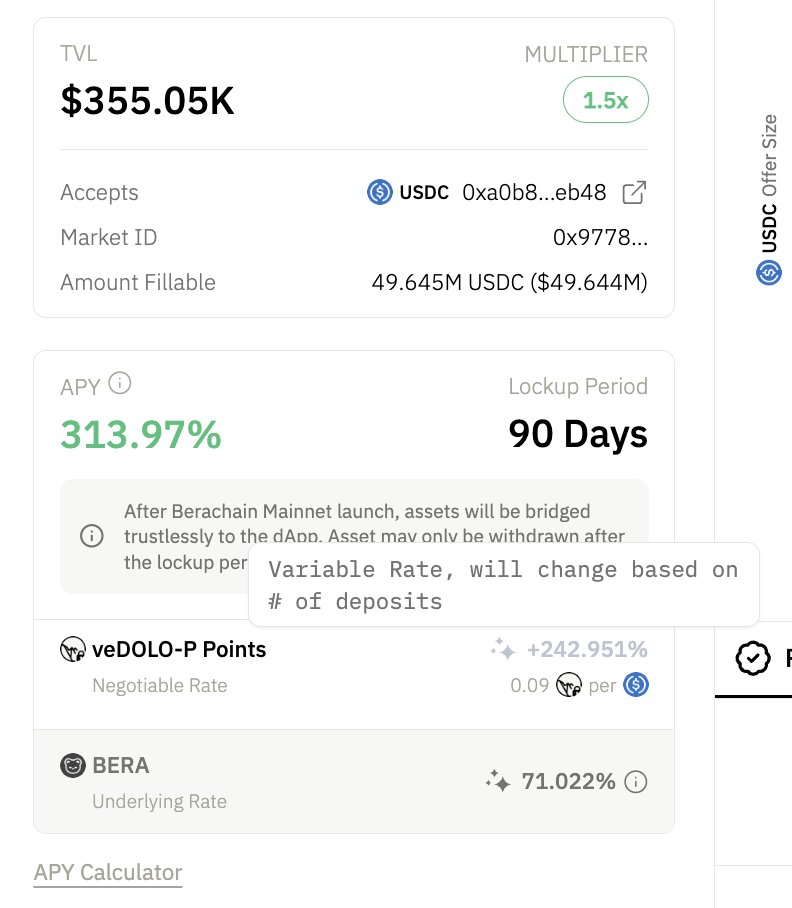

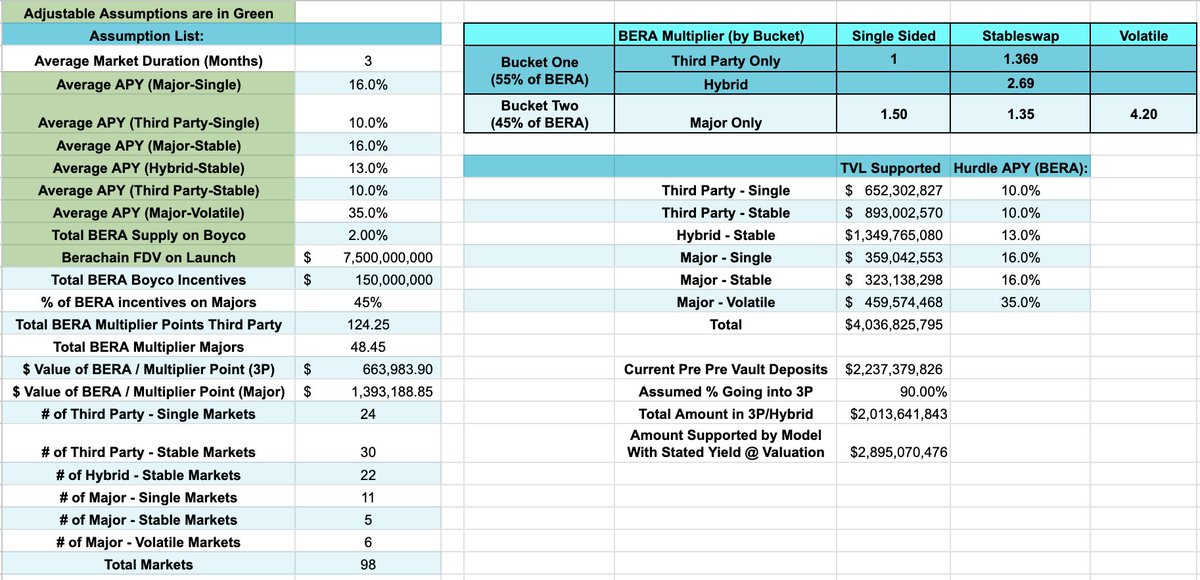

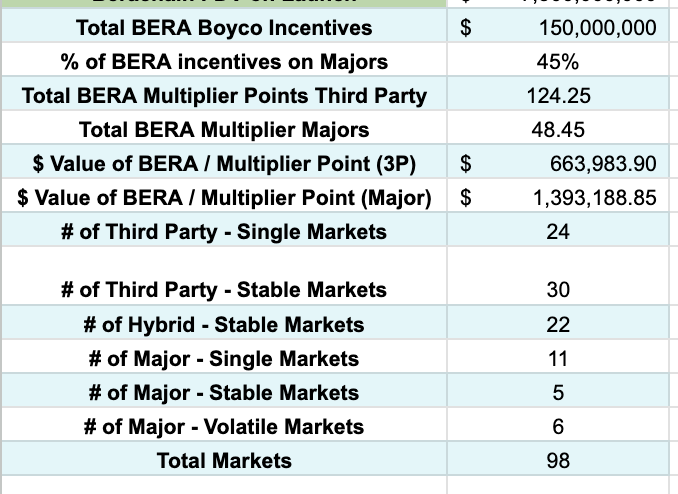

I'll share a preview of my model here, as a lot of folks are struggling with the math. I arbitrarily chose $7.5bn FDV BERA, as that's what many folks coming to me were using, but if anyone wants it adjusted to something else, let me know. I have no prediction on price.

I'll share a preview of my model here, as a lot of folks are struggling with the math. I arbitrarily chose $7.5bn FDV BERA, as that's what many folks coming to me were using, but if anyone wants it adjusted to something else, let me know. I have no prediction on price.

Model/

Let's walk through the things people are missing:

1/ For the sake of the model being conservative, I assumed 3 month duration for ALL markets. That's not true, a good number of the 3P/Hybrid markets are one month. This makes yield better in reality than posted here.

Let's walk through the things people are missing:

1/ For the sake of the model being conservative, I assumed 3 month duration for ALL markets. That's not true, a good number of the 3P/Hybrid markets are one month. This makes yield better in reality than posted here.

Model/

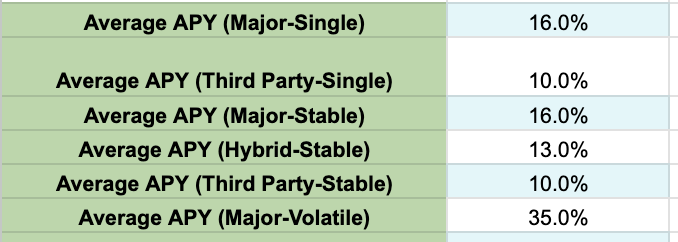

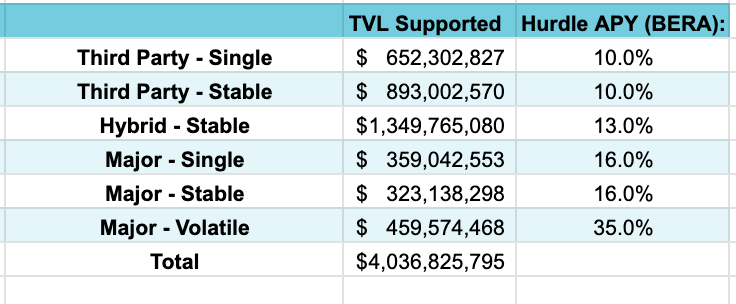

2/ These were the assumptions used as hurdle rates for Boyco. The goal was to ensure that we could service the deposits we already had in pre-pre deposit vaults, while clearing some minimum expected return profile.

NOTE THAT THESE DO NOT INCLUDE DAPP / UNDERLYING YIELD

2/ These were the assumptions used as hurdle rates for Boyco. The goal was to ensure that we could service the deposits we already had in pre-pre deposit vaults, while clearing some minimum expected return profile.

NOTE THAT THESE DO NOT INCLUDE DAPP / UNDERLYING YIELD

Model/

3/ You then have to back into the number of markets by category, weight them by multiplier points, and then use that to create baseline assumptions for the value of each multiplier point in BERA incentive terms (this doesn't factor for TVL yet)

3/ You then have to back into the number of markets by category, weight them by multiplier points, and then use that to create baseline assumptions for the value of each multiplier point in BERA incentive terms (this doesn't factor for TVL yet)

Model/

4/ Then, using the stated hurdle rates from before, you're able to get an understanding of how much TVL can be supported at those hurdle rates in just BERA terms, based on the FDV that you decided on.

4/ Then, using the stated hurdle rates from before, you're able to get an understanding of how much TVL can be supported at those hurdle rates in just BERA terms, based on the FDV that you decided on.

Model/

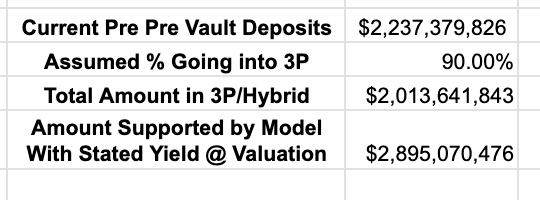

5/ Based on the above hurdle rates, Boyco can support ~2.9bn in Third-Party/Hybrid vaults (vs. ~2-2.2b expected right now).

This is variable based on where you think BERA's actual FDV ends up, and how much dApp + Underlying incentives contribute to yield.

5/ Based on the above hurdle rates, Boyco can support ~2.9bn in Third-Party/Hybrid vaults (vs. ~2-2.2b expected right now).

This is variable based on where you think BERA's actual FDV ends up, and how much dApp + Underlying incentives contribute to yield.

Goals/

Let's be very, very clear though. The goal of Boyco was to ensure that we were meeting or exceeding the hurdle rates of existing yield farms for certain assets, and then giving folks upside in the form of dApp tokens and Asset issuer incentives.

Different assets have different hurdle rates. If you swapped USDC into another asset that you didn't actually want to hold to farm a pre-deposit vault, while we mentioned that there would be more markets coming for full Boyco, I don't know how to help you.

Let's be very, very clear though. The goal of Boyco was to ensure that we were meeting or exceeding the hurdle rates of existing yield farms for certain assets, and then giving folks upside in the form of dApp tokens and Asset issuer incentives.

Different assets have different hurdle rates. If you swapped USDC into another asset that you didn't actually want to hold to farm a pre-deposit vault, while we mentioned that there would be more markets coming for full Boyco, I don't know how to help you.

Goals Cont/

The goal of Boyco was not to reward folks at insane rates for depositing assets that have lower utility. At the end of the day, what we care about is creating productive liquidity to fuel the fat Bera thesis, not creating vanity TVL.

The goal of Boyco was not to reward folks at insane rates for depositing assets that have lower utility. At the end of the day, what we care about is creating productive liquidity to fuel the fat Bera thesis, not creating vanity TVL.

When most people were doing their basic math for calculating the above, they weren't factoring in things correctly like

1/ Hurdle rate

2/ Duration of markets

3/ Chicken Game on Major deposits etc

If we see a meaningful imbalance of liqudity at conclusion, we will re-evaluate then.

Hope this was helpful.

1/ Hurdle rate

2/ Duration of markets

3/ Chicken Game on Major deposits etc

If we see a meaningful imbalance of liqudity at conclusion, we will re-evaluate then.

Hope this was helpful.

• • •

Missing some Tweet in this thread? You can try to

force a refresh